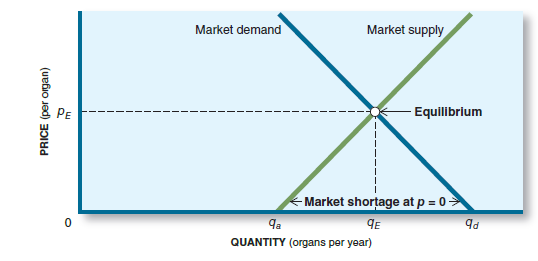

Question: The shortage in the organ market (Figure

The shortage in the organ market (Figure 3.8) requires a nonmarket rationing scheme. Who should get the available (qa) organs? Is this fairer than the market-driven distribution?

Figure 3.8

> Between 1980 and 2010, by how much did the labor force participation rate (Figure 6.2) of (a) Men fall? (b) Women rise?

> What share of U.S. total income in 2010 consisted of (a) Wages and salaries? (b) Corporate profits? ( Note: See Table 5.5 for data.) Expenditure Income C: Consumer goods and Wages and salaries Corporate profits Proprietors' income $ 7,985 1,625 1,055

> If tuition keeps increasing at the same rate as in 2010–2011 (see News, p. 134), how much will it cost to complete a degree at a private college in four years? IN THE NEWS Rise in College Costs Hits Public Schools Hardest While head

> According to the World View on page 138, how many Zimbabwean dollars could you buy with one U.S. dollar in January 2009? WORLD VIE W Zimbabwe to Introduce $100 Trillion Banknote Zimbabwe's central bank will introduce a $100 trillion banknote, worth a

> If the unemployment rate in 2010 had not risen since 2008, how many more workers would have been employed in 2010? (Use Figure 6.1 and this book’s endpapers). Figure 6.1: Total population (310 million) Out of the labor force (155 mi

> If everyone seeks a free ride, what mix of output will be produced in Figure 4.2? Why would anyone voluntarily contribute to the purchase of public goods like flood control or snow removal? B (Market mix) A (Optimal mix) W Production possibilities R

> According to Figure 6.1 (p. 114), (a) What percentage of the civilian labor force was employed? (b) What percentage of the civilian labor force was unemployed? (c) What percentage of the population was employed in civilian jobs? Total population (310

> According to the World View on page 442, what was the peso price of a euro in May 2011?

> If a euro is worth $1.40, what is the euro price of a dollar?

> Which countries are the two largest export markets for the United States? (See Table 19.3.) (1) __________ (2) __________ Exports to (S billions) Imports from (S billions) Trade Balance Country (S billions) Top Deficit Countries China $113 $376 -

> According to the News on page 401, what is the implied value of the multiplier for (a) Increased unemployment benefits? (b) Infrastructure spending?

> What MPC for tax cuts is assumed in the News on page 401?

> If the Congressional Budget Office makes its average error this year, by how much will it underestimate next year’s budget deficit?

> If the labor force increases by 1.1 percent each year and productivity increases by 3.4 percent, how fast will output grow?

> Which AS curve (a, b, or c) in Figure 16.1 causes the least unemployment when fiscal or monetary restraint is pursued? Figure 16.1 (a) The Keyneslan view Aggregate supply AD AD AD, OUTPUT (roal GDP por pariod) (b) The monetarist vlew Aggregate supply

> If the tax elasticity of supply is 0.16, by how much do tax rates have to be reduced to increase the labor supply by 2 percent?

> Why should taxpayers subsidize public colleges and universities? What external benefits are generated by higher education?

> According to Bernanke’s rule of thumb (p. 320), how much fiscal stimulus would be equivalent to a 2-point reduction in long-term interest rates?

> If the nominal rate of interest is 5 percent and the real rate of interest is 3 percent, what rate of inflation is anticipated?

> In Table 15.1, what is the implied price of holding money in a checking account rather than in Treasury bonds? Option Interest Rate Cash 0.00% Checking accounts 0.17 6-month CD 0.37 10-year Treasury bond Corporate bond 3.41 5.13 Source: Federal Reser

> What was the Fed’s target for the fed funds rate in December 2008?

> If the GM bond described on pages 303–304 was resold for $1,500, what would its yield be?

> How large is the difference between the interest rates on six-month and five-year jumbo CDs?

> In Table 13.2, how much unused lending capacity does Eternal Savings have at step 4? Step 1: You deposit cash at Unversity Bank. The deposit creates $100 of reserves, $20 of which are designated as required reserves. This leaves $80 of excess reserve

> What is the value of the money multiplier when the required reserve ratio is (a) 12.5 percent? (b) 10 percent?

> Suppose a bank’s balance sheet looks like this: (a) What is the required reserve ratio? (b) How much money can this bank still lend? Assets Llabilities Reserves Deposits $600 Excess $ 70 Required Loans 30 500 Total $600 Total $600

> Between 2000 and 2010, in how many years was fiscal restraint initiated?

> Is there a shortage of on-campus parking at your school? How might the shortage be resolved?

> What country had the largest budget deficit (as a percentage of GDP) in 2011?

> Since 1980, in how many years has the federal budget had a surplus? $300 200 Budget surpluses 100 -100 -200 -300 -400 Budget deficits -500 -600 -700 -800 -900 -1000 -1100 -1200 -1300 -1400 -1500 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000

> If the AD excess is $300 billion and the MPC is 0.8, (a) How much fiscal restraint is desired? (b) By how much do income taxes have to be increased to get that restraint?

> Suppose the government decides to increase taxes by $20 billion to increase Social Security benefits by the same amount. How will this combined tax transfer policy effect aggregate demand at current prices?

> Suppose that an increase in income transfers rather than government spending was the preferred policy for stimulating the economy depicted in Figure 11.4. By how much would transfers have to increase to attain the desired shift of AD? Fiscal policy h

> In the tax cut example on pages 236–37, (a) By how much does consumer saving increase initially? (b) How large is the initial spending injection?

> How large is the inflationary GDP gap in Figure 10.9? AS AC = $300 billion Al = $100 billion New spending causes sequential AD shifts and inflationary pressure. Pe Po ADS AD5 Inflationary KGDP ADo gap i QF (= $3,000) REAL OUTPUT (in billions of dolla

> According to World Bank estimates, by how much did consumer spending decline as a result of the 40-point drop in the index of consumer confidence between 2007 and 2009?

> If Korean exports to the United States decline by $15 billion (World View, p. 217) by how much will cumulative Korean spending drop if their MPC is 0.75?

> By how much did annualized consumption decline in November 2008 when GDP was $14 trillion?

> What would happen in the apple market if the government set a minimum price of $5.00 per apple? What might motivate such a policy?

> If the marginal propensity to consume is 0.8, (a) What is the value of the multiplier? (b) What is the marginal propensity to save?

> If the consumption function is C = $300 billion + 0.9Y, (a) How much do consumers spend with incomes of $4 trillion? (b) How much do they save?

> What was the range, in absolute percentage points, of the variation in quarterly growth rates between 2005 and 2008 of (a) Consumer spending? (b) Investment spending? ( See Figure 9.8 for data given below +16 +12 +8 Consumption +4 Investment is more

> If every $1,000 increase in the real price of homes adds 6 cents to annual consumer spending (the “wealth effect”), by how much did consumption decline when home prices fell by $2 trillion in 2006–2008?

> (a) What is the implied MPC in the News on page 186? (b) What is the implied APC? IN THE NE WS News Release: Personal Income and Outlays Personal Income and Outlays: May 2011 Personal income increased $36 billion, or 0.27 percent, and disposable pers

> Suppose you have $7,000 in savings when the price level index is at 100. (a) If inflation pushes the price level up by 10 percent, what will be the real value of your savings? (b) What is the real value of your savings if the price level declines by 10 p

> In Figure 8.8, what price level will induce people to buy all the output produced at full employment? Aggregate supply PE P* Aggregate demand Equilibrium output Full-employment output QE QF REAL OUTPUT (quantity per year) PRICE LE VEL (average price)

> According to Table 7.3 (p. 137), what happened during the period shown to the (a) Nominal price of gold? (b) Real price of gold? Table 7.3:

> If a basic input like oil goes up in price by 20 percent and accounts for 3 percent of total costs in the economy, how much cost-push inflation results?

> For each situation described here determine the type of unemployment: (a) Steelworkers losing their jobs due to decreased demand for steel. (b) A college graduate waiting to accept a job that allows her to utilize her level of education. (c) The Great Re

> Using the information on page 141 and Table 7.5, by what percentage did the price level increase (a) Between 1982–1984 and 2010? (b) Between 2000 and 2010? Year CPI Year CPI Year CPI Year CPI 1800 17.0 1915 10.1 1950 24.1 1982–1984

> According to the News on page 126, in October 2009 (a) How many people were in the labor force? (b) How many people were employed? IN THE NEWS Unemployment Rate Hits 10.2 Percent, a 26-Year High In another sign that workers are being left out of the

> Suppose all the dollar values in Problem 4 were in 2000 dollars. Use the Consumer Price Index shown on the end cover of this book to convert Problem 4’s GDP to 2010 dollars. What is the value of that GDP in 2010 dollars? (You’ll be converting the figures

> If 150 million workers produced America’s GDP in 2010 (World View, p. 31), how much output did the average worker produce? 14.6 2010 Gross Domestic Product (GDP) (in trillions of U.S. dollars) 10.1 4.4 3.1 2.7 2.3 1.6 1.4 0.63 0.01

> What market failure does Bill Gates (World View, p. 465) cite as the motivation for global philanthropy?

> If economic growth reduced poverty but widened inequalities, would it still be desirable?

> Can poor nations develop without substantial increases in agricultural productivity? (See Figure 21.2.) How?

> How does microfinance alter prospects for economic growth? The distribution of political power?

> How do unequal rights for women affect economic growth?

> Are property rights a prerequisite for economic growth? Explain.

> Why are scalpers able to resell tickets to the Final Four basketball games at such high prices?

> How do more children per family either restrain or expand income-earning potential?

> If a poor nation must choose between building an airport, some schools, or a steel plant, which one should it choose? Why?

> Why should Americans care about extreme poverty in Haiti, Ethiopia, or Bangladesh?

> Why does the World View on page 451 say the undervalued yuan is “more bane than boom”?

> How would each of these events affect the supply or demand for Japanese yen? (a) Stronger U.S. economic growth. (b) A decline in Japanese interest rates. (c) Higher inflation in the United States. (d) A Japanese tsunami.

> If a nation’s currency depreciates, are the reduced export prices that result “unfair”?

> In the World View on page 445, who is Farshad Shahabadi referring to as “everyone else”?

> In what sense do fixed exchange rates permit a country to “export its inflation”?

> Under what conditions would a country welcome a balance-of-payments deficit? When would it not want a deficit?

> How would rapid inflation in Canada affect U.S. tourism travel to Canada? Does it make any difference whether the exchange rate between Canadian and U.S. dollars is fixed or flexible?

> With respect to the demand for college enrollment, which of the following would cause (1) a movement along the demand curve or (2) a shift of the demand curve? a. An increase in incomes. b. Lower tuition. c. More student loans. d. An increase in te

> How do changes in the value of the U.S. dollar affect foreign enrollments at U.S. colleges?

> Why would a decline in the value of the dollar prompt foreign manufacturers such as BMW to build production plants in the United States?

> Has the tariff on Chinese tires (World View, p. 428) affected you or your family? Who has been affected?

> Who gains and who loses from nontariff barriers to Mexican trucks (World View, p. 432)? What made President Obama offer renewed negotiations?

> Why did President Obama pursue “buy American” rules if they actually hurt the economy?

> On the basis of the News on page 434, how do U.S. furniture manufacturers feel about NAFTA? How about farmers?

> Domestic producers often base their demands for import protection on the fact that workers in country X are paid substandard wages. Is this a valid argument for protection?

> Suppose we refused to sell goods to any country that reduced or halted its exports to us. Who would benefit and who would lose from such retaliation? Can you suggest alternative ways to ensure import supplies?

> If a nation exported much of its output but imported little, would it be better or worse off? How about the reverse—that is, exporting little but importing a lot?

> What would be the effects of a law requiring bilateral trade balances?

> In our story of Tom, the student confronted with a web design assignment, we emphasized the great urgency of his desire for web tutoring. Many people would say that Tom had an "absolute need" for web help and therefore was ready to "pay anything" to get

> Suppose a lawyer can type faster than any secretary. Should the lawyer do her own typing? Can you demonstrate the validity of your answer?

> What is the “magic wand” referred to in this chapter’s opening quotation?

> What are the pros and cons of tax cuts or increased government spending as stimulative tools?

> Suppose the economy is slumping into recession and needs a fiscal policy boost. Voters, however, are opposed to larger federal deficits. What should policymakers do?

> Suppose the government proposes to cut taxes while maintaining the current level of government expenditures. To finance this deficit, it may either (a) sell bonds to the public or (b) print new money (via Federal Reserve cooperation). What are the l

> Why is the multiplier higher for unemployment benefits than for infrastructure spending (News, p. 401)? Which occurs faster?

> Suppose it’s an election year and that aggregate demand is growing so fast that it threatens to set off an inflationary movement. Why might Congress and the president hesitate to cut back on government spending or raise taxes, as economic theory suggest

> If policymakers have instant data on the economy’s performance, should they respond immediately? Why or why not?

> What policies would Keynesian, monetarists, and supply-siders advocate for (a) restraining inflation and (b) reducing unemployment?

> Why do some nations grow and prosper while others stagnate?

> Why are incomes so much more unequal in poor nations than in rich ones?

> Is limitless growth really possible? What forces do you think will be most important in slowing or halting economic growth?

> Fertility rates in the United States have dropped so low that we are approaching zero population growth, a condition that France has maintained for decades. How will this affect our economic growth? Our standard of living?

> In 1866 Stanley Jevons predicted that economic growth would come to a halt when England ran out of coal, a doomsday that he reckoned would occur in the mid-1970s. How did we avert that projection? Will we avert an “oil crisis” in the same way?

> Should fiscal policy encourage more consumption or more saving? Does it matter?

> How might economic growth be impeded by (a) high levels of national debt and/or (b) fiscal restraint designed to reduce that national debt?

> Should we grant immigration rights based on potential contributions to economic growth as Canada does?

> Why don't we consume all of our current output instead of sacrificing some present consumption for investment?