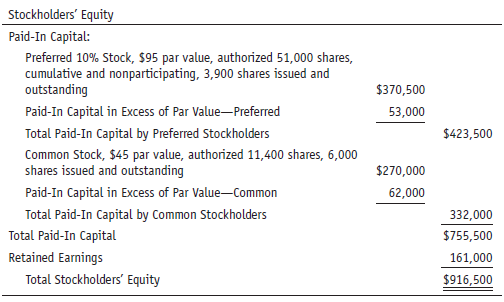

Question: The stockholders’ equity of Franklin Company is

The stockholders’ equity of Franklin Company is as follows:

Given a redemption value of $109 per share for the preferred stock, calculate the book value per share of preferred and common stock, assuming the following:

a. No preferred dividends in arrears

b. Two years’ preferred dividends in arrears

Transcribed Image Text:

Stockholders' Equity Paid-In Capital: Preferred 10% Stock, $95 par value, authorized 51,000 shares, cumulative and nonparticipating, 3,900 shares issued and outstanding $370,500 Paid-In Capital in Excess of Par Value-Preferred 53,000 Total Paid-In Capital by Preferred Stockholders $423,500 Common Stock, $45 par value, authorized 11,400 shares, 6,000 shares issued and outstanding $270,000 Paid-In Capital in Excess of Par Value-Common 62,000 Total Paid-In Capital by Common Stockholders 332,000 Total Paid-In Capital $755,500 Retained Earnings 161,000 Total Stockholders' Equity $916,500

> LaPaglia Co. has requested that you prepare journal entries from the following (this company uses the Allowance for Doubtful Accounts method based on the income statement approach): 2015 Dec. 31 Recorded Bad Debts Expense of $13,000. 2016 7 Wrote of

> Using the ledger balances and additional data given, do the following for Crew Lumber for the year ended December 31, 201X. 1. Prepare the worksheet. 2. Prepare the income statement, statement of owner’s equity, and balance sheet. 3. J

> Using the data from Concept Check 2 plus the additional information in Figure 21.11, compute net cash flows from operating activities using the direct method. Concept Check 2: From the following, calculate the net cash flow from operating activities us

> From the partial worksheet for Justin’s Supplies in Figure 12.18, do the following: 1. Complete the worksheet. 2. Prepare the income statement, statement of owner’s equity, and classified balance sheet. (Note: The amou

> Prepare a statement of owner’s equity and a classified balance sheet from the worksheet shown for Jager Company in Figure 12.17. (Note: Of the Mortgage Payable, $200 is due within 1 year.) Figure 12.17: JAGER COMPANY PARTIAL WORKS

> Prepare a formal income statement from the partial worksheet for Wright Co. in Figure 12.16. Figure 12.16: WRIGHT CO. PARTIAL WORKSHEET FOR YEAR ENDED DECEMBER 31, 201X Income Statement Account Titles Dr. Cr. Income Summary 41000 230 00 Sales 28500

> Jeanne’s Toy Shop completed the following merchandise transactions in the month of April: Jeanne’s Toy Shop accounts included the following: Cash 101; Accounts Receivable 112; Merchandise Inventory 120; Office Equipm

> Abby Ellen opened Abby’s Toy House. As her newly hired accountant, your tasks are to do the following: 1. Journalize the transactions for the month of March. Use the periodic method. 2. Record to subsidiary ledgers and post to the gener

> Wendy Johnson operates a wholesale computer center and has hired you as her bookkeeper to record the following transactions. She would like you to (1) journalize the following transactions, (2) record to the accounts payable subsidiary ledger and post to

> As the accountant of Trina’s Natural Food Store, (1) journalize the following transactions into the general journal (p. 2), (2) record and post as appropriate, and (3) prepare a schedule of accounts payable. If using working papers, be

> Rasheed Chase recently opened Rasheed’s Skate Shop. As the bookkeeper of the company, use the periodic method to journalize, record, and post when appropriate the following transactions (account numbers are Store Supplies 115; Store Equ

> Al Franklin opened Al’s Cosmetic Market on December 1. An 8% sales tax is calculated and added to all cosmetic sales. Al offers no sales discounts. The following transactions occurred in December: Required: 1. Journalize, record, and

> Max Peney owns Peney’s Sneaker Shop. (Balances as of August 1 are provided for the accounts receivable and general ledger accounts as follows: Donovan, $375 Dr.; Littler, $900 Dr.; Pry, $750 Dr.; Zamora, $350 Dr.; Cash, $16,500 Dr.; Acc

> From the following, calculate the net cash flow from operating activities using the indirect method: 2013 2014 Accounts Receivable $ 570 $ 830 Merchandise Inventory 2,100 4,000 Prepaid Insurance 625 300 Accounts Payable 1,025 770 Salaries Payable 58

> The following transactions of Jack’s Auto Supply occurred in January (Balances as of January 1 are given for general ledger and accounts receivable ledger accounts: Nonack, $1,400 Dr.; Seth, $50 Dr.; Corner, $200 Dr.; Accounts Receivabl

> Sandra Hills has opened Macchiato and More, a wholesale grocery and coffee company. The following transactions occurred in June: Required: 1. Journalize the transactions. 2. Record to the accounts receivable subsidiary ledger and post to the general le

> The following is the monthly payroll for the last three months of the year for Turner’s Sporting Goods Shop, 2 Boat Road, Lynn, Massachusetts 01945. The shop is a sole proprietorship owned and operated by Bill Turner. The EIN for Turner

> The following is the monthly payroll of White Company, owned by Dale White. Employees are paid on the last day of each month. White Company is located at 2 Square Street, Marblehead, Massachusetts 01945. Its EIN is 29-3458822. The FICA tax rate for S

> You gathered the following data from time cards and individual employee earnings records. Your tasks are as follows: 1. On December 5, 201X, prepare a payroll register for this biweekly payroll. 2. Calculate the employer taxes of FICA OASDI, FICA Medicar

> From the following, record the transactions in Kona’s auxiliary petty cash record and general journal as needed: 201X A check was drawn (no. 444) payable to Harold Hauer, petty cashier, to establish a $220 petty cash fund. Oct. 1 P

> The following transactions occurred in April for Jolly Co.: Your tasks are to do the following: a. Record the appropriate entries in the general journal as well as the auxiliary petty cash record as needed. b. Replenish the petty cash fund on April 30

> From the following statement, please (1) complete the bank reconciliation for Jackie’s Deli found on the reverse of the following bank statement and (2) journalize the appropriate entries as needed. a. A deposit of $2,500 is in transit

> Work.com received a bank statement from Waldorf Bank indicating a bank balance of $7,800. Based on Work.com’s check stubs, the ending checkbook balance was $8,320. Your task is to prepare a bank reconciliation for Work.com as of July 31, 201X, from the f

> As the bookkeeper of Palmer’s Plowing, you have been asked to complete the entire accounting cycle for Palmer from the following information. Use the following chart of accounts. Chart of Accounts Assets …â&

> Facts: Bond issue: $95,000, 13%, 35-year bonds; selling price of bonds $191,805; market rate 6%. Use the interest method. Calculate the following: a. Carrying value at beginning of period b. Interest paid to bondholders each 6 months c. Interest expense

> Enter the beginning balance in each account in your working papers from the Trial Balance columns of the worksheet (Figure 5.26). From the worksheet, (1) journalize and post adjusting and closing entries and (2) prepare from the ledger a post-closing tri

> Consider the data in Figure 5.25 for Deb’s Dance Studio: Figure 5.25: Adjustment Data a. Insurance expired, $500. b. Dance supplies on hand, $400. c. Depreciation on dance equipment, $1,200. d. Salaries earned by employees but not du

> The trial balance for Don’s Repair Service appears in Figure 4.28. Figure 4.28: Adjustment Data to Update Trial Balance a. Insurance expired, $400. b. Repair supplies on hand, $2,900. c. Depreciation on repair equipment, $350. d. Wag

> Update the trial balance for Kyle’s Moving Co. (Figure 4.27) for October 31, 201X. Figure 4.27: Adjustment Data to Update Trial Balance a. Insurance expired, $600. b. Moving supplies on hand, $800. c. Depreciation on moving truck, $5

> The following transactions occurred in April 201X for A. French’s Placement Agency: The chart of accounts for A. French Placement Agency is as follows: Your task is to do the following: a. Set up a ledger based on the chart of accou

> On April 1, 201X, Beth Orth opened Beth’s Art Studio. The following transactions occurred in April. Your tasks are to do the following: a. Set up a ledger based on the following chart of accounts using four column accounts. b. Journal

> Jimmy Cook operates Jimmy’s Cleaning Service. As the bookkeeper, you have been requested to journalize the following transactions: The chart of accounts for Jimmy’s Cleaning Service is as follows: Chart of Acco

> The chart of accounts of Aikman’s Delivery Service is as follows: Chart of Accounts Assets ………………………………….……………………………….. Revenue Cash 111 ……………………..……………….. Delivery Fees Earned 411 Accounts Receivable 112 ……………………………………….. Expenses Office Equipment 121…

> From the trial balance of Gretchen Lyman, Attorney-at-Law, given in Figure 2.8, prepare (a) an income statement for the month of January, (b) a statement of owner’s equity for the month ended January 31, and (c) a balance sheet at Janua

> Bill Palu opened a consulting company, and the following transactions resulted. A. Bill invested $30,000 in the consulting agency. B. Bought office equipment on account, $5,000. C. Agency received cash for consulting work that it completed for a client,

> Facts: Bond issue: $150,000, 9%, 13-year bonds; selling price of bonds $129,569; market rate 11%. Use the interest method. Calculate the following: a. Carrying value at beginning of period b. Interest paid to bondholders every 6 months c. Interest expen

> John Thildore, a retired army officer, opened Thildore’s Catering Service. As his accountant, analyze the transactions listed and present them in proper form. a. The analysis of the transactions by using the expanded accounting equatio

> Jeanette Wu, owner of Wu Home Decorating Service has requested that you prepare from the following balances (a) an income statement for June 201X, (b) a statement of owner’s equity for June, and (c) a balance sheet as of June 30, 201X.

> From the following T accounts of Breck’s Cleaning Service, (a) foot and determine the ending balances, and (b) prepare a trial balance in proper form for May 31, 201X. Cash 111 Accounts Receivable 112 Office Equipment 121 (A) 15,00

> Brad Sealy is the accountant for Sealy’s Internet Service. From the following information, his task is to construct a balance sheet as of November 30, 201X, in proper form. Can you help him? Building $ 50,000 Cash 55,000 Accounts P

> The following transactions occurred in the opening and operation of Bob’s Delivery Service. A. Bob O’Brien opened the delivery service by investing $25,000 from his personal savings account. B. Purchased used delivery trucks on account, $12,000. C. Rent

> On May 1, 201X, Lexington Corporation issued $180,000 of 10%, 5-year bonds for $194,679, yielding a market rate of 8%. Interest is paid on November 1 and May 1. Lexington Corporation uses the interest method to amortize the premium. 1. Prepare an amorti

> On January 1, 201X, Fish Corporation issued $300,200 of 11%, 10-year bonds for $267,192, yielding a market rate of 13%. Interest is paid on July 1 and December 31. Fish uses the interest method to amortize the discount. 1. Prepare an amortization schedu

> On May 1, 201X, Lance Corporation issued $1,000,000 of 9%, 20-year bonds at 103. The interest is payable on November 1 and May 1. The premium is amortized by the straight-line method. Prepare an amortization schedule for the first three semiannual period

> On January 1, 201X, Lonny Corporation sold $400,000 of 10%, 10-year bonds at 97. Interest is to be paid on June 30 and December 31. The straightline method of amortizing the discount is used. Prepare (1) an amortization schedule for the first three semia

> The following is the stockholders’ equity of Pinkerton Corporation on October 1, 201X: 1. Journalize the transactions in general journal form. 2. Prepare the stockholders’ equity section of the balance sheet using th

> Journalize the following transactions: a. Issued five $10,000, 9% bonds that mature in 10 years at face value on September 1. b. Paid semiannual interest on February 28. c. Bonds retired at end of 10 years.

> At the beginning of January 201X, the stockholders’ equity of Long View Corporation consisted of the following: 1. Record the transactions in general journal form. 2. Prepare the stockholders’ equity section at year-

> Rondo Corporation has 430,000 shares of $6 par-value common stock issued and outstanding. Record the following entries into the general journal for Rondo: 201X July 2 Declared a cash dividend of $0.70 per share. Aug. 1 Paid the $0.70 cash dividend t

> Lynch Corporation was just issued a charter by the state of New York. This charter gives Lynch the authority to issue 350,000 shares of $6 par-value common stock. From the following transactions: 1. Prepare journal entries to record the transactions of L

> From the following partial mixed list, select the appropriate titles and prepare a stockholders’ equity section using the source-of-capital approach as shown in the Blueprint example for Argon Corporation on July 31, 201X: Office Equipment …………………………………

> Dirkson Corporation has 20,500 shares outstanding of $12 par value, 7% preferred stock, and 41,000 shares outstanding of $12 par-value common stock. In its first 5 years of operation, the company paid the following dividends: 2011, $0; 2012, $17,220; 201

> The following is the Paid-In Capital section of stockholders’ equity for the Akebono Corporation on June 1, 201X: The following transactions occurred in the months of June and July: 1. Journalize the preceding entries and update the

> The partnership of Justman, Raisor, and Sunseri is being liquidated. All gains and losses are shared in a 3:2:1 ratio. Before liquidation, their balance sheet looks as follows: Journalize the entries needed in the liquidation process under the followin

> Lee, Rapada, and Villone are partners. On July 30, 201X, the balance sheet (30 min) was as follows: The partners agree to share all losses and gains in a 2:2:1 ratio. Villone is withdrawing from the partnership. From the following independent situation

> Bob Lake and Whitney Becker are partners with capital balances of $1,400 and $700, respectively. They share all profits and losses equally. From the following independent situations, journalize the admission of the new partner, Jack Underwood: Situation

> Journalize the entries to record the stock subscription plan for Green Co. On January 1, Green received subscriptions for 1,200 shares of $27 par-value common stock at $41 per share. The buyer will pay two equal installments on March 31 and June 30.

> a. The partnership of Tammy and Mark began with the partners investing $3,900 and $2,700, respectively. At the end of the first year, the partnership earned net income of $7,900. Under each of the following independent situations, calculate how much of t

> Journalize the following transactions for the Rox Company and show all calculations: 201X 1 Sold a truck for $1,100 that cost $6,200 and had accumulated depreciation of $5,700. Jan. Feb. 10 A machine costing $3,100 with accumulated depreciation of $

> On January 1, 2014, a machine was installed at Francis Factory at a cost of $52,000. Its estimated residual value at the end of its estimated life of4 years is $24,000. The machine is expected to produce 70,000 units with the following production schedul

> Record the following transactions (all paid in cash except on March 24) in the general journal of Orange Company: 201X Feb. 5 Purchased land for $92,000. The $92,000 included attorney's fees of $5,900. 18 Orange Company decided to pave the parking l

> Over the past 4 years, the gross profit rate for Bachand Company was 25%. Last week a fire destroyed all of Bachand’s inventory. Luckily, all the records for Bachand were in a fireproof safe and indicated the following facts: Inventory (January 1, 201X)

> Mander Company uses the retail method to estimate the cost of ending inventory for its monthly interim reports. From the following facts, estimate Mander’s ending inventory at cost for the end of January. (Round the cost ratio to the nearest tenth percen

> Althea Company uses a perpetual inventory system. From the following information, prepare an inventory record form (a) assuming that the FIFO method is in use and (b) assuming that the LIFO method is in use. Assume on January 1, 201X, a beginning invento

> Sheffield Electronics, an electronics supply company, uses the perpetual inventory system with a subsidiary inventory ledger to maintain control over an inventory of thousands of electronic parts. The quantities and costs for three of the parts in invent

> The Acworth Company uses the perpetual inventory system. Record these transactions in a two-column journal. All credit sales are n/30. 201X 5 Purchased merchandise on account totaling $2,100; terms n/30. 6 Sold merchandise on account to Tommy Dorse

> Journalize the following transactions for Barry Company: 201X Received a $13,000, 90-day, 8% note from Alex Coates in payment of account past due. Apr. 18 Wrote off the Nicole Mason account as uncollectible for $570. (Barry uses the Allowance method

> Journalize the following: Jan. 12 Plank Co. sells 1,200 shares of $28 par-value common stock at $28. Oct. 21 Johnson Co. sells 300 shares of $6 par-value common stock at $24. Anton Co. sells 200 shares of no-par common stock with a stated value of $

> Journalize the following transactions for Joye Company: 201X June 18 Joye Company discounted its own $55,000, 60-day note at Newton Bank at 14%. Aug. Paid the amount due on the note of June 18. (Be sure to record interest expense from Discount on No

> On May 1, 201X, George Company received a $29,000, 70-day, 7% note from Nottingham Company dated May 1. On June 20, 201X, George discounted the note at Ashland Bank at a discount rate of 10%. 1. Calculate the following: a. Maturity value of the note b.

> Journalize the following entries for (1) the buyer and (2) the seller. Record all entries for the buyer first. Both companies use the periodic inventory method. 201X June 11 Lawton Company sold $6,500 of merchandise on account to Ritter Company. Jul

> Sherrill Company completed the following transactions: From the preceding as well as the following additional data, complete a–c: a. Journalize the transactions. The company uses the periodic method. b. Post to Allowance for Doubtfu

> T. J. Radcliff Company uses the direct write-off method for recording Bad Debts Expense. At the beginning of 2015, Accounts Receivable has a $120,000 balance. Journalize the following transactions for T. J. Radcliff: 2015 Mar. 13 Wrote off S. Rose's

> Given the information presented in Figure 13.12, do the following: a. Prepare on December 31, 2015, the adjusting journal entry for Bad Debts Expense. Balances: Cash, $26,000; Accounts Receivable, $215,000; Allowance for Doubtful Accounts, $250; Merchand

> Lambert Co. has requested that you prepare journal entries from the following (this company uses the Allowance for Doubtful Accounts method based on the income statement approach): 2015 Dec. 31 Recorded Bad Debts Expense of $11,000. 2016 Jan. 7 Wrot

> Using the ledger balances and additional data given, do the following for Cullen Lumber for the year ended December 31, 201X: 1. Prepare the worksheet. 2. Prepare the income statement, statement of owner’s equity, and balance sheet. 3.

> From the partial worksheet for Josh’s Supplies in Figure 12.15, do the following: 1. Complete the worksheet. 2. Prepare an income statement, a statement of owner’s equity, and a classified balance sheet. (Note: The amo

> Prepare a statement of owner’s equity and a classified balance sheet from the worksheet for James Company in Figure 12.14. (Note: Of the Mortgage Payable, $240 is due within 1 year.) Figure 12.14: JAMES COMPANY PARTIAL WORKSHEET F

> Complete the following using the gross profit method. Assume a normal gross profit rate of 27% of net sales. Goods Available for Sale Inventory January 1, 201X $69 Net Purchases 16 Cost of Goods Available for Sale A Less: Estimated Cost of Goods Sol

> Prepare a formal income statement from the partial worksheet for Nelson Company in Figure 12.13. Figure 12.13: NELSON CO. PARTIAL WORKSHEET FOR YEAR ENDED DECEMBER 31, 201X Income Statement Account Titles Dr. Cr. 36000 27000 Income Summary Sales 29

> Jackie’s Toy Shop completed the following merchandise transactions in the month of April: Jackie’s Toy Shop accounts included the following: Cash 101; Accounts Receivable 112; Merchandise Inventory 120; Store Equipme

> Abby Gray opened Abby’s Toy House. As her newly hired accountant, your tasks are to do the following: 1. Journalize the transactions for the month of December. Use the periodic method. 2. Record to subsidiary ledgers and post to the gen

> Wendy Drew operates a wholesale computer center and has hired you as her bookkeeper to record the following transactions. She would like you to (1) journalize the following transactions, (2) record to the accounts payable subsidiary ledger and post to th

> As the accountant for Riley’s Natural Food Store, (1) journalize the following transactions into the general journal (p. 2), (2) record and post as appropriate, and (3) prepare a schedule of accounts payable. If using working papers, be

> Robert Chase recently opened Robert’s Skate Shop. As the bookkeeper of the company, use the periodic method to journalize, record, and post when appropriate the following transactions (account numbers are Store Supplies 115; Store Equip

> Chevy Canton opened Chevy’s Cosmetic Market on May 1. A 16% sales tax is calculated and added to all cosmetic sales. Chevy offers no sales discounts. The following transactions occurred in May: Required: 1. Journalize, record, and pos

> Jared Payne owns Payne’s Sneaker Shop. (Balances as of March 1 are provided for the accounts receivable and general ledger accounts as follows: Durant, $250 Dr.; Lanham, $550 Dr.; Pry, $800 Dr.; Zamara, $550 Dr.; Cash, $15,500 Dr.; Acco

> The following transactions of Jeff’s Auto Supply occurred in February (Balances as of February 1 are given for general ledger and accounts receivable ledger accounts: Dick, $1,100 Dr.; Metcalf, $200 Dr.; Black, $100 Dr.; Accounts Receiv

> Kate Collins has opened Fontina and Stuff, a wholesale grocery and cheese company. The following transactions occurred in February: Required: 1. Journalize the transactions. 2. Record to the accounts receivable subsidiary ledger and post to the general

> Porter Morse returned $275 (selling price) of merchandise to Labrie Co. The cost of the merchandise to Labrie Co. is $100. What would be the journal entry on the books of both the buyer and seller?

> The following is the monthly payroll for the last three months of the year for Allen’s Sporting Goods Shop, 2 Boat Road, Lynn, Massachusetts 01945. The shop is a sole proprietorship owned and operated by Bill Allen. The EIN for Allen&ac

> The following is the monthly payroll of White Company, owned by Dana White. Employees are paid on the last day of each month. White Company is located at 2 Square Street, Marblehead, Massachusetts 01945. Its EIN is 29-3458822. The FICA tax rate for S

> You gathered the following data from time cards and individual employee earnings records. Your tasks are as follows: 1. On December 5, 201X, prepare a payroll register for this biweekly payroll. 2. Calculate the employer taxes of FICA OASDI, FICA Medicar

> From the following, record the transactions in Rochester’s auxiliary petty cash record and general journal as needed: 201X A check was drawn (no. 444) payable to Harold Hauer, petty cashier, to establish a $210 petty cash fund. Oct

> The following transactions occurred in April for Exultant Co.: Your tasks are to do the following: a. Record the appropriate entries in the general journal as well as the auxiliary petty cash record as needed. b. Replenish the petty cash fund on April

> From the following bank statement, please (1) complete the bank reconciliation for Josh’s Deli found on the reverse of the following bank statement and (2) journalize the appropriate entries as needed. a. A deposit of $2,400 is in tran

> Denim.com received a bank statement from Waldorf Bank indicating a bank balance of $7,900. Based on Denim.com’s check stubs, the ending checkbook balance was $8,974. Your task is to prepare a bank reconciliation for Denim.com as of July 31, 201X, from th

> Enter the beginning balance in each account in your working papers from the Trial Balance columns of the worksheet (Figure 5.24). From that worksheet, (1) journalize and post adjusting and closing entries and (2) prepare from the ledger a post-closing tr

> Consider the data in Figure 5.23 for Drew’s Dance Studio: Figure 5.23: Adjustment Data a. Insurance expired, $400. b. Dance supplies on hand, $800. c. Depreciation on dance equipment, $1,500. d. Salaries earned by employees but not t

> Journalize the following transactions: a. Issued credit memo no. 2, $43, to Lenny Co. b. Cash sales, $183. c. Received check from Dolly Co., $45, less 2% discount. d. Bought merchandise on account from Joseph Co., $31, invoice no. 20; terms 3/10, n/30.