Question: The long-term liabilities section of CPS

The long-term liabilities section of CPS Transportation’s December 31, 2017, balance sheet included the following:

a. A lease liability with 15 remaining lease payments of $10,000 each, due annually on January 1:

Lease liability ………………………… $76,061

Less: current portion …………………. 2,394

…………………………………………….. $73,667

The incremental borrowing rate at the inception of the lease was 11% and the lessor’s implicit rate, which was known by CPS Transportation, was 10%.

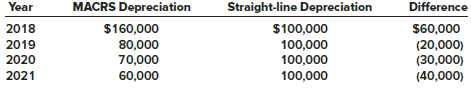

b. A deferred income tax liability due to a single temporary difference. The only difference between CPS Transportation’s taxable income and pretax accounting income is depreciation on a machine acquired on January 1, 2017, for $500,000. The machine’s estimated useful life is five years, with no salvage value. depreciation is computed using the straight-line method for financial reporting purposes and the MACRS method for tax purposes. depreciation expense for tax and financial reporting purposes for 2018 through 2021 is as follows:

The enacted federal income tax rates are 35% for 2017 and 40% for 2018 through 2021. For the year ended December 31, 2018, CPS’s income before income taxes was $900,000.

On July 1, 2018, CPS Transportation issued $800,000 of 9% bonds. The bonds mature in 20 years, and interest is payable each January 1 and July 1. The bonds were issued at a price to yield the investors 10%. CPS records interest at the effective interest rate.

Required:

1. Determine CPS Transportation’s income tax expense and net income for the year ended December 31, 2018.

2. Determine CPS Transportation’s interest expense for the year ended December 31, 2018.

3. Prepare the long-term liabilities section of CPS Transportation’s December 31, 2018, balance sheet.

Transcribed Image Text:

Year MACRS Depreciation Straight-line Depreciation Difference $100,000 100,000 100,000 100,000 2018 $160,000 80,000 70,000 60,000 $60,000 2019 (20,000) (30,000) (40,000) 2020 2021

> Warrick Boards calculated pension expense for its underfunded pension plan as follows: __________________________________________($ in millions) Service cost ………………………………………………..………………………………………….. $224 Interest cost ………………………………………………..….…………………………………………

> Suppose a tax reform bill is enacted that causes the corporate tax rate to change from 34% to 36%. How would this affect an existing deferred tax liability? How would the change be reflected in income?

> Additional disclosures are required pertaining to the income tax expense reported in the income statement. What are the needed disclosures?

> Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2018, are shown below: Required: 1. For each independent case, calculate any amortization of the net loss or gain that should

> What is a pension plan? What motivates a corporation to offer a pension plan for its employees?

> How do U.S. GAAP and IFRS differ with regard to reporting gains and losses from changing assumptions used to measure the pension obligation?

> The income statement of Mid-South Logistics includes $12 million for amortized prior service cost. Does Mid-South Logistics prepare its financial statements according to U.S. GAAP or IFRS? Explain.

> Clark Industries has a defined benefit pension plan that specifies annual retirement benefits equal to: 1.2% × Service years × Final year’s salary Stanley Mills was hired by Clark at the beginning of 1999. Mills is expected to retire at the end of 2043 a

> The EPBO for Branch Industries at the end of 2018 was determined by the actuary to be $20,000 as it relates to employee Will Lawson. Lawson was hired at the beginning of 2004. He will be fully eligible to retire with health care benefits after 15 more ye

> How are the costs of providing postretirement benefits other than pensions expensed?

> What are two ways to measure the obligation for postretirement benefits other than pensions? Define these measurement approaches.

> A pension plan is underfunded when the employer’s obligation (PBO) exceeds the resources available to satisfy that obligation (plan assets) and overfunded when the opposite is the case. How is this funded status reported on the balance sheet if plan asse

> Williams-Santana Inc. is a manufacturer of high-tech industrial parts that was started in 2004 by two talented engineers with little business training. In 2018, the company was acquired by one of its major customers. As part of an internal audit, the fol

> TFC Inc. revises its estimate of future salary levels, causing its PBO estimate to increase by $3 million. How is the $3 million reflected in TFC’s financial statements?

> When accounting for pension costs, how should the payment into the pension fund be recorded? How does it affect the funded status of the plan?

> Evaluate this statement: The excess of the actual return on plan assets over the expected return decreases the employer’s pension cost.

> A net operating loss occurs when tax-deductible expenses exceed taxable revenues. Tax laws permit the net operating loss to be used to reduce taxable income in other, profitable years by either a carryback of the loss to prior years or a carryforward of

> Is a company’s PBO reported in the balance sheet? Its plan assets? Explain.

> How should gains or losses related to pension plan assets be recognized? How does this treatment compare to that for gains or losses related to the pension obligation?

> The projected benefit obligation was $80 million at the beginning of the year and $85 million at the end of the year. Service cost for the year was $10 million. At the end of the year, there was no prior service cost and a negligible net loss–AOCI. The a

> Qualified pension plans offer important tax benefits. What is the special tax treatment and what qualifies a pension plan for these benefits?

> What is a reverse stock split? What would be the effect of a reverse stock split on one million $1 par shares? On the accounting records?

> Brandon Components declares a 2-for-1 stock split. What will be the effects of the split, and how should it be recorded?

> The prescribed accounting treatment for stock dividends implicitly assumes that shareholders are fooled by small stock dividends and benefit by the market value of their additional shares. Explain this statement. Is it logical?

> Define prior service cost. How is it reported in the financial statements? How is it included in pension expense?

> Discuss the conceptual basis for accounting for a share buyback as treasury stock.

> When a corporation acquires its own shares, those shares assume the same status as authorized but unissued shares, as if they never had been issued. Explain how this is reflected in the accounting records if the shares are formally retired.

> The costs of legal, promotional, and accounting services necessary to effect the sale of shares are referred to as share issue costs. How are these costs recorded? Compare this approach to the way debt issue costs are recorded.

> At times, companies issue their shares for consideration other than cash. What is the measurement objective in those cases?

> The balance sheet reports the balances of shareholders’ equity accounts. What additional information is provided by the statement of shareholders’ equity?

> How do we report components of comprehensive income created during the reporting period?

> Air France–KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2015, are available in Connect. This m

> JDS Foods’ projected benefit obligation, accumulated benefit obligation, and plan assets were $40 million, $30 million, and $25 million, respectively, at the end of the year. What, if any, pension liability must be reported in the balance sheet? What wou

> Superior Developers sells lots for residential development. When lots are sold, Superior recognizes income for financial reporting purposes in the year of the sale. For some lots, Superior recognizes income for tax purposes when collected. In the prior y

> Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended January 30, 2016, are available in Connect. This material also is available under the Investor Relations li

> The return on plan assets is the increase in plan assets (at fair value), adjusted for contributions to the plan and benefits paid during the period. How is the return included in the calculation of the periodic pension expense?

> The projected benefit obligation was $80 million at the beginning of the year and $85 million at the end of the year. At the end of the year, pension benefits paid by the trustee were $6 million and there were no pension-related other comprehensive incom

> FASB ASC 715–60: Compensation–Retirement Benefits–Defined Benefit Plans–Other Postretirement (previously Statement of Financial Accounting Standards No. 106) establishes accounting standards for postretirement benefits other than pensions, most notably p

> One of the longest debates in accounting history is the issue of deferred taxes. The controversy began in the 1940s and has continued, even after the FASB issued Statement of Financial Accounting Standards No. 109 [FASB ASC 740: Income Taxes] in 1992. At

> Russell-James Corporation is a diversified consumer products company. During 2018, Russell-James discontinued its line of cosmetics, which constituted discontinued operations for financial reporting purposes. As vice president of the food products divisi

> The following is a portion of the balance sheets of Macy’s, Inc. for the years ended January 30, 2016 and January 31, 2015: Macy’s debt to equity ratio for the year ended January 30, 2016, was 3.84, calculated as ($2

> The DeVille Company reported pretax accounting income on its income statement as follows: 2018 …………………………. $350,000 2019 …………………………… 270,000 2020 ………………………….. 340,000 2021 ………….……………….. 380,000 Included in the income of 2018 was an installment sale of p

> Zekany Corporation would have had identical income before taxes on both its income tax returns and income statements for the years 2018 through 2021 except for differences in depreciation on an operational asset. The asset cost $120,000 and is depreciate

> Dixon Development began operations in December 2018. When lots for industrial development are sold, Dixon recognizes income for financial reporting purposes in the year of the sale. For some lots, Dixon recognizes income for tax purposes when collected.

> Times-Roman Publishing Company reports the following amounts in its first three years of operation: The difference between pretax accounting income and taxable income is due to subscription revenue for one-year magazine subscriptions being reported for

> Alsup Consulting sometimes performs services for which it receives payment at the conclusion of the engagement, up to six months after services commence. Alsup recognizes service revenue for financial reporting purposes when the services are performed. F

> The income tax rate for Hudson Refinery has been 35% for each of its 12 years of operation. Company forecasters expect a much-debated tax reform bill to be passed by Congress early next year. The new tax measure would increase Hudson’s tax rate to 42%. W

> The projected benefit obligation was $80 million at the beginning of the year. Service cost for the year was $10 million. At the end of the year, pension benefits paid by the trustee were $6 million and there were no pension-related other comprehensive i

> Tru Developers, Inc., sells plots of land for industrial development. Tru recognizes income for financial reporting purposes in the year it sells the plots. For some of the plots sold this year, Tru took the position that it could recognize the income fo

> Delta Air Lines revealed in its 10-K filing that its valuation allowance for deferred tax assets at the end of 2013 was $177 million, dramatically lower than the over $10 billion recorded at the end of 2012. Here is an excerpt from a press report from Bl

> Fores Construction Company reported a pretax operating loss of $135 million for financial reporting purposes in 2018. Contributing to the loss were (a) A penalty of $5 million assessed by the Environmental Protection Agency for violation of a federal law

> Corning-Howell reported taxable income in 2018 of $120 million. At December 31, 2018, the reported amount of some assets and liabilities in the financial statements differed from their tax bases as indicated below: The total deferred tax asset and defe

> Arndt, Inc., reported the following for 2018 and 2019 ($ in millions): a. Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2018 for $60 million. The cost is tax deductible in 2018. b. Expenses include $2 mil

> Sherrod, Inc., reported pretax accounting income of $76 million for 2018. The following information relates to differences between pretax accounting income and taxable income: a. Income from installment sales of properties included in pretax accounting i

> You are the new accounting manager at the Barry Transport Company. Your CFO has asked you to provide input on the company’s income tax position based on the following: 1. Pretax accounting income was $41 million and taxable income was $8 million for the

> For the year ended December 31, 2018, Fidelity Engineering reported pretax accounting income of $977,000. Selected information for 2018 from Fidelity’s records follows: Interest income on municipal bonds ……………………………………………………………………… $32,000 Depreciation c

> Southern Atlantic Distributors began operations in January 2018 and purchased a delivery truck for $40,000. Southern Atlantic plans to use straight-line depreciation over a four-year expected useful life for financial reporting purposes. For tax purposes

> On January 1, 2018, Medical Transport Company’s accumulated postretirement benefit obligation was $25 million. At the end of 2018, retiree benefits paid were $3 million. Service cost for 2018 is $7 million. Assumptions regarding the trend of future healt

> Identify three examples of differences with no deferred tax consequences.

> When a company records a deferred tax asset, it may need to also report a valuation allowance if it is “more likely than not” that some portion or all of the deferred tax asset will not be realized. The FASB Accounting Standards Codification represents t

> At the end of 2017, Payne Industries had a deferred tax asset account with a balance of $30 million attributable to a temporary book-tax difference of $75 million in a liability for estimated expenses. At the end of 2018, the temporary difference is $70

> At the end of 2017, Payne Industries had a deferred tax asset account with a balance of $30 million attributable to a temporary book–tax difference of $75 million in a liability for estimated expenses. At the end of 2018, the temporary difference is $70

> Eight independent situations are described below. Each involves future deductible amounts and/or future taxable amounts ($ in millions). Required: For each situation, determine taxable income, assuming pretax accounting income is $100 million. Temp

> Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences: The enacted tax rate is 40%. Required: For each situation, determine the: a. Income tax payable c

> Listed below are 10 causes of temporary differences. For each temporary difference indicate the balance sheet account for which the situation creates a temporary difference. Temporary Difference _____ 1. Accrual of loss contingency; tax-deductible when p

> Listed below are 10 causes of temporary differences. For each temporary difference, indicate (by letter) whether it will create future deductible amounts (D) or future taxable amounts (T). Temporary Difference _____ 1. Accrual of loss contingency; tax-de

> Lance Lawn Services reports warranty expense by estimating the amount that eventually will be paid to satisfy warranties on its product sales. For tax purposes, the expense is deducted when the cost is incurred. At December 31, 2018, Lance has a warranty

> In 2018, DFS Medical Supply collected rent revenue for 2019 tenant occupancy. For income tax reporting, the rent is taxed when collected. For financial statement reporting, the rent is recorded as deferred revenue and then recognized as income in the per

> Prince Distribution Inc. has an unfunded postretirement benefit plan. Medical care and life insurance benefits are provided to employees who render 10 years service and attain age 55 while in service. At the end of 2018, Jim Lukawitz is 31. He was hired

> Ayres Services acquired an asset for $80 million in 2018. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). For tax purposes the asset’s cost is depreciated by MACRS.

> Temporary differences result in future taxable or deductible amounts when the related asset or liability is recovered or settled. Some differences, though, are not temporary. What events create permanent differences? What effect do these have on the dete

> On January 1, 2013, Ameen Company purchased a building for $36 million. Ameen uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. At December 31, 2017, the book value of the building was $30 million and i

> Alvis Corporation reports pretax accounting income of $400,000, but due to a single temporary difference, taxable income is only $250,000. At the beginning of the year, no temporary differences existed. Required: 1. Assuming a tax rate of 35%, what will

> The following income statement does not reflect intraperiod tax allocation. Required: Recast the income statement to reflect intraperiod tax allocation. INCOME STATEMENT For the Fiscal Year Ended March 31, 2018 ($ in millions) Revenues ……………………………………………

> Delta Catfish Company has taken a position in its tax return to claim a tax credit of $10 million (direct reduction in taxes payable) and has determined that its sustainability is “more likely than not,” based on its t

> Listed below are several terms and phrases associated with accounting for income taxes. Pair each item from List A with the item from List B (by letter) that is most appropriately associated with it. List A List B 1. No tax consequences a. Deferred

> As of December 31, 2016, Lange Company has the following deferred tax assets and liabilities: Deferred tax assets Pension plans …………………………………………………………. $300,000 Inventory …………………………………………………………………. 200,000 Total deferred tax assets ………………………………………….. $50

> Case Development began operations in December 2018. When property is sold on an installment basis, Case recognizes installment income for financial reporting purposes in the year of the sale. For tax purposes, installment income is reported by the instal

> Case Development began operations in December 2018. When property is sold on an installment basis, Case recognizes installment income for financial reporting purposes in the year of the sale. For tax purposes, installment income is reported by the instal

> Andrews Medical reported a net loss–AOCI in last year’s balance sheet. This year, the company revised its estimate of future salary levels causing its PBO estimate to decline by $4 million. Also, the $8 million actual return on plan assets fell short of

> At December 31, DePaul Corporation had a $16 million balance in its deferred tax asset account and a $68 million balance in its deferred tax liability account. The balances were due to the following cumulative temporary differences: 1. Estimated warranty

> Listed below are ten independent situations. For each situation indicate (by letter) whether it will create a deferred tax asset (A), a deferred tax liability (L), or neither (N). Situation _____ 1. Advance payments on insurance, deductible when paid ___

> The benefit of future deductible amounts can be achieved only if future income is sufficient to take advantage of the deferred deductions. For that reason, not all deferred tax assets will ultimately be realized. How is this possibility reflected in the

> Wynn Sheet Metal reported a net operating loss of $160,000 for financial reporting and tax purposes in 2018. The enacted tax rate is 40%. Taxable income, tax rates, and income taxes paid in Wynn’s first four years of operation were as f

> Wynn Sheet Metal reported a net operating loss of $100,000 for financial reporting and tax purposes in 2018. The enacted tax rate is 40%. Taxable income, tax rates, and income taxes paid in Wynn’s first four years of operation were as f

> During 2018, its first year of operations, Baginski Steel Corporation reported a net operating loss of $375,000 for financial reporting and tax purposes. The enacted tax rate is 40%. Required: 1. Prepare the journal entry to recognize the income tax ben

> The information that follows pertains to Richards Refrigeration, Inc.: a. At December 31, 2018, temporary differences existed between the financial statement carrying amounts and the tax bases of the following ($ in millions): b. No temporary differenc

> The information that follows pertains to Esther Food Products: a. At December 31, 2018, temporary differences were associated with the following future taxable (deductible) amounts: Depreciation …………………………… $ 60,000 Prepaid expenses ……………………….. 17,000 Wa

> Bronson Industries reported a deferred tax liability of $8 million for the year ended December 31, 2017, related to a temporary difference of $20 million. The tax rate was 40%. The temporary difference is expected to reverse in 2019, at which time the de

> Arnold Industries has pretax accounting income of $33 million for the year ended December 31, 2018. The tax rate is 40%. The only difference between accounting income and taxable income relates to an operating lease in which Arnold is the lessee. The inc

> The Warren Group’s pension expense is $67 million. This amount includes a $70 million service cost, a $50 million interest cost, a $55 million reduction for the expected return on plan assets, and a $2 million amortization of a prior service cost. How is

> Allmond Corporation, organized on January 3, 2018, had pretax accounting income of $14 million and taxable income of $20 million for the year ended December 31, 2018. The 2018 tax rate is 35%. The only difference between accounting income and taxable inc

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine the specific citation for accounting for each of the following items: 1. The specific items to which income tax expense is allocated for intraperiod tax alloc

> Differences between financial statement and taxable income were as follows: ________________________________($ in millions) Pretax accounting income ………………………………………………… $300 Permanent difference ………………………………………………………… (24) …………………………………………………………………………………

> Sometimes a temporary difference will produce future deductible amounts. Explain what is meant by future deductible amounts. Describe two general situations that have this effect. How are such situations recognized in the financial statements?

> VeriFone Systems is a provider of electronic card payment terminals, peripherals, network products, and software. In its 2015 annual report, the company reported deferred tax assets totaling about $398 million. The company also reported valuation allowan

> At the end of the year, the deferred tax asset account had a balance of $12 million attributable to a cumulative temporary difference of $30 million in a liability for estimated expenses. Taxable income is $35 million. No temporary differences existed at

> Refer to the situation described in BE 16–4. Suppose the deferred portion of the rent collected was $40 million at the end of 2019. Taxable income is $200 million. Prepare the appropriate journal entry to record income taxes. In BE 16–4 In 2018, Ryan Ma

> In 2018, Ryan Management collected rent revenue for 2019 tenant occupancy. For financial reporting, the rent is recorded as deferred revenue and then recognized as income in the period tenants occupy rental property, but for income tax reporting it is ta

> A company reports pretax accounting income of $10 million, but because of a single temporary difference, taxable income is $12 million. No temporary differences existed at the beginning of the year, and the tax rate is 40%. Prepare the appropriate journa