Question: This continues our accounting for Fitness Equipment

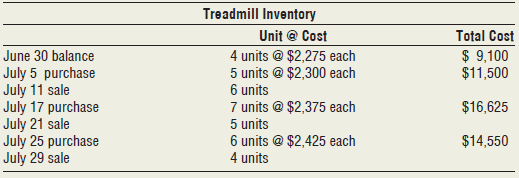

This continues our accounting for Fitness Equipment Doctor, Inc. As stated in the Continuing Problem in Chapter 4, Fitness Equipment Doctor, Inc., began selling gym equipment in June. For this problem, we focus on the purchases and sales of treadmills during the month of July, which are as follows:

Requirements

1. Assuming Fitness Equipment Doctor, Inc., uses the FIFO inventory cost-flow assumption, what is the July 31 ending treadmill inventory balance and July cost of goods sold for treadmills?

2. Assuming Fitness Equipment Doctor, Inc., uses the LIFO inventory cost-flow assumption, what is the July 31 ending treadmill inventory balance and July cost of goods sold for treadmills?

3. Assuming Fitness Equipment, Inc., uses the average cost inventory cost-flow assumption, what is the July 31 ending treadmill inventory balance and July cost of goods sold for treadmills? Round the average cost per unit to the nearest cent and all other amounts to the nearest dollar.

> The adjusted trial balance for Motion Auto, Inc., as of June 30, 2018, is presented next: Requirements 1. Prepare the multistep income statement for June for Motion Auto, Inc. 2. Calculate the gross profit percentage for June for Motion Auto, Inc. 3. W

> The following transactions for Quality Tire, Inc., occurred during November: Requirements 1. Journalize the transactions on the books of Quality Tire, Inc., assuming the “net” method is used. 2. What was Quality Tire

> The following transactions occurred between Retro Furnishings and DM Furniture Warehouse during July of the current year: Requirements 1. Journalize these transactions on the books of Retro Furnishings, assuming the “netâ€&

> New Brunswick Hardware, Inc., had sales during the month of August that totaled $13,800. Based on experience, company management expects 6 percent of the sales amount will be refunded to customers in the form of sales returns and allowances. The cost to

> This problem is the first problem in a sequence that begins an accounting cycle. The cycle is continued in Chapter 2 and completed in Chapter 3. Adam Mazella recently left his job to open his own gym equipment repair business. Adam took all of the money

> The following purchase-related transactions for Terroso, Inc., occurred during the month of April. Requirement 1. Journalize the transactions for Terroso, Inc., assuming the “net” method is used. No explanations are

> Fischer Remodeling, Inc., completed the following selected transactions and prepared these adjusting entries during August: Requirements 1. State whether each transaction would increase revenues, decrease revenues, increase expenses, decrease expenses,

> The trial balance of A-1 Web Design, Inc., at June 30, 2018, and the data needed for the month-end adjustments follow: a. Insurance coverage still remaining at June 30, $575 b. Supplies used during the month, $875 c. Depreciation for the month, $1,650

> Assume the unadjusted and adjusted trial balances for Affordable Pet Dental, Inc., at September 30, 2018, show the following data: Requirement 1. Journalize the adjusting entries that account for the differences between the two trial balances

> The September 30, 2018, adjusted trial balance of Buzzy’s, Inc., is shown next. Requirements 1. Prepare the September closing entries for Buzzy’s, Inc. 2. Calculate the ending balance in Retained Earnings. 3. Prepare

> The adjusted trial balance of Valley Realty, Inc., at December 31, 2018, follows: Requirements 1. Prepare Valley Realty’s income statement and statement of retained earnings for the year ending December 31, 2018, and year-end balance

> Warren Enterprises, Inc., completed the following selected transactions and prepared these adjusting entries during March: Requirements 1. State whether each transaction would increase revenues, decrease revenues, increase expenses, decrease expenses,

> The trial balance of Designs by Jill, Inc., at September 30, 2018, and the data needed for the month-end adjustments follow: a. Insurance coverage still remaining at September 30, $1,950 b. Supplies used during the month, $900 c. Depreciation for the m

> Assume the unadjusted and adjusted trial balances for Davis Chiropractic, Inc., at April 30, 2018, show the following data: Requirement 1. Journalize the adjusting entries that account for the differences between the two trial balances.

> Journalize the adjusting entry needed at December 31, the end of the current accounting year, for each of the following independent cases affecting Premier Powersports, Inc. No other adjusting entries have been made for the year. a. Before making the adj

> This continues the Fitness Equipment Doctor, Inc., example from the Continuing Problem in Chapter 8. Fitness Equipment Doctor, Inc., purchased some of its long-term assets during 2018 using longterm debt. The following table summarizes the nature of this

> The April 30, 2018, adjusted trial balance of The Grind Finale, Inc., is shown below. Requirements 1. Prepare the April closing entries for The Grind Finale, Inc. 2. Calculate the ending balance in Retained Earnings. 3. Prepare a post-closing trial bal

> The adjusted trial balance for Bayside Realty, Inc., at November 30, 2018, follows: Requirements 1. Prepare Bayside Realty’s income statement and statement of retained earnings for the year ended November 30, 2018, and year-end balanc

> The trial balance for Security Systems, Inc., at May 15, 2018, follows: During the remainder of May, Security Systems, Inc., completed the following transactions: Requirements 1. Journalize the transactions that occurred May 16 to May 31 on page 6 of

> Thao Le opened an accounting firm on March 1, 2018. During the month of March, the business completed the following transactions: Requirements 1. Open or set up the following T-accounts: Cash, Accounts Receivable, Supplies, Land, Furniture, Accounts Pa

> A to Z Fabrication, Inc., engaged in the following business transactions during August 2018: A to Z Fabrication, Inc., uses the following accounts: Cash, Accounts Receivable, Supplies, Building, Accounts Payable, Notes Payable, Common Stock, Dividends

> Tim Collett practices law under the business title Tim Collett, Attorney at Law, Inc. During November, his law practice engaged in the following transactions: Collett’s business uses the following accounts: Cash, Accounts Receivable,

> The accounts of Hernandez Computer Repair, Inc., and their normal balances at March 31, 2018, follow. The accounts are listed in no particular order. Requirements 1. Prepare the company’s trial balance at March 31, 2018, listing accou

> The trial balance for Safenet, Inc., at September 15, 2018, follows: During the remainder of September, Safenet, Inc., completed the following transactions: Requirements 1. Journalize the transactions that occurred September 16 to September 30 on pag

> Braeden Miller opened an accounting firm on January 1, 2018. During the month of January, the business completed the following transactions: Requirements 1. Open or set up the following T-accounts: Cash, Accounts Receivable, Supplies, Land, Furniture,

> First Choice Fabrication, Inc., engaged in the following business transactions during May 2018: First Choice Fabrication, Inc., uses the following accounts: Cash, Accounts Receivable, Supplies, Building, Accounts Payable, Notes Payable, Common Stock, D

> This problem continues our accounting for Fitness Equipment Doctor, Inc., from Chapter 7. During 2018, Fitness Equipment Doctor made the following purchases: • On March 3, Fitness Equipment Doctor, Inc., purchased equipment for $3,600 cash. The equipment

> Amanda Bradford practices law under the business title Amanda Bradford, Attorney at Law, Inc. During June, her law practice engaged in the following transactions: Bradford’s business uses the following accounts: Cash, Accounts Receiva

> The following errors occurred in the accounting records of Wilburton Electronics, Inc.: a. The company accountant recorded the receipt of cash for service revenue by debiting Cash for $1,640 instead of the correct amount of $1,460. Service Revenue was al

> The accounts of Wellington Electronics Repair, Inc., and their normal balances at October 31, 2018, follow. The accounts are listed in no particular order. Requirements 1. Prepare the company’s trial balance at October 31, 2018, listi

> The IT manager of Highland Realty, Inc., prepared the balance sheet of the company while the accountant was ill. The balance sheet contains numerous errors. In particular, the IT manager knew that the balance sheet should balance, so she plugged in the r

> Presented here are the amounts of Assets, Liabilities, Stockholders’ Equity, Revenues, and Expenses of The Fitness Guru, Inc., at August 31, 2018. The items are listed in alphabetical order. The retained earnings balance of the business

> Classic Cars, Inc., restores antique automobiles. The retained earnings balance of the corporation was $22,300 at December 31, 2017. During 2018, the corporation paid $20,000 in dividends to its stockholders. At December 31, 2018, the businessâ

> Breanna Baxter started an interior design company called Interiors on Demand, Inc., on June 1, 2018. The following amounts summarize the financial position of her business on June 14, 2018, after the first two weeks of operations: During the remainder

> Darin Oliver worked as an accountant at a local accounting firm for five years after graduating from college. He recently opened his own accounting practice, which he operates as a corporation. The name of the new entity is Oliver and Associates, Inc. Da

> The IT manager of Valley Realty, Inc., prepared the balance sheet of the company while the accountant was ill. The balance sheet contains numerous errors. In particular, the IT manager knew that the balance sheet should balance, so she plugged in the ret

> Presented here are the amounts of Assets, Liabilities, Stockholders’ Equity, Revenues, and Expenses of Extreme Sports, Inc., at October 31, 2018. The items are listed in alphabetical order. The retained earnings balance of the busines

> In this problem, we continue our accounting for Fitness Equipment Doctor, Inc. Refer to the Continuing Problem in Chapters 4 and 5. Assume that all 15 of the treadmills Fitness Equipment Doctor, Inc., sold in July were sold on account for $4,350 each. In

> Go to the Columbia Sportswear Company Annual Report located in Appendix A. Now access the 2016 Annual Report for Under Armour, Inc. For instructions on how to access the report online, see the Industry Analysis in Chapter 1. Requirements Answer these qu

> To help you understand and compare the performance of two companies in the same industry. Go to the Columbia Sportswear Company Annual Report located in Appendix A and find the Consolidated Balance Sheets on page 663. Now access the 2016 Annual Report fo

> Find the Columbia Sportswear Company Annual Report located in Appendix A and go to the Consolidated Financial Statements starting on page 663. Now go online and access the 2016 Annual Report for Under Armour, Inc. For instructions on how to access the re

> Find the Columbia Sportswear Company Annual Report located in Appendix A and go to the Notes to the Consolidated Financial Statements starting on page 668. Now access the 2016 Annual Report for Under Armour, Inc., online. (For instructions on how to acce

> Find the Columbia Sportswear Company Annual Report located in Appendix A and go to the Financial Statements starting on page 663. Now access the 2016 Annual Report for Under Armour, Inc., from the Internet. For instructions on how to access the report on

> Find the Columbia Sportswear Company Annual Report located in Appendix A and go to the section titled “Design and Evaluation of Internal Control Over Financial Reporting” in Item 9A starting on page 693. Now access the online 2016 Annual Report for Under

> Find the Columbia Sportswear Company annual report located in Appendix A, and go to the financial statements starting on page 663. Now access the 2016 annual report for Under Armour, Inc., online. For instructions on how to access the report, see the Ind

> Find the Columbia Sportswear Company Annual Report located in Appendix A, and go to the financial statements starting on page 663. Now access online the 2016 Annual Report for Under Armour, Inc.. For instructions on how to access the report online, see t

> Purpose: To help you understand and compare the performance of two companies in the same industry. Go to the Columbia Sportswear Company Annual Report located in Appendix A. Now access the 2016 Annual Report for Under Armour, Inc. For instructions on how

> Although we do not have access to the journals used by Columbia Sportswear, we can still understand various business transactions on the financial statements in Columbia Sportswear’s annual report. Refer to the Columbia Sportswear incom

> Bike World, Inc., wholesales a line of custom road bikes. Bike World’s inventory as of November 30, 2018, consisted of 22 mountain bikes costing $1,650 each. Bike World’s trial balance as of November 30 appears as foll

> To help familiarize you with the financial reporting of a real company to further your understanding of the chapter material you are learning. Each chapter will have a financial statement case that focuses on material contained in that chapter. You will

> This case focuses on the liabilities of Columbia Sportswear Company. Current liabilities are those obligations that will become due and payable within the next year or operating cycle (whichever is longer), whereas long-term liabilities are those that ar

> This case addresses the long-term assets of Columbia Sportswear. The majority of these assets consist of property and equipment and intangible assets. In the text, you learned how most longterm tangible assets used in business are capitalized and depreci

> This case addresses the accounts receivable reflected on Columbia Sportswear’s balance sheet. We once again refer to the annual report for Columbia Sportswear, located in Appendix A, in order to answer some questions related to Columbia Sportswear’s rece

> This case continues our examination of the financial statements of Columbia Sportswear. In addition to the income statement (statement of operations) and the balance sheet of Columbia Sportswear in Appendix A, you will also be investigating the notes to

> This case uses both the income statement (statement of operations) and the balance sheet of Columbia Sportswear in Appendix A at the end of the book. Requirements 1. What income statement format does Columbia Sportswear use? How can you tell? 2. Calcula

> This case will help you to better understand the effect of adjusting journal entries on financial statements. You know that adjusting journal entries are entered in the journal and then posted to the ledger accounts. We do not have access to the journals

> Bergmann’s Deli had $142,000 of total assets and $87,000 of total stockholders’ equity at December 31, 2018. At December 31, 2019, Bergmann’s Deli had assets totaling $163,000 and stockholders’ equity totaling $92,000. After analyzing the data, answer th

> The following are six transactions for Aaron’s Auto Repair, Inc., during the month of February: Requirement 1. Complete the following table. For each transaction shown above, determine the accounts affected, the type of account, wheth

> Suppose you started your own landscaping business. A customer paid you $120 in advance to mow his lawn while he was on vacation. You also performed landscaping services for a local business, but the business hasn’t paid you the $390 fee yet. In addition,

> In this problem, we continue the accounting for Fitness Equipment Doctor, Inc., from Chapter 3. On June 1, Fitness Equipment Doctor, Inc., expanded its business and began selling and installing gym equipment. The post-closing trial balance for Fitness Eq

> Elm Street Motors maintains a petty cash fund of $200. On December 31, the fund holds $12 cash, and petty cash tickets for office supplies totaling $121 and delivery expense totaling $55. Requirements 1. Make the journal entry to replenish the petty cas

> Lynn’s Music School created a $250 petty cash fund on August 1. During the month, the fund custodian authorized and signed five petty cash tickets: Requirements 1. Record the journal entry to create the petty cash fund. 2. Assuming th

> Janson Corp. maintains a petty cash fund of $225. On July 31, the fund holds $14 cash and petty cash tickets for office supplies, $172; and delivery expense, $32. Requirements 1. Make the journal entry to replenish the petty cash fund. 2. Janson Corp. d

> Lori’s Music School created a $200 petty cash fund on May 1. During the month, the fund custodian authorized and signed five petty cash tickets: Requirements 1. Record the journal entry to create the petty cash fund. 2. Assuming that

> Selected accounts of Andover Consulting, Inc., a financial services business, have the following balances at December 31, 2018, the end of its first year of operations. During the year, Lynne Andover, the only stockholder, bought $15,000 of stock in the

> The following are the balances of the assets, liabilities, and equity of Jerome’s Coffee Shop at March 31, 2018: Requirements 1. What type of business organization is Jerome’s Coffee Shop? 2. Prepare the balance shee

> Trina Lynch opened a medical practice titled Trina Lynch M.D., Inc. During July, the first month of operations, the business experienced the following events: Requirement 1. Analyze the effects of these events on the accounting equation of the medical

> The balance sheet data for Bell Computers, Inc., at August 31, 2018, and September 30, 2018, follow: Requirement 1. The following are three independent assumptions about the business during September. For each assumption, compute the amount of net inco

> Tony’s Advertising started a business in 2018 with total assets of $50,000 and total liabilities of $18,000. At the end of 2018, Tony’s Advertising’s total assets were $39,000 and total liabilities were $10,000. After analyzing the data, answer the follo

> Amicho Deli had $94,000 of total assets and $10,000 of total stockholders’ equity at July 31, 2018. At July 31, 2019, Amicho Deli had assets totaling $151,000 and stockholders’ equity totaling $112,000. After analyzing the data, answer the following ques

> Let’s look at Dick’s Sporting Goods (Dick’s) some more. Think about Dick’s. Think about accountants reporting what Dick’s has, where it got its money, and what it has been doing to create value. Is Dick’s earning net income or loss? What resources did Di

> Determine the missing amounts in the following accounting equations.

> Presented here is information for Anderson Sign, Inc., for the year ended August 31, 2018. Requirements 1. What is the beginning stockholders’ equity of Anderson Sign, Inc.? 2. What is the ending stockholders’ equity

> Selected accounts of Annis Consulting, Inc., a financial services business, have the following balances at December 31, 2018, the end of its first year of operations. During the year, Laura Annis, the only stockholder, bought $27,000 of stock in the busi

> The following are the balances of the assets, liabilities, and equity of Fitness Fanatics at March 31, 2018: Requirements 1. What type of business organization is Fitness Fanatics? 2. Prepare the balance sheet of the business at March 31, 2018. 3. What

> Shavon Loreal opened a medical practice titled Shavon Loreal M.D., Inc. During August, the first month of operations, the business experienced the following events: Requirement 1. Analyze the effects of these events on the accounting equation of the me

> The balance sheet data for Angel’s Countertops, Inc., at August 31, 2018, and September 30, 2018, follow: Requirement 1. The following are three independent assumptions about the business during September. For each assumption, comput

> Tim’s Tee Shirts started business in 2018 with total assets of $40,000 and total liabilities of $26,000. At the end of 2018, Tim’s Tee Shirts total assets were $53,000 and total liabilities were $16,000. After analyzing the data, answer the following que

> Country Supply had the following balances as of December 31, 2018: Total Current Assets............................................................................................ $ 181,000 Total Long-Term Assets.........................................

> At December 31, 2018, Salish Hardware owes $4,800 on accounts payable, plus salaries payable of $5,300 and income tax payable of $6,100. Salish Hardware also has $320,000 of notes payable that require payment of a $26,000 installment in 2019 and the rema

> Tri-County Medical Group borrowed $1,050,000 on July 1, 2018, by issuing a 5 percent long-term note payable that must be paid in three equal annual installments, plus interest, each July 1 for the next three years. Requirement 1. Insert the appropriate

> Let’s consider Dick’s Sporting Goods (Dick’s) again. Think about Dick’s. Think about accountants reporting what Dick’s has, where it got its money, and what it has been doing to create value. Is Dick’s earning net income or loss? What resources did Dick’

> Lincoln Machine Tool, Inc., issued $540,000 of 20-year, 5 percent bonds payable on January 1. Lincoln Machine Tool, Inc., pays interest each January 1 and July 1 and amortizes any discount or premium using the straight-line method. Lincoln Machine Tool c

> On January 1, Prescott Corp. issues 6 percent, 15-year bonds payable with a maturity value of $120,000. The bonds sell at 94 and pay interest on January 1 and July 1. Prescott Corp. amortizes any bond discount or premium using the straight-line method.

> On March 31, Cunnington Corporation issued 5 percent, 20-year bonds payable with a maturity value of $480,000. The bonds were issued at par and pay interest on March 31 and September 30. Requirements 1. Record the issuance of the bonds on March 31. 2. R

> Orbit Corp. issued a $410,000, 9 percent mortgage on January 1, 2018, to purchase warehouses. Requirements 1. Complete the amortization schedule for Orbit Corp., assuming payments are made semiannually. Round amounts to the nearest dollar. 2. Record th

> The accounting records of Prestige Auto Repair showed a balance of $6,700 in Estimated Warranty Payable at December 31, 2017. In the past, Prestige Auto Repair’s warranty expense has been 2 percent of sales. During 2018, Prestige Auto Repair made sales o

> Adirondack Publishing Company completed the following transactions during 2018: Requirements 1. Journalize these transactions. Explanations are not required. 2. What amounts would Adirondack Publishing Company report on the balance sheet at December 31

> Record the following note payable transactions of Cranmore Corp. in the company’s journal. Round intermediate interest calculations to the nearest cent and final amounts to the nearest dollar. Explanations are not required.

> Make journal entries to record the following transactions. Explanations are not required. November 30 Recorded cash sales of $62,000 for the month, plus sales tax of 6% collected for the state of Mississippi. Ignore cost of goods sold. December 5 Sent

> Appleway Supply had the following balances as of December 31, 2018: Total Current Assets............................................................................................. $ 122,000 Total Long-Term Assets.......................................

> At December 31, 2018, Christianson Cabinets owes $5,700 on accounts payable, plus salaries payable of $3,200 and income tax payable of $7,000. Christianson Cabinets also has $280,000 of notes payable that require payment of a $20,000 installment in 2019

> Let’s think about Dick’s Sporting Goods (Dick’s) again. Think about accountants reporting what Dick’s has, where it got its money, and what it has been doing to create value. Is Dick’s earning net income or loss? What resources did Dick’s need to operate

> Seattle Physicians Group borrowed $300,000 on July 1, 2018, by issuing a 6 percent long-term note payable that must be paid in three equal annual installments, plus interest, each July 1 for the next three years. Requirement 1. Insert the appropriate am

> Barret, Inc., issued $270,000 of 6-year, 8 percent bonds payable on January 1. Barret, Inc., pays interest each January 1 and July 1, and amortizes any discount or premium using the straight-line method. Barret, Inc., can issue its bonds payable under va

> On January 1, Dogwood Industries issues 9 percent, 10-year bonds payable with a maturity value of $130,000. The bonds sell at 96 and pay interest on January 1 and July 1. Dogwood Industries amortizes any bond discount or premium using the straight-line m

> Hart Corporation issued 4 percent, 20-year bonds payable with a maturity value of $330,000 on January 31. The bonds were issued at par and pay interest on January 31 and July 31. Requirement 1. Record (a) issuance of the bonds on January 31, (b) payment

> Solar Corp. issued a $460,000, 8 percent mortgage on January 1, 2018, to purchase warehouses. Requirements 1. Complete the amortization schedule for Solar Corp., assuming payments are made semiannually. Round amounts to the nearest dollar. 2. Record th

> The accounting records of Miller Upholstery showed a balance of $2,300 in Estimated Warranty Payable at December 31, 2017. In the past, Miller Upholstery’s warranty expense has been 2.5 percent of sales. During 2018, Miller Upholstery made sales of $312,

> Horizon Publishing Company completed the following transactions during 2018: Requirements 1. Journalize these transactions. Explanations are not required. 2. What amounts would Horizon Publishing Company report on the balance sheet at December 31, 2018