Question: This problem demonstrates the effects of

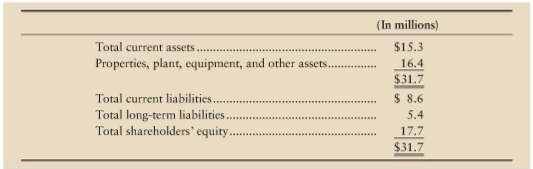

This problem demonstrates the effects of transactions on the current ratio and the debt ratio of Hillsboro Company. Hillsboros condensed and adapted balance sheet at December 31, 2009, follows.

Assume that during the first quarter of the following year 2010, Hillsboro completed the following transactions:

a. Paid half of the current liabilities.

b. Borrowed $7.0 million on long-term debt.

c. Earned revenue of $2.5 million, on account.

d. Paid selling expense of $3.0 million.

e. Accrued general expense of $0.7 million. Credit General Expense Payable, a current liability. f. Purchased equipment for $4.7 million, paying cash of $1.9 million and signing a longterm note payable for $2.8 million.

g. Recorded depreciation expense of $0.6 million.

Requirements

1. Compute Hillsboros current ratio and debt ratio at December 31, 2009. Round to two decimal places.

2. Consider each transaction separately. Compute Hillsboros current ratio and debt ratio after each transaction during 2010, that is, seven times. Round ratios to two decimal places.

3. Based on your analysis, you should be able to readily identify the effects of certain transactions on the current ratio and the debt ratio. Test your understanding by completing these statements with either increase or decrease.

a. Revenues usually the current ratio.

b. Revenues usually the debt ratio.

c. Expenses usually the current ratio. (Note: depreciation is an exception to this rule.)

d. Expenses usually the debt ratio.

e. If a company’s current ratio is greater than 1.0, as for Hillsboro, paying off a current liability will always the current ratio.

f. Borrowing money on long-term debt will always the current ratio and the debt ratio.

Transcribed Image Text:

(In millions) Total current assets $15.3 Properties, plant, equipment, and other assets. 16.4 $31.7 Total current liabilities. $ 8.6 Total long-term liabilities. Total shareholders' equity. 5.4 17.7 $31,7

> King Company failed to record depreciation of equipment. How does this omission affect Kings financial statements? a. Net income is overstated and assets are understated. b. Net income is overstated and assets are overstated. c. Net income is understat

> Boston Corporation acquired a machine for $33,000 and has recorded depreciation for two years using the straight-line method over a five-year life and $6,000 residual value. At the start of the third year of use, Boston revised the estimated useful life

> Boston Corporation acquired a machine for $33,000 and has recorded depreciation for two years using the straight-line method over a five-year life and $6,000 residual value. At the start of the third year of use, Boston revised the estimated useful life

> Which statement about depreciation is false? a. Depreciation should not be recorded in years that the market value of the asset has increased. b. Depreciation is a process of allocating the cost of an asset to expense over its useful life. c. A major o

> Suppose you buy land for $2,900,000 and spend $1,200,000 to develop the property . You then divide the land into lots as follows: How much did each hilltop lot cost you? a. $246,000 b. $175,715 c. $234,285 d. $410,000 Sale Price per Lot Catergory

> Which of the following items should be accounted for as a capital expenditure? a. The monthly rental cost of an office building b. Taxes paid in conjunction with the purchase of office equipment c. Maintenance fees paid with funds provided by the compa

> A capital expenditure a. adds to an asset. b. is expensed immediately . c. is a credit like capital (owners equity). d. records additional capital.

> The following data come from the inventory records of Draper Company: Based on these facts, the gross profit for Draper Company is a. $130,000. b. $163,000. c. $134,000. d. Some other amount. Net sales revenue... $623,000 64,000 Beginning invent

> The sum of (a) ending inventory and (b) cost of goods sold is a. beginning inventory . b. goods available. c. net purchases. d. gross profit.

> Northern Corporation, the investment banking company, often has extra cash to invest. Suppose Northern buys 800 shares of Andy, Inc., stock at $54 per share. Assume Northern expects to hold the Andy stock for one month and then sell it. The purchase occu

> The word market as used in the lower of cost or market generally means a. retail market price. b. Replacement cost. c. Retail market price. d. Liquidation price.

> The income statement for Feel Good Health Foods shows gross profit of $151,000, operating expenses of $126,000, and cost of goods sold of $215,000. What is the amount of net sales revenue? a. $277,000 b. $366,000 c. $492,000 d. $341,000

> In a period of rising prices, a. Net income under LIFO will be higher than under FIFO. b. Gross profit under FIFO will be higher than under LIFO. c. LIFO inventory will be greater than FIFO inventory . d. Cost of goods sold under LIFO will be less th

> The next two questions use the following facts. Perfect Corner Frame Shop wants to know the effect of different inventory costing methods on its financial statements. Inventory and purchases data for April follow: If Perfect Corner uses the LIFO method,

> The next two questions use the following facts. Perfect Corner Frame Shop wants to know the effect of different inventory costing methods on its financial statements. Inventory and purchases data for April follow: If Perfect Corner uses the FIFO method,

> When does the cost of inventory become an expense? a. When inventory is purchased from the supplier. b. When cash is collected from the customer. c. When payment is made to the supplier. d. When inventory is delivered to a customer.

> What is Oceanviews gross profit for January? a. Zero b. $7,400 c. $5,400 d. $2,000

> Oceanview Software began January with $3,200 of merchandise inventory . During January , Oceanview made the following entries for its inventory transactions: How much was Oceanviews inventory at the end of January? a. $5,200 b. Zero c. $4,200 d. $4,70

> Refer to Quiz questions 5-49 and 5-50. The following year, Graham Company wrote off $3,900 of old receivables as uncollectible. What is the balance in the Allowance account now?

> Refer to Question 5-47. The net receivables on the balance sheet is. From 5-47: Vincent Company uses the aging method to adjust the allowance for uncollectible accounts at the end of the period. At December 31, 2010, the balance of accounts receivable i

> Bobby Flynn served as executive director of Downtown Kalamazoo, an organization created to revitalize Kalamazoo, Michigan. Over the course of 13 years Flynn embezzled $333,000. How did Flynn do it? By depositing subscriber cash receipts in his own bank a

> Vincent Company uses the aging method to adjust the allowance for uncollectible accounts at the end of the period. At December 31, 2010, the balance of accounts receivable is $200,000 and the allowance for uncollectible accounts has a credit balance of $

> On August 1, 2010, Botores, Inc., sold equipment and accepted a six-month, 12%, $50,000 note receivable. Botores year-end is December 31. If Botores, Inc., fails to make an adjusting entry for the accrued interest, a. net income will be overstated and

> On August 1, 2010, Botores, Inc., sold equipment and accepted a six-month, 12%, $50,000 note receivable. Botores year-end is December 31. How much interest revenue should Botores accrue on December 31, 2010? a. $6,000 b. $3,000 c. $2,500 d. Some other

> The Little French Bakery is budgeting cash for 2011. The cash balance at December 31, 2010, was $6,000. The Little French Bakery budgets 2011 cash receipts at $83,000. Estimated cash payments include $36,000 for inventory , $26,000 for operating expenses

> Refer to question 5-49. The balance of Allowance for Doubtful Accounts, after adjustment, will be a. $7,900. b. $1,000. c. $5,900. d. $5,200. e. Cannot be determined from the information given.

> Graham Company uses the percent-of-sales method to estimate uncollectibles. Net credit sales for the current year amount to $130,000 and management estimates 3% will be uncollectible. Allowance for doubtful accounts prior to adjustment has a credit balan

> If a bank reconciliation included a deposit in transit of $880, the entry to record this reconciling item would include a a. credit to cash for $880. b. debit to cash for $880. c. credit to prepaid insurance for $880. d. no entry is required.

> If a bookkeeper mistakenly recorded a $35 deposit as $53, the error would be shown on the bank reconciliation as a a. $53 deduction from the book balance. b. $53 addition to the book balance. c. $18 deduction from the book balance. d. $18 addition to

> Under the allowance method for uncollectible receivables, the entry to record uncollectible-account expense has what effect on the financial statements? a. Decreases owners equity and increases liabilities b. Increases expenses and increases owners equ

> Refer to the United First Bank data in Quiz question 5-44. At December 31, United First Banks balance sheet should report: a. dividend revenue of $37,000. b. short-term investment of $700,000. c. short-term investment of $705,000. d. unrealized gain

> The following situations describe two cash payment situations and two cash receipt situations. In each pair, one set of internal controls is better than the other. Evaluate the internal controls in each situation as strong or weak, and give the reason fo

> United First Bank, the nationwide banking company, owns many types of investments. Assume that United First Bank paid $700,000 for trading securities on December 3. Two weeks later United First Bank received a $37,000 cash dividend. At December 31, these

> Aquarium Trade Mart has recently had lackluster sales. The rate of inventory turnover has dropped, and the merchandise is gathering dust. At the same time, competition has forced Aquariums suppliers to lower the prices that Aquarium will pay when it repl

> The records of Buzz Aviation include the following accounts for inventory of aviation fuel at December 31 of the current year: Requirements 1. Prepare a partial income statement through gross profit under the average, FIFO, and LIFO methods. Round ave

> SWAT Team Surplus began July with 66 tents that cost $23 each. During the month, SWAT Team Surplus made the following purchases at cost: SWAT Team Surplus sold 310 tents, and at July 31 the ending inventory consists of 55 tents. The sale price of each t

> Assume a Championship Sports outlet store began March 2010 with 46 pairs of running shoes that cost the store $39 each. The sale price of these shoes was $65. During March the store completed these inventory transactions: Requirements 1. The preceding

> Best Guy purchases inventory in crates of merchandise; each crate of inventory is a unit. The fiscal year of Best Guy ends each February 28. Assume you are dealing with a single Best Guy store in Denver, Colorado. The Denver store began 2010 with an inve

> The accounting records of R.B. Video Sales show the data on the following page (in millions). The shareholders are very happy with R.B.s steady increase in net income. Auditors discovered that the ending inventory for 2008 was understated by $3 million a

> Maroneys Convenience Stores income statement and balance sheet reported the following. The business is organized as a proprietorship, so it pays no corporate income tax. The owner is budgeting for 2010. He expects sales and cost of goods sold to increa

> ELV Trade Mart has recently had lackluster sales. The rate of inventory turnover has dropped, and the merchandise is gathering dust. At the same time, competition has forced ELVs suppliers to lower the prices that ELV will pay when it replaces its invent

> Identify the internal control weakness in the following situations. State how the person can hurt the company. a. James Mason works as a security guard at SAFETY parking in Detroit. Mason has a master key to the cash box where customers pay for parking.

> The records of Bell Aviation include the following accounts for inventory of aviation fuel at December 31 of the current year: Requirements 1. Prepare a partial income statement through gross profit under the average, FIFO, and LIFO methods. Round ave

> Fatigues Surplus began October with 72 tents that cost $17 each. During the month, Fatigues Surplus made the following purchases at cost: Fatigues Surplus sold 324 tents and at October 31 the ending inventory consists of 52 tents. The sale price of eac

> Assume a Tiger Sports outlet store began October 2010 with 48 pairs of running shoes that cost the store $34 each. The sale price of these shoes was $69. During October, the store completed these inventory transactions: Requirements 1. The preceding d

> Nice Buy purchases inventory in crates of merchandise; each crate of inventory is a unit. The fiscal year of Nice Buy ends each February 28. Assume you are dealing with a single Nice Buy store in Dallas, Texas. The Dallas store began 2010 with an invento

> Quick Meals completed the following selected transactions: Requirements 1. Record the transactions in Quick Meals journal. Round all amounts to the nearest dollar. Explanations are not required. 2. Show what Quick Meals will report on its comparative

> Assume Smith & Jones, the accounting firm, advises Catch of the Day Seafood that its financial statement must be changed to conform to GAAP. At December 31, 2010, Catch of the Days accounts include the following: The accounting firm advised Catch of

> The September 30, 2011, records of Image Communications include these accounts: During the year, Image Communications estimates doubtful-account expense at 1% of credit sales. At year-end, the company ages its receivables and adjusts the balance in Allo

> Refer back to Problem 3-84B. From problem 84: The accounts of Sunny Stream Service, Inc., at March 31, 2010, are listed in alphabetical order. Requirements 1. Prepare the company’s classified balance sheet in report form at March 31,

> The accounts of Sunny Stream Service, Inc., at March 31, 2010, are listed in alphabetical order. Requirements 1. All adjustments have been journalized and posted, but the closing entries have not yet been made. Journalize Sunny Streams closing entries

> Accounting records for Richmond Corporation yield the following data for the year ended December 31, 2010: Requirements 1. Journalize Richmonds inventory transactions for the year under the perpetual system. 2. Report ending inventory, sales, cost of

> This problem takes you through the accounting for sales, receivables, and uncollectibles for Dependable Delivery Corp, the overnight shipper. By selling on credit, the company cannot expect to collect 100% of its accounts receivable. At May 31, 2010, and

> Fairview Apartments, Inc.s unadjusted and adjusted trial balances at April 30, 2010, follow: Requirements 1. Make the adjusting entries that account for the differences between the two trial balances. 2. Compute Fairviews total assets, total liabiliti

> Consider the unadjusted trial balance of Kings, Inc., at August 31, 2010, and the related month-end adjustment data. Adjustment data at August 31, 2010 include the following: a. Accrued advertising revenue at August 31, $2,000 b. Prepaid rent expired

> Journalize the adjusting entry needed on December 31, the end of the current accounting period, for each of the following independent cases affecting Irons Corp. Include an explanation for each entry. a. Details of Prepaid Insurance are shown in the acc

> Kings Consulting had the following selected transactions in May: Requirements 1. Show how each transaction would be handled using the cash basis and the accrual basis. 2. Compute May income (loss) before tax under each accounting method. 3. Indicate

> Gauge Corporation earned revenues of $33 million during 2010 and ended the year with net income of $6 million. During 2010 Gauge collected cash of $24 million from customers and paid cash for all of its expenses plus an additional $1 million on account f

> This problem demonstrates the effects of transactions on the current ratio and the debt ratio of Hartford Company. Hartfords condensed and adapted balance sheet at December 31, 2010, follows. Assume that during the first quarter of the following year, 2

> Refer back to Problem 3-75A. From problem 75: The accounts of Spa View Service, Inc., at March 31, 2010, are listed in alphabetical order. Requirements 1. Use the Spa View data in Problem 3-75A to prepare the companys classified balance sheet at March

> The accounts of Spa View Service, Inc., at March 31, 2010, are listed in alphabetical order. Requirements 1. All adjustments have been journalized and posted, but the closing entries have not yet been made. Journalize Spa Views closing entries at March

> The September 30, 2011, records of Perfecto Communications include these accounts: During the year, Perfecto Communications estimates doubtful-account expense at 1% of credit sales. At year-end (December 31), the company ages its receivables and adjusts

> This case is based on the Foot Locker, Inc. s consolidated balance sheets, consolidated statements of cash flows, and Footnote 6 of its financial statements in Appendix B at the end of this book. 1. What securities are included in Foot Lockers Short-ter

> Peachtree Apartments, Inc.s unadjusted and adjusted trial balances at April 30, 2010, follow. Requirements 1. Make the adjusting entries that account for the differences between the two trial balances. 2. Compute Peachtrees total assets, total liabili

> Consider the unadjusted trial balance of London, Inc., at December 31, 2010, and the related month-end adjustment data. Adjustment data December 31, 2010: a. Accrued service revenue at December 31, $2,100. b. Prepaid rent expired during the month. The

> Journalize the adjusting entry needed on December 31, end of the current accounting period, for each of the following independent cases affecting Rowling Corp. Include an explanation for each entry a. Details of Prepaid Insurance are shown in the account

> Elders Consulting had the following selected transactions in August: Requirements 1. Show how each transaction would be handled using the cash basis and the accrual basis. 2. Compute August income (loss) before tax under each accounting method. 3. In

> Labear Corporation earned revenues of $41 million during 2011 and ended the year with net income of $5 million. During 2011, Labear collected $23 million from customers and paid cash for all of its expenses plus an additional $5 million for amounts payab

> Lakeview Software Solutions makes all sales on account, so virtually all cash receipts arrive in the mail. Larry Higgins, the company president, has just returned from a trade association meeting with new ideas for the business. Among other things, Higgi

> During the fourth quarter of 2010, Main St., Inc., generated excess cash, which the company invested in trading securities, as follows: Requirements 1. Open T-accounts for Cash (including its beginning balance of $22,000), Short-Term Investment, Divide

> This problem takes you through the accounting for sales, receivables, and uncollectibles for Mail Time Corp., the overnight shipper. By selling on credit, the company cannot expect to collect 100% of its accounts receivable. At May 31, 2010, and 2011, re

> Healthy Meal completed the following selected transactions. Requirements 1. Record the transactions in Healthy Meals journal. Round interest amounts to the nearest dollar. Explanations are not required. 2. Show what Healthy Meal will report on its com

> Assume Smith & Jones, the accounting firm, advises Ocean Mist Seafood that its financial statements must be changed to conform to GAAP. At December 31, 2010, Ocean Mists accounts include the following: The accounting firm advised Ocean Mist that Ca

> Refer to the Foot Locker, Inc., Consolidated Financial Statements in Appendix B at the end of this book. 1. Focus on cash and cash equivalents. Why did cash change during 2007? The statement of cash flows holds the answer to this question. Analyze the s

> Don Beecher, chief financial officer of Carvel Wireless, is responsible for the companys budgeting process. Beechers staff is preparing the Carvel cash budget for 2011. A key input to the budgeting process is last year’s statement of ca

> Flawless Skin Care makes all sales on credit. Cash receipts arrive by mail, usually within 30 days of the sale. Elizabeth Nelson opens envelopes and separates the checks from the accompanying remittance advices. Nelson forwards the checks to another empl

> Laptop Delivery, Inc., makes all sales on account. Sarah Carter, accountant for the company, receives and opens incoming mail. Company procedure requires Carter to separate customer checks from the remittance slips, which list the amounts that Carter pos

> During the fourth quarter of 2010, Cable, Inc., generated excess cash, which the company invested in trading securities as follows: Requirements 1. Open T-accounts for Cash (including its beginning balance of $15,000), Short-Term Investments, Dividend

> Each of the following situations reveals an internal control weakness: Situation a. In evaluating the internal control over cash payments of York Manufacturing, an auditor learns that the purchasing agent is responsible for purchasing diamonds for use i

> International Imports is an importer of silver, brass, and furniture items from France. Elaine Spencer is the general manager of International Imports. Spencer employs two other people in the business. Marie Walsh serves as the buyer for International Im

> John Watson, chief financial officer of Jasper Wireless, is responsible for the companys budgeting process. Watsons staff is preparing the Jasper cash budget for 2011. A key input to the budgeting process is last year’s statement of cas

> Fresh Skin Care makes all sales on credit. Cash receipts arrive by mail, usually within 30 days of the sale. Kate Martin opens envelopes and separates the checks from the accompanying remittance advices. Martin forwards the checks to another employee, wh

> Each of the following situations reveals an internal control weakness: a. In evaluating the internal control over cash payments of Framingham Manufacturing, an auditor learns that the purchasing agent is responsible for purchasing diamonds for use in the

> Celtic Imports is an importer of silver, brass, and furniture items from Ireland. Eileen Sullivan is the general manager of Celtic Imports. Sullivan employs two other people in the business. Mary McNicholas serves as the buyer for Celtic Imports. In her

> During 2007, Foot Locker, Inc., had numerous accruals and deferrals. As a new member of Foot Locker, Inc.s accounting staff, it is your job to explain the effects of accruals and deferrals on net income for 2007. The accrual and deferral data follow, alo

> At the end of 2009, Great Financial Associates (GFA) had total assets of $17.4 billion and total liabilities of $9.9 billion. Included among the assets were property, plant, and equipment with a cost of $4.5 billion and accumulated depreciation of $3.3 b

> South Pacific Energy Companys balance sheet includes the asset Iron Ore. South Pacific Energy paid $2.2 million cash for a lease giving the firm the right to work a mine that contained an estimated 190,000 tons of ore. The company paid $61,000 to remove

> Parem, Inc., sells electronics and appliances. The excerpts that follow are adapted from Parems financial statements for 2010 and 2009. Requirements 1. How much was Parems cost of plant assets at February 28, 2010? How much was the book value of plant

> The board of directors of Cooper Structures, Inc., is reviewing the 2010 annual report. A new board member a wealthy woman with little business experience questions the company accountant about the depreciation amounts. The new board member wonders why d

> Tarrier, Inc., has the following plant asset accounts: Land, Buildings, and Equipment, with a separate accumulated depreciation account for each of these except land. Tarrier completed the following transactions: Requirement 1. Record the transactions

> Rossi Lakes Resort reported the following on its balance sheet at December 31, 2010: In early July 2011, the resort expanded operations and purchased additional equipment at a cost of $105,000. The company depreciates buildings by the straight-line meth

> Assume Lance Pharmacy, Inc., opened an office in Vero Beach, Florida. Further assume that Lance Pharmacy incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales building: Assume Lance Pharm

> At the end of 2009, Solving Engineering Associates (SEA) had total assets of $17.1 billion and total liabilities of $9.7 billion. Included among the assets were property, plant, and equipment with a cost of $4.4 billion and accumulated depreciation of $3

> Northeastern Energy Company’s balance sheet includes the asset Iron Ore. Northeastern Energy paid $2.5 million cash for a lease giving the firm the right to work a mine that contained an estimated 197,000 tons of ore. The company paid $65,000 to remove u

> Floral, Inc., sells electronics and appliances. The excerpts that follow are adapted from Florals financial statements for 2010 and 2009. Requirements 1. How much was Florals cost of plant assets at February 28, 2010? How much was the book value of pla

> For each of the following situations, answer the following questions: 1. What is the ethical issue in this situation? 2. What are the alternatives? 3. Who are the stakeholders? What are the possible consequences to each? Analyze from the following sta

> The board of directors of Gold Structures, Inc., is reviewing the 2010 annual report. A new board member a wealthy woman with little business experience questions the company accountant about the depreciation amounts. The new board member wonders why dep

> Carr, Inc., has the following plant asset accounts: Land, Buildings, and Equipment, with a separate accumulated depreciation account for each of these except land. Carr completed the following transactions: Requirement 1. Record the transactions in Car

> Romano Lakes Resort reported the following on its balance sheet at December 31, 2010: In early July 2011, the resort expanded operations and purchased additional equipment at a cost of $102,000. The company depreciates buildings by the straight-line met

> Assume Online, Inc., opened an office in Clearwater, Florida. Further assume that Online incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales building: Assume Online depreciates building