Question: Trask Corporation (a fictional company) had the

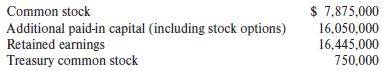

Trask Corporation (a fictional company) had the following shareholders’ equity account balances at December 31, 20X0:

Transactions during 20X1 and other information relating to the shareholders’ equity accounts follow:

• As of January 1, 20X1, Trask had 4,000,000 authorized shares of $5 par value common stock; it had issued 1,575,000 shares, of which 75,000 were held in treasury.

• On January 21, 20X1, Trask issued 50,000 shares of $100 par value, 6% cumulative preferred stock at par in exchange for all of Rover Company’s assets and liabilities. On that date, the net carrying amount of Rover’s assets and liabilities equaled their fair values.

• On January 22, 20X1, Rover distributed the Trask shares to its stockholders in a complete liquidation and dissolution of Rover. Trask had 150,000 authorized shares of preferred stock.

• On February 17, 20X1, Trask formally retired 25,000 of 75,000 treasury common stock shares. The shares were originally issued at $15 per share and had been acquired on September 25, 20X0, for $10 per share.

• Trask owned 15,000 shares of Harbor Inc. common stock purchased in 20X0 for $600,000. The Harbor stock shares are carried at fair value with price changes included in net income. On March 5, 20X1, Trask declared a property dividend of one share of Harbor common stock for every 100 shares of Trask common stock held by a shareholder of record on April 16, 20X1. Harbor stock’s market price on March 5, 20X1, was $60 per share. The property dividend was distributed on April 29, 20X1.

• On January 2, 20W6, Trask granted stock options to employees to purchase 200,000 shares of the company’s common stock at $12 per share, which was also the market price on that date. The options had a grant date fair value of $1.50 per share and are exercisable within a three-year period, beginning January 2, 20X1. On June 1, 20X1, employees exercised 150,000 options when the stock’s market value was $25 per share. Trask issued new shares to settle the transaction.

• On December 12, 20X1, Trask declared the yearly cash dividend on preferred stock, payable on January 11, 20X2, to shareholders of record on December 31, 20X1.

• On January 16, 20X2, before the accounting records were closed for 20X1, Trask learned that depreciation expense had been understated by $350,000 for the year ended December 31, 20X0. The after-tax effect on 20X0 net income was $245,000. The appropriate correcting entry to adjust January 1, 20X1, retained earnings was recorded on the same day. Net income for 20X1 was $2,400,000.

Required:

1. Prepare a schedule to show how Trask’s retained earnings changed from January 1, 20X1, to December 31, 20X1. See the retained earnings column within the Marriott Vacations Worldwide Statement of Shareholders’ Equity presented in Exhibit 16.3.

2. Prepare the shareholders’ equity section of Trask’s balance sheet at December 31, 20X1.

3. Compute the book value per share of common stock at December 31, 20X1.

> The following is the operating section of the statement of cash flows (direct method) of Battery Builders, Inc.: Collections from customers………………………………………………………………….$ 28,000 Payments to suppliers for inventory purchases………………………………………(13,000) Payments fo

> Delta Air Lines adopted the provisions of ASC Topic 842 using the optional alternative ­transitionmethod in which a company makes a cumulative adjustment to the opening balance of retained earnings in the period of adoption instead of to the f

> The following cash flow information pertains to the 20X1 operations of Fish master, Inc., a maker of fishing equipment. Cash collections from customers……………………………………………….$ 79,533 Cash payments to suppliers of inventory……………………………………64,097 Cash payments f

> The following cash flow information pertains to the 20X1 operations of Matterhorn, Inc., a maker of ski equipment: Cash collections from customers……………………………………………….$ 16,670 Cash payments to suppliers of inventory……………………………………19,428 Cash payments for va

> A December 31, 20X1, post closing trial balance for Short Erin Company follows. Additional information about Short Erin’s account balances: 1. Cash includes $12,000 in U.S. treasury bills purchased on December 21, 20X1, that mature in J

> Kay Wing, Inc., prepared the following balance sheet at December 31, 20X0. The following occurred during 20X1. 1. A $35,000 note payable was issued. 2. Land was purchased for $50,000. 3. Bonds payable (maturing in 20X5) in the amount of $30,000 were reti

> Ricky Corporation had the following alphabetical account balance listing at December 31, 20X1 (in thousands of dollars). Required: Prepare a balance sheet for Ricky Corporation at December 31, 20X1.

> Berger Company had sales in 20X1 of $200,000. The goods sold cost Berger $125,000. The goods were sold with the right of return. By the end of 20X1, goods having a total selling price of $10,000 had been returned. As of December 31, 20X1, Berger expected

> Online Auction Company (OAC) provides a platform for its users to buy and sell goods. Sellers post goods for sale and other users bid on them. The high bidder wins the auction and purchases the goods. After each auction, the seller pays OAC a 10% fee and

> Zahava Corporation sells equipment to Ari Company for $700,000. Ari does not need the equipment until December 31, 20X3, but agrees to pay $600,000 immediately on December 31, 20X1, in order to assist Zahava with its finances. The remaining $100,000 is d

> Zahava Corporation sells equipment to Ari Company for $700,000 on December 31, 20X1. The two companies agree that Ari will pay $100,000 upon delivery (December 31, 20X1), with the remaining $600,000 due on December 31, 20X3. Zahava is confident that Ari

> Ladd Corporation sells construction equipment to a customer for $200,000 on January 1, 20X1. The equipment comes with a standard 10-year warranty covering all maintenance and repairs during that time. Initially, Ladd estimates that it will incur $10,000

> Refer to the Target Corporation financial statement information contained in C13-1. Required: Explain how the financial statements and disclosures would change if Target were using IFRS 16. Be as specific as possible.

> On January 1, 20X1, Quenneville Corporation sold equipment to Wirtz, Inc., for $500,000. The equipment had cost $300,000 to manufacture. The contract with Wirtz requires Quenneville to provide complete maintenance and repair services on the equipment for

> MSK Construction Company contracted to construct a factory building for $525,000. Construction started during 20X1 and was completed in 20X2. Information relating to the contract follows: Required: 1. Record the preceding transactions in MSKâ€

> Cornwell Construction Company has been operating in Pennsylvania for a number of years. During 20X1, the firm contracted with the Borough of Lewisburg to build a domed sports complex. Cornwell estimated that it would take three years to complete the faci

> Foremost Company owns a royalty interest in an oil well. The contract stipulates that Foremost will receive royalty payments semiannually on January 31 and July 31. The January 31 payment will be for 30% of the oil sold to jobbers between the previous Ju

> Dale Golf Course, Inc., operates golf courses in South Carolina. A round of golf at one of Dale’s courses costs $75. Dale also sells one-year season passes, good for unlimited rounds of golf for a single golfer, for $3,000. In 20X1, Dale’s first year of

> Smith, Inc., produces and sells clothing to department stores. Its supply arrangement with Leftwich Department Stores calls for Smith to purchase from Leftwich each month in-store advertising at a cost equal to 5% of the month’s sales to Leftwich. The in

> Ball Data Corporation provides stock market data to investors. On January 1, 20X1, it sells a customer access to its real-time database for two years at a price of $600,000. The customer has the right to access Ball’s database any time, 24 hours per day,

> On January 1, 20X1, Skinner Equipment Company leased equipment used in mineral extraction operations to Erickson Corporation. The monthly base rental fee was $250,000. In addition, at the end of the year, Erickson must pay Skinner a bonus of one month’s

> On July 1, 20X1, Grams Construction, Inc., agreed to construct a factory for a customer. The contract called for payments to Grams totaling $2 million. Grams has correctly determined that it is appropriate to recognize revenue over time, and it uses its

> Posa Hotels, Inc., has a sixth-night-free policy. Every sixth night a guest stays at the hotel is free. Because not all guests stay enough nights to earn a free stay, on average the number of free nights redeemed is 70% of the maximum possible number of

> Target adopted the new leasing standard for the year ended February 2, 2019, using themodified retrospective approach outlined in ASC Topic 842. All questions relate to the yearended February 2, 2019 (fiscal 2018) unless stated otherwise. The supplementa

> AT&T Inc. is a global provider of telecommunications, media, and technology services. The following information was taken from AT&€™s Form 10-K for the year ended December 31, 2018. Required: 1. What journal entry did AT&T make to

> Barrios Communications is a provider of satellite television services. It will install a satellite dish free of charge for any customer that agrees to a one-year service contract at a price of $50 per month. Installation costs Barrios $150. Customers typ

> Maffett Ticket Brokers is a reseller of tickets to sporting events and concerts. During 20X1, Maffett sold gift cards totaling $250,000. Based on past experience, Maffett expects that 1% of the gift card purchases will not be redeemed by the time they ex

> Holman Electronics manufactures audio equipment, selling it through various distributors. Holman’s days sales outstanding (Accounts receivable/Average daily credit sales) figures increased steadily in 20X1 and then spiked dramatically in 20X2, peaking at

> For 20X1, Silvertip Construction, Inc., reported income from continuing operations (after tax) of $1,650,000. On November 15, 20X1, the company adopted a plan to dispose of a component of the business. This component qualifies for discontinued operations

> The following condensed statement of income of Helen Corporation, a diversified company, is presented for the two years ended December 31, 20X1 and 20X0: On January 1, 20X1, Helen entered into an agreement to sell for $3,200,000 the assets and product li

> Bob’s Chocolate Chips and More, a bakery specializing in gourmet pizza and chocolate chip cookies, started business October 1, 20X1. The following transactions occurred during the month of October. a. Common stock of $90,000 was sold at par to start the

> During August 20X1, Packer Manufacturing had the following cash receipts and disbursements: Cash received from customers $319,000 Cash received from selling equipment 11,200 Cash paid for salaries 47,000 Cash paid to suppliers for inventory

> Locate the December 31, 2018, consolidated financial statements for Carrefour Group, the French retail company and the second largest retailer in the world, at www.carrefour.com/ financial-information/releases? plink=4472&link=1785. Required: 1. What ty

> Richard’s Inc. (a fictional company) operates toy stores throughout the United States. In August 20X1, the company said that it might default on certain of the financial covenants contained in one of the company loan agreements. Here is an excerpt from t

> Driscol Bank is considering a $500,000 loan to Darrow Productions. Three items appearing on Darrow’s balance sheets are: a. Cash on hand and in the bank, $20,000. b. Accounts receivable of $60,000, less an allowance for uncollectible of $15,000. c. Accum

> Presented below is information from Toys “R” Us, Inc., Form 10-K for the fiscal years ending January 31, 2017, and January 30, 2016. 2017 NOTE 2: SHORT-TERM BORROWINGS AND LONG-TERM DEBT On August 16, 2016, we complete

> You have decided to buy a new automobile and have been gathering information about the purchase price. The manufacturer’s website shows a “list price” of $44,500, which includes your preferred options: leather trim and navigation. You have also consulted

> Seydoux Industries manufactures and sells home sound equipment. A note to the company’s annual report states: While certain of the Company’s loans are outstanding, the Company must meet specific financial tests on an ongoing basis. These agreements limit

> The Shareholders’ Equity section in the balance sheet of Holiday Roads Company (a fictional company) appears as follows: Net income for 20X1 was $1,700,000, preferred stock dividends were $200,000, and common stock dividends were $500,0

> Blackman Corp. (a fictional company) issues 10-year convertible notes at par for $10,000 on December 31, 20X1. The notes mature in 10 years and are convertible into 400 shares of Blackman common stock at any time after January 1, 20X6. Interest is paid a

> On January 1, 20X1, when its $30 par value common stock was selling for $80 per share, Gierach Corporation issued $10 million of 4% convertible debentures due in 10 years. The conversion option allowed the holder of each $1,000 bond to convert the bond i

> It’s July 1, 20X2, and the market price of Warm Ways’s common stock (Problem P16-3) is $175 per share. There are 1.1 million common shares outstanding, and the Retained earnings account shows a balance of $45,000,000. Management wants to declare and pay

> The stockholders’ equity section of Warm Ways Inc.’s balance sheet at January 1, 20X1, shows: Warm Ways (a fictional company) reported net income of $9,250,000 for 20X1, declared and paid the preferred stock cash divid

> Keystone Enterprises (a fictional company) just announced record 20X1 EPS of $5.00, up $0.25 from last year. This is the 10th consecutive year that the company has increased its EPS, an enviable record. Unfortunately, management fears that this string of

> On January 2, 20X1, Dwyer Corporation (a fictional company) granted 4,000 nonqualified stock options each to 10 of its key executives (40,000 options in total). Under the terms of the option plan, upon exercise, each executive will pay the exercise price

> On January 1, 20X1, Darth Corp. (a fictional company) granted nonqualified stock options to certain key employees as additional compensation. The options were for 100,000 shares of Darth’s $1 par value common stock at an exercise price of $24 per share.

> Potter Corporation (a fictional company) operates a chain of discount retail stores. The following is information taken from a recent Potter annual report. In connection with these mortgages, the company is required to maintain minimum net worthand compl

> Riggs Corporation (a fictional company) has the following balance sheet information at December 31, 20X2. The convertible bonds were issued at par in 20X0 and are convertible into Riggs’s common stock at a ratio of 20 shares of stock to

> In its December 31, 20X0, balance sheet, Castle, Inc. (a fictional company), reported 400,000 issued shares of common stock and 50,000 shares of treasury stock. The 20X0 annual report also reported 100,000 exercisable incentive stock options. Each option

> Kadri Corporation (a fictional company) reported basic EPS of $3.00 and diluted EPS of $2.40 for 20X1. Its EPS calculations follow: Kadri issued the convertible preferred stock at the beginning of 20X1 and the Series A and Series B convertible debt at pa

> Hanigan Manufacturing (a fictional company) had 1,800,000 shares of common stock Outstanding as of January 1, 20X1, and 900,000 shares of 10% noncumulative (nonconvertible) preferred stock outstanding. The following events occurred during 20X1: • On Febr

> Information from the annual report of Hicks Company (a fictional company) to shareholders follows: Required: 1. Suppose that the increase in the preferred stock account was due to the issuance of new preferred shares at par on January 1, 20X2. What journ

> Craig Incorporated (a fictional company) manufactures and sells security systems. Selected information from the company’s 20X3 financial statements show: On December 31, 20X1, Craig Incorporated bought back 1,237,000 shares of common st

> Locate the Form 10-K for the year ended December 31, 2018, for Southwest Airlines Co. You can find it at http://investors.southwest.com/financials/sec-filings. 1. What is Southwest Airlines’ main business? 2. List some of the nonfinancial metrics that S

> In recent years, investors, creditors, governments, and the public have demanded more information from companies about climate change. Required: 1 Why have investors and creditors become interested in business activities related to climate change? 2. Wh

> Locate the 2018 Sustainability Information report for Siemens AG, the German manufacturing conglomerate,athttps://www.siemens.com/investor/pool/en/investor_relations/siemens_sustainability_ information2018.pdf. Required: 1. What are the main areas for w

> As a senior partner at one of the nation’s largest public accounting firms, you serve as chair ofthe firm’s financial reporting policy committee. You are also the firm’s chief spokesperson onfinancial reporting matters that come before the FASB and the S

> Krewatch, Inc., is a vertically integrated manufacturer and retailer of golf clubs and accessories (gloves, shoes, bags, etc.). Krewatch maintains separate financial reporting systems for each of its facilities. The company experienced the following even

> Presented below is a combined single-step income and retained earnings statement for Hardrock Mining Co. for 20X1. Additional facts gleaned from notes to Hardrock’s financial statements follow (dollar amounts in thousands): a. Other, ne

> The following information is provided for Kelly Plumbing Supply. Cash received from customers during December 20X1 $387,000 Cash paid to suppliers for inventory during December 20X1 131,000 Cash received from customers includes all $139,000 of the accoun

> Under Hart Company’s accounting system, all insurance premiums paid are debited to prepaid insurance. Hart then makes monthly charges to Insurance expense with credits to prepaid insurance as the insurance coverage period is used up. Additional informati

> Joel Hamilton, D.D.S., keeps his accounting records on the cash basis. During 20X1, he collected $200,000 in fees from his patients. At December 31, 20X0, Dr. Hamilton had accounts receivable of $18,000 and no liability for deferred fee revenue. At Decem

> In November and December 20X1, Gee Company, a newly organized magazine publisher, received $36,000 for 1,000 three-year subscriptions at $12 per year, starting with the January 20X2 issue of the magazine. Required: How much should Gee report in its 20X1

> On January 1, 20X1, Hardy, Inc., purchased certain plant assets under a deferred paymentcontract. The agreement called for making annual payments of $10,000 for five years. The firstpayment is due on January 1, 20X1, and the remaining payments are due on

> Samson Manufacturing Company, a calendar-year company, purchased a machine for $65,000on January 1, 20X0. At the date of purchase, Samson incurred the following additional costs: The machine’s estimated salvage value was $5,000, and Sam

> Apex Company purchased a tooling machine on January 3, 20W1, for $30,000. The machinewas being depreciated on the straight-line method over an estimated useful life of 20 years, withno salvage value. At the beginning of 20X1, when the machine had been in

> On April 1, 20X1, Mills Company acquired equipment for $125,000. The estimated useful lifeis six years, and the estimated residual value is $5,000. Mills estimates that the equipment canproduce 25,000 units of product. During 20X1 and 20X2, respectively,

> For several years, the Securities and Exchange Commission (SEC) has been considering whether to transition U.S. firms to International Financial Reporting Standards (IFRS) for filing public financial reports. During 2011, Matthew J. Foehr, the vice presi

> Gonzo Co. owns a building in Georgia. The building’s historical cost is $970,000, and $440,000of accumulated depreciation has been recorded to date. During 20X1, Gonzo incurred the following expenses related to the building: Required:

> On July 1, 20X1, Ritz Company signs a contract with Venticello, Inc., to install Ritz’sinventory management software throughout Venticello, Inc. Ritz will begin the installation immediately and expectsto compete the installation in thre

> In January 20X1, Vorst Company purchased a mineral mine for $2,640,000. Removable orewas estimated at 1,200,000 tons. After it has extracted all the ore, Vorst will be required by lawto restore the land to its original condition. The expected present val

> Pearl, Inc., develops and markets computer software. During 20X0, one of Pearl’s engineersbegan developing a new and very innovative software product. On July 1, 20X1, a team of Pearlengineers determined that the software product was te

> In 20X1, Ball Labs incurred the following costs: Required: What was Ball’s total research and development expense in 20X1?

> During 20X1, Orr Company incurred the following costs: Required: How much research and development expense should Orr report in 20X1?

> On January 2, 20X1, Lava, Inc., purchased a patent for a new consumer product for $90,000. At the time of purchase, the patent was valid for 15 years; however, its useful life was estimatedto be only 10 years due to the product’s competitive nature. On D

> On January 1, 20X0, Vick Company purchased a trademark for $400,000, which had an estimated useful life of 16 years. On January 1, 20X4, Vick paid $60,000 for legal fees in a successful defense of the trademark. Required: How much should Vick record as

> Union Company acquired machinery on January 2, 20X1, for $315,000. The machinery’s estimated useful life is 10 years, and the estimated residual value is $15,000. Union estimates thatthe machine will produce 15,000 units of product and that 20,000 direct

> Information from Jacob Perez Company’s records is available as follows for the year ended December 31, 20X1: No work-in-process inventories existed at the beginning or end of 20X1. Required: 1. What would be Perez’s f

> Baines Corporation (a fictional company) manufactures fireplace tools and accessories. It has been prosperous since its incorporation, largely due to a small, exceptionally skilled, and highly motivated managerial staff. Baines has been able to attract a

> Frate Company was formed on January 1, 20X1. The following information is available from Frate’s inventory records for Product Ply: A physical inventory on December 31, 20X1, shows 1,600 units on hand. Required: Prepare schedules to co

> On June 30, 20X1, a tornado damaged Jensen Corporation’s warehouse and factory, completely destroying the work-in-process inventory. Neither the raw materials nor finished goods inventories were damaged. A physical inventory taken after

> Hestor Company’s records indicate the following information: On December 31, 20X1, a physical inventory determined that ending inventory of $600,000 was in the warehouse. Hestor’s gross profit on sales has remained con

> For the year 20X1, Dumas Company’s gross profit was $96,000; the cost of goods manufactured was $340,000; the beginning inventories of goods in process and finished goods were $28,000 and $45,000, respectively; and the ending inventories of goods in proc

> The following information is available for Day Company for 20X1: Required: What is the cost of goods sold for 20X1?

> Jessica’s Office Supply, Inc., had 300 calculators on hand at January 1, 20X1, costing $16 each. Purchases and sales of calculators during the month of January were as follows: Jessica does not maintain perpetual inventory records. Acco

> Sperry-New Holland manufactures farm machinery. During 20X1, it incurred a variety of costs, several of which appear on the following list. Nature of Incurred Cost a. Comprehensive liability insurance premium on corporate headquarters b. Depreciation on

> On December 31, 20X1, Fern Company adopted the dollar-value LIFO inventory method. All of Fern’s inventories constitute a single pool. The inventory on December 31, 20X1, using the dollar-value LIFO inventory method was $600,000. Invent

> Acute Company manufactures a single product. On December 31, 20X0, it adopted the dollar- value LIFO inventory method. The inventory on that date using the dollar-value LIFO inventory method was determined to be $300,000. Inventory data for succeeding ye

> The following inventory valuation errors have been discovered for Knox Corporation: •The 20X1 year-end inventory was overstated by $23,000. •The 20X2 year-end inventory was understated by $61,000. •Th

> The following information related to Exxon Mobil’s inventories is taken from its 2017 annual report. Required: 1. By how much would net income for 2017 have differed had Exxon Mobil used FIFO to value those inventory items valued under

> Watsontown Yacht Sales has been selling large power cruisers for 25 years. On January 1, 20X1, the company had $5,950,000 in inventory (based on a FIFO valuation). While the number of yachts in Watsontown Yacht Sales’s inventory remained fairly constant

> Nathan’s Grills, Inc., imports and sells premium-quality gas grills. The company had the following layers in its LIFO inventory at January 1, 20X4, at which time the replacement cost of the inventory was $675 per unit. The replacement c

> KW Steel Corp. uses the LIFO method of inventory valuation. Waretown Steel, KW’s major competitor, instead uses the FIFO method. The following are excerpts from each company’s 20X1 financial statements: Required: 1. C

> Blago Wholesale Company began operations on January 1, 20X1, and uses the average cost method in costing its inventory. Management is contemplating a change to the FIFO method in 20X2 and is interested in determining how such a change will affect net inc

> Selected information concerning the operation of Kern Company for the year ended December 31, 20X1, is available as follows: No work-in-process inventories existed at the beginning or end of 20X1. Required: 1. What would be Kern’s fini

> On January 1, 20X1, Manuel Company’s merchandise inventory was $300,000. During 20X1, Manuel purchased $1,900,000 of merchandise and recorded sales of $2,000,000. The gross profit margin on these sales was 20% of the selling price. Required: What is Man

> Smithfield Farms purchased a combine from John Deere for $175,000 on January 2, 20X1. Smithfield paid $25,000 in cash and signed an installment note calling for five annual payments of $39,569.58 beginning on December 31, 20X1. Deere based the payments o

> On December 31, 20X1, Fenton Company sold equipment to Denver, Inc., accepting a $275,000 non–interest-bearing note receivable due on December 31, 20X4. Denver, Inc., normally pays 12% for its borrowed funds. The equipment is carried in Fenton’s perpetua

> Blue, Inc., sells playground equipment to schools and municipalities. It mails invoices at the end of each month for all goods shipped during that month; credit terms are net 30 days. Sales and accounts receivable data for 20X1, 20X2, and 20X3 follow: R

> Kendall Corporation designs and manufactures sports cars. During the course of its business, Kendall generates substantial receivables from its customers. On July 1, 20X1, to improve its cash flow, Kendall establishes a securitization entity (SE) and (1)