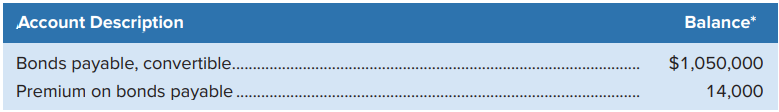

Question: Trilium Gold Inc.’s December 31, 2020,

Trilium Gold Inc.’s December 31, 2020, adjusted trial balance shows the following:

Required

1. What is the carrying value of the bonds on December 31, 2020?

2. The bonds were converted into 105,000 common shares on January 1, 2021. Journalize the entry assuming the market value per common share on this date was $9.10.

> CHECK FIGURES: 3. Book value per common share = $92.00 4. Book value per common share = $90.75 Delta Tech Corporation’s common shares are currently selling on a stock exchange at $85 per share, and a recent balance sheet shows the follo

> Book value per common share; Western Grass Inc. Equity Section of Balance Sheet December 31, 2020. Required Using the information provided, calculate book value per common share assuming: a. There are no dividends in arrears. b. There are three years of

> Spence Resources Inc.’s December 31 incomplete balance sheet information follows along with additional information: Required 1. Prepare a three-year comparative balance sheet for Spence Resources Inc. 2. To evaluate the companyâ&#

> The following information is available from the financial statements of Landscape Enhancements Inc.: Calculate Landscape Enhancements’ return on total assets for 2019 and 2020. (Round answers to one decimal place.) Comment on whether th

> Use the following information to calculate the ratio of pledged assets to secured liabilities for both companies: Which company appears to have the riskier secured debt?

> Trend analysis, profitability ratios (millions of $) Required: Calculate Tia’s Trampolines Inc.’s profitability ratios for 2020 (round calculations to two decimal places). Also identify whether each of Tiaâ€

> The original income statements for ZoomMed Inc. presented the following information when they were first published in 2019, 2020, and 2021: The company also experienced some changes in the number of outstanding common shares over the three years through

> Brainium Technologies showed the following information in its Property, Plant, and Equipment subledger regarding a warehouse. During 2020, it was determined that the original useful life on the warehouse doors should be reduced to a total of 12 years and

> Common-size and trend percentages for a company’s net sales, cost of goods sold, and expenses follow: Required: Determine whether the company’s profit increased, decreased, or remained unchanged during this three-year

> Laura’s Fresh Cooking Inc. began operations on January 1, 2019. Laura’s prepares gourmet dinners and delivers to customers in fresh coolers; customers put them in the oven and have a meal within 30 minutes. The busines

> Refer to the information about Western Environmental Inc. presented in Exercise 16-7. Use the direct method and prepare a statement of cash flows. Data from Exercise 16-7: Required: Use the Western Environmental Inc. information given below to prepare a

> Required: Use the Western Environmental Inc. information given below to prepare a statement of cash flows for the year ended June 30, 2020, using the indirect method. a. A note is retired at carrying value. b. The only changes affecting retained earnings

> Use the following income statement and information about changes in non-cash current assets and current liabilities to present the cash flows from operating activities using the indirect method: Changes in current asset and current liability accounts dur

> Analyzing cash inflows and outflows Required: Which of the three competing corporations is in the strongest relative position as indicated by its comparative statements of cash flows?

> Green Forest Corp.’s 2020 income statement showed the following: profit, $292,600; depreciation expense, building, $43,000; depreciation expense, equipment, $6,630; and gain on sale of equipment, $7,000. An examination of the company’s current assets and

> The account balances for the non-cash current assets and current liabilities of Kid-game Software Inc. are as follows: During 2020, Kid-game Software Inc. reported depreciation expense of $57,000. All purchases and sales are on account. Profit for 2020 w

> Making adjustments to derive cash flow from operating activities (indirect method) Indicate by an X in the appropriate column whether an item is added or subtracted to derive cash flow from operating activities.

> The summarized journal entries below show the total debits and credits to the Zebra Corporation’s Cash account during 2020. Required Use the information to prepare a statement of cash flows for 2020. The cash flow from operating activit

> Pace Oil & Gas Corp. began operations in 2018. Its balance sheet reported the following components of equity on December 31, 2018. The corporation completed these transactions during 2019 and 2020: Required 1. Prepare journal entries to record the tr

> Rosetta Inc.’s records contain the following information about the 2020 cash flows. Required Prepare a statement of cash flows using the direct method and a note describing non-cash investing and financing activities.

> Use the following income statement and information about changes in non-cash current assets and current liabilities to present the cash flows from operating activities using the direct method: Changes in current asset and current liability accounts durin

> In each of the following cases, use the information provided about the 2020 operations of River Bungee Inc. to calculate the indicated cash flow:

> In each of the following cases, use the information provided about the 2020 operations of Prestige Water Corp. to calculate the indicated cash flow:

> The following occurred during the year. Assuming that the company uses the direct method of reporting cash provided by operating activities, indicate the proper accounting treatment for each item by placing an X in the appropriate column.

> The following transactions occurred during the year. Assuming that the company uses the indirect method of reporting cash provided by operating activities, indicate the proper accounting treatment for each transaction listed below by placing an X in the

> You have been asked by the VP of Finance to explain the appropriate accounting treatment for the following series of investments made by Metaphor Investments Inc.: • Purchased 50,000 of the 80,000 shares outstanding for The Natural Pharmacy Inc. • Purch

> The following events are for King Investment Inc.: Required Prepare general journal entries to record each transaction. Round per share calculations to two decimal places.

> The following events are for Toronto Investment Inc.: Required: Prepare general journal entries to record each transaction. Round per share calculations to two decimal places.

> Monkey Mortgage Inc. engaged in the following non-strategic investment transactions during 2020: Required 1. Prepare an amortization schedule for the Jaguar bond showing only 2020 and 2021. 2. Prepare the entries to record the transactions described abov

> Labtech Pharmacy Inc. is authorized to issue an unlimited number of common shares and 100,000 shares of $24 non-cumulative preferred. The company completed the following transactions: Required 1. Prepare general journal entries to record the transactions

> Following are the non-strategic investment transactions of Corona Inc.: Required 1. For each of the bond investments, prepare an amortization schedule showing only 2020 and 2021. 2. Prepare the entries to record the transactions described above. 3. Show

> The cost and fair value of non-strategic investments of International Journalist Corporation on December 31, 2020, and December 31, 2021, are as follows: Required 1. Prepare the fair value adjustment at December 31, 2020, and December 31, 2021, based on

> Pacific Fishing Inc.’s actively traded non-strategic investments as of December 31, 2020, are as follows: Pacific Fishing Inc. had no investments prior to 2020. Required 1. Prepare the fair value adjustment at December 31, 2020, based o

> Prepare entries to record the following non-strategic investment transactions of Wiki Garden Tool Inc. Assume each bond acquired is purchased with the intention to actively trade. Analysis Component: How would the financial statements have been affected

> Prepare entries to record the following non-strategic investment transactions of Arrowhead Investment Corporation. Analysis Component: If the fair value adjusting entry on December 31, 2020, were not recorded, what would the effect be on the income state

> SweetFish Corp. issued bonds with a par value of $820,000 and a five-year life on May 1, 2020. The contract interest rate is 7%. The bonds pay interest on October 31 and April 30. They were issued at a price of $803,164 when the market interest rate was

> Huskey Mining Corporation issued bonds with a par value of $105,000 on January 1, 2020. The annual contract rate on the bonds is 9%, and the interest is paid semiannually. The bonds mature after three years. The annual market interest rate at the date of

> Mindsetta Music Inc. issued bonds on March 1, 2020, with a par value of $300,000. The bonds mature in 15 years and pay 8% annual interest in two semiannual payments. On the issue date, the annual market rate of interest for the bonds turned out to be 10%

> Chinook Inc. has available for issue a $3,200,000 bond due in eight years. Interest at the rate of 6% is to be paid semiannually. Calculate the issue price if the market interest rate is: a. 5.5% b. 6% c. 6.75%

> On October 1, 2020, Eastern Timber Inc. has available for issue $840,000 bonds due in four years. Interest at the rate of 4% is to be paid quarterly. Calculate the issue price if the market interest rate is: a. 5% b. 4% c. 3%

> The balance sheet for QuickStream Inc. reported the following components of equity on December 31, 2020: Common shares, unlimited shares authorized, 100,000 shares issued and outstanding:$ 480,000 Retained earnings: 648,000 Total equity: $1,128,000 The

> Omni Film Corporation had a $1,250,000, 7% bond available for issue on April 1. Interest is to be paid on the last day of each month. On April 14 and 25, bonds with a face value of $890,000 and $360,000, respectively, were issued at par. Record the entri

> Extra Gold Corporation had a $1,270,000, 6% bond available for issue on September 1, 2020. Interest is to be paid quarterly beginning November 30. All of the bonds were issued at par on October 1. Prepare the appropriate entries for: a. October 1, 2020 b

> For Solar Industries and its related but separate financing company Solar Financing Corp, calculate the debt to equity ratio for 2019 and 2020. Explain why there are such significant differences in the ratios.

> On December 31, 2020, a day when the available interest rate was 9%, Valcent Products Inc. leased equipment with an eight-year life. The contract called for an $8,400 annual lease payment at the end of each of the next five years, with the equipment beco

> Use the data in Exercise 14-25 to prepare journal entries that KEC Environmental Corp. would make to record the loan on December 31, 2020, and the four payments starting on December 31, 2021, through the final payment on December 31, 2024. Data from Exe

> On December 31, 2020, KEC Environmental Corp. borrowed $100,000 by signing a four-year, 5% installment note. The note requires four equal payments of accrued interest and principal on December 31 of each year from 2021 through 2024. a. Calculate the size

> Use the data in Exercise 14-23 to prepare journal entries that Sack Port Ventures Inc. would make to record the loan on December 31, 2020, and the four payments starting on December 31, 2021, through the final payment on December 31, 2024. Data from Exe

> On December 31, 2020, Sack Port Ventures Inc. borrowed $90,000 by signing a four-year, 5% installment note. The note requires annual payments of accrued interest and equal amounts of principal on December 31 of each year from 2021 through 2024. a. How mu

> Computalog Inc. showed the following on its December 31, 2020, balance sheet: Bonds payable, convertible: $4,000,000 Less: Unamortized discount: 14,400: $3,985,600 Required 1. Assuming the bonds are convertible into 400,000 common shares, journalize the

> Kangaroo Media Inc. has issued and outstanding a total of 40,000 shares of $7.20 preferred shares and 120,000 of common shares. The company began operations and issued both classes of shares on January 1, 2019. Required 1. Calculate the total dividends t

> Solar Energy Inc. issued a $900,000, 5%, five-year bond on October 1, 2020. Interest is paid annually each October 1. Solar’s year-end is December 31. Required: Using the amortization schedule provided below, record the entry to retire

> On March 1, 2020, Jagger Metal Corp. issued 9% bonds dated January 1, 2020. The bonds have a $902,000 par value, mature in 20 years, and pay interest semiannually on June 30 and December 31. The bonds were sold to investors at their par value plus the tw

> Refer to the amortization schedule prepared in Exercise 14-18. Assume a November 30 year-end. Required Part 1 Record the following entries: a. Issuance of the bonds on October 1, 2020 b. Adjusting entry to accrue bond interest and premium amortization on

> On October 1, 2020, Best Biopharma Inc. issued an $850,000, 11%, seven-year bond. Interest is to be paid annually each October 1. Required a. Calculate the issue price of the bond assuming a market interest rate of 9%. b. Prepare an amortization schedule

> Refer to the amortization schedule prepared in Exercise 14-16. Assume a November 30 year-end. Required Part 1 Record the following entries: a. Issuance of the bonds on October 1, 2020 b. Adjusting entry to accrue bond interest and premium amortization on

> On October 1, 2020, Ross Wind Energy Inc. issued a $1,500,000, 7%, seven-year bond. Interest is to be paid annually each October 1. Required a. Calculate the issue price of the bond assuming a market interest rate of 6% on the date of the bond issue. b.

> Tahoe Tent Ltd. issued bonds with a par value of $800,000 on January 1, 2020. The annual contract rate on the bonds was 12%, and the interest is paid semiannually. The bonds mature after three years. The annual market interest rate at the date of issuanc

> Point North Inc. issued bonds on September 1, 2020, with a par value of $150,000. The bonds mature in 15 years and pay 8% annual interest in two semiannual payments. On the issue date, the annual market rate of interest for the bonds turned out to be 6%.

> On January 1, 2020, Ultra Vision Corp. issued $1,200,000 of 20-year 8% bonds that pay interest semiannually on June 30 and December 31. Assume the bonds were sold at (1) 98; and (2) 102. Journalize the issuance of the bonds at 98 and 102.

> Refer to the amortization schedule prepared in Exercise 14.11. Dejour Energy Inc. has a November 30 year-end. Required Part 1 Record the following entries: a. Issuance of the bonds on October 1, 2020 b. Adjusting entry to accrue bond interest and discoun

> Analyzing equity, dividend allocation Rainchief Energy Inc. Equity Section of the Balance Sheet October 31, 2020 Required 1. Calculate A assuming an average issue price of $12 per share. 2. Calculate B assuming an average issue price of $60 per share. 3.

> On October 1, 2020, Dejour Energy Inc. issued a $680,000, 7%, seven-year bond. Interest is to be paid annually each October 1. Required a. Calculate the issue price of the bond assuming a market interest rate of 8% on the date of the bond issue. b. Using

> On November 1, 2020, Yardley Distributors Inc. issued a $740,000, 5%, two-year bond. Interest is to be paid semiannually each May 1 and November 1. Required: a. Calculate the issue price of the bond assuming a market interest rate of 6% on the date of th

> On January 1, 2020, British Software Ltd. issued $466,000 of 20-year, 10.5% bonds that pay interest semiannually on June 30 and December 31. The bonds were sold to investors at their par value. a. How much interest will British pay to the holders of thes

> Earlyrain Inc.’s 2020 income statement, excluding the earnings per share portion of the statement, was as follows: The weighted-average number of common shares outstanding during the year was 100,000. Present the earnings per share port

> Mady Entertainment Inc. showed the following equity account balances on the December 31, 2019, balance sheet: During 2020, the following selected transactions occurred: Required a. Journalize the transactions above (assuming the retirements were the firs

> The Data Group Inc. had the following balances in its equity accounts at December 31, 2019: During 2020, the following equity transactions occurred: Apr. 15 Repurchased and retired 15,000 common shares at $10.40 per share. May 1 Repurchased and retired 2

> Information taken from Nanotec Security Inc.’s January 31, 2020, balance sheet follows: Common shares, 400,000 shares authorized, 32,000 shares issued and outstanding=$240,000 Retained earnings = 79,850 On February 1, 2020, the company repurchased and re

> CarFind Inc. showed the following equity information at December 31, 2019. On April 1, 2020, 200,000 common shares were issued at $0.60 per share. On June 1, the board of directors declared a 15% share dividend to shareholders of record on June 15; the d

> On March 1, 2020, VisionTech Inc.’s board of directors declared a 5% share dividend when the market price per share was $10.00. On November 15, 2020, the board of directors declared a 4:1 share split. The equity section of the company’s December 31, 2019

> Bandara Gold Inc.’s equity section on the October 31, 2020, balance sheet showed the following information: Common shares, unlimited shares authorized, 600,000 shares issued and outstanding = $1,800,000 Retained earnings = 150,000 On November 15, 2020, B

> Convertible preferred shares Jager Metal Corp. Equity Section of the Balance Sheet November 30, 2020 Required Refer to the equity section above. Assume that the preferred shares are convertible into common at a rate of eight common shares for each share

> Selected information regarding the accounts of Infinity Minerals Corp. follows: Prepare a statement of changes in equity for the year ended December 31, 2020, assuming 7,000 common shares were issued during 2020 at an average price of $21.84 per share an

> Pacifica Papers Inc. needed to conserve cash, so instead of a cash dividend the board of directors declared a 15% common share dividend on June 30, 2020, distributable on July 15, 2020. Because performance during 2020 was better than expected, the compan

> Holt Developments Ltd. put an asset in service on January 1, 2018. Its cost was $270,000, its predicted service life was six years, and its expected residual value was $27,000. The company decided to use double-declining-balance depreciation. After consu

> Ice Industries Inc. showed the following equity account balances at December 31, 2019: Common shares, unlimited shares authorized, 70,000 shares issued and outstanding=$816,000 Retained earnings = 112,800 The company issued long-term debt during 2020 tha

> Use the data for GlenTel Inc. in Exercise 13-16 to present a multiple-step income statement for 2020. You need not complete the earnings per share calculations. Data from Exercise 13-16: During 2020, GlenTel Inc. sold its interest in a chain of wholesal

> During 2020, GlenTel Inc. sold its interest in a chain of wholesale outlets. This sale took the company out of the wholesaling business completely. The company still operates its retail outlets. Following is a lettered list of sections of an income state

> In preparing the annual financial statements for Jade Oil Inc., the correct manner of reporting the following items was not clear to the company’s employees. Explain where each of the following items should appear in the financial statements. a. After de

> The following list of items was extracted from the December 31, 2020, trial balance of Future Products Corp. Using the information contained in this listing, prepare the company’s multiple step income statement for 2020. You need not co

> A company reported $237,110 of profit for 2020. It also declared $36,000 of dividends on preferred shares for the same year. At the beginning of 2020, the company had 52,000 outstanding common shares. These three events changed the number of outstanding

> Kiwi Charter Corp. reported $1,445,710 of profit for 2020. On November 2, 2020, it declared and paid the annual preferred dividends of $155,000. On January 1, 2020, Kiwi had 80,000 and 240,000 outstanding preferred and common shares, respectively. The fo

> The equity sections from the 2020 and 2021 balance sheets of The Saucy Bread Company Inc. appeared as follows: On February 11, May 24, August 13, and December 12, 2021, the board of directors declared $0.30 per share cash dividends on the outstanding sha

> Horticultural Products Inc. reported $928,470 profit in 2020 and declared preferred dividends of $74,600. The following changes in common shares outstanding occurred during the year. Jan. 1 75,000 common shares were outstanding. Mar. 1 Declared and issue

> Liberty Ventures Inc. reported $209,840 profit in 2020 and declared preferred dividends of $34,400. The following changes in common shares outstanding occurred during the year: Jan. 1 60,000 common shares were outstanding. June 30 Sold 20,000 common shar

> Arcus Development Inc.’s equity section on the December 31, 2019, balance sheet showed the following information: Common shares, unlimited shares authorized, 210,000 shares issued and outstanding = $3,360,000 Retained earnings = 575,000 On January 15, 20

> Selected T-accounts for Jade Mineral Corporation at December 31, 2020, are duplicated below. Note: • Dividends were not paid during 2018 or 2019. Dividends of $4.80 per common share were declared and paid for the year ended December 31,

> White Pear Inc., an organic soap manufacturer, showed the following equity information as at December 31, 2020: Other information: a. The preferred shares had sold for an average price of $36.00. b. The common shares had sold for an average price of $14.

> The December 31, 2020, equity section of ZoomZoom Inc.’s balance sheet appears below. Required: All the shares were issued on January 1, 2018 (when the corporation began operations). No dividends had been declared during the first two y

> Westby Corp., a high school uniform manufacturer, was authorized to issue an unlimited number of common shares. During January 2020, its first month of operations, the following selected transactions occurred: Required a. Journalize the above transaction

> Mainland Resources Inc. began operations on June 5, 2020. Journalize the following equity transactions that occurred during the first month of operations:

> On March 1, the board of directors declared a cash dividend of $0.70 per common share to shareholders of record on March 10, payable March 31. There were 127,000 shares issued and outstanding on March 1 and no additional shares had been issued during the

> Fast Cars Inc. was authorized to issue 50,000 $1.50 preferred shares and 300,000 common shares. During 2020, its first year of operations, the following selected transactions occurred: Required a. Journalize the above transactions. b. Prepare the equity

> Using the information from the alphabetized post-closing trial balance below, prepare a classified balance sheet for Malta Industries Inc. as at October 31, 2020. Be sure to use proper form, including all appropriate subtotals.

> SW Company provides the Equity & Liability information below for analysis. SW Company had net income of $389,050 in 2020 and $342,650 in 2019. Note 1: Cash dividends were paid at the rate of $1 per share in 2019 and $2 per share in 2020. Required 1.

> Prepare journal entries for each of the following selected transactions that occurred during Trio Networks Corporation’s first year of operations:

> Sunray Solar Ltd. is a growing company with a hot new marketing plan. On January 1, 2020, it had 127,650 shares outstanding, and it issued an additional 44,500 shares during the year. The company reported $3,222,850 in common shareholders’ equity in its

> Earth Star Diamonds Inc. began a potentially lucrative mining operation on October 1, 2020. It is authorized to issue 100,000 shares of $0.60 cumulative preferred shares and 500,000 common shares. Part A Required: Prepare journal entries for each of the

> The equity section of the December 31, 2019, balance sheet for Delicious Alternative Desserts Inc. showed the following: During the year 2020, the company had the following transactions affecting equity accounts: The board of directors had not declared d