Question: The purchase schedule for Laundryman's Corporation

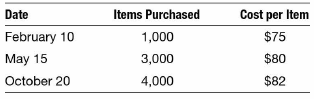

The purchase schedule for Laundryman's Corporation is as follows:

The inventory balance as of the beginning of the year was $35,000 (500 units at $70 each). During the year ended December 31, the company sold 6,000 units for $150 per unit. Operating expenses other than cost of goods sold totaled $125,000. The effective income tax rate is 30 percent.

INSTRUCTIONS:

a. Prepare three income statements, one under each assumption- FIFO, LIFO, average.

b. How many tax dollars would be saved by using LIFO instead of FIFO?

c. Assume the net realizable value of an item of inventory dropped to $78 as of the end of the year. Apply the lower-of-cost-or-market (net realizable value) rule, and provide the appropriate journal entry (if necessary) under the FIFO, LIFO, and average assumptions.

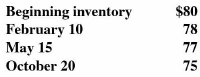

d. Repeat (a) above, assuming the costs per item were the following:

Which of the three assumptions now gives rise to the highest net income and ending inventory?

> Consider the three notes payable listed here . Each was issued on January 1, 2021, and matures on December 31, 2023. Interest payments are made annually on December 31. INSTRUCTIONS: a. Compute the present value of the remaining cash outflows for each no

> Ross Running Shoes issued ten $1,000 bonds with a stated annual rate of 10 percent on June 30, 2021. These bonds mature on June 30, 2024. The bonds have an effective interest rate of 8 percent, and interest is paid semiannually on December 31 and June 30

> Hartney Enterprises issued twenty $1,000 bonds on June 30, 2021, with a stated annual interest rate of 6 percent. The bonds mature in six years. Interest is paid semiannually on December 31 and June 30. The effective interest rate as of June 30, 2021, th

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of DuPont and Lyondel!Basell Industries, competing firms in the chemical industry, on inventory turnover and cost of good

> Earl Rix, president of Rix Driving Range and Health Club, has provided you with the following information: The stated annual interest rate on the notes is 10 percent, and interest is paid annually on December 31. The $95,000 in interest expense is due so

> The balance sheet as of December 31, 2021, for Boyton Sons follows: The company needs capital to finance operations and purchase new equipment. Boyton is not certain how much money it will need and is considering one of the following three-year notes pay

> Patnon Plastics needs some cash to finance expansion. Patnon issued the following debt to acquire the cash: A. A five-year note with a stated interest rate of zero, a face value of $20,000, and an effective interest rate of 10 percent. B. An eight-year

> The balance sheet as of December 31, 2020, for Manheim Corporation follows: INSTRUCTIONS: a. Compute Manheim Corporation's long-term debt/equity ratio. b. Assume that Manheim Corporation is considering borrowing money and signing a five-year note with th

> Hartl Enterprises issued ten $1,000 bonds on September 30, 2020, with a stated annual interest rate of 8 percent. These bonds will mature on October 1, 2030, and have an effective rate of 10 percent. Interest is paid semiannually on October 1 and April 1

> On June 1, 2020, Mayberry Imports purchased bonds on the open market, paying $92,994. The bonds had a face value of $100,000, a stated annual interest rate of 4 percent, and a remaining time to maturity of two years. Interest was paid semiannually on Nov

> Hodge Sports bonds are selling on the open market at par value. The bonds have a stated interest rate of 9 percent and mature in five years. You have determined that the risk-free rate is 7 percent. INSTRUCTIONS: a. What is the maximum risk premium you c

> Memminger Corporation purchased equipment on January 1, 2021. The terms of the purchase required that the company pay $1,000 in interest at the end of each year for five years and $20,000 at the end of the fifth year. The FMV of the equipment on January

> The balance sheet as of December 31, 2020, for Thompkins Laundry follows: The $20,000 of long-term debt on the balance sheet represents a long-term note that requires Thompkins to maintain a debt/equity ratio of less than 1: 1. If the covenant is violate

> Mackey Company acquired equipment on January 1, 2020, through a leasing agreement that required an annual year-end payment of $30,000. Assume that the lease has a term of five years and that the life of the equipment is also five years. The FMV of the eq

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of Caterpillar and AGCO, competing firms in the farm and construction industry, on inventory turnover and cost of goods s

> Taylor Corporation is contemplating issuing bonds to raise cash to finance an expansion. Before issuing the debt, the controller of the company wants to prepare an analysis of the cash flows and the interest expense associated with the issuance. Taylor C

> Ficus Tree Farm issued five $1,000 bonds with a stated annual interest rate of 12 percent on January 1, 2021. The bonds mature on January 1, 2026. Interest is paid semiannually on June 30 and December 31. The bonds were sold at a price that resulted in a

> Ginny & Bill Eateries reported the following account balances in the December 31, 2020, financial report: The bonds have a stated annual interest rate of 8 percent and an effective interest rate of 6 percent. Interest is paid on June 30 and December

> On December 31, 2020, East Race Kayak Club decided to borrow $20,000 for two years. The Bend Bank currently is charging a 10 percent effective annual interest rate on similar loans. INSTRUCTIONS: a. Assume that the club borrows $20,000 and signs a two-ye

> Acme Inc. purchased machinery at the beginning of 2018 for $50,000. Management used the straight-line method to depreciate the cost for financial reporting purposes and the double-declining balance method to depreciate the cost for tax purposes. The life

> Shelby Company instituted a defined benefit pension plan for its employees at the beginning of 2016. An actuarial method that is acceptable under generally accepted accounting principles indicates that the company should contribute $40,000 each year to t

> Pharmaceutical manufacturer Eli Lilly announced that it was taking a $425 million restructuring charge due to the sale of its Tippecanoe Laboratories unit. Of the total expense, the company indicated that $364 million was related to "noncash" asset impai

> To kick off its 2020 advertising campaign, Rachel's Breakfast Cereal is offering a $1 refund in exchange for five cereal box tops. The company estimates that the tops of 10 percent of the cereal boxes sold will be returned for the refund. The cereal boxe

> Arden's Used Cars offers a one-year warranty from the date of sale on all cars. From historical data, Mr. Arden estimates that, on average, each car will require the company to incur warranty costs of $760. The following activities occurred during 2020:

> While shopping on October 13, 2020, at the Floor Wax Shop, Tom Jacobs slipped and seriously injured his back. Mr. Jacobs believed that the Floor Wax Shop should have warned him that the floors were slick; hence, he sued the company for damages. As of Dec

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of Caterpillar and AGCO, competing companies in the farm and construction industry, on the current and quick ratios, inte

> Linton Industries borrowed $500,000 from Security Bankers to finance the purchase of equipment costing $360,000 and to provide $140,000 in cash. The note states that the loan matures in 20 years, and the principal is to be paid in annual installments of

> The following information was taken from the 2019 annual reports of Wal greens and CVS, competing drug store chains (dollars in millions): INSTRUCTIONS: Compute the conservatism ratios for both companies and comment on the differences. Would you consider

> You are a security analyst for Magneto Investments and have chosen to invest in one firm from the semiconductor manufacturing industry. You have narrowed your choice to either Owen-Foley Company or Amerton Industries, firms of similar size and direct com

> Beth Morgan, controller of Boulder Corporation, is currently preparing the 2020 financial report. She is trying to decide how to classify the following items: 1. Account payable of $170,000 owed to suppliers for inventory. 2. A $60,000 note payable that

> Garmen Oil Company recently discovered an oil field on one of its properties in Texas. In order to extract the oil, the company purchased drilling equipment on January I, 2020, for $800,000 cash and also purchased a mobile home on the same date for $54,0

> Bently Poster Company pays a bonus to its officers of 8 percent of net income and pays dividends to its shareholders in the amount of 75 percent of net income. On January 1, 2020, the company purchased equipment for $400,000. This asset will be depreciat

> Several years ago, Zimmer Holdings changed the method it used to account for handheld instruments used by orthopedic surgeons. Prior to that date, the cost of these instruments was carried as a prepaid expense, and when used, the cost was converted to an

> Burke Copy Center purchased a machine on January I, 2015, for $ 180,000 and estimated its useful life and salvage value at ten years and $30,000, respectively. On January 1, 2020, the company added three years to the original useful-life estimate. INSTRU

> Hulteen Hardware purchased a new building on January 1, 2016, for $ 1.5 million. The company expected the building to last 25 years and expected to be able to sell it then for $150,000. During 2021, the building was painted at a cost of $5,000. Almost IO

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of ExxonMobil and Imperial Oil, competing companies in the oil and gas industry, on the current and quick ratios, interes

> McCartney Manufacturing purchased a dryer for $100,000 on January 1, 2017. The estimated life of the dryer is five years, and the salvage value is estimated to be $10,000. McCartney uses the straightline method of depreciation. On January 1, 2021, McCart

> Westmiller Construction Company purchased a new truck on December 31, 2020, for $48,000. The truck has an estimated useful life of three years and an estimated salvage value of $12,000. When the truck was purchased, the company's accountant mistakenly ma

> When The Walt Disney Company purchased the common stock of Twenty-First Century Fox, Inc., for $69.5 billion, the fair market value of the assets acquired and liabilities assumed was estimated to be $79.0 billion and $58.5 billion, respectively. a. Comp

> On January 1, 2020, Diversified Industries purchased Specialists Inc. for $1.8 million. The balance sheet of Specialists Inc. at the time of purchase follows: The total FMV of the individual assets of Specialists is $1.35 million, and the liabilities are

> Webb Net Manufacturing purchased a new net weaving machine on January 1, 2018, for $500,000. The new machine has an estimated life of five years and an estimated salvage value of $100,000. It is company policy to use straight-line depreciation for all of

> Stonebrecker International recently purchased new manufacturing equipment. The equipment cost $1 million. The company also incurred additional costs related to the acquisition of the equipment. The total cost to transport the equipment to Stonebrecker's

> You are a financial analyst currently reviewing the financial statements of Danner International and Brady Enterprises, two companies of similar size within the same industry. Net incomes of $39,300 and $42,700 were reported for 2020 by Danner and Brady,

> Ruhe Auto Supplies began operations in 2007. The company's inventory purchases and sales in the first and subsequent years of operations are as follows: The company's federal income tax rate is 30 percent, and the inventory at December 31, 2019, was $112

> Financial statements as of December 31, 2019, for Johnson & Johnson are as follows. The company used the FIFO inventory cost flow assumption to prepare these statements (dollars in millions). Assume that on December 30, 2019, Johnson & Johnson de

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of Becton Dickinson and ResMed, competitors in the medical technology industry, on capital structure leverage, the curren

> The Magic Teddy Bear Toy Company entered into the following transactions during January 2020: The Magic Teddy Bear Toy Company has 5,000 teddy bears on hand at $ 19 each as of January 1, 2020. INSTRUCTIONS: Prepare all necessary entries, including adjust

> The purchase schedule for Lumbermans and Associates is as follows: The inventory balance as of the beginning of the year was $15,000 (15,000 units at $1), and an inventory count at year-end indicated that 11,000 items were on hand. Sales and operating ex

> The following information was taken from the records of Eli Lilly, a major pharmaceutical (dollars in millions). Assume that ending inventory was overstated by $500 in 201 7, understated by $150 in 2018, and overstated by $320 in 2019. INSTRUCTIONS: Comp

> Stober Corporation made two purchases of inventory on account during the month of March. The first purchase was made on March 5 for $30,000, and the second purchase was made on March 10 for $60,000. The first purchase was settled on March 13, and the sec

> The 2020 inventory activity for Helio Brothers, a discount retailer that prepares financial statements under IFRS using the FIFO cost flow assumption, is provided below. Many of the items in the company's inventory at the end of 2020 were judged to be ou

> IBT has used the LIFO inventory cost flow assumption for five years. As of December 31, 2019, IBT had 700 items in its inventory, and the $9,000 inventory dollar amount reported on the balance sheet consisted of the following costs: During 2020, IBT sold

> On November 15 and 26, Brown and Swazey purchased merchandise on account for prices of $8,000 and $ 12,000, respectively. None of these items has been sold, and both accounts are paid in full on December 2. INSTRUCTIONS: Provide all the journal entries t

> In an attempt to include all relevant information for decision-making purposes, Merimore Company estimates bad debts using the aging method. However, for external reporting purposes, the company estimates bad debts as a percentage of credit sales. Merimo

> Fine Linen Service began operations on January 28, 2017. The company does not establish an allowance for bad debts. It simply recognizes a bad debt expense when an account is deemed uncollectible. The company has written off the following items over the

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of Kohl 's and JC Penney, competing retail fashion stores, on capital structure leverage, the current ratio, total asset

> Excerpts from the 2020 financial statements of Finley Ltd., a service company, follow: Auditors from Price and Company reviewed the financial records of Finley and found that a credit sale of $10,000 (for services rendered), which was included in the ser

> The following financial information represents Hadley Company's first year of operations, 2020: After reading Hadley's financial statements, you conclude that the company had a very successful first year of operations. However, after further examination,

> The information below was taken from the footnotes of JPMorgan Chase's 2019 annual report. The December 31, 2019, balance in the allowance account was $13,123 (dollars in millions). INSTRUCTIONS: Compute the actual write-offs recognized by JPMorgan Chase

> Albertson's Locksmith Corporation started operations on January 1, 2019. Albertson's estimates Un collectibles using the percentage-of-credit-sales method. The following information pertains to the company's sales, receivables, and collections for the fi

> Glacier Ice Company uses a percentage-of-net-sales method to account for estimated bad debts. Historically, 3 percent of net sales has proven to be uncollectible. During 2020 and 2021 , the company reported the following: INSTRUCTIONS: a. Prepare the nec

> Financial information for CNG Inc. follows: The company estimates bad debts for financial reporting purposes at 3 percent of credit sales. The balance in allowance for bad debts as of January 1, 2019, was $10,000. INSTRUCTIONS: a. Provide the journal ent

> International Services entered into a debt covenant requiring it to maintain a current ratio of at least 1.5: l. The company's condensed balance sheet as of December 31 follows: International's primary customer is Buckingham Ltd., a company located in Br

> Hughes International is a U.S. company that conducts business throughout the world. Assume that during 2019 the company entered into the following transactions at the following exchange rates. 1. Sold merchandise to Royal Equipment Company (a United King

> Excerpts from the financial statements of Ticheley Enterprises are as follows: On December 27, 2020, Ticheley sent merchandise with a sales price of $8,500 to a major customer. The merchandise was in transit as of December 31 . The cost of the inventory

> On September 30, 2020, Print-O-Matic Inc. entered into an arrangement with its bank to borrow $250,000. The principal is due on October 1, 2025, and the note has a stated annual interest rate of 10 percent. Under the borrowing agreement, Print-O-Matic ag

> Access the Data Analytic worksheet at www.wiley.coin/go/pratt/financialaccountinglle and create a statement that explains the change in Dillard’s retained earnings balance during 2017 and 2018.

> Bob Cleary, the controller of Mountain-Pacific Railroad, has prepared the financial statements for 2019 and 2020, which follow. The market prices of the company's stock as of January 1, 2019, December 31, 2019, and December 31, 2020, were $50, $45, and $

> Tumwater Canyon Campsites began operations on January 1, 2020. The following information is available at year-end. Assume that all sales were on credit. INSTRUCTIONS: Prepare an income statement and the current asset and current liability portions of the

> The following selected financial information was obtained from the 2020 financial reports of Robotronics Inc. and Technology, Limited: Assume that total assets, total liabilities, and total shareholders' equity were constant throughout 2020. INSTRUCTIONS

> Excerpts from the 2019 financial statements for Goodyear are as follows (dollars in millions): INSTRUCTIONS: Assume that you have some capital to invest and that you are considering an equity investment in Goodyear. Review the financial statements and co

> The following information was obtained from the 2020 financial reports of Hathaway Toy Company and Yakima Manufacturing: Assume that the only change to shareholders' equity during 2020 is due to net income earned in 2020. The number of outstanding shares

> You have just been hired as a stock analyst for a large stock brokerage company. Your first assignment is to analyze the performance of Gidley Electronics. The company's balance sheet for 2019 and 2020 follows. The company's income statement and reconcil

> You are considering investing in Eli Lilly, a major pharmaceutical company. As part of your investigation of Lilly, you obtained the following balance sheets for the years ended December 31, 2019 and 2018 (dollars in millions): INSTRUCTIONS: a. Compute t

> Edgemont Repairs began operations on January 1, 2018. The 2018, 2019, and 2020 financial statements follow: On January 1, 2020, the company expanded operations by taking out a $40,000 long-term loan at a 10 percent annual interest rate. INSTRUCTIONS: a.

> Obtain and review the 2019 consolidated income statement and balance sheet published by Unilever, which is located online at the Unilever website. INSTRUCTIONS: a. Compute the profitability, solvency, leverage, and turnover ratios listed in Figure 5- 3.

> Information about PepsiCo's six primary segments follows (dollars in millions). The information was taken from the company's 2019 SEC Form I 0-K. INSTRUCTIONS: a. Compute the percent each segment contributes to the total revenues reported for 2019. b. Ra

> Access the Data Analytic worksheet at www.witey.comfgu/prattffinanciaIaccounting11e and create a statement that explains the change in Bed, Bath and Beyond’s retained earnings balance during 2017.

> The following relationships were obtained for Boulder Mineral Company for 2020: ADDITIONAL INFORMATION: I. Boulder Mineral Company generated $450,000 in net income during 2020. 2. Credit sales comprise 80 percent of sales. 3. Cost of goods sold is 55 per

> Watson Metal Products is planning to expand its operations to France in response to increased demand from the French for quality metal products to use in production processes. Ben Watson, president of Watson Metal Products, and his consultants have estim

> You have just been hired as a loan officer for Washington Mutual Savings. Selig Equipment and Mountain Bike Inc. have both applied for $125,000 nine-month loans to acquire additional plant equipment. Neither company offered any security for the loans. It

> Mountain-Pacific Railroad, whose financial statements are presented in P5.9, is interested in comparing itself to the rest of the industry. Bob Cleary, the controller, has obtained the following industry averages from a trade journal. (The industry avera

> Advanced Micro Devices, a global technology company, reported the following selected items as part of its 2019 annual report (dollars in millions): INSTRUCTIONS: Compute the following ratios: 1. Current ratio 2. Quick ratio 3. Receivable turnover (time a

> The following information is available for Derrick Company immediately before and immediately after the adjusting journal entries: INSTRUCTIONS: Prepare the adjusting journal entries that gave rise to the changes indicated.

> The following information is available for M&M Johnson Inc.: a. The December 31, 2(120, supplies inventory balance is $85,000. A count of supplies reveals that the company actually has $30,000 of supplies on hand. b. As of December 31, 2020, Johnson Inc.

> Beta Alloys made the following adjusting journal entries on December 31, 2020. INSTRUCTIONS: Classify each adjusting entry as either an accrual adju6tmeni (A) or a cost expiration adjustment (C), and indicate whether each entry increases (+ ), decreases

> Ten transactions are listed below. INSTRUCTIONS: For each one, indicate what specific accounts are affected as well as the direction (increase or decrease) of the effect. Also indicate whether the transaction would increase or decrease both net income

> The December 31, 2020, balance sheet of Tybee Corporation is provided below (in millions). Transactions during 2021: • Paid $5 for employee payroll that was incurred during the year. • Collected $10 cash from customers

> Access the Data Analytic worksheet at www.wiley.corn/gofpratt/financialaccountinglle and compare and discuss the size of two large Internet information providers: U.S.-based Alphabet. which reports U.S. GAAP financial statements expressed in U.S. dollars

> The December 31. 2020, balance sheet for Morrison Home Services is summarized below. During January 2021, the following transactions were entered into: 1. Services were performed for $7,000 cash. 2. $3,000 cash was received from customers on outstanding

> Ryan Hope, controller of Hope Inc., provides you with the following information concerning Hope during 2020. (Hope Inc. began operations on January 1, 2020.) 1. Issued 1,000 shares of common stock at $95 per share. 2. Paid $2,600 per month to rent office

> You are a credit analyst for First American Bank, and Badger Business has applied for a loan. The company claims to have more than tripled profits from 2019 to 2020 and believes that it should be given prime credit terms. In addition, you note that Badge

> The following T-accounts reflect seven different transactions that Rodman Container Company entered into during 2020: INSTRUCTIONS: For each transaction, describe what occurred and how it affected the accounting equation.

> Mayberry Enterprises has two sources of revenue. It sells advertising displays to retail firms and provides a consulting service on how to mount and use these displays. You represent a large manufacturing company that is considering purchasing Mayberry.

> You are a credit analyst for First American Bank, and Badger Business has applied for a loan. The company claims to have more than tripled profits from 2019 to 2020 and believes that it should be given prime credit terms. In addition, you note that Badge

> The following balance cheer is presented for J.D.F. Company as of December 31, 2020. During 2021, J.D.F. entered into the following transactions. 1. Made credit sales of $1,350,000 and cash sales of $350,000. The cost of the inventory sold was $700,000.

> The following balances were taken from the December 31, 2(1l9, balance sheet of AT&T (dollars in millions): Early in 2020, AT&T considered the financial effects of several events. INSTRUCTIONS: For each of the five events listed here, indicate ho

> The following balances were taken from the December 31, 2019, balance sheet of Manpower In a world-leading workforce provider (dollars in millions): Early in 2020, Manpower considered the financial effects of seven events. INSTRUCTIONS: For each of the

> The following balances were taken from the October 31, 2019, balance sheet of HP, Inc. (dollars in millions). Early in fiscal 2020, HP considered the financial effects of several events. INSTRUCTIONS: For each of the five events listed here, indicate how

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialacconntinglle and compare and discuss the size of two large media companies: U.S.-based News Corp, which reports U.S. GAAP financial statements expressed in U.S. dollars, and Norwegian