Question: The newly formed Buffalo School District engaged

The newly formed Buffalo School District engaged in the following transactions and other events during the year:

1. It levied and collected property taxes of $110 million.

2. It issued $30 million in longâ€term bonds to construct a building. It placed the cash received in a special fund set aside to account for the bond proceeds.

3. During the year it constructed the building at a cost of $25 million. It expects to spend the $5 million balance in the following year. The building has an estimated useful life of 25 years.

4. It incurred $70 million in general operating costs, of which it paid $63 million. It expects to pay the balance early the following year.

5. It transferred $12 million from its general fund to a fund established to account for resources set aside to service the debt. Of this, $10 million was for repayment of the debt; $2 million was for interest.

6. From the special fund established to service the debt, it paid $2 million in interest and $6 million in principal.

7. It collected $4 million in hotel taxes restricted to promoting tourism. Since the resources were restricted they were accounted for in a special restricted fund. During the year, the district spent $3 million on promoting tourism.

8. The district established a supplies store to provide supplies to the district’s various departments by transferring $4 million from the general fund. It accounted for the store in an internal service (proprietary) fund. During the year the store purchased (and paid for) $2 million in supplies. Of these it “soldâ€

$1 million, at cost (for cash), to departments accounted for in the general fund. During the year these departments used all of the supplies that they had purchased.

a. Prepare journal entries to record the transactions and other events in appropriate funds. Assume that governmental funds are accounted for on a modified accrual basis and focus only on current financial resources (and thus do not give balance sheet recognition either to capital assets or longâ€term debts). Proprietary funds are accounted for on a full accrual basis.

b. Prepare a combined balance sheet—one that has a separate column for each of the governmental funds you established.

c. Prepare a combined statement of revenues, expenditures, and changes in fund balances for all governmental funds. Prepare a separate statement of revenues, expenses, and changes in fund net position for any proprietary funds you established.

d. Prepare a governmentâ€wide statement of net position and a governmentâ€wide statement of activities in which all funds are consolidated and are accounted for on a full accrual basis. Be sure to include both longâ€term assets and liabilities on the statement of net position and to depreciate the longâ€term assets. Also, be sure to adjust for any interfund activity. You may find it helpful to redo the journal entries you made in Part (a), this time recording the transactions (and not the interfund activity) as if the district accounted for its activities in a single entity and on the full accrual basis.

Transcribed Image Text:

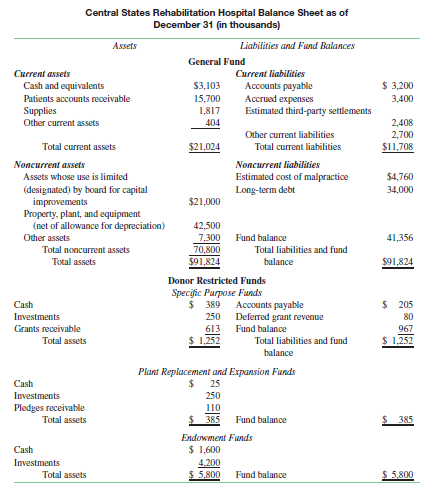

Central States Rehabilitation Hospital Balance Sheet as of December 31 (in thousands) Assets Liabilities and Fund Balances General Fund Current assets Current liabilities $ 3,200 Cash and equivalents Patients accounts receivable Supplies Accounts payable Accrued expenses Estimated third-party settlements $3,103 15,700 3,400 1,817 Other current assets 404 2,408 2,700 $11,708 Other current liabilities Total current assets $21,024 Total current liabilities Noncurrent liabilities Estimated cost of malpractice Noncurrent assets Assets whose use is limited $4,760 Long-term debt (designated) by board for capital improvements Property, plant, and equipment (net of allowance for depreciation) 34,000 $21,000 42,500 Other assets 7,300 Fund balance 41,356 70,800 $91,824 Total noncurrent assets Total liabilities and fund Total assets balance $91,824 Donor Restricted Funds Specific Parpose Funds $ 389 Accounts payable Deferred grant revenue Cash $ 205 Investments 250 80 Grants receivable 613 Fund balance 967 Total assets $ 1.252 $ 1,252 Total liabilities and fund balance Plant Replacement and Expansion Funds Cash 25 Investments 250 Pledges receivable 110 $ 385 Total assets Fund balance $ 385 Endowment Funds $ 1,600 4.200 $ 5,800 Cash Investments Total assets Fund balance $ 5,800

> The GASB has established a “60-day” rule for the recognition of property taxes in governmental funds. On what basis can you justify such a rule for property taxes but not for other revenues? Do you think the 60-day rule should be extended to all revenues

> In 2018, the Bakersville Independent School District incurred $12 million in expenditures for teachers’ salary and benefits. In that year, the legislature of the state in which the district is located voted to enhance the pension benefits of all teachers

> In October 2018, the Village of Mason levied $80 million of property taxes for its 2019 fiscal year (which is the same as the calendar year). The taxes are payable 50 percent by December 31, 2018, and 50 percent by June 30, 2019. The village collected $5

> The board of trustees of an independent school district is contemplating several policy changes and other measures, all of which it intends to implement within the fiscal year that ends August 31, 2018. It requests your advice on how the changes would af

> The Foundation for Educational Excellence has decided to support the Tri-County School District’s series of teacher training workshops intended to improve instruction in mathematics. The foundation is considering four ways of wording the grant agreement,

> For each of the following grants and awards, indicate whether the recipient government should recognize revenues and expenditures. In a sentence or two, justify your response. 1. As the result of damaging floods, the state of New York receives disaster a

> A city received two state grants in fiscal 2018. The first was an award for a maximum of $800,000, over a two-year period, to reimburse the city for 40 percent of specified costs incurred to operate a job opportunity program. During 2018, the city incurr

> The Metropolitan Housing Authority is charged with providing housing to low‐income residents. The authority is currently assessing two options, each of which would provide homes for 100 families. Under the first option the authority would renovate an exi

> Kyle Township charges residents $100 per year to license household pets. As specified in a statute enacted in 2018, residents are required to purchase a license by October 1 of each year; the license covers the period October 1 through September 30. The

> Manor County was awarded a state grant to establish evening athletic programs for at-risk youth. The $3.6 million award, to cover the calendar year 2018, was announced on November 15, 2017. According to the terms of the grant, the county will be reimburs

> A state imposes a sales tax of 6 percent. The state’s counties are permitted to levy an additional tax of 2 percent. The state administers the tax for the counties, forwarding the proceeds to the counties 15 days after it receives the proceeds from the m

> A city levies property taxes of $4 billion in June 2018 for its fiscal year beginning July 1, 2018. The taxes are due by January 31, 2019. The following (in millions) indicates actual and anticipated cash collections relating to the levy: June 2018………………

> The town of Blair determines that it requires $22.5 million in property tax revenues to balance its budget. According to the town’s property tax assessor, the town contains taxable property that it assessed at $900 million. However, the town permits disc

> Nonexchange revenues can be of four types. The GASB has identified four classes of nonexchange revenues: • Derived tax • Imposed • Government mandated • Voluntary For each of the following revenue transactions affecting a city, identify the class in whic

> For each of the following indicate the amount of revenue that Beanville should recognize in its 2017 (1) government-wide statements and (2) governmental fund statements. Provide a brief justification or explanation for your responses. 1. The state in w

> For each of the following situations, indicate the amount of revenue that the government should recognize in an appropriate governmental fund as well as in its government-wide statement of activities in its fiscal year ending December 31, 2018. Briefly j

> Why may flexible budgets be more important to a government’s business‐type activities than to its governmental activities?

> What are the main sources of the government’s revenues, including those from both governmental and business-type activities?

> The Pleasant Valley School District, which leases its buses from a private transportation company, has determined that the direct costs of operating a bus (including rental fees, driver, and fuel) is $40,000 per year. The district currently operates 30 b

> What is the purpose and effect of reinstating year‐end encumbrances on the books at the beginning of the following year?

> In what way will budgetary entries and encumbrances affect amounts reported on year‐end balance sheets or operating statements?

> The variances reported in the “final” budget‐to‐actual comparisons incorporated in the financial statements of many governments may be of no value in revealing the reliability of budget estimates made at the start of the year. Why? How can you rationaliz

> Why may a government’s year‐end results, reported in accordance with generally accepted accounting principles, not be readily comparable with its legally adopted budget?

> A political official boasts that the year‐end excess of revenues over expenditures was significantly greater than was budgeted. Are “favorable” budget variances necessarily a sign of efficient and effective governmental management? Explain.

> Why do most governments and not‐for‐profits budget on a cash or near‐cash basis even though the cash basis does not capture the full economic costs of the activities in which they engage?

> Why may flexible budgets be more important to a government’s business‐type activities than to its governmental activities?

> Why is it important that governments and not‐for‐profits coordinate their processes for developing appropriations budgets with those for developing capital budgets?

> Generally accepted accounting principles require governments to include in their annual reports a comparison of actual results with the budget for each governmental fund for which an annual budget has been adopted. This information is generally presented

> The Disability Research Institute receives its funding mainly from government grants and private contributions. In turn, it supports research and related projects carried out by universities and other not-for‐ profits. Most of its government grants are r

> For each of the following organizations, propose at least one measure of outputs and two of outcomes. 1. The admissions office of a selective private college 2. The sales tax division of a city government 3. A private foundation that provides college sch

> Does the government encumber goods or services that have been ordered but have not yet been received? How, if at all, are encumbrances reflected on the governmental fund balance sheet? How, if at all, are they reflected on the government‐wide statement o

> Does the CAFR include budget‐to‐actual comparisons of nonmajor funds? If so, in what section?

> In which section of the Comprehensive Annual Financial Report (CAFR) are the budget‐to‐actual comparisons of the major funds? a. Which accounting basis did the City follow to prepare its annual operating budget? b. Are the actual amounts on a GAAP or a b

> Distinguish between nonspendable, restricted, committed, and assigned fund balance.

> Distinguish among the three categories of restrictiveness into which the net assets of not‐for‐profit organizations must be separated for purposes of external reporting. By whom must these restrictions be imposed for resources to be considered restricted

> What is a CAFR? What are its main components?

> In what way, if any, does the accounting equation as applied in governmental and not‐for‐profit accounting differ from that as applied in business accounting?

> From what two perspectives must the financial statements under the GASB No. 34 reporting model be prepared? How do the two differ from each other?

> What is permanent about a permanent fund?

> What are fiduciary funds? What are the two main types, and what is the distinction between them?

> The “object classification” budget of a police department includes the following expense categories: • Salaries • Employee benefits • Supplies • Equipment • Vehicle maintenance, gas, etc. • Dues and subscriptions Based on your lay knowledge of the operat

> As will be emphasized later in this text, depreciation is recorded in proprietary funds but not in governmental funds. What is the rationale for recording depreciation in proprietary funds?

> Distinguish between funds as the term is used in governmental as contrasted with business accounting

> Why are there generally no capital projects (work in progress or other long‐lived assets) in governments’ capital projects funds? Why are there generally no long‐term debts in debt service funds?

> Upon examining the balance sheet of a large city, you notice that the total assets of the general fund far exceed those of the combined total of the city’s ten separate special revenue funds. Moreover, you observe that there are no funds for public safet

> Define the seven key elements that comprise the financial statements.

> GASB Statement No. 34 has been widely criticized for mandating the preparation and presentation of government‐wide statements. Mainly, the critics contend that the benefits of the statements are not commensurate with the costs of preparing them. They arg

> A school district receives a grant from the federal government to support programs directed at special needs students. The grant is a matching grant in which each dollar spent by the school district on teacher salaries for special needs education will be

> This chapter has described the fund structure in governments. Do you think that it is necessary to display individual funds in a government’s annual report? If so, then do you think it is any less necessary to display individual funds in a not‐for‐profit

> See the balance sheet of a not‐for‐profit hospital presented on page 83. It is intended to display the hospital’s fund structure. Inasmuch as it does not conform to FASB standards, it is inappropriate for external reporting. 1. On what basis of accountin

> Select the best answer. 1. Which of the following is likely to be a line item in a fire department’s program budget but not its object classification budget? a. Administrative salaries b. Travel to conferences and training c. Safety inspections d. Acqui

> The balance sheet of the Hillcrest Home Care Service, a not‐for‐profit organization providing assistance to the elderly, is presented here: Hillcrest Home Care Service Balance Sheet as of December 31 (in thousands) Assets Current assets Cash and cash eq

> A newly formed not‐for‐profit advocacy organization, the Center for Participatory Democracy, requests your advice on setting up its financial accounting and reporting system. Meeting with the director, you learn the following: • Member dues can be expect

> Kendal County engaged in the following transactions. For each, prepare an appropriate journal entry and indicate the type of fund in which it would most likely be recorded: 1. It levied and collected $1million in taxes and dedicated to the repayment of o

> See the following balance sheet for the town of Paris governmental funds. In addition, you learn from other records that the town has capital assets with a book value (net of depreciation) of $1,450 million and has outstanding long‐term bonds of $1,315 m

> Bertram County maintains a fund accounting system. Nevertheless, its comptroller (who recently retired from a position in private industry) prepared the following balance sheet (in millions): The fund balance restricted for debt service represents entire

> The following balance sheet was adapted from the financial statements of the Williamsburg Regional Sewage Treatment Authority (dates have been changed). Fund Types The transactions of the authority are accounted for in the following governmental fund ty

> The Sherill Utility District was recently established. Its balance sheet, after one year, is presented below. Note the following additional information: • The general fund received all of its revenue, $150 million, from taxes. It had op

> Entrepreneurs Consultants, a state agency, was established to provide consulting services to small businesses. It maintains only a single general fund and accounts for its activities on a modified accrual basis. During its first month of operations, the

> Review the statistical section. a. What is the population of the entity being reported on? b. Who is the entity’s major employer? c. What types of information are included in the statistical section?

> Review the financial section. a. Which, if any, independent audit firm performed an audit of the CAFR? b. Did the entity receive an “unqualified” audit opinion? If not, why not? c. Does the report contain management’s discussion and analysis (MD&A)? If s

> What are the three main categories of SEA indicators?

> Review the introductory section of the CAFR. a. Was the entity’s annual report of the previous year awarded a “certificate of achievement for excellence in financial reporting” by the Government Finance Officers Association? What is the significance of t

> A city maintains the following funds: 1. General 2. Special revenue 3. Capital projects 4. Debt service 5. Enterprise 6. Internal service 7. Permanent (trust) 8. Agency For each of the following transactions, indicate the fund in which each transaction w

> The newly established Society for Ethical Teachings, a not‐for‐profit organization, maintains two funds—a general fund for operations and a building fund to accumulate resources for a new building. In its first year, it engaged in the following transacti

> A special district accounts for its general fund (its only fund) on a modified accrual basis. In a particular period it engaged in the following transactions: • It issued $20 million in long‐term bonds. • It acquired several tracts of land at a total cos

> A newly established not‐for‐profit organization engaged in the following transactions. 1. A donor pledged $1,000,000, giving the organization a legally enforceable 90‐day note for the full amount. 2. The donor paid $300,000 of the amount pledged. 3. The

> Select the best answer. 1. Oak Township issued the following bonds during the year: Bonds to acquire equipment for a vehicle repair service that is accounted for in an internal service fund…………………………………………………. $3,000,000 Bonds to construct a new city hal

> The following relate to the town of Coupland (dollar amounts in thousands): Equipment used in a vehicle repair service that provides service to other departments on a cost‐reimbursement basis; the equipment has a 10‐year life with no salvage value….....

> What are three main sections of the report?

> The following is from the governmental funds balance sheet section of the Town of Libertyville’s Comprehensive Annual Financial Report. 1. What is the most likely reason that there are no unassigned balances in any of the funds other th

> What is an agency fund? Why is it the easiest fund for which to account?

> The ultimate aim of governmental and not‐for‐profit organizations is to produce outcomes. Yet in preparing program budgets, many organizations link expenditures to outputs rather than outcomes. Why?

> The balance sheets of both enterprise funds and internal service funds report capital assets and longterm debt. What does that tell you about the funds’ measurement focus and basis of accounting? Explain.

> As the auditor of Clearwater County you learn that various assets are subject to spending constraints. Indicate how each of the following constraints would affect the county’s reported fund balance (i.e., in which category of fund balance it would be rep

> Do encumbrances that remain outstanding at year‐end lapse? That is, do the amounts that will be expended in the following year, when the goods or services are received, have to be rebudgeted in the following year? How can you tell?

> The following schedule shows the amounts related to general purpose supplies that a city debited and credited to the indicated accounts during a year (not necessarily the year‐end balances), excluding closing entries. The organization r

> At the start of its fiscal year on October 1, Fox County reported the following (all dollar amounts in thousands): Fund balance: Committed for encumbrances……………………………. $200 Unassigned…………………………………………………………. 400 Total fund balance……………………………………………... $600

> London Township began Year 1 with a balance of $10 million in its bridge repair fund, a capital projects fund. The fund balance is classified as restricted. At the start of the year, the governing council appropriated $6 million for the repair of two bri

> The budgeted and actual revenues and expenditures of Seaside Township for a recent year (in millions) were as presented in the schedule that follows. 1. Prepare journal entries to record the budget. 2. Prepare journal entries to record the actual revenue

> Wickliffe County authorized the issuance of bonds and contracted with the USA Construction Company (UCC) to build a new sports complex. During 2014, 2015, and 2016 the county engaged in the transactions that follow. All were recorded in a capital project

> Kilbourne County engaged in the following transactions in summary form during its fiscal year. All amounts are in millions. You need not be concerned with the category of funds balances to which reserves for encumbrances are classified on the fund balanc

> Select the best answer. 1. Upon ordering supplies a government should a. Debit encumbrances and credit reserve for encumbrances b. Debit reserve for encumbrances and credit encumbrances c. Debit expenditures and credit encumbrances d. Debit expenditures

> What are the key elements of program budgets as exemplified by a zero‐base budget decision package for an activity?

> In what way do the reporting standards of the GAO differ from those of the AICPA as to (1) public dissemination of the reports and (2) tests of compliance and internal controls?

> Select the best answer. 1. Appropriation budgets are typically concerned with a. The details of appropriated expenditures b. Long‐term revenues and expenditures c. Current operating revenues and expenditures d. Capital outlays 2. Which of the following

> The following is a recommendation from Against the Grain, a series of proposals by the State Comptroller of Texas on how the state could enhance revenues and decrease expenditures: Amend the Lottery Act to Abolish the Lottery Stabilization Fund The sta

> The following is an excerpt (with dates changed) from Against the Grain, a series of recommendations by the State Comptroller of Texas on how to “save” $4.5 billion and thereby balance the state’s budget: Require an Annual August Remittance of One-Half o

> Shown below is an excerpt from a city’s subsidiary ledger for the first two months of its fiscal year. Missing is the column that explains or references each of the entries. 1. Prepare the journal entries that were most likely made in the account, adding

> Review the budget note to the Smith City’s financial statements presented in the previous problem. Assume that the city engaged in the following transactions in 2017 and 2018: • In 2017 it signed a service contract wit

> A city’s note to its financial statements provides considerable insight into its budget practices. Shown below is an excerpt from a note, headed Budgets, from the Smith City, annual report for the fiscal year ended June 30. 1. The note

> The data presented below were taken from the books and records of the village of Denaville. All amounts are in millions. The village encumbers all outlays. As is evident from the data, some goods or services that were ordered and encumbered have not yet

> The following information was drawn from a county’s general fund budgets and accounts for a particular year (in millions): You also learn the following: • For purposes of budgeting, the county recognizes encumbrances a

> The transactions that follow relate to the Danville County Comptroller’s Department over a two‐year period. Year 1 • The county appropriated $12,000 for employee education and training. • The department signed contracts with outside consultants to cond

> A city prepares its budget in traditional format, classifying expenditures by fund and object. In 2010, amid considerable controversy, the city authorized the sale of $20 million in bonds to finance construction of a new sports and special events arena.

> In what key ways do program budgets more directly link expenditures to organizational goals than do conventional object classification budgets?

> A city’s visitors’ bureau, which promotes tourism and conventions, is funded by an 8 percent local hotel occupancy tax (a tax on the cost of a stay in a hotel). Because the visitors’ bureau is supported entirely by the occupancy tax, it is accounted for

> The following schedule shows the amounts related to supplies that a city debited and credited to the indicated accounts during a year (not necessarily the year‐end balances), excluding closing entries. The city records its budget, encum

> The following schedule shows the amounts (in thousands) related to expenditures that a city welfare department debited and credited to the indicated accounts during a year (not necessarily the year‐end balances), excluding closing entri

> Your government is permitted to amend the budget even after the end of the year. When presenting the final actual‐to‐budget comparisons, is it permitted to include the amendments that were adopted after the year‐end?