Question: Tristan, who is single, operates three sole

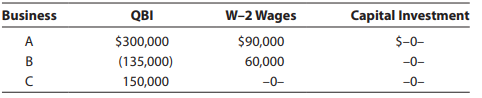

Tristan, who is single, operates three sole proprietorships that generate the following information in 2021 (none are “specified services†businesses).

Tristan chooses not to aggregate the businesses. She also earns $150,000 of wages from an unrelated business, and her modified taxable income (before any QBI deduction) is $380,000.

a. What is Tristan’s QBI deduction?

b. Assume that Tristan can aggregate these businesses. Determine her QBI deduction if she decides to aggregate the businesses.

> Paul and Sonja, who are married, had itemized deductions of $13,200 and $400, respectively, during 2021. Paul suggests that they file separately—he will itemize his deductions from AGI, and she will claim the standard deduction. a. Evaluate Paul’s sugges

> Your client, Dave’s Sport Shop, sells sports equipment and clothing in three retail outlets in New York City. During 2021, the CFO decided that keeping track of inventory using a combination of QuickBooks and spreadsheets was not an efficient way to mana

> Esther owns a large home on the Southeast Coast. Her home is surrounded by large, mature oak trees that significantly increase the value of her home. In September 2021, a hurricane damaged many of the trees surrounding her home; her region was declared a

> During 2021, your client, Kendra Adams, was the chief executive officer and a shareholder of Maze, Inc. She owned 60% of the outstanding stock of Maze. In 2018, Kendra and Maze, as co-borrowers, obtained a $100,000 loan from United National Bank. This lo

> Rex and Agnes Harrell purchased a beach house at Duck, North Carolina, in early 2021. Although they intended to use the beach house occasionally for recreational purposes, to help pay the mortgage payments, property taxes, and maintenance costs, they als

> Gray Chemical Company manufactured pesticides that were toxic. Over the course of several years, the toxic waste contaminated the air and water around the company’s plant. Several employees suffered toxic poisoning, and the Environmental Protection Agenc

> Your client, Simon Che, is an avid Texas Rangers fan. Last March at the Rangers’ home opener, as a result of a random drawing of those in attendance at the game, Simon won 300 Shipley Do-Nut coupons. Each coupon entitled him to a cup of coffee and a free

> Your client is a new retailer who often issues store gift (debit) cards to customers in lieu of a cash refund. You recall that a special rule allows accrual method taxpayers to defer all or a portion of advance payments received. Conduct research to dete

> (1) Use an internet search engine (e.g., Google) to find Internal Revenue Code § 61(a). What is defined in this Code Section? Is the definition broad or narrow? (2) Go to the U.S. Tax Court website (ustaxcourt.gov), and find the U.S Tax Court case in whi

> Compute the taxable income for 2021 for Emily on the basis of the following information. Her filing status is single. Salary………………………………………………………………………………$85,000 Interest income from bonds issued by Xerox……………………………1,100 Alimony payments received (divorc

> Compute the taxable income for 2021 in each of the following independent situations: a. Aaron and Michele, ages 40 and 41, respectively, are married and file a joint return. In addition to four dependent children, they have AGI of $125,000 and itemized d

> Compute the 2021 standard deduction for the following taxpayers. a. Ellie is 15 and claimed as a dependent by her parents. She has $800 in dividend income and $1,400 in wages from a part-time job. b. Ruby and Woody are married and file a joint tax return

> As a result of a cancer diagnosis in early 2021, Laura has begun chemotherapy treatments. A cancer specialist has stated that Laura has less than one year to live. She has incurred many medical bills and other general living expenses and is in need of ca

> Vito is the sole shareholder of Vito, Inc. He is also employed by the corporation. On June 30, 2021, Vito borrowed $8,000 from Vito, Inc., and on July 1, 2022, he borrowed an additional $10,000. Both loans were due on demand. No interest was charged on t

> Ridge is a generous individual. During the year, he made interest-free loans to various family members when the Federal rate was 3%. What are the tax consequences of the following loans by Ridge: a. On June 30, 2021, Ridge loaned $12,000 to his cousin, J

> Nell and Kirby are in the process of negotiating their divorce agreement, to be finalized in 2021. What should be the tax consequences to Nell and Kirby if the following, considered individually, became part of the agreement? a. In consideration for her

> Faye, Gary, and Heidi each have a one-third interest in the FGH Partnership. The following information is available with respect to the partnership for the year and the amount allocable to each partner. Compute each partner’s gross inco

> Troy, a cash basis taxpayer, is employed by Eagle Corporation, also a cash basis taxpayer. Troy receives a salary of $60,000 per year. He also receives a bonus equal to 10% of all collections from clients he serviced during the year. Determine the tax co

> Freda is a cash basis taxpayer. In 2021, she negotiated her salary for 2022. Her employer offered to pay her $21,000 per month in 2022 for a total of $252,000. Freda countered that she would accept $10,000 each month for the 12 months in 2022 and the rem

> Drake Appliance Company, an accrual basis taxpayer, sells home appliances and service contracts. Determine the effect of each of the following transactions on the company’s 2021 gross income assuming that the company uses any available options to defer i

> Linda and Don are married and file a joint return. In 2021, they received $12,000 in Social Security benefits and $35,000 in taxable pension benefits and interest. a. Compute the couple’s adjusted gross income on a joint return. b. Don would like to know

> Herbert was employed for the first six months of 2021 and earned $90,000 in salary. During the next six months, he collected $8,800 of unemployment compensation, borrowed $12,000 (using his personal residence as collateral), and withdrew $2,000 from his

> On January 1, 2021, Kunto, a cash basis taxpayer, pays $46,228 for a 24-month certificate of deposit. The certificate is priced to yield 4% (the effective interest rate) with interest compounded annually. No interest is paid until maturity, when Kunto re

> Marlene, a cash basis taxpayer, invests in Series EE U.S. government savings bonds and bank certificates of deposit (CDs). Determine the tax consequences of the following on her 2021 gross income: a. On September 30, 2021, she cashed in Series EE bonds f

> Determine the effects of the following on a cash basis taxpayer’s gross income for 2021 and 2022: a. On the morning of December 31, 2021, the taxpayer received a $1,500 check from a customer. The taxpayer did not cash the check until January 3, 2022. b.

> Each year, Tom and Cindy Bates normally have itemized deductions of $22,000 (which includes a $4,000 pledge payment to their church). On the advice of a friend, they do the following: in early January 2021, they pay their pledge for 2020; during 2021, th

> During 2021, Chester (a married taxpayer filing a joint return) had the following transactions involving capital assets: Gain on the sale of an arrowhead collection (acquired as an investment at different times but all pieces have been held for more than

> During 2021, Inez (a single taxpayer) had the following transactions involving capital assets: Gain on the sale of unimproved land (held as an investment for 3 years)………………..$ 6,000 Loss on the sale of a camper (purchased 2 years ago and used for family

> Terri, age 16, is a dependent of her parents. During 2021, Terri earned $5,000 in interest income and $3,000 from part-time jobs. a. What is Terri’s taxable income? b. How much of Terri’s income is taxed at her rate? At her parent’s rate? c. Can the pare

> Paige, age 17, is a dependent of her parents. Her parents report taxable income of $120,000 on their joint return (no qualified dividends or capital gains). During 2021, Paige earned $3,900 pet sitting and $4,300 in interest on a savings account. What ar

> Nadia died in 2020 and is survived by her husband, Jerold (age 44); her married son, Travis (age 22); and her daughter-in-law, Macy (age 18). Jerold is the executor of his wife’s estate. He maintains the household where he, Travis, and Macy live and furn

> Christopher died in 2019 and is survived by his wife, Chloe, and their 18- year-old son, Dylan. Chloe is the executor of Christopher’s estate and maintains the household in which she and Dylan live. All of their support is furnished by

> During the year, Alva received dividends on her stocks as follows: Amur Corporation (a French corporation whose stock is traded on an established U.S. securities market) …………………………………..$60,000 Blaze, Inc., a Delaware corporation……………………………………. 40,000 Gra

> Euclid acquires a 7-year class asset on May 9, 2021, for $80,000 (the only asset acquired during the year). Euclid does not elect immediate expensing under § 179. She does not claim any available additional first-year depreciation. Calculate Euclid’s cos

> Sarah and Brandi are engaged and plan to get married. During 2021, Sarah is a full-time student and earns $9,000 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, she is self-supporting. For the year, Brandi is

> Which of the following individuals are required to file a tax return for 2021? Should any of these individuals file a return even if filing is not required? Why or why not? a. Patricia, age 19, is a self-employed single individual with gross income of $5

> Morgan (age 45) is single and provides more than 50% of the support of Tammy (a family friend), Jen (a niece, age 18), and Jerold (a nephew, age 18). Both Tammy and Jen live with Morgan, but Jerold (a French citizen) lives in Canada. Morgan earns a salar

> Charlotte (age 40) is a surviving spouse and provides all of the support of her four minor children (ages 4, 8, 11, and 14) who live with her. She also maintains the household in which her parents live and furnished 60% of their support. Besides interest

> Walter and Nancy provide 60% of the support of their daughter (age 18) and son-in-law (age 22). The son-in-law (John) is a full-time student at a local university, and the daughter (Stella) holds various part-time jobs from which she earns $11,000. Walte

> Taylor, age 18, is claimed as a dependent by her parents. For 2021, she has the following income: $6,000 wages from a summer job, $800 interest from a money market account, and $300 interest from City of Chicago bonds. a. What is Taylor’s taxable income

> Wesley and Camilla (ages 90 and 88, respectively) live in an assisted care facility and for 2020 and 2021 received their support from the following sources: Percentage of Support Social Security benefits………………………………………….16% Son………………………………………………

> During 2021, Jenny, age 14, lives in a household with her father, uncle, and grandmother. The household is maintained by the uncle. The parties, all of whom file separate returns, have AGI as follows: father ($30,000), uncle ($50,000), and grandmother ($

> Trip Garage, Inc. (459 Ellis Avenue, Harrisburg, PA 17111), is an accrual basis taxpayer that repairs automobiles. In late December 2021, the company repaired Samuel Mosley’s car and charged him $1,000. Samuel did not think the problem had been fixed and

> Determine the gross income of the beneficiaries in the following cases: a. Justin’s employer was downsizing and offered employees an amount equal to one year’s salary if the employee would voluntarily retire. b. Trina contracted a disease and was unable

> In November 2021, Kortney (who is a self-employed management consultant) travels from Chicago to Barcelona (Spain) on business. She is gone 10 days (including 2 days of travel) during which time she spends 5 days conducting business and 3 days sightseein

> For tax year 2021, determine the number of dependents in each of the following independent situations: a. Ben and Molly (ages 48 and 46, respectively) are married and furnish more than 50% of the support of their two children, Libby (age 18) and Sam (age

> Al is a medical doctor who conducts his practice as a sole proprietor. During 2021, he received cash of $280,000 for medical services. Of the amount collected, $40,000 was for services provided in 2020. At the end of 2021, Al had accounts receivable of $

> Determine the amount of the standard deduction allowed for 2021 in the following independent situations. In each case, assume that the taxpayer is claimed as another person’s dependent. a. Curtis, age 18, has income as follows: $700 interest from a certi

> Compute the taxable income for 2021 for Aiden on the basis of the following information. Aiden is married but has not seen or heard from his wife since 2019. Salary………………………………………………………………………………………………….$ 80,000 Interest on bonds issued by City of Boston…

> Ben and Molly are married and will file jointly. Ben generates $300,000 of qualified business income from his single-member LLC (a law firm). He reports his business as a sole proprietorship. Wages paid by the law firm amount to $40,000; the law firm has

> Scott and Laura are married and will file a joint tax return. Scott has a sole proprietorship (not a “specified services” business) that generates qualified business income of $300,000. The proprietorship pays W–2 wages of $40,000 and holds property with

> Donald (a married taxpayer filing jointly) owns a wide variety of commercial rental properties held in a single-member LLC. Donald’s LLC reports rental income of $1,500,000. The LLC pays no W–2 wages; rather, it pays a management fee to an S corporation

> Ashley (a single taxpayer) is the owner of ABC LLC. The LLC (which reports as a sole proprietorship) generates QBI of $900,000 and is not a “specified services” business. ABC paid total W–2 wages of $300,000, and the total unadjusted basis of property he

> Peter owns and manages his single-member LLC that provides a wide variety of financial services to his clients. He is married and will file a joint tax return with his spouse, Marta. His LLC reports $300,000 of qualified business income, W–2 wages of $12

> Tyler, a self-employed taxpayer, travels from Denver to Miami primarily on business. He spends five days conducting business and two days sightseeing. His expenses are $400 (airfare), $150 per day (meals at local restaurants), and $300 per night (lodging

> Shelly has $200,000 of QBI from her local jewelry store (a sole proprietorship). Shelly’s proprietorship paid $30,000 in W–2 wages and has $20,000 of qualified property. Shelly’s spouse earned $75,100 of wages as an employee, they earned $20,000 of inter

> Melanie is employed full-time as an accountant for a national hardware chain. She recently started a private consulting practice, which provides tax advice and financial planning to the general public. For this purpose, she maintains an office in her hom

> During 2021, José, a self-employed technology consultant, made gifts in the following amounts: To Haley (José’s personal assistant) at Christmas …………………………………..$36 To Darryl (a key client)—$3 was for gift wrapping ……………………………………53 To Darryl’s wife (a hom

> Kim works for a clothing manufacturer as a dress designer. During 2021, she travels to New York City to attend five days of fashion shows and then spends three days sightseeing. Her expenses are as follows: Airfare ………………………………………………………………………$1,500 Lodgi

> In June 2021, Enrique and Denisse Espinosa traveled to Denver to attend a three-day conference sponsored by the American Society of Implant Dentistry. Denisse, a self-employed practicing oral surgeon, participated in scheduled technical sessions dealing

> On July 1, 2017, Brent purchases a new automobile for $40,000. He uses the car 80% for business and drives the car as follows: 8,000 miles in 2017, 19,000 miles in 2018, 20,000 miles in 2019, and 15,000 miles in 2020. Determine Brent’s basis in the busin

> Jackson, a self-employed taxpayer, uses his automobile 90% for business and during 2021 drove a total of 14,000 business miles. Information regarding his car expenses is listed below. Business parking ………………………………………………………………………$ 140 Auto insurance ……………

> Jamie purchased $100,000 of new office furniture for her business in June of the current year. Jamie understands that if she elects to use ADS to compute her regular income tax, there will be no difference between the cost recovery for computing the regu

> Dennis Harding is considering acquiring a new automobile that he will use 100% for business. The purchase price of the automobile would be $64,500. If Dennis leased the car for five years, the lease payments would be $875 per month. Dennis will acquire t

> On May 28, 2021, Mary purchased and placed in service a new $60,000 car. The car was used 60% for business, 20% for production of income, and 20% for personal use in 2021. In 2022, the usage changed to 40% for business, 30% for production of income, and

> Jayden calculates his 2021 income tax by using both the Tax Tables and the Tax Rate Schedules. Because the Tax Rate Schedules yield a slightly lower tax liability, he plans to pay this amount. a. Why is there a difference? b. Is Jayden’s approach permiss

> Classify each of the following expenditures paid in 2021 as a deduction for AGI, a deduction from AGI, or not deductible: a. Barak contributes to his H.R. 10 plan (i.e., a retirement plan for a self-employed individual). b. Keith pays child support to hi

> What are the major differences between the collector characteristics of a BJT transistor and the drain characteristics of a JFET transistor? Compare the units of each axis and the controlling variable. How does IC react to increasing levels of IB versus

> a. Determine VDS for VGS = 0 V and ID = 6 mA using the characteristics of Fig. 6.11. b. Using the results of part (a), calculate the resistance of the JFET for the region ID = 0 to 6 mA for VGS = 0 V. c. Determine VDS for VGS = - 1 V and ID = 3 mA. d. Us

> Given k = 0.4 * 10-3 A>V2 and ID(on) = 3 mA with VGS(on) = 4 V, determine VT.

> Using an average value of 2.9 mA for the IDSS of the 2N3797 MOSFET of Fig. 6.31, determine the level of VGS that will result in a maximum drain current of 20 mA if VP = - 5 V.

> Given ID = 4 mA at VGS = - 2 V, determine IDSS if VP = - 5 V.

> Given ID = 14 mA and VGS = 1 V, determine VP if IDSS = 9.5 mA for a depletion-type MOSFET.

> Sketch the transfer and drain characteristics of an n-channel depletion-type MOSFET with IDSS = 12 mA and VP = - 8 V for a range of VGS = - VP to VGS = 1 V.

> Given a depletion-type MOSFET with IDSS = 6 mA and VP = - 3 V, determine the drain cur- rent at VGS = - 1, 0, 1, and 2 V. Compare the difference in current levels between - 1 V and 0 V with the difference between 1 V and 2 V. In the positive VGS region,

> A resistor RC = 470 Ω is added to the network of Fig. 5.181 along with a bypass capacitor CE = 5 mF across the emitter resistor. If bD = 4000, VBET = 1.6 V and ro1 = ro2 = 40 kΩ for a packaged Darlington amplifier: a. Find the dc levels of VB1, VE2, and

> For the common-gate configuration of Fig. 8.92: a. Determine AvNL, Zi, and Zo. b. Sketch the two-port model of Fig. 5.75 with the parameters determined in part (a) in place. c. Determine AvL and Avs. d. Change RL to 2.2 kΩ and calcula

> The input impedance to a common-emitter transistor amplifier is 1.2 kΩ with b = 140, ro = 50 kΩ, and RL = 2.7 kΩ. Determine: a. re. b. Ib if VI = 30 mV. c. Ic. d. Ai = Io>Ii = IL>Ib. e. Av = VO>VI.

> For the source-follower network of Fig. 8.91: a. Determine AvNL, Zi, and Zo. b. Sketch the two-port model of Fig. 5.75 with the parameters determined in part (a) in place. c. Determine AvL and Avs. d. Change RL to 4.7 kΩ and calculate

> For the self-bias JFET network of Fig. 8.90: a. Determine AvNL, Zi, and Zo. b. Sketch the two-port model of Fig. 5.75 with the parameters determined in part (a) in place. c. Determine AvL and Avs. d. Change Rsig to 10 kΩ and calculate

> a. Describe in your own words the operation of the network of Fig. 6.45 with Vi = 0 V. b. If the “on” MOSFET of Fig. 6.45 (with Vi = 0 V) has a drain current of 4 mA with VDS = 0.1 V, what is the approximate resistance level of the device? If ID = 0.5 mA

> For the common-base network of Fig. 5.176:

> For the network of Fig. 5.175:

> For the emitter-stabilized network of Fig. 5.174:

> Repeat Problem 6 using the universal JFET bias curve

> For the voltage-divider configuration of Fig. 5.173:

> For the network of Fig. 5.172:

> For the network of Fig. 5.171:

> Using the model of Fig. 5.16, determine the following for a common-emitter amplifier if b = 80, IE (dc) = 2 mA, and ro = 40 kΩ. a. Zi. b. Ib. c. Ai = Io>Ii = IL>IB if RL = 1.2 kΩ. d. Av if RL = 1.2 kΩ.

> a. What is the significant difference between the construction of an enhancement-type MOSFET and a depletion-type MOSFET? b. Sketch a p-channel enhancement-type MOSFET with the proper biasing applied (VDS 7 0 V, VGS 7 VT) and indicate the channel, the di

> For the fixed-bias configuration of Fig. 5.170: a. Determine AvNL, Zi, and Zo. b. Sketch the two-port model of Fig. 5.63 with the parameters determined in part (a) in place. c. Calculate the gain AvL = VO>VI. d. Determine the current gain AiL = Io>

> Repeat the analysis of problem 15 for the network of Fig. 9.83 with the addition of a source

> Repeat the analysis of problem 15 for the network of Fig. 9.82 with the addition of a source

> Repeat the analysis of problem 15 for the network of Fig. 9.81 with the addition of a source

> Repeat the analysis of problem 15 for the network of Fig. 9.80 with the addition of a source

> Repeat Problem 15 for the common-base configuration of Fig. 9.83. Keep in mind that the common-base configuration is a noninverting network when you consider the Miller effect.

> Repeat Problem 15 for the emitter-follower network of Fig. 9.82.

> Repeat Problem 15 for the emitter-stabilized network of Fig. 9.81.

> a. Compare the levels of stability for the fixed-bias configuration of Problem 65. b. Compare the levels of stability for the voltage-divider configuration of Problem 67. c. Which factors of parts (a) and (b) seem to have the most influence on the stabil

> For the common-base configuration of Fig. 5.18, an ac signal of 10 mV is applied, resulting in an ac emitter current of 0.5 mA. If a = 0.980, determine: a. Zi. b. Vo if RL = 1.2 kΩ. c. Av = VO>VI. d. Zo with ro = ∞ Ω. e. Ai = Io>Ii. f. Ib.