Question: Use the information in BE4-9 to

Use the information in BE4-9 to prepare a multiple-step income statement for Taylor Corporation, showing expenses by function.

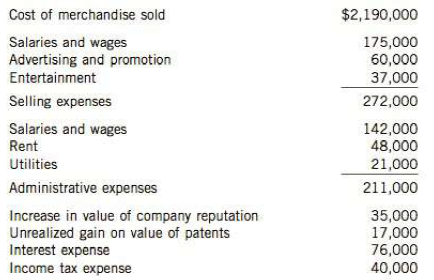

Taylor Corporation had net sales revenue of 52,780,000 and investment revenue of$103,000 in 2014. Other items pertaining to 2014 were as follows:

In Be4-9

Taylor has 10,000 common shares outstanding. Prepare a single-step income statement showing expenses by nature.

Include calculation of EPS.

Transcribed Image Text:

Cost of merchandise sold $2,190,000 Salaries and wages Advertising and promotion 175,000 60,000 Entertainment 37,000 Selling expenses 272,000 Salaries and wages Rent 142,000 48,000 21,000 Utilities Administrative expenses 211,000 Increase in value of company reputation Unrealized gain on value of patents Interest expense Income tax expense 35,000 17,000 76,000 40,000

> Obtain the 2001 and 2011 annual reports for Goldcorp Inc. (from SEDAR www.sedar.com). Read the material leading up to the financial statements and answer the following questions: (a) Explain how the company's business changed from 2000 to 2001. 'What sig

> The financial statements for Maple Leaf Foods Inc. may be found on the company's website or at www.sedar.com. Instructions (a) Calculate the liquidity and coverage (solvency) ratios identified in Appendix 5A for both years that are presented in the fina

> The partner in charge of the Spencer Corporation audit comes by desk and leaves a letter he has started to the CEO and a copy of cash flows for the year ended December 31, 2014. Because he must leave on an emergency, he asks you to finish the letter by e

> Write a brief essay highlighting the differences between IFRS and accounting standards for private enterprises noted in this chapter, discussing the conceptual justification for each.

> In determining if a contingent liability should be recognized or not on the balance sheet at the report date, management must decide if there is a present obligation or a contingent obligation or both. Only a present obligation would be recorded under IF

> Brookfield Properties Corporation reported net income of $1,896 million for the year ended December 31, 2011, which is up 12.5% from the prior year. The company owns, develops, and manages North American office properties and its shares trade on both the

> The Big and Rich Corporation had income from operations before tax for 2014 of57.3 million. In addition, it suffered an unusual and infrequent loss of $ 1,770,000 from a tornado. Of this amount, $500,000 was insured. In addition, the company realized a l

> The ethical accountant for Khouri Industries, is trying to decide how to present property, plant, and equipment in the notes to the balance sheet. She realizes that the statement of cash flows will show that the company made a significant investment in p

> Franklin Drug Ltd. (FDL) is a global public company that researches, develops, markets, and sells prescription drugs. Revenues and net income are down this year, partly because one of the company’s competitors, Balogun Drug Inc. (BDI), has created and is

> Hastings Inc. (HI) is a manufacturer that produces stainless steel car parts. It began as a fan1ily business several years ago and all shares are owned by the Hastings family. The company's main assets are its manufacturing facility and surrounding land.

> Use the information in E5-14 for Carmichael Industries. Information from E5-14o Instructions (a) Calculate the current and acid test ratios for 2013 and 2014. (b) Calculate Carmichael's current cash debt coverage ratio for 2014. (c) Based on the analyse

> In the late 1990s, CIBC helped Enron Corporation structure 34 "loans" that appeared in the financial statements as cash proceeds from sales of assets. Enron subsequently went bankrupt in 200 I and left many unhappy investors and creditors with billions o

> Statement of financial position items for Montoya Inc. follow for the current year, 2014: Instructions (a) Prepare a classified statement of financial position in good form. The numbers of authorized shares are as follows: 400,000 common and 20,000 pref

> A list of accounts follows: / / The Loss-Other account contains a loss due to a flood during the year. Instructions Prepare a classified statement of financial position in good form, without monetary an10unts.

> A comparative statement of financial position for Spencer Corporation follows: Additional information: 1. Net income for the fiscal year ending December 31, 2014, was $19,000. 2. In March 2014, a plot of land was purchased for future construction of a p

> The statement of financial position of Rodges Corporation follows (in thousands): Instructions Evaluate the statement of financial position. Briefly describe the proper treatment of any item that you find incorrect. Assume the company follows IFRS. RO

> The statement of financial position of Sargent Corporation follows for the current year, 2014: The following additional information is available: 1. The current assets section includes the following: cash $150,000; accounts receivable $ 170,000, less $10

> Jia Inc. applies ASPE and had the following statement of financial position at the end of operations for 2013: During 2014, the following occurred: 1. Jia Inc. sold some of its fair value-net income investment portfolio for $19,000. This transaction res

> Use the information in E5-17 for Marubeni Corporation. The information in E5-17 Instructions (a) Calculate the current ratio and debt to total assets ratio as at December 31, 2013 and 2014. Calculate the free cash flow for December 31, 2014. (b) Based o

> The comparative statement of financial position of Marubeni Corporation for the fiscal year ending December 31, 2014, follows: Net income of $37,000 was reported and dividends of $13,000 were paid in 2014. New equipment was purchased, and equipment with

> The income statement of Kneale Transport Inc. for the year ended December 31, 2014, reported the following condensed information: Kneale's statement of financial position contained the following comparative data at December 31: Additional information:

> The major classifications of activities reported in the statement of cash flows are operating, investing, and financing. For this question, assume the following: 1. The direct method is used. 2. The indirect method is used. Instructions Assume that the

> A comparative statement of financial position for Carmichael Industries Inc. follows: Additional information: 1. Net income for the fiscal year ending December 31, 2014, was $ 129,000. 2. Cash dividends of $60,000 were declared and paid. Dividends paid

> It is February 2015 and Janix Corporation is preparing to issue financial statements for the year ended December 31, 2014. To prepare financial statements and related disclosures that are faithfully representative, Janix is reviewing the following events

> The current assets and current liabilities sections of the statement of financial position of Agincourt Corp. are as follows: The following errors have been discovered in the corporations accounting: 1. January 2015 cash disbursements that were entered

> Zezulka Corporation's statement of financial position at the end of 2013 included the following items: The following information is available for 2014: 1. Net income was $391,000. 2. Equipment (cost of $20,000 and accumulated depreciation of $8,000) was

> The Blue Collar Corporation had income from continuing operations of $ 12.6 million in 2014. During 2014, it disposed of its restaurant division at an after tax loss of $89,000. Before the disposal, the division operated at a loss of $315,000 (net of tax

> Selected accounts follow of Aramis Limited at December 31, 2014: The following additional information is available: 1. Inventory is valued at lower of cost and net realizable value using FIFO. 2. Equipment is recorded at cost. Accumulated depreciation, c

> Chelsea Smith is the controller of Lincoln Corporation and is responsible for the preparation of the year-end financial statements on December 31. Lincoln prepares financial statements in accordance with ASPE. The following transactions occurred during t

> Taylor Corporation had net sales revenue of $2,780,000 and investment revenue of$103,000 in 2014. Other items pertaining to 2014 were as follows: Taylor has 10,000 common shares outstanding. Prepare a single-step income statement showing expenses by nat

> The trial balance of Zeitz Corporation at December 31, 2014, follows: Instructions (a) Prepare a classified statement of financial position as at December 31, 2014. Ignore income taxes. (b) Is there any situation where it would make more sense to have a

> Samson Corporation is preparing its December 31, 2014 statement of financial position. The following items may be reported as either current or long-term liabilities: 1. On December 15, 2014, Samson declared a cash dividend of $2.50 per share to sharehol

> Assume that Iris Inc. has the following accounts at the end of the current year: 1. Common Shares 2. Raw Materials 3. FV-OCI Investments 4. Unearned Rent Revenue 5. Work-in-Process Inventory 6. Intangible Assets-Copyrights 7. Buildings 8. Notes Receivabl

> The bookkeeper for Garfield Corp. has prepared the following statement of financial position as at July 31, 2014: The following additional information is provided: 1. Cash includes $1,200 in a petty cash fund and $12,000 in a bond sinking fund. 2. The n

> Lowell Corp's December 31, 2014 trial balance includes the following accounts: Inventory……………………………………………………………$120,000 Buildings……………………………………………………………$207,000 Accumulated Depreciation-Equipment…………………$19,000 Equipment…………………………………………………………$190,000 Lan

> The following accounts are in Tan Limited's December 31, 2014 trial balance: Prepaid Rent………………………………………………$1,300 Fair Value-OCT Investments………………………$62,000 Unearned Revenue………………………………………$7,000 Land Held for Investment………………………………$139,000 Long-Term Rec

> Kahnert Corporation's adjusted trial balance contained the following asset accounts at December 31, 2014: Cash……………………………………………………………………………..$3,000 Treasury Bills (with original maturity of three months) $4,000 Land……………………………………………………………………………..$40,000

> Aero Inc. had the following statement of financial position at the end of operations for 2013: During 2014, the following occurred: 1. Aero liquidated its investment portfolio at a loss of $5,000. The investments were fair value-net income investments. 2

> Gator Printers Incorporated is an on-line retailer of printing services, reaching thousands of customers across North America every year. The company was founded 15 years ago as a university campus copy shop, and has reported consistent year-over-year sa

> Larsen Corporation is a popular clothing retailer with 15 stores located across Canada. After five consecutive years of increasing sales, Larsen would like to expand operations by adding 10 stores within the next three years. To help fund the expansion,

> Midwest Beverage Company reported the following items in the most recent year: (a) Calculate net cash provided (used) by operating activities, the net change in cash during the year, and free cash flow. Dividends paid are treated as financing activities

> Mega Inc’s manufacturing division lost 5100,000 (net of tax) for the year ended December 31, 2014, and Mega estimates that it can sell the division at a loss of $200,000 (net of tax). The division qualifies for treatment as a discontinued operation. (a)

> Use the information from BE5-14 for Mills Corporation. Determine Mills’s free cash flow, assuming that it reported net cash provided by operating activities of $400,000. Information from BE5-14 Sale of land and building $196,000 25,

> Use the information from BE5- 14 for Mills Corporation. (a) Calculate the net cash provided (used) by financing activities, if dividends paid are treated as operating activities. (b) Explain how your answer to part (a) would be different if Mills prepa

> Mills Corporation engaged in the following cash transactions during 2014: Mills prepares financial statements in accordance with IFRS. Calculate the net cash provided (used) by investing activities. Sale of land and building $196,000 25,000 43,000 58

> Ames Company reported 2014 net income of $151,000. During 2014, accounts receivable increased by the $13,000 and accounts payable increased by $9,500. Depreciation expense was $44,000. Prepare the cash flows from operating activities section of the state

> Healey Corporation's statement of financial position as at December 31, 2014, showed the following amounts: Cash…………………………………. $100 Accounts Receivable……………$600 Land…………………………………$1,000 Accounts Payable…………………$300 Bonds Payable……………………$500 Common Shares…

> What is the purpose of the statement of cash flows? How does it differ from a statement of financial position and an income statement?

> In an examination of Wirjanto Corporation as at December 31, 2014, you have learned about the following situations. No entries have been made in the accounting records for these items. 1. The corporation erected its present factory building in 1998. Depr

> Sunman Inc. is a discount retailer with 1,000 stores located across North America. Sunman purchases bulk quantities of groceries and household goods, and then sells the goods directly to retail customers at a markup. Pharmedical Inc. is a pharmaceutical

> Daisy Construction Ltd. has entered into a contract beginning January 1, 2014, to build a parking complex. It has estimated that the complex will cost $8 million and will take three years to construct. The complex will be billed to the purchasing company

> Soorya Enterprises sells a corporate monitoring system that includes the hardware, software, and monitoring services and annual maintenance for three years for a fixed price of $750,000. The new controller would like to understand the accounting for this

> You have been engaged by Ashely Corp. to advise it on the proper accounting for a series of long-term contracts. Ashely began doing business on January 1, 2014, and its construction activities for the first year of operations are shown below. All contrac

> On March 1, 2014, Wilma Limited signed a contract to build a factory for Slate Construction Manufacturing Inc. for a total contract price of $9.4 million. The building was completed by October 31, 2016. The annual contract costs that were incurred, the e

> Jupiter Inc. was established in 1985 by Joyce Fukomoto and initially operated under contracts to build highly energy-efficient, customized homes. In me 1990s, Joyce's two daughters joined the firm and expanded the company's activities into me high-rise a

> Dave Scotland Inc. (DSI) sold inventory to a new customer, Jamali Ltd., on December 20, 2014. Jamali was given a significant discount to entice it to switch from its regular supplier. Jamali asked DSI not to ship the inventory until January 2, 2015, beca

> On May 3, 2014, Brown Motors Limited consigned 80 motorcycles, costing $25,000 each, to Mississauga Motors Inc. The total cost of shipping the motorcycles was $5,800 and was paid by Brown Motors. On December 30, 2014, an account sales report was received

> Mackenzie Construction Services Ltd. has entered into a contract to construct an office building for Designers Corporation. Mackenzie prepares financial statements in accordance with IFRS. Explain how Mackenzie should recognize revenue under the earnings

> For each of the following scenarios, how will these circumstances affect the recognition of revenue under the earnings approach and under the contract-based approach? (a) The anticipated revenues on a contract are $10 million but the associated costs can

> For each of the scenarios noted in BE6-4 above, when would revenue be recognized under the earnings approach? In BE6-4 (a) A manufacturer makes and sells farm equipment. The customer picks up the equipment upon purchase. In addition, there is a one-year

> The Comfort-Zone Company installs heating, ventilation, and air conditioning in large buildings such as domed stadiums, military bases, airports, and high rises. Its contracts usually take two to three years to complete. At any fiscal year end, this work

> Write a brief essay highlighting the differences between IFRS and ASPE, discussing the conceptual justification for each.

> XYZ Company has manufactured a new product that will be marketed and sold during the current year. To encourage distributors to carry the product, XYZ will not require payment until the distributor receives the final payment from its customers. This is n

> The IASB exposure draft (ED) and re-exposure draft (RED) on revenue recognition discuss how onerous contracts should be reported and measured. Instructions Refer to the IASBs ED and RED "Revenue Recognition in Contracts with Customers" from June 2010 an

> The IASB was considering additional guidance on reporting revenues when other parties are involved in providing goods and services to a company's customer. The Board has been debating the conditions that must be present for a company to record revenue at

> Treetop Pharmaceuticals (TP) researches, develops, and produces over- the-counter drugs. During the year, it acquired 100% of the net assets of Treeroot Drugs Limited (TDL) for $200 million. The fair value of the identifiable assets at the time of purcha

> Comminc Industries (CI) is a leader in delivering communications technology that powers global commerce and secures the world's most critical information. Its shares trade on the Canadian and U.S. national stock exchanges. The company had been experienci

> Stock Car Auto Inc. (SCA) is a promoter and sponsor of motor-sport activities. Its shares trade on the Toronto Stock Exchange. The company owns two racing tracks where it hosts races (including those sponsored by NASCAR the National Association for Stock

> Nimble Health and Racquet Club (NHRC) is a public company that operates eight clubs in a large city and offers one-year memberships. The members may use any of the eight facilities but must reserve racquetball court time and pay a separate fee before usi

> What is the earnings process for each of the following scenarios? (a) A manufacturer makes and sells farm equipment. The customer picks up the equipment upon purchase. In addition, there is a one-year warranty that will be honored by another company. (b)

> Cutting Edge is a monthly magazine that has been on the market for 18 months. It is owned by a private company and has a circulation of 1.4 million copies. Negotiations are underway to obtain a bank loan in order to update its facilities. It is producing

> Vaughan Construction Ltd. has entered into a contract beginning in February 2014 to build two warehouses for Atlantis Structures Ltd. The contract has a fixed price of $9.5 million. The following data are for the construction period: Instructions (a) Us

> Granite Engineering Ltd. has entered into a contract beginning January 1, 2013, to build a bridge in Tuktoyuktuk Shores. It estimates that the bridge will cost $14.8 million and will take three years to construct. The bridge will be billed to the municip

> Consider the following unrelated situations: 1. Book of the Week Limited sends books out to potential customers on a trial basis. If the customers do not like the books, they can return them at no cost. 2. Sea Clothing Company Inc. has a return policy th

> The following are independent situations that require professional judgment for determining when to recognize revenue from the transactions. 1. Costco sells you a one-year membership with a single, one-time upfront payment. This non-refundable fee is pai

> Van Horn Construction Corp. uses the percentage-of-completion method of accounting. In 2014, Van Horn began work under contract #SG-OO1, which provided for a contract price of $5.2 million. Other details follow: Instructions Under the earnings approach:

> Vaneeta Construction Ltd. began operations in 2014. Construction activity for the first year follows. All contracts are with different customers, and any work remaining at December 31, 2014, is expected to be completed in 2015. Instructions Under the ea

> Venetian Construction Corp. began operations on January 1, 2014. During the year, Venetian entered into a contract with Ravi Corp. to construct a manufacturing facility. At that time, Venetian estimated that it would take five years to complete the facil

> During 2014, Darwin Corporation started a construction job with a contract price of S4.2 million. Darwin ran into severe technical difficulties during construction but managed to complete the job in 2016. The following information is available: Instruct

> During 2014, Antoinette started a construction job with a contract price of $2.5 million. The job was completed in 2016 and information for the three years of construction is as follows: Instructions Under the earning approach: (a) Calculate the amount

> In 2014, Ronalda Construction Inc. agreed to construct an apartment building at a price of $10 million. Information on the costs and billings for the first two years of this contract is as follows: Instructions Assun1e the earnings approach is used. Rou

> On April 1, 2014, Lisboa Limited entered into a cost-plus-fixed fee contract to manufacture an electric generator for Martinez Corporation. At the contract date, Lisboa estimated that it would take two years to complete the project at a cost of $6.5 mill

> In 2014, Aldcorn Construction Corp. began construction work on a three-year, $ 10-million contract. Aldcorn uses the percentage-of-completion method for financial accounting purposes. The income to be recognized each year is based on the proportion of co

> Explain the rights and obligations created in the following transactions. (a) A manufacturer sells goods with terms FOB shipping point. (b) A manufacturer sells goods with terms FOB destination point. (c) A manufacturer sells goods with terms FOB shippin

> Chang Industries ships merchandise costing $120,000 on consignment to XYZ Inc. Chang pays the freight of $5,000. XYZ Inc. is to receive a 15% commission upon sale and a 5% allowance to offset its advertising expenses. At the end of the period, XYZ notifi

> Genesis Corporation is an equipment manufacturing company. Instructions (a) How should revenue be recorded under the earnings and contract-based approaches if Genesis has a normal business practice of offering customers a one-year payment term? (b) How

> Discuss how the contract-based approach to revenue recognition is consistent with the definition of revenues in the conceptual framework. Explain the main concepts of the earnings approach and the contract-based approach. What are the conceptual differen

> Rancourt Corp. is a real estate company. Approximately 50% of sales are properties that Rancourt owns. In the remaining 50%, Rancourt brokers the transactions by finding buyers for property owned by other companies. Explain how Rancourt should present th

> Compare the accounting for long-term contracts under ASPE and under IFRS.

> Lombardo Construction Corp. began work on a $100-million construction contract in 2014 to build a luxury hotel to be completed in 2016. During 2014, Lombardo incurred costs of $42 million, billed its customer for $38 million, and collected $35 million. I

> Louis Manufacturing Inc. (LMI) purchased some telecommunications equipment in January of the current year. The equipment normally sells for $2,300. In order to entice LMI to close the deal, the salesperson offered LMI related services that normally sell

> Inexperienced construction company ABC Corp. signed a risky contract to build a research facility at a fixed contract amount of $2 million. The work began in early 2014 and ABC incurred costs of $900,000. At December 31, 2014, the estimated future costs

> Tampa Inc. began work on an $11.5-million contract in 2014 to construct an office building. During 2014, Tampa Inc. incurred costs of $3.3 million, billed its customers for $5.1 million, and collected $2.9 million. At December 31, 2014, the estimated fut

> Seaport Marina has 500 slips (boat docks) that rent for $1,000 per season. Payments must be made in full at the start of the boating season, April 1. Slips may be reserved for the next season if they are paid for by December 31. Under a new policy, if pa

> Explain the basic economics of what is being received and what is being given up in each of the following business transactions. (a) A company sells packaging material to another company. The terms of sale require full payment upon delivery. (b) A compan

> Pennfield Construction Corp. began work on a $5,020,000 construction contract in 2014. During 2014, the company incurred costs of $1,600,000, billed its customer for $ 1,750,000, and collected $1,500,000. At December 31, 2014, the estimated future costs

> On August 15, 2014, Japan Ideas consigned 500 electronic play systems, costing $100 each, to YoYo Toys Company. The cost of shipping the play systems amounted to $1,250 and was paid by Japan Ideas. On December 31, 2014, an account sales sun1mary was rece

> Finch Industries shipped $550,000 of merchandise on consignment to Royal Crown Company. Finch paid freight costs of $5,000. Royal Crown Company paid $1,500 for local advertising, which is reimbursable from Finch. By year end, 75% of the merchandise had b

> Builder Corp. is constructing a warehouse that is expected to take two years to complete. Builder prepares financial statements in accordance with IFRS. Explain how Builder should recognize revenue under the earnings approach, in each of the following sc

> Eastern Chemicals Corp. produces a chemical compound at its plant in Halifax, Nova Scoria, and Western Polymers Inc. produces the same chemical compound at its plant in Kelowna, British Columbia. Both companies have manufacturing facilities across Canada