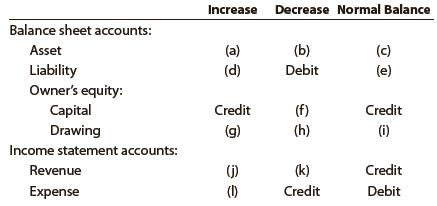

Question: The following table summarizes the rules of

The following table summarizes the rules of debit and credit. For each of the items (a) through (l), indicate whether the proper answer is a debit or a credit.

Transcribed Image Text:

Increase Decrease Normal Balance Balance sheet accounts: Asset (a) (b) (c) Liability Owner's equity: Capital (d) Debit (e) Credit (f) Credit Drawing (g) (h) (i) Income statement accounts: Revenue (k) Credit () (1) Expense Credit Debit

> A company’s fixed operating costs are $500,000, its variable costs are $3.00 per unit, and the product’s sales price is $4.00. What is the company’s breakeven point; that is, at what unit sales volume will its income equal its costs?

> What four financial statements are contained in most annual reports?

> Identify and briefly compare the two leading stock exchanges in the United States today.

> Early in September 1983, it took 245 Japanese yen to equal $1. Nearly 25 years later, in May 2008, that exchange rate had fallen to 103.5 yen to $1. Assume that the price of a Japanese-manufactured automobile was $9,000 in September 1983 and that its pri

> Computer World Inc. paid out $22.5 million in total common dividends and reported $278.9 million of retained earnings at year-end. The prior year’s retained earnings were $212.3 million. What was the net income? Assume that all dividends declared were ac

> In its most recent financial statements, Newhouse Inc. reported $50 million of net income and $810 million of retained earnings. The previous retained earnings were $780 million. How much in dividends were paid to shareholders during the year? Assume tha

> What would happen to the U.S. standard of living if people lost faith in the safety of the financial institutions? Explain.

> INCOME STATEMENT Pearson Brothers recently reported an EBITDA of $7.5 million and net income of $1.8 million. It had $2.0 million of interest expense, and its corporate tax rate was 40%. What was its charge for depreciation and amortization?

> Is an initial public offering an example of a primary or a secondary market transaction? Explain.

> If most investors expect the same cash flows from Companies A and B but are more confident that A’s cash flows will be closer to their expected value, which company should have the higher stock price? Explain.

> Little Books Inc. recently reported $3 million of net income. Its EBIT was $6 million, and its tax rate was 40%. What was its interest expense? [Hint: Write out the headings for an income statement and fill in the known values. Then divide $3 million of

> Evaluate the following statement: Issuing convertible securities represents a means by which a firm can sell common stock at a price above the existing market price.

> Marble Construction estimates that its WACC is 10% if equity comes from retained earnings. However, if the company issues new stock to raise new equity, it estimates that its WACC will rise to 10.8%. The company believes that it will exhaust its retained

> Why would a company choose to issue floating-rate as opposed to fixed-rate preferred stock?

> In the spot market, 10.5 Mexican pesos can be exchanged for 1 U.S. dollar. A compact disc costs $15 in the United States. If purchasing power parity (PPP) holds, what should be the price of the same disc in Mexico?

> Suppose a firm is considering two mutually exclusive projects. One project has a life of 6 years; the other, a life of 10 years. Both projects can be repeated at the end of their lives. Might the failure to employ a replacement chain or EAA analysis bias

> The exercise price on one of Flanagan Company’s call options is $15, its exercise value is $22, and its premium is $5. What are the option’s market value and the stock’s current price?

> A call option on Bedrock Boulders stock has a market price of $7. The stock sells for $30 a share, and the option has an exercise price of $25 a share. a. What is the exercise value of the call option? b. What is the premium on the option?

> Certain liability and net worth items generally increase spontaneously with increases in sales. Put a check mark (3) next to those items that typically increase spontaneously. Accounts payable Notes payable to banks Accrued wages Accrued taxes Mortga

> Would you agree that computerized corporate planning models were a fad during the 1990s but that because of a need for flexibility in corporate planning, they are no longer used by most firms?

> Assume that an average firm in the office supply business has a 6% profit margin, a 40% debt/assets ratio, a total assets turnover of 2 times, and a dividend payout ratio of 40%. Is it true that if such a firm is to have any sales growth (g > 0), it will

> Charlie’s Cycles Inc. has $110 million in sales. The company expects that its sales will increase 5% this year. Charlie’s CFO uses a simple linear regression to forecast the company’s inventory level for a given level of projected sales. On the basis of

> Edwards Industries has $320 million in sales. The company expects that its sales will increase 12% this year. Edwards’ CFO uses a simple linear regression to forecast the company’s receivables level for a given level of projected sales. On the basis of r

> Jasper Furnishings has $300 million in sales. The company expects that its sales will increase 12% this year. Jasper’s CFO uses a simple linear regression to forecast the company’s inventory level for a given level of projected sales. On the basis of rec

> Carter Corporation’s sales are expected to increase from $5 million in 2008 to $6 million in 2009, or by 20%. Its assets totaled $3 million at the end of 2008. Carter is at full capacity, so its assets must grow in proportion to projected sales. At the e

> Why are interest charges not deducted when a project’s cash flows for use in a capital budgeting analysis are calculated?

> Operating cash flows rather than accounting income are listed in Table 12-1. Why do we focus on cash flows as opposed to net income in capital budgeting?

> Huang Industries is considering a proposed project who’s estimated NPV is $12 million. This estimate assumes that economic conditions will be “average.” However, the CFO realizes that conditions could

> Kennedy Air Services is now in the final year of a project. The equipment originally cost $20 million, of which 80% has been depreciated. Kennedy can sell the used equipment today for $5 million, and its tax rate is 40%. What is the equipment’s after-tax

> Why is the NPV of a relatively long-term project (one for which a high percentage of its cash flows occurs in the distant future) more sensitive to changes in the WACC than that of a short-term project?

> NPV Project K costs $52,125, its expected net cash inflows are $12,000 per year for 8 years, and its WACC is 12%. What is the project’s NPV?

> Midwest Water Works estimates that its WACC is 10.5%. The company is considering the following capital budgeting projects: Assume that each of these projects is just as risky as the firm’s existing assets and that the firm may accept al

> Javits & Sons’ common stock currently trades at $30.00 a share. It is expected to pay an annual dividend of $3.00 a share at the end of the year (D1 = $3.00), and the constant growth rate is 5% a year. a. What is the company’s cost of common equity if a

> After a 5-for-1 stock split, Strasburg Company paid a dividend of $0.75 per new share, which represents a 9% increase over last year’s pre-split dividend. What was last year’s dividend per share?

> What is an “equivalent annual annuity (EAA)?” When and how are EAAs used in capital budgeting?

> Accrued salaries owed to employees for October 30 and 31 are not considered in preparing the financial statements for the year ended October 31. Indicate which items will be erroneously stated, because of the error, on (a) The income statement for the ye

> The wages payable and wages expense accounts at May 31, after adjusting entries have been posted at the end of the first month of operations, are shown in the following T accounts: Determine the amount of wages paid during the month. Wages Payable

> The adjusting entry for accrued fees was omitted at the end of the current year. Indicate which items will be in error, because of the omission, on (a) The income statement for the current year and (b) The balance sheet at the end of the year. Also indic

> If the effect of the debit portion of an adjusting entry is to increase the balance of an asset account, which of the following statements describes the effect of the credit portion of the entry? a. Increases the balance of a revenue account. b. Increase

> Identify the four different categories of adjusting entries frequently required at the end of an accounting period.

> The comparative temporary investments and inventory balances of a company follow. Based on this information, what is the amount and percentage of increase or decrease that would be shown on a balance sheet with horizontal analysis? Current Year Pre

> What is the difference between adjusting entries and correcting entries?

> Why are adjusting entries needed at the end of an accounting period?

> Is the matching concept related to (a) The cash basis of accounting or (b) The accrual basis of accounting?

> Does every adjusting entry affect net income for a period? Explain.

> Describe the two distinct obligations incurred by a corporation when issuing bonds.

> Indicate whether each of the following activities would be reported on the statement of cash flows as (a) An operating activity, (b) An investing activity, or (c) A financing activity: 1. Cash received from fees earned. 2. Cash paid for expenses. 3. Cash

> If the effect of the credit portion of an adjusting entry is to increase the balance of a liability account, which of the following statements describes the effect of the debit portion of the entry? a. Increases the balance of a revenue account. b. Incre

> As of January 1, Terrace Waters, Capital had a credit balance of $500,000. During the year, withdrawals totaled $10,000, and the business incurred a net loss of $320,000. a. Compute the balance of Terrace Waters, Capital as of the end of the year. b. Ass

> Checking accounts are a common form of deposits for banks. Assume that Surety Storage has a checking account at Ada Savings Bank. What type of account (asset, liability, owner’s equity, revenue, expense, drawing) does the account balance of $11,375 repre

> Assume that a trial balance is prepared with an account balance of $8,900 listed as $9,800 and an account balance of $1,000 listed as $100. Identify the transposition and the slide.

> Identify whether each of the following would be reported as an operating, investing, or financing activity on the statement of cash flows: a. Retirement of bonds payable b. Purchase of inventory for cash c. Cash sales d. Repurchase of common stock e. Pay

> Based on the data presented in Exercise 1-16, identify those items that would appear on the income statement. In Exercise 1-16 The following list of selected items taken from the records of Rosewood Appliance Service as of a specific date. 1. Accounts P

> If the two totals of a trial balance are equal, does it mean that there are no errors in the accounting records? Explain.

> eCatalog Services Company performed services in October for a specific customer for a fee of $7,890. Payment was received the following November. (a) Was the revenue earned in October or November? (b) What accounts should be debited and credited in (1) O

> Junkyard Arts, Inc., had earnings of $316,000 for the year. The company had 40,000 shares of common stock outstanding during the year and issued 15,000 shares of $50 par value preferred stock. The preferred stock has a dividend of $1.60 per share. There

> Do the terms debit and credit signify increase or decrease, or can they signify either? Explain.

> The income statement of a proprietorship for the month of February indicates a net income of $17,500. During the same period, the owner withdrew $25,500 in cash from the business for personal use. Would it be correct to say that the business had incurred

> What is the difference between an account and a ledger?

> The total assets and total liabilities (in millions) of Dollar Tree Inc. and Target Corporation follow: Determine the owners’ equity of each company. Target Corporation $41,404 Dollar Tree Assets $3,567 Liabilities 1,782 27,407

> Indicate whether each of the following types of transactions will either (a) Increase owner’s equity or (b) Decrease owner’s equity: 1. Expenses 2. Owner’s investments 3. Owner’s withdrawals 4. Revenues

> The financial statements are interrelated. (a) What item of financial or operating data appears on both the income statement and the statement of owner’s equity? (b) What item appears on both the balance sheet and the statement of owner’s equity? (c) Wha

> For each of the following errors, considered individually, indicate whether the error would cause the adjusted trial balance totals to be unequal. If the error would cause the adjusted trial balance totals to be unequal, indicate whether the debit or cre

> On May 15, Maynard Co. borrowed cash from Texas Bank by issuing a 60-day note with a face amount of $100,000. a. Determine the proceeds of the note, assuming that the note carries an interest rate of 6%. b. Determine the proceeds of the note, assuming th

> A company reports the following income statement and balance sheet information for the current year: Net income …………………………………… $ 410,000 Interest expense ……………………………….. 90,000 Average total assets ……………………… 5,000,000 Determine the return on total assets

> For each of the following errors, considered individually, indicate whether the error would cause the adjusted trial balance totals to be unequal. If the error would cause the adjusted trial balance totals to be unequal, indicate whether the debit or cre

> Copper Grill Restaurant Corporation wholesales ovens and ranges to restaurants throughout the Southwest. Copper Grill Restaurant Corporation, which had 50,000 shares of common stock outstanding, declared a 3-for-1 stock split. a. What will be the number

> A company reports the following income statement and balance sheet information for the current year: Net income …………………………………… $ 250,000 Interest expense ………………………………. 100,000 Average total assets ………………………. 2,500,000 Determine the return on total asset

> A business had revenues of $640,000 and operating expenses of $715,000. Did the business (a) Incur a net loss or (b) Realize net income?

> For the year ending August 31, Mammalia Medical Co. mistakenly omitted adjusting entries for (1) Depreciation of $5,800, (2) Fees earned that were not billed of $44,500, and (3) Accrued wages of $7,300. Indicate the effect of the errors on (a) Revenues,

> A company reports the following: Sales ……………………………………. $4,400,000 Average total assets ………………… 2,000,000 Determine the asset turnover ratio. Round to one decimal place.

> A company reports the following: Sales ………………………………………. $1,800,000 Average total assets ……………………. 1,125,000 Determine the asset turnover ratio. Round to one decimal place.

> A business had revenues of $679,000 and operating expenses of $588,000. Did the business (a) Incur a net loss or (b) Realize net income?

> A company reports the following: Income before income tax …………………. $8,000,000 Interest expense ……………………………………. 500,000 Determine the times interest earned ratio. Round to one decimal place.

> A company reports the following: Income before income tax …………………………. $4,000,000 Interest expense ……………………………………………. 400,000 Determine the times interest earned ratio. Round to one decimal place.

> A building acquired at the beginning of the year at a cost of $1,450,000 has an estimated residual value of $300,000 and an estimated useful life of 10 years. Determine (a) The depreciable cost, (b) The straight-line rate, and (c) The annual straight-lin

> The total assets and total liabilities (in millions) of Keurig Green Mountain, Inc. and Starbucks Corporation follow: Determine the owners’ equity of each company. Keurig Green Mountain Starbucks Assets $4,002 $12,446 Liabilities

> Indicate how prior period adjustments should be reported on the financial statements presented only for the current period.

> On October 23, Wilkerson Company had a market price of $40 per share of common stock. For the previous year, Wilkerson paid an annual dividend of $1.20. Compute the dividend yield for Wilkerson Company.

> Sales reported on the income statement were $112,000. The accounts receivable balance decreased $10,500 over the year. Determine the amount of cash received from customers.

> On June 30, Setzer Corporation had a market price of $100 per share of common stock. For the previous year, Setzer paid an annual dividend of $4.00. Compute the dividend yield for Setzer Corporation.

> Sales reported on the income statement were $480,000. The accounts receivable balance increased $54,000 over the year. Determine the amount of cash received from customers.

> Determine the missing amount for each of the following: Assets Llabilitles + Owner's Equity $556,000 + $3,374,000 a. %3D b. $6,111,200 $5,725,000 $2,150,000 $812,500 + X C.

> From the following list of steps in the accounting cycle, identify what two steps are missing: a. Transactions are analyzed and recorded in the journal. b. Transactions are posted to the ledger. c. An unadjusted trial balance is prepared. d. An optional

> From the following list of steps in the accounting cycle, identify what two steps are missing: a. Transactions are analyzed and recorded in the journal. b. An unadjusted trial balance is prepared. c. Adjustment data are assembled and analyzed. d. An opti

> On July 12, Reliable Repair Service extended an offer of $150,000 for land that had been priced for sale at $185,000. On September 3, Reliable Repair Service accepted the seller’s counteroffer of $167,500. Describe how Reliable Repair Service should reco

> Prepare a journal entry on June 30 for the withdrawal of $11,500 by Dawn Pierce for personal use.

> Identify each of the following as relating to (a) The control environment, (b) Control procedures, or (c) Monitoring: 1. Hiring of external auditors to review the adequacy of controls 2. Personnel policies 3. Safeguarding inventory in a locked warehouse

> What are the three classifications of restrictions of retained earnings, and how are such restrictions normally reported on the financial statements?

> A truck with a cost of $82,000 has an estimated residual value of $16,000, has an estimated useful life of 12 years, and is depreciated by the straight-line method. (a) Determine the amount of the annual depreciation. (b) Determine the book value at the

> Prepare a journal entry on December 23 for the withdrawal of $20,000 by Steve Buckley for personal use.

> Equipment with a cost of $180,000 has an estimated residual value of $14,400, has an estimated useful life of 16 years, and is depreciated by the straight-line method. (a) Determine the amount of the annual depreciation. (b) Determine the book value at t

> Josh Reilly is the owner of Dispatch Delivery Service. Recently, Josh paid interest of $4,500 on a personal loan of $75,000 that he used to begin the business. Should Dispatch Delivery Service record the interest payment? Explain.

> Prepare a journal entry on August 13 for cash received for services rendered, $9,000.

> Equipment acquired at the beginning of the year at a cost of $175,000 has an estimated residual value of $12,000 and an estimated useful life of 10 years. Determine (a) The double-declining-balance rate and (b) The double-declining-balance depreciation f

> Prepare a journal entry on April 30 for fees earned on account, $11,250.

> A building acquired at the beginning of the year at a cost of $1,375,000 has an estimated residual value of $250,000 and an estimated useful life of 40 years. Determine (a) The double-declining-balance rate and (b) The double-declining-balance depreciati

> Describe two reports provided by independent auditors in the annual report to shareholders.

> Kroger, a grocery store, recently had a price-earnings ratio of 17.5, while the average price-earnings ratio in the grocery store industry was 21.4. What might explain this difference?

> Prepare a journal entry for the purchase of office equipment on February 19 for $18,500 paying $4,500 cash and the remainder on account.