Question: Use the data given in S8-12.

Use the data given in S8-12. On May 21, 2017, Hilton Company sold its investment in Microscape Co. stock for $30 per share. 1. Journalize the sale. No explanation is required. 2. How does the gain or loss that you recorded here differ from the gain or loss that was recorded at December 31, 2016?

From S8-12

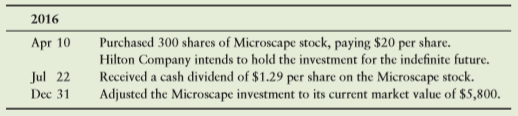

Hilton Company completed these long-term available-for-sale investment transactions during 2016:

Transcribed Image Text:

2016 Purchased 300 shares of Microscape stock, paying $20 per share. Hilton Company intends to hold the investment for the indefinite future. Received a cash dividend of $1.29 per share on the Microscape stock. Adjusted the Microscape investment to its current market value of $5,800. Apr 10 Jul 22 Dec 31

> In a bank reconciliation, an EFT cash payment is a. deducted from the bank balance. b. deducted from the book balance. c. added to the book balance. d. added to the bank balance.

> In a bank reconciliation, an outstanding check is a. added to the bank balance. b. deducted from the book balance. c. deducted from the bank balance. d. added to the book balance.

> All of the following are controls for cash received over the counter except a. a printed receipt must be given to the customer. b. the customer should be able to see the amounts entered into the cash register. c. the sales clerk must have access to th

> Requiring that an employee with no access to cash do the accounting is an example of which characteristic of internal control? a. Competent and reliable personnel b. Monitoring of controls c. Assignment of responsibility d. Separation of duties

> All of the following are internal control procedures except a. Sarbanes-Oxley reforms. b. adequate records. c. assignment of responsibilities. d. internal and external audits.

> All of the following are objectives of internal control except a. to comply with legal requirements. b. to ensure accurate and reliable accounting records. c. to maximize net income. d. to safeguard assets.

> Upon graduation from Texas State Technical College in Waco, Texas, your neighbor John Abel immediately accepted a position as an electrician’s assistant for a large electrical repair company in Austin, Texas. After three years of hard work, John received

> Tidy Car, Inc., provides mobile detailing to its customers. The Income Statement for the month ended January 31, 2016, the Balance Sheet for December 31, 2015, and details of postings to the Cash account in the general ledger for the month of January 201

> The accounts of United Digital Services Company prior to the year-end adjustments follow: Adjusting data at the end of the year include the following: a. Unearned service revenue that has been earned, $1,650 b. Accrued service revenue, $32,200 c. Su

> Satterfield Corporation reported the following current accounts at December 31, 2016 (amounts in thousands): During January 2017, Satterfield completed these selected transactions: â– Sold services on account, $9,000 â–&nb

> Refer to Exercise 2-39 of Chapter 2. Start from the trial balance and the posted T-accounts that Barbara Miracle, Certified Public Accountant, Professional Corporation (P.C.), prepared for her accounting practice at August 18. A professional corporation

> Barbara Miracle, Certified Public Accountant, operates as a professional corporation (P.C.). The business completed these transactions during the first part of August 2016: Requirements 1. Journalize the transactions for

> Use the data in S6A-1 to do the following for Wexton Technologies. Requirements 1. Post to the Inventory and Cost of Goods Sold accounts. 2. Compute cost of goods sold by the cost-of-goods-sold model. 3. Prepare the income statement of Wexton Techno

> Wexton Technologies began the year with inventory of $560. During the year, Wexton purchased inventory costing $1,160 and sold goods for $2,600, with all transactions on account. Wexton ended the year with inventory of $640. Journalize all the necessary

> Superior Drive-Ins Ltd. borrowed money by issuing $1,000,000 of 7% bonds payable at 96.5 on July 1, 2016. The bonds are 10-year bonds and pay interest each January 1 and July 1. 1. How much cash did Superior receive when it issued the bonds payable? Jou

> McQueen Corp. issued 7.5% seven-year bonds payable with a face amount of $90,000 when the market interest rate was 7.5%. Assume that the accounting year of McQueen ends on December 31 and that bonds pay interest on January 1 and July 1. Journalize the fo

> Determine whether the following bonds payable will be issued at par value, at a premium, or at a discount: a. Typecast Corporation issued 5% bonds when the market interest rate was 5%. b. Eugene Company issued bonds payable that pay stated interest of

> Read each statement below, indicate if it is true or false, and give a brief explanation of your answer. 1. When a bond is sold at a discount, the cash received is less than the present value of the future cash flows from the bond, based on the market r

> Hamm Cycles, Inc., the motorcycle manufacturer, included the following note in its annual report: 1. Why are these contingent (versus real) liabilities? 2. In the United States, how can the contingent liability become a real liability for Hamm Cycles,

> Refer to the data given in S9-3. What amount of warranty expense will Barnstormers USA report during 2016? Which accounting principle addresses this situation? Does the warranty expense for the year equal the year’s cash payments for warranties? Explain

> Barnstormers USA guarantees tires against defects for five years or 60,000 miles, whichever comes first. Suppose Barnstormers USA can expect warranty costs during the five-year period to add up to 7% of sales. Assume that a Barnstormers USA dealer in St. Pa

> Wango Sales, Inc.’s, comparative income statements and balance sheets show the following selected information for 2015 and 2016: Requirements 1. Calculate the company’s accounts payable turnover and daysâ€

> LuxAll, Inc., includes the following selected accounts in its general ledger at December 31, 2016: Prepare the liabilities section of LuxAll, Inc.’s, balance sheet at December 31, 2016, to show how the company would report these items

> Complete the following statements with one of the terms listed here. Capital lease Overfunded Underfunded Lessee Pension Operating lease Lessor Liability 1. A(n) is an agreement that does not transfer the risks or rewards of asset o

> Jalbert Plumbing Products Ltd. reported the following data in 2016 (in millions): Compute Jalbert’s leverage ratio, debt ratio, and times-interest-earned ratio, and write a sentence to explain what those ratio values mean. Use year-en

> Nautical Marina needs to raise $1.0 million to expand the company. Nautical Marina is considering the issuance of either ■ $1,000,000 of 8% bonds payable to borrow the money, or ■ 100,000 shares of common stock at $10 per share. Before any new financin

> Examine the following selected financial information for Best Buy Co., Inc., and Walmart Stores, Inc., as of the end of their fiscal years ending in 2015: 1. Complete the table, calculating all the requested information fo

> Use the amortization table that you prepared for Jackson Corporation’s bonds in S9-13 to answer the following questions: 1. How much cash did Jackson Corporation borrow on January 1, 2016? How much cash will Jackson Corporation pay back at maturity? 2.

> Jackson Corporation issued $600,000 of 6%, 10-year bonds payable on January 1, 2016. The market interest rate at the date of issuance was 4%, and the Jackson Corporation bonds pay interest semiannually. Jackson Corporation’s year-end is June 30. 1. Usin

> Use the amortization table that you prepared for Hartley Corporation’s bonds in S9-11 to answer the following questions: 1. How much cash did Hartley Corporation borrow on March 31, 2016? How much cash will Hartley Corporation pay back at maturity on Ma

> Hartley Corporation issued $520,000 of 5%, 12-year bonds payable on March 31, 2016. The market interest rate at the date of issuance was 8%, and the Hartley Corporation bonds pay interest semiannually. Hartley Corporation’s year-end is March 31. 1. Usin

> Charley Company borrowed money by issuing $2,000,000 of 6% bonds payable at 101.5 on July 1, 2016. The bonds are five-year bonds and pay interest each January 1 and July 1. 1. How much cash did Charley receive when it issued the bonds payable? Journalize

> Drexel Sports Authority purchased inventory costing $23,000 by signing a 10%, six-month, short-term note payable. The purchase occurred on January 1, 2016. Drexel will pay the entire note (principal and interest) on the note’s maturity date of July 1, 20

> Williams Company purchases 1,000 shares of American Express common stock at the market price of $81.34 on March 23, 2016. (The equity method does not apply in this situation.) Williams intends to hold this investment for more than one year. On June 22, 2

> Return to S8-7, the Helio Ward (HW) investment in Amexon bonds. Journalize the following on HW’s books: a. Purchase of the bond investment on June 30, 2016. HW expects to hold the investment to maturity. b. Receipt of semiannual cash interest on Decemb

> Helio Ward (HW) owns vast amounts of corporate bonds. Suppose that on June 30, 2016, HW buys $1,300,000 of Amexon bonds at a price of 103. The Amexon bonds pay cash interest semiannually on June 30 and December 31 at the annual rate of 5% and mature at t

> Using the data from S8-5, make the adjusting entries that Sunshine Pools would need to make on December 31, 2016, related to the investment in BHT bonds. How would the bonds be reported on Sunshine Pools’ balance sheet as of December 31, 2016? What amoun

> Sunshine Pools purchased $100,000 of 12% BHT bonds on January 1, 2016, at a price of 107.5 when the market rate of interest was 10%. Sunshine intends to hold the bonds until their maturity date of January 1, 2021. The bonds pay interest semiannually on e

> Using the data from S8-2, make the adjusting entry that Broadbent Insurance would need to make on December 31, 2016, related to the investment in DGM bonds. How would the bonds be reported on Broadbent Insurance’s balance sheet as of December 31, 2016? W

> Using the data from S8-2, calculate the amount of discount amortization (using the straight-line amortization method) on July 1, 2016, and record the related journal entry. What is the total interest revenue for the first six months of 2016? From S8-2 B

> Chaplin Leasing leased a car to a customer. Chaplin will receive $150 a month for 60 months. 1. What is the present value of the lease if the annual interest rate in the lease is 12%? Use the PV function in Excel to compute the present value. 2. What i

> Calculate the present value of the following amounts: 1. $12,000 at the end of five years at 10% 2. $12,000 a year at the end of the next five years at 10%

> Broadbent Insurance purchased $100,000 of 5.5% DGM bonds on January 1, 2016, at a price of 90 when the market rate of interest was 8%. Broadbent intends to hold the bonds until their maturity date of January 1, 2021. The bonds pay interest semiannually o

> Excerpts from The Ink Spot Company statement of cash flows, as adapted, appear as follows: As the chief executive officer of The Ink Spot Company, your duty is to write the management letter to your stockholders explaining Ink Spotâ

> Companies divide their cash flows into three categories for reporting on the cash flow statement. 1. List the three categories of cash flows in the order they appear on the cash flow statement. Which category of cash flows is most closely related to this c

> Two accounts that arise from consolidation accounting are goodwill and noncontrolling interest. 1. What is goodwill, and how does it arise? Which company reports goodwill, the parent or the subsidiary? Where is goodwill reported? 2. What is noncontrolli

> Answer these questions about consolidation accounting: 1. Define “parent company.” Define “subsidiary company.” 2. How do consolidated financial statements differ from the financial statements of a single company? 3. Which company’s name appears on th

> Use the data given in S8-14. Assume that on January 1, 2017, Eastern Motors sold half its investment in Tripp Motors. The sale price was $125 million. Compute Eastern Motors’ gain or loss on the sale. From S8-14 Suppose on January 1, 2016, Eastern Moto

> Suppose on January 1, 2016, Eastern Motors paid $430 million for a 30% investment in Tripp Motors. Assume Tripp earned net income of $80 million and declared and paid cash dividends of $40 million during 2016. 1. What method should Eastern Motors use to

> Hilton Company completed these long-term available-for-sale investment transactions during 2016: 1. Journalize Hilton Company’s investment transactions. Explanations are not required. 2. Assume the Microscape Co. stock is Hilton Comp

> Use the data from S8-9 and S8-10 for this exercise. Williams Company sells its entire investment in American Express common stock on November 22, 2017, for a total of $74,500. Record the entries for the sale. From S8-10 Use the data from S8-9 for this

> Use the data from S8-9 for this exercise. At year-end on December 31, 2016, the American Express common stock that Williams Company holds has a quoted market price of $84.16 per share. Assuming that Williams Company has no other investments, record the e

> On January 1, 2016, Midtown Industries purchased $10,000 of 5% BRS bonds at a price of 100 (par.) Midtown intends to hold the bonds until their maturity date of January 1, 2021. The bonds pay interest semiannually on each January 1 and July 1. Record the

> Lovell, Inc., purchased a used van for use in its business on January 1, 2015. It paid $13,000 for the van. Lovell expects the van to have a useful life of four years, with an estimated residual value of $1,000 at the end of the four years. Lovell expect

> Dazzle, Inc., purchased a new car for use in its business on January 1, 2015. It paid $25,000 for the car. Dazzle expects the car to have a useful life of four years with an estimated residual value of zero at the end of the four years. Dazzle expects to

> Dazzle, Inc., purchased a new car for use in its business on January 1, 2015. It paid $25,000 for the car. Dazzle expects the car to have a useful life of four years with an estimated residual value of zero at the end of the four years. Dazzle expects to

> Dazzle, Inc., purchased a new car for use in its business on January 1, 2015. It paid $25,000 for the car. Dazzle expects the car to have a useful life of four years with an estimated residual value of zero at the end of the four years. Dazzle expects to

> This exercise uses the QuickAir data from S7-4. Assume QuickAir is trying to decide which depreciation method to use for income tax purposes. The company can choose from among the following methods: a. straight-line, b. units-of-production, or c. doub

> Assume that at the beginning of 2015 QuickAir purchased a used Jumbo 747 aircraft at a cost of $56,700,000. QuickAir expects the plane to remain useful for five years (5,000,000 miles) and to have a residual value of $4,700,000. QuickAir expects to fly t

> Identify each of the following items as either a capital expenditure (C), expense on the income statement (E), or neither (N): Type of Expenditure (C, E, or N) Transaction 1. Paid property taxes of $75,000 for the first year the new building is occu

> During 2016, Northwest Satellite Systems, Inc., purchased two other companies for $13 million in cash. Also during 2016, Northwest made capital expenditures of $11.3 million in cash to expand its market share. During the year, Northwest sold its North Am

> Pittsfield Sound Center pays $330,000 for a group purchase of land, building, and equipment. At the time of acquisition, the land has a current market value of $54,000, the building’s current market value is $90,000, and the equipment’s current market va

> Oswald Optical, Inc., provides a full line of designer eyewear to optical dispensaries. Oswald reported the following information for 2016 and 2015: Compute return on assets (ROA) for 2016 and 2015. Using the DuPont model, identify the components and s

> In 2016, Amici, Inc., reported $800 million in sales, $33 million in net income, and average total assets of $300 million. What is Amici’s return on assets in 2016?

> For each of the following scenarios, indicate whether a long-term asset has been impaired (Y for yes and N for no) and, if so, the amount of the loss that should be recorded. Impaired? Amount (Y or N) Estimated Future Asset Book Value Cash Flows Fai

> Crunchies, Inc., dominates the snack-food industry with its Salty Chip brand. Assume that Crunchies, Inc., purchased Healthy Snacks, Inc., for $5.8 million cash. The market value of Healthy Snacks’ assets is $7 million, and Healthy Snacks has liabilities

> BB Petroleum, a giant oil company, holds reserves of oil and gas assets. At the end of 2016, assume the cost of BB Petroleum’s oil reserves totaled $208 billion, representing 16 billion barrels of oil in the ground. 1. Which depreciation method is simil

> On January 1, 2015, Global Manufacturing purchased a machine for $920,000 that it expected to have a useful life of five years. The company estimated that the residual value of the machine was $70,000. Global Manufacturing used the machine for two years

> Happy Times Amusement Park paid $180,000 for a concession stand. Happy Times started out depreciating the building using the straight-line method over ten years with zero residual value. After using the concession stand for three years, Happy Times deter

> Assume that on September 30, 2015, LuxAir, an international airline based in Germany, purchased a Jumbo aircraft at a cost of €42,500,000 (€ is the symbol for the euro). LuxAir expects the plane to remain useful for five years (5,000,000 miles) and to ha

> Lovell, Inc., purchased a used van for use in its business on January 1, 2015. It paid $13,000 for the van. Lovell expects the van to have a useful life of four years, with an estimated residual value of $1,000 at the end of the four years. Lovell expect

> Lovell, Inc., purchased a used van for use in its business on January 1, 2015. It paid $13,000 for the van. Lovell expects the van to have a useful life of four years, with an estimated residual value of $1,000 at the end of the four years. Lovell expect

> Examine the excerpt of a footnote from Red Rock’s September 30, 2016, annual report to follow. 1. What are Red Rock’s largest two categories of property and equipment as of September 30, 2016? Describe in general ter

> Using the LIFO method, calculate the cost of ending inventory and cost of goods sold for Cowell Corporation. A1 Quantity Unit Cost Total 1 2 Beginning inventory 3 Purchases 4 Goods available for sale 5 Ending inventory 6 Cost of goods sold 100 S 150

> Using the FIFO method, calculate the cost of ending inventory and cost of goods sold for Cowell Corporation. A1 Quantity Unit Cost Total 1 2 Beginning inventory 3 Purchases 4 Goods available for sale 5 Ending inventory 6 Cost of goods sold 100 S 150

> Using the average-cost method, calculate the cost of ending inventory and cost of goods sold for Cowell Corporation. A1 Quantity Unit Cost Total 1 2 Beginning inventory 3 Purchases 4 Goods available for sale 5 Ending inventory 6 Cost of goods sold 1

> Marley Corporation uses the LIFO method to account for inventory. Marley is having an unusually good year, with net income well above expectations. The company’s inventory costs are rising rapidly. What can Marley do immediately before the end of the yea

> McDonough Copy Center is a corporation subject to a 30% income tax. Compute McDonough Copy Center’s income tax expense under the average, FIFO, and LIFO inventory costing methods. Which method would you select to a. maximize income before tax and b. mi

> McDonough Copy Center sells laser printers and supplies. Assume McDonough Copy Center started the year with 100 containers of ink (average cost of $8.00 each, FIFO cost of $8.60 each, LIFO cost of $7.90 each). During the year, McDonough Copy Center purch

> Trinkets Unlimited made total purchases of $250,000 in the most current year. It paid freight in of $3,000 on its purchases. Freight out (the cost to deliver the merchandise to its customers) totaled $7,000. Of the total purchases, Trinkets Unlimited ret

> Rootstown Company sold 10,000 jars of its organic honey in the most current year for $8 per jar. The company had paid $3.50 per jar of honey. (Assume that sales returns are nonexistent.) Calculate the following: 1. Sales revenue 2. Cost of goods sold

> Here is the original schedule of cost of goods sold for Truman Company for the years of 2014 through 2017: During the preparation of its 2017 financial statements, Truman Company discovered that its 2015 ending inventory was understated

> Richardson Supply’s $3.9 million cost of inventory at the end of last year was understated by $1.2 million. 1. Was last year’s reported gross profit of $2.9 million overstated, understated, or correct? What was the correct amount of gross profit last ye

> Determine whether each of the following actions in buying, selling, and accounting for inventories is ethical or unethical. Give your reason for each answer. 1. In applying the lower-of-cost-or-market rule to inventories, Blue Mountain Coffee Company re

> Metro Technology began the year with inventory of $299,000 and purchased $1,820,000 of goods during the year. Sales for the year are $3,887,500, and Metro Technology’s gross profit percentage is 60% of sales. Compute Metro Technology’s estimated cost of e

> Spritzer Company made sales of $24,000 million during 2016. Cost of goods sold for the year totaled $11,040 million. At the end of 2015, Spritzer’s inventory stood at $1,000 million, and Spritzer ended 2016 with inventory of $1,400 million. Compute Sprit

> It is December 31, the end of the year, and the controller of Saxton Corporation is applying the lower-of-cost-or-market (LCM) rule to inventories. Before any year-end adjustments, Saxton reports the following data: Saxton determines that the current r

> This exercise tests your understanding of the four inventory methods. List the name of the inventory method that best fits the description. Assume that the cost of inventory is rising. 1. Results in an old measure of the cost of endi

> Cozelle, Inc., purchased inventory costing $125,000 and sold 80% of the goods for $200,000. All purchases and sales were on account. Cozelle later collected 25% of the accounts receivable. Assume that sales returns are nonexistent. 1. Journalize these t

> As a recent college graduate, you land your first job in the customer collections department of Silktown Publishing. Alicia Donovan, the manager, asked you to propose a system to ensure that cash received from customers by mail is handled properly. Draft

> Perform the following accounting for the receivables of Bronson and Moore, a law firm, at December 31, 2016. Requirements 1. Set up T-accounts for Cash, Accounts Receivable, and Service Revenue. Start with the beginning balances as follows: Cash $27,00

> On April 3, Parker Company sold $5,000 of merchandise to Wheeler Corporation, terms 2∕10, n∕30, FOB shipping point. Parker Company’s cost of sales for this merchandise was $4,000. The merchandise left Parker Company’s facility on April 4 and arrived at W

> In August, Landeau Designs sold $500,000 of merchandise; all sales were in cash. The cost of sales for August was $320,000. Based on past experience, Landeau uses an estimated refund rate of 4% of sales. Record the journal entries for the monthly sales,

> Costello Company purchases inventory from Terry Pool Supplies on June 1. The sales terms on the invoice from Terry Pool Supplies are 4∕20, net 30. What does this mean? What is Costello’s potential savings, if any? How much time does the company have to t

> On December 23, 2016, Robertson Sports Manufacturing sells a truckload of sporting goods to the Sports R Us store in Columbus, Ohio. The terms of the sale are FOB destination. The truck runs into bad weather on the way to Columbus and doesn’t arrive unti

> Barfield Investments purchased Melnick Corp. shares as a trading security on December 16 for $109,000. 1. Suppose the Melnick Corp. shares decreased in value to $92,000 at December 31. Make the Barfield journal entry to adjust the Investment in Trading S

> Slocomb Corp. holds a portfolio of trading securities. Suppose that on January 15, Slocomb paid $80,000 for an investment in Turok Co. shares to add to its portfolio. At October 31, the market value of Turok Co. shares is $97,000. For this situation, sho

> Answer these questions about receivables and uncollectibles. For the true-false questions, explain any answers that turn out to be false. 1. True or false? Credit sales increase receivables. Collections and write-offs decrease receivables. 2. True or f

> Highland Products reported the following amounts in its 2017 financial statements. The 2016 amounts are given for comparison. Requirements 1. Compute Highland’s quick (acid-test) ratio at the end of 2017. Round to two

> Collins Woodworking accepts credit cards at its store. Collins’ credit card processor charges a fee of 3% of the total amount of any credit sale. Assume that Russell Knight purchases $8,000 of custom furniture and pays with a VISA card. Make the entry th