Question: The following transactions for Westcoast Tire Co.,

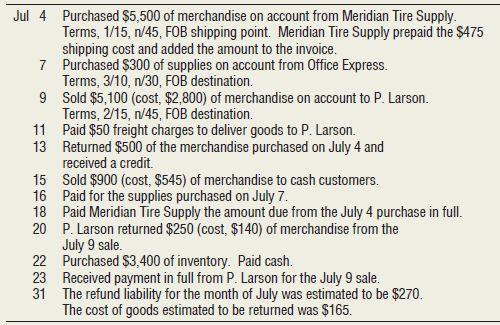

The following transactions for Westcoast Tire Co., occurred during July:

Requirements

1. Journalize the transactions on the books of Westcoast Tire Co., assuming the “net†method is used.

2. What was Westcoast Tire’s gross profit for the month of July?

> Paiscik Corp. completed the following transactions in 2018: Requirements 1. Complete the following amortization schedule for the first four payments on the $190,000 mortgage note, assuming semiannual payments of $12,360. Round amounts to the nearest do

> Following are pertinent facts about events during the current year at Sun Mountain Snowboards. a. December sales totaled $207,000, and Sun Mountain collected sales tax of 5 percent. The sales tax will be sent to the state of Oregon early in January. b. S

> The following transactions of Newport Marine Supply occurred during 2018 and 2019 Requirement 1. Record the transactions in the company’s journal. Explanations are not required.

> The following are selected data for Patina Industries: Requirements 1. Calculate the return on assets (ROA) and the fixed asset turnover ratio for Patina Industries for 2017 and 2018. Round your answers to two decimal places. 2. Have the ratios improve

> The Log Cabin Cafe acquired Hungry Boy Diners. The financial records of Hungry Boy Diners included: Book Value of Assets ....................................................................................... $440,000 Market Value of Assets ............

> If a company with a December 31 year-end were to borrow money in the form of a fourmonth note on November 1, what accounts would be debited on March 1 when it pays the note off?

> On January 4, 2018, Crux Systems, Inc., paid $281,200 for equipment used in manufacturing automotive supplies. In addition to the basic purchase price, the company paid $2,800 for transportation charges; $1,100 for insurance for the equipment while in tr

> Brown Freightway provides freight service. The company’s balance sheet includes Land, Buildings, and Motor-Carrier Equipment. Brown Freightway uses a separate accumulated depreciation account for each depreciable asset. During 2018, Bro

> Zenith Manufacturing incurred the following costs in acquiring land, making land improvements, and constructing and furnishing a new building: Zenith Manufacturing depreciates buildings over 35 years, land improvements over 15 years, and furniture over

> The following are selected data for Armada Industries: Requirements 1. Calculate the return on assets (ROA) and the fixed asset turnover ratio for Armada Industries for 2017 and 2018. Round your answers to two decimal places. 2. Have the ratios improve

> Tico’s Restaurants acquired Dave’s Diner. The financial records of Dave’s Diner included: a. $8,000 loss b. $2,000 gain c. $3,000 gain d. $3,500 loss Book Value of Assets ..................................................................................

> Allen Construction, Inc., had a piece of equipment that cost $32,000 and had accumulated depreciation of $24,000. Requirement 1. Record the disposition of the equipment assuming the following independent situations: a. Allen Construction discarded the e

> On January 3, 2018, Grey Enterprises, Inc., paid $280,600 for equipment used in manufacturing automotive supplies. In addition to the basic purchase price, the company paid $500 for transportation charges, $300 for insurance for the equipment while in tr

> Regal Freightway provides freight service. The company’s balance sheet includes Land, Buildings, and Motor-Carrier Equipment. Regal Freightway uses a separate accumulated depreciation account for each depreciable asset. During 2018, Reg

> Arrow Manufacturing incurred the following costs in acquiring land, making land improvements, and constructing and furnishing a new building. Arrow Manufacturing depreciates buildings over 40 years, land improvements over 20 years, and furniture over 1

> The comparative financial statements of Appleway Flowers, Inc., for 2018, 2017, and 2016 include the following selected data: Requirements 1. Compute these ratios for 2018 and 2017: a. Quick ratio b. Current ratio c. Accounts receivable turnover (assum

> If a company with a December 31 year end lends money in the form of a six-month note on November 1, which accounts will be credited when the note is paid off on April 30?

> Record the following transactions in the journal of Sounds on Wheels, Inc. Explanations are not required. Use a 360-day year for interest computations and round to the nearest dollar.

> KJ Auto Sales, Inc., received the following notes during 2018: Requirements 1. Identifying each note by number, compute the total interest on each note over the note term using a 360-day year, and determine the due date and maturity value of each note.

> Checker Flag Auto Parts, Inc., completed the following selected transactions during 2018: Requirements 1. Open T-accounts for Allowance for Uncollectible Accounts and Bad Debt Expense. These accounts have beginning balances of $1,100 (cr.) and $0, resp

> The March bank statement of Sparky’s Sub Shop just arrived from Inland Bank. To prepare the bank reconciliation, you gather the following additional data: a. The following checks are outstanding on March 31: b. On March 31, Sparky&a

> The May cash records of Van Brunt Coffee, Inc., follow: Van Brunt Coffee, Inc.’s Cash account shows a balance of $6,191 on May 31. On May 31, Van Brunt Coffee, Inc., received the following bank statement: Additional data for the ban

> The comparative financial statements of O’Doherty’s Irish Grille for 2018, 2017, and 2016 include the following selected data: Requirements 1. Compute these ratios for 2018 and 2017: a. Quick ratio b. Current ratio c

> Record the following transactions in the journal of Redmond Printing Supply, Inc. Explanations are not required. Use a 360-day year for interest computations and round to the nearest dollar.

> Titan Truck, Inc., received the following notes during 2018: Requirements 1. Identifying each note by number, compute the total interest on each note over the note term using a 360-day year, and determine the due date and maturity value of each note. R

> Turyin Auto Parts, Inc., completed the following selected transactions during 2018: Requirements 1. Open T-accounts for Allowance for Uncollectible Accounts and Bad Debt Expense. These accounts have beginning balances of $1,200 (cr.) and $0, respective

> The December bank statement of Charly’s Burger Haven, Inc., just arrived from United Bank. To prepare the bank reconciliation, you gather the following additional data: a. The following checks are outstanding at December 31: b. On D

> Financial statements are defined as “historical reports that communicate financial information about a business to people or organizations outside the company.” Why is the word historical used?

> The September cash records of Povich Industrial, Inc., follow: Povich Industrial’s Cash account shows a balance of $5,941 on September 30. On September 30, Povich Industrial, Inc., received the following bank statement: Additional d

> Sundance Marine Supply, Inc., lost its entire inventory in a hurricane that occurred on March 31, 2018. Over the past five years, gross profit has averaged 35 percent of net sales. The company’s records reveal the following data for the

> Savemore Supply, Co., shows the following financial statement data for 2016, 2017, and 2018: Before issuing the 2018 statements, auditors found that the ending inventory for 2016 was overstated by $4,000 and that the ending inventory for 2018 was under

> Because of a nationwide recession, Computer World, Inc.’s merchandise inventory is gathering dust. It is now October 31, 2018, and the $66,800 that Computer World, Inc., paid for its ending inventory is $2,300 higher than current replacement cost. Before

> Titan Truck Parts, Inc., uses the LIFO inventory method and values its inventory using the lower-of-cost-or-market (LCM) rule. Titan Truck Parts, Inc., has the following account balances at December 31, 2018, before releasing its financial statements for

> Monitor Industries, Inc., completed the following inventory transactions during the month of March: Requirements 1. Without resorting to calculations, determine which inventory method will result in Monitor Industries, Inc., paying the lowest income ta

> Refer to the data for Star Line Equipment, Inc., in P5-48B. However, assume Star Equipment, Inc., uses the average cost method. Requirements 1. Prepare a perpetual inventory record using average cost. Round the average unit cost to the nearest cent and

> Star Equipment, Inc., sells hand-held engine analyzers to automotive service shops. Star Equipment, Inc., started April with an inventory of 75 units that cost a total of $10,500. During the month, Star Equipment, Inc., purchased and sold merchandise on

> Pugliese Whole Foods, Inc., has the following information for the years ending December 31, 2018, and December 31, 2017: Requirements 1. Compute the rate of inventory turnover for Pugliese Whole Foods, Inc., for the years ended December 31, 2018, and D

> This problem continues the accounting process for Fitness Equipment Doctor, Inc., from the Continuing Problem in Chapter 2. The trial balance for Fitness Equipment Doctor, Inc., at April 30, 2018, should look like this: The following transactions occur

> Gallinger Enterprises, Inc., lost its entire inventory in a hurricane that occurred on May 31, 2018. Over the past five years, gross profit has averaged 38 percent of net sales. The company’s records reveal the following data for the mo

> Build Right Supply, Co., shows the following financial statement data for 2016, 2017, and 2018. Before issuing the 2018 statements, auditors found the ending inventory for 2016 was understated by $1,000 and that the ending inventory for 2018 was overstat

> Because of a nationwide recession, Liquidation Universe, Inc.’s merchandise inventory is gathering dust. It is now November 30, 2018, and the $162,750 that Liquidation Universe, Inc., paid for its ending inventory is $3,125 higher than the current replac

> Mid Valley Sporting Goods, Inc., uses the LIFO inventory method and values its inventory using the lower-of-cost-or-market (LCM) rule. Mid Valley Sporting Goods, Inc., has the following account balances at December 31, 2018, before releasing its financia

> MAC Industries, Inc., completed the following inventory transactions during the month of July: Requirements 1. Without resorting to calculations, determine which inventory method will result in MAC Industries, Inc., paying the lowest income taxes. 2. Pr

> Refer to the data for Inland Equipment Sales, Inc., in P5-40A. However, assume Inland Equipment Sales, Inc., uses the average cost method. Requirements 1. Prepare a perpetual inventory record using average cost. Round the average unit cost to the neares

> Inland Equipment Sales, Inc., sells hand-held engine analyzers to automotive service shops. Inland Equipment Sales, Inc., started November with an inventory of 55 units that cost a total of $8,470. During the month, Inland Equipment Sales, Inc., purchase

> Use the data for Lake City Industries, Inc., from P4-50B. Requirements 1. Calculate the earnings per share for Lake City Industries for the year. Assume an average of 25,000 common shares were outstanding during the year. Round to the nearest cent. 2. T

> The accounts for the year ended October 31, 2018, for Lake City Industries, Inc., are listed next: Requirements 1. Prepare Lake City Industries, Inc.’s multistep income statement. 2. Prepare Lake City Industries, Inc.â€

> The adjusted trial balance for Checker Flag Auto, Inc., as of January 31, 2018, is presented next: Requirements 1. Prepare the multistep income statement for January for Checker Flag Auto, Inc. 2. Calculate the gross profit percentage for January for C

> This problem continues with the business of Fitness Equipment Doctor, Inc., begun in the Continuing Problem in Chapter 1. Here you will account for Fitness Equipment Doctor, Inc.’s transactions using formal accounting practices. The tri

> The following transactions occurred between Sasaki’s Fine Furnishings and C & C Furniture Warehouse during May of the current year: Requirements 1. Journalize these transactions on the books of Sasaki’s Fine Furn

> Olympia Hardware, Inc., had sales totaling $14,300 during the month of September. Based on experience, company management expects 7 percent of the sales amount will be refunded to customers in the form of sales returns and allowances. The cost to Olympia

> The following purchase-related transactions for Chandler Industries, Inc., occurred during the month of March. Requirement 1. Journalize the transactions for Chandler Industries, Inc., assuming the “net” method is us

> Use the data for River City Fabrication, Inc., from P4-43A. Requirements 1. Calculate the earnings per share for River City Fabrication for the year. Assume an average of 16,000 common shares were outstanding during the year. Round to the nearest cent.

> The account balances for the year ended December 31, 2018, for River City Fabrication, Inc., are listed next: Requirements 1. Prepare River City Fabrication, Inc.’s multistep income statement. 2. Prepare River City Fabrication, Inc.&a

> The adjusted trial balance for Motion Auto, Inc., as of June 30, 2018, is presented next: Requirements 1. Prepare the multistep income statement for June for Motion Auto, Inc. 2. Calculate the gross profit percentage for June for Motion Auto, Inc. 3. W

> The following transactions for Quality Tire, Inc., occurred during November: Requirements 1. Journalize the transactions on the books of Quality Tire, Inc., assuming the “net” method is used. 2. What was Quality Tire

> The following transactions occurred between Retro Furnishings and DM Furniture Warehouse during July of the current year: Requirements 1. Journalize these transactions on the books of Retro Furnishings, assuming the “netâ€&

> New Brunswick Hardware, Inc., had sales during the month of August that totaled $13,800. Based on experience, company management expects 6 percent of the sales amount will be refunded to customers in the form of sales returns and allowances. The cost to

> This problem is the first problem in a sequence that begins an accounting cycle. The cycle is continued in Chapter 2 and completed in Chapter 3. Adam Mazella recently left his job to open his own gym equipment repair business. Adam took all of the money

> The following purchase-related transactions for Terroso, Inc., occurred during the month of April. Requirement 1. Journalize the transactions for Terroso, Inc., assuming the “net” method is used. No explanations are

> Fischer Remodeling, Inc., completed the following selected transactions and prepared these adjusting entries during August: Requirements 1. State whether each transaction would increase revenues, decrease revenues, increase expenses, decrease expenses,

> The trial balance of A-1 Web Design, Inc., at June 30, 2018, and the data needed for the month-end adjustments follow: a. Insurance coverage still remaining at June 30, $575 b. Supplies used during the month, $875 c. Depreciation for the month, $1,650

> Assume the unadjusted and adjusted trial balances for Affordable Pet Dental, Inc., at September 30, 2018, show the following data: Requirement 1. Journalize the adjusting entries that account for the differences between the two trial balances

> The September 30, 2018, adjusted trial balance of Buzzy’s, Inc., is shown next. Requirements 1. Prepare the September closing entries for Buzzy’s, Inc. 2. Calculate the ending balance in Retained Earnings. 3. Prepare

> The adjusted trial balance of Valley Realty, Inc., at December 31, 2018, follows: Requirements 1. Prepare Valley Realty’s income statement and statement of retained earnings for the year ending December 31, 2018, and year-end balance

> Warren Enterprises, Inc., completed the following selected transactions and prepared these adjusting entries during March: Requirements 1. State whether each transaction would increase revenues, decrease revenues, increase expenses, decrease expenses,

> The trial balance of Designs by Jill, Inc., at September 30, 2018, and the data needed for the month-end adjustments follow: a. Insurance coverage still remaining at September 30, $1,950 b. Supplies used during the month, $900 c. Depreciation for the m

> Assume the unadjusted and adjusted trial balances for Davis Chiropractic, Inc., at April 30, 2018, show the following data: Requirement 1. Journalize the adjusting entries that account for the differences between the two trial balances.

> Journalize the adjusting entry needed at December 31, the end of the current accounting year, for each of the following independent cases affecting Premier Powersports, Inc. No other adjusting entries have been made for the year. a. Before making the adj

> This continues the Fitness Equipment Doctor, Inc., example from the Continuing Problem in Chapter 8. Fitness Equipment Doctor, Inc., purchased some of its long-term assets during 2018 using longterm debt. The following table summarizes the nature of this

> The April 30, 2018, adjusted trial balance of The Grind Finale, Inc., is shown below. Requirements 1. Prepare the April closing entries for The Grind Finale, Inc. 2. Calculate the ending balance in Retained Earnings. 3. Prepare a post-closing trial bal

> The adjusted trial balance for Bayside Realty, Inc., at November 30, 2018, follows: Requirements 1. Prepare Bayside Realty’s income statement and statement of retained earnings for the year ended November 30, 2018, and year-end balanc

> The trial balance for Security Systems, Inc., at May 15, 2018, follows: During the remainder of May, Security Systems, Inc., completed the following transactions: Requirements 1. Journalize the transactions that occurred May 16 to May 31 on page 6 of

> Thao Le opened an accounting firm on March 1, 2018. During the month of March, the business completed the following transactions: Requirements 1. Open or set up the following T-accounts: Cash, Accounts Receivable, Supplies, Land, Furniture, Accounts Pa

> A to Z Fabrication, Inc., engaged in the following business transactions during August 2018: A to Z Fabrication, Inc., uses the following accounts: Cash, Accounts Receivable, Supplies, Building, Accounts Payable, Notes Payable, Common Stock, Dividends

> Tim Collett practices law under the business title Tim Collett, Attorney at Law, Inc. During November, his law practice engaged in the following transactions: Collett’s business uses the following accounts: Cash, Accounts Receivable,

> The accounts of Hernandez Computer Repair, Inc., and their normal balances at March 31, 2018, follow. The accounts are listed in no particular order. Requirements 1. Prepare the company’s trial balance at March 31, 2018, listing accou

> The trial balance for Safenet, Inc., at September 15, 2018, follows: During the remainder of September, Safenet, Inc., completed the following transactions: Requirements 1. Journalize the transactions that occurred September 16 to September 30 on pag

> Braeden Miller opened an accounting firm on January 1, 2018. During the month of January, the business completed the following transactions: Requirements 1. Open or set up the following T-accounts: Cash, Accounts Receivable, Supplies, Land, Furniture,

> First Choice Fabrication, Inc., engaged in the following business transactions during May 2018: First Choice Fabrication, Inc., uses the following accounts: Cash, Accounts Receivable, Supplies, Building, Accounts Payable, Notes Payable, Common Stock, D

> This problem continues our accounting for Fitness Equipment Doctor, Inc., from Chapter 7. During 2018, Fitness Equipment Doctor made the following purchases: • On March 3, Fitness Equipment Doctor, Inc., purchased equipment for $3,600 cash. The equipment

> Amanda Bradford practices law under the business title Amanda Bradford, Attorney at Law, Inc. During June, her law practice engaged in the following transactions: Bradford’s business uses the following accounts: Cash, Accounts Receiva

> The following errors occurred in the accounting records of Wilburton Electronics, Inc.: a. The company accountant recorded the receipt of cash for service revenue by debiting Cash for $1,640 instead of the correct amount of $1,460. Service Revenue was al

> The accounts of Wellington Electronics Repair, Inc., and their normal balances at October 31, 2018, follow. The accounts are listed in no particular order. Requirements 1. Prepare the company’s trial balance at October 31, 2018, listi

> The IT manager of Highland Realty, Inc., prepared the balance sheet of the company while the accountant was ill. The balance sheet contains numerous errors. In particular, the IT manager knew that the balance sheet should balance, so she plugged in the r

> Presented here are the amounts of Assets, Liabilities, Stockholders’ Equity, Revenues, and Expenses of The Fitness Guru, Inc., at August 31, 2018. The items are listed in alphabetical order. The retained earnings balance of the business

> Classic Cars, Inc., restores antique automobiles. The retained earnings balance of the corporation was $22,300 at December 31, 2017. During 2018, the corporation paid $20,000 in dividends to its stockholders. At December 31, 2018, the businessâ

> Breanna Baxter started an interior design company called Interiors on Demand, Inc., on June 1, 2018. The following amounts summarize the financial position of her business on June 14, 2018, after the first two weeks of operations: During the remainder

> Darin Oliver worked as an accountant at a local accounting firm for five years after graduating from college. He recently opened his own accounting practice, which he operates as a corporation. The name of the new entity is Oliver and Associates, Inc. Da

> The IT manager of Valley Realty, Inc., prepared the balance sheet of the company while the accountant was ill. The balance sheet contains numerous errors. In particular, the IT manager knew that the balance sheet should balance, so she plugged in the ret

> Presented here are the amounts of Assets, Liabilities, Stockholders’ Equity, Revenues, and Expenses of Extreme Sports, Inc., at October 31, 2018. The items are listed in alphabetical order. The retained earnings balance of the busines

> In this problem, we continue our accounting for Fitness Equipment Doctor, Inc. Refer to the Continuing Problem in Chapters 4 and 5. Assume that all 15 of the treadmills Fitness Equipment Doctor, Inc., sold in July were sold on account for $4,350 each. In

> Go to the Columbia Sportswear Company Annual Report located in Appendix A. Now access the 2016 Annual Report for Under Armour, Inc. For instructions on how to access the report online, see the Industry Analysis in Chapter 1. Requirements Answer these qu

> To help you understand and compare the performance of two companies in the same industry. Go to the Columbia Sportswear Company Annual Report located in Appendix A and find the Consolidated Balance Sheets on page 663. Now access the 2016 Annual Report fo

> Find the Columbia Sportswear Company Annual Report located in Appendix A and go to the Consolidated Financial Statements starting on page 663. Now go online and access the 2016 Annual Report for Under Armour, Inc. For instructions on how to access the re

> Find the Columbia Sportswear Company Annual Report located in Appendix A and go to the Notes to the Consolidated Financial Statements starting on page 668. Now access the 2016 Annual Report for Under Armour, Inc., online. (For instructions on how to acce

> Find the Columbia Sportswear Company Annual Report located in Appendix A and go to the Financial Statements starting on page 663. Now access the 2016 Annual Report for Under Armour, Inc., from the Internet. For instructions on how to access the report on

> Find the Columbia Sportswear Company Annual Report located in Appendix A and go to the section titled “Design and Evaluation of Internal Control Over Financial Reporting” in Item 9A starting on page 693. Now access the online 2016 Annual Report for Under

> Find the Columbia Sportswear Company annual report located in Appendix A, and go to the financial statements starting on page 663. Now access the 2016 annual report for Under Armour, Inc., online. For instructions on how to access the report, see the Ind

> Find the Columbia Sportswear Company Annual Report located in Appendix A, and go to the financial statements starting on page 663. Now access online the 2016 Annual Report for Under Armour, Inc.. For instructions on how to access the report online, see t