Question: The information that follows relates to equipment

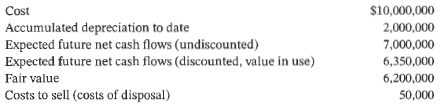

The information that follows relates to equipment owned by Gaurav Limited at December 31, 2020:

Assume that Gaurav will continue to use this asset in the future. As at December 31, 2020, the equipment has a remaining useful life of four years. Gaurav uses the straight-line method of depreciation.

Instructions

a. Assume that Gaurav is a private company that follows ASPE.

1. Prepare the journal entry at December 31, 2020, to record asset impairment, if any.

2. Prepare the journal entry to record depreciation expense for 2021.

3. The equipment's fair value at December 31, 2021 is $6.5 million. Prepare the journal entry, if any, to record the increase in fair value.

b. Repeat the requirements in part (a) above assuming that Gaurav is a public company that follows IFRS.

c. Referring to the qualitative characteristics identified in the conceptual framework for financial

reporting (discussed in Chapter 2), discuss the differences between the cost recovery impairment model and the rational entity impairment model. Which method is preferred?

> Assume the facts given in E6.37 except that Vaughn's non-cancellable fixed price contract with Atlantis is for $9.5 million. Billings and collections are lower in 2022 by $500,000 each. Instructions a. Using the percentage-of-completion method, calcul

> Assume the facts given in E6.37 except now assume that the construction industry has experienced significant expansion, making construction materials and labor more costly than originally estimated. Vaughn finds it extremely difficult to estimate the cos

> Vaughn Enterprises Ltd. has entered into a contract beginning in February 2020 to build two warehouses for Atlantis Structures Ltd. The contract is a non-cancellable fixed price contract for $10 million. The following data pertain to the construction per

> Shanahan Construction Company has entered into a non-cancellable contract beginning January 1, 2020, to build a parking complex. It has been estimated that the complex will cost $600,000 and will take three years to construct. The complex will be billed

> Yanmei Construction Company began operations on January 1, 2020. During the year, Yanmei entered into a non-cancellable contract with Lundquist Corp. to construct a manufacturing facility. At that time, Yanmei estimated that it would take five years to c

> Hamilton Construction Company uses the percentage-of-completion method of accounting. In 2020, Hamilton began work under non-cancellable contract #E2-D2, which provided for a contract price of $2.2 million. Other details follow: Instructions a. How muc

> On April 1, 2020, Dougherty Inc. entered into a cost plus fixed fee non-cancellable contract to construct an electric generator for Altom Corporation. At the contract date, Dougherty estimated that it would take two years to complete the project at a cos

> During 2020, Nilsen Company started a construction job with a contract price of $1.6 million. The job was completed in 2022. The following information is avai lable. The contract is non-cancellable. Instructions a. Calculate the amount of gross profit

> Neon Limited had 40,000 common shares on January 1, 2020. On April 1, 8,000 shares were repurchased. On August 31, 12,000 shares were issued. Calculate the number of shares outstanding at December 31, 2020, and the weighted average number of shares for 2

> Refer to the information in E6.30. Information of E6.30: Rex's Reclaimers entered into a contract with Dan's Demolition to manage the processing of recycled materials on Dan's various demolition projects. Services for the three-year contract include col

> The following are transactions between Wang Corp., the consignor, and Ren Stores Ltd., the consignee, for the month of June 2020. Wang uses a perpetual inventory system and has a separate perpetual record for inventory sent out on consignment. At the end

> On May 31, 2020, Eisler Company consigned 80 freezers, costing $500 each, to Remmers Company. The cost of shipping the freezers amounted to $740 and was paid by Eisler Company. On December 30, 2020, a report was received from the consignee, indicating th

> Sider Inc., a registered broker, enters into a finder's fee agreement with HOM Homes Ltd. on June 15, 2020. Sider will find leads in the form of buyers potentially interested in purchasing HO M's real estate holdings. Along with finding potential buyers,

> On October 5, 2020, Diamond in the Rough Recruiting Group Inc.'s board of directors decided to dispose of the Blue Division. A formal plan was approved. Diamond derives approximately 75% of its income from its human resources management practice. The Blu

> Assume that Elrond Inc. decided to sell DemandTV Ltd., a subsidiary, on September 30, 2020. There is a formal plan to dispose of the business component, and the sale qualifies for discontinued operations treatment. Pertinent data on the operations of the

> Pike Corporation, a clothing retailer, had income from operations (before tax) of $375,000, and recorded the following before-tax gains/(losses) for the year ended December 31, 2020: As at January 1, 2020, Pike had one piece of land that had an original

> Canviar Corp. maintains its financial records using the cash basis of accounting. Because it would like to secure a long-term loan from its bank, the company asks you, as an independent CPA, to convert its cash basis income statement information to the a

> In its first year of operations, 2020, Strats Corp. invoiced $172,000 in service revenue. Of that amount, $18,000 was still owing from customers at the end of year. In 2020, Strats incurred various operating expenses totalling $81,000, of which $77,500 w

> At December 31, 2020, Tres Hombres Corporation had the following shares outstanding: 10% cumulative preferred shares, 107,500 shares outstanding…………………..$10,750,000 Common shares, 4,000,000 shares outstanding……………………………………….20,000,000 During 2020, the c

> Use the information in BE4.l 7 to prepare a statement of retained earnings for Global Corporation, assuming that in 2020, Global discovered that it had overstated 2017 depreciation by $40,000 (net of tax of $17,000).

> The shareholders' equity section of Cadmium Corporation as at December 31, 2020, follows: Net income of $24 million for 2020 reflects a total effective tax rate of 25%. Included in the net income figure is a loss of $15 million (before tax) relating to t

> Rainy Day Umbrella Corporation had the following balances at December 31, 2019 (all amounts in thousands): preferred shares, $3,375; common shares, $8,903; contributed surplus, $3,744; retained earnings, $23,040; and accumulated other comprehensive incom

> Eddie Zambrano Corporation, a private company, began operations on January 1, 2017. During its first three years of operations, Zambrano reported net income and declared dividends as follows: Instructions Prepare a 2020 statement of retained earnings fo

> Reach Out Card Company Limited reported the following for 2020: sales revenue, $1.2 million; cost of goods sold, $750,000; selling and administrative expenses, $320,000; gain on disposal of building, $250,000; and unrealized gain-OCI (related to FV-OCI e

> The following balances were taken from the books of Quality Fabrication Limited on December 31, 2020: Assume the total effective tax rate on all items is 25%. Instructions Prepare a multiple-step income statement showing expenses by function. Assume tha

> Two accountants, Yuan Tsui and Sergio Aragon, are arguing about the merits of presenting an income statement in the multiple-step versus the single-step format. The discussion involves the following 2020 information for P. Bride Company (in thousands): C

> The financial records of Geneva Inc. were destroyed by fire at the end of 2020. Fortunately, the controller had kept the following statistical data related to the income statement: 1. The beginning inventory was $84,000 and it decreased by 20% during the

> The following is information for Gottlieb Corp. for the year ended December 31, 2020: The effective tax rate is 25% on all items. Gottlieb prepares financial statements in accordance with IFRS. The FV-OCI equity investments trade on the stock exchange. G

> The following information was taken from the records of Biscay Inc. for the year 2020: The following additional information was also available: income tax applicable to income from continuing operations, $465,000; income tax recovery applicable to loss f

> Income statement information for Flett Tire Repair Corporation for the year 2020 follows: The effective tax rate on all income is 25%, and Flett follows ASPE. Instructions a. Prepare a multiple-step income statement for 2020, showing expenses by function

> Global Corporation prepares financial statements in accordance with ASPE. At January 1, 2020, the company had retained earnings of $1,038,000. In 2020, net income was $335,000, and cash dividends of $70,000 were declared and paid. Prepare a 2020 statemen

> Dr. Gary Morrow, a former surgeon, is the president and owner of Morrow Medical (MM), a private Ontario company that focuses on the design and implementation of various medical and pharmaceutical products. With the recent success of various products put

> Jon Seceda Furnace Corp. purchased machinery for $260,000 on July 1, 2020. It is estimated that it will have a useful life of 10 years, residual value of $40,000, production of 110,000 units, and working hours of 44,000. During 2021, Seceda Corp. uses th

> Deluxe Ezra Company purchases equipment on January 1, 2020, at a cost of $469,000. The asset is expected to have a service life of 12 years and a salvage value of $40,000. Instructions a. Calculate the amount of depreciation for each of 2020, 2021, and 2

> Jared Industries Ltd., a public company, presents you with the following information: Instructions a. Complete the table for the year ended December 31, 2024. The company depreciates all assets for a half year in the year of acquisition and the year of d

> Jupiter Wells Corp. purchased machinery for $315,000 on May 1, 2020. It is estimated that it will have a useful life of 10 years, residual value of $15,000, production of 240,000 units, and 25,000 working hours. The machinery will have a physical life of

> Gambit Corporation purchased a new plant asset on April 1, 2020, at a cost of $769,000. It was estimated to have a useful life of 20 years and a residual value of $300,000, a physical life of 30 years, and a salvage value of $0. Gambit's accounting perio

> Diderot Corp. acquired a property on September 15, 2020, for $220,000, paying $3,000 in transfer taxes and a $1,500 real estate fee. Based on the provincial assessment information, 75% of the property's value was related to the building and 25% to the la

> Barnett Inc. purchased computer equipment on March 1, 2020, for $31, 000. The computer equipment has a useful life of five years and a residual value of $1,000. Barnett uses a double-declining-balance method of depreciation for this type of capital asset

> During 2020, Laiken Limited sold its only Class 3 asset. At the time of sale, the balance of the undepreciated capital cost for this class was $37,450. The asset originally cost $129,500. Instructions a. Calculate recaptured CCA, capital gains, and term

> On August 1, 2020, Iroko Corporation purchased a new machine for its assembly process at a cost of $136,400. The company estimated that the machine would have a trade-in value of $14,200 at the end of its useful life. Its useful life was estimated to be

> The 2020 annual report of Trocchi Inc. contains the following information (in thousands): Instructions a. Calculate the following ratios for Trocchi Inc. for 2020. Round answers to two decimal places. 1. Asset turnover ratio 2. Rate of return on assets 3

> Joe Schreiner, controller for On Time Clock Company Inc., recently prepared the company's income statement and statement of changes in equity for 2020. Schreiner believes that the statements are a fair presentation of the company's financial progress dur

> On April 1, 2020, Lombardi Corp. was awarded $460,000 cash as compensation for the forced sale of its land and building, which were directly in the path of a new highway. The land and building cost $60,000 and $280,000, respectively, when they were acqui

> On December 31, 2019, Grey Inc. owns a machine with a carrying amount of $940,000. The original cost and accumulated depreciation for the machine on this date are as follows: Depreciation is calculated at $60,000 per year on a straight-line basis. Instr

> Consider the following independent situations for Kwok Corporation. Kwok applies ASPE. Situation 1: Kwok purchased equipment in 2013 for $120,000 and estimated a $12,000 residual value at the end of the equipment's 10-year useful life. At December 31, 20

> Jamoka Corporation is a public company that manufactures farm implements, such as tractors, combines, and wagons. Jamoka uses the revaluation model per IAS 16, and records asset revaluations using the elimination method. (This means the balance in the ac

> Onkar Corporation bought a machine on June 1, 2016, for $31,800, f.o.b. the place of manufacture. Freight costs were $300, and $500 was spent to install it. The machine's useful life was estimated at 10 years, with a residual value of $1,900, while the m

> Assume the same information as in Ell.22, except that at December 31, 2020, Gaurav discontinues use of the equipment and intends to dispose of it in the coming year by selling it to a competitor. It is expected that the costs of disposal will total $50,0

> Green Thumb Landscaping Limited has determined that its lawn maintenance division is a cash-generating unit under IFRS. The carrying amounts of the division's assets at December 31, 2020, are as follows: The lawn maintenance division has been assessed fo

> Perez Corp., a mining company, owns a significant mineral deposit in a northern territory. Perez prepares financial statements in accordance with IFRS. Included in the asset is a road system that was constructed to give company personnel access to the mi

> The management of Luis Inc., a small private company that uses the cost recovery impairment model, was discussing whether certain equipment should be written down as a charge to current operations because of obsolescence. The assets had a cost of $900,00

> Parfait Limited reported the following for 2020: sales revenue, $900,000; cost of sales, $750,000; operating expenses, $100,000; and unrealized gain on FV-OCI investments, $60,000. The company had January 1, 2020 balances as follows: common shares, $600,

> Finlay Limited constructed a building at a cost of $2.8 million and has occupied it since January 2000. It was estimated at that time that its life would be 40 years, with no residual value. In January 2020, a new roof was installed at a cost of $370,000

> In 1991, Lincoln Limited completed the construction of a building at a cost of $1.8 million; it occupied the building in January 1992. It was estimated that the building would have a useful life of 40 years and a residual value of $400,000. Early in 2003

> Machinery purchased for $56,000 by Wong Corp. on January 1, 2015, was originally estimated to have an eight-year useful life with a residual value of $4,000. Depreciation has been entered for five years on this basis. In 2020, it is determined that the t

> At the beginning of 2020, Kao Company, a small private company, acquired a mine for $850,000. Of this amount, $100,000 was allocated to the land value and the remaining portion to the minerals in the mine. Surveys conducted by geologists found that appro

> Rachel Timber Inc., a small private company that follows ASPE, owns 9,000 hectares of timberland purchased in 2007 at a cost of $1,400 per hectare. At the time of purchase, the land without the timber was valued at $420 per hectare. In 2008, Rachel built

> Wettlauffer Company Ltd. shows the following entries in its Equipment account for 2020. All amounts are based on historical cost. Instructions a. Prepare any necessary correcting entries. b. Assuming that depreciation is to be charged for a full year bas

> Gibbs Inc. purchased a machine on January 1, 2020, at a cost of $60,000. The machine is expected to have an estimated residual value of $5,000 at the end of its five-year useful life. The company capitalized the machine and depreciated it in 2020 using t

> On March 10, 2020, Lucas Limited sold equipment that it bought for $192,000 on August 20, 2013. It was originally estimated that the equipment would have a useful life of 12 years and a residual value of $16,800 at the end of that time, and depreciation

> Jiang Company Ltd. buys equipment on January 1, 2020, for $387,000 cash. The asset is expected to have a useful life of 12 years and a residual value of $39,000. Jiang prepares financial statements under IFRS. Instructions a. Calculate the amount of dep

> Samson Corporation is preparing its December 31, 2020 statement of financial position. The following items may be reported as either current or long-term liabilities: 1. On December 15, 2020, Samson declared a cash dividend of $1.50 per common share to s

> The Big and Rich Corporation had income from operations before tax for 2020 of $4.4 million. In addition, it suffered an unusual and infrequent loss of $1,060,000 from a tornado. Of this amount, $300,000 was insured. In addition, the company realized a l

> The bookkeeper for Garfield Corp. has prepared the following statement of financial position as at July 31, 2020: The following additional information is provided: 1. Cash includes $1,200 in a petty cash fund and $12,000 in a bond sinking fund. 2. The ne

> Bruno Corp. has decided to expand its operations. The bookkeeper recently completed the following statement of financial position in order to obtain additional funds for expansion: Instructions a. Prepare a revised statement of financial position using t

> Use the information in E5.l 7 for Dropafix Inc. Instructions a. Calculate the current and acid-test ratios for 2019 and 2020. b. Calculate Dropafix's current cash debt coverage ratio for 2020. c. Calculate Dropafix's cash debt coverage ratio for 2020. d

> Use the information in E5.14 for Carmichael Industries. Instructions a. Calculate the current and ac id-test ratios for 2019 and 2020. b. Calculate Carmichael's current cash debt coverage ratio for 2020. c. Based on the analyses in parts (a) and (b), co

> Use the information in E5.18 for Sensify Corporation. Instructions a. Calculate the current ratio and debt to total assets ratio as at December 31, 2019 and 2020. Calculate the free cash flow for December 31, 2020. b. Based on the analysis in part (a),

> The comparative statement of financial position of Sensify Corporation as at December 31, 2020, follows: Net income of $37,000 was reported and dividends of $13,000 were declared and paid in 2020. New equipment was purchased, and equipment with a carryin

> The comparative statement of financial position of Dropafix Inc. as at June 30, 2020, and a statement of comprehensive income for the 2020 fiscal year follow: Additional information: 1. Dropa fix follows IFRS. Assume that interest is treated as an operat

> The statement of income of Kneale Transport Inc. for the year ended December 31, 2020, reported the following condensed information: Kneale's statement of financial position included the following comparative data at December 31: Additional information:

> A comparative statement of financial position for Carmichael Industries Inc. follows: Additional information: 1. Net income for the fiscal year ending December 31, 2020, was $129,000. 2. Cash dividends of $60,000 were declared and paid. Dividends paid ar

> It is February 2021 and Janix Corporation is preparing to issue financial statements for the year ended December 31, 2020. To prepare financial statements and related disclosures that are faithfully representative, Janix is reviewing the following events

> Redo the analysis using Excel functions for an annuity due. Will the conclusion reached be the same as in P3.4? Assume the same information as in P3.4.

> The current assets and current liabilities sections of the statement of financial position of Agin court Corp. are as follows: The following errors have been discovered in the corporation's accounting: 1. January 2021 cash disbursements that were entered

> Selected accounts follow of Aramis Limited at December 31, 2020: The following additional information is available: 1. Inventory is valued at the lower of cost and net realizable value using FIFO. 2. Equipment is recorded at cost. Accumulated depreciatio

> Lujie Xie is the controller of Lincoln Corporation and is responsible for the preparation of the year-end financial statements on December 31, 2020. Lincoln prepares financial statements in accordance with ASPE. The following transactions occurred during

> The trial balance of Zhang Ltd. At December 31, 2020, follows: Instructions a. Prepare a classified statement of financial position as at December 31, 2020. Ignore income taxes. b. Is there any situation where it would make more sense to have a statement

> Shannonrock Racing Inc. (SR) is a promoter and sponsor of motorsport activities. It is privately owned. The owner is looking to expand and has approached the local bank,which has agreed to accept financial statements prepared in accordance with ASPE. The

> In the late 1990s, CIBC helped Enron Corporation structure 34 "loans" that appeared in the financial statements as cash proceeds from sales of assets. Enron subsequently went bankrupt in 2001 and left many unhappy investors and creditors with billions of

> Real Estate Investment Trust (RE) was created to hold hotel properties. RE currently holds 15 luxury and first-class hotels in Europe. The entity is structured as an investment trust, which means that the trust does not pay income taxes because it distri

> Findit Gold Inc. (FGI) was created in 2012 and is 25% owned by Findit Mining Corporation (FMC). FGI's shares trade on the local exchange and its objective is to become a substantial low-cost mineral producer in developing countries. FMC provided substant

> TELUS Corporation is one of Canada's largest telecommunications companies and provides both products and services. Its shares are traded on the Toronto and New York stock exchanges, and its credit facilities contain certain covenants relating to the amou

> The Blue Collar Corporation had income from continuing operations of $12.6 million in 2020. During 2020, it disposed of its restaurant division at a loss of $89,000 (net of tax of $38,000). Before the disposal, the division operated at a loss of $315,000

> Rouge Valley Golf and Health Club (RVGH) is a public company that operates eight clubs in a large city and offers one-year memberships. Membership gives members access to golf and the fitness centre including fitness classes. The members may use any of t

> Towers Inc. (TI) is a leader in delivering communications technology that powers global commerce and secures the world's most critical information. Its shares trade on the Canadian and U.S. national stock exchanges. The company had been experiencing unpr

> Environmental Inc. operates in Canada and the United States. Its basic business is high-temperature treatment services for contaminated soil. In its 2020 financial statements, the company had a loss of $9.3 million (and an accumulated deficit of $43.7 mi

> Verity Retail Limited was a private company that experienced cash flow difficulties and hired new management to turn the company around. The company then went public and the shares sold at $15 per share. Within months, however, the share price plummeted

> Oil Company Limited (OCL) is in the oil and gas business and operates internationally. The company is public and lists on the National Stock Exchange. In the past two years, oil prices have been declining significantly. The company's Canadian operations

> Branson Restaurants Limited is currently reviewing its financial operations for the past year. Specifically, it is looking to determine what is happening with one of its restaurants (which it owns - including the land). The following summary gives data a

> Bradford Construction Ltd. submitted a $14.5-million sealed bid for a fixed-price roads contract with the local municipality. Historically, Bradford is awarded 20% of the contracts on which it submits sealed bids. Using the three-step analysis for determ

> The Sarbanes-Oxley Act was enacted to combat fraud and curb poor reporting practices. What are some key provisions of this legislation? Are these provisions in effect in Canada?

> What are the sources of pressure that change and influence the development of accounting principles and standards?

> Ethics Refer to the information for Bradford Construction Ltd. in BE2.5. Assume that the sealed bid for the road contract was submitted on December 28, 2020, that Bradford has a calendar year end, and that the annual financial statements are issued in la

> Use the information in BE4.12 to prepare a multiple-step income statement for Sierra Corporation, showing expenses by function. (b) Assume the average market price for the common shares is $66. What is Sierra's price-earnings ratio?

> Early in its 2020 fiscal year (December 31 year end), Hayes Company purchased 10,000 Kenyon Corporation common shares for $26.18 per share, plus $1,800 in brokerage commissions. These securities were accounted for at FV-OCI (with no recycling), and trans

> Trottier Ltd. has a single debt investment that it accounts for using FV-OCI recycled to net income. The carrying value of the debt investment on July 1 after the collection of interest and amortization of premium was $72,500. To date, $1,500 of unrealiz

> Gauthier Ltd. has a single investment that it accounts for using FV-OCI. The carrying value of the investment at the last reporting period was $72,500. To date, $2,500 of unrealized gains on fair value adjustments have been recorded to other comprehensiv

> Lachapelle Traders Inc. has cyclical cash flows and decided to invest some excess cash on hand by purchasing a 60-day Government of Canada treasury bill. On December 15, 2020, Lachapelle paid $99,509 for a treasury bill that has a maturity amount of $100