Question: The general principles of revenue recognition are

The general principles of revenue recognition are the same for both governmental and government-wide statements.

For each of the following situations, indicate the amount of revenue that the government should recognize in an appropriate governmental fund as well as in its government-wide statement of activities in its fiscal year ending December 31, 20X2. Briefly justify your response, making certain that, as appropriate, you identify the key issue of concern.

1. In October 20Xl, a state was awarded a federal grant of $300 million to assist local law enforcement efforts. The grant is intended to cover costs incurred in the calendar years 20X2 through 20X3. In 20X2, the state incurred $160 million of appropriate costs.

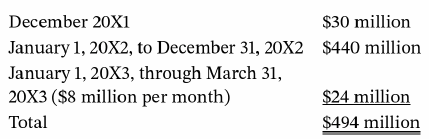

2. In December 20Xl, a city levied property taxes of $500 million for the calendar year 20X2. The taxes are due on June 30, 20X2. The city collects the taxes as follows:

It estimates the balance will be uncollectible.

3. In January 20X2, a city received a cash gift of $1 million to support its museum of city history. Per the wishes of the donor the funds are to be invested and only the income may be expended. In 20X2, the endowment generated $50,000 in income, none of which was spent during the year.

4 . For the year 20X2, the teachers of the Nuvorich School District earned $26 million in insurance benefits. In January 20X3 the state in which the district is located paid the entire amount into the State Teachers Insurance Fund.

> A wealthy alumna donates $500,000 in marketable securities to her alma mater to establish a scholarship fund . Per the trust agreement, only the interest and dividends (including any gains in fair value) from the securities can be distributed to scholars

> For each of the following indicate the type of fiduciary fund in which it is most likely the fiduciary activity should be accounted for and reported. 1. Per a trust agreement a state maintains an investment pool in which governments within the state can

> What was the city's largest expenditure for the fiscal year? By how much did this increase or decrease since the prior year? Can you draw any inferences from this comparison as to the efficiency and effectiveness of the city in providing this service? If

> A city's general fund has an outstanding payable to its electric utility, which is accounted for in an enterprise fund. The utility has a corresponding receivable from the general fund. In the city's government-wide statement of net position, which would

> A city signs a three-year licensing agreement with a software company for use of a payroll management system in its electrical utility fund. Annual charges are $10,000 per year. It is the policy of the city to use a discount rate of 6 percent to value ri

> The accounting for BANs depends on events subsequent to year-end. In anticipation of issuing of long-term bonds, a state issues on May 1, 20Xl, $200 million of 60-day BANs to finance highway construction. It expects to roll over the BANs into long-term b

> What are the four main objectives of federal financial reporting as established by the FASAB?

> Government debts may be reported differently in governmental and government-wide statements. The Alpine school district engaged in the following transactions in its fiscal year ending August 31, 20Xl. By law, the district is required to establish a capit

> What should it use as its discount rate in determining its pension obligation?

> The Office of Management and Budget is responsible for granting agencies apportionments. What are apportionments?

> What is the primary role of the Treasury Department's Bureau of Fiscal Service?

> Into what two categories does the FASAB divide government assets? How are each of the two accounted for?

> What are the basic statements that an agency may have to prepare to be in compliance with FASAB standards?

> What are the key criteria of whether an entity should be accounted for as a "consolidation" entity or a "disclosure" entity?

> Why is the FASAB named an advisory board? What is the relationship between the FASAB and the GAO, the Treasury Department, and the OMB?

> What are tax expenditures, and how must they be reported upon in the federal government's consolidated financial report?

> If an agency makes a loan at a below market rate, what would be the nature of any expense recognized at the time of the loan? If it guaranteed a loan made by others, what would be the nature of any expense recognized at the time of the guarantee?

> Why does it matter whether Social Security is considered a pension plan or an entitlement program? How does the FASAB direct that Social Security be reported? What unique issue does the federal government face in calculating the actuarial value of its So

> Which of the following is true with respect to bankruptcy? a. Per the federal bankruptcy code, a municipality can be declared bankrupt but not insolvent. b. Many major cities have avoided bankruptcy by being placed under the control of financial control

> Suppose that you are the independent auditor for a local not-for-profit performing arts association that recently received a sizable endowment. The association's president has asked whether gains, both realized and unrealized, from the appreciation of en

> What measures might be of more value to donors than the fund-raising ratio?

> What are permanent funds used to account for? In light of the requirement that governmental funds can recognize revenues only when they are measurable and available, how can a permanent fund ever recognize revenue?

> As a general rule, when should a government recognize a fiduciary fund liability to the beneficiaries of the fund? More specifically when should a government that collects taxes on behalf of another government recognize the liability to the beneficiary g

> What is the rationale for the requirement that only resources held for the benefit of parties other than the government itself can be accounted for in a fiduciary fund?

> What are investment pools? Why might a government maintain an investment pool? On what basis are the assets measured and reported?

> In what two basic financial statements should a government report its fiduciary funds? On what basis of accounting should they be prepared?

> What is conduit debt? Who issues debt through these conduits? Why are governments required to report it only in notes to their financial statements, not on their balance sheets?

> Why are bond ratings of vital concern to bond issuers?

> What distinguishes moral obligation bonds from other types of debt? Why would one government assume a moral obligation for another government's bonds?

> Which of the following would be least likely to be classified as a city's general capital assets? a. Roads and bridges b. Electric utility lines c. Computers used by the police department d. Computers used by the department that collects the city's sale

> What special problems do governments face in measuring the income taxes associated with a particular year?

> What are the key distinguishing characteristics of fiduciary funds?

> What is meant by "combining statements"?

> Why may it be unclear whether a particular organization associated with the federal government should be considered a federal reporting entity? What are the key criteria as to whether an entity should be included in the Consolidated Financial Report (CPR

> What is meant by the unified budget? Why are Social Security receipts and disbursements said to be "off budget?"

> You are the auditor of a state. The state made a $10 million grant to a city. The grant reimburses the city for allowable costs incurred in hosting a meeting of international leaders. The meeting was held two weeks prior to the end of the state's fiscal

> According to the GASB, "Financial statements for governmental funds should be presented using the current financial resources measurement focus and the modified accrual basis of accounting." Financial resources are conventionally defined as "cash, invest

> The city of Carlasville imposes a one percent sales tax in addition to that levied by the state. The state, however, collects the tax on behalf of the city. The state typically does not notify the city of the amount of taxes collected in the fourth quart

> A separate column to report the variance between the final budget and actual amounts is encouraged but not required. Governments may also report the variance between original and final budget amounts. The implication is clear. The variance between the fi

> Central School District is awarded a $400,000 federal grant to implement and test a new way of teaching middle school math. The award stipulates that the district must provide a 20 percent match. a. In what fund-type ( e.g., general, special revenue, cap

> Did the government receive any funding for SNAP or any other Federal programs? Explain with details.

> Generally accepted accounting principles require governments to include in their annual reports a comparison of actual results with the budget for each governmental fund for which an annual budget has been adopted. This information is generally presented

> To encourage a private health care company to construct a nursing home, a city agrees to issue tax exempt bonds for the benefit of the company. The bonds will fund the construction of the facility. The city will hold title to the home for a period of 30

> A city enters into an 11 month lease with an option to renew the lease for additional 11 months up to 5 times. In your opinion does the lease qualify for the one-year exception and thereby be accounted for as an operating rather than a capital lease? Wou

> Per the GASB, training costs should be expensed as incurred for both internally generated computer software and subscription-based technology arrangements (SBITAs). They should not be capitalized as part of either the resultant computer software or the s

> As discussed in Chapter 4, governments must mark-tomarket their investments (including held-to-maturity debt securities). Suppose that a city has in its portfolio debt securities that it intends to hold to maturity. Interest rates increase. Therefore the

> As indicated in the chapter, the GASE takes a different position with respect to capitalization of interest during periods of construction than does the FASB. Inasmuch as there appears to be little difference in the nature of the transactions, especially

> The "In Practice" on page 261 notes that tax-exempt advance refundings involving debt redemptions are no longer allowed under U.S. tax law and that, as a result, the cost of debt issuance may go up for state and local governments. How might states and ci

> For each of the following indicate the amount of revenue that Beanville should recognize in its 20X2 (1) governmentwide statements and (2) governmental fund statements. Provide a brief justification or explanation for your responses. 1. The state in wh

> For each of the following, indicate the fund, if any in which the government would account for the resources described. If a fiduciary, rather than a governmental fund, indicate the type of fund. Briefly justify your response. 1. A government contributes

> Were there any tax abatements disclosed for the year? If so, provide a brief description and the gross amount of taxes that were reduced during the reporting period.

> A state government, enters into an arrangement in which it will transfer to the Western Tollway Corporation (WTC) a recently constructed highway. The state reports the highway on its financial statements at its cost of $2 billion. Upon transfer, the stat

> A city entered into a contract with World Wide Construction Company (WWCC) to design, construct and operate a tunnel for a period of 30 years. Once the tunnel was completed, WWCC had complete responsibility for all aspects of tunnel operations, including

> Decommissioning costs are often nontrivial and must be recognized years in advance. A city constructed a power plant at a cost of $600 million. The facility has an estimated useful life of 50 years. At the end of the year in which the plant went on-line,

> Landfill costs must be reported as expenses during the periods of use-but only in enterprise funds. In 2X21, a city opens a municipal landfill, which it will account for in an enterprise fund. It estimates capacity to be 6 million cubic feet and usable l

> A lessor must report on its balance sheet both a receivable and the underlying asset. Bean County recently acquired a commercial office building at a cost $20 million, paid in cash. It estimates that the economic life of the building is 40 years (with no

> Overlapping debt can significantly alter key measures of debt capacity. The following information was taken from the City of Wyoming, Michigan's, schedule of direct and overlapping debt. 1. What is the most likely way the applicable percentages were deri

> A government hospital entered into a licensing agreement with a commercial software company that would permit it to use the firm's patient billing program and related data storage facilities for a period of five years. The following information relates t

> BANs, TANs, and RANs may sound alike, but they are not necessarily accounted for in the same way. In August 20X0, voters of Balcones, a medium-sized city, approved a $15 million general obligation bond issue to finance the construction of recreational fa

> Demand bonds may provide the issuer with the disadvantages, but not the advantages, of long-term debt. On June l, 20Xl, a city issues $2 million in 7 percent demand bonds. Although the bonds have a term of 10 years , they contain a " put" option permitti

> This example provides an overview of transactions addressed in this and previous chapters. Zeff Township assessed property owners $1,000,000 to construct sidewalks. The assessments were payable over a period of 10 years in annual installments of $123,290

> Did the city enter into any SBITAs? What type and for how long?

> Key information as to long-term obligations may be found in a city's annual comprehensive financial report (ACFR) in sections other than the primary financial statements. This problem is based on information drawn from the ACFR of the City of Davis. 1. T

> Entries in both governmental funds and government-wide statements can be reconstructed from a city's schedule of changes in long-term debt. The accompanying table was drawn from the City of Fort Leah's schedule of long-term liabilities (all amounts in th

> Government-wide statements are on a full accrual basis; fund statements are on a modified accrual basis. The East Eanes School District engaged in or was affected by the following events and transactions during its fiscal year ending June 30, 20Xl. 1. Te

> If governments don't preserve their infrastructure assets, they must depreciate them . In 20XO , Bantham County incurred $80 million in costs to construct a new highway. Engineers estimate that the useful life of the highway is 20 years . 1. Prepare the

> Favorable revenue-to-expenditure ratios may not always be as favorable as they appear. In the management discussion and analysis accompanying its 20XS financial statements, Tiber County reported that "for the fifth consecutive year revenues exceeded expe

> Charter City issued $100 million of 6 percent, 20-year general obligation bonds on January 1, 20Xl. The bonds were sold to yield 6.2 percent and hence were issued at a discount of $2.27 million (i.e., at a price of $97.73 million). Interest on the bonds

> What is the City's credit rating with the different Bond rating agencies?

> Assume that Nolanville's fiscal year ends on December 31. 1. Nolanville's payroll for one of its departments is $15,000 per week. It pays its employees on the Thursday of the week following that in which the wages and salaries are earned. In 20Xl, Decemb

> One of O’Neill’s high-end wetsuits is called the Animal. Total demand for this wetsuit is normally distributed with a mean of 200 and a standard deviation of 130. In order to ensure an excellent fit, the Animal comes in 16 sizes. Furthermore, it comes in

> You are in charge of designing a supply chain for furniture distribution. One of your products is a study desk. This desk comes in two colors: black and cherry. Weekly demand for each desk type is normal with mean 100 and standard deviation 65 (demands f

> Consider the following excerpts from a New York Times article (Kaufman, 2000): Despite its early promise . . . Restoration has had trouble becoming a mass-market playerWhat went wrong? High on its own buzz, the company expanded at breakneck speed, more t

> Cyber Chemicals uses liquid nitrogen on a regular basis. Average daily demand is 178 gallons with a standard deviation of 45. Due to a substantial ordering cost, which is estimated to be $58 per order (no matter the quantity in the order), Cyber currentl

> ACold Inc. is a frozen food distributor with 10 warehouses across the country. Iven Tory, one of the warehouse managers, wants to make sure that the inventory policies used by the warehouse are minimizing inventory while still maintaining quick delivery

> Schmears Inc. is a catalog retailer of men’s shirts. Daily demand for a particular SKU (style and size) is Poisson with mean 1.5. It takes three days for a replenishment order to arrive from Schmears’ supplier and orders are placed daily. Schmears uses t

> Dr. Jack is in charge of the Springfield Hospital’s Blood Center. Blood is collected in the regional Blood Center 200 miles away and delivered to Springfield by air- plane. Dr. Jack reviews blood reserves and places orders every Monday morning for delive

> Shelf space in the grocery business is a valuable asset. Every good supermarket spends a significant amount of effort attempting to determine the optimal shelf space allocation across products. Many factors are relevant to this decision: the profitabilit

> Office Supply Company (OSC) has a spare parts warehouse in Alaska to support its office equipment maintenance needs. Once every six months, a major replenishment shipment is received. If the inventory of any given part runs out before the next replenishm

> Consider the relationship between TEC and O’Neill with unlimited, but expensive, reactive capacity. Recall that TEC is willing to give O’Neill a midseason replenishment (see Figure 15.1) but charges O’Neill a 20 percent premium above the regular wholesal

> The following table shows financial data (year 2004) for Costco Wholesale and Walmart, two major U.S. retailers. Assume that both companies have an average annual holding cost rate of 30 percent (i.e., it costs both retailers $3 to hold an item that they

> You are traveling abroad and have only American dollars with you. You are currently in the capital but you will soon be heading out to a small town for an extended stay. In the town, no one takes credit cards and they only accept the domes- tic currency

> Lucky Smokes currently operates a warehouse that serves the Virginia market. Some trucks arrive at the warehouse filled with goods to be stored in the ware- house. Other trucks arrive at the warehouse empty to be loaded with goods. Based on the number of

> Sarah is planning her wedding. She and her fianceˊ have signed a con- tract with a caterer that calls for them to tell the caterer the number of guests that will attend the reception a week before the actual event. This “fina

> CPG Bagels starts the day with a large production run of bagels. Through- out the morning, additional bagels are produced as needed. The last bake is completed at 3 p.m. and the store closes at 8 p.m. It costs approximately $0.20 in materials and labor t

> Geoff Gullo owns a small firm that manufactures “Gullo Sunglasses.” He has the opportunity to sell a particular seasonal model to Land’s End. Geoff offers Land’s End two purchasing options: ∙ Option 1. Geoff offers to set his price at $65 and agrees to c

> To ensure a full line of outdoor clothing and accessories, the marketing department at Teddy Bower insists that they also sell waterproof hunting boots. Unfortunately, neither Teddy Bower nor TeddySports has expertise in manufacturing those kinds of boot

> Teddy Bower is an outdoor clothing and accessories chain that purchases a line of parkas at $10 each from its Asian supplier, TeddySports. Unfortunately, at the time of order placement, demand is still uncertain. Teddy Bower forecasts that its demand is

> Weekday lunch demand for spicy black bean burritos at the Kiosk, a local snack bar, is approximately Poisson with a mean of 22. The Kiosk charges $4.00 for each burrito, which are all made before the lunch crowd arrives. Virtually all burrito customers a

> Four partners in a big consulting firm try to estimate the number of new recruits needed for the next year. Their forecasts are 32, 44, 21, and 51, respectively. What would be the result of a simple forecast combination? [13.6]

> GoPro is a training company that helps athletes applying for college improve their sports. Most colleges have their application deadline at the end of December, so the third and fourth quarters tend to be the busiest for the company. Based on the last th

> Mt. Kinley is a strategy consulting firm that divides its consult- ants into three classes: associates, managers, and partners. The firm has been stable in size for the last 20 years, ignoring growth opportunities in the 90s, but also not suffering from

> Online-MBA is an online university that allows students to get credit for various online courses they have taken, as long as they come to campus for a six-week intense boot camp. Demand for this program is quickly increasing. For the last six months, mon

> Tom’s Towing LLC operates a fleet of tow trucks that it sends to help drivers in need on the nearby highway. The numbers of calls requesting a tow truck for Monday, Tuesday, Wednesday, and Thursday were 27, 18, 21, and 15, respectively. What would be its

> Tom’s Towing LLC operates a fleet of tow trucks that it sends to help drivers in need on the nearby highway. The numbers of calls requesting a tow truck for Monday, Tuesday, Wednesday, and Thursday were 27, 18, 21, and 15, respectively. What would be its

> Tom’s Towing LLC operates a fleet of tow trucks that it sends to help drivers in need on the nearby highway. The numbers of calls requesting a tow truck for Monday, Tuesday, Wednesday, and Thursday were 27, 18, 21, and 15, respectively. What would be its

> Jim and John run a barber shop. Every night, both of them predict how many guests will come on the next day. Over the last four days, they have collected some data about their predictions and the actual outcome. Jim predicts the number of guests to be 56

> A small project consists of three activities: A, B, and C. To start activity C, both activities A and B need to be complete. Activity A takes 3 days with a probability of 50 percent and 5 days with a probability of 50 percent, and so does Activity B. Act

> Thierry, Ute, and Vishal are getting ready for their last period in the MBA program. Following the final exams, they intend to throw a big party with many of their friends from back home. Presently, they have identified the following set of activities th

> Consider the dependency matrix and the activity durations provided above. a. Build a project graph, visually depicting the evolution of this project. [12.2] b. Find the critical path. What is the earliest time that the project can be completed? [12.4] c.