Question: Use the following income statement and balance

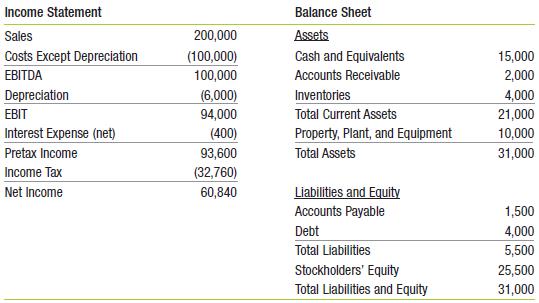

Use the following income statement and balance sheet for Jim’s Espresso:

What is the amount of net new financing needed for Jim’s?

Transcribed Image Text:

Income Statement Balance Sheet Sales 200,000 Assets Costs Except Depreciation (100,000) Cash and Equivalents 15,000 EBITDA 100,000 Accounts Receivable 2,000 Depreciation (6,000) 94,000 Inventories 4,000 21,000 EBIT Total Current Assets Interest Expense (net) (400) Property, Plant, and Equipment 10,000 Pretax Income 93,600 Total Assets 31,000 Income Tax (32,760) Net Income 60,840 Liabilities and Equity Accounts Payable 1,500 Debt 4,000 Total Liabilities 5,500 Stockholders' Equity 25,500 Total Liabilities and Equity 31,000

> The following data were taken from the general ledgers and other data of Alpha Manufacturing, Inc., and Bravo Merchandising Co. on April 30 of the current year: Merchandise inventory, April 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> Beth Elkins, a factory worker, earns $1,000 each week. In addition, she will receive a $4,000 bonus at year-end and a four-week paid vacation. Prepare the entry to record the weekly payroll and the costs and liabilities related to the bonus and the vacat

> Prepare a performance report for the dining room of Leonardo’s Italian Cafe´ for the month of February 2011, using the following data: Budgeted Data: January February Dining room wages $4,300 $4,150 Laundry and houseke

> St. Lawrence Manufacturing Co. manufactures engines that are made only on customers’ orders and to their specifications. During January, the company worked on Jobs 007, 008, 009, 010. The following figures summarize the cost records for

> Spokane Manufacturing Co. obtained the following information from its records for the month of July: Required: 1. Prepare, in summary form, the journal entries that would have been made during the month to record the distribution of materials, labor, and

> Hidalgo Company manufactures goods to special order and uses a job order cost system. During its first month of operations, the following selected transactions took place: a. Materials purchased on account . . . . . . . . . . . . . . . . . . . . . . . .

> Fayetteville Manufacturing Co. produces only one product. You have obtained the following information from the corporation’s books and records for the year ended December 31, 2011: a. Total manufacturing cost during the year was $1,000,000, including dir

> O’Reilly Manufacturing, Inc.’s cost of goods sold for the month ended July 31 was $345,000. The ending work in process inventory was 90% of the beginning work in process inventory. Factory overhead was 50% of the direct labor cost. Other information pert

> Marta Johns is the Division Controller and Kevin Deere is the Division Vice President of Tuffy Tractor, Inc. Due to pressures to meet earnings estimates for 2011, Deere instructs Johns to record as revenue $5,000,000 of orders for tractors that are still

> The following form is used by MoJo Manufacturing Company to compute payroll taxes incurred during the month of April: 1. Using the above form, calculate the employer’s payroll taxes for April. Assume that none of the employees has achi

> Go to the companion Website at www.cengage.com/accounting/vanderbeck and click on the link to ‘‘The Sarbanes-Oxley Act.’’ Read the accompanying PowerPoint presentation, and write a one-page summary of it.

> A weekly payroll summary made from labor time records shows the following data for Musketeer Manufacturing Company: Overtime is payable at one-and-a-half times the regular rate of pay for an employee and is distributed to all jobs worked on during the p

> The total wages and salaries earned by all employees of Cutler Manufacturing Company during the month of March, as shown in the labor cost summary and the schedule of fixed administrative and sales salaries, are classified as follows: Direct labor . . .

> Using the earnings data developed in E3-1, and assuming that this was the eighth week of employment for Jolly and the previous earnings to date were $7,900, prepare the journal entries for the following: a. The week’s payroll. b. Paymen

> Using the earnings data developed in E3-1, and assuming that this was the eighth week of employment for Jolly and the previous earnings to date were $7,900, prepare the journal entries for the following: a. The week’s payroll. b. Payme

> Fontana Fabricating Company paid wages to its employees during the year as follows: Burris . . . . . . . . . . . . . . . . . . . . . . . . $ 15,400 Combs . . . . . . . . . . . . . . . . . . . . . . . 16,700 Detrick . . . . . . . . . . . . . . . . .

> A partial summary of the payroll data for Burrington Manufacturing Company for each week of June is as follows: a. Compute the missing amounts in the summary, assuming that no employees have reached the $100,000 FICA maximum. b. For each payroll period,

> Albert Machine Tool Company produces tools on a job order basis. During May, two jobs were completed, and the following costs were incurred: Other factory costs for the month totaled $16,800. Factory overhead costs are allocated one-third to Job 401 and

> What kind of information and data are needed to calculate an order point?

> What factors should management consider when determining the amount of investment in materials?

> A rush order was accepted by San Diego Machine Conversions for five van conversions. The labor time records for the week ended January 27 show the following: All employees are paid $10.00 per hour, except Peavy, who receives $20 per hour. All overtime p

> The payroll records of Torero Machining Company show the following information for the week ended April 17: Hourly workers are paid time-and-a-half for overtime. a. Determine the net earnings of each employee. b. Prepare the journal entries for the foll

> Study the performance report for Leonardo’s Italian Cafe´ in Figure and write a brief explanation of the strengths and weaknesses of September and year-to-date operations. H. Leonardo's Italian Café Performance Report-K

> Construct a short-term financial plan for Springfield Snowboards based on its expansion opportunity described in the “Positive Cash Flow Shocks” part of Section 20.1. Base the plan on the following table, which forecas

> The Rasputin Brewery is considering using a public warehouse loan as part of its short-term financing. The firm will require a loan of $500,000. Interest on the loan will be 10% (APR, annual compounding) to be paid at the end of the year. The warehouse c

> Kurz Manufacturing is currently an all-equity firm with 20 million shares outstanding and a stock price of $7.50 per share. Although investors currently expect Kurz to remain an all-equity firm, Kurz plans to announce that it will borrow $50 million and

> The Ohio Valley Steel Corporation has borrowed $5 million for one month at a stated annual rate of 9%, using inventory stored in a field warehouse as collateral. The warehouser charges a $5000 fee, payable at the end of the month. What is the effective a

> The Signet Corporation has issued four-month commercial paper with a $6 million face value. The firm netted $5,870,850 on the sale. What effective annual rate is Signet paying for these funds?

> Assume that the prime rate is 8% APR, compounded quarterly. How much dollar savings in interest did Treadwater (Problem 12) and Magna (Problem 11) achieve by accessing the commercial paper market? Data from Problem 12: The Mighty Power Tool Company has

> The Needy Corporation borrowed $10,000 from Bank Ease. According to the terms of the loan, Needy must pay the bank $400 in interest every three months for the three-year life of the loan, with the principal to be repaid at the maturity of the loan. What

> Which of the following one-year, $1000 bank loans offers the lowest effective annual rate? a. A loan with an APR of 6%, compounded monthly b. A loan with an APR of 6%, compounded annually, with a compensating balance requirement of 10% (on which no inte

> Magna Corporation has an issue of commercial paper with a face value of $1,000,000 and a maturity of six months. Magna received net proceeds of $973,710 when it sold the paper. What is the effective annual rate of the paper to Magna?

> Consider two loans with one-year maturities and identical face values: an 8% loan with a 1% loan origination fee and an 8% loan with a 5% (no-interest) compensating balance requirement. Which loan would have the higher effective annual rate? Why?

> The Hand-to-Mouth Company needs a $10,000 loan for the next 30 days. It is trying to decide which of three alternatives to use: Alternative A: Forgo the discount on its trade credit agreement that offers terms of 2/10, net 30. Alternative B: Borrow the m

> If you want to limit your maximum short-term borrowing to $500, how much excess cash must you carry? Quarter ($000) 2 Cash $100 $100 $100 $100 Accounts Receivable 200 100 100 600 Inventory 200 500 900 50 Accounts Payable 100 100 100 100

> NatNah, a builder of acoustic accessories, has no debt and an equity cost of capital of 15%. NatNah decides to increase its leverage to maintain a market debt-to-value ratio of 0.5. Suppose its debt cost of capital is 9% and its corporate tax rate is 35%

> Assume the credit terms offered to your firm by your suppliers are 3/5, net 30. Calculate the cost of the trade credit if your firm does not take the discount and pays on day 30.

> Your firm currently has net working capital of $100,000 that it expects to grow at a rate of 4% per year forever. You are considering some suggestions that could slow that growth to 3% per year. If your discount rate is 12%, how would these changes impac

> Aberdeen Outboard Motors is contemplating building a new plant. The company anticipates that the plant will require an initial investment of $2 million in net working capital today. The plant will last ten years, at which point the full investment in net

> Westerly Industries has the following financial information. What is its cash conversion cycle? Sales 100,000 Cost of Goods Sold 80,000 Accounts Receivable 30,000 Inventory 15,000 Accounts Payable 40,000

> Use the following income statement and balance sheet for Global Corp.: Global expects sales to grow by 8% next year. Using the percent of sales method, forecast: a. Costs except depreciation b. Depreciation c. Net income d. Cash e. Accounts receivable f.

> Use the following income statement and balance sheet for Jim’s Espresso: If Jim’s adjusts its payout policy to 70% of net income, how will the net new financing change? Income Statement Balance Sheet Sales 200,000

> The Treadwater Bank wants to raise $1 million using three-month commercial paper. The net proceeds to the bank will be $985,000. What is the effective annual rate of this financing for Treadwater?

> You are long both a call and a put on the same share of stock with the same exercise date. The exercise price of the call is $40 and the exercise price of the put is $45. Plot the value of this combination as a function of the stock price on the exercise

> Assume that you have shorted the put option in Problem 4. a. If the stock is trading at $8 in three months, what will you owe? b. If the stock is trading at $23 in three months, what will you owe? c. Draw a payoff diagram showing the amount you owe at ex

> If you choose to enter the year with $400 total in cash, what is your maximum short-term borrowing? Quarter ($000) 2 Cash $100 $100 $100 $100 Accounts Receivable 200 100 100 600 Inventory 200 500 900 50 Accounts Payable 100 100 100 100

> If you hold only $100 in cash at any time, what is your maximum short-term borrowing and when? Quarter ($000) 2 Cash $100 $100 $100 $100 Accounts Receivable 200 100 100 600 Inventory 200 500 900 50 Accounts Payable 100 100 100 100

> If you chose to use only long-term financing, what total amount of borrowing would you need to have on a permanent basis? Forecast your excess cash levels under this scenario. Quarter ($000) 2 Cash $100 $100 $100 $100 Accounts Receivable 200 100 100

> What are the permanent working capital needs of your company? What are the temporary needs? Quarter ($000) 2 Cash $100 $100 $100 $100 Accounts Receivable 200 100 100 600 Inventory 200 500 900 50 Accounts Payable 100 100 100 100

> Emerald City Umbrellas sells umbrellas and rain gear in Seattle, so its sales are fairly level across the year. However, it is branching out to other markets where it expects demand to be much more variable across the year. It expects sales in its new ma

> FastChips Semiconductors has inventory days of 75, accounts receivable days of 30, and accounts payable days of 90. What is its cash conversion cycle?

> Sailboats Etc. is a retail company specializing in sailboats and other sailing-related equipment. The following table contains financial forecasts as well as current (month 0) working capital levels. a. During which month are the firm’s

> Use the following income statement and balance sheet for Jim’s Espresso: Assume that Jim’s pays out 90% of its net income. Use the percent of sales method to forecast: a. Stockholders’ equity b. Accou

> Happy Valley Homecare Suppliers, Inc. (HVHS), had $20 million in sales in 2010. Its cost of goods sold was $8 million, and its average inventory balance was $2,000,000. a. Calculate the average number of day’s inventory outstanding ratios for HVHS. b. T

> Summit Builders has a market debt-equity ratio of 0.65 and a corporate tax rate of 40%, and it pays 7% interest on its debt. By what amount does the interest tax shield from its debt lower Summit’s WACC?

> Your company had $10 million in sales last year. Its cost of goods sold was $7 million and its average inventory balance was $1,200,000. What was its average days of inventory?

> Use the financial statements supplied below and on the next page for International Motor Corporation (IMC) to answer the following questions: a. Calculate the cash conversion cycle for IMC for both 2009 and 2010. What change has occurred, if any? All els

> Your firm purchases goods from its supplier on terms of 3/15, net 40. a. What is the effective annual cost to your firm if it chooses not to take the discount and makes its payment on day 40? b. What is the effective annual cost to your firm if it choose

> Simple Simon’s Bakery purchases supplies on terms of 1/10, net 25. If Simple Simon’s chooses to take the discount offered, it must obtain a bank loan to meet its short-term financing needs. A local bank has quoted Simple Simon’s owner an interest rate of

> The Mighty Power Tool Company has the following accounts on its books: The firm extends credit on terms of 1/15, net 30. Develop an aging schedule using 15-day increments through 60 days, and then indicate any accounts that have been outstanding for more

> The Manana Corporation had sales of $60 million this year. Its accounts receivable balance averaged $2 million. How long, on average, does it take the firm to collect on its sales?

> Milton Industries expects free cash flows of $5 million each year. Milton’s corporate tax rate is 35%, and its unlevered cost of capital is 15%. The firm also has outstanding debt of $19.05 million, and it expects to maintain this level of debt permanent

> The Saban Corporation is trying to decide whether to switch to a bank that will accommodate electronic funds transfers from Saban’s customers. Saban’s financial manager believes the new system would decrease its collection float by as much as five days.

> The Fast Reader Company supplies bulletin board services to numerous hotel chains nationwide. The owner of the firm is investigating the desirability of employing a billing firm to do her billing and collections. Because the billing firm specializes in t

> Your supplier offers terms of 1/10, net 45. What is the effective annual cost of trade credit if you choose to forgo the discount and pay on day 45?

> Use the following income statement and balance sheet for Jim’s Espresso: Jim’s expects sales to grow by 10% next year. Using the percent of sales method, forecast: a. Costs b. Depreciation c. Net income d. Cash e. Acco

> Assume your beginning debt in Problem 2 is $100,000. What amount of equity and what amount of debt would you need to issue to cover the net new financing in order to keep your debt-equity ratio constant? Data from Problem 2: For the next fiscal year, yo

> For the next fiscal year, you forecast net income of $50,000 and ending assets of $500,000. Your firm’s payout ratio is 10%. Your beginning stockholders’ equity is $300,000 and your beginning total liabilities are $120,000. Your non-debt liabilities such

> Your company has sales of $100,000 this year and cost of goods sold of $72,000. You forecast sales to increase to $110,000 next year. Using the percent of sales method, forecast next year’s cost of goods sold.

> Assuming a cost of capital of 10%, compute the value of KMS under the 0.25% growth scenario.

> Calculate the continuation value of KMS using your reproduction of Table 18.8 from Problem 14, and assuming an EBITDA multiple of 8.5. In Problem 14 Year 2010 2011 2012 2013 2014 2015 Depreciation 5,492 5,443 7,398 7,459 7,513 7,561

> Forecast KMS’s free cash flows (reproduce Table 18.13), assuming KMS’s market share will increase by 0.25% per year; investment, financing, and depreciation will be adjusted accordingly; and working capital will be as you projected in Problem 15.

> IZAX, Co. had the following items on its balance sheet at the beginning of the year: Its net income this year is $20,000 and it pays dividends of $5,000. If its assets grew at its internal growth rate, what is its new D/E ratio? Assets Liabilities an

> Your firm has an ROE of 12%, a payout ratio of 25%, $600,000 of stockholders’ equity, and $400,000 of debt. If you grow at your sustainable growth rate this year, how much additional debt will you need to issue?

> Did KMS’s expansion plan call for it to grow slower or faster than its sustainable growth rate?

> Rumolt Motors has 30 million shares outstanding with a price of $15 per share. In addition, Rumolt has issued bonds with a total current market value of $150 million. Suppose Rumolt’s equity cost of capital is 10%, and its debt cost of capital is 5%. a.

> Using the information in the table below, calculate this company’s: a. Internal growth rate. b. Sustainable growth rate. c. Sustainable growth rate if it pays out 40% of its net income as a dividend. Net Income 50,000 Beginning Tota

> Assuming that KMS’s market share will increase by 0.25% per year (implying that the investment, financing, and depreciation will be adjusted as described in Problems 13 and 14), and that the working capital assumptions used in the chapt

> Under the assumption that KMS’s market share will increase by 0.25% per year, you project the following depreciation: Using this information, project net income through 2015 (that is, reproduce Table 18.8 under the new assumptions).

> Under the assumption that KMS’s market share will increase by 0.25% per year, you determine that the plant will require an expansion in 2012. The expansion will cost $20 million. Assuming that the financing of the expansion will be delayed accordingly, c

> Assume that KMS’s market share will increase by 0.25% per year rather than the 1% used in the chapter (see Table 18.5) and that its prices remain as in the chapter. What production capacity will KMS require each year? When will an expansion become necess

> Use the following income statement and balance sheet for Global Corp.: If Global decides that it will limit its net new financing to no more than $9 million, how will this affect its payout policy? Figures in $ millions Net sales 186.7 Assets Costs E

> Use the following income statement and balance sheet for Global Corp.: What is the amount of net new financing needed for Global? Figures in $ millions Net sales 186.7 Assets Costs Except Depreciation -175.1 Cash 23.2 EBITDA 11.6 Accounts Receivable

> Use the following income statement and balance sheet for Global Corp.: Assume that Global pays out 50% of its net income. Use the percent of sales method to forecast stockholders’ equity. Figures in $ millions Net sales 186.7 Assets

> Suppose the board of Natsam Corporation decided to do the share repurchase in Problem 7(b), but you as an investor would have preferred to receive a dividend payment. How can you leave yourself in the same position as if the board had elected to make the

> Natsam Corporation has $250 million of excess cash. The firm has no debt and 500 million shares outstanding with a current market price of $15 per share. Natsam’s board has decided to pay out this cash as a one-time dividend. a. What is the ex-dividend p

> Rogot Instruments makes fine violins, violas, and cellos. It has $1 million in debt outstanding, equity valued at $2 million, and pays corporate income tax at a rate of 35%. Its cost of equity is 12% and its cost of debt is 7%. a. What is Rogot’s pretax

> EJH Company has a market capitalization of $1 billion and 20 million shares outstanding. It plans to distribute $100 million through an open market repurchase. Assuming perfect capital markets: a. What will the price per share of EJH be right before the

> Suppose that KMS in Problem 4 decides to initiate a dividend instead, but it wants the present value of the payout to be the same $20 million. If its cost of equity capital is 10%, to what amount per year in perpetuity should it commit (assuming perfect

> KMS corporation has assets of $500 million, $50 million of which are cash. It has debt of $200 million. If KMS repurchases $20 million of its stock: a. What changes will occur on its balance sheet? b. What will its new leverage ratio be?

> ECB Co. has 1 million shares outstanding selling at $20 per share. It plans to repurchase 100,000 shares at the market price. What will its market capitalization be after the repurchase? What will its stock price be?

> RFC Corp. has announced a $1 dividend. If RFC’s last price while trading cum dividend is $50, what should its first ex-dividend price be (assuming perfect capital markets)?

> ABC Corporation announced that it would pay a dividend to all shareholders of record as of Monday, April 5, 2010. It takes three business days after a purchase for the new owners of a share of stock to be registered. a. What was the date of the ex-divide

> After the market close on May 11, 2001, Adaptec, Inc., distributed a dividend of shares of the stock of its software division, Roxio, Inc. Each Adaptec shareholder received 0.1646 share of Roxio stock per share of Adaptec stock owned. At the time, Adapte

> If Berkshire Hathaway’s A shares are trading at $120,000, what split ratio would it need to bring its stock price down to $50?

> Suppose the stock of Host Hotels & Resorts is currently trading for $20 per share. a. If Host issues a 20% stock dividend, what would its new share price be? b. If Host does a 3:2 stock split, what would its new share price be?

> FCF Co. has 20,000 shares outstanding and a total market value of $1 million, $300 thousand of which is debt and the other $700 thousand is equity. It is planning a 10% stock dividend. a. What is the stock price before the dividend and what will it be af

> Arnell Industries has $10 million in permanent debt outstanding. The firm will pay interest only on this debt. Arnell’s marginal tax rate is expected to be 35% for the foreseeable future. a. Suppose Arnell pays interest of 6% per year on its debt. What i

> AMC Corporation currently has an enterprise value of $400 million and $100 million in excess cash. The firm has 10 million shares outstanding and no debt. Suppose AMC uses its excess cash to repurchase shares. After the share repurchase, news will come o

> AMC Corporation currently has an enterprise value of $400 million and $100 million in excess cash. The firm has 10 million shares outstanding and no debt. Suppose AMC uses its excess cash to repurchase shares. After the share repurchase, news will come o