Question: This comprehensive review problem requires you to

This comprehensive review problem requires you to complete the accounting cycle for Sousa Realty twice. This practice set allows you to review Chapters 1–5 while reinforcing the relationships between all parts of the accounting cycle. By completing two cycles, you will see how the ending September balances in the ledger are used to accumulate data in October.

First, look at the chart of accounts for Sousa Realty.

Sousa Realty

Chart of Accounts

Assets …………………………………………………………………………………………. Revenue

111 Cash ………………………………………………………………. 411 Commissions Earned

112 Accounts Receivable ………………………………………….……………………. Expenses

114 Prepaid Rent ………………………………………………………………. 511 Rent Expense

115 Office Supplies ……………………………………………….………. 512 Salaries Expense

121 Office Equipment …………………………………………………….……. 513 Gas Expense

122 Accumulated Depreciation, Office Equipment ……….… 514 Repairs Expense

123 Automobile ………………………………………………….……. 515 Telephone Expense

124 Accumulated Depreciation, Automobile ….…………. 516 Advertising Expense

Liabilities ………………………………………………….………. 517 Office Supplies Expense

211 Accounts Payable ………………… 518 Depreciation Expense, Office Equipment

212 Salaries Payable …………………………… 519 Depreciation Expense, Automobile

Owner’s Equity ……………………………………………………. 524 Miscellaneous Expense

311 James Sousa, Capital

312 James Sousa, Withdrawals

313 Income Summary

On September 1, 201X, James Sousa opened a real estate office called Sousa Realty. The following transactions were completed for the month of September:

201X

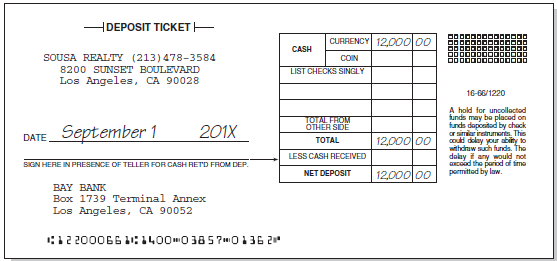

September 1 James Sousa invested $12,000 cash in the real estate agency along with $5,000 of office equipment.

Sept. 1 Rented and paid 5 months’ rent in advance to Murray Property Management, $1,000.

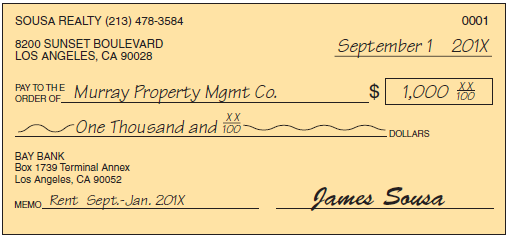

Sept. 1 Bought an automobile on account from Hyundai North, $19,000.

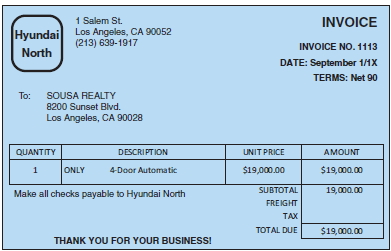

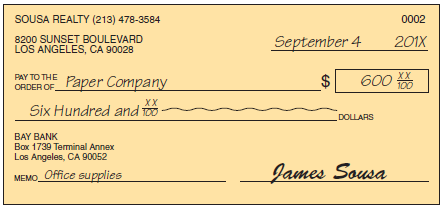

Sept. 4 Purchased office supplies from Paper Company, for cash, $600.

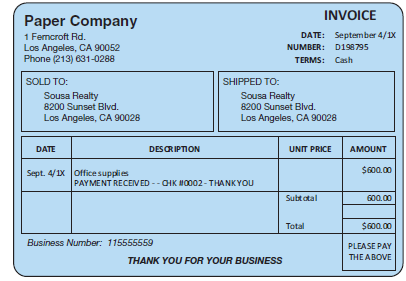

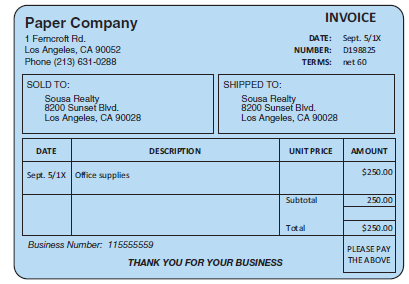

Sept. 5 Purchased additional office supplies from Paper Company, on account, $250.

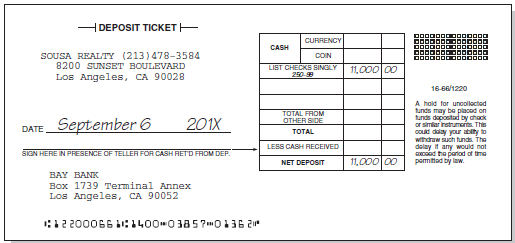

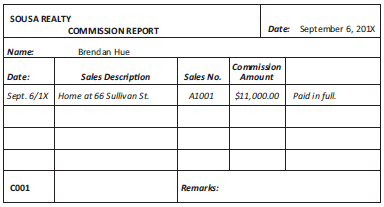

Sept. 6 Sold a house to Brendan Hue and collected a $11,000 commission.

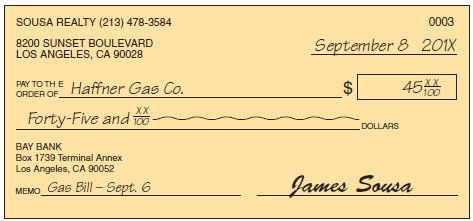

Sept. 8 Paid gas bill to Haffner Gas Co., $45.

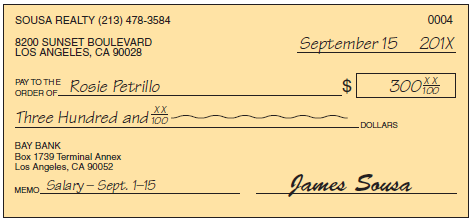

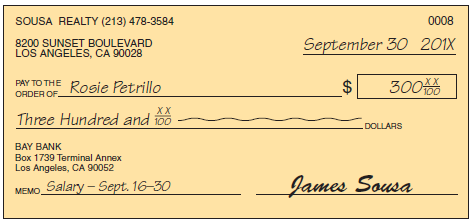

Sept. 15 Paid Rosie Petrillo, office secretary, $300.

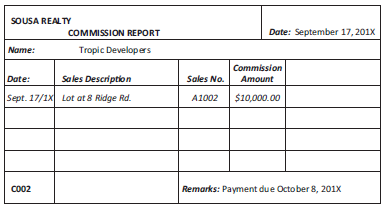

Sept. 17 Sold a building lot to Tropic Developers and earned a commission, $10,000; payment to be received on October 8.

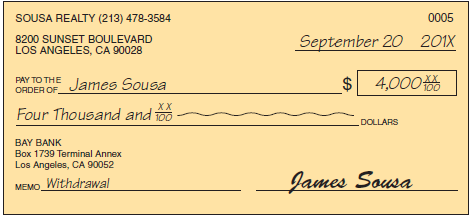

Sept. 20 James Sousa withdrew $4,000 from the business to pay personal expenses.

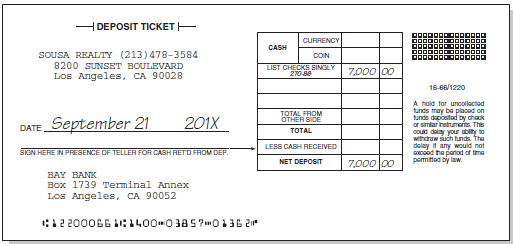

Sept. 21 Sold a house to Suzanne Horngam and collected a $7,000 commission.

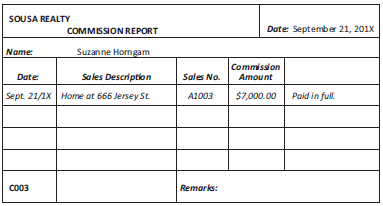

Sept. 22 Paid gas bill, $80, to Haffner Gas Co.

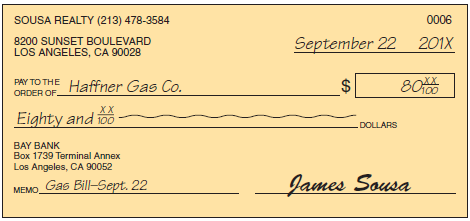

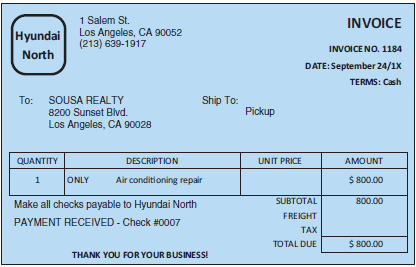

Sept. 24 Paid Hyundai North $800 to repair automobile.

Sept. 30 Paid Rosie Petrillo, office secretary, $300.

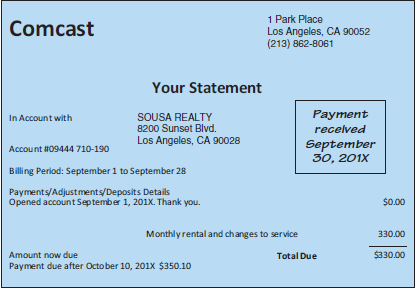

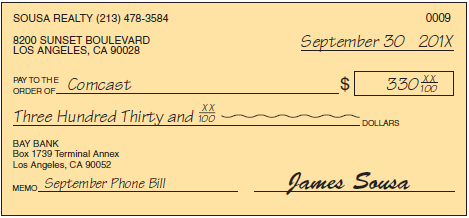

Sept. 30 Paid Comcast September telephone bill, $330.

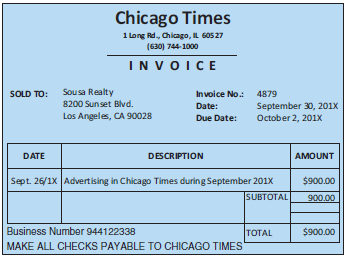

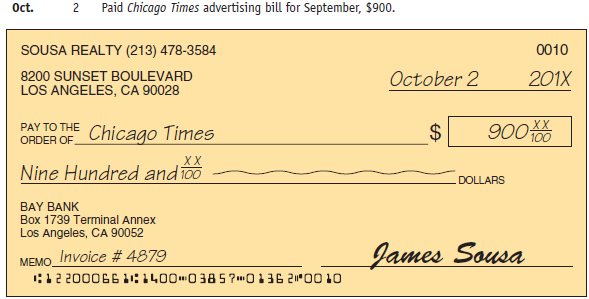

Sept. 30 Received advertising bill for September, $900, from Chicago Times. The bill is to be paid on October 2.

Required Work for September

1. Journalize transactions and post to ledger accounts.

2. Prepare a trial balance in the first two columns of the worksheet and complete the worksheet using the following adjustment data:

a. One month’s rent had expired.

b. An inventory shows $100 of office supplies remaining.

c. Depreciation on office equipment, $160.

d. Depreciation on automobile, $210.

3. Prepare a September income statement, statement of owner’s equity, and balance sheet.

4. From the worksheet, journalize and post adjusting and closing entries (p. 3 of journal).

5. Prepare a post-closing trial balance.

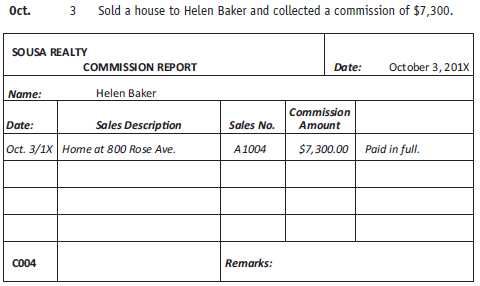

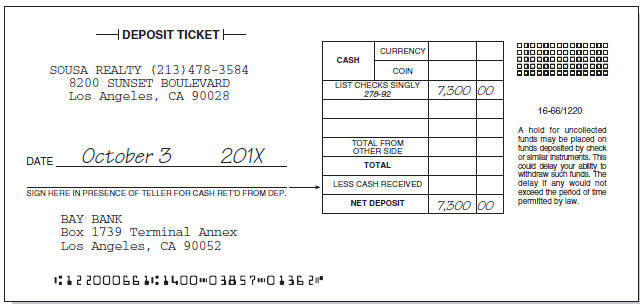

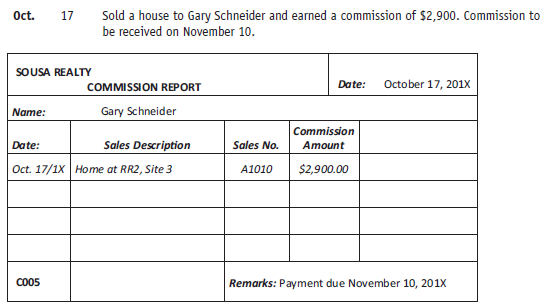

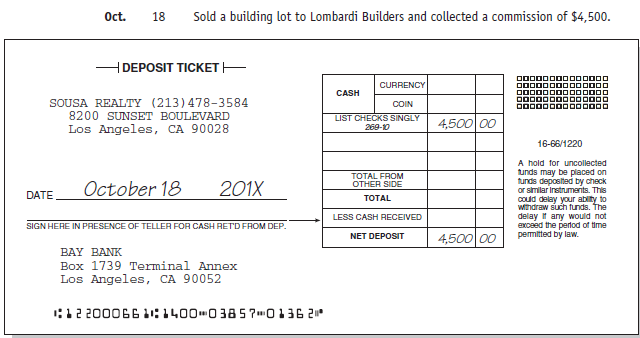

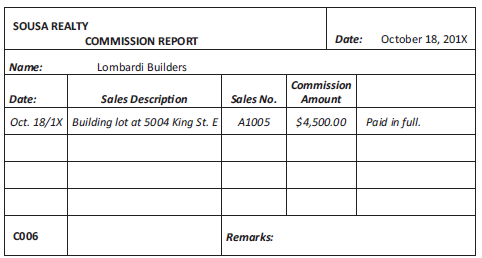

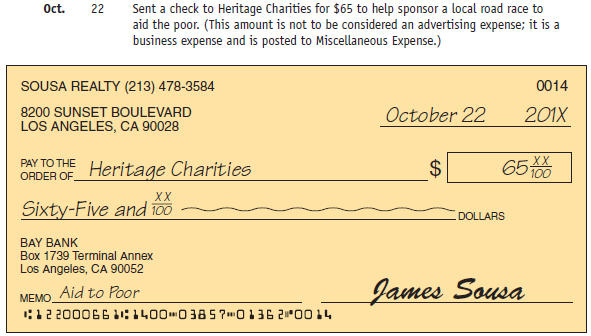

During October, Sousa Realty completed these transactions:

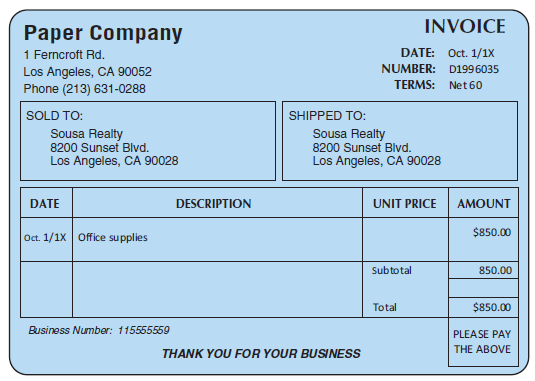

Oct. 1 Purchased additional office supplies on account from Paper Co., $850.

Required Work for October

1. Journalize transactions in a general journal (p. 4) and post to ledger accounts.

2. Prepare a trial balance in the first two columns of a blank, fold-out worksheet located at the end of your textbook and complete the worksheet using the following adjustment data:

a. One month’s rent had expired. Paid 5 months’ rent in advance on September

1, $1,000

b. An inventory shows $130 of office supplies remaining.

c. Depreciation on office equipment, $160.

d. Depreciation on automobile, $210.

3. Prepare an October income statement, statement of owner’s equity, and balance sheet.

4. From the worksheet, journalize and post adjusting and closing entries (p. 6 of journal).

5. Prepare a post-closing trial balance.

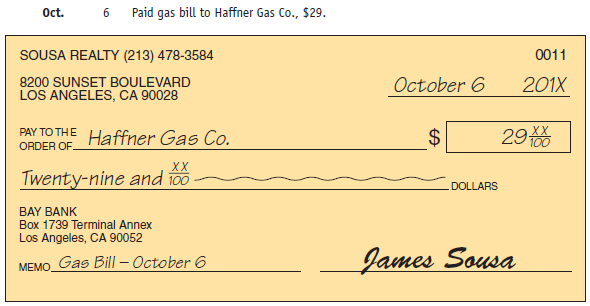

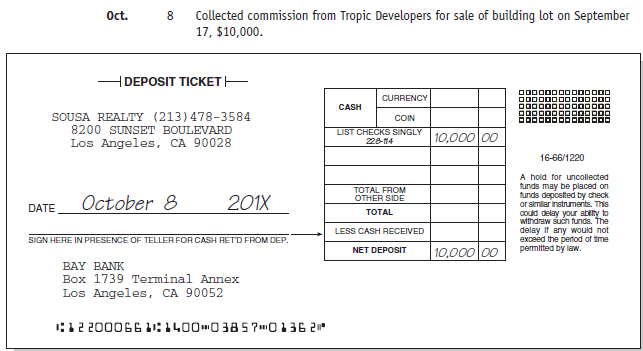

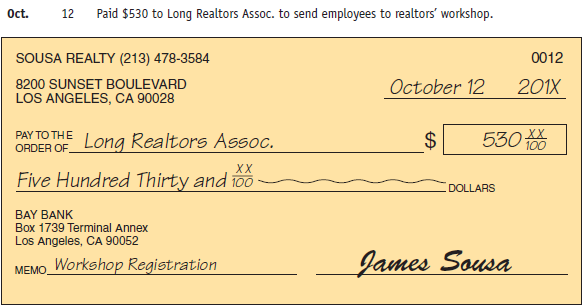

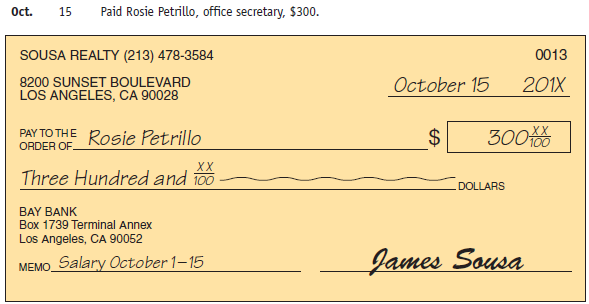

Transcribed Image Text:

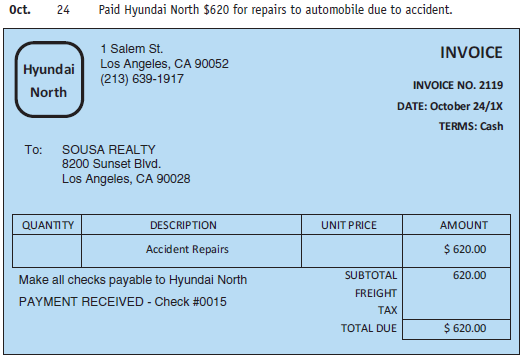

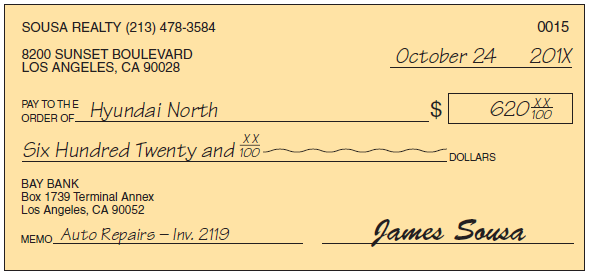

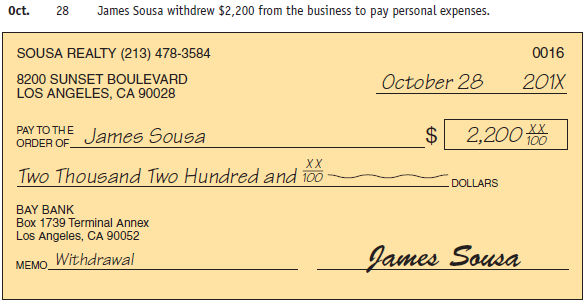

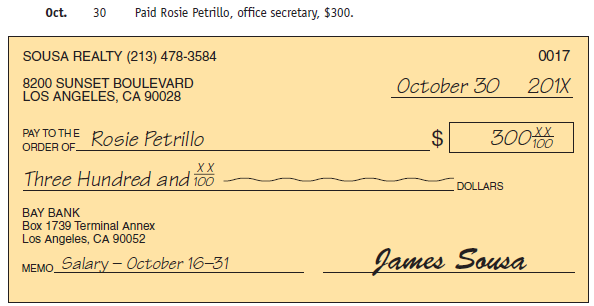

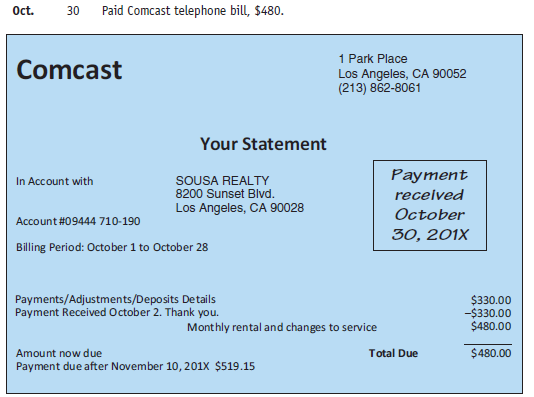

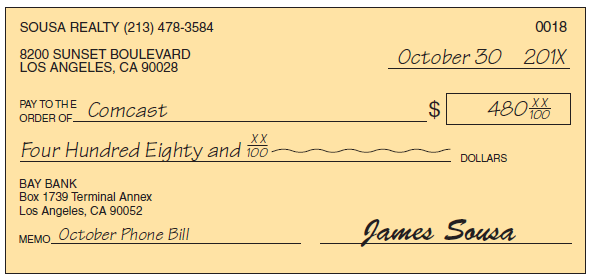

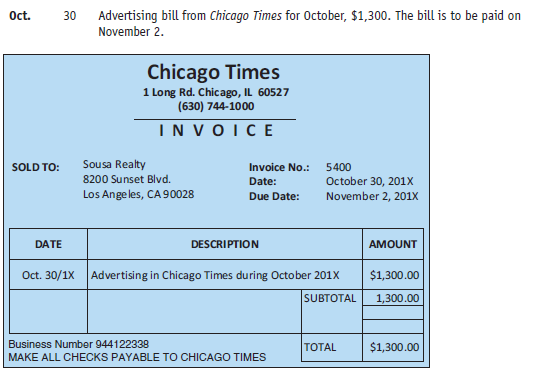

|DEPOSIT TICKETE CURRENCY 12000 00 CASH SOUSA REALTY (213)478-3584 8200 SUNSET BOULEVARD Los Angeles, CA 90028 COIN LIST CHECKS SINGLY 16-66/1220 A hold for uncollactod unds may ba placed on funds duponitad by chack or similar inetrumarts. This couti dokay your abity to withdraw such funds. The daky i any would not NCood the pariod of time pormitted by law. TOTAL FROM OTHER SIDE September 1 201X DATE ТOTAL 12,000 00 LESS CASH RECEIVED SIGN HERE IN PRESENCE OF TELLER FOR CASH RETD FROM DEP. NET DEPOSIT 12,000|00 BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 :12 20006601400038570136 2 SOUSA REALTY (213) 478-3584 0001 September 1 201X 8200 SUNSET BOULEVARD LOS ANGELES, CA 90028 BAY TO THE Murray Property Mgmt Co. $ 1,000 ORDER OF XX One Thousand and f00 DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 MEMO_Rent Sept.-Jan. 201X James Sousa 1 Salem St. INVOICE Hyundai Los Angeles, CA 90052 (213) 639-1917 INVOICE NO. 1113 North DATE: September 1/1X TERMS: Net 90 SOUSA REALTY 8200 Sunset Blvd. Los Angeles, CA 90028 To: QUANTITY DESCRIPTION UNIT PRICE AMOUNT 1 ONLY 4-Door Automatic $19,000.00 $19,000.00 SUBTOTAL 19,000.00 Make all checks payable to Hyundai North FREIGHT ТАХ TOTAL DUE $19,000.00 THANK YOU FOR YOUR BUSINESS! INVOICE Paper Company 1 Femcroft Rd. Los Angeles, CA 90052 Phone (213) 631-0288 DATE: September 4/1X NUMBER: D198795 TERMS: Cash SOLD TO: SHIPPED TO: Sousa Realty Sousa Realty 8200 Sunset Blvd. Los Angeles, CA 90028 8200 Sunset Blvd. Los Angeles, CA 90028 DATE DESCRIPTION UNIT PRICE AMOUNT Sept. 4/1X Office supplies $600.00 PAYMENT RECEVED -- CHK HO002- THANKYOU Subt otal 600.00 Total $600.00 Business Number: 115555559 PLEASE PAY THE ABOVE THANK YOU FOR YOUR BUSINESS SOUSA REALTY (213) 478-3584 0002 8200 SUNSET BOULEVARD LOS ANGELES, CA 90028 September 4 201X PAY TO THE 600 XX 100 ORDER OF Paper Company Six Hundred and o XX DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 MEMO_Office supplies James Sousa %24 INVOICE Paper Company 1 Femcroft Rd. Los Angeles, CA 90052 Phone (213) 631-0288 DATE: Sept. 5/1x NUMBER: D1988 25 TERMS: net 60 SOLD TO: SHIPPED TO: Sousa Realty 8200 Sunsef Blvd. Sousa Realty 8200 Sunsef Blvd. Los Angeles, CA 90028 Los Angeles, CA 90028 DATE DESCRIPTION UNIT PRICE AMOUNT Sept. 5/1X Office supplies $250.00 Subtotal 250.00 Total $250.00 Business Number: 115555559 PLEASE PAY THANK YOU FOR YOUR BUSINESS THE ABOVE H DEPOSIT TICKET E CURRENCY 0000 החחש CASH SOUSA REALTY (213) 478-3584 8200 SUNSET BOULEVARD Los Angeles, CA 90028 CON LIST CHECKS SINGLY 250. 11,000 00 16-66/1220 A hold for unoollocted tunds may be placed on tunds dapostad by chack or simlar nstrumots. This could dalay your abity to withdraw such funds The delay it any would not CODod he parod of time pemittad by law. TOTAL FROM OTHER SIDE September 6 201X DATE TOTAL LESS CASH RECEIVED SIGN HERE IN PRESENCE OF TELLER FOR CASH RETD FROM DEP. NET DEPOSIT 11,000 00 BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 1:1 2 200066 C1400-0385 70136 2" SOUSA REALTY COMMISSION REPORT Date September 6, 201X Name Brendan Hue Commission Date: Sales Description Sales No. Amount Sept. 6/1x Home at 66 Sullivan St. A1001 $11,000.00 Paid in full CO01 Remarks: SOUSA REALTY (213) 478-3584 0003 September 8 8200 SUNSET BOULEVARD 201X LOS ANGELES, CA 90028 PAY TO TH E Haffner Gas Co. ORDER OF $ 4500 XX Forty-Five and - DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 MEMO_Gas Bill - Sept. 6 James Sousa %24 SOUSA REALTY (213) 478-3584 0004 September 15 201X 8200 SUNSET BOULEVARD LOS ANGELES, CA 90028 PAY TO THE Rosie Petrillo 300 XX ORDER OF- XX Three Hundred and 00 DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 MEMO_Salary- Sept. 1-15 James Sousa %24 SOUSA REALTY COMMISSION REPORT Date: September 17, 201X Name: Tropic Developers Commission Date: Sa les Descripton Sales No. Amount Sept. 17/1X Lot at 8 Ridge Rd. A1002 $10,000.00 CO02 Remarks: Payment due October 8, 201X SOUSA REALTY (213) 478-3584 0005 September 20 201X 8200 SUNSET BOULEVARD LOS ANGELES, CA 90028 PAY TO THE James Sousa 4,000 XX $ ORDER OF XX Four Thousand and 00 DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 MEMO_Withdrawal James Sousa %24 H DEPOSIT TICKET E CURRENCY DOOC CASH SOUSA REALTY (213)478-3584 8200 SUNSET BOULEVARD COIN LIST CHECKS SINGLY 270 0 7,000 00 Los Angeles, CA 90028 16-66/1220 A hold for unoollocted tunds may ba placed on tunds dopiositad by chack or simlar nstrumots. This could dalay your abity to withdraw such tunds. The delay it any would not CODod he parod of time pemitiad by law. TOTAL FROM OTHER SIDE DATE September 21 201X TOTAL LESS CASH RECEIVED SIGN HERE IN PRESENCE OF TELLER FOR CASH RETD FROM DEP. NET DEPOSIT 7,000 00 BAY BANTК Box 1739 Terminal Annex Los Angeles, CA 90052 1:12 20006G CILO0-0 385 ?0136 2 SOUSA REALTY COMMISSION REPORT Date: September 21, 201X Name Suzanne Horngam Commission Date: Sales Description Sales No. Amount Sept. 21/1x Home at 666 Jersey St $7,000.00 Paid in full. A1003 Co03 Remarks: SOUSA REALTY (213) 478-3584 0006 September 22 201X 8200 SUNSET BOULEVARD LOS ANGELES, CA 90028 PAY TO THE Haffner Gas Co. $ 80 XX ORDER OF- XX Eighty and o .DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 MEMO_Gas Bill-Sept. 22 James Sousa МЕМО. %24 1 Salem St. Los Angeles, CA 90052 (213) 639-1917 INVOICE Hyundai INVOICENO. 1184 North DATE: September 24/1x TERMS: Cash To: Ship To: SOUSA REALTY 8200 Sunset Blvd. Los Angeles, CA 90028 Pickup QUANTITY DESCRIPTION UNIT PRICE AMOUNT ONLY Air conditioning repair $ 800.00 1 SUBTOTAL 800.00 Make all checks payable to Hyundai North FREIGHT PAYMENT RECEIVED - Check #0007 TAX TOTAL DUE $ 800.00 THANK YOU FOR YOUR BUSINESS! SOUSA REALTY (213) 478-3584 0007 8200 SUNSET BOULEVARD LOS ANGELES, CA 90028 September 24 201X PAY TO THE Hyundai North 80000 XX ORDER OF XX Eight Hundred and .DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 MEMO Auto Repairs – Inv. 1184 James Sousa %24 SOUSA REALTY (213) 478-3584 0008 8200 SUNSET BOULEVARD LOS ANGELES, CA 90028 September 30 201X PAY TO THE Rosie Petrillo 300 XX ORDER OF. XX Three Hundred and 00 DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 MEMO Salary - Sept. 16-30 James Sousa %24 1 Park Place Los Angeles, CA 90052 (213) 862-8061 Comcast Your Statement Раyment recelved In Account with SOUSA REALTY 8200 Sunset Blvd. Los Angeles, CA 90028 September 30, 201X Account #09444 710-190 Billing Period: September 1 to September 28 Payments/Adjustments/Deposits Details Opened account September 1, 201X. Thank you. $0.00 Monthly rental and changes to service 330.00 Amount now due Total Due $330.00 Payment due after October 10, 201X $350.10 SOUSA REALTY (213) 478-3584 0009 September 30 201X 8200 SUNSET BOULEVARD LOS ANGELES, CA 90028 PAY TO THE Comcast 330 XX. ORDER OF- XX Three Hundred Thirty and i00 DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 MEMO September Phone Bill James Sousa %24 Chicago Times 1 Long Rd., Chicago, IL 605 27 (630) 744-1000 INVOICE SOLD TO: Sou sa Realty 8200 Sunset Blvd. Invoice No.: 4879 September 30, 201X October 2, 201X Date: Los Angeles, CA 90028 Due Date: DATE DESCRIPTION AMOUNT Sept. 26/1x Advertising in Chicago Times during September 201X $900.00 SUBTOTAL 900.00 Business Number 944122338 TOTAL $900.00 MAKE ALL CHECKS PAYABLE TO CHICAGO TIMES INVOICE Paper Company DATE: Oct. 1/1X 1 Ferncroft Rd. Los Angeles, CA 90052 Phone (213) 631-0288 NUMBER: D1996035 TERMS: Net 60 SOLD TO: SHIPPED TO: Sousa Realty Sousa Realty 8200 Sunset Blvd. 8200 Sunset Blvd. Los Angeles, CA 90028 Los Angeles, CA 90028 DATE DESCRIPTION UNIT PRICE AMOUNT $850.00 Oct. 1/1x Office supplies Subtotal 850.00 Total $850.00 Business Number: 115555559 PLEASE PAY THE ABOVE THANK YOU FOR YOUR BUSINESS Ot. Paid Chicago Times advertising bill for September, $900. SOUSA REALTY (213) 478-3584 0010 8200 SUNSET BOULEVARD October 2 201X LOS ANGELES, CA 90028 XX 100 PAY TO THE Chicago Times 2$ ORDER OF, XX Nine Hundred andioo DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 James Sousa Invoice # 4879 MEMO :12 2000661:1400038570136 2°00 10 Oct. Sold a house to Helen Baker and collected a commission of $7,300. SOUSA REALTY COMMISSION REPORT Date: October 3, 201X Name: Helen Baker Commission Date: Sales Description Sales No. Amount Oct. 3/1x Home at 800 Rose Ave. $7,300.00 Paid in full. A1004 C004 Remarks: DEPOSIT TICKETE CURRENCY CASH 000000 SOUSA REALTY (213) 478-3584 8200 SUNSET BOULEVARD COIN 100000 Los Angeles, CA 90028 LIST CHECKS SINGLY 278-92 7,300 00 16-66/1220 A hold for uncollected tunds may be placed on tunds deposited by check or simlar instrumerits, This could delay your abiity to withdraw sucn tunds. The delay If any would not exceed the pertod of time pemitted by law. TOTAL FROM OTHER SIDE October 3 201X DATE TOTAL LESS CASH RECEIVED SIGN HERE IN PRESENCE OF TELLER FOR CASH RETD FROM DEP. 7,300 00 NET DEPOSIT BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 :12 200066 11:1400"0385 70136 2º Oct. 6 Paid gas bill to Haffner Gas Co., $29. SOUSA REALTY (213) 478-3584 0011 8200 SUNSET BOULEVARD October 6 201X LOS ANGELES, CA 90028 PAY TO THE Haffner Gas Co. $ 29 XX 100 ORDER OF. XX Twenty-nine and foo DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 James Sousa MEMO_Gas Bill – October 6 Collected commission from Tropic Developers for sale of building lot on September 17, $10,000. Oct. 8 |DEPOSIT TICKETE CURRENCY CASH SOUSA REALTY (213)478-3584 8200 SUNSET BOULEVARD COIN Los Angeles, CA 90028 LIST CHECKS SINGLY 228-14 10,000 00 16-66/1220 A hold for uncollected tunds may be placed on tunds deposted by check or simlar instruments. This COud delay your ability to withdraw suốn funds. The delay if any would not expeed the pertod of tme permitted by law. TOTAL FROM OTHER SIDE October 8 201X DATE TOTAL LESS CASH RECEIVED SIGN HERE IN PRESENCE OF TELLER FOR CASH RETD FROM DEP. NET DEPOSIT 10,000 00 BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 :12 200066 21:1400-038570136 2 Oct. 12 Paid $530 to Long Realtors Assoc. to send employees to realtors' workshop. SOUSA REALTY (213) 478-3584 0012 8200 SUNSET BOULEVARD October 12 201X LOS ANGELES, CA 90028 PAY TO THE Long Realtors Assoc. XX 530 100 ORDER OF. XX Five Hundred Thirty and oo DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 Workshop Registration James Sousa МЕМО, Oct. 15 Paid Rosie Petrillo, office secretary, $300. SOUSA REALTY (213) 478-3584 0013 8200 SUNSET BOULEVARD October 15 201X LOS ANGELES, CA 90028 PAY TO THE Rosie Petrillo ORDER OF. 300 XX Three Hundred and 100 DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 MEMO_Salary October 1-15 James Sousa Sold a house to Gary Schneider and earned a commission of $2,900. Commission to be received on November 10. Oct. 17 SOUSA REALTY COMMISSION REPORT Date: October 17, 201X Name: Gary Schneider Commission Sales Description Oct. 17/1x Home at RR2, Site 3 Date: Sales No. Amount A1010 $2,900.00 CO05 Remarks: Payment due November 10, 201X Oct. 18 Sold a building lot to Lombardi Builders and collected a commission of $4,500. H DEPOSIT TICKETE 0D0D0000000000 CURRENCY CASH SOUSA REALTY (213)478-3584 8200 SUNSET BOULEVARD Los Angeles, CA 90028 COIN LIST CHECKS SINGLY 269-10 4,500 00 16-66/1220 A hold for uncollected unds may be placed on tunds deposited by check or similar Instruments. This Coud delay your ability to TOTAL FROM OTHER SIDE October 18 201X DATE TOTAL withdraw such funds. The delay if any would not exceed the perod of time permitted by law. LESS CASH RECEIVED SIGN HERE IN PRESENCE OF TELLER FOR CASH RETD FROM DEP. 4,500 00 NET DEPOSIT BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 :12 200066 11:1400-038570136 2* SOUSA REALTY COMMISSION REPORT Date: October 18, 201X Lombardi Builders Name: Commission Date: Sales Description Sales No. Amount Oct. 18/1x Building lot at 5004 King St. E $4,500.00 Paid in full. A1005 C006 Remarks: Sent a check to Heritage Charities for $65 to help sponsor a local road race to aid the poor. (This amount is not to be considered an advertising expense; it is a business expense and is posted to Miscellaneous Expense.) Oct. 22 SOUSA REALTY (213) 478-3584 0014 8200 SUNSET BOULEVARD LOS ANGELES, CA 90028 October 22 201X 65 XX 100 PAY TO THE ORDER OF Heritage Charities 2$ XX Sixty-Five and 100 DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 James Sousa Aid to Poor MEMO, 1:12 200066 C1400-038 5 7-0136 2º0014 Oct. 24 Paid Hyundai North $620 for repairs to automobile due to accident. 1 Salem St. Los Angeles, CA 90052 (213) 639-1917 INVOICE Hyundai INVOICE NO. 2119 North DATE: October 24/1x TERMS: Cash To: SOUSA REALTY 8200 Sunset Blvd. Los Angeles, CA 90028 QUANTITY DESCRIPTION UNIT PRICE AMOUNT Accident Repairs $ 620.00 SUBTOTAL 620.00 Make all checks payable to Hyundai North FREIGHT PAYMENT RECEIVED - Check #0015 TAX TOTAL DUE $ 620.00 SOUSA REALTY (213) 478-3584 0015 October 24 201X 8200 SUNSET BOULEVARD LOS ANGELES, CA 90028 PAY TO THE Hvundai North $ 620 XX 100 ORDER OF. XX Six Hundred Twenty and 100 DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 Auto Repairs - Inv. 2119 James Sousa MEMO, Oct. 28 James Sousa withdrew $2,200 from the business to pay personal expenses. SOUSA REALTY (213) 478-3584 0016 8200 SUNSET BOULEVARD October 28 201X LOS ANGELES, CA 90028 PAY TO THE James Sousa $ 2,200 XX 100 ORDER OF. XX Two Thousand Two Hundred and 100 DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 James Sousa Withdrawal МЕМО Oct. 30 Paid Rosie Petrillo, office secretary, $300. SOUSA REALTY (213) 478-3584 0017 8200 SUNSET BOULEVARD October 30 201X LOS ANGELES, CA 90028 PAY TO THE Rosie Petrillo $ 100 ORDER OF. XX Three Hundred and foô DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 MEMO_Salary - October 16-31 James Sousa Oct. 30 Paid Comcast telephone bill, $480. 1 Park Place Los Angeles, CA 90052 (213) 862-8061 Comcast Your Statement In Account with SOUSA REALTY 8200 Sunset Blvd. Payment recelved Los Angeles, CA 90028 October Account #09444 710-190 30, 201X Billing Period: October 1 to October 28 Payments/Adjustments/Deposits Details Payment Received October 2. Thank you. $330.00 -$330.00 $480.00 Monthly rental and changes to service Amount now due Total Due $480.00 Payment due after November 10, 201X $519.15 SOUSA REALTY (213) 478-3584 0018 8200 SUNSET BOULEVARD LOS ANGELES, CA 90028 October 30 201X PAY TO THE Comcast $ 480 ORDER OF. XX Four Hundred Eighty and io0 DOLLARS BAY BANK Box 1739 Terminal Annex Los Angeles, CA 90052 MEMO_October Phone Bill James Sousa Advertising bill from Chicago Times for October, $1,300. The bill is to be paid on November 2. Oct. 30 Chicago Times 1 Long Rd. Chicago, IL 60527 (630) 744-1000 INVOICE SOLD TO: Sousa Realty Invoice No.: 5400 8200 Sunset Blvd. Date: October 30, 201X Los Ange les, CA 90028 Due Date: November 2, 201X DATE DESCRIPTION AMOUNT Oct. 30/1X Advertising in Chicago Times during October 201X $1,300.00 SUBTOTAL 1,300.00 Business Number 944122338 TOTAL $1,300.00 MAKE ALL CHECKS PAYABLE TO CHICAGO TIMES

> Explain how to calculate the total cost of goods manufactured.

> Using the Allowance for Doubtful Accounts method, what journal entries would be made to write off an account as well as later record the recovery of the accounts receivable?

> From the following, calculate the cost of raw materials used: Raw materials inventory, January 1 …………………………………… $ 6,700 Raw materials inventory, December 31 ……………………………….. 13,100 Purchases of raw materials ……………………………………………….. 86,000

> Classify each of the following as raw material, direct labor, or overhead: a. Finishing material for an automobile manufacturer b. Labor of a person who paints automobiles for an automobile manufacturer c. Depreciation expense of manufacturing assets d.

> Given the following, calculate net income: Dept. 1 Dept. 2 Net Sales $36,000 $43,000 Cost of Goods Sold 14,000 31,000 Operating Expenses $16,150 Income Tax Expense, 30% rate

> Calculate the assignment of fire insurance of $24,000 to each department based on square footage. Indirect Expense Basis of Assignment Bakery Grocery Fire Insurance 6,100 square feet total 1,900 square feet 4,200 square feet

> The cost of rent of $19,000 for Linville Co. is appropriated to each department based on its sales. Given the following, assign the cost of rent to each department: Rent Toys Sales Clothing Sales $19,000 $26,000 $52,000

> On April 5, Lein Co. prepared voucher no. 15 to record purchases of equipment on account for $1,900. On April 14, Lein Co. decided to pay the $1,900 in two equal installments (voucher nos. 18 and 19). Record the general journal entries.

> On April 15, Kratz Co. prepared a voucher for $800 for merchandise purchased on account from Plum Co. On April 19, Kratz Co. decided to return merchandise valued at $170 due to poor workmanship. Record the general journal entries.

> Record the following transactions into the general journal. The company uses a voucher system along with a petty cash fund. 201X Mar. 11 Voucher no. 18 was prepared to establish petty cash for $125. Voucher no. 42 was prepared to replenish the petty

> Before Adjustment Given: At year end, an inventory of Office Supplies showed $400. a. How much is the adjustment for Office Supplies? b. Complete a transaction analysis box for this adjustment. c. What will the balance of Office Supplies be on the adju

> From the following, foot and balance each account. Cash 110 M. Meade, Capital 311 9/5 4,000 800 7/25 9,000 6/9 9/9 10,000 5,000 9/3 3,000 9/7

> List the advantages of the corporate form of organization.

> Thad’s computer center’s business is picking up, so he has decided to expand his bookkeeping system to a general journal/ledger system. The balances from August have been forwarded to the ledger accounts. Assignment 1

> Who elects the board of directors?

> In stock subscriptions, why does one credit Common Stock Subscribed?

> What is the purpose of the account Organization Costs?

> Explain the account Paid-In Capital in Excess of Par Value as it relates to exchange of stock for noncash assets.

> What is meant by a “side transaction” when a new partner is admitted by an existing partner’s selling the new partner equity?

> The statement of partners’ capital is a required report. Agree or disagree? Defend your position.

> Give an example of a fractional ratio.

> Explain why salary and interest allowances are not expenses for a partnership.

> What is the function of the Purchases account?

> Mutual agency could create unlimited liability. Agree or disagree? Defend your position.

> Explain how a company could operate even when being dissolved.

> The Smith Computer Center created its chart of accounts as follows: You will use this chart of accounts to complete the Continuing Problem. The following problem continues from Chapter 1. Assignment 1. Set up T accounts in a ledger and post the ending

> What is the function of the articles of partnership?

> List five characteristics of a partnership.

> What are the four steps of the liquidation process?

> Why would a partner who is withdrawing take more or less than book equity?

> When a partner withdraws, why would a partnership revalue its assets?

> What is meant by a “bonus” when a partner is admitted?

> How is the equity of a partnership different from that of a sole proprietorship?

> What purpose could a typical invoice approval form serve?

> A loss on an exchange of plant assets occurs when the book value of the old machine is more than the trade-in allowance. True or false?

> When a plant asset is sold, a loss results if the cash received is greater than book value. Agree or disagree? Please explain.

> Which method of depreciation does not deduct residual value in its calculation?

> The following problem continues from one chapter to the next, carrying the balances of each month forward. Each chapter focuses on the learning experience of the chapter, adds information as the business grows, and shows how critical the knowledge of acc

> A betterment is a revenue expenditure. True or false? Please explain.

> What is the purpose of the Modified Accelerated Cost Recovery System?

> What are three methods of calculating depreciation? Briefly explain the key points of each.

> What is the difference between revenue and capital expenditures?

> What is the purpose of the Land Improvements account?

> List and describe three intangible assets.

> What is the relationship between a purchase requisition and a purchase order?

> What is the purpose of the Accumulated Depletion account?

> Explain how the income tax method differs from the Accounting Principles Board ruling with regard to the recording of exchanges of plant assets that result in a loss.

> What types of costs are considered “reasonable and necessary” when determining the cost of an asset?

> Which inventory method provides the most current valuation of inventory on the balance sheet? Please explain.

> During inflation, which inventory method will provide the lowest income on the income statement?

> What are the four methods of inventory valuation? Explain each.

> Must the flow of cost in inventory match the physical movement of merchandise? Please explain.

> Explain the relationship between the Merchandise Inventory account and the subsidiary inventory ledger.

> Why are there two entries required to record each sale in the perpetual inventory system?

> Why could the balance of the controlling account, Accounts Payable, equal the sum of the accounts payable subsidiary ledger during the month?

> In the perpetual system, what account is debited to record the cost of merchandise purchased?

> What are the two key accounts in the perpetual inventory system?

> Lyon Co. has used a perpetual inventory system for 6 months. The president of the company issued a memo stating that the new computer system failed to deliver acceptable standards in servicing the customers and that too many goods are out of stock. Fran,

> Why would a company use the retail method to determine the value of the ending inventory? Why would it use the gross profit method?

> When ending inventory is understated, what effect will it have on cost of goods sold and net income?

> Kevin Hoffaman works as a teller in Victory Bank. Yesterday, he looked up confidential information about promissory notes concerning several friends. Kevin told his girlfriend all about the confidential information. Do you think Kevin acted appropriately

> Explain why goods in transit (F.O.B. shipping point) to buyer and goods issued on consignment are added to inventory valuations.

> Why would a manager prefer the perpetual inventory system over the periodic system of inventory?

> What is meant by a contingent liability?

> List the four steps to arrive at proceeds in the process of discounting a note.

> What is the normal balance of each creditor in the accounts payable subsidiary ledger?

> Explain what will happen if a maker defaults on a note. (Assume that the note has not been discounted.)

> Only matured notes are listed in the Notes Receivable account. Agree or disagree? Please discuss.

> Why is a subsidiary ledger not needed for notes?

> Notes Receivable is a current liability on the balance sheet. Accept or reject. Why?

> What is the difference between finding a maturity date by (a) days or (b) months?

> Explain the parts of a promissory note.

> Spring Co. bought merchandise from All Co. with terms 2/10, n/30. Joanne Ring, the bookkeeper, forgot to pay the bill within the first 10 days. She went to Mel Ryan, the head accountant, who told her to backdate the check so that it looked like the bill

> How could Discount on Notes Payable be adjusted?

> How is the effective interest rate calculated?

> What is the normal balance of the Discount on Notes Payable account?

> F.O.B. destination means that title to the goods will switch to the buyer when goods are shipped. Do you agree or disagree? Why?

> When could interest be deducted in advance by a lender?

> List three reasons why a company may use Notes Payable instead of Accounts Payable and whether the company is the maker or payee.

> Why would a company age its Accounts Receivable?

> In which approach is the balance of the Allowance for Doubtful Accounts considered when the estimate of Bad Debts Expense is made? Please explain.

> The income statement approach used to estimate bad debts is based on Accounts Receivable on the balance sheet. Agree or disagree? Why?

> Recording Bad Debts Expense is a closing entry. True or false? Defend your position.

> Explain why the Allowance for Doubtful Accounts is a contra-asset account.

> Sean Nah, the bookkeeper for Revell Co., received a bank statement from Lone Bank. Sean noticed a $250 mistake made by the bank in the company’s favor. Sean called his supervisor, who said that as long as it benefits the company, he should not tell the b

> When an account receivable is written off, Bad Debts Expense must be debited. True or false? Please discuss.

> What is net realizable value?

> Explain the difference between F.O.B. shipping point and F.O.B. destination.

> What is the purpose of the Allowance for Doubtful Accounts?

> Pete Sazich, the accountant for Moore Company, feels that all bad debts will be eliminated if credit transactions are done by credit card. He also feels that the cost of the credit cards should be added to the price of the goods. Pete feels that in the f

> Explain the purpose of the Bad Debts Recovered account.

> What is the purpose of using a direct write-off method?

> The trial balance for Damon’s Repair Service appears in Figure 4.24. Figure 4.24: Adjustment Data to Update Trial Balance a. Insurance expired, $600. b. Repair supplies on hand, $2,400. c. Depreciation on repair equipment, $600. d. W

> Update the trial balance for Kent’s Moving Co. (Figure 4.23) for December 31, 201X. Figure 4.23: Adjustment Data to Update Trial Balance a. Insurance expired, $200. b. Moving supplies on hand, $1,100. c. Depreciation on moving truck,

> The following transactions occurred in June 201X for A. One’s Placement Agency: The chart of accounts for A. One Placement Agency is as follows: Your tasks are to do the following: a. Set up the ledger based on the chart of accounts

> On June 1, 201X, Brenda Rennicke opened Brenda’s Art Studio. The following transactions occurred in June: Your tasks are to do the following: a. Set up the ledger based on the following chart of accounts using four-column accounts. b.

> Jason Lang operates Jason’s Cleaning Service. As the bookkeeper, you have been requested to journalize the following transactions: The chart of accounts for Jason’s Cleaning Service is as follows: 201X Oct. 1 Pa

> The chart of accounts for Adler’s Delivery Service is as follows: Chart of Accounts Assets …………………………………….…..………………….………………………… Revenue Cash 111 ………………………………………………….………… Delivery Fees Earned 411 Accounts Receivable 112 …………………………………………………………… Expenses O

> From the trial balance of Girtie Lillis, Attorney-at-Law given in Figure 2.7 (40 min) on page 62, prepare (a) an income statement for the month of May, (b) a statement of owner’s equity for the month ended May 31, and (c) a balance shee

> Brett Pillows opened a consulting company, and the following transactions resulted: A. Brett invested $20,000 in the consulting agency. B. Bought office equipment on account, $8,000. C. Agency received cash for consulting work that it completed for a cl