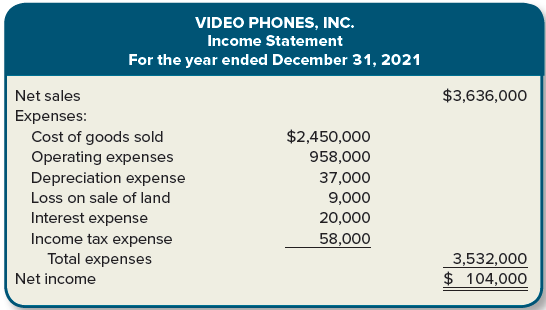

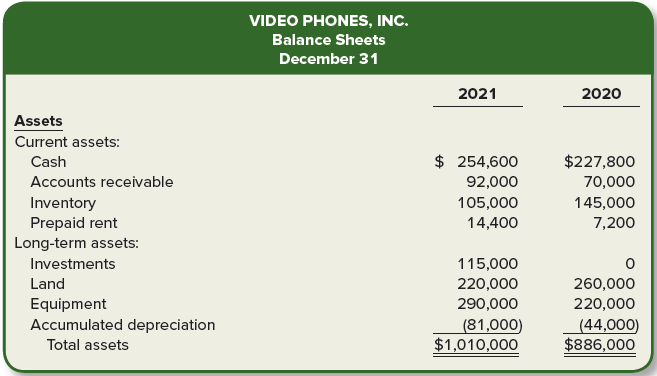

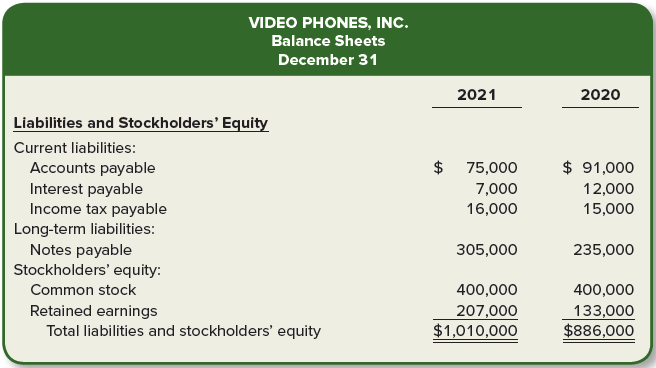

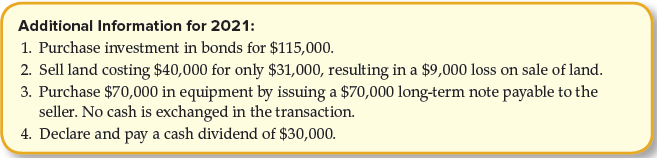

Question: The income statement, balance sheets, and

The income statement, balance sheets, and additional information for Video Phones, Inc., are provided.

Required:

Prepare the statement of cash flows using the indirect method. Disclose any noncash transactions in an accompanying note.

> At the end of February, Howard Productions’ accounting records reveal a balance for cash equal to $19,225. However, the balance of cash in the bank at the end of February is only $735. Howard is concerned and asks the companyâ

> The general ledger of Jackrabbit Rentals at January 1, 2021, includes the following account balances: The following is a summary of the transactions for the year: 1. January 12 Provide services to customers on account, $62,400. 2. February 25 Provide se

> The general ledger of Pipers Plumbing at January 1, 2021, includes the following account balances: The following is a summary of the transactions for the year: 1. January 24 Provide plumbing services for cash, $20,000, and on account, $65,000. 2. March 1

> Jaguar Auto Company provides general car maintenance to customers. The company’s fiscal year-end is December 31. The December 31, 2021, trial balance (before any adjusting entries) appears below. In addition, the company had the followi

> The year-end financial statements of Fighting Illini Financial Services are provided below. Required: 1. Record year-end closing entries. 2. Prepare a post-closing trial balance. (Hint: The balance of retained earnings will be the amount shown in the bal

> Orange Designs provides consulting services related to home decoration. Orange Designs provides customers with recommendations for a full range of home décor, including window treatments, carpet and wood flooring, paint colors, furniture, an

> Grasshopper Lawn Service provides general lawn maintenance to customers. The company’s fiscal year-end is December 31. Information necessary to prepare the year-end adjusting entries appears below. 1. On October 1, 2021, Grasshopper lent $60,000 to anoth

> The information necessary for preparing the 2021 year-end adjusting entries for Bearcat Personal Training Academy appears below. Bearcat’s fiscal year-end is December 31. 1. Depreciation on the equipment for the year is $7,000. 2. Salaries earned (but no

> Horned Frogs Fine Cooking maintains its books using cash-basis accounting. However, the company recently borrowed $50,000 from a local bank, and the bank requires the company to provide annual financial statements prepared using accrual-basis accounting

> Consider the following transactions. Required: For each transaction, determine the amount of revenue or expense, if any, that is recorded under accrual-basis accounting and under cash-basis accounting.

> Financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. What was the amount of increase or decrease in cash and cash equivalents for the most recent year? 2. What was net cash from operating activities for the mos

> Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1. For the most recent year, what amount does American Eagle report for current assets? What is the ratio of current assets to total assets? 2. For the

> Thunder Cat Services specializes in training and veterinary services to household pets, such as dogs, birds, lizards, fish, horses, and of course, cats. After the first 11 months of operations in 2021, Thunder Cat has the following account balances: The

> Buckeye Incorporated had the following balances at the beginning of November. The following transactions occur in November. November 1 Issue common stock in exchange for $13,000 cash. November 2 Purchase equipment with a long-term note for $3,500 from Sp

> Below are the transactions for Salukis Car Cleaning for June, the first month of operations. June 1 Obtain a loan of $70,000 from the bank by signing a note. June 2 Issue common stock in exchange for cash of $40,000. June 7 Purchase car wash equipment

> Below are account balances of Ducks Company at the end of September. Required: Prepare a trial balance by placing amounts in the appropriate debit or credit column and determining the balance of the Service Revenue account.

> Refer to the transactions described in P2–4B. Required: 1. Record transactions for Olivia’s Maintenance Services. Keep in mind that Olivia may not need to record each transaction. 2. Using the format shown, indicate th

> Eli owns an insurance office, while Olivia operates a maintenance service that provides basic custodial duties. For the month of May, the following transactions occurred. May 2 Olivia decides that she will need insurance for a one-day special event at

> Below is a list of typical accounts. Required: For each account, indicate (1) the type of account and (2) whether the normal account balance is a debit or credit. For type of account, choose from asset, liability, stockholders’ equity,

> Below is a list of activities for Vikings Incorporated. Required: For each activity, indicate the impact on the accounting equation. After doing all the transactions, ensure that the accounting equation remains in balance.

> Below is a list of activities for Tigers Corporation. Required: For each activity, indicate whether the transaction increases, decreases, or has no effect on assets, liabilities, and stockholders’ equity.

> Listed below are several terms and definitions associated with the FASB’s conceptual framework. Required: Pair each term with its related definition.

> Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1. What was the amount of increase or decrease in cash and cash equivalents for the most recent year? 2. What was net cash from operating activities for

> The four underlying assumptions of generally accepted accounting principles are economic entity, monetary unit, periodicity, and going concern. Consider the following four independent situations. 1. Mound Builders Groceries has over 1,000 grocery stores

> Tar Heel Corporation provides the following information at the end of 2021. Required: Prepare the income statement, statement of stockholders’ equity, and balance sheet for Tar Heel Corporation on December 31, 2021.

> Below are incomplete financial statements for Cyclone, Inc. Required: Calculate the missing amounts.

> Gator Investments provides financial services related to investment selections, retirement planning, and general insurance needs. At the end of the year on December 31, 2021, the company reports the following amounts: In addition, the company had common

> Account classifications include assets, liabilities, stockholders’ equity, dividends, revenues, and expenses. Required: For each transaction, indicate whether the related account would be classified in the balance sheet as (a) an asset,

> Below are typical transactions for Caterpillar Inc. Required: Indicate whether each transaction is classified as a financing, investing, or operating activity.

> Viking Voyager specializes in the design and production of replica Viking boats. On January 1, the company issues $3,000,000 of 7% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. The market interest rate o

> As a long-term investment at the beginning of the year, Acquisitions, Inc., purchased 3 million shares (30%) of Takeover Target’s 10 million shares outstanding for $52 million. During the year, Takeover Target earned net income of $9 million and distribu

> Emmitt, Walter, and Barry form a company named Long Run Investments, with the intention of investing in stocks with great long-run potential. A clothing company named National League Gear looks like a great investment prospect. National League Gear has t

> Barry, Hank, and Babe form a company named Long Ball Investments, hoping to find that elusive home run stock. A new clothing company by the name of Major League Apparel has caught their eye. Major League Apparel has two classes of stock authorized: 5%, $

> The income statement, balance sheets, and additional information for Great Adventures, Inc., are provided below. Required: Prepare the statement of cash flows for the year ended December 31, 2022, using the indirect method.

> Justin Investor, Inc., purchases $180,000 of 8% bonds from M.R. Bonds Company on January 1. Management intends to hold the debt securities to maturity. For bonds of similar risk and maturity, the market yield is 10%. Justin paid $152,000 for the bonds. I

> Hollywood Tabloid needs a new state-of-the-art camera to produce its monthly magazine. The company is looking at two cameras that are both capable of doing the job and has determined the following: Camera 1 costs $6,000. It should last for eight years an

> Bruce is considering the purchase of a restaurant named Hard Rock Hollywood. The restaurant is listed for sale at $1,000,000. With the help of his accountant, Bruce projects the net cash flows (cash inflows less cash outflows) from the restaurant to be t

> Alec, Daniel, William, and Stephen decide today to save for retirement. Each person wants to retire by age 65 and puts $11,000 into an account earning 10% compounded annually. Required: Calculate how much each person will have accumulated by the age of 6

> Income statement and balance sheet data for Virtual Gaming Systems are provided below. Required: 1. Calculate the following risk ratios for 2021 and 2022: a. Receivables turnover ratio. b. Inventory turnover ratio. c. Current ratio. d. Debt to equity r

> Data for Virtual Gaming Systems are provided in P12–4A. Earnings per share for the year ended December 31, 2021, are $1.40. The closing stock price on December 31, 2021, is $28.30. Required: Calculate the following profitability ratios for 2021. 1. Gross

> The following income statement and balance sheets for Virtual Gaming Systems are provided. Required: Assuming that all sales were on account, calculate the following risk ratios for 2021. 1. Receivables turnover ratio. 2. Average collection period. 3. In

> The balance sheets for Sports Unlimited for 2021 and 2020 are provided below. Required: 1. Prepare a vertical analysis of Sports Unlimited’s 2021 and 2020 balance sheets. Express each amount as a percentage of total assets for that year

> The income statements for Anything Tennis for the years ending December 31, 2021 and 2020, are provided below. Required: 1. Complete the “Amount” and “%” columns to be used in a hori

> Sports Emporium has two operating segments: sporting goods and sports apparel. The income statement for each operating segment is presented below. Required: 1. Complete the “%” columns to be used in a vertical analysis

> Renegade Clothing is struggling to meet analysts’ forecasts. It’s early December 2021, and the year-end projections are in. Listed below are the projections for the year ended 2021 and the comparable actual amounts for

> Cash flows from operating activities for both the indirect and direct methods are presented for Reverse Logic. All amounts are in thousands (000s). Required: Complete the following income statement for Reverse Logic. Assume all accounts payable are to su

> Data for Video Phones, Inc., are provided in P11–4A. Required: Prepare the statement of cash flows for Video Phones, Inc., using the direct method. Disclose any noncash transactions in an accompanying note.

> Refer to the information provided in P11–3A for Alliance Technologies. Required: Prepare the operating activities section of the statement of cash flows for Alliance Technologies using the direct method.

> Cyberdyne Systems and Virtucon are competitors focusing on the latest technologies. Selected financial data is provided below. Required: 1. Calculate the return on assets for both companies. 2. Calculate the cash return on assets for both companies. 3. C

> Portions of the financial statements for Alliance Technologies are provided below. Required: Prepare the operating activities section of the statement of cash flows for Alliance Technologies using the indirect method.

> Seth Erkenbeck, a recent college graduate, has just completed the basic format to be used in preparing the statement of cash flows (indirect method) for ATM Software Developers. All amounts are in thousands (000s). Listed below in random order are line i

> Listed below are several transactions. For each transaction, indicate by letter whether the cash effect of each transaction is reported in a statement of cash flows as an operating (O), investing (I), financing (F), or noncash (NC) activity. Also, indica

> Khaki Republic sells clothing and accessories through premium outlet locations and online. Selected financial data for Khaki Republic is provided as follows: Required: 1. Calculate the return on equity for Khaki Republic. How does it compare with the ret

> Major League Apparel has two classes of stock authorized: 6%, $10 par preferred, and $1 par value common. The following transactions affect stockholders’ equity during 2021, its first year of operations: January 2 Issue 110,000 shares of common stock for

> Preferred stock has characteristics of both liabilities and stockholders’ equity. Convertible bonds are another example of a financing arrangement that blurs the line between liabilities and stockholders’ equity. Items like these have led some to conclud

> Refer to the information provided in P10–2A. Required: Taking into consideration the beginning balances on January 1, 2021 and all the transactions during 2021, respond to the following for Donnie Hilfiger: 1. Prepare the stockholders’ equity section of

> The stockholders’ equity section of Velcro World is presented here. Required: Based on the stockholders’ equity section of Velcro World, answer the following questions. Remember that all amounts are presented in thousa

> Sammy’s Sportshops has been very profitable in recent years and has seen its stock price steadily increase to over $100 per share. The CFO thinks the company should consider either a 100% stock dividend or a 2-for-1 stock split. Require

> Donnie Hilfiger has two classes of stock authorized: $1 par preferred and $0.01 par value common. As of the beginning of 2021, 300 shares of preferred stock and 4,000 shares of common stock have been issued. The following transactions affect stockholders

> Match (by letter) the following terms with their definitions. Each letter is used only once. Definitions a. The amount invested by stockholders. b. Shares available to sell. c. Shares can be returned to the corporation at a predetermined price. d. The ea

> Selected financial data for Bahama Bay and Caribbean Key are as follows: Required: 1. Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year. Which company has the higher ratio? 2. Calculate the return on assets for

> Coney Island Entertainment issues $1,300,000 of 7% bonds, due in 15 years, with interest payable semiannually on June 30 and December 31 each year. Required: Calculate the issue price of a bond and complete the first three rows of an amortization schedul

> On January 1, 2021, Universe of Fun issues $900,000, 8% bonds that mature in 10 years. The market interest rate for bonds of similar risk and maturity is 9%, and the bonds issue for $841,464. Interest is paid semiannually on June 30 and December 31. Requ

> On January 1, 2021, Vacation Destinations issues $40 million of bonds that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below: Required: 1. Were the bonds issued at face amount, a discount, or a

> On January 1, 2021, Twister Enterprises, a manufacturer of a variety of transportable spin rides, issues $600,000 of 8% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year. Required: 1. If the market interest r

> EDGAR, the Electronic Data Gathering, Analysis, and Retrieval system, is a giant database of documents the U.S. Securities and Exchange Commission (SEC) requires that companies submit. All publicly traded domestic companies use EDGAR to make the majority

> Thrillville has $41 million in bonds payable. One of the contractual agreements in the bond is that the debt to equity ratio cannot exceed 2.0. Thrillville’s total assets are $81 million, and its liabilities other than the bonds payable are $11 million.

> On January 1, 2021, Strato Corporation borrowed $2 million from a local bank to construct a new building over the next three years. The loan will be paid back in three equal installments of $776,067 on December 31 of each year. The payments include inter

> On January 1, 2021, Gundy Enterprises purchases an office for $360,000, paying $60,000 down and borrowing the remaining $300,000, signing a 7%, 10-year mortgage. Installment payments of $3,483.25 are due at the end of each month, with the first payment d

> Selected financial data regarding current assets and current liabilities for ACME Corporation and Wayne Enterprises, are as follows: Required: 1. Calculate the current ratio for ACME Corporation and Wayne Enterprises. Which company has the better ratio?

> Dinoco Petroleum faces three potential contingency situations, described below. Dinoco’s fiscal year ends December 31, 2021, and it issues its 2021 financial statements on March 15, 2022. Required: Determine the appropriate means of reporting each situat

> The ink-jet printing division of Environmental Printing has grown tremendously in recent years. Assume the following transactions related to the ink-jet division occur during the year ended December 31, 2021. Required: Record any amounts as a result of e

> Texas Roadhouse opened a new restaurant in October. During its first three months of operation, the restaurant sold gift cards in various amounts totaling $3,500. The cards are redeemable for meals within one year of the purchase date. Gift cards totalin

> The University of Michigan football stadium, built in 1927, is the largest college stadium in America, with a seating capacity of 114,000 fans. Assume the stadium sells out all six home games before the season begins, and the athletic department collects

> Vacation Destinations offers its employees the option of contributing up to 7% of their salaries to a voluntary retirement plan, with the employer matching their contribution. The company also pays 100% of medical and life insurance premiums. Assume that

> Caribbean Tours’ total payroll for the month of January was $600,000. The following withholdings, fringe benefits, and payroll taxes apply: Assume that none of the withholdings or payroll taxes has been paid by the end of January (recor

> Brooke Remming is the Chief Executive Officer of Dundem Corp. The board of directors has agreed to pay Brooke a salary of $400,000 plus a 15% bonus if the company’s pretax income increases by at least 10% from the prior year. In the prior year, Dundem re

> Precision Castparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $41 million cash on October 1, 2021, to provide working capital for anticipated expansion. Precision signs a one-year, 9% promissory note to M

> Listed below are several terms and phrases associated with current liabilities. Pair each item from List A (by letter) with the item from List B that is most appropriately associated with it.

> Sub Station and Planet Sub reported the following selected financial data ($ in thousands). Sub Station’s business strategy is to sell the best-tasting sandwich with the highest- quality ingredients. Planet Sub’s busin

> New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $700,000. The ovens originally cost $910,000, had an estimated service life of 10 years, had an estimated residual value of

> Solich Sandwich Shop had the following long-term asset balances as of December 31, 2021: Solich purchased all the assets at the beginning of 2019 (3 years ago). The building is depreciated over a 10-year service life using the double-declining-balance me

> The following information relates to the intangible assets of University Testing Services (UTS): a. On January 1, 2021, UTS completed the purchase of Heinrich Corporation for $3,510,000 in cash. The fair value of the net identifiable assets of Heinrich w

> University Car Wash built a deluxe car wash across the street from campus. The new machines cost $270,000 including installation. The company estimates that the equipment will have a residual value of $24,000. University Car Wash also estimates it will u

> Several years ago, Health Services acquired a helicopter for use in emergency situations. Health Services incurred the following expenditures related to the helicopter delivery operations in the current year: 1. Overhauled the engine at a cost of $7,500.

> Fresh Cut Corporation purchased all the outstanding common stock of Premium Meats for $12,000,000 in cash. The book values and fair values of Premium Meats’ assets and liabilities were. Required: 1. Calculate the amount Fresh Cut should

> Great Harvest Bakery purchased bread ovens from New Morning Bakery. New Morning Bakery was closing its bakery business and sold its two-year-old ovens at a discount for $700,000. Great Harvest incurred and paid freight costs of $35,000, and its employees

> Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. The stock prices as of February 3, 2018, for American Eagle and Buckle wer

> University Hero is considering expanding operations beyond its healthy sandwiches. Jim Axelrod, vice president of marketing, would like to add a line of smoothies with a similar health emphasis. Each smoothie would include two free health supplements suc

> The Italian Bread Company purchased land as a factory site for $70,000. An old building on the property was demolished, and construction began on a new building. Costs incurred during the first year are listed as follows: Required: Determine the amounts

> Refer to the transactions of CD City in P6–3A. Required: 1. Assuming that CD City uses a periodic inventory system, record the transactions. 2. Record the month-end adjustment to inventory, assuming that a final count reveals ending inventory with a cost

> Wawa Food Markets is a convenience store chain located primarily in the Northeast. The company sells gas, candy bars, drinks, and other grocery-related items. St. Jude Medical Incorporated sells medical devices related to cardiovascular needs. Suppose a

> Baskin-Robbins is one of the world’s largest specialty ice cream shops. The company offers dozens of different flavors, from Very Berry Strawberry to lowfat Espresso ’n Cream. Assume that a local Baskin-Robbins in Rale

> At the beginning of October, Bowser Co.’s inventory consists of 50 units with a cost per unit of $50. The following transactions occur during the month of October. October 4 Purchase 130 units of inventory on account from Waluigi Co. for $50 per unit, te

> For the current year, Parker Games has the following inventory transactions related to its traditional board games. Required: 1. Using FIFO, calculate ending inventory and cost of goods sold. 2. Using LIFO, calculate ending inventory and cost of goods so

> A local Chevrolet dealership carries the following types of vehicles: Because of recent increases in gasoline prices, the car dealership has noticed a reduced demand for its SUVs, vans, and trucks. Required: 1. Compute the total cost of the entire invent

> At the beginning of July, CD City has a balance in inventory of $3,400. The following transactions occur during the month of July. July 3 Purchase CDs on account from Wholesale Music for $2,300, terms 1/10, n/30. July 4 Pay cash for freight charges

> Greg’s Bicycle Shop has the following transactions related to its top-selling Mongoose mountain bike for the month of March. Required: 1. Calculate ending inventory and cost of goods sold at March 31, using the specific identification m

> Financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. What is the par value per share for the common stock? 2. How many common shares were issued at the end of the most recent year? 3. Did the company have any t

> Over a four-year period, Jackie Corporation reported the following series of gross profits. In 2021, the company performed a comprehensive review of its inventory accounting procedures. Based on this review, company records reveal that ending inventory w