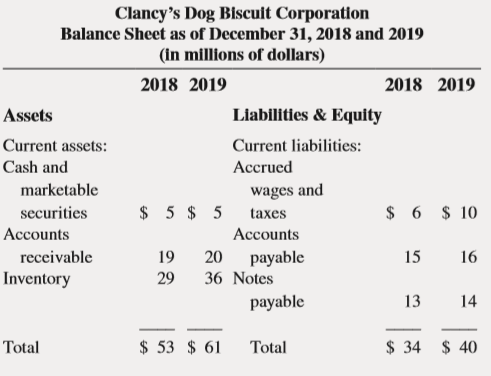

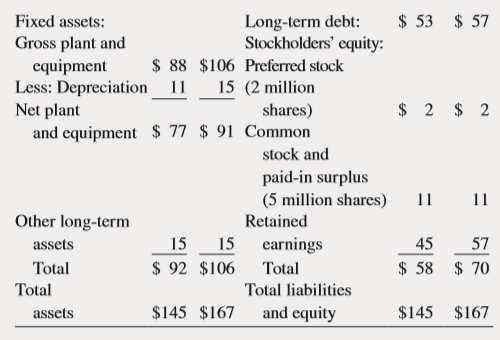

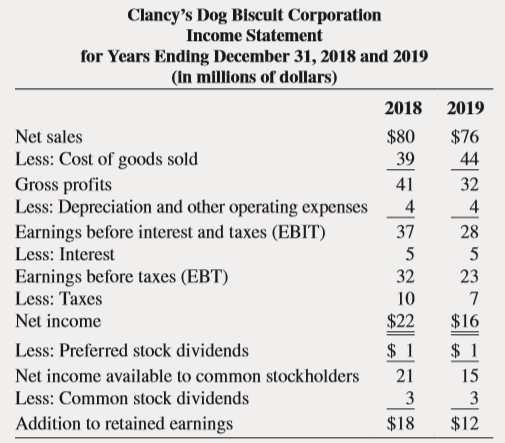

Question: Use the balance sheet and income statement

Use the balance sheet and income statement below to construct a statement of cash flows for 2019 for Clancy’s Dog Biscuit Corp.

Transcribed Image Text:

Clancy's Dog Biscuit Corporation Balance Sheet as of December 31, 2018 and 2019 (In millions of dollars) 2018 2019 2018 2019 Assets Liabilities & Equity Current assets: Current liabilities: Cash and Accrued marketable wages and securities $ 5 $ 5 taxes $ 6 $ 10 Accounts Accounts receivable 19 20 рayable 15 16 Inventory 29 36 Notes раyable 13 14 Total $ 53 $ 61 Total $ 34 $ 40 $ 53 $ 57 Long-term debt: Stockholders' equity: $ 88 $106 Preferred stock 15 (2 million Fixed assets: Gross plant and equipment Less: Depreciation_ 11 Net plant and equipment $ 77 $ 91 Common shares) $ 2 $ 2 stock and paid-in surplus (5 million shares) 11 11 Other long-term Retained assets 15 15 earnings 45 57 Total $ 92 $106 Total $ 58 $ 70 Total Total liabilities assets $145 $167 and equity $145 $167 Clancy's Dog Biscuit Corporation Income Statement for Years Ending December 31, 2018 and 2019 (In millions of dollars) 2018 2019 Net sales $80 $76 Less: Cost of goods sold Gross profits Less: Depreciation and other operating expenses Earnings before interest and taxes (EBIT) Less: Interest 39 44 41 32 4 4 37 28 5 Earnings before taxes (EBT) 32 23 Less: Taxes 10 7 Net income $22 $16 Less: Preferred stock dividends $ 1 $ 1 Net income available to common stockholders 21 15 Less: Common stock dividends 3 3 Addition to retained earnings $18 $12

> 1. Evidence suggests that globalization can help developing nations boost incomes for their poorest citizens in what part of the debate over inequality? 2. In the debate over inequality between nations, evidence suggests that developing nations that are

> Research Project. Imagine that you and several of your classmates own a company that manufactures cheap sunglasses. To lower production costs, you choose to move your factory from your developed country to a more cost-effective nation. 1. What elements

> 1. The national competitive advantage theory states that a nation’s competitiveness in an industry depends on the capacity of the industry to do what? 2. The four main components of the Porter diamond are: (1) factor conditions, (2) demand conditions,

> 1. What is the main thrust of new trade theory? 2. The economic and strategic advantage gained by being the first company to enter an industry is called what?

> 1. The international product life cycle theory says that a company will begin by exporting its product and later undertake “what” as the product moves through its life cycle? 2. List the three stages that a product goes through according to the internati

> You are executive director of Qualitative Research Consultants Association (QRCA), an organization designed to assist market research practitioners. As part of their membership agreement, QRCA members agree to abide by a nine-point code of ethics that fo

> You are the CEO of a major U.S. apparel company that contracts work to garment manufacturers abroad. Employees of the contractors report 20-hour workdays, pay lower than the minimum wage, overcrowded living conditions, physically abusive supervisors, and

> The financial statements for THE Bank are shown below: a. Calculate THE Bank’s earning assets. b. Calculate THE Bank’s ROA. c. Calculate THE Bank’s total operating income. d. Calculate THE Bank&aci

> National Bank has the following balance sheet (in millions) and has no off-balance-sheet activities. a. What is the CET1 risk-based ratio? b. What is the Tier I risk-based capital ratio? c. What is the total risk–based capital ratio?

> A bank has a balance sheet as shown below. At the beginning of the month, the bank has $15,141,000 in its loan portfolio and $183,000 in the allowance for loan losses. During the month, management estimates that an additional $5,200 of loans will not be

> The financial statements for BSW National Bank (BSWNB) are shown below: Income Statement BSW National Bank Interest income ………………&ac

> The financial statements for First National Bank (FNB) are shown below: a. Calculate the dollar value of FNB’s earning assets. b. Calculate FNB’s ROA. c. Calculate FNB’s asset utilization ratio. d

> Two depository institutions have composite CAMELS ratings of 1 or 2 and are “well capitalized.” Thus, each institution falls into the FDIC Risk Category I deposit insurance assessment scheme. Institution A has average

> A bank is considering two securities: a 30-year Treasury bond yielding 7 percent and a 30-year municipal bond yielding 5 percent. If the bank’s tax rate is 30 percent, which bond offers the higher tax equivalent yield?

> Consider a GNMA mortgage pool with principal of $20 million. The maturity is 30 years with a monthly mortgage payment of 10 percent per year. Assume no prepayments. a. What is the monthly mortgage payment (100 percent amortizing) on the pool of mortgages

> What is the impact on GNMA pricing if a pass-through is not fully amortized? What is the present value of a $10 million pool of 15-year mortgages with an 8.5 percent per year monthly mortgage coupon if market rates are 5 percent? The GNMA guarantee fee

> Consider $100 million of 30-year mortgages with a coupon of 5 percent per year paid quarterly. a. What is the quarterly mortgage payment? b. What are the interest and principal repayments over the first year of life of the mortgages? c. Construct a 30-ye

> Tree Row Bank has assets of $150 million, liabilities of $135 million, and equity of $15 million. The asset duration is six years and the duration of the liabilities is four years. Market interest rates are 10 percent. Tree Row Bank wishes to hedge the b

> Consider $200 million of 30-year mortgages with a coupon of 10 percent paid quarterly. a. What is the quarterly mortgage payment? b. What are the interest repayments over the first year of life of the mortgages? What are the principal repayments? c. Cons

> An FI is planning to issue $100 million in commercial loans. It will finance all of it by issuing demand deposits. a. What is the minimum capital required if there are no reserve requirements? b. What is the minimum demand deposits it needs to attract in

> An FI is planning the purchase of a $5 million loan to raise the existing average duration of its assets from 3.5 years to 5 years. It currently has total assets worth $20 million, $5 million in cash (0 duration), and $15 million in loans. All the loans

> City Bank has made a 10-year, $2 million loan that pays annual interest of 10 percent per year. The principal is expected at maturity. a. What should it expect to receive from the sale of this loan if the current market rate on loans is 12 percent? b. Th

> A bank has made a three-year, $10 million loan that pays annual interest of 8 percent. The principal is due at the end of the third year. a. The bank is willing to sell this loan with recourse at an 8.5 percent discount rate. What should it receive for t

> Use the data provided for Gotbucks Bank Inc. to answer this question. Notes to the balance sheet: Currently, the fed funds rate is 8.5Â percent. Variable-rate loans are priced at 4Â percent over LIBOR (currently at 11Â

> Consider the following. a. Calculate the leverage-adjusted duration gap of an FI that has assets of $1 million invested in 30-year, 10 percent semiannual coupon Treasury bonds selling at par and whose duration has been estimated at 9.94 years. It has lia

> Consider the following. a. What is the duration of a two-year bond that pays an annual coupon of 10 percent and whose current yield to maturity is 14 percent? Use $1,000 as the face value. b. What is the expected change in the price of the bond if intere

> Use the following information about a hypothetical government security dealer named J.P. Groman. (Market yields are in parentheses; amounts are in millions.) a. What is the re pricing or funding gap if the planning period is 30 days? 91 days? 2 years?

> A bank has the following balance sheet: Suppose interest rates rise such that the average yield on rate-sensitive assets increases by 45 basis points and the average yield on rate-sensitive liabilities increases by 35Â basis points. a. Calcu

> Hedge Row Bank has the following balance sheet (in millions): The duration of the assets is six years and the duration of the liabilities is four years. The bank is expecting interest rates to fall from 10 percent to 9 percent over the next year. a. Wh

> Consider the following balance sheet for Watchovia Bank (in millions): a. What is Watchovia’s expected net interest income at year-end? b. What will net interest income be at year-end if interest rates rise by 2Â&nbs

> Consider the following balance sheet for Watch over Savings Inc. (in millions): a. What is Watch over’s expected net interest income at year-end? b. What will be the net interest income at year-end if interest rates rise b

> Consider the following balance sheet positions for a financial institution: (LG 22-1) Rate-sensitive assets = $200 million; Rate-sensitive liabilities = $100 million. Rate-sensitive assets = $100 million; Rate-sensitive liabilities = $150 million. Rate-s

> Two banks are being examined by regulators to determine the interest rate sensitivity of their balance sheets. Bank A has assets composed solely of a 10-year $1 million loan with a coupon rate and yield of 12 percent. The loan is financed with a 10-year,

> Use the following balance sheet information to answer this question. a. What is the average duration of all the assets? b. What is the average duration of all the liabilities? c. What is the FI’s leverage-adjusted duration gap? What i

> An insurance company issued a $90 million one-year, zero coupon note at 8 percent add-on annual interest (paying one coupon at the end of the year) and used the proceeds plus $10 million in equity to fund a $100 million face value, two-year commercial lo

> Calculate the re pricing gap and impact on net interest income of a 1 percent increase in interest rates for the following positions: a. Rate-sensitive assets = $100 million; Rate-sensitive liabilities = $50 million. b. Rate-sensitive assets = $50 millio

> An investment fund has $1 million in cash and $9 million invested in securities. It currently has 1 million shares outstanding. a. What is the NAV of this fund? b. Assume that some of the shareholders decide to cash in their shares of the fund. How many

> An investment fund has the following assets in its portfolio: $40 million in fixed-income securities and $40 million in stocks at current market values. In the event of a liquidity crisis, it can sell its assets at a 96 percent discount if they are dispo

> A DI has $10 million in T-bills, a $5 million line of credit to borrow in the repo market, and $5 million in excess cash reserves (above reserve requirements) with the Fed. The DI currently has borrowed $6 million in fed funds and $2 million from the Fed

> An FI holds a 15-year, $10,000,000 par value bond that is priced at 104 and yields 7 percent. The FI plans to sell the bond but for tax purposes must wait two months. The bond has a duration of 9.4 years. The FI’s market analyst is predicting that the Fe

> A DI has assets of $10 million consisting of $1 million in cash and $9 million in loans. It has core deposits of $6 million. It also has $2 million in subordinated debt and $2 million in equity. Increases in interest rates are expected to result in a net

> Consider the balance sheet for the DI listed below: The DI is expecting a $15 million net deposit drain. Show the DI’s balance sheet under these two conditions: a. The DI purchases liabilities to offset this expected drain

> Banc Two has the following balance sheet (in millions of dollars): Calculate the NSFR for BancTwo. Assets Liabilities and Equity Cash $ 20 Stable retail deposits $ 190 Less stable retail Deposits at the Fed deposits CDs maturing in 6 145 months 30

> First Bank has the following balance sheet (in millions of dollars): Calculate the NSFR for FirstBank. Assets Liabilities and Equity $ 12 Stable retail deposits $ 55 19 Less stable retail deposits Cash Deposits at the Fed 20 Unsecured wholesale Tre

> Walls Farther Bank has the following balance sheet (in millions of dollars): Cash inflows over the next 30 days from the FI’s performing assets are $5.5 million. Calculate the LCR for Walls Farther Bank. Assets Liabili

> Central Bank has the following balance sheet (in millions of dollars): Cash inflows over the next 30 days from the FI’s performing assets are $7.5 million. Calculate the LCR for Central Bank. Ássets Liabilities and Equity Cash $ 1

> The All Star Bank has the following balance sheet: Its largest customer decides to exercise a $15 million loan commitment. Show how the new balance sheet changes if All Star uses (a) stored liquidity management or (b) purchased liquidity management.

> Calculate the following ratios for Lake of Egypt Marina Inc. as of year-end 2019. Using these ratios for Lake of Egypt Marina Inc. and the industry, what can you conclude about Lake of Egypt Marina’s financial performance for 2019? (R

> Harper Outdoor Furniture Inc. has net cash flows from operating activities for the last year of $340 million. The income statement shows that net income is $315 million and depreciation expense is $46 million. During the year, the change in inventory on

> Answer the following. a. What is the duration of a 20-year 8 percent coupon (paid semiannually) Treasury bond (deliverable against the Treasury bond futures contract) selling at par? b. What is the predicted impact on the Treasury bond price based on its

> Suppose you are a loan officer at Carbondale Local Bank. Joan Doe listed the following information on her mortgage application: Characteristic ……………&acir

> A bank has two loans of equal size outstanding, A and B, and the bank has identified the returns they would earn in two different states of nature, 1 and 2, representing default and no default, respectively. If the probability of state 1 is 0.2 and the

> An FI is planning to give a loan of $5,000,000 to a firm in the steel industry. It expects to charge an up-front fee of 0.10 percent and a service fee of 5 basis points. The loan has a maturity of 8 years. The cost of funds (and the RAROC benchmark) for

> The following is ABC Inc.’s balance sheet (in thousands): Also, sales equal $500, cost of goods sold equals $360, interest payments equal $62, taxes equal $56, and net income equals $22. The beginning retained earnings is $0, the mark

> Suppose you purchase a 10-year AAA-rated Swiss bond for par that is paying an annual coupon of 8 percent and has a face value of 1,000 Swiss francs (SF). The spot rate is US$0.66667 for SF1. At the end of the year, the bond is downgraded to AA and the yi

> Six months ago, Quality bank issued a $100 million, one year-maturity CD, denominated in British pounds (Euro CD). On the same date, $60 million was invested in a £-denominated loan and $40 million in a U.S. Treasury bill. The exchange rate on this date

> Assume that a bank has assets located in Germany worth €150 million earning an average of 8 percent. It also holds €100 in liabilities and pays an average of 6 percent per year. The current spot rate is €1.50 for $1. If the exchange rate at the end of th

> If a bank invested $50 million in a two-year asset paying 10 percent interest per year and simultaneously issued a $50 million one-year liability paying 8 percent interest per year, what would be the impact on the bank’s net interest income if, at the en

> Consider the following income statement for Watch over U Savings Inc. (in millions): a. What is Watch over U’s expected net interest income at year-end? b. What will be the net interest income at year-end if interest rates rise by 2&A

> A financial institution has the following market value balance sheet structure: a. The bond has a 10-year maturity, a fixed-rate coupon of 10Â percent paid at the end of each year, and a par value of $10,000. The certificate of deposit has a

> Bank 1 can issue five-year CDs at an annual rate of 11 percent fixed or at a variable rate of LIBOR + 2 percent. Bank 2 can issue five-year CDs at an annual fixed rate of 13 percent or at a variable rate of LIBOR + 3 percent. a. Is a mutually beneficial

> Your company sponsors a 401(k) plan into which you deposit 10 percent of your $120,000 annual income. Your company matches 75 percent of the first 10 percent of your earnings. You expect the fund to yield 12 percent next year. If you are currently in the

> Using the information in Problem 7, and assuming all variables remain constant over the next 25 years, what will your 401(k) fund value be in 25 years (when you expect to retire)? Data from Problem 7: Your company sponsors a 401(k) plan into which you

> Your company sponsors a 401(k) plan into which you deposit 12 percent of your $60,000 annual income. Your company matches 50 percent of the first 5 percent of your earnings. You expect the fund to yield 10 percent next year. If you are currently in the 3

> An employer uses a final pay formula to determine retirement payouts to its employees. The annual payout is 3 percent of the average salary over the employees’ last three years of service times the total years employed. Calculate the annual benefit under

> An employee with 25 years of service at a company is considering retirement at some time in the next 10 years. The employer uses a final pay benefit formula by which the employee receives an annual benefit payment of 3.5 percent of her average salary dur

> An employer uses a career average formula to determine retirement payments to its employees. The annual retirement payout is 5 percent of an employee’s career average salary times the number of years of service. Calculate the annual benefit payment under

> An employee contributes $15,000 to a 401(k) plan each year, and the company matches 10Â percent of this annually, or $1,500. The employee can allocate the contributions among equities (earning 12Â percent annually), bonds (earning 5

> Using the information in Problem 9, and assuming all variables remain constant over the next 15 years, what will your 401(k) fund value be in 15 years (when you expect to retire)? Data from Problem 9: Your company sponsors a 401(k) plan into which you

> What is a mutual fund? In what sense is it a financial institution?

> How do credit unions differ from savings institutions?

> How has the savings institution industry performed over the last several decades?

> What regulatory agencies oversee deposit insurance services to savings institutions?

> If we examine a typical bank’s asset portion of the balance sheet, how are the assets arranged in terms of expected return and liquidity?

> Classify the following accounts into one of the following categories: a. Assets b. Liabilities c. Equity d. Revenue e. Expense f. Off-balance-sheet activities (1) Service fees charged on deposit accounts (2) Retail CDs (3) Surplus and paid-in capital (4)

> How do loan sales and securitization help an FI manage its interest rate and liquidity risk exposures?

> Your employer uses a flat benefit formula to determine retirement payments to its employees. The fund pays an annual benefit of $2,500 per year of service. Calculate your annual benefit payments for 25, 28, and 30 years of service.

> Consider Table 23–3 again. a. What happens to the price of a call when: (1) The exercise price increases? (2) The time until expiration increases? b. What happens to the price of the put when these two variables increase? Table 23&acir

> Consider Table 23–3. What are the prices paid for the following futures options: a. December U.S. Treasury-bond calls at 17400. b. December 5-year Treasury puts at 12125. c. December Eurodollar calls at 9887. Table 23–

> In each of the following cases, indicate whether it would be appropriate for an FI to buy or sell a forward contract to hedge the appropriate risk. a. A commercial bank plans to issue CDs in three months. b. An insurance company plans to buy bonds in two

> Give two reasons why credit swaps have been the fastest growing form of swaps in recent years.

> Match these three types of cash balances with the functions that they serve: a. Vault cash b. Deposits at the Federal Reserve c. Deposits at other FIs (1) Used to meet legal reserve requirements (2) Used to purchase services (3) Used to meet customer wit

> Distinguish between a swap seller and a swap buyer.

> Suppose that a pension fund manager anticipates the purchase of a 20-year, 8 percent coupon T-bond at the end of two years. Interest rates are assumed to change only once every year at year end. At that time, it is equally probable that interest rates wi

> Why can insolvency risk be classified as a consequence or outcome of any or all of the other types of risks?

> How is asset-side liquidity risk likely to be related to liability-side liquidity risk?

> Bank 1, with $130 million in assets and $20 million in costs, acquires Bank 2, which has $50 million in assets and $10 million in costs. After the acquisition, the bank has $180 million in assets and $35 million in costs. Did this acquisition produce eco

> Suppose an individual invests $10,000 in a load mutual fund for two years. The load fee entails an up-front commission charge of 4 percent of the amount invested and is deducted from the original funds invested. In addition, annual fund operating expense

> A British bank issues a $100 million, three-year Eurodollar CD at a fixed annual rate of 7 percent. The proceeds of the CD are lent to a British company for three years at a fixed rate of 9 percent. The spot exchange rate of pounds for U.S. dollars is £1

> Why would a DI be forced to sell assets at fire-sale prices?

> What has been the fastest-growing area of asset business for finance companies?

> Webb Bank has a composite CAMELS rating of 2, a total risk–based capital ratio of 10.2 percent, a Tier I risk-based capital ratio of 7.2 percent, a CET1 capital ratio of 6.4 percent, and a leverage ratio of 4.8 percent. Assuming the DIF reserve ratio is

> How does the degree of liquidity risk differ for different types of financial institutions?

> How does loan portfolio risk differ from individual loan risk?

> What does it mean when a bank has a CAMELS rating of 2? Of 4?

> What are compensating balances? What is the relationship between the amount of compensating balance requirement and the return on the loan to the FI?

> Why could a lender’s expected return be lower when the risk premium is increased on a loan?

> What components are used in the calculation of credit risk– adjusted assets?

> If a bank’s asset utilization ratio increases, what will happen to its return on equity, all else constant?

> Suppose an individual invests $20,000 in a load mutual fund for two years. The load fee entails an up-front commission charge of 2.5 percent of the amount invested and is deducted from the original funds invested. In addition, annual fund operating expen