Question: United Continental Holdings, Inc., did not adopt

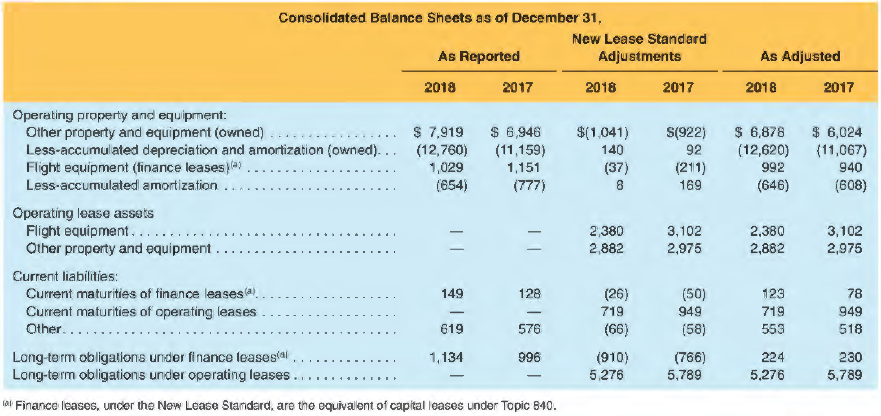

United Continental Holdings, Inc., did not adopt the new lease standard in 2018 but provides the following disclosure its 2018 10-K report($ millions).

The adoption of the New Lease Standard primarily resulted in the recording of assets and obligations of our operating leases on our consolidated balance sheets. Certain amounts recorded for prepaid and accrued rent associated with historical operating leases were reclassified to the newly captioned Operating lease assets in the consolidated balance sheets. Also, certain leases designated under Topic 840 as owned assets and capitalized finance leases will not be considered assets under the New Lease Standard and will be removed from the consolidated balance sheets, along with the related capital lease liability.

a. What is the amount United discloses that it would have capitalized for operating leases as right-of-use lease assets for the year ended December 31, 2018?

b. What is the amount of additional liability United discloses that it would have recorded for operating leases had United adopted the new lease standard in 2018?

c. What is the amount of asset under the new lease standard for finance leases? For the lease liability related to finance leases?

d. Why do you think the amount of operating leases is so much greater than finance leases?

e. United reported total assets of $44,792 million, total liabilities of $34,797 million, and total shareholders' equity of $9,995 million. Net income for the year was reported as $2,129 for the year and is essentially unchanged as a result of the new lease standard. Compute the reported return-on-assets and debt-to-equity ratios. Compute the ratios adjusted for the new lease standard, only taking into account the changes for operating leases (ignore all other changes).

> Regardless of whether premium or discount is involved. what generalization can be made about the change in the book value of bonds payable during the period in which they are outstanding?

> Identify at least two factors that limit the usefulness of ratio analysis.

> How is the operating cash flow to capital expenditures ratio calculated? Explain its use.

> How is the operating cash flow to current liabilities ratio calculated? Explain its use.

> What separate disclosures are required for a company that reports a statement of cash flows using the direct method?

> Rusk Company sold equipment for $5,100 cash that had cost $35,000 and had $29,000 of accumulated depreciation. How is this event reported in a statement of cash flows using the direct method?

> A firm reports $43,000 advertising expense in its income statement. If beginning and ending prepaid advertising are $6,000 and $7,600, respectively, what is the amount of cash paid for advertising?

> A firm reports $86,000 wages expense in its income statement. If beginning and ending wages payable are $3,900 and $2,800, respectively, what is the amount of cash paid to employees?

> A firm is converting its accrual revenues to corresponding cash amounts using the direct method. Sales on the income statement are $925,000. Beginning and ending accounts receivable on the balance sheet are $58,000 and $44,000, respectively. What is the

> Bai man Corporation commences operations at the beginning of January. It provides its services on credit and bills its customers $30,000 for January sales to be collected in February. Its employees also earn January wages of $12,000 that are not paid unt

> If a business had a net loss for the year, under what circumstances would the statement of cash flows show a positive net cash flow from operating activities?

> Dehning Corporation is an international manufacturer of films and industrial identification products. Included among its prepaid expenses is an account titled Prepaid Catalog Costs; in recent years, this account's size has ranged between $2.500.000 and $

> What is the purpose of a post-closing trial balance? Which of the following accounts should not appear in the post-closing trial balance: Cash; Unearned Revenue; Prepaid Rent; Depreciation Expense; Utilities Payable; Supplies Expense; and Retained Earnin

> What are the two major steps in the closing process?

> Which groups of accounts are closed at the end of the accounting year?

> The Bayou Company earns interest amounting to $360 per month on its investments. The company receives the interest every six months, on December 31 and June 30. Monthly financial statements are prepared. What adjusting entry should be made on January 3 I

> Globe Travel Agency pays an employee $475 in wages each Friday for the live-day workweek ending on that day. The last Friday of January falls on January 27. What adjusting entry should he made on January 31, the fiscal year-end?

> The publisher of l111ema1io11af View, a monthly magazine, received two-year subscriptions totaling $9,720 on January I. (a) What entry should be made to record the receipt of the $9,720? (b) What entry should be made at the end of January before financi

> At the beginning of January, the first month of the accounting year. the supplies account had a debit balance of $825. During January, purchases of $260 worth of supplies were debited to the account. Although only $630 of supplies were still available at

> On December 31, 2018, Miller Company had $700,000 in total assets and owed $220,000 to creditors. If this corporation's common stock totaled $300,000, what amount of retained earnings is reported on its December 3 1, 2018, balance sheet?

> Vista Company sold for $98,000 cash land originally costing $70,000. The company recorded a gain on the sale of $28,000. How is this event reported in a statement of cash flows using the indirect method?

> What are the two fundamental qualitative characteristics and the six enhancing qualitative characteristics of accounting information? Explain how each characteristic improves the quality of accounting disclosures.

> What are the objectives of financial accounting? Which of the financial statements satisfies each of these objectives?

> What is the primary function of the auditor? To what does the auditor attest in its opinion'!

> What are International Financial Reporting Standards (IFRS)? Why are IFRS needed? What potential issues can you see with requiring all public companies to prepare financial statements using IFRS?

> What are generally accepted accounting principles and what organization presently establishes them?

> Business decision makers external to the company increasingly demand more financial information on business activities of companies. Discuss the reasons why companies have traditionally opposed the efforts of regulatory agencies like the SEC to require m

> The current asset section of the 2017 and 2016 fiscal year end balance sheets of The Kroger Co. are presented in the accompanying table: In addition, Kroger provides the following footnote describing its inventory accounting policy (assume the following

> Caterpillar Inc., consists of two business units: the manufacturing company (parent corporation) and a wholly owned finance subsidiary. These two units are consolidated in Caterpillar's 2018 10-K report. Following is a supplemental disclosure that Caterp

> Columbia Company began operations in 20 19 and by year-end (December 31) had made six bond investments. Year-end information on these bond investment follows. REQUIRED a. At what total amount will the trading bond investments be reported in the December

> Vireo Manufacturing Corp. provided the following note in its annual report for the year ended January 31, 2011: On January 31, 2011, the Company elected to change its costing method for the material component of raw materials, work in process, and finish

> On January 1, 2016, Gem Company purchased for $392,000 cash a 70% stock interest in Alpine, Inc., which then had common stock of $420,000 and retained earnings of $ 140,000. Balance sheets of the two companies immediately after the acquisition were as fo

> Following is a portion of the investments footnote 8 from MetLife lnc.'s 2017 I 0-K report. Investment earnings are a crucial component of the financial performance of insurance companies such as MetLife, and investments comprise a large part of its asse

> The 2017 and 2018 statements of stockholders' equity for Alphabet Inc. are presented below along with portions on Notes LO and 12 relating to stockholders' equity and equity-based compensation. Note 10: Stockholders' Equity Convertible Preferred Stock Ou

> Following is the stockholders' equity section of the balance sheet for The Procter & Gamble Company along with selected earnings and dividend data. For simplicity, balances for non-controlling interests have been left out of income and shareholders'

> Following is the stockholders' equity of Dennis Corporation at December 31, 2018. The following transactions, among others, occurred during 201 9. Jan. 15 Issued 1,000 shares of preferred stock for $62 cash per share. Jan. 20 Issued 4,000 shares of commo

> The stockholders' equity of Verrecchia Company at December 31, 2018 follows. During 2019, the following transactions occurred. Jan. 5 Issued 10,000 shares of common stock for $ 12 cash per share. Jan. 18 Purchased 4,000 shares of common stock for the tre

> The stockholders' equity of Sougiannis Company at December 31, 2018, follows. The following transactions, among others, occurred during 20 I 9. Jan. 12 Announced a 3-for-l common stock split, reducing the par value of the common stock to $5 per share. Th

> The stockholders' equity section of Gupta Company at December 31, 2018, follows. During 2019, the following transactions occurred: Jan. 10 Issued 28,000 shares of common stock for $ 17 cash per share. Jan. 23 Purchased 8,000 shares of common stock for th

> Macy's, Inc., reported the following in its 2017 annual report: On December 22, 2017, H.R. 1 was enacted into law. This new tax legislation, among other things, reduced the U.S. federal corporate tax rate from 35% to 21% effective January 1, 2018. In app

> Carter Inc. began operations in 2019. The company reported $130,000 of depreciation expense on its 2019 income statement and $128,000 in 2020. Carter Inc. deducted $ 140,000 for depreciation on its tax return in 2019 and $122,000 in 2020. The company rep

> What is the definition of cash equivalents? Give three examples of cash equivalents.

> Lynch Company began operations in 2019. The company reported $24,000 of depreciation expense on its income statement in 2019 and $26,000 in 2020. On its tax returns, Lynch deducted $32,000 for depreciation in 2019 and $37,000 in 2020. The 2020 tax return

> Deere & Company reports the following tax information in its fiscal 2018 financial report. The provision for income taxes by taxing jurisdiction and by significant component consisted of the following in millions of dollars: REQUIRED a. What amount o

> Hoopes Corporation 's December 31, 2019, I 0-K report has the following disclosures related to its retirement plans. The following table provides a reconciliation of the changes in the pension plans' benefit obligations and fair value of assets over the

> Cisco Systems, Inc., reports the following in the Commitments and Contingencies note to their 10-K for the year ended July 2018. Purchase Commitments with Contract Manufacturers and Suppliers We purchase components from a variety of suppliers and use se

> American Airlines Group, Inc., provides the following disclosures in the notes to their 2018 financial statements (excerpted for brevity): Note 1: Basis of Presentation and Summary of Significant Accounting Policies ASU 2016-02: Leases (Topic 842) (the N

> BP operates off-shore oil drilling platforms including rigs in the Gulf of Mexico. In April 2010, explosions and a fire on the Deepwater Horizon rig led to the death of 11 crew members and a 200-million-gallon oil spill in the Gulf of Mexico. BP's 2010 a

> On December 31, 2018, Watts Corporation borrowed $950,000 on an 8%, 5-year mortgage note payable. The note is to be repaid with equal quarterly installments, beginning March 31, 20 19. REQUIRED a. Compute the amount of the quarterly installment payment.

> On December 3 l, 2018, Wasley Corporation borrowed $500,000 on a 10%, I 0-year mortgage note payable. The note is to be repaid with equal semiannual installments, beginning June 30, 2019. REQUIRED a. Compute the amount of the semiannual installment payme

> On April 30, 2019, Cheng, Inc., issued $250,000 of 6%, 15-year bonds for $206,770, yielding an effective interest rate of 8%. Semiannual interest is payable on October 31 and April 30 each year. The firm uses the effective interest method to amortize the

> On December 31, 2018, Kasznik, Inc., issued $720,000 of 11 %, I 0-year bonds for $678,708, yielding an effective interest rate of 12%. Semiannual interest is payable on June 30 and December 31 each year. The firm uses the effective interest method to amo

> Petroni, Inc., which closes its books on December 31, is authorized to issue $800,000 of 9%, 20 year bonds dated March I, 2019, with interest payments on September I and March I. REQUIRED Assuming that the bonds were sold at 100 plus accrued interest on

> CVS Health Corp. discloses the following footnote in its 10-K relating to its debt: Following is a summary of the Company's borrowings as reported in note 5 to the firm's 10-K / / CVS also discloses that its interest expense was $ 1.04 billion in 2017,

> Eskew, Inc., which closes its books on December 3 1, is authorized to issue $500,000 of 9%, 15- year bonds dated May I, 2018, with interest payments on November I and May I. REQUIRED Assuming that the bonds were sold at I 00 plus accrued interest on Octo

> The f0llowing information was extracted from the 10-K reports for the years ended in 2018 for Hewlett-Packard Enterprise and Cisco Systems, Inc. REQUIRED a. Compute the amount of warranty costs incurred in 2018 for each company. (That is, what amount was

> Note B from the fiscal 2010 I 0-K report of Williams-Sonoma, Inc., (February 3, 2019) follows. Its cash flow statement reported that the company made capital expenditures of $190. !02.000 during fiscal 2018, impaired assets of $9.639.000 and recorded dep

> The 2018and2017 income statements and balance sheets (asset section only) for Target Corporation follow, along with its footnote describing Target's accounting for property and equipment. Target's cash flow statement for fiscal 20 I 8 reported capital ex

> Aglent Technologies, Inc., the high-tech spin-off from Hewlett-Packard Company, reports the following operating profit for 2018 in its 10-K ($ millions): REQUIRED a. What percentage of its total net revenue is Agilent spending on research and development

> The following information was provided in the 2018 10-K of Hilton Worldwide Holdings, Inc. Note 7: Property and Equipment (S millions) Note 7 also revealed that depreciation expense on property and equipment totaled $54 million in 2018. The cash flow sta

> What four different types of adjustments are frequently necessary at the close of an accounting period? Give examples of each type.

> Refer to Exercise EA-5. How much interest will Robert Smith pay as part of his first monthly payment?

> Take-Two Interactive Software, Inc. (TTWO) is a developer, marketer, publisher, and distributor of video game software and content to be played on a variety of platforms. There is an increasing demand for the ability to play these games in an on line env

> In its income statement for the first quarter of fiscal year 2018, The Gap, Inc., reported net sales of $3,783 million and cost of goods sold and occupancy expenses of $2,356 million, resulting in a gross profit of $1,427 million. In its footnotes, The G

> Mattel, Inc. designs, manufactures, and markets a broad variety of toy products worldwide which are sold to its customers and directly to consumers. The company's brands include American Girl, Fisher-Price, Hot Wheels, and Barbie. The following informati

> Harris Corporation pays senior management an annual bonus from a bonus pool. The size of the bonus pool is determined as follows. REQUIRED a. Assume that senior management expects current earnings to be $21 million and next year's earnings to be $18 mill

> Philbrick Company signed a three-year contract to develop custom sales training materials and provide training to the employees of Elliot Company. The contract price is $1,200 per employee and the number of employees to be trained is 400. Philbrick can s

> The following information comes from recent DowDuPont Inc. income statements. REQUIRED a. Identify the components in its statement that you would consider operating. b. Identify those components that you would consider nonrecurring. c. Compute net operat

> Selected financial statement data for Best Buy Co., Inc., The Kroger Co .. Nordstrom, Inc., Office Depot, Inc., and Walgreens Boots Alliance, Inc. is presented in the following table: REQUIRED a. Compute return on assets (ROA), profit margin (PM), and as

> Selected income statement data for Abbott Laboratories, Bristol-Myers Squibb Company. Johnson & Johnson. GlaxoSmithKline pie. and Pfizer, Inc. is presented in the following table: REQUIRED a. Compute the profit margin (PM) and gross profit margin (GP

> Refer to the financial statements of United Parcel Service in P5-4 l to answer the following requirements. The following assumptions should be useful: UPS's sales forecast for 2018 is $70,000 million. • Operating expenses and operating profits increase i

> Balance sheet information for Lang Services at the end of 2018 and 2017 is: a. Prepare its balance sheet for December 31 of each year. b. Lang Services raised $5,000 cash through issuing additional common stock early in 2018, and it declared and paid a $

> Refer to the financial statements of United Parcel Service in PS-4 1 to answer the following requirements. REQUIRED a. Compute net operating profit after taxes (NOPAT) for 2017 and net operating assets (NOA) for 2017 and 2016. Assume a tax rate of 35%. b

> Refer to the financial information of United Parcel Service in PS-41 to answer the following requirements. REQUIRED a. Compute its current ratio and quick ratio for 2017 and 2016. Comment on any observed trends. b. Compute its times interest earned and i

> Balance sheets and income statements for United Parcel Service, Inc., (UPS) follow. Refer to these financial statements to answer the following requirements. REQUIRED a. Compute ROA and disaggregate it into profit margin (PM) and asset turnover (AT) for

> Refer to the financial statements of Home Depot and Lowe's presented in PS-38. REQUIRED a. Compute each company's net operating profit after taxes (NOPAT) for 2017 and net operating assets (NOA) for 201 7 and 2016. Classify other assets and other liabili

> Refer to the financial statements of Home Depot and Lowe's presented in PS-38. REQUIRED a. Compute each company's current ratio and quick ratio for each year. Comment on any changes that you observe. b. Compute each company's times interest earned ratio

> Balance sheets and income statements for The Home Depot, Inc., and Lowe's Companies, Inc., follow. Refer to these financial statements to answer the requirements. REQUIRED a. Compute return on equity (ROE) return on assets (ROA), and return on financial

> Refer to the financial statements of Nike and Adidas presented in PS-36. REQUIRED a. Compute each company's current ratio and quick ratio for each year. Comment on any changes that you observe. b. Compute each company's times interest earned ratio and de

> Balance sheets and income statements for Nike, Inc., and Adidas Group follow. Refer to these financial statements to answer the requirements. REQUIRED a. Compute return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for

> Why is the adjusting step of the accounting cycle necessary?

> The 201 7 cash flow statement for Apple Inc. is presented below (all $ amounts in millions): REQUIRED a. Did Apple's accounts receivable go up or down in 2017? Apple reported net sales of $229,234 in its fiscal 2017 income statement. What amount of cash

> Refer to the data for Rainbow Company in Problem 4-52. REQUIRED a. Compute the change in cash that occurred in 2018. b. Prepare a 201 8 statement of cash flows using the di rect method. Use one cash outflow for "cash paid for wages and other operating ex

> Rainbow Company's income statement and comparative balance sheets follow. During 2018, the following transactions and events occurred: I. Sold long-term investments costing $57,000 for $60,000 cash. 2. Purchased land for cash. 3. Capitalized an expenditu

> For this question, refer to the information in Exhibits 4.1 and 4.7. a. Based on the information presented in its statement of cash flows, what amount of revenues should CVS Health report in its 2017 income statement? b. CVS Health reported retained earn

> Dair Company's income statement and comparative balance sheets follow. During 2018, the company sold for $17,000 cash old equipment that had cost $36,000 and had $19,000 accumulated depreciation. Also in 2018, new equipment worth $60,000 was acquired in

> Refer to the income statement and comparative balance sheets for Arctic Company presented in P4-48. REQUIRED a. Compute Arctic Company's cash flow from operating activities using the direct method. Use the format illustrated in Exhibit 4.5 in the chapter

> Arctic Company's income statement and comparative balance sheets follow. During 2018, Arctic sold land for $70,000 cash that had originally cost $45,000. Arctic also purchased equipment for cash, acquired treasury stock for cash, and issued bonds payable

> Refer to the income statement and comparative balance sheets for Wolff Company presented in P4-46. REQUIRED a. Compute Wolff Company's cash flow from operating activities using the direct method. Use the format illustrated in Exhibit 4.5 in the chapter.

> Wolff Company's income statement and comparative balance sheets follow. Cash dividends of $29,000 were declared and paid during 2018. Also in 2018, plant assets were purchased for cash, and bonds payable were issued for cash. Bond interest is paid semian

> Petroni Company reports the following selected results for its calendar year 2018. REQUIRED Prepare the operating section only of Petroni Company's statement of cash flows for 2018 under the indirect method of reporting.

> Match each item in the left column with the correct description in the right column.

> Rhoades Tax Services began business on December I, 2018. Its December transactions are as follows. Dec. I Rhoades invested $20,000 in the business in exchange for common stock. 2 Paid $1,200 cash for December rent to Bomba Realty. 2 Purchased $1,080 of s

> Fischer Card Shop is a small retail shop. Fischer's balance sheet at year-end 2018 is as follows. The following information details transactions and adjustments that occurred during 2019. 1. Sales total $ 145,850 in 2019; all sales were cash sales. 2. In

> The following selected accounts appear in Zimmerman Company's unadjusted trial balance at December 31 , 2018, the end of its fiscal year (all accounts have normal balances). Additional information is as follows. 1. On September I, 20 18, the company ente

> The following adjusted trial balance is for Mayflower Moving Service at December 31, 2018. REQUIRED a. Prepare closing entries in journal entry form. b. After its closing entries are posted, what is the post-closing balance for the Retained Earnings acco

> Trails, Inc., publishes magazines for skiers and hikers. The company's adjusted trial balance for the year ending December 31, 2018, is: REQUIRED a. Prepare its income statement and statement of stockholders' equity for 2018, and its balance sheet at Dec

> Wheel Place Company began operations on March I, 2019, to provide automotive wheel alignment and balancing services. On March 3 1, 20 I 9, the unadjusted balances of the firm's accounts are as follows. The following information is available. 1. The balan

> The following adjusted trial balance is for Wilson Company at December 31, 2018. REQUIRED a. Prepare closing entries in journal entry form. b. After the firm's closing entries are posted, what is the post-closing balance for the Retained Earnings account

> The following adjusted trial balance is for Trueman Consulting Inc. at December 31, 2018. The company had no stock issuances or repurchases during 2018. REQUIRED a. Prepare its income statement and statement of stockholders' equity for 2018 and its balan