Question: The Monteiro Manufacturing Corporation manufactures

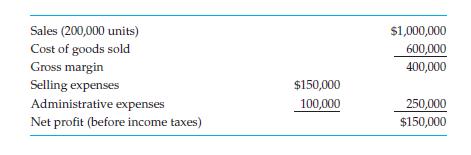

The Monteiro Manufacturing Corporation manufactures and sells folding umbrellas. The corporation’s condensed income statement for the year ended December 31, 2011, follows:

Monteiro’s budget committee has estimated the following changes for 2012:

30% increase in number of units sold

20% increase in material cost per unit

15% increase in direct labor cost per unit

10% increase in variable indirect cost per unit

5% increase in indirect fixed costs

8% increase in selling expenses, arising solely from increased volume

6% increase in administrative expenses, reflecting anticipated higher wage and supply price levels

Any changes in administrative expenses caused solely by increased sales volume are considered immaterial.

Because inventory quantities remain fairly constant, the budget committee considered that for budget purposes any change in inventory valuation can be ignored. The composition of the cost of a unit of finished product during 2011 for materials, direct labor, and manufacturing support, respectively, was in the ratio of 3:2:1. In 2011, $40,000 of manufacturing support was for fixed costs. No changes in production methods or credit policies were contemplated for 2012.

Required

(a) Compute the unit sales price at which the Monteiro Manufacturing Corporation must sell its umbrellas in 2012 in order to earn a budgeted profit of $200,000.

(b) Unhappy about the prospect of an increase in selling price, Monteiro’s sales manager wants to know how many units must be sold at the old price to earn the $200,000 budgeted profit. Compute the number of units that must be sold at the old price to earn $200,000.

(c) Believing that the estimated increase in sales is overly optimistic, one of the company’s directors wants to know what annual profit is likely if the selling price determined in part a is adopted but the increase in sales volume is only 10%. Compute the budgeted profit in this case.

Transcribed Image Text:

$1,000,000 600,000 Sales (200,000 units) Cost of goods sold Gross margin Selling expenses Administrative expenses 400,000 $150,000 100,000 250,000 Net profit (before income taxes) $150,000

> The following information pertains to VI Division, which has $1,400,000 in investments. The company’s cost of capital is 10%. Required (a) What is the division’s return on investment? (b) What is the divisionâ&

> Division Q’s current turnover is 2 and its return on sales ratio is 0.8. The division is considering a sales promotion that would increase its current return on sales ratio by 20%, but decrease its turnover by 20%. Required (a) If the division undertake

> Eta Company would like to examine the sales margin and asset components of return on investment for three of its divisions and has accordingly prepared the following information: Required (a) Compute each division’s return on investmen

> Green Company has prepared the following information for three of its divisions: Required (a) Compute each division’s return on investment and residual income, assuming a 10% cost of capital. (b) Suppose the net book value of each divi

> Why did accountants develop the expression “soft number”?

> What is the main advantage and the main obstacle in using market-based transfer prices?

> In a fishing products company, the harvesting division catches and delivers the fish to the processing division that, in turn, delivers the processed fish to the selling division to sell to customers. How can you determine the appropriate transfer price

> How might a transfer price for logs be chosen in an organization that cuts down trees and processes the logs either in a sawmill to make lumber or in a pulp mill to make paper?

> Identify an organization with the customer solutions value proposition and suggest at least two possible measures within each of the four Balanced Scorecard perspectives.

> Organizations might desire to use one transfer pricing system designed to support international transfer pricing and another domestic transfer pricing system designed to achieve motivational objectives. Give a reason why you think organizations would not

> McCann Company has two divisions, Division C and Division D. Division C manufactures Part C82 and sells it to Division D, and also sells the same part to the outside market for $50 per unit. Division C has capacity to make 400,000 units of C82 per year.

> Give an example of a situation for which invoking the controllability principle would have a desirable motivational effect. Also give an example of a situation for which suspending the controllability principle would have a desirable motivational effect.

> Shellie’s Lawn and Gardening performs various lawn and garden maintenance activities, including lawn mowing, tree and shrub pruning, fertilizing, and treating for pests. Unlike other lawn and garden businesses in the city, Shellie also

> Baden is a city with a population of 450,000. It has a distinct organization group, called the Public Utilities Commission of the city of Baden, or Baden PUC, whose responsibility is to provide the water and electrical services to the businesses and home

> You are a senior manager responsible for overall company operations in a large courier company. Your company has 106 regional offices (terminals) scattered around the country and a main office (hub) located in the geographical center of the country. Your

> Is employee training an example of a discretionary expenditure? Why?

> What is the relationship between a demand forecast and a sales plan?

> What is a production plan? Give an example of one in a courier company.

> A student develops a spending plan for a school semester. Is this budgeting? Why?

> Identify an organization with the product leadership value proposition and suggest at least two possible measures within each of the four Balanced Scorecard perspectives.

> What is the difference between flexible and capacity-related resources?

> What is a budget?

> You are willing to donate to worthy organizations. However, you believe strongly that each request for a donation should be evaluated on the basis of its own merits. You would not feel bad in any year if you donated nothing. What approach to budgeting ar

> You are planning your expenditures for the upcoming school semester. You assume that this year’s expenditures will equal last year’s plus 2%. What approach to budgeting are you using?

> What is a periodic budget?

> What is an appropriation? Give an example of one in a university.

> What two steps are taken to reconcile the difference between actual and planned sales revenue?

> What effect will the purchase and use of cheaper, lower quality materials likely have on price and quantity (efficiency) components of both materials and labor variances?

> Why is it useful to decompose a flexible budget variance into a rate (price) variance and an efficiency (quantity) variance?

> What is a flexible budget?

> Identify an organization with the low-total-cost value proposition and suggest at least two possible measures within each of the four Balanced Scorecard perspectives.

> What is a variance? How is a dashboard warning light that indicates low oil pressure like a variance?

> What is an example of a capacity-related expenditure?

> What does a capital spending plan do?

> Are materials always a flexible resource? Why?

> Are food costs in a university residence cafeteria a variable cost or a capacity-related fixed cost? Briefly explain.

> What is a demand forecast? Why is it relevant in budgeting?

> Would a labor hiring and training plan be more important in a university that is hiring faculty members, or a municipal government office that hires casual workers to do unskilled work? Why?

> What is the difference between an operating and a financial budget?

> How does a family’s budget differ from a budget developed for an organization?

> What are two fundamental ways in which the beyond budgeting approach differs from traditional budgeting?

> Discuss whether the Balanced Scorecard strategy map approach is a performance measurement system, a management system, or both.

> What are some criticisms of the traditional budgeting model?

> “If more experienced workers work on the job than were planned when developing the labor standards, the labor efficiency variance is likely to be favorable, but the labor rate variance is likely to be unfavorable.” Do you agree with this statement? Expla

> How are first, second, and third levels of variance analysis related?

> How does analysis of reasons for variances between actual and estimated costs help managers?

> What are the similarities and differences between what-if and sensitivity analyses?

> What are three broad uses for budget information?

> What is a line of credit? How is it useful to a small organization?

> Shadyside Insurance Company manages a medical insurance program for its clients. Employees of client firms submit claims for reimbursement of medical expenses. Shadyside processes these claims, checks them to ensure that they are covered by the claimant’

> Adams Company, a merchandising firm that sells one product, estimates it will sell 12,000 units of its product at $60 per unit in December. In November, the company prepared other information to prepare a budget for December, as shown here: â€

> Explain how a Balanced Scorecard for a nonprofit or governmental organization typically differs from for-profit Balanced Scorecards.

> In September, TEE Company, a merchandising firm that sells one product, assembled the following information and estimates to prepare a budget for October. Expected sales are 40,000 units at a price of $32 per unit. The cost of merchandise purchases is ex

> Country Club Road Nurseries grows and sells garden plants. The nursery is active between January and October each year. During January, the potting tables and equipment are prepared. The potting and seeding are done in February. In March and April, the p

> Nathaniel’s Motor Shop does major repair work on automobile engines. The major cost in the shop is the wages of the mechanics. The shop employs nine mechanics who are paid $750 each for working a 40-hour week. The workweek consists of f

> Masefield Dairy is preparing a third-quarter budget (July, August, and September) for its ice cream products. It produces five brands of ice cream, and each uses a different mix of ingredients. Its suppliers deliver ingredients just in time, provided tha

> Worthington Company makes cash (20% of total sales), credit card (50% of total sales), and account (30% of total sales) sales. Credit card sales are collected in the month following the sale, net a 3% credit card fee. This means that if the sale is $100,

> During the school year, the Homebush School band arranges concert dates in many communities. Because only part of the school’s travel expenses are covered by the concert admission fees, the band raises money to help defray its operating

> Strathfield Motel is planning its operations for the upcoming tourist season. The motel has 60 units. The following table presents the average number of daily rentals expected for each of the 12 weeks of the tourist season. The motel hires housekeeping s

> Mira Vista Planters provides reforestation services to large paper products companies. It must hire one planter for every 10,000 trees that it has contracted to plant each month. New employees are hired in the month needed, on the first day of the month.

> Borders Manufacturing is developing a sales and production plan as part of its master budgeting process. Following are the projected monthly sales, which occur uniformly during each month, for the upcoming year: Production for each month equals one-half

> Air Peanut Company manufactures and sells roasted peanut packets to commercial airlines. Following are the price and cost data per 100 packets of peanuts: Required (a) Determine Air Peanut’s breakeven point in units. (b) How many packe

> One financial service organization formerly measured its performance using only a single financial measure, profits. It decided to adopt a more “balanced” measurement approach by introducing a 4P Scorecard: (1) Profits (2) Portfolio (size of loan volume)

> Discuss the possible effect on human behavior of a preoccupation with variances in financial control.

> Bakery Extraordinaire sells several types of muffins and scones and also sells carrot bread loaves. Planned prices and sales quantities for February are shown here: The actual results for February are shown here: The owner would like to know how the pr

> Asahi USA, Inc., based in Denver, Colorado, is a subsidiary of a Japanese company manufacturing specialty tools. Asahi USA employs a standard cost system. Following are the standards per unit of one of its products, tool KJ79. This tool requires a specia

> Mountain View Hospital has adopted a standard cost accounting system for evaluation and control of nursing labor. Diagnosis-related groups (DRGs), instituted by the U.S. government for health insurance reimbursement, are used as the output measure in the

> Trieste Toy Company manufactures only one product, Robot Ranger. The company uses a standard cost system and has established the following standards per unit of Robot Ranger: During November, the company recorded the following activity: â€&ce

> For each of the following two jobs manufacturing two different products, determine the missing amounts for items (a) through (h): ITEM Jов 321 Jов 322 Units produced 200 (e) Standards per unit: Material quantity Material price 5 pounds (f) $2 per po

> The North Point plant of Englehart Electronics Company has the following standards for component C93: Required Determine the following variances for May: (a) Total direct material cost variance (b) Total direct labor cost variance (c) Total variable sup

> The Sudbury, South Carolina, plant of Saldanha Sports Company has the following standards for its soccer ball production: Required Determine the following variances for October: (a) Total direct material cost variance (b) Total direct labor cost varianc

> Tang Company’s production performance report for April includes the information shown below. Prepare a flexible budget for the items shown and compute the flexible budget cost variances and planning cost variances for each item. Indicat

> The following information pertains to Torasic Company’s budgeted income statement for the month of June 2011: Required (a) Determine the company’s breakeven point in both units and dollars. (b) The sales manager belie

> Respond to the following statement: “Our organization has key performance indicators that measure financial and nonfinancial performance, including customer satisfaction, product and service quality, cost, revenues, and employee satisfaction. We therefor

> Tenneco, Inc., produces three models of tennis rackets: standard, deluxe, and pro. Following are the sales and cost information for 2011: Fixed manufacturing support costs are $800,000, and fixed selling and administrative costs are $400,000. In additio

> Premier Products, Inc., is considering replacing its existing machine with a new and faster machine that will produce a more reliable product and will turn around customer orders in a shorter period. This change is expected to increase the sales price an

> The Herschel Candy Company produces a single product: a chocolate almond bar that sells for $0.40 per bar. The variable costs for each bar (sugar, chocolate, almonds, wrapper, and labor) total $0.25. The total monthly fixed costs are $60,000. Last month,

> Many managers consider the pro forma financial statements to be the most important product of the master budgeting process. Why do you think they believe this?

> For a university, identify a cost that you think is controllable in the short term and explain why. Identify a cost that you think is controllable in the intermediate term and explain why. Identify a cost that you think is controllable in the long term a

> Some people say that budgets are great for planning but not for control. What do you think they mean? Do you agree with this sentiment? Explain.

> Consider a company that sells prescription drugs. It has salespeople who visit doctors and hospitals to encourage physicians to prescribe its drugs. The company sells to drugstores. Salespeople are evaluated based on the sales in their territories. For e

> An organization plans to make a product in batches of 25,000 units. Planned production is 1,000,000 units, and actual production is 1,125,000 units. What are the planned (master budget) number of batches and the flexible budget number of batches?

> Assembly of product P13 requires one unit of component X, two units of component Y, and three units of component Z. Job J372 produced 220 units of P13. The following information pertains to material variances for this job, analyzed by component: The act

> Each unit of job Y703 has standard requirements of 5 pounds of raw material at a price of $100 per pound and 0.5 hour of direct labor at $12 per hour. To produce 9,000 units of this product, job Y703 actually required 40,000 pounds of the raw material co

> Respond to the following statement: “It is impossible for an organization to focus on the 20 to 30 different measures that result if each of the four Balanced Scorecard perspectives contains between four to eight measures.”

> How do responsibility centers interact?

> Pharout Company uses a standard cost system. Job 822 is for the manufacturing of 500 units of the product P521. The company’s standards for one unit of product P521 are as follows: The job required 2,800 ounces of raw material costing

> The following information is available for Mandalay Company: Required (a) Determine the material price variance based on the quantity of materials purchased. (b) Determine the material quantity variance. (c) Determine the direct labor rate variance. (d)

> A university faced with a deficit reacts by cutting resource allocations to all faculties and departments by 8%. Do you think this is a good approach to budgeting? Why or why not?

> Sensitivity analysis is an important component of any budgeting exercise. Which estimates do you think will be most crucial in developing a master budget? Why?

> Jeren Company is considering replacing its existing cutting machine with a new machine that will help reduce its defect rate. Relevant information for the two machines includes the following: Required (a) Determine the sales level, in number of units, a

> Glynn Company is preparing a budget to determine the amount of part G12 to produce for the first quarter of the year, and the amount of resin to purchase for part G12. The company desires to have 25% of the next month’s estimated sales of G12 in inventor

> Boynton Company sells a variety of recycling bins. The company estimates that it will sell 40,000 units of bin BLX in April. The company expects to have 6,000 units of BLX in inventory on April 1 and would like 5,000 units of BLX in inventory on April 30

> Budgeting allows an organization to compare its projected operating and financial results with those of competitors as a general test of the efficiency of the organization’s operating processes. Explain how this might be valuable for a machine shop that

> Monthly cash budgets of inflows and outflows are an important part of the budgeting process in most organizations. In the course of preparing a cash budget, the organization must estimate its cash inflows from credit sales. Suppose that in response to pr

> Budgeting allows an organization to identify potential problems so that plans can be developed to avoid these problems or to deal with them systematically. Give an example of how budgeting might serve this role in a company that buys vegetables and cans

> Discuss the accuracy of the following statement: “The Balanced Scorecard approach is incomplete because it does not include measures on environmental performance and measures of employee health and safety.”

> Budgeting allows an organization to identify broad resource requirements so that it can develop plans to put needed resources in place. Use an example to illustrate why this might be valuable in a consulting company that provides advice to clients.

> Steelmax, Inc., sells office furniture in the Chicago metropolitan area. To better serve its business customers, Steelmax recently introduced a new same-day service. Any order placed before 2:00 P.M. is delivered the same day. Steelmax hires five workers

> The following budget information for the year ending December 31, 2011, pertains to Rust Manufacturing Company’s operations: The following information is also provided: 1. Rust has no beginning inventory. Production is planned so that