Question: The Stockholders’ Equity section of the balance

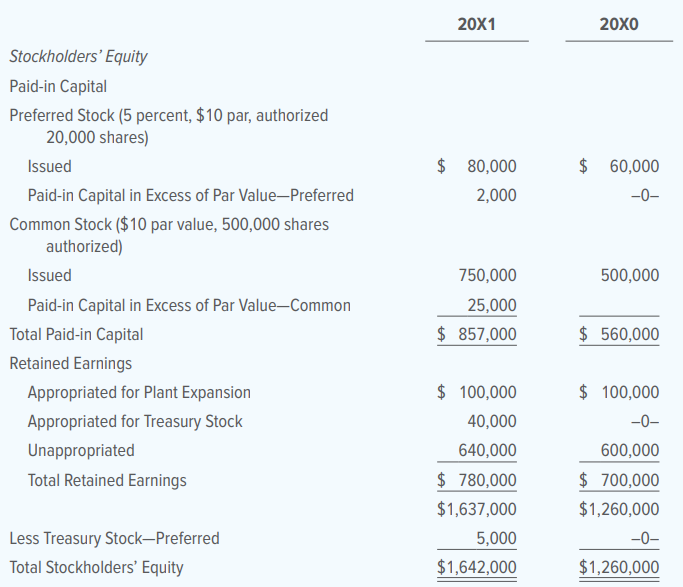

The Stockholders’ Equity section of the balance sheets for Ztop Corporation on December 31, 20X0, and December 31, 20X1, along with other selected account balances on the two dates is provided below. (Certain information is missing from the statements.)

In 20X1 (the current year), the following transactions affecting equity occurred:

a. Additional shares of common stock were issued in July. No other common stock was issued during the year.

b. A cash dividend of $1 per share was declared and paid on common stock in December.

c. The Treasury Stock—Preferred was purchased at par in January.

d. Additional preferred stock was issued for cash in July.

e. The yearly cash dividend of $0.50 per share was declared and paid on preferred stock outstanding as of December 3, 20X1.

INSTRUCTIONS

Answer the following questions about transactions in 20X1:

1. How many shares of preferred stock were outstanding at year-end?

2. How many common stock shares were outstanding at year-end?

3. How many shares of preferred stock were purchased as treasury stock?

4. How many shares of preferred stock were issued for cash?

5. What was the sales price per share of the preferred stock issued?

6. What was the total cash dividend on preferred stock?

7. What was the total cash dividend on common stock?

Analyze: What is the yearly dividend reduction because of the treasury stock purchase?

> What information does a job order cost sheet contain?

> Describe a just-in-time inventory system, including its advantages and disadvantages, if any.

> Discuss how costs flow through the Raw Materials Inventory, Work in Process Inventory, and Finished Goods Inventory accounts to cost of goods sold.

> Name three types of businesses that would use a job order cost accounting system.

> Doors, Inc.’s condensed income statement and balance sheet for the years 2022 and 2021 follow. INSTRUCTIONS Using the following additional information, fill in the missing values: 1. Accounts Receivable increased 50 percent from 2021 to

> What is a time ticket? What is its relationship to an order cost sheet?

> What account is debited and what account is credited when completed goods are transferred from the factory floor to the finished goods storeroom?

> Why is an overhead application rate used?

> Name five common manufacturing overhead costs.

> What is a perpetual inventory?

> Why does the figure for total manufacturing cost not equal the cost of goods manufactured?

> What is manufacturing overhead?

> How would the wages of the employee who issues materials from the factory storeroom be classified?

> It is possible that one company might consider an item, such as glue, as one of its direct materials, while another company with identical manufacturing processes might classify the item as one of its indirect materials. Why?

> What is indirect labor?

> On December 31, 2022, Express, Inc., has $1,000,000 of 6 percent, 10-year bonds outstanding. These bonds were issued on January 1, 2016, at par value. Interest rates have dropped to 5 percent, and the president of the company is considering buying back t

> What procedure is used on the statement of cost of goods manufactured to arrive at the cost of raw materials used?

> What is the relationship between the cost of goods manufactured and the income statement?

> Name the three inventory accounts found in the chart of accounts of a manufacturing business and explain each one.

> Explain how a manufacturing business records reversing entries and why the reversing entries are made.

> How is the cost of goods sold determined for a manufacturing business?

> Give three examples not given in the chapter of indirect labor for a manufacturing firm.

> Describe the flow of costs through the inventory accounts of a manufacturing firm.

> Is the statement of cost of goods manufactured prepared before or after the income statement? Explain.

> Are the financial statements prepared after the closing entries have been posted? Explain.

> What is the source of the information for preparing the journal entry to close manufacturing cost accounts to the Manufacturing Summary account?

> On December 31, 2022, the equity accounts of Book Creations, Inc., contained the following balances: Common stock ($10 par, 100,000 shares authorized) 50,000 shares issued and outstanding $500,000 Retained earnings $500,000 For the year 2022, the corpor

> Give some examples of manufacturing overhead items.

> How is the work in process inventory determined?

> How do the accounting problems of a manufacturing business differ from those of a merchandising business?

> Suggest a logical basis for allocating these indirect expenses: housekeeping services; office equipment repairs; general institutional advertising.

> Explain the difference between semidirect and indirect expenses.

> How does a departmentalized income statement differ from one that is not departmentalized?

> How is contribution margin computed?

> Why would a retail operation departmentalize its records?

> Is departmental accounting a form of responsibility accounting? Explain.

> Briefly define responsibility accounting.

> EZLife Inc. has the following stockholders’ equity on June 30, 20X1: Common Stock, $15 par (200,000 shares issued) $3,000,000 Paid-in Capital in Excess of Par 2,000,000 Retained Earnings 4,000,000 Total Stockholders’ Equity $9,000,000 For the past three

> 1. How might a poor set of recording procedures affect the flow of information to management? 2. Why should management be concerned about the efficiency of a firm’s procedures for journalizing and posting transactions? 3. Why should man

> Why does managerial accounting focus on the future?

> Why is interest expense not allocated to departments?

> How does managerial accounting differ from financial accounting?

> A corporation’s income statement shows a gain of $8,000 on the sale of plant and equipment. In computing the net cash provided by operating activities, how would this $8,000 be treated?

> Is an investment in a corporate bond maturing 180 days after the purchase date a cash equivalent? Explain.

> What are cash and cash equivalents?

> Give two examples of cash inflows from financing activities.

> Give two examples of cash outflows from financing activities.

> Give two examples of cash outflows from investing activities.

> Give two examples of cash inflows from investing activities.

> Where is information obtained for preparing the statement of cash flows?

> Identify in which of the three types of activities on the statement of cash flows the following transactions appear. Indicate whether each is a cash inflow or outflow: a. Cash dividends paid. b. Cash interest payment received. c. Cash on notes receivable

> Why must noncash investing and financing activities be disclosed on the statement of cash flows?

> Why are cash equivalents included on the statement of cash flows?

> On January 1, 2022, the balance of the Accounts Payable account was $31,000. On December 31, 2022, the balance was $41,000. How, if at all, would this change be reflected in the statement of cash flows?

> Explain the difference between the direct method and the indirect method of preparing the statement of cash flows.

> A corporation’s income statement shows bond interest expense of $16,500. Amortization of the discount on the bonds during the year was $1,500. What is the amount of cash outflow for bond interest expense?

> What is the purpose of the statement of cash flows?

> How does the acid-test ratio differ from the current ratio?

> What is the procedure for measuring earnings per share of common stock?

> The Stockholders’ Equity section of the FT Company balance sheet at the close of the current year follows: Stockholders’ Equity Preferred Stock (6%, $100 par value, 100,000 shares authorized) At Par Value (60,000 shares issued) $ 6,000,000 Paid-in Capita

> What does the rate of net income on stockholders’ equity tell stockholders?

> Which is more important: a larger change in percentage or a large change in dollar amount?

> In a vertical analysis of the balance sheet, what is the base for comparing each item on the statement?

> What is meant by vertical analysis of the income statement?

> If a company’s net sales and its cost of goods sold both increase by 12 percent from 2021 to 2022, would gross profit on sales also increase by 12 percent?

> Why would a short-term creditor be interested in the analysis of a company’s income statement?

> As a rule of thumb, what is the minimum desired current ratio?

> What does the accounts receivable turnover measure?

> How is inventory turnover computed?

> What are common-size statements?

> Just after its formation on September 1, 20X1, the ledger accounts of Ducks, Inc., contained the following balances: Accrued Expenses Payable $ 4,000 Accounts Payable 7,000 Accounts Receivable 53,000 Allowance for Doubtful Accounts 4,000 Building 300,000

> How are the legal costs and other costs related to issuing bonds accounted for?

> Why is the year-end adjusting entry for amortization of a bond premium or discount reversed at the start of the new year?

> Why is a bond premium or discount amortized as part of the adjustment process at the end of the year?

> In a bond indenture dated January 1, 2022, Pink Company authorized the issuance of $500,000 face value, 10 percent, 20-year bonds payable. No bonds were issued until July 1, 2023, when bonds with a face value of $200,000 were issued. At that time, the ma

> Why might a company use a special bank account for paying bond interest?

> Are authorized, unissued bonds shown on the balance sheet? If so, where?

> How is the Bonds Payable account classified on the balance sheet?

> What is a bond indenture?

> Explain the accounting treatment necessary when bonds are retired before maturity.

> What is the relationship between a bond sinking fund and an appropriation of retained earnings for bond retirement? Explain.

> For several years, Herschel Anderson had operated Management Consulting Company as its sole proprietor. On January 1, 20X1, he formed a partnership with Richard Harris to operate the company under the name Harris-Anderson Professional Management Consulta

> What is a bond sinking fund?

> What is a collateral trust bond?

> Several years ago a corporation made an appropriation of retained earnings because of a building project. The building project was completed in the current year. What accounting entry will probably be made with respect to the appropriation?

> What effect does an appropriation have on total retained earnings?

> What effect does a stock split have on retained earnings? Explain.

> How is the Common Stock Dividend Distributable account classified in the financial statements?

> When a stock dividend is declared, what journal entry is made? How is the amount of the dividend determined or measured?

> Compare the effects on stockholders’ equity of a cash dividend and a stock dividend.

> Explain the three dates related to declaration and payment of a cash dividend. On which of these dates must journal entries be made?

> What causes “deferred income taxes” to arise? How are balances in “deferred income taxes” accounts disposed of?

> Joseph Colgan has operated a successful motorcycle repair business for the past several years. Colgan thinks his business is almost too successful because he has very little time for himself. Colgan and Brianna Jenkins, who is also a motorcycle enthusias

> What is the purpose of the statement of stockholders’ equity?

> What information is shown on the statement of retained earnings?

> At what amount is treasury stock shown on the balance sheet? How is it classified on the balance sheet?

> As an inducement for Paul Company to locate in Townville, the local chamber of commerce gave the corporation a tract of land with an appraised value of $250,000. How should the gift be accounted for by Paul?

> How is income tax expense classified in the corporation’s income statement?

> Describe the flow of authority and responsibility in a corporate entity.

> Who makes the day-to-day decisions necessary for a corporation to operate?