Question: The Haverly Company expects to finish the

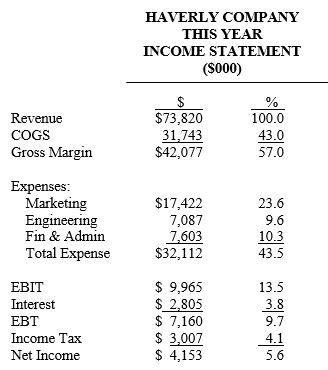

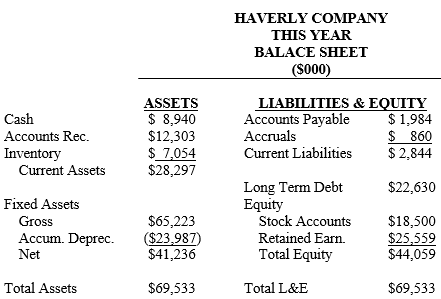

The Haverly Company expects to finish the current year with the following financial results, and is developing its Annual Plan for next year.

The following facts are available

1. Payables are almost entirely due to inventory purchases, and can be estimated through COGS, which is approximately 45% purchased material.

2. Currently owned assets will depreciate an additional $1,840,000 next year.

3. There are two balance sheet accruals. The first is for unpaid wages. The current payroll of $32 million is expected to grow by 12% next year. The closing date of the year will be six working days after a payday. The second accrual is an estimate of the cost of purchased items that have arrived in inventory, but for which vendor invoices have not yet been received. This materials accrual is generally about 10% of the payables balance at year end.

4. The combined state and federal income tax rate is 42%.

5. Interest on current and future borrowing will be at a rate of 12%.

PLANNING ASSUMPTIONS

Income Statement Items

1. Revenue will grow by 13% with no change in product mix. However, competitive pressure is expected to force some reductions in pricing.

2. The pressure on prices will result in a 1.5% deterioration in next year's cost ratio.

3. Spending in the marketing department is considered excessive and will be held to 21% of revenue next year.

4. Due to a major development project, expenses in the engineering department will increase by 20%.

5. Finance and administration expenses will increase by 6%.

Assets and Liabilities

6. An enhanced cash management system will reduce cash balances by 10%.

7. The ACP will be reduced by 15 days. (Calculate the current value to arrive at the target.)

8. The inventory turnover ratio (COGS/Inv.) will decrease by .5ï‚´.

9. Capital spending is expected to be $7 million. The average depreciation life of the assets to be acquired is five years. The firm uses straight-line depreciation, and takes a half-year in the first year.

10. Bills are currently paid in 50 days. Plans are to shorten that to 40 days.

11. A dividend totaling $1.5 million will be paid next year. No new stock will be sold.

Develop next year's financial plan for Haverly based on these assumptions and last year's financial statements. Include a projected income statement, balance sheet and a statement of cash flows.

Transcribed Image Text:

HAVERLY COMPANY THIS YEAR INCOME STATEMENT (S000) $ $73,820 31,743 $42,077 Revenue 100.0 COGS 43.0 Gross Margin 57.0 Expenses: Marketing Engineering Fin & Admin Total Expense $17,422 7,087 7,603 $32,112 23.6 9.6 10.3 43.5 $ 9,965 $ 2,805 $ 7,160 $ 3,007 $ 4,153 EBIT 13.5 Interest 3.8 EBT 9.7 Income Tax 4.1 Net Income 5.6 HAVERLY COMPANY THIS YEAR BALACE SHEET (S000) Cash Accounts Rec. Inventory Current Assets ASSETS $ 8,940 $12,303 $ 7,054 $28,297 LIABILITIES & EQUITY $ 1,984 $ 860 $ 2,844 Accounts Payable Accruals Current Liabilities Long Term Debt EQUITY Stock Accounts $22,630 Fixed Assets $65,223 ($23,987) $41,236 $18,500 $25,559 $44,059 Gross Accum. Deprec. Retained Earn. Net Total EQUITY Total Assets $69,533 Total L&E $69,533

> Working capital spontaneously finances itself because it's being turned over all the time. Is this statement true, false, or a little of both? Exactly what is meant by spontaneous financing? Does working capital require funding? Why?

> How long does it take for the following to happen? a. $856 grows into $1,122 at 7%. b. $450 grows into $725.50 at 12% compounded monthly. c. $5,000 grows into $6724.44 at 10% compounded quarterly.

> What interest rates are implied by the following lending arrangements? a. You borrow $500 and repay $555 in one year. b. You lend $1,850 and are repaid $2,078.66 in two years. c. You lend $750 and are repaid $1,114.46 in five years with quarterly compoun

> Assume that interest rates on federal government bonds are as follows: Do the theories of the shape of the yield curve offer any insights into this rate pattern? Discuss the expectations, liquidity preference, and market segmentation theories separate

> The Owl Corporation is planning for 20X2. The firm expects to have the following financial results in 20X1 ($000). Management has made the following planning assumptions: Income Statement Revenue will grow by 10%. The cost ratio will improve to 37% of

> Economists have forecast the following yearly inflation rates over the next 10 years: Calculate the inflation components of interest rates on new bonds issued today with terms varying from one (1) to ten (10) years. Year.. Inflation Rate 1 3.0 2...

> Inflation is expected to be 5% next year and a steady 7% each year thereafter. Maturity risk premiums are zero for one-year debt but have an increasing value for longer debt. One-year government debt yields 9% whereas two-year debt yields 11%. a. What

> Use the interest rate model to solve the following problem. One-year treasury securities are yielding 12% and two-year treasuries yield 14%. The maturity risk premium is zero for one-year debt and 1% for two-year debt. The real risk-free rate is 3%. Wha

> Lytle Trucking projects a $3.2 million EBIT next year. The firm’s marginal tax rate is 40%, and it currently has $8 million in long-term debt with an average coupon rate of 8%. Management is projecting a requirement for additional assets costing $1.5 m

> The Waterford Wax Company had the following current account activity last year. a. Calculate and display the current account detail required for the Cash From Operating Activities section of the Statement of Cash Flows. b. If you also knew that Water

> The Dalmatian Corporation expects the following summarized financial results this year ($000) Use the EFR relation to estimate Dalmatian’s external funding requirements under the following conditions. a. Sales growth of 15%. b. Sal

> Define the following terms: primary market, secondary market, capital market, money market.

> The Blandings Home Construction Company purchased a new crane for $350,000 this year. They sold the old crane for $80,000. At the time it had a net book value of $20,000. Assume any profit on the sale of old equipment is taxed at 25%. These were the

> Fred Klein started his own business recently. He began by depositing $5,000 of his own money (equity) in a business account. Once he’d done that his balance sheet was as follows: During the next month, his first month of business, h

> Axtel Company has the following financial statements: In addition, Axtel retired stock for $1,000,000 and paid a dividend of $1,727,000. Depreciation for the year was $1,166,000. Construct a Statement of Cash Flows for Axtel for 2001. (Hint: Retiring

> A group of investors is considering buying the Wheelwright Corporation, but does not want to contribute to the company’s financial support after the purchase. Wheelwright’s management has offered the following financia

> Norton Industries recorded total cost of goods sold for 20X2 of $6.5 million. Norton had the following inventory balances for the months indicated (end of period balances): a. Compute inventory turnover for Norton using the following methods to calcula

> Epsom Co. manufactures furniture and sells about $40 million a year at a gross margin of 45%. a. What is the maximum inventory level the firm can carry to maintain an inventory turnover (based on COGS) of 8.0? b. If the inventory contains $1.2 million

> Slattery Industries reported the following financial information for 20X2: The firm expects revenues costs, expenses (excluding depreciation), and working capital to grow at 10% per year for the next three years. It also expects to invest $2 million p

> Prahm & Associates had EBIT of $5M last year. The firm carried an average debt of $15M during the year on which it paid 8% interest. The company paid no dividends and sold no new stock. At the beginning of the year it had equity of $17M. The tax rate

> Milford Inc. has the following summarized financial statements ($000): Milford’s equity investors have typically demanded an expected return of at least 25% before they will buy the company’s stock Evaluate Milford&

> Tribke Enterprises collected the following data from their financial reports for 20X3: Complete the following abbreviated financial statements and calculate per share ratios indicated. (Hint: Start by subtracting the formula for the quick ratio from th

> Explain the following terms: privately held company, publicly traded company, listed company, OTCBB, NASDAQ, BATS, IPO, prospectus, and red herring.

> Companies often use ratios as a basis for planning. The technique is to assume the business being planned will achieve targeted levels of certain ratios and then calculate the financial statement amounts that will result in those ratios. The process al

> You are given the following selected financial information for The Blatz Corporation. Calculate accounts receivable, inventory, current assets, current liabilities, long-term debt, equity, ROA, and ROE. Income Statement Balance Sheet $750 Net In

> The Paragon Company has sales of $2,000 with a cost ratio of 60%, current ratio of 1.5, inventory turnover ratio (based on cost) of 3.0, and average collection period (ACP) of 45 days. Complete the following current section of the firm's balance sheet.

> Home mortgage rates are determined by market forces and individual borrowers can't do much about them. The time it takes to pay off a mortgage loan, however, varies a great deal with the size of the monthly payment, which is under the borrower's control

> The Orion Corp. is evaluating a proposal for a new project. It will cost $50,000 to get the undertaking started. The project will then generate cash inflows of $20,000 in its first year and $16,000 per year in the next five years after which it will en

> Use amount and annuity techniques to calculate the present value of the following pattern of annual cash flows at an annual interest rate of 12%. Round to the nearest dollar. 5-9 $30,000 10 1-4 $20,000 Years $40,000 Cash Flow per year

> Lee Childs is negotiating a contract to do some work for Haas Corp. over the next five years. Haas proposes to pay Lee $10,000 at the end of each of the third, fourth and fifth years. No payments will be received prior to that time. If Lee discounts t

> Amy’s uncle died recently and left her some money in a trust that will pay her $500 per month for five years starting on her twenty fifth birthday. Amy is getting married soon, and would like to use this money as a down payment on a house now. If the tru

> Joan Colby is approaching retirement and plans to purchase a condominium in Florida in three years. She now has $40,000 saved toward the purchase in a bank account that pays 8% compounded quarterly. She also has five $1,000 face value corporate bonds th

> Carol Pasca just had her fifth birthday. As a birthday present, her uncle promised to contribute $300 per month to her education fund until she turns 18 and starts college. Carol’s parents estimate college will cost $2,500 per month for four years, but d

> A financial plan has to be either a prediction about the future or a statement of goals; it can't be both. Explain this statement and comment on its validity.

> Merritt Manufacturing needs to accumulate $20 million to retire a bond issue that matures in 13 years. The firm’s manufacturing division can contribute $100,000 per quarter to an account that will pay 8%, compounded quarterly. How much will the remaining

> Janet Elliott just turned 20, and received a gift of $20,000 from her rich uncle. Janet plans ahead and would like to retire on her 55th birthday. She thinks she’ll need to have about $2 million saved by that time in order to maintain her lavish lifest

> Joe Trenton expects to retire in 15 years and has suddenly realized that he hasn’t saved anything toward that goal. After giving the matter some thought, he has decided that he would like to retire with enough money in savings to withdraw $85,000 per ye

> Clyde Atherton wants to buy a car when he graduates college in two years. He has the following sources of money: 1. He has $5,000 now in the bank in an account paying 8% compounded quarterly. 2. He will receive $2,000 in one year from a trust. 3. He'll

> The Stein family wants to buy a small vacation house in a year and a half. They expect it to cost $75,000 at that time. They have the following sources of money 1. They currently have $10,000 in a bank account that pays 6% compounded monthly. 2. Uncle Mu

> The real risk-free rate is 2.5%. The maturity risk premium is 0.1% for 1-year maturities, growing by 0.2% per year up to a maximum of 1.0%. The interest rate on 4-year treasuries (federal government bonds) is 6.2%, 7.5% on 8-year treasuries and 8.0% on 1

> Local banks are all offering 6% compounded monthly on five-year Certificates of Deposit. Hanover Bank has offered continuous compounding at the same rate on new CDs hoping to attract additional customers. Sharon Shaker has just received a $50,000 royalt

> Roper Metals Inc. is in negotiations to acquire the Hanson Sheet Metal Company. Hanson’s after-tax earnings have averaged $19 million per year for the last four years without much variation around that average figure. So far discussions have been about

> How long will it take a payment of $500 per quarter to amortize a loan of $8,000 at 16% compounded quarterly? Approximate your answer in terms of years and months. How much less time will it take if loan payments are made at the beginning of each month

> Lansing Inc., a profitable food products manufacturer, has undertaken a major expansion that will be financed by new debt and equity issues as well as earnings. During the last year the company borrowed $5 million for a term of 30 years to finance a new

> Your friend Charlie is excited about a newly issued stock. You've looked at the company's prospectus and feel it's a very risky venture. You told Charlie your opinion, and he said he wasn't worried because the stock has been approved by the SEC and ther

> Harrison Conway is choosing between a fix rate and an adjustable rate mortgage (ARM) for $300,000. Both are 30-year mortgages with monthly payments and compounding. The fixed rate is offered at 8% while the initial rate on the ARM is 6%. Harrison is c

> Adam Wilson just purchased a home and took out a $250,000 mortgage for 30 years at 8%, compounded monthly. a. How much is Adam’s monthly mortgage payment? b. How much sooner would Adam pay off his mortgage if he made an additional $100 payment each mont

> What are the payments to interest and principal during the twenty-fifth year of the loan?

> How soon would the loan be paid off if the borrower made a single additional payment of $33,000 to reduce principal at the end of the fifth year?

> Assume we’re at the end of “this year” planning “next year’s” financial statements. Calculate the following using indirect planning assumptions as indicated. (To keep the calculations simple formulate ratios using ending balance sheet figures only.) a.

> Ryan and Laurie Middleton just purchased their first home with a traditional (monthly compounding and payments) 6% 30-year mortgage loan of $178,000. a. How much is their monthly payment? b. How much interest will they pay the first month? c. If they ma

> Calculate all of the ratios discussed in the chapter for the Axtel Company of problem 5. Assume Axtel had leasing costs of $7,267,000 and amortization of $1,416,000 in 20X1, and had 1,268,000 shares of stock outstanding that were valued at $28.75 per sh

> Linden Corp. has a 10% market share in its industry. Below are income statements ($M) for Linden and for the industry. a. Develop common sized income statements for Linden and the industry as a whole. b. What areas should management focus on to impr

> The Bubar Building Co. has the following current financial results ($000). On the average, other building companies pay about one quarter of their earnings in dividends, earn about six cents on the sales dollar, carry assets worth about six months of s

> Describe the nature and purpose of dark pools. Who runs dark pools for whose benefit?

> The Seymour Corp attempted to increase sales rapidly in 20X1 by offering a new, low cost product line designed to appeal to credit customers in relatively poor financial condition. The company sold no new stock during the year but paid dividends of $3,0

> Paxton Sheet Metal Works Inc. is about to acquire a new stamping press that costs $400,000. It is considering purchasing the asset with money it can borrow at 10% repayable in annual, year-end installments over six years. It has also been offered an op

> Problem 22 in Chapter 8 concerned the Rollins Metal Company, which is engaged in long-term planning. The firm is trying to choose among several strategic options that imply different future growth rates and risk levels. Reread that problem now. The CAP

> The Picante Corp's beta is .7. Treasury bills yield 5% and an average stock yields 10%. a. Write and sketch the SML, and locate Picante on it. Calculate Picante's required rate of return and show it on the graph. b. Assume the yield on Treasury bills s

> The Griffin Company is launching a maritime project by purchasing a small, previously owned cargo ship for $2M which will be used to ferry iron ore across the Great Lakes The ship will be depreciated over four years straight line. Freight revenue and ex

> EverFit Inc. manufactures commercial grade fitness equipment used in spas and health clubs. The firm produces complex resistance exercise machines designed to strengthen specific muscles. EverFit’s engineering department designs the equipment and then

> Griffin-Kornberg is reviewing the following projects for next year’s capital program. Projects A and B are mutually exclusive and so are Projects D and E. Griffin-Kornberg has a 9% cost of capital and a maximum of $14 million to spen

> Smithson Hydraulics Inc. carries an inventory of valves that cost $25 each. The firm's inventory carrying cost is approximately 18% of the value of the inventory. It costs $38 to place, process, and receive an order. The firm uses 20,000 valves a year

> Sharon’s Sweater Shop orders 5,000 sweaters per year from a supplier at a wholesale cost of $65 each. Carrying costs are 22% of cost, and it costs $52 to place and receive an order. How many orders should Sharon place with the supplier each year and ho

> The Kranberry Kids Klothing Kompany is in the volatile garment business. The firm has annual revenues of $250 million and operates with a 30% gross margin on sales. Bad debt losses average 3% of revenues. Kranberry is contemplating an easing of its cr

> Financial planning is no longer a problem in business because of the advent of personal computers. Armed with a computer and the appropriate software, anyone can do a plan for even the largest and most complicated company. Evaluate this statement.

> Over the past few years, the marketing department at Goldston & Co has convinced the finance department to permit credit sales to increasingly marginal customers. Revenue has risen as a result, but bad debts are now at 6% of sales. Finance has suggested

> The Bailey Machine Tool Company thinks it can increase sales by $10M by loosening its credit standards somewhat. The firm normally experiences bad debts of about 2% of sales, but marketing estimates that the incremental business would be from financially

> Bozarth Business Machines (BBM) has analyzed the value of implementing a lock box system. The firm anticipates revenues of $630 million with an average invoice of $1,500. BBM borrows at 12% and has made an arrangement with Old Second Bank to manage a l

> Colburn Inc. is considering a lock box system. The firm has analyzed its credit receipts and determined the following: Average time checks are in mail – 3 days Average internal check processing time – 3 days Average to clear the banking system – 2 days T

> The Hadley Motor Company is located in Florida but has a number of customers in the Pacific Northwest. Sales to those customers are $30 million a year paid in checks that average about $1,500. The checks take an average of nine days to clear into Hadle

> Tambourines Inc. collects $12M per year from customers in a remote location. The average remittance check is $1,200. A lock box system would shorten the overall float on these receipts from 8 days to 7 days, but would cost $2,500 per year plus $.20 per

> The Shamrock Company has a raw materials inventory of $20M, which is completely replaced approximately 10 times a year. The Bridgewater Bank is willing to advance financing of 75% of the value of Shamrock's inventory at an interest rate of 12%. However

> Central City Bank will lend Williams Inc. 60% of the value of its inventory at 12% if Williams will pledge the inventory as collateral for the loan. The bank also insists that Williams employ a warehousing company to monitor and control the inventoried

> The Hamilton Corp has 35,000 shares of common stock outstanding with a book value of $20 per share. It owes creditors $1.5 million at an interest rate of 12%. Selected financial results are as follows. Restructure the financial line items shown assum

> Garwood Industries has filed for bankruptcy and will probably be liquidated. The firm’s balance sheet is shown below: ($M) The administrative costs of bankruptcy total $1.6 million. Current assets can be sold for 60% of book value,

> Contrast planning cash requirements, especially borrowing, using the statement of cash flows derived from forecast financial statements with a cash budget. Which is likely to be more useful in running a finance department?

> Lee & Long, a clothing manufacturer, is considering filing for bankruptcy. The firm has EBIT of $1.4 million, and long-term debt of $40 million on which it pays interest at an average rate of 8.5%. It also has fixed assets (gross) totaling $60 million.

> Hanover Inc. spent £11.5 million building a factory in England several years ago when the British Pound cost $1.5500. The plant operation was set up as a British subsidiary to manufacture Hanover’s product for sale and distribution in the U.K. and Europe

> The Latimore Company invested $8.5 million in a new plant in Italy when the exchange rate was 1.1500 euros to the dollar. At the end of the year, the rate was 1.2000 euros to the dollar (indirect quotes). a. Did Latimore make or lose money on the exchan

> In the last problem, assume that the cash flow from the Downhill acquisition grows at 10% from its initial value for one year and then grows at 5% indefinitely (starting in the third year). Calculate the value of the firm and the implied stock price und

> Frozen North Outfitters Inc. makes thermal clothing for winter sports and outdoor work, and is considering acquiring Downhill Fashions Corp. which manufactures and sells ski clothing. Downhill is about one quarter of Frozen's size and manufactures its e

> Benson's Markets is a five-store regional supermarket chain that has done very well by using modern management and distribution techniques. Benson competes with Foodland Inc., a larger chain with 10 stores. However, Foodland has not kept pace with tech

> Hirschler Motors is considering making a takeover bid for the chain of Richard’s Auto Superstores. Richard’s has 800,000 shares of stock outstanding that is trading at $18 per share. Richard’s generated $2.5 million in cash last year, and cash flows ar

> Steve Harris, CFO of Alston Concrete Products, is currently evaluating the purchase of an innovative machine that tests the strength of concrete. The machine is sold only in England and Alston has a price quote at £52,500 from the manufacturer that’s go

> The Johnson Machine Tool Company is thinking of acquiring Lansing Gear Works Inc. Lansing’s is a stable company that produces cash flows of $525,000 per year. That figure isn’t expected to change in the near future, and no synergies are expected from t

> Harrison Ltd. is considering acquiring Pugs International Inc. Pugs had cash flows of $15 million last year and has 2.5 million shares outstanding which are currently selling at $29 per share. The discount rate for analysis has been correctly estimated

> What is a yield curve? Briefly outline three theories that purport to explain its shape. How does the yield curve influence the behavior of lenders?

> The Langley Corporation is in a seasonal business. It requires a permanent base of net working capital of $10 million all year long, but that requirement temporarily increases to $20 million during a four-month period each year. Langley has three finan

> A Japanese importer owes an American exporter $450,520. a. What is her bill in yen if she pays immediately? b. What would the bill be if the importer wanted to lock in an exchange rate today but pay in 3 months? The dollar is expected to strengthen by

> The target of an acquisition generates cash flows of $8M per year with a risk level consistent with a return on equity of 16%. a. How much should an acquirer be willing to pay if it won’t consider more than five years of future earnings in setting a pr

> The Appleridge Company is a large manufacturer of capital goods. (The demand for capital goods typically swings up and down a great deal between good and bad economic times.) Business has been good lately and is expected to remain so in the foreseeable

> The Revere Company currently has good earnings and a capital structure that's 20% debt. Its EPS is in the upper quarter of firms in its industry. Top management's compensation is in large part based on the year-end price of the company's stock. It's n

> You're the CFO of Axelrod Trucking, a privately held firm whose owner, Joe Axelrod, is interested in selling the company and retiring. He therefore wants to pump up its value by any means possible. Joe read an article about leverage in a business magaz

> You're the CFO of a small company that is considering a new venture. The president and several other members of management are very excited about the idea for reasons related to engineering and marketing rather than profitability. You've analyzed the p

> The Armageddon Corp is in big trouble. Sales are down and profits are off. On top of that, the firm's credit rating has been reduced so it's facing very high interest rates on anything it borrows in the future. Current long-term borrowing represents 60

> Wilson Petroleum is a local distributor of home heating oil. The firm also installs and services furnaces and heating systems in homes and small commercial buildings. The customer service department maintains sales and service records on current custom

> The Capricorn Company is launching a new venture in a field related to, but separate from, its present business. Management is proposing that financing for the new enterprise be supplied by a local bank that it has approached for a loan. Capricorn's fi

> Comment on the value of the formula (EFR) approach to estimating funding requirements. Could it create more problems than it solves?

> Whitefish Inc. operates a fleet of 15 fishing boats in the North Atlantic Ocean. Fishing has been good in the last few years, as has the market for product, so the firm can sell all the fish it can catch. Charlie Bass, the vice president for operations