Question: The physical inventory for Ajak Manufacturing was

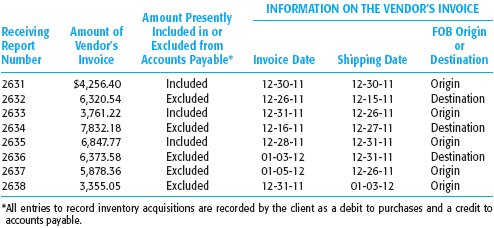

The physical inventory for Ajak Manufacturing was taken on December 30, 2011, rather than December 31, because the client had to operate the plant for a special order the last day of the year. At the time of the client’s physical count, you observed that acquisitions represented by receiving report number 2631 and all preceding ones were included in the physical count, whereas inventory represented by succeeding numbers was excluded. On the evening of December 31, you stopped by the plant and noted that inventory represented by receiving report numbers 2632 through 2634 was received subsequent to the physical count but before the end of the year. You later noted that the final inventory on the financial statements contained only those items included in the physical count. In testing accounts payable at December 31, 2011, you obtain a schedule from the client to aid you in testing the adequacy of the cutoff. The following schedule includes the information that you have not yet resolved:

Required

a. Explain the relationship between inventory and accounts payable cutoff.

b. For each of the receiving reports, state the misstatement in inventory or accounts payable, if any exists and prepare an adjusting entry to correct the financial statements, if a misstatement exists.

c. Which of the misstatements in part b are most important? Explain.

Transcribed Image Text:

INFORMATION ON THE VENDOR'S INVOICE Amount Presently Included in or Amount of Vendor's Invoice Receiving FOB Origin Report Number Excluded from Accounts Payable* or Invoice Date Shipping Date Destination Induded Excluded Included Excluded Included Excluded Excluded Excluded Origin Destination Origin Destination Origin Destination Origin Origin 2631 $4,256.40 6,320.54 3,761.22 7,832.18 6,847.77 6,373.58 5,878.36 3,355.05 12-30-11 12-30-11 2632 12-26-11 12-15-11 2633 12-31-11 12-26-11 2634 12-16-11 12-27-11 2635 12-28-11 12-31-11 2636 01-03-12 12-31-11 2637 01-05-12 12-26-11 2638 12-31-11 01-03-12 *All entries to record inventory acquisitions are recorded by the client as a debit to purchases and a credit to accounts payable.

> List five types of authorizations in the payroll and personnel cycle and state the type of misstatement that is likely to occur when each authorization is lacking.

> If an audit client does not have prenumbered checks, what type of misstatement has a greater chance of occurring? Under the circumstances, what audit procedure can the auditor use to compensate for the deficiency?

> Why are liability accounts included in the capital acquisition and repayment cycle audited differently from accounts payable?

> List the supporting documents and records the auditor will examine in a typical payroll audit in which the primary objective is to detect fraud.

> Distinguish among a payroll master file, a W-2 form, and a payroll tax return. Explain the purpose of each.

> Explain the circumstances under which an auditor should perform audit tests primarily designed to uncover fraud in the payroll and personnel cycle. List three audit procedures that are primarily for the detection of fraud and state the type of fraud the

> List several analytical procedures for the payroll and personnel cycle and explain the type of misstatement that might be indicated when there is a significant difference in the comparison of the current year with previous years’ results for each of the

> In auditing payroll withholding and payroll tax expense, explain why emphasis should normally be on evaluating the adequacy of the payroll tax return preparation procedures rather than the payroll tax liability. If the preparation procedures are inadequa

> Distinguish between the following payroll audit procedures and state the purpose of each: (1) Trace a random sample of prenumbered time cards to the related payments in the payroll register and compare the hours worked with the hours paid, (2) Trace a

> Evaluate the following comment by an auditor: “My job is to determine whether the payroll records are fairly stated in accordance with accounting standards, not to find out whether they are following proper hiring and termination procedures. When I condu

> Explain why the percentage of total audit time in the cycle devoted to performing tests of controls and substantive tests of transactions is usually far greater for the payroll and personnel cycle than for the sales and collection cycle.

> List five tests of controls that can be performed for the payroll and personnel cycle and state the purpose of each control tested.

> Explain the relationship between the payroll and personnel cycle and inventory valuation.

> List four examples of interest-bearing liability accounts commonly found in balance sheets. What characteristics do these liabilities have in common? How do they differ?

> What are the similarities and differences in the objectives of the following two procedures? (1) Select a random sample of receiving reports and trace them to related vendors’ invoices and acquisitions journal entries, comparing the vendor’s name, type

> Identify five general ledger accounts that are likely to be affected by the payroll and personnel cycle in most audits.

> Roost and Briley, CPAs, are doing the audit of Leggert Lumber Co., an international wholesale lumber broker. Because of the nature of their business, payroll and telephone expense are the two largest expenses. You are the in-charge auditor on the engagem

> Outsourcing the payroll function can provide many benefits, but there are also risks associated with outsourcing. The IRS (www.irs.gov) provides information on outsourcing payroll duties for employers who outsource the payroll function (search for “payro

> You are doing the audit of the UTE Corporation, for the year ended December 31, 2011. The following schedule for the property, plant, and equipment and related allowance for depreciation accounts has been prepared by the client. You have compared the ope

> Examine the tests of controls and substantive tests of transactions results, including the sampling application, for Ward Publishing Company. Assume that you have already reached several conclusions. 1. Your tests of details of balances for accounts paya

> While you are having lunch with a banker friend, you become involved in explaining to him how your firm conducts a typical audit. Much to your surprise, your friend is interested and is able to converse intelligently in discussing your philosophy of emph

> As part of the audit of different audit areas, auditors should be alert for the possibility of unrecorded liabilities. For each of the following audit areas or accounts, describe a liability that can be uncovered and the audit procedures that can uncover

> The following program has been prepared for the audit of accrued real estate taxes of a client that pays taxes on 25 different pieces of property, some of which have been acquired in the current year: 1. Obtain a schedule of accrued taxes from the client

> Your client, Edgartown Corporation, prepared the following schedule of land, buildings and equipment for the audit of financial statements for the year ended December 31, 2011: a. What type of evidence would you examine to support the beginning balances

> Many companies aspire to go public and have their shares traded on exchanges such as the New York Stock Exchange (NYSE) and NASDAQ. Visit the Website of the NYSE (www.nyse.com) and search for the “Guide to the NYSE Marketplace” to answer the following qu

> The following audit procedures were planned by Linda King, CPA, in the audit of the acquisition and payment cycle for Cooley Products, Inc.: 1. Review the acquisitions journal for large and unusual transactions. 2. Send letters to several vendors, includ

> List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and payment cycle for a typical manufacturing company.

> The following types of internal controls are commonly used by organizations for property, plant, and equipment: 1. A fixed asset master file is maintained with a separate record for each fixed asset. 2. Written policies exist and are known by accounting

> For each of the following misstatements in property, plant, and equipment accounts, state an internal control that the client can implement to prevent the misstatement from occurring and a substantive audit procedure that the auditor can use to discover

> The following questions concern analytical procedures in the acquisition and payment cycle. Choose the best response. a. Which of the following comparisons will be most useful to an auditor in auditing an entity’s income and expense accounts? (1) Prior y

> The following questions concern internal controls in the acquisition and payment cycle. Choose the best response. a. Which of the following controls will most likely justify a reduced assessed level of control risk for the existence assertion for equipme

> List the factors that should affect the auditor’s decision whether to analyze an account balance. Considering these factors, list four expense accounts that are commonly analyzed in audits.

> How will the approach for verifying repair expense differ from that used to audit depreciation expense? Why will the approach be different?

> What is meant by the analysis of expense accounts? Explain how expense account analysis relates to the tests of controls and substantive tests of transactions that the auditor has already completed for the acquisition and payment cycle.

> List three expense accounts that are tested as part of the acquisition and payment cycle or the payroll and personnel cycle. List three expense accounts that are not directly verified as part of the cycle.

> You have been engaged for the audit of the Y Company for the year ended December 31, 2011. The Y Company is in the wholesale chemical business and makes all sales at 25% over cost. Following are portions of the client’s sales and purcha

> Explain the relationship between tests of the acquisition and payment cycle and tests of inventory. Give specific examples of how these two types of tests affect each other.

> In verifying accounts payable, it is common to restrict the audit sample to a small portion of the population items, whereas in auditing accrued property taxes, it is common to verify all transactions for the year. Explain the reason for the difference.

> Explain the relationship between accrued rent and substantive tests of transactions for the acquisition and payment cycle. Which aspects of accrued rent are not verified as part of the substantive tests of transactions?

> Evaluate the following statement by an auditor concerning tests of acquisitions and cash disbursements: “In selecting the acquisitions and cash disbursements sample for testing, the best approach is to select a random month and test every transaction for

> What are the major differences between the audit of prepaid expenses and other asset accounts such as accounts receivable or property, plant, and equipment?

> Distinguish between the evaluation of the adequacy of insurance coverage and the verification of prepaid insurance. Explain which is more important in a typical audit.

> Explain why the audit of prepaid insurance should ordinarily take a relatively small amount of audit time if the client’s assessed control risk for acquisitions is low.

> Explain the relationship between substantive tests of transactions for the acquisition and payment cycle and tests of details of balances for the verification of prepaid insurance.

> In auditing depreciation expense, what major considerations should the auditor keep in mind? Explain how each can be verified.

> List and briefly state the purpose of all audit procedures that might reasonably be applied by an auditor to determine that all property, plant, and equipment retirements have been recorded in the accounting system.

> What is the relationship between the audit of property, plant, and equipment accounts and the audit of repair and maintenance accounts? Explain how the auditor organizes the audit to take this relationship into consideration.

> As a part of your clerical tests of inventory for Martin Manufacturing, you have tested about 20% of the dollar items and have found the following exceptions: 1. Extension errors: 2. Differences located in comparing last year’s costs wi

> You are the manager in the audit of Vernal Manufacturing Company and are turning your attention to the income statement accounts. The in-charge auditor assessed control risk for all cycles as low, supported by tests of controls. There are no major inhere

> As part of the June 30, 2011, audit of accounts payable of Milner Products Company, the auditor sent 22 confirmations of accounts payable to vendors in the form of requests for statements. Four of the statements were not returned by the vendors, and five

> List one possible control for each of the six transaction-related audit objectives for acquisitions. For each control, list a test of control to test its effectiveness.

> Even though Bergeron Wholesale Company is privately held, management has decided that it is worthwhile to have effective internal controls to the extent it is practical in a small company, as a way to reduce the likelihood of error and fraud. They have i

> You were in the final stages of your audit of the financial statements of Ozine Corporation for the year ended December 31, 2011, when you were consulted by the corporation’s president, who believes there is no point to your examining the year 2012 acqui

> The Broughton Cap Company requires that prenumbered receiving reports be completed when purchased inventory items arrive in the receiving department. At the time of receipt, the receiving clerk writes the date of receipt on the receiving document. The la

> Lecimore Company has a centralized purchasing department that is managed by Joan Jones. Jones has established policies and procedures to guide the clerical staff and purchasing agents in the day-to-day operation of the department. She is satisfied that t

> Haskin Company was founded 40 years ago and now has several manufacturing plants in the Northeast and Midwest. The evaluation of proposed capital expenditures became increasingly difficult for management as the company became geographically dispersed and

> Weston Corporation has an internal audit department operating out of the corporate headquarters. Various types of audit assignments are performed by the department for the eight divisions of the company. The following findings resulted from recent audits

> In an annual audit at December 31, 2011, you find the following transactions near the closing date: 1. Merchandise costing $1,822 was received on January 3, 2012, and the related acquisition invoice recorded January 5. The invoice showed the shipment was

> In testing cash disbursements for the Jay Klein Company, you obtained an understanding of internal control. The controls are reasonably good, and no unusual audit problems arose in previous years.Although there are not many individuals in the accounting

> Lajod Company has an internal audit department consisting of a manager and three staff auditors. The manager of internal audits, in turn, reports to the corporate controller. Copies of audit reports are routinely sent to the audit committee of the board

> What are the major differences between reporting for operational and financial auditing?

> Explain how planning for operational auditing is similar to and different from financial auditing.

> Identify the three phases of an operational audit.

> Explain what is meant by the criteria for evaluating efficiency and effectiveness. Provide five possible specific criteria for evaluating effectiveness of an IT system for payroll.

> Under what circumstances are external auditors likely to be involved in operational auditing? Give one example of operational auditing by a CPA firm.

> Explain the role of government auditors in operational auditing. How is this similar to and different from the role of internal auditors?

> Distinguish among the following types of operational audits: functional, organizational, and special assignment. State an example of each for a not-for-profit hospital.

> Distinguish between efficiency and effectiveness in operational audits. State one example of an operational audit explaining efficiency and another explaining effectiveness.

> The following are sales, cost of sales, and inventory data for Aladdin Products Supply Company, a wholesale distributor of cleaning supplies. Dollar amounts are in millions. Required a. Calculate the following ratios, using an electronic spreadsheet prog

> Identify the three major differences between financial and operational auditing.

> The following auditing procedures were performed in the audit of accounts payable: 1. Obtain a list of accounts payable. Re-add and compare with the general ledger. 2. Trace from the general ledger trial balance and supporting documentation to determine

> Identify the key required reports of the Single Audit Act and OMB Circular A-133.

> Identify the primary specific objectives that must be incorporated into the design of audit tests under the Single Audit Act.

> In what ways is the Yellow Book consistent with generally accepted auditing standards, and what are some additions and modifications?

> Explain what is meant by the Single Audit Act. What is its purpose?

> Explain how governmental financial auditing is similar to and different from audits of commercial companies. Who does governmental auditing?

> Explain the difference between the independence of internal auditors and external auditors in the audit of historical financial statements. How can internal auditor’s best achieve independence?

> What is the nature of the two categories of standards in the IIA International Standards for the Professional Practice of Auditing?

> Explain the role of internal auditors for financial auditing. How is it similar to and different from the role of external auditors?

> In connection with his audit of the financial statements of Knutson Products Co., an assembler of home appliances, for the year ended May 31, 2011, Ray Abel, CPA, is reviewing with Knutson's controller the plans for a physical inventory at the company wa

> Superior Co. manufactures automobile parts for sale to the major U.S. automakers. Superior's internal audit staff is to review the internal controls over machinery and equipment and make recommendations for improvements when appropriate. The internal aud

> The Institute of Internal Auditors (IIA) is an international professional association of more than 170,000 members with global headquarters in Altamonte Springs, Florida. Throughout the world, The IIA is recognized as the internal audit profession's lead

> The following misstatements are included in the accounting records of Westgate Manufacturing Company. 1. The accounts payable clerk prepares a monthly check to Story Supply Company for the amount of an invoice owed and submits the unsigned check to the t

> Jones, CPA, has completed the audit of Sarack Lumber Supply Co. and has issued a standard unqualified report. In addition to a report on the overall financial statements, the company needs a special audited report on three specific accounts: sales, net f

> Bengston, CPA, is conducting the audit of Pollution Control Devices, Inc. In addition, a supplemental negative assurance report is required to a major mortgage holder. The supplemental report concerns indenture agreements to keep the client from defaulti

> You have been requested by the management of J. L. Lockwood Co. to issue a debt compliance letter as a part of the audit of Taylor Fruit Farms, Inc. J. L. Lockwood Co. is a supplier of irrigation equipment. Much of the equipment, including that supplied

> Carl Monson, the owner of Major Products Manufacturing Company, a small, successful, longtime audit client of your firm, has requested you to work with his company in preparing 3-year forecasted information for the year ending December 31, 2012, and two

> Each of the following represents different client requests for engagements related to WebTrust and SysTrust assurance services. a. Ware Hospital Systems, Inc. is in the process of developing a new patient records system. Management has approached a licen

> Lucia Johnson, of Johnson and Lecy, CPAs, has completed the first-year audit of Tidwell Publishing Co., a publicly held company, for the year ended December 31, 2011. She is now working on a review of interim financial statements for the quarter ended Ma

> In an engagement to review the financial statements of a nonpublic company, SSARS require the accountant to obtain review evidence that is primarily based on inquiries and analytical procedures. The nature of the accountant's inquiries is a matter of jud

> You encountered the following situations during the December 31, 2011, physical inventory of Latner Shoe Distributor Company: Required a. Latner maintains a large portion of the shoe merchandise in 10 warehouses through-out the eastern United States. Th

> SSARS contain several procedures that are required when engaged to perform a compilation or review engagement. Below are ten statements that may or may not be relevant to a compilation or review engagement. For each of the ten statements, indicate whethe

> You are doing a review services and related tax work engagement for Murphy Construction Company. You have made extensive inquiries of management about their financial statements and have concluded that management has an excellent understanding of its bus

> Evaluate the following comments about compiled financial statements: "When CPAs associate their name with compiled financial statements, their only responsibility is to the client and that is limited to the proper summarization and presentation on the fi

> Donnen Designs, Inc. is a small manufacturer of women’s casual-wear jewelry, including bracelets, necklaces, earrings, and other moderately priced accessory items. Most of their products are made from silver, various low-cost stones, beads, and other dec

> The following questions concern reports issued by auditors, other than those on historical financial statements. Choose the best response. a. An auditor is reporting on cash basis financial statements. These statements are best referred to in the opinion

> The following questions concern attestation engagements. Choose the best response. a. Which of the following professional services is considered an attestation engagement? (1) A management consulting engagement to provide IT advice to a client. (2) An in

> The following are miscellaneous questions about compilation and review services. Choose the best response. a. It is acceptable for a CPA to be associated with financial statements when not independent with respect to the client and still issue a substant

> The Absco Corporation has requested that Herb Germany, CPA, provide a report to the Northern State Bank as to the existence or nonexistence of certain loan conditions. The conditions to be reported on are the working capital ratio, dividends paid on pref

> State the reporting requirements for statements prepared on a basis other than GAAP.