Question: The shareholders' equity section of Mayberry

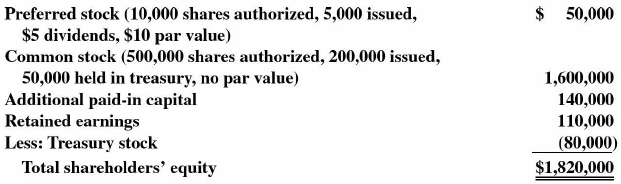

The shareholders' equity section of Mayberry Corporation, as of the end of 2021, follows. Mayberry began operations in 2017. The 5,000 shares of preferred stock have been outstanding since 2017.

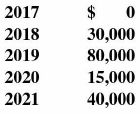

The company has paid the following total cash dividends since 2017:

a. Compute the dividends paid to the preferred and common shareholders for each of the years since 2017 assuming that missed preferred dividends never have to be paid in future years.

b. Repeat (a) but assume that missed preferred dividends must be paid first in future years when dividends are declared.

> The following information was taken from the 2019 annual report of Target Corporation ( dollars in millions): a. Compute the inventory purchases made by Target during 2019. Record a single entry that reflects these purchases. b. How much cash did Target

> The following information was taken from the IFRS-based 2019 financial statements published by Carrefour, a French retailer (in million euros): From the information above, estimate net cash from operations.

> The following balance sheet and income statement data were taken from the records of Standard Center Manufacturing for the year ended December 31, 2021. The company sells goods and provides services. All sales are made on account, and cash is received in

> The following balance sheet and income statement data were taken from the records of Harbaugh Auto Supply for the year ended December 31, 2021: The company sells goods and provides services. All sales are made on account, and cash is received in advance

> The following balance sheet and income statement data were taken from the records of Steeler and Jones for the year ended December 31, 2021: Prepare the operating section of the statement of cash flows, and present it under both the direct and indirect m

> The following are several activities that Wallingford Inc. engaged in during 2021: l. Wrote off an open receivable as uncollected. 2. Purchased a piece of plant equipment. 3. Reacquired 5,000 shares of its common stock. 4. Sold a building in exchange for

> The following balance sheet and income statement data were taken from the records of Mako Retail Supply for the year ended December 31, 2021: Prepare the operating section of the statement of cash flows, and present it under both the direct and indirect

> The following balance sheet and income statement data were taken from the records of Martland Stores for the year ended December 31, 2021: Prepare the operating section of the statement of cash flows, and present it under both the direct and indirect met

> The following balance sheet and income statement data were taken from the records of L. L. Beeno for the year ended December 31, 2021: Prepare the operating section of the statement of cash flows, and present it under both the direct and indirect methods

> The operating cash flows and balance sheet excerpts of Schlee and Associates for the period ending December 31, 2021, follow. Compute net income for the period ending December 31, 2021.

> The following information was taken from the records of Romora Supply House. Prepare a statement of cash flows ( direct method) for the period ending December 31, 2021. Assume that all transactions involve cash.

> In the 2019 operating section of its IFRS-based statement of cash flows, European retailer Carrefour reported the following (in millions of euros): a. Describe the basic form of the entries recorded by Carrefour related to the two adjustments listed abov

> The following information was taken from the records of Grimes Pools. Prepare a statement of cash flows (direct method) for the period ending December 31, 2021. Assume that all transactions involve cash.

> Income statement and balance sheet excerpts of Shevlin and Liberty for the period ending December 31, 2021, follow. Compute cash provided (used) by operating activities for the period ending December 31, 2021. Use both the direct and indirect forms of pr

> Excerpts from the 2019 financial statements of General Mills are as follows ( dollars in millions): For 2019, compute estimates of cash receipts from customers and cash payments to suppliers. Assume that all sales are on account and that accounts payable

> The following information was taken from the records of Dylan's Toys: Equipment with a cost of $8,000 was sold during 2021. a. How much equipment was purchased during 2021? b. How much cash was collected on the sale of the equipment during 2021? c. Provi

> The following year-end totals were taken from the records of Landau's Supply House. Compute the cash outflows associated with insurance and salaries and wages during 2021.

> Classify each of the following transactions as an operating, investing, or financing activity, even those that would not appear explicitly on the statement of cash flows. Some transactions may be Classifying in more than one category: 1. Purchase of mach

> The 2019 income statement for Bayer, a German-based pharmaceutical company that publishes IFRS-based financial statements, follows (in million euros): a. Briefly explain each of the line items on the income statement. b. Comment on the persistence of the

> It is December 2021, and Rob Blandig, the CEO of Carmich Industries, has decided to sell the chemical division. He has received an offer for $350,000, but he is undecided about whether he wishes to complete the sale in 2021 or 2022. He is currently evalu

> It is December 2021, and Sharon Sowers, the CEO of Mallory Services, has decided to sell the clerical division. She has received an offer for $105,000 but is undecided about whether she wishes to complete the sale in 2021 or 2022. She is currently evalua

> LTB Enterprises consists of four separate divisions: building products, chemicals, mining, and plastics. On March 15, 2021 , LTB sold the chemicals division for $625,000 cash. Financial information related to the chemicals division follows: a. Provide th

> The footnote below was taken from the 2019 annual report of Johnson & Johnson (dollars in millions). a. Approximately how much land did Johnson & Johnson sell during 2019? For simplicity, assume there was no land purchased during 2019. b. Why did

> You work in the finance and investment department of Mega industries, which recently purchased several small high-tech companies. Microline's most recent financial statements are as follows (dollars in thousands):

> In a three-year period, AT&T, the telecommunications provider, reported net income of $1.9 billion (Year 3), a net loss of $13 billion (Year 2), and net income of $7.7 billion (Year 1). Included in these numbers were the following special items: a. D

> Morton Manufacturing maintains a credit line with First Bank that allows the company to borrow up to $1 million. A covenant associated with the loan contract limits the company's dividends in any one year to 20 percent of net income. The 2021 income stat

> The December 31, 2021, balance sheet of Smedley Company is as follows: During 2022, the company entered into the following transactions: 1. Common stock was issued for $35,000 cash. 2. Services were performed for $50,000 cash. 3. Cash expenses of $24,000

> Transactions include the following: 1. Declaration of a stock dividend. 2. Purchase of 50 percent of the outstanding stock of another company. 3. Payment of previously accrued interest payable. 4. Accrual of interest expense. 5. Purchase of machinery. 6.

> Madigan International is planning a major stock issuance in early 2022. During 2021, the company reported net income from operations of $865,000 before taxes. The following four items describe major events that occurred during 2021. 1. A $42,000 gain was

> Kennington Company has outstanding debt that contains restrictive covenants limiting dividends to 15 percent of net income from continuing operations. During 2021, the company reported net operating income of $335,000, excluding the following items-all o

> The following pretax amounts were obtained from the financial records of Watson Company for 2021: The company's tax rate is 25 percent. a. Prepare an income statement for the year ended December 31, 2021. b. Prepare a reconciliation of retained earnings

> The following information was taken from the 2021 financial records of Rothrock Consolidated. All items are pretax. The company's income tax rate is 25 percent, and the items above are treated identically for financial reporting and tax purposes. Prepare

> The following income statement was reported by Battery Builders for the year ending December 31, 2021: Show how Battery Builders would report earnings per share on the face of the income statement, assuming the following: a. An average of 15,000 shares o

> The management of Sting Enterprises shares in a bonus that is determined and paid at the end of each year. The amount of the bonus is defined by multiplying net income from continuing operations (after tax) by 12 percent. The bonus is not used in the cal

> The Boeing Company reported in its 2019 annual report $1,567 million in depreciation expense and $704 million in amortization expense for the year ending December 31, 2019. a. Describe how the recognition of depreciation and amortization affects the basi

> You are currently auditing the financial records of Paxson Corporation, which is located in San Francisco, California. During the current year, inventories with an original cost of $2,325,000 were destroyed by an earthquake. The loss is deductible for ta

> The following are transactions or items that are frequently reported in financial statements: l. Income effect due to changing from the double-declining-balance method to the straight-line method of depreciation. 2. Collection of accounts receivable. 3.

> The following information was taken from the statement of shareholders' equity of Chinook Furs: Provide the journal entries for the following: a. The issuance of preferred stock during 2021. b. The issuance of common stock during 2021. c. The sale of tre

> The condensed 2019 balance sheet of Honeywell International follows (dollars in millions): Outstanding were 712.6 million shares of common stock and no preferred stock. The following instructions are independent: a. Compute the book value per common shar

> In 2011, Stuart Corporation began operations, issuing 100,000 shares of $1 par value common stock for $25 per share. Since that time, the company has been very profitable. The shareholders' equity section as of December 31, 2020, follows: In 2021, the co

> The shareholders' equity section of Rodman Corporation as of December 31, 2020, follows: During 2021, the company entered into the following transactions: 1. Purchased 1,000 shares of common stock for $60 per share and held them in treasury. 2. As part o

> Twin Lakes incorporated on April 1, 2021, and was authorized to issue 100,000 shares of $5 par value common stock and 10,000 shares of $8, no-par preferred stock. During the remainder of 2021, the company entered into the following transactions: 1. Issue

> Before the merger of Wendy's and Arby's, Wendy's made a huge purchase of its own shares and in total bought back over 26 million shares for approximately $1 billion. Before the purchase, 125.5 million shares were outstanding, and the financial statements

> Deming Contractors was involved in the following events involving stock during 2021 : 1. Authorized to issue (a) 100,000 shares of $100 par value, 8 percent preferred stock; (b) 150,000 shares of no-par, $5 preferred stock; and (c) 250,000 shares of $5 p

> The balance sheet of Lamont Bros. follows: a. What portions of Lamont's assets were provided by debt, contributed capital, and earned capital? Reduce contributed capital by the cost of the treasury stock. b. Compute the company's capital structure levera

> A footnote to the financial statements of Allegheny Teledyne Incorporated stated the following: The straight-line method of depreciation was adopted for all property placed into service after July I , 1996. Buildings and equipment acquired prior to that

> Taylor Manufacturing entered into a borrowing arrangement that requires the company to maintain a retained earnings balance of $500,000. The company also wishes to finance internally a major plant addition in the not-too-distant future. Accordingly, the

> The December 31, 2020, balances in retained earnings and additional paid-in capital for Railway Shippers Company are $135,000 and $50,000, respectively. Five thousand no par value common shares are outstanding with a market value of $85 each. The company

> The shareholders' equity section of Pioneer Enterprises as of December 31, 2021, follows: Answer the questions below for the following independent transactions: a. How many common shares are outstanding after the company declares and distributes a 2 perc

> The board of directors of Enerson Manufacturing is in the process of declaring a dividend. The company is considering paying a cash dividend of $12 per share. Enerson Manufacturing is authorized to issue 800,000 shares of common stock. The company has is

> The following information was taken from the statement of shareholders' equity of Kidd Sports as of December 31, 2021. The par value of Kidd stock is $1, and as of the beginning of 2021, the company held 1,500 shares in treasury. a. Kidd issued common st

> The following information was taken from the statement of shareholders' equity of Zielow Siding as of December 31, 2021. The par value of the Zielow stock is $5, and as of the beginning of 2021 , the company held 400 shares in treasury. a. Zielow issued

> The following are possible transactions that affect shareholders' equity: 1. A company issues common stock above par value for cash. 2. A company declares a 3-for-1 stock split. 3. A company repurchases 10,000 shares of its own common stock for retiremen

> The following information was extracted from the financial records of Leong Cosmetics: a. What is the effective interest rate on the notes payable? b. Prepare the journal entry to record interest expense during 2022.

> Morrow Enterprises purchased a building on January 1, 2021, in exchange for a three-year, non-interest-bearing note with a face value of $693,000. Independent appraisers valued the building at $550,125. a. At what amount should this building be capitaliz

> John Deere uses the LIFO inventory cost flow assumption, reporting inventories on its 2019 balance sheet of $5.975 billion and a LIFO reserve of approximately $ 1.670 billion. What would be Deere's 2019 inventory balance if it used the FIFO assumption in

> On January 1, 2021, Wilmes Floral Supplies borrowed $2,413 from Bower Financial Services. Wilmes Floral Supplies gave Bower a $2,500 note with a maturity date of December 31, 2022. The note specified an annual stated interest rate of 8 percent. a. Comput

> Candleton borrowed cash, signing a two-year, interest-bearing note payable with a face value of $8,000 and an effective interest rate of 8 percent. Interest payments on the note are made annually. Provide the journal entries that would be recorded over t

> Tradewell Rentals purchased a piece of equipment with an FMV of $11 ,348 in exchange for a five-year, non-interest-bearing note with a face value of $20,000. a. Compute the effective interest rate on the note payable. b. Prepare the journal entry to reco

> Compute the proceeds from the following notes payable. Interest payments are made annually.

> The stated and effective interest rates for several notes and bonds follow: Indicate whether each note/bond would be issued at a discount, par value, or a premium.

> On January 1, 2020, Tracy Supply purchased ten bonds on the open market, paying $9,260. The bonds had a total face value of $10,000, a stated interest rate of interest of 5 percent, and a time to maturity of ten years. As of the end of 2020, the bonds ha

> Dylander bonds are selling on the open market at 89 .16. The bonds have a stated interest rate of 8 percent and mature in ten years. Interest payments are made semiannually. a. Assume that your required rate of return is 12 percent. Would you buy the bon

> Compute the effective rate of interest on the following long-term debts. Interest payments on the notes are made annually, and interest payments on the bonds are made semiannually:

> Watts Motors plans to acquire a building and can either borrow cash from a bank to finance the purchase or lease the building from the current owner. The sales price of the building is $149,388. If the company wishes to finance the purchase with a bank l

> Tradeall Inc. leases automobiles for its sales force. On January 1, 2020, the company leased 100 automobiles and agreed to make lease payments of $10,000 per automobile each year. Assume an effective rate of 10 percent. a. Compute the annual rental expen

> The following information was taken from the footnotes in the 2019 annual report of Johnson & Johnson: a. From information in the footnote alone, indicate whether Johnson & Johnson is a retailer, manufacturer, or service firm. Explain. b. From in

> On January 1, 2020, Q-Mart entered into a five-year lease agreement requiring annual payments of $10,000 on December 31 of each year. The fair market value of the building was estimated by appraisers to be $39,927. a. Compute the effective interest rate

> The following information was taken from the balance sheet of Cohort Enterprises as of December 31, 2021: The bonds have a stated interest rate of 5 percent paid annually and will mature on December 31, 2023. The market value of the bonds as of December

> The following information was taken from the balance sheet of Beasley Brothers as of December 31, 2020: The bonds have a stated interest rate of 5 percent paid annually and will mature on December 31, 2022. The market value of the bonds as of December 31

> Hathaway Manufacturing issued long-term debt on January 1, 2020. The debt has a face value of $300,000 and an annual stated interest rate of 10 percent. The debt matures on January 1, 2025. a. Assume that the debt agreement requires Hathaway Manufacturin

> Marker Musical Products issued bonds with a face value of $100,000 and an annual stated interest rate of 8 percent on January 1, 2018. The effective interest rate on the bonds was 10 percent. Interest is paid semiannually on July 1 and January 1. As of D

> American Greetings Corporation, a large producer of greetings cards, repurchased some of its outstanding long-term debt. Shortly thereafter, the company issued new debt. At the time of the refinancing, where old debt was replaced by new debt, the balance

> When Eli Lilly, a major pharmaceutical company, chose to refinance some of its outstanding bonds payable, the company paid off the outstanding debt and replaced it with a new bond issuance. At the time of the refinancing, the balance sheet value of the o

> On September 10, 2018, Mooney Plastic Products issued bonds with a face value of $500,000 for a price of 96. During 2021, Mooney exercised a call provision and redeemed the bonds for 101. At the time of the redemption, the bonds had a balance sheet value

> Treadway Company issued bonds with a face value of $20,000 on January 1, 2020. The bonds were due to mature in five years and had a stated annual interest rate of 8 percent. The bonds were issued at face value. Interest is paid semiannually. a. As of Dec

> Coral Sands Marina issued 100 five-year bonds on July 1, 2021. The interest payments are due semiannually (January 1 and July 1) at an annual rate of 8 percent. The effective rate on the bonds is 6 percent. The face value of each bond is $1,000. a. Prepa

> In its fiscal 2019 annual report, Hewlett-Packard (commonly referred to as HP) reported beginning inventory of $6.1 billion, ending inventory of $5. 7 billion on the balance sheet, and cost of goods sold of $47.6 billion on the income statement. Compute

> Tingham Village issued 500 five-year bonds on July 1, 2021. The interest payments are due semiannually (January 1 and July 1) at an annual rate of 6 percent. The effective interest rate on the bonds is 8 percent. The face value of each bond is $1,000. a.

> On January 1, 2020, Collins Copy Machine Company issued thirty $1,000 face-value bonds with a stated annual rate of 10 percent that mature in ten years. Interest is paid semiannually on June 30 and December 31. The bonds were issued at face value. a. Pre

> Three different bond issuances are listed here with interest payments made semiannually: a. Compute the proceeds of each bond issuance. b. For each bond issuance, indicate whether the balance sheet value of the bond liability will increase, decrease, or

> During November 2017, Southwest Airlines issued five-year notes with a face value of $300 million. The stated interest rate on the notes was 2.8 percent, and proceeds from the issuance approximated $300 million. a. Estimate the effective interest rate o

> The balance sheet as of December 31, 2020, for Melrose Enterprises follows: During 2020, Melrose entered into a loan agreement that required the company to maintain a debt/equity ratio of less than 2: 1. a. How much additional debt can Melrose take on be

> Jordan Brothers recently instituted a bonus plan to pay its executives. The plan specifies that net income must exceed $200,000 before any bonus payments are made. Cash in the amount of 10 percent of net income in excess of $200,000 is placed in a bonus

> Zeus Power has brought suit against Regional Supply in the amount of $825,000 for patent infringement. As of December 31, the suit is in process, and the attorneys have determined that there is a greater than 50 percent chance that Zeus Power will win th

> The following information was taken from the 2019 annual report of Bed Bath & Beyond, a leading household retailer (dollars in thousands): a. Assume that accounts payable reflects only accounts with inventory suppliers, and compute the cash payments

> Norsums Department Store sells gift certificates that are redeemable in merchandise. During 2020, Norsums sold gift certificates for $88,000. Merchandise with the total price of $52,000 was redeemed during the year. The cost of the sold merchandise to No

> On January 1, 2016, Lacey Treetoppers borrowed $300,000. The principal is to be paid back in annual payments of $20,000 on December 30 of each year. a. Assuming that Lacey has met all principal payments on a timely basis, how should this liability be rep

> CIT Group is a holding company for consumer and commercial financial services companies that provide lending products to customers. The following information concerning the Allowance for Loan Losses (Bad Debts) account was taken from CIT's 2019 10-K (dol

> On December 1, Spencer Department Store borrowed $19,250 from First Bank and Trust. Spencer signed a 90-day note with a face amount of $20,000. The interest rate stated on the face of the note is 15 percent per year. a. Provide the journal entry recorded

> Lily May Electronics recognizes expenses for wages, interest, and rent when cash payments are made. The following related cash payments were made during December 2020: As of December 31, the current assets and current liabilities reported on Lily May's b

> Darrington and Darling borrowed $100,000 from Commercial Financing to finance the purchase of fixed (i.e., property, plant, and equipment) assets. The loan contract provides for a 5 percent annual interest rate and states that the principal must be paid

> The following information was taken from the annual report of Sega-Venus Enterprises: a. Compute Sega-Venus's conservatism ratio, and comment on how conservative the company's reporting methods are. b. Explain why the conservatism ratio provides a measur

> The following information was taken from the annual report of Busytown Industries: a. Compute Busytown's conservatism ratio, and comment on how conservative the company's reporting methods are. b. Explain why the conservatism ratio provides a measure of

> Swingley Company uses an accelerated method to depreciate its fixed assets for tax purposes and the straight-line method for financial reporting purposes. In 2020, the accelerated method recognized depreciation of $35,000, while the straight-line method

> Seasaw Seasons instituted a defined benefit pension plan for its employees three years ago. Each year since the adoption of the plan, Seasaw has contributed $ 16,000 to the pension fund, which is managed by Fiduciary Trust Associates. As of the end of th

> DuPont, the giant chemical company, booked restructuring charges (expenses) on its income statement in 2019, 2018, and 2017. The 2019 charge was $138 million, which included a $34 million asset write-down and $104 million to cover employee severance cost

> Southwest Airlines is paid in advance for its ticket sales, recognizing a deferred revenue, called air traffic liability, when it receives the cash. The liability is then converted to revenue when the passenger takes the flight. During 2019, Southwest re

> During 2020, Seagul Outboards sold 200 outboard engines for $250 each. The engines are under a one-year warranty for parts and labor, and from past experience, the company estimates that, on average, warranty costs will equal $20 per engine. As of Decemb

> The following information was taken from the 2019 annual report of Emerson Electric Co., a leader in the network power sector (dollars in millions): a. Compute total accounts receivable as of the end of 2019 and 2018, and compute the uncollectible allowa