Question: Transactions follow for Emily Cain, D.D.

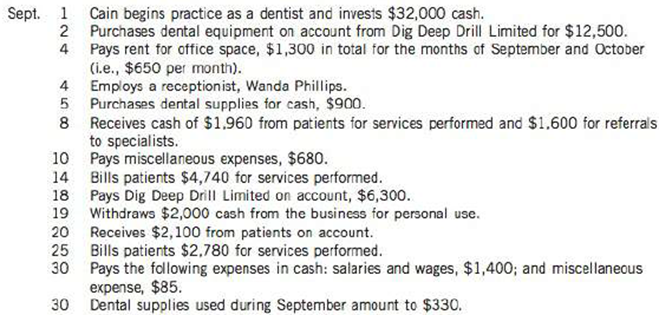

Transactions follow for Emily Cain, D.D.S., for the month of September:

Instructions

(a) Enter the transactions in appropriate ledger accounts, using the following account titles: Cash; Accounts Receivable; Prepaid Rent; Supplies; Equipment; Accumulated Depreciation-Equipment; Accounts Payable; Emily Cain's Owner's Drawings; Service Revenue; Rent Expense; Miscellaneous Expense; Salaries and Wages Expense; Supplies Expense; Depreciation Expense; Income Summary; and Emily Cain's Owner's Capital. Allow 10 lines for the Cash and Income Summary accounts, and five lines for each of the other accounts that are needed. Record depreciation on the equipment using the straightline method, five-year useful life, and no residual value.

(b) Prepare an adjusted trial balance.

(c) Prepare an income statement, balance sheet, and statement of owners' equity.

(d) Prepare a post-closing trial balance at September 30.

Transcribed Image Text:

Sept. 1 Cain begins practice as a dentist and invests $32,000 cash. 2 Purchases dental equipment on account from Dig Deep Drill Limited for $12,500. 4 Pays rent for office space, $1,300 in total for the months of September and October (i.e., $650 per month). 4 Employs a receptionist, Wanda Phillips. 5 Purchases dental supplies for cash, $900. 8 Receives cash of $1.960 from patients for services performed and $1.600 for referrals to specialists. 10 Pays miscellaneous expenses, $680. 14 Bills patients $4,740 for services performed. 18 Pays Dig Deep Drill Limited on account, $6,300. 19 Withdraws $2,000 cash from the business for personal use. 20 Receives $2,100 from patients on account. 25 Bills patients $2,780 for services performed. 30 Pays the following expenses in cash: salaries and wages, $1,400; and miscellaneous expense, $85. 30 Dental supplies used during September amount to $330.

> During 2014, Antoinette started a construction job with a contract price of $2.5 million. The job was completed in 2016 and information for the three years of construction is as follows: Instructions Under the earning approach: (a) Calculate the amount

> In 2014, Ronalda Construction Inc. agreed to construct an apartment building at a price of $10 million. Information on the costs and billings for the first two years of this contract is as follows: Instructions Assun1e the earnings approach is used. Rou

> On April 1, 2014, Lisboa Limited entered into a cost-plus-fixed fee contract to manufacture an electric generator for Martinez Corporation. At the contract date, Lisboa estimated that it would take two years to complete the project at a cost of $6.5 mill

> In 2014, Aldcorn Construction Corp. began construction work on a three-year, $ 10-million contract. Aldcorn uses the percentage-of-completion method for financial accounting purposes. The income to be recognized each year is based on the proportion of co

> Explain the rights and obligations created in the following transactions. (a) A manufacturer sells goods with terms FOB shipping point. (b) A manufacturer sells goods with terms FOB destination point. (c) A manufacturer sells goods with terms FOB shippin

> Chang Industries ships merchandise costing $120,000 on consignment to XYZ Inc. Chang pays the freight of $5,000. XYZ Inc. is to receive a 15% commission upon sale and a 5% allowance to offset its advertising expenses. At the end of the period, XYZ notifi

> Genesis Corporation is an equipment manufacturing company. Instructions (a) How should revenue be recorded under the earnings and contract-based approaches if Genesis has a normal business practice of offering customers a one-year payment term? (b) How

> Discuss how the contract-based approach to revenue recognition is consistent with the definition of revenues in the conceptual framework. Explain the main concepts of the earnings approach and the contract-based approach. What are the conceptual differen

> Rancourt Corp. is a real estate company. Approximately 50% of sales are properties that Rancourt owns. In the remaining 50%, Rancourt brokers the transactions by finding buyers for property owned by other companies. Explain how Rancourt should present th

> Compare the accounting for long-term contracts under ASPE and under IFRS.

> Lombardo Construction Corp. began work on a $100-million construction contract in 2014 to build a luxury hotel to be completed in 2016. During 2014, Lombardo incurred costs of $42 million, billed its customer for $38 million, and collected $35 million. I

> Louis Manufacturing Inc. (LMI) purchased some telecommunications equipment in January of the current year. The equipment normally sells for $2,300. In order to entice LMI to close the deal, the salesperson offered LMI related services that normally sell

> Inexperienced construction company ABC Corp. signed a risky contract to build a research facility at a fixed contract amount of $2 million. The work began in early 2014 and ABC incurred costs of $900,000. At December 31, 2014, the estimated future costs

> Tampa Inc. began work on an $11.5-million contract in 2014 to construct an office building. During 2014, Tampa Inc. incurred costs of $3.3 million, billed its customers for $5.1 million, and collected $2.9 million. At December 31, 2014, the estimated fut

> Seaport Marina has 500 slips (boat docks) that rent for $1,000 per season. Payments must be made in full at the start of the boating season, April 1. Slips may be reserved for the next season if they are paid for by December 31. Under a new policy, if pa

> Explain the basic economics of what is being received and what is being given up in each of the following business transactions. (a) A company sells packaging material to another company. The terms of sale require full payment upon delivery. (b) A compan

> Pennfield Construction Corp. began work on a $5,020,000 construction contract in 2014. During 2014, the company incurred costs of $1,600,000, billed its customer for $ 1,750,000, and collected $1,500,000. At December 31, 2014, the estimated future costs

> On August 15, 2014, Japan Ideas consigned 500 electronic play systems, costing $100 each, to YoYo Toys Company. The cost of shipping the play systems amounted to $1,250 and was paid by Japan Ideas. On December 31, 2014, an account sales sun1mary was rece

> Finch Industries shipped $550,000 of merchandise on consignment to Royal Crown Company. Finch paid freight costs of $5,000. Royal Crown Company paid $1,500 for local advertising, which is reimbursable from Finch. By year end, 75% of the merchandise had b

> Builder Corp. is constructing a warehouse that is expected to take two years to complete. Builder prepares financial statements in accordance with IFRS. Explain how Builder should recognize revenue under the earnings approach, in each of the following sc

> Eastern Chemicals Corp. produces a chemical compound at its plant in Halifax, Nova Scoria, and Western Polymers Inc. produces the same chemical compound at its plant in Kelowna, British Columbia. Both companies have manufacturing facilities across Canada

> Storage Services Corporation recognizes revenue under the earnings approach. Explain how uncertainty about collectability would affect revenue recognition if Storage prepares financial statements in accordance with (a) ASPE or (b) IFRS.

> Massey Ltd., an equipment manufacturer, sold and delivered a piece of equipment to a buyer for $100,000, with 50% payable in one year and the remaining 50% payable in two years from the date of sale. Massey estimates that the interest rate for a similar

> Gardi Inc. sold a unit of inventory to a buyer for $1,000 payable in one year. Gardi estimates that the interest rate for a similar financing arrangement would be 8%. The unit of inventory normally sells for $900. Calculate the discount rate to be applie

> Alpha Corp. is a major supplier to Beta Corp. To encourage Beta to buy more, Alpha offers Beta an annual volume rebate of 1% of total invoiced purchases exceeding $100,000. Beta's invoiced purchases in 2014 totaled $110,000. Prepare the journal entry to

> Adventurers Inc. sold a mountain bike to a customer for $1,000 including a two-year annual maintenance package. The fair value of the mountain bike is $1,100 and the fair value of the maintenance package is $100. Calculate the allocation of revenue for e

> Access the financial statements for EADS N .V. for its year ended December 31, 2011, from the company's website (www.eads.com). Instructions Answer the following questions with respect to EADS N.V. (a) What business is EADS in? (b) Explain how the reven

> The adjusted trial balance of West Kayne Consulting is provided in the following worksheet for the month ended Apri130, 2014. Instructions (a) Complete the work sheet and prepare a balance sheet as illustrated in this chapter. (b) How would the balance

> The trial balance of Airbourne Travel Inc. on March 31, 2014, is as follows: Additional information: 1. A physical count reveals only S520 of supplies on hand. 2. Equipment is depreciated at a rate of $ !00 per month. 3. Unearned ticket revenue amounted

> Selected accounts follow for Kings Inc., as reported in the work sheet at the end of May 2014: Instructions Extend the amounts reported in the adjusted trial balance to the appropriate columns in the work sheet. Do not total individual columns. Adju

> At the end of Rafael Limited's first year of operations, its trial balance shows Equipment $20,000; Accumulated Depreciation- Equipment $0; and Depreciation Expense $0. Depreciation for the year is estimated to be $4,000. Prepare the adjusting entry for

> Prepare the following adjusting entries at December 31 for Karpai Ltd: 1. Interest on notes receivable of $600 is accrued. 2. Fees earned but unbilled total $1,800. 3. Salaries earned of $ 1,200 have not been recorded. 4. Bad debt expense for the year is

> Included in Carville Corp.'s December 31, 2014 trial balance is a note payable of $20,000. The note is an eight-month, 12% note dated October I, 2014. Prepare Carville's December 31, 2014 adjusting entry to record the accrued interest, and June I, 2015 j

> The following transactions for Juan More Taco Inc. (JMT) occurred in the month of May. Prepare journal entries for each transaction. May 1 Owners invest $12,000 cash in exchange for common shares of JMT Inc., a small chain of fast food outlets. 3 Buy

> The trial balance of Jangles Corporation at the end of its fiscal year, August 31, 2014, includes the following accounts: Purchases $ 151,600; Sales Revenue $250,000; Freight in $4,000; Sales Returns and Allowances $4,000; Freight-out $1,000; and Purchas

> Kothari Ltd. made the following transactions: 1. Payment of a S200 invoice on account 2. Increase in the fair value of a Fair Value-Net Income Investment by S250 3. Sale on account for $100 4. Purchase of equipment paid for with $500 cash and a $ 1,000 n

> Moosa Corp. has the following accounts: 1. Accounts Receivable 2. Income Tax Expense 3. Rent Revenue 4. Retained Earnings 5. Bank Loans 6. Unrealized Gain or Loss-OCI 7. Accumulated Other Comprehensive Income For each account, indicate (a) whether a $100

> Plant Inc. uses the following accounts in its trial balance: 1. Sales 2. Investment Loss 3. Dividends 4. Salaries and Wages Payable 5. Fair Value-OCI Investment 6. Cost of Goods Sold 7. Accumulated Other Comprehensive Income 8. Allowance for Doubtful Acc

> Extensible business reporting language (XBRL) is a financial reporting system that allows a company to "tag" each piece of financial information as it is input into the company's books of account. Information is tagged in the database according to a stan

> ABC Commerce Corp.'s weekly payroll totals $20,000 and is paid every two weeks. The final payroll for the year was for the week ended December 24. ABC pays full payroll during the holiday season. The next payroll was paid on January 7. To prepare for yea

> ERP software systems include bookkeeping systems as well as systems to monitor and manage human resource functions, quality control functions, and many other aspects of business. The software runs off a centralized database that services all company depa

> The following accounts appeared in the December 31 trial balance of the Majestic Theatre: Instructions (a) From the account balances above and the information that follows, prepare the annual adjusting entries necessary on December 31: 1. The equipment h

> Second-Hand Almost New Department Store Inc. is located near the shopping mall. At the end of the company's fiscal year on December 31, 2014, the following accounts appeared in two of its trial balances: Analysis reveals the following additional informa

> The trial balance of Slum Dog Fashion Centre Inc. contained the following accounts at November 30, the company's fiscal year end: Adjustment data: 1. Store supplies on hand totalled $3,100. 2. Depreciation is $40,000 on the store equipment and $30,000 on

> Noah's Foods has a fiscal year ending on September 30. Selected data from the September 30 work sheet follow: Instructions (a) Prepare a complete work sheet. (b) Prepare a statement of financial position. (In the next fiscal year, $ 10,000 of the mortgag

> Tiger Inc. has the following year-end account balances: Sales Revenue $928,900; Interest Income $17,500; Cost of Goods Sold $406,200; Operating Expenses $ 12 9,000; Income Tax Expense $55, I 00; and Dividends $15,900. Prepare the year-end closing entri

> Below are the completed financial statement columns of the work sheet for Canned Heat Limited: Instructions (a) Prepare a statement of comprehensive income, statement of changes in shareholders' equity, and statement of financial position. Canned Heat's

> A review of the ledger of Rolling Resort Inc. at December 31 produces the following data for the preparation of annual adjusting entries: 1. Salaries and Wages Payable, $0. There are eight salaried employees. Five employees receive a salary of $1,200 eac

> Yancy Advertising Agency Limited was founded by Tang Mia in January 2010. Presented below are both the adjusted and unadjusted trial balances as at December 31, 2014: Instructions (a) Joumalize the annual adjusting entries that were made. (b) Prepare a

> Samuels Corp. began operations on January 1, 2014. Its fiscal year end is December 31. Samuels has decided that prepaid costs are debited to an asset account when paid, and all revenues are credited to revenue when the cash is received. During 2014, the

> On September I, it rented storage space to a lessee (tenant) for six months for a total cash payment of $ 12,000 received in advance. Prepare two sets of journal entries for Store-it Here, with each set of journal entries recording the September 1 journa

> To prepare financial statements for the month of March 2014. Mona accumulated all the ledger balances from the business records and found the following: Mona reviewed the records and found the following errors: 1. Cash received from a customer on account

> The unadjusted trial balance of Imagine Ltd. at December 31,2014, is as follows: Additional information: 1. On November 1, 2014, Imagine received $10,200 rent from its lessee for a 12-month lease beginning on that date. This was credited to Rent Revenue.

> The unadjusted trial balance of Clancy Inc. at December 31, 2014, is as follows: Additional information: 1. Actual advertising costs amounted to$1,500 per month. The company has already paid for advertisements in Montezuma Magazine for the first quarter

> The December 31 trial balance of Red Roses Boutique Inc. follows: Instructions (a) Create T accounts and enter the balances shown. (b) Prepare adjusting entries for the following and post to the T accounts. Open additional T accounts as necessary. (The b

> Willis Corporation has Beginning Inventory $76,000; Purchases $486,000; Freight-in $16,200; Purchase Returns 55,800; Purchase Discounts $5,000; and Ending Inventory $69,500. Calculate Willis's cost of goods sold.

> The trial balance follows of the Masters Golf Club, Inc. as at December 31. The books are closed annually on December 31. Instructions (a) Enter the balances in ledger accounts. Allow five lines for each account. (b) From the trial balance and the inform

> The following information relates to Joachim Anderson, Realtor, at the close of the fiscal year ending December 31: 1. Joachim paid the local newspaper S335 for an advertisement to be run in January of the next year, and charged it to Advertising Expense

> Brook Corporation was founded by Ronnie Brook in January 2003. The adjusted and unadjusted trial balances as at December 31, 2014, follow: Instructions (a) Journalize the annual adjusting entries that were made. (b) Prepare an income statement and state

> The trial balance and the other information for consulting engineers Mustang Rovers Consulting Limited follow: Additional information: 1. Fees received in advance from clients were $6,900. 2. Services performed for clients that were not recorded by Decem

> LD Driving Range Inc. was opened on March 1 by Phil Woods. The following selected events and transactions occurred during March: Woods uses the following accounts for his company: Cash; Prepaid Insurance; Prepaid Rent; Land; Buildings; Equipment; Accoun

> The trial balance of Mis-Match Inc. on June 30, 2014, is as follows: The following transactions took place in July 2014: 1. Payments received from customers on account amounted to $ 1,320. 2. A computer printer was purchased on account for $500. 3. Ser

> On August I, Secret Sauce Technologies Inc. paid $ 12,600 in advance for two years' membership in a global technology association. Prepare two sets of journal entries for Secret Sauce, with each set of journal entries recording the August I journal entry

> Below is the April 30 trial balance of Blues Around the Corner Corporation: An examination of the ledger shows these errors: 1. Salaries and Wages Payable include $300 of salaries and wages accrued in April, which are related to employee services provid

> The April 30, 2014 trial balance below of Many Happy Returns Company, a sole proprietorship, does not balance. Your review of the ledger reveals the following: 1. Each account has a normal balance. 2. The debit footings (totals) in Prepaid Insurance, Acc

> Bill Rosenberg recently opened his legal practice. During the first month of operations of his business (a sole proprietorship), the following events and transactions occurred: Instructions Prepare a correct trial balance. April 2 Invested $15,000 c

> Jerry Holiday is the maintenance supervisor for Ray's Insurance Co. and has recently purchased a riding lawn mower and accessories that will be used in caring for the grounds around corporate headquarters. He sent the following information to the account

> Financial information follows for four different companies: Instructions Determine the missing amounts for (a) to (i). Show all calculations. Pamela's Scheibli Berthault Kaiserman Cosmetics Inc. $98,000 Grocery Inc. Supply Ltd. $120,000 9,000 Wholesa

> Financial information follows for two different companies: Instructions Calculate the missing amounts. Bessembinder Ltd. Doberman Inc. $192,000 (a) 162,000 55,500 (b) 35,000 (c) Sales Revenue (d) $16,000 65,000 (e) 37,000 23,000 14,000 Sales Returns

> Selected accounts for Winslow Inc. as at December 31, 2014, are as follows: Instructions Prepare closing entries for Winslow Inc. on December 31, 2014. Inventory FV-NI Investments FV-OCI Investments Retained Earnings Dividends Accumulated Other Comp

> Information follows for Shakira Corporation for the month of January: Instructions Prepare the necessary closing entries. $228,000 62,000 3,200 33,000 9,000 12,000 20,000 $ 61,000 16,000 1,200 7,000 1,000 364,000 14,000 Cost of Goods Sold Salary and

> The adjusted trial balance of Serious Limited shows the following sales data at the end of its fiscal year on October 31, 2014: Sales $1,250,000; Freight-out $18,000; Sales Returns and Allowances $4,000; and Sales Discounts $15,000. Instructions (a) Pr

> The trial balance for Hanna Resort Limited on August 31 is as follows: Additional information: 1. The balance in Prepaid Rent includes payment of the final month's rent and rent for August 2014. 2. An inventory count on August 31 shows $650 of supplies

> Selected accounts of Bang Bang Boom Fireworks Limited follow: Inst ructions From an analysis of the T accounts, reconstruct (a) the August transaction entries, and (b) the adjusting entries that were recorded on August 3 I. Supplies Accounts Receiva

> Using the data in BE3-6, prepare two sets of journal entries for No Claims Insurance, with each set of journal entries recording the July I, 2014 entry and the December 31, 2014 adjusting entry. No Claims uses an Unearned Revenue account and an Insurance

> Alberto Rock is the new owner of Summer Computer Services Inc. At the end of August 2014, his first month of ownership, Alberto is trying to prepare monthly financial statements. Information follows for transactions that occurred in August: 1. At August

> A partial adjusted trial balance of Joy Limited at January 31, 2014, shows the following: Instructions Answer the following questions, assuming the company's fiscal year begins January 1: (a) If the amount in Supplies Expense is the January 31 adjusting

> On May I, Bashir and Hendricks (B&H), Accountants, pays $1,200 to a landlord for one month's rent in advance for the month of May. (a) Assuming that B&H records all prepayments in (permanent) balance sheet accounts: 1. Prepare the journal entry B&H shoul

> Suli Mani opened a legal practice on January 1, 2014. During the first month of operations, the following transactions occurred. 1. Performed services for clients represented by insurance companies. At January 31, $6,000 of such services was earned but n

> The ledger of Rainy Day Umbrella Ltd. on March 31 of the current year includes the following selected accounts before adjusting entries have been prepared: An analysis of the accounts shows the following: 1, The equipment depreciation is $3 50 per month

> Black-Eyed Pears Ltd. initially records all prepaid costs as expenses and all revenue collected in advance as revenues. The following information is available for the year ended December 31, 2014. 1. Purchased a one-year insurance policy on May I, 2014,

> At Sugarland Ltd., prepaid costs are debited to expense when cash is paid and unearned revenues are credited to revenue when the cash is received. During January of the current year, the following transactions occurred. On January 31, it is determined t

> A review of the accounts of Tucker and Wu Pan Accountants reflected the following transactions, which may or may not require adjustment at the year ended December 31, 2014. 1. The Prepaid Rent account shows a debit of $7,200 paid October 1, 2014, for a o

> On December 31, the adjusted trial balance of Domino Inc. shows the following selected data: Analysis shows that adjusting entries had been made, and included above, for (1) $9,700 of services performed but not billed, and (2) $6,400 of accrued but unpa

> On December 31, adjusting information for Big & Rich Corporation is as follows: 1. Estimated depreciation on equipment is S3, 400. 2. Property taxes amounting to $2,525 have been incurred but are unrecorded and unpaid. 3. Employee wages that are earned b

> Lazy Dog Inc. is a small private company that prepares monthly financial statements from a work sheet. Selected parts of the February work sheet showed the following data: During February, no events occurred that affected these accounts. At the end of F

> On July 1, 2014, Blondie Ltd. pays $18,000 to No Claims Insurance Ltd. for a three-year insurance contract. Both companies have fiscal years ending December 31. Prepare two sets of journal entries for Blondie, with each set of journal entries recording t

> The adjusted trial balance of North Bay Corporation is provided in the following work sheet for the year ended December 31, 2014. Instructions The note payable is due in four months. Complete the work sheet and prepare a statement of financial position

> Yeliw Enterprises purchases inventory amounting to $12,000, and records the expenditure as a debit to Office Equipment. What would be the effect of this error on the balance sheet and income statement in the period of the purchase, assuming the inventory

> One Wiser Corp. had the following transactions during the first month of business. Journalize the transactions. August 2 Invested $12,000 cash and $2,500 of equipment in the business in exchange for common shares. 7 Purchased supplies on account for

> Recently, your Uncle Warren, who knows that you always have your eye out for a profitable investment, has discussed the possibility of your purchasing some corporate bonds that he just learned of. He suggests that you may wish to get in on the ground flo

> Indicate the qualitative characteristic of financial information being described in each item below: (a) Financial statements should include all information necessary to portray the underlying transactions. (b) Financial information should make a differe

> A Special Committee on Financial Reporting proposed the following constraints related to financial reporting. 1. Business reporting should exclude information outside of management's expertise or for which management is not the best source, such as infor

> The following transactions fall somewhere in the continuum of the choices in accounting decision-making that are shown in Illustration 2-5. 1. The company president approaches one of the company's creditors to ask for a modification of the repayment te

> For each item that follows, indicate which element of the financial statements it belongs to: (a) Retained earnings (b) Sales Revenue (c) Acquired goodwill (d) Inventory (e) Depreciation (f) Loss on sale of equipment (g) Interest payable (h) Dividends

> You are hired to review the accounting records of Sheridan Corporation (a public corporation) before it closes its revenue and expense accounts as at December 31, 2014, the end of its current fiscal year. The following information comes to your attention

> Examples of some operational guidelines used by accountants follow. 1. The treasurer of Sweet Grapes Corp. would like to prepare financial statements only during downturns in the company's wine production, which occur periodically when the grape crop fai

> The following are operational guidelines and practices that have developed over time for financial reporting. 1. Price-level changes (inflation and deflation) are not recognized in the accounting records. 2. Financial information is presented so that rea

> The foundational principles of accounting are as follows: Recognition/ Derecognition 1. Economic entity 2. Control 3. Revenue recognition and realization 4. Matching Measurement 5. Periodicity 6. Monetary unit 7. Going concern 8. Historical cost 9. Fair

> Lucky Enterprises is using a discounted cash flow model. Identify which model Lucky might use to estimate discounted fair value under each scenario, and calculate the fair value: Scenario 1: Cash flows are fairly certain $1 00/year for 5 years Risk-adjus