Question: The trial balance columns of the worksheet

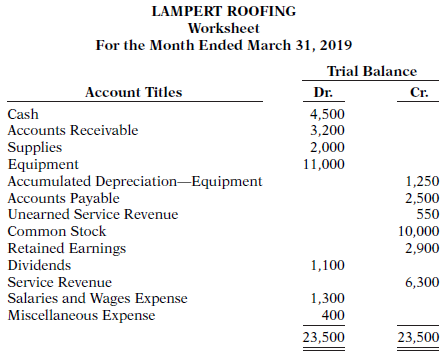

The trial balance columns of the worksheet for Lampert Roofing at March 31, 2019, are as follows.

Other data:

1. A physical count reveals only $550 of roofing supplies on hand.

2. Depreciation for March is $250.

3. Unearned service revenue amounted to $210 at March 31.

4. Accrued salaries are $700.

Instructions

(a) Enter the trial balance on a worksheet and complete the worksheet.

(b) Prepare an income statement and a retained earnings statement for the month of

March and a classified balance sheet at March 31.

(c) Journalize the adjusting entries from the adjustments columns of the worksheet.

(d) Journalize the closing entries from the financial statement columns of the worksheet.

Transcribed Image Text:

LAMPERT ROOFING Worksheet For the Month Ended March 31, 2019 Trial Balance Account Titles Dr. Cr. Cash Accounts Receivable 4,500 3,200 Supplies Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue 2,000 11,000 1,250 2,500 550 Common Stock 10,000 2,900 Retained Earnings Dividends 1,100 Service Revenue 6,300 Salaries and Wages Expense Miscellaneous Expense 1,300 400 23,500 23,500

> What are the content and purpose of a post-closing trial balance?

> Describe the nature of the Income Summary account and identify the types of summary data that may be posted to this account.

> Identify the account(s) debited and credited in each of the four closing entries, assuming the company has net income for the year.

> Why is it necessary to prepare formal financial statements if all of the data are in the statement columns of the worksheet?

> If a company’s revenues are $125,000 and its expenses are $113,000, in which financial statement columns of the worksheet will the net income of $12,000 appear? When expenses exceed revenues, in which columns will the difference appear?

> What is the relationship, if any, between the amount shown in the adjusted trial balance column for an account and that account’s ledger balance?

> Harper Travel Agency purchased land for $85,000 cash on December 10, 2019. At December 31, 2019, the land’s value has increased to $93,000. What amount should be reported for land on Harper’s balance sheet at December 31, 2019? Explain.

> Cigale Company prepares reversing entries. If the adjusting entry for interest payable is reversed, what type of an account balance, if any, will there be in Interest Payable and Interest Expense after the reversing entry is posted?

> Explain the purpose of the worksheet.

> Using Apple’s annual report, determine its current liabilities at September 27, 2014, and September 26, 2015. Were current liabilities higher or lower than current assets in these two years?

> Distinguish between long-term investments and property, plant, and equipment.

> What is meant by the term “operating cycle?”

> What standard classifications are used in preparing a classified balance sheet?

> How do correcting entries differ from adjusting entries?

> Identify, in the sequence in which they are prepared, the three trial balances that are used in the accounting cycle.

> Indicate, in the sequence in which they are made, the three required steps in the accounting cycle that involve journalizing.

> Distinguish between a reversing entry and an adjusting entry. Are reversing entries required?

> (a) How does the time period assumption affect an accountant’s analysis of business transactions? (b) Explain the terms fiscal year, calendar year, and interim periods.

> “A worksheet is a permanent accounting record and its use is required in the accounting cycle.” Do you agree? Explain.

> What is the debit/credit effect of a prepaid expense adjusting entry?

> Distinguish between the two categories of adjusting entries, and identify the types of adjustments applicable to each category.

> “Adjusting entries are required by the historical cost principle of accounting.” Do you agree? Explain.

> In completing the engagement in Question 3, Zupan pays no costs in March, $2,000 in April, and $2,500 in May (incurred in April). How much expense should the firm deduct from revenues in the month when it recognizes the revenue? Why?

> Susan Zupan, a lawyer, accepts a legal engagement in March, performs the work in April, and is paid in May. If Zupan’s law firm prepares monthly financial statements, when should it recognize revenue from this engagement? Why?

> Laurie Belk is president of Better Books. She has no accounting background. Belk cannot understand why fair value is not used as the basis for all accounting measurement and reporting. Discuss.

> Describe the constraint inherent in the presentation of accounting information.

> What is the distinction between comparability and consistency?

> The bank portion of the bank reconciliation for Bogalusa Company at October 31, 2019, is shown below. The adjusted cash balance per bank agreed with the cash balance per books at October 31. The November bank statement showed the following checks and de

> On July 31, 2019, Keeds Company had a cash balance per books of $6,140. The statement from Dakota State Bank on that date showed a balance of $7,690.80. A comparison of the bank statement with the Cash account revealed the following facts. 1. The bank se

> Kael Company maintains a petty cash fund for small expenditures. These transactions occurred during the month of August. Aug. 1 Established the petty cash fund by writing a check payable to the petty cash custodian for $200. 15 Replenished the petty cas

> How do documentation procedures contribute to good internal control?

> Why do accrual-basis financial statements provide more useful information than cash-basis statements?

> Rondelli Middle School wants to raise money for a new sound system for its auditorium. The primary fund-raising event is a dance at which the famous disc jockey D.J. Sound will play classic and not-so-classic dance tunes. Matt Ballester, the music and th

> Bolz Office Supply Company recently changed its system of internal control over cash disbursements. The system includes the following features. Instead of being unnumbered and manually prepared, all checks must now be prenumbered and prepared by using th

> The management of Felipe Inc. is reevaluating the appropriateness of using its present inventory cost fl ow method, which is average-cost. The company requests your help in determining the results of operations for 2019 if either the FIFO or the LIFO met

> Ziad Company had a beginning inventory on January 1 of 150 units of Product 4-18-15 at a cost of $20 per unit. During the year, the following purchases were made. Mar. 15 400 units at $23………..Sept. 4 350 units at $26 July 20 250 units at $24………….Dec. 2

> Express Distribution markets CDs of the performing artist Fishe. At the beginning of October, Express had in beginning inventory 2,000 of Fishe’s CDs with a unit cost of $7. During October, Express made the following purchases of Fishe’s CDs. Oct. 3 2,5

> Austin Limited is trying to determine the value of its ending inventory as of February 28, 2019, the company’s year-end. The following transactions occurred, and the accountant asked your help in determining whether they should be recorded or not. (a) On

> The trial balance of Valdez Fashion Center contained the following accounts at November 30, the end of the company’s fiscal year. Adjustment data: 1. Supplies on hand totaled $2,000. 2. Depreciation is $11,500 on the equipment. 3. Int

> Adam Nichols, a former disc golf star, operates Adam’s Discorama. At the beginning of the current season on April 1, the ledger of Adam’s Discorama showed Cash $1,800, Inventory $2,500, and Common Stock $4,300. The following transactions were completed d

> The Deluxe Store is located in midtown Madison. During the past several years, net income has been declining because of suburban shopping centers. At the end of the company’s fi scal year on November 30, 2019, the following accounts app

> Latona Hardware Store completed the following merchandising transactions in the month of May. At the beginning of May, the ledger of Latona showed Cash of $5,000 and Common Stock of $5,000. May 1 Purchased merchandise on account from Gray’s Wholesale Sup

> Identify the five components of a good internal control system.

> Powell’s Book Warehouse distributes hardcover books to retail stores and extends credit terms of 2/10, n/30 to all of its customers. At the end of May, Powell’s inventory consisted of books purchased for $1,800. During June, the following merchandising t

> Dao Vang, CPA, was retained by Universal Cable to prepare financial statements for April 2019. Vang accumulated all the ledger balances per Universal’s records and found the following. Dao Vang reviewed the records and found the follow

> Heidi Jara opened Jara’s Cleaning Service on July 1, 2019. During July, the following transactions were completed. July 1 Stockholders invested $20,000 cash in the business in exchange for common stock. 1 Purchased used truck for $9,000, paying $4,000 ca

> Jarmuz Management Services began business on January 1, 2018, with a capital investment of $90,000. The company manages condominiums for owners (service revenue) and rents space in its own office building (rent revenue). The trial balance and adjusted tr

> The completed financial statement columns of the worksheet for Fleming Company are as follows. Instructions (a) Prepare an income statement, a retained earnings statement, and a classified balance sheet. (b) Prepare the closing entries. (c) Post the clo

> The adjusted trial balance columns of the worksheet for Alshwer Company are as follows. Instructions (a) Complete the worksheet by extending the balances to the financial statement columns. (b) Prepare an income statement, a retained earnings statement,

> A review of the ledger of Carmel Company at December 31, 2019, produces the following data pertaining to the preparation of annual adjusting entries. 1. Prepaid Insurance $10,440. The company has separate insurance policies on its buildings and its motor

> Everett Co. was organized on July 1, 2019. Quarterly financial statements are prepared. The unadjusted and adjusted trial balances as of September 30 are shown as follows. Instructions (a) Journalize the adjusting entries that were made. (b) Prepare an

> The Skyline Motel opened for business on May 1, 2019. Its trial balance before adjustment on May 31 is as follows. In addition to those accounts listed on the trial balance, the chart of accounts for Skyline Motel also contains the following accounts an

> (a) “Cash equivalents are the same as cash.” Do you agree? Explain. (b) How should restricted cash funds be reported on the balance sheet?

> Deanna Nardelli started her own consulting firm, Nardelli Consulting, on May 1, 2019. The trial balance at May 31 is as follows. In addition to those accounts listed on the trial balance, the chart of accounts for Nardelli Consulting also contains the f

> The Palace Theater opened on April 1. All facilities were completed on March 31. At this time, the ledger showed No. 101 Cash $6,000, No. 140 Land $12,000, No. 145 Buildings (concession stand, projection room, ticket booth, and screen) $8,000, No. 157 Eq

> The trial balance of Dominic Company shown below does not balance. Your review of the ledger reveals that each account has a normal balance. You also discover the following errors. 1. The totals of the debit sides of Prepaid Insurance, Accounts Payable

> Tom Zopf owns and manages a computer repair service, which had the following trial balance on December 31, 2018 (the end of its fiscal year). Summarized transactions for January 2019 were as follows. 1. Advertising costs, paid in cash, $1,000. 2. Addit

> Julia Dumars is a licensed CPA. During the first month of operations of her business, Julia Dumars, Inc., the following events and transactions occurred. May 1 Stockholders invested $20,000 cash in exchange for common stock. 2 Hired a secretary-receptio

> Grandview Park was started on April 1 by R. S. Francis and associates. The following selected events and transactions occurred during April. Apr. 1 Stockholders invested $50,000 cash in the business in exchange for common stock. 4 Purchased land costing

> Financial statement information about four different companies is as follows. Instructions (a) Determine the missing amounts. (Hint: For example, to solve for (a), Assets − Liabilities = Stockholders’ Equity = $27,00

> Nancy Tercek started a delivery service, Tercek Deliveries, on June 1, 2019. The following transactions occurred during the month of June. June 1 Stockholders invested $10,000 cash in the business in exchange for common stock. 2 Purchased a used van for

> On May 1, Nimbus Flying School, a company that provides flying lessons, was started by using common stock in exchange for cash of $45,000. Following are the assets and liabilities of the company on May 31, 2019, and the revenues and expenses for the mont

> On August 31, the balance sheet of La Brava Veterinary Clinic showed Cash $9,000, Accounts Receivable $1,700, Supplies $600, Equipment $6,000, Accounts Payable $3,600, Common Stock $13,000, and Retained Earnings $700. During September, the following tran

> Heather Kemp asks for your help concerning an NSF check. Explain to Heather (a) what an NSF check is, (b) how it is treated in a bank reconciliation, and (c) whether it will require an adjusting entry.

> Fredonia Repair Inc. was started on May 1. A summary of May transactions is presented below. 1. Stockholders invested $10,000 cash in the business in exchange for common stock. 2. Purchased equipment for $5,000 cash. 3. Paid $400 cash for May office rent

> Horvath Company uses an imprest petty cash system. The fund was established on March 1 with a balance of $100. During March, the following petty cash receipts were found in the petty cash box. The fund was replenished on March 15 when the fund contained

> Setterstrom Company established a petty cash fund on May 1, cashing a check for $100. The company reimbursed the fund on June 1 and July 1 with the following results. June 1: Cash in fund $1.75. Receipts: delivery expense $31.25, postage expense $39.00,

> Listed below are fi ve procedures followed by Gilmore Company. 1. Employees are required to take vacations. 2. Any member of the sales department can approve credit sales. 3. Paul Jaggard ships goods to customers, bills customers, and receives payment fr

> Listed below are fi ve procedures followed by Eikenberry Company. 1. Several individuals operate the cash register using the same register drawer. 2. A monthly bank reconciliation is prepared by someone who has no other cash responsibilities. 3. Joe Cock

> At Danner Company, checks are not prenumbered because both the purchasing agent and the treasurer are authorized to issue checks. Each signer has access to unissued checks kept in an unlocked file cabinet. The purchasing agent pays all bills pertaining t

> The following control procedures are used in Mendy Lang’s Boutique Shoppe for cash disbursements. 1. The company accountant prepares the bank reconciliation and reports any discrepancies to the owner. 2. The store manager personally approves all payments

> The following control procedures are used at Torres Company for over-the-counter cash receipts. 1. To minimize the risk of robbery, cash in excess of $100 is stored in an unlocked briefcase in the stockroom until it is deposited in the bank. 2. All over-

> Eve Herschel is the owner of Herschel’s Pizza. Herschel’s is operated strictly on a carryout basis. Customers pick up their orders at a counter where a clerk exchanges the pizza for cash. While at the counter, the customer can see other employees making

> Hamid’s Hardware reported cost of goods sold as follows. Hamid’s made two errors: (1) 2018 ending inventory was overstated $3,000, and (2) 2019 ending inventory was understated $6,000. Instructions Compute the corre

> (a) Identify the three activities that pertain to a petty cash fund, and indicate an internal control principle that is applicable to each activity. (b) When are journal entries required in the operation of a petty cash fund?

> Inventory data for Kaleta Company are presented in E6-7. Data from E6-7: Instructions (a) Compute the cost of the ending inventory and the cost of goods sold using the average-cost method. (Round average cost per unit to nearest cent.) (b) Will the resu

> Lisa Company had 100 units in beginning inventory at a total cost of $10,000. The company purchased 200 units at a total cost of $26,000. At the end of the year, Lisa had 80 units in ending inventory. Instructions (a) Compute the cost of the ending inve

> Kaleta Company reports the following for the month of June. Instructions (a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO and (2) LIFO. (b) Which costing method gives the higher ending inventory? Why? (c) Which met

> Xiong Co. uses a periodic inventory system. Its records show the following for the month of May, in which 65 units were sold Instructions Compute the ending inventory at May 31 and cost of goods sold using the FIFO and LIFO methods. Prove the amount al

> Linda’s Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Information relating to Linda’s purchases of Xpert snowboards during September is shown below. During the same month, 121 Xpert snowb

> On December 1, Marzion Electronics Ltd. has three DVD players left in stock. All are identical, all are priced to sell at $150. One of the three DVD players left in stock, with serial #1012, was purchased on June 1 at a cost of $100. Another, with serial

> Gato Inc. had the following inventory situations to consider at January 31, its year-end. (a) Goods held on consignment for Steele Corp. since December 12. (b) Goods shipped on consignment to Logan Holdings Inc. on January 5. (c) Goods shipped to a custo

> Rachel Warren, an auditor with Laplante CPAs, is performing a review of Schuda Company’s inventory account. Schuda did not have a good year, and top management is under pressure to boost reported income. According to its records, the inventory balance at

> Tri-State Bank and Trust is considering giving Josef Company a loan. Before doing so, management decides that further discussions with Josef’s accountant may be desirable. One area of particular concern is the inventory account, which has a year-end bala

> Presented below are selected accounts for B. Midler Company as reported in the worksheet at the end of May 2019. Ending inventory is $75,000. Instructions Complete the worksheet by extending amounts reported in the adjusted trial balance to the appropr

> Fraud experts often say that there are three primary factors that contribute to employee fraud. Identify the three factors and explain what is meant by each.

> The following information is related to Lor Co. 1. On April 5, purchased merchandise on account from Garcia Company for $19,000, terms 2/10, net/30, FOB shipping point. 2. On April 6, paid freight costs of $800 on merchandise purchased from Garcia. 3. On

> This information relates to Rana Co. 1. On April 5, purchased merchandise on account from Craig Company for $25,000, terms 2/10, net/30, FOB shipping point. 2. On April 6, paid freight costs of $900 on merchandise purchased from Craig Company. 3. On Apri

> Below is a series of cost of goods sold sections for companies B, F, L, and R. Instruction Fill in the lettered blanks to complete the cost of goods sold sections. B F L R $ 70 $ 150 1,620 $1,000 (g) 290 $ (j) 43,590 (k) 41,090 2,240 (1) 49,530 6,2

> On January 1, 2019, Christel Madan Corporation had inventory of $50,000. At December 31, 2019, Christel Madan had the following account balances. Freight-in……………………………………. $ 4,000 Purchases…………………………………..509,000 Purchase discounts…………………………6,000 Purchas

> The trial balance of D. Savage Company at the end of its fiscal year, August 31, 2019, includes these accounts: Inventory $17,200, Purchases $149,000, Sales Revenue $190,000, Freight-In $5,000, Sales Returns and Allowances $3,000, Freight-Out $1,000, and

> The trial balance columns of the worksheet using a perpetual inventory system for Marquez Company at June 30, 2019, are as follows. Other data: Operating expenses incurred on account, but not yet recorded, total $1,500. Instructions Enter the trial ba

> Presented below are selected accounts for Salazar Company as reported in the worksheet using a perpetual inventory system at the end of May 2019. Instructions Complete the worksheet by extending amounts reported in the adjusted trial balance to the app

> Financial information is presented below for three different companies. Instructions Determine the missing amounts. Allen Bast Corr Cosmetics Grocery Wholesalers Sales revenue $90,000 (a) 86,000 56,000 (b) 15,000 (c) 4,000 (d) $ (e) 5,000 95,000 (f

> Presented below is financial information for two different companies. Instructions (a) Determine the missing amounts. (b) Determine the gross profit rates. (Round to one decimal place.) May Company Reed Company Sales revenue $90,000 (a) 87,000 56,00

> In 2019, Matt Cruz Company had net sales of $900,000 and cost of goods sold of $522,000. Operating expenses were $225,000, and interest expense was $11,000. Cruz prepares a multiple-step income statement. Instructions (a) Compute Cruz’s gross profit. (b

> Explain how these principles apply to cash disbursements: (a) physical controls, and (b) human resource controls.

> An inexperienced accountant for Huang Company made the following errors in recording merchandising transactions. 1. A $195 refund to a customer for faulty merchandise was debited to Sales Revenue $195 and credited to Cash $195. 2. A $180 credit purchase

> In its income statement for the year ended December 31, 2019, Lemere Company reported the following condensed data. Operating expenses $ 725,000 Interest revenue $ 28,000 Cost of goods sold 1,289,000 Loss on disposal of plant assets 17,000

> Presented below is information for Furlow Company for the month of March 2019. Cost of goods sold $212,000 Rent expense $ 32,000 Freight-out 7,000 Sales discounts 8,000 Insurance expense 6,000 Sales returns and 13,000 Allowances Salar