Question: The units of an item available for

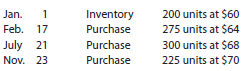

The units of an item available for sale during the year were as follows:

There are 220 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost by

(a). the first-in, first-out method,

(b). the last-in, first-out method, and

(c). the weighted average cost method.

Transcribed Image Text:

1 200 units at $60 275 units at $64 Jan. Inventory Purchase Feb. 17 July 21 Purchase 300 units at $68 225 units at $70 Nov. 23 Purchase

> Classify the following items as (1) prepaid expense, (2) unearned revenue, (3) accrued revenue, or (4) accrued expense: a. Cash received for use of land next month b. Fees earned but not received c. Rent expense owed but not yet paid d. Supplies on han

> Assume that you recently accepted a position with Five Star National Bank & Trust as an assistant loan officer. As one of your first duties, you have been assigned the responsibility of evaluating a loan request for $300,000 from West Gate Auto Co.,

> On April 18, 2016, Bontanica Company, a garden retailer, purchased $9,800 of seed, terms 2/10, n/30, from Whitetail Seed Co. Even though the discount period had expired, Shelby Davey subtracted the discount of $196 when he processed the documents for pay

> In groups of three or four, compare the balance sheets of two different companies, and present to the class a summary of the similarities and differences of the two companies. You may obtain the balance sheets you need from one of the following sources:

> Picasso Graphics is a graphics arts design consulting firm. Pablo Taylor, its treasurer and vice president of finance, has prepared a classified balance sheet as of July 31, 2016, the end of its fiscal year. This balance sheet will be submitted with Pica

> Daryl Kirby opened Squid Realty Co. on January 1, 2015. At the end of the first year, the business needed additional capital. On behalf of Squid Realty Co., Daryl applied to Ocean National Bank for a loan of $375,000. Based on Squid Realty Co.’s financia

> TearLab Corp. is a health care company that specializes in developing diagnostic devices for eye disease. TearLab reported the following data (in thousands) for three recent years: 1. Determine the monthly cash expenses for Year 3, Year 2, and Year 1.

> Select a public corporation you are familiar with or which interests you. Using the Internet, develop a short (1 to 2 pages) profile of the corporation. Include in your profile the following information: 1. Name of the corporation. 2. State of incorporat

> You hold a 25% common stock interest in You-OwnIt, a family-owned construction equipment company. Your sister, who is the manager, has proposed an expansion of plant facilities at an expected cost of $26,000,000. Two alternative plans have been suggested

> The unadjusted trial balance that you prepared for PS Music at the end of Chapter 2 should appear as follows: The data needed to determine adjustments are as follows: a. During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hour

> The transactions completed by PS Music during June 2016 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business’s operations: July 1. Peyton Smith made an additiona

> Be-The-One is a motivational consulting business. At the end of its accounting period, December 31, 2015, Be-The-One has assets of $395,000 and liabilities of $97,000. Using the accounting equation, determine the following amounts: a. Stockholders’ equit

> Peyton Smith enjoys listening to all types of music and owns countless CDs. Over the years, Peyton has gained a local reputation for knowledge of music from classical to rap and the ability to put together sets of recordings that appeal to all ages. Duri

> The unadjusted trial balance of PS Music as of July 31, 2016, along with the adjustment data for the two months ended July 31, 2016, are shown in Chapter 3. Based upon the adjustment data, the following adjusted trial balance was prepared: Instructions

> The following equity investment transactions were completed by Chung Company in 2016: Mar. 4. Purchased 4,000 shares of Jas Company for a price of $50 per share plus a brokerage commission of $100. May 12. Received a quarterly dividend of $0.75 per share

> On March 4, Breen Corporation acquired 7,500 shares of the 200,000 outstanding shares of Melton Co. common stock at $40 plus commission charges of $175. On June 15, a cash dividend of $2.10 per share was received. On October 12, 3,000 shares were sold at

> On April 1, 2016, Rizzo Company purchased $80,000 of 4.5%, 20-year Energizer Company bonds at their face amount plus one month’s accrued interest. The bonds pay interest on March 1 and September 1. On November 1, 2016, Rizzo Company sold $30,000 of the E

> List any errors you can find in the following partial balance sheet: Napa Vino Company Balance Sheet December 31, 2016 Assets Current assets: Cash $ 78,500 $ 300,000 Notes receivable Less interest receivable 4,500 $1,200,000 11,500 295,500 Accounts

> During 2016, the accountant discovered that the physical inventory at the end of 2015 had been understated by $42,750. Instead of correcting the error, however, the accountant assumed that the error would balance out (correct itself) in 2016. Are there a

> Equipment acquired on January 6, 2013, at a cost of $425,000, has an estimated useful life of 16 years and an estimated residual value of $65,000 a. What was the annual amount of depreciation for the years 2013, 2014, and 2015 using the straight-line met

> Parilo Company acquired $170,000 of Makofske Co., 5% bonds on May 1, 2016, at their face amount. Interest is paid semiannually on May 1 and November 1. On November 1, 2016, Parilo Company sold $50,000 of the bonds for 96. Journalize entries to record the

> Lerner Corporation wholesales repair products to equipment manufacturers. On April 1, 2016, Lerner Corporation issued $12,000,000 of five-year, 8% bonds at a market (effective) interest rate of 6%, receiving cash of $13,023,576. Interest is payable semia

> On February 10, 15,000 shares of Sting Company are acquired at a price of $25 per share plus a $150 brokerage commission. On April 12, a $0.40-per-share dividend was received on the Sting Company stock. On May 29, 6,000 shares of the Sting Company stock

> On February 22, Kountry Repair Service extended an offer of $200,000 for land that had been priced for sale at $250,000. On April 3, Kountry Repair Service accepted the seller’s counteroffer of $230,000. On September 15, the land was assessed at a value

> On the first day of its fiscal year, Pretender Company issued $18,500,000 of five-year, 10% bonds to finance its operations of producing and selling home improvement products. Interest is payable semiannually. The bonds were issued at a market (effective

> Bamboo Consulting is a consulting firm owned and operated by Lisa Gooch. The following end-of-period spreadsheet was prepared for the year ended July 31, 2016: Based on the preceding spreadsheet, prepare an income statement, retained earnings statement

> On April 20, Gallatin County Rocks Inc., a marble contractor, issued for cash 75,000 shares of $45 par common stock at $54, and on August 7, it issued for cash 20,000 shares of preferred stock, $10 par at $12. a. Journalize the entries for April 20 and A

> Assume the same facts as in Exercise 9-25, except that the book value of the press traded in is $108,500. Exercise 9-25: A printing press priced at a fair market value of $275,000 is acquired in a transaction that has commercial substance by trading i

> The current assets and current liabilities for Apple Inc. and Dell, Inc., are as follows at the end of a recent fiscal period: *These represent prepaid expense and other non-quick current assets. a. Determine the quick ratio for both companies. (Round

> The series of seven transactions recorded in the following T accounts were related to a sale to a customer on account and the receipt of the amount owed. Briefly describe each transaction. CASH NOTES RECEIVABLE (7) 61,509 (5) 60,000 (6) 60,000 ACCOU

> The following data (in thousands) were taken from recent annual reports of Apple Inc., a manufacturer of personal computers and related products, and American Greetings Corporation, a manufacturer and distributor of greeting cards and related products:

> Based on the data in Exercise 12-1, what factors other than earnings per share should be considered in evaluating these alternative financing plans? Exercise 12-1: Domanico Co., which produces and sells biking equipment, is financed as follows: Incom

> Paragon Tech Company, a communications equipment manufacturer, recently fell victim to a fraud scheme developed by one of its employees. To understand the scheme, it is necessary to review Paragon Tech’s procedures for the purchase of services. The purch

> The following selected transactions were taken from the records of Shipway Company for the first year of its operations ending December 31, 2016: Apr. 13. Wrote off account of Dean Sheppard, $8,450. May 15. Received $500 as partial payment on the $7,100

> On January 1, the first day of the fiscal year, a company issues a $500,000, 5%, 10-year bond that pays semiannual interest of $12,500 ($500,000 × 5% × ½ year), receiving cash of $500,000. Journalize the entries to record (a) the issuance of the bonds, (

> The payroll registers for Proctor Company for the week ended February 14 indicated the following: In addition, state and federal unemployment taxes were calculated at the rate of 5.4% and 0.8%, respectively, on $270,000 of salaries. a. Journalize the e

> Assume that the business in Exercise 6-9 maintains a perpetual inventory system. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, assuming the first-in, first-out method. Present the data in the form illustr

> Bon Nebo Co. sold 25,000 annual subscriptions of Bjorn 20XX for $85 during December 2016. These new subscribers will receive monthly issues, beginning in January 2017. In addition, the business had taxable income of $840,000 during the first calendar qua

> Journalize entries for the following related transactions of South Coast Heating & Air Company: a. Purchased $48,000 of merchandise from Atlas Co. on account, terms 1/10, n/30. b. Paid the amount owed on the invoice within the discount period. c. Discove

> Elliptical Consulting is a consulting firm owned and operated by Jayson Neese. The following end-of-period spreadsheet was prepared for the year ended June 30, 2016: Based on the preceding spreadsheet, prepare an income statement, retained earnings sta

> Journalize the following transactions in the accounts of Dining Interiors Company, a restaurant supply company that uses the allowance method of accounting for uncollectible receivables: Apr. 2. Sold merchandise on account to Peking Palace Co., $41,900.

> The following table shows the revenue and average net fixed assets (in millions) for a recent fiscal year for Best Buy and RadioShack: a. Compute the fixed asset turnover for each company. Round to two decimal places. b. Which company uses its fixed as

> MGM Resorts International owns and operates hotels and casinos including the MGM Grand and the Bellagio in Las Vegas, Nevada. As of a recent year, MGM reported accounts receivable of $592,937,000 and allowance for doubtful accounts of $101,207,000 Johnso

> Identify each of the following reconciling items as: (a). an addition to the cash balance according to the bank statement, (b). a deduction from the cash balance according to the bank statement, (c). an addition to the cash balance according to the co

> Journalize the entries for the following transactions: a. Sold merchandise for cash, $30,000. The cost of the merchandise sold was $18,000. b. Sold merchandise on account, $258,000. The cost of the merchandise sold was $154,800. c. Sold merchandise to cu

> Prepare a journal entry for the purchase of office equipment on October 27 for $32,750, paying $6,550 cash and the remainder on account.

> Journalize the following transactions in the accounts of Midwest Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Feb. 3. Sold merchandise on account to Dr. Jill Hall, $17,340. Th

> Jardine Consulting Co. has the following accounts in its ledger: Cash, Accounts Receivable, Supplies, Office Equipment, Accounts Payable, Common Stock, Retained Earnings, Dividends, Fees Earned, Rent Expense, Advertising Expense, Utilities Expense, Misce

> Verizon Communications is a major telecommunications company in the United States. Two recent balance sheets for Verizon disclosed the following information regarding fixed assets: Verizon’s revenue for Year 2 was $115,846 million. As

> Using Wikipedia (www.wikipedia.com), look up the entry for Sarbanes-Oxley Act. Look over the table of contents and find the section that describes Section 404. What does Section 404 require of management’s internal control report?

> Polo Ralph Lauren Corporation designs, markets, and distributes a variety of apparel, home decor, accessory, and fragrance products. The company’s products include such brands as Polo by Ralph Lauren, Ralph Lauren Purple Label, Ralph La

> Journalize the following transactions in the accounts of Safari Games Co., which operates a riverboat casino: Apr. 18. Received a $60,000, 30-day, 7% note dated April 18 from Glenn Cross on account. 30. Received a $42,000, 60-day, 8% note dated April 30

> Alaska Impressions Co. records all cash receipts on the basis of its cash register tapes. Alaska Impressions Co. discovered during October 2016 that one of its sales clerks had stolen an undetermined amount of cash receipts by taking the daily deposits t

> The following selected transactions were completed by Zippy Do Co., a supplier of zippers for clothing: 2015 Dec. 3. Received from Chicago Clothing & Bags Co., on account, a $36,000, 90-day, 6% note dated December 3. 31. Recorded an adjusting entry for a

> Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31, 2016: The company prepared the following aging schedule for its accounts receivable on December 31, 2016: a. Journalize the write-off

> Dream-It LLC is a motivational consulting business. At the end of its accounting period, December 31, 2015, Dream-It has assets of $780,000 and liabilities of $150,000. Using the accounting equation, determine the following amounts: a. Stockholders’ equi

> Casebolt Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31, 2016: a. Journalize the write-offs for 2016 under the direct write-off method. b. Journalize the write-offs for 2016

> The following income statement data (in millions) for Dell Inc. and Hewlett-Packard Company (HP) were taken from their recent annual reports: a. Prepare a vertical analysis of the income statement for Dell. Round to one decimal place. b. Prepare a vert

> Amicus Therapeutics, Inc., is a biopharmaceutical company that develops drugs for the treatment of various diseases, including Parkinson’s disease. Amicus Therapeutics reported the following financial data (in thousands) for three recen

> Capstone Turbine Corporation produces and sells turbine generators for such applications as charging electric, hybrid vehicles. Capstone Turbine reported the following financial data for a recent year (in thousands): a. Determine the monthly cash expen

> The Home Depot, Inc., is the world’s largest home improvement retailer and one of the largest retailers in the United States based on sales volume. The Home Depot operates over 2,200 Home Depot® stores that sell a wide assort

> Mattel, Inc., designs, manufactures, and markets toy products worldwide. Mattel’s toys include Barbie™ fashion dolls and accessories, Hot Wheels™, and Fisher-Price brands. For a recent year, Mattel re

> Identify the errors in the following income statement: Curbstone Company Income Statement For the Year Ended August 31, 2016 Sales $8,595,000 Cost of merchandise sold Income from operations 6,110,000 $2,485,000 Expenses: $ 800,000 575,000 425,000 Se

> Identify the errors in the following bank reconciliation: Poway Co. Bank Reconcillation For the Month Ended June 30, 2016 Cash balance according to bank statement... Add outstanding checks: $16,185 No. 1067.. $ 575 1106. 470 1110. 1,050 1113.. 910 3

> An accounting clerk for Chesner Co. prepared the following bank reconciliation: a. From the data in this bank reconciliation, prepare a new bank reconciliation for Chesner Co., using the format shown in the illustrative problem. b. If a balance sheet w

> The following data were accumulated for use in reconciling the bank account of Zek’s Co. for May 2016: 1. Cash balance according to the company’s records at May 31, 2016, $22,110. 2. Cash balance according to the bank

> Journalize the following transactions, using the allowance method of accounting for uncollectible receivables: June 2. Received $1,200 from Melissa Crone and wrote off the remainder owed of $4,000 as uncollectible. Oct. 9. Reinstated the account of Melis

> Which of the reconciling items listed in Exercise 7-16 require an entry in the company’s accounts? Exercise 7-16: Identify each of the following reconciling items as: (a) an addition to the cash balance according to the bank statement, (b) a deduction

> Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period: Frelght Pald by Seller Cu

> Assume that the business in Exercise 6-9 maintains a perpetual inventory system. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, assuming the last-in, first-out method. Present the data in the form illustra

> Based on the data in Exercise 4-25, prepare the closing entries for Alert Security Services Co. Exercise 4-25: Alert Security Services Co. offers security services to business clients. Complete the following end-of-period spreadsheet for Alert Security

> Based on the data in Exercise 4-24, prepare the adjusting entries for Alert Security Services Co. Exercise 4-24: Alert Security Services Co. offers security services to business clients. The trial balance for Alert Security Services Co. has been prepar

> We-Sell Realty, organized August 1, 2016, is owned and operated by Omar Farah. How many errors can you find in the following statements for We-Sell Realty, prepared after its first month of operations? We-Sell Realty Income Statement August 31, 20

> The following data (in millions) are taken from the financial statements of Target Corporation: a. For Target Corporation, determine the amount of change in millions and the percent of change (round to one decimal place) from the prior year to the rece

> The following data (in thousands) were taken from recent financial statements of Starbucks Corporation: a. Compute the working capital and the current ratio for Year 2 and Year 1. Round to two decimal places. b. What conclusions concerning the company&

> Kroger, Safeway Inc., and Whole Foods Markets, Inc. are three grocery chains in the United States. Inventory management is an important aspect of the grocery retail business. Recent balance sheets for these three companies indicated the following merchan

> Fonda Motorcycle Shop sells motorcycles, ATVs, and other related supplies and accessories. During the taking of its physical inventory on December 31, 2016, Fonda Motorcycle Shop incorrectly counted its inventory as $337,500 instead of the correct amount

> Beginning inventory, purchases, and sales for Item ProX2 are as follows: Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a). the cost of merchandise sold on January 25 and (b). the inventory on January

> Missouri River Supply Co. sells canoes, kayaks, whitewater rafts, and other boating supplies. During the taking of its physical inventory on December 31, 2016, Missouri River Supply incorrectly counted its inventory as $233,400 instead of the correct amo

> The accounts in the ledger of Hickory Furniture Company as of December 31, 2016, are listed in alphabetical order as follows. All accounts have normal balances. The balance of the cash account has been intentionally omitted. Prepare an unadjusted trial

> List the errors you find in the following balance sheet. Prepare a corrected balance sheet. Labyrinth Services Co. Balance Sheet For the Year Ended August 31, 2016 Assets Liabilities Current assets: Cash.. Current liabilities: Accounts receivable...

> Identify the errors in the following trial balance. All accounts have normal balances. Mascot Co. Unadjusted Trial Balance For the Month Ending July 31, 2016 Debit Balances Credit Balances Cash 36,000 Accounts Receivable. 112,600 Prepaid Insurance E

> For the fiscal year, sales were $25,565,000 and the cost of merchandise sold was $15,400,000. a. What was the amount of gross profit? b. If total operating expenses were $4,550,000, could you determine net income? c. Is Customer Refunds Payable an asset,

> The following preliminary unadjusted trial balance of Ranger Co., a sports ticket agency, does not balance: When the ledger and other records are reviewed, you discover the following: (1) the debits and credits in the cash account total $77,600 and $62

> Optimum Weight Loss Co. offers personal weight reduction consulting services to individuals. After all the accounts have been closed on November 30, 2016, the end of the fiscal year, the balances of selected accounts from the ledger of Optimum Weight Los

> The debits and credits for three related transactions are presented in the following T accounts. Describe each transaction. Cash Sales (5) 39,200 (1) 41,160 Accounts Recelvable Cost of Merchandlse Sold (1) 41,160 (3) 1,960 (2) 25,200 (5) 39,200 Merc

> On January 7, 2016, Captec Company purchased $4,175 of supplies on account. In Captec Company’s chart of accounts, the supplies account is No. 15, and the accounts payable account is No. 21. a. Journalize the January 7, 2016, transaction on page 33 of Ca

> The accountant for Eva’s Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted trial balance and the amounts of the adjustments are correct. Identify the errors in the accounta

> Marcie Davies owns and operates Gemini Advertising Services. On January 1, 2015, Retained Earnings had a balance of $618,500. During the year, Marcie invested an additional $40,000 in exchange for common stock, and $15,000 of dividends were paid. For the

> Identify the errors in the following schedule of the cost of merchandise sold for the year ended May 31, 2016: Cost of merchandise sold: $ 105,000 Merchandise inventory, May 31, 2016 Purchases.... $1,110,000 Plus: Purchases returns and allowances. $

> Based on the following data, determine the cost of merchandise sold for July: Merchandise inventory, July 1 $ 190,850 Merchandise inventory, July 31 160,450 Purchases 1,126,000 .... Purchases returns and allowances . - 46,000 Purchases discounts. 23

> Based on the following data, determine the cost of merchandise sold for November: Merchandise inventory, November 1 $ 28,000 Merchandise inventory, November 30 . 31,500 .... Purchases 475,000 Purchases returns and allowances 15,000 Purchases discoun

> The following data were extracted from the accounting records of Harkins Company for the year ended April 30, 2016: Merchandise inventory, May 1, 2015 ………………………………………… $ 380,000 Merchandise inventory, April 30, 2016 …………………………………………. 415,000 Purchases …

> Lowe’s Companies Inc., a major competitor of The Home Depot in the home improvement business, operates over 1,700 stores. Lowe’s recently reported the following balance sheet data (in millions): a. Determine the tota

> The following data (in millions) were taken from the financial statements of Walmart Stores, Inc: Exercise 2-23: The following data (in millions) are taken from the financial statements of Target Corporation: a. For Walmart Stores, Inc., determine t

> A summary of cash flows for Ethos Consulting Group for the year ended May 31, 2016, follows: Prepare a statement of cash flows for Ethos Consulting Group for the year ended May 31, 2016. Cash receipts: Cash received from customers $637,500 Cash rec

> Kroger, a national supermarket chain, reported the following data (in millions) in its financial statements for a recent year: a. Compute the ratio of sales to assets. Round to two decimal places. b. Tiffany & Co. is a large North American retailer

> The Home Depot reported the following data (in millions) in its recent financial statements: a. Determine the ratio of sales to assets for The Home Depot for Year 2 and Year 1. Round to two decimal places. b. What conclusions can be drawn from these ra

> Use the data in Exercises 8-27 and 8-28 to analyze the accounts receivable turnover ratios of H.J. Heinz Company and The Limited Brands Inc. Exercises 8-27: H.J. Heinz Company was founded in 1869 at Sharpsburg, Pennsylvania, by Henry J. Heinz. The comp

> Classify the following items as (1) prepaid expense, (2) unearned revenue, (3) accrued revenue, or (4) accrued expense: a. Cash received for services not yet rendered b. Insurance paid for the next year c. Rent revenue earned but not received d. Salari