Question: Use the option quote information shown here

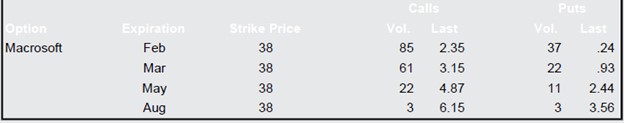

Use the option quote information shown here to answer the questions that follow. The stock is currently selling for $40.

a. Suppose you buy 10 contracts of the February 38 call option. How much will you pay, ignoring commissions?

b. In part (a), suppose that Macrosoft stock is selling for $43 per share on the expiration date. How much is your options investment worth? What if the terminal stock price is $39? Explain.

c. Suppose you buy 10 contracts of the August 38 put option. What is your maximum gain? On the expiration date, Macrosoft is selling for $32 per share. How much is your options investment worth? What is your net gain?

d. In part (c), suppose you sell 10 of the August 38 put contracts. What is your net gain or loss if Macrosoft is selling for $34 at expiration? For $41? What is the break-even price—that is, the terminal stock price that results in a zero profit?

> As a new graduate, you’ve taken a management position with Exotic Cuisines, Inc., a restaurant chain that just went public last year. The company’s restaurants specialize in exotic main dishes, using ingredients such as alligator, bison, and ostrich. A c

> S&S Air is preparing its first public securities offering. In consultation with Renata Harper of underwriter Raines and Warren, Chris Guthrie decided that a convertible bond with a 20-year maturity was the way to go. He met the owners, Mark and Todd, and

> Joi Chatman recently received her finance degree and has decided to enter the mortgage broker business. Rather than working for someone else, she will open her own shop. Her cousin Mike has approached her about a mortgage for a house he is building. The

> Sterling Wyatt, the president of Howlett Industries, has been exploring ways of improving the company’s financial performance. Howlett manufactures and sells office equipment to retailers. The company’s growth has been

> Webb Corporation was founded 20 years ago by its president, Bryan Webb. The company originally began as a mail-order company, but it has grown rapidly in recent years, in large part due to its website. Because of the wide geographical dispersion of the c

> Stephenson Real Estate Company was founded 25 years ago by the current CEO, Robert Stephenson. The company purchases real estate, including land and buildings, and rents the property to tenants. The company has shown a profit every year for the past 18 y

> After deciding to buy a new car, you can either lease the car or purchase it on a three-year loan. The car you wish to buy costs $43,000. The dealer has a special leasing arrangement where you pay $4,300 today and $505 per month for the next three years.

> Mark Sexton and Todd Story have been discussing the future of S&S Air. The company has been experiencing fast growth, and the two see only clear skies in the company’s future. However, the fast growth can no longer be funded by internal sources, so Mark

> Assume that the tax rate is 21 percent. You can borrow at 8 percent before taxes. Should you lease or buy?

> You have recently been hired by Swan Motors, Inc. (SMI), in its relatively new treasury management department. SMI was founded eight years ago by Joe Swan. Joe found a method to manufacture a cheaper battery that will hold a larger charge, giving a car p

> Sunset Boards is a small company that manufactures and sells surfboards in Malibu. Tad Marks, the founder of the company, is in charge of the design and sale of the surfboards, but his background is in surfing, not business. As a result, the company&acir

> In Problem 8, are the shareholders of Firm T better off with the cash offer or the stock offer? At what exchange ratio of B shares to T shares would the shareholders in T be indifferent between the two offers?Problem 8:Consider the following premerger in

> Consider the following premerger information about a bidding firm (Firm B) and a target firm (Firm T). Assume that both firms have no debt outstanding.Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $9,300. a. If

> The shareholders of Bread Company have voted in favor of a buyout offer from Butter Corporation. Information about each firm is given here:Bread’s shareholders will receive one share of Butter stock for every three shares they hold in B

> Three Guys Burgers, Inc., has offered $16.5 million for all of the common stock in Two Guys Fries, Corp. The current market capitalization of Two Guys as an independent company is $13.4 million. Assume the required return on the acquisition is 9 percent

> Penn Corp. is analyzing the possible acquisition of Teller Company. Both firms have no debt. Penn believes the acquisition will increase its total aftertax annual cash flows by $1.6 million indefinitely. The current market value of Teller is $38 million,

> Silver Enterprises has acquired All Gold Mining in a merger transaction. Construct the balance sheet for the new corporation if the merger is treated as a purchase of interests for accounting purposes. The following balance sheets represent the premerger

> Assume that the following balance sheets are stated at book value. Suppose that Meat Co. purchases Loaf, Inc.The fair market value of Loaf’s fixed assets is $9,800 versus the $6,900 book value shown. Meat pays $17,800 for Loaf and raise

> Bilbo Baggins wants to save money to meet three objectives. First, he would like to be able to retire 30 years from now with retirement income of $17,500 per month for 25 years, with the first payment received 30 years and 1 month from now. Second, he wo

> Locate the Treasury issue in Figure 7.4 maturing in May 2038. What is its coupon rate? What is its bid price? What was the previous day’s asked price? Assume a par value of $10,000. Figure 7.4:

> Consider the following premerger information about Firm X and Firm Y:Assume that Firm X acquires Firm Y by issuing new long-term debt for all the shares outstanding at a merger premium of $6 per share. Assuming that neither firm has any debt before the m

> Fly-By-Night Couriers is analyzing the possible acquisition of Flash-in-the-Pan Restaurants.Neither firm has debt. The forecasts of Fly-By-Night show that the purchase would increase its annual aftertax cash flow by $375,000 indefinitely. The current mar

> You are given the following information concerning options on a particular stock:a. What is the intrinsic value of the call option? Of the put option?b. What is the time value of the call option? Of the put option?c. Does the call or the put have the lar

> Consider the following premerger information about Firm A and Firm B:Assume that Firm A acquires Firm B via an exchange of stock at a price of $49 for each share of B’s stock. Both Firm A and Firm B have no debt outstanding.a. What will

> Pearl, Inc., has offered $228 million cash for all of the common stock in Jam Corporation. Based on recent market information, Jam is worth $214 million as an independent operation. If the merger makes economic sense for Pearl, what is the minimum estima

> You own a lot in Key West, Florida, that is currently unused. Similar lots have recently sold for $1,250,000. Over the past five years, the price of land in the area has increased 7 percent per year, with an annual standard deviation of 30 percent. A buy

> What are the deltas of a call option and a put option with the following characteristics? What does the delta of the option tell you?,,,

> What are the prices of a call option and a put option with the following characteristics?,,,

> A put option and call option with an exercise price of $50 expire in four months and sell for $5.99 and $8.64, respectively. If the stock is currently priced at $52.27, what is the annual continuously compounded rate of interest?

> A put option and a call option with an exercise price of $70 and three months to expiration sell for $1.30 and $6.25, respectively. If the risk-free rate is 3.1 percent per year, compounded continuously, what is the current stock price?

> Say you own an asset that had a total return last year of 11.65 percent. If the inflation rate last year was 2.75 percent, what was your real return?

> Rework Problem 55 assuming that the loan agreement calls for a principal reduction of $14,300 every year instead of equal annual payments.Data from Problem 55:Prepare an amortization schedule for a five-year loan of $71,500. The interest rate is 7 percen

> A put option that expires in six months with an exercise price of $45 sells for $2.34. The stock is currently priced at $48, and the risk-free rate is 3.5 percent per year, compounded continuously. What is the price of a call option with the same exercis

> A stock is currently selling for $67 per share. A call option with an exercise price of $70 sells for $3.21 and expires in three months. If the risk-free rate of interest is 2.6 percent per year, compounded continuously, what is the price of a put option

> If you need $20,000 in 12 years, how much will you need to deposit today if you can earn 9 percent per year compounded continuously?

> A call option has an exercise price of $60 and matures in six months. The current stock price is $64, and the risk-free rate is 5 percent per year, compounded continuously. What is the price of the call if the standard deviation of the stock is 0 percent

> A call option matures in six months. The underlying stock price is $75, and the stock’s return has a standard deviation of 20 percent per year. The risk-free rate is 4 percent per year, compounded continuously. If the exercise price is $0, what is the pr

> A call option with an exercise price of $25 and four months to expiration has a price of $2.75. The stock is currently priced at $23.80, and the risk-free rate is 2.5 percent per year, compounded continuously. What is the price of a put option with the s

> In Problem 9, suppose you wanted the option to sell the land to the buyer in one year. Assuming all the facts are the same, describe the transaction that would occur today. What is the price of the transaction today?Problem 9:You own a lot in Key West, F

> If you have $1,275 today, how much will it be worth in six years at 8 percent per year compounded continuously?

> A $1,000 par convertible debenture has a conversion price for common stock of $27 per share. With the common stock selling at $31, what is the conversion value of the bond?

> An investment offers a total return of 12.3 percent over the coming year. Janice Yellen thinks the total real return on this investment will be only 8 percent. What does Janice believe the inflation rate will be over the next year?

> Buckeye Industries has a bond issue with a face value of $1,000 that is coming due in one year. The value of the company’s assets is currently $1,040. Urban Meyer, the CEO, believes that the assets in the company will be worth either $940 or $1,270 in a

> Prepare an amortization schedule for a five-year loan of $71,500. The interest rate is 7 percent per year, and the loan calls for equal annual payments. How much interest is paid in the third year? How much total interest is paid over the life of the loa

> Rackin Pinion Corporation’s assets are currently worth $1,065. In one year, they will be worth either $1,000 or $1,340. The risk-free interest rate is 3.9 percent. Suppose the company has an outstanding debt issue with a face value of $1,000.a. What is t

> A one-year call option contract on Cheesy Poofs Co. stock sells for $845. In one year, the stock will be worth $64 or $81 per share. The exercise price on the call option is $70. What is the current value of the stock if the risk-free rate is 3 percent?

> The price of Cilantro, Inc., stock will be either $70 or $90 at the end of the year. Call options are available with one year to expiration. T-bills currently yield 6 percent.a. Suppose the current price of the company’s stock is $80. What is the value o

> The price of Chive Corp. stock will be either $67 or $91 at the end of the year. Call options are available with one year to expiration. T-bills currently yield 4 percent.a. Suppose the current price of the company’s stock is $75. What is the value of th

> You have looked at the current financial statements for Reigle Homes, Co. The company has an EBIT of $3.15 million this year. Depreciation, the increase in net working capital, and capital spending were $265,000, $105,000, and $495,000, respectively. You

> Pearl Corp. is expected to have an EBIT of $1.8 million next year. Depreciation, the increase in net working capital, and capital spending are expected to be $155,000, $75,000, and $115,000, respectively.All are expected to grow at 18 percent per year fo

> Minder Industries stock has a beta of 1.08. The company just paid a dividend of $.65, and the dividends are expected to grow at 4 percent. The expected return on the market is 10.5 percent, and Treasury bills are yielding 3.4 percent. The most recent sto

> Suppose the real rate is 2.1 percent and the inflation rate is 3.4 percent. What rate would you expect to see on a Treasury bill?

> Consider the following project of Hand Clapper, Inc. The company is considering a four-year project to manufacture clap-command garage door openers. This project requires an initial investment of $14 million that will be depreciated straight-line to zero

> You have been hired to value a new 25-year callable, convertible bond. The bond has a coupon rate of 2.3 percent, payable annually. The conversion price is $68, and the stock currently sells for $27.83. The stock price is expected to grow at 11 percent p

> You want to buy a new sports car from Muscle Motors for $57,500. The contract is in the form of a 60-month annuity due at an APR of 5.9 percent. What will your monthly payment be?

> Liberty Products, Inc., is considering a new product launch. The firm expects to have annual operating cash flow of $5.3 million for the next eight years. The company uses a discount rate of 11 percent for new product launches. The initial investment is

> Use the option quote information shown here to answer the questions that follow. The stock is currently selling for $85.a. Are the call options in the money? What is the intrinsic value of an RWJ Corp. call option?b. Are the put options in the money? Wha

> Campbell, Inc., has a $1,000 face value convertible bond issue that is currently selling in the market for $960. Each bond is exchangeable at any time for 18 shares of the company’s stock. The convertible bond has a 4.9 percent coupon, payable semiannual

> Which of the following two sets of relationships, at time of issuance for convertible bonds, is more typical? Why?,,,

> Suppose a share of stock sells for $63. The risk-free rate is 5 percent, and the stock price in one year will be either $70 or $80.a. What is the value of a call option with an exercise price of $70?b. What’s wrong here? What would you do?

> In Problem 15, suppose the scale of the project can be doubled in one year in the sense that twice as many units can be produced and sold. Naturally, expansion would be desirable only if the project is a success. This implies that if the project is a suc

> In Problem 14, suppose you think it is likely that expected sales will be revised upward to 10,800 units if the first year is a success and revised downward to 3,900 units if the first year is not a success. Problem 14:We are examining a new project. We

> If Treasury bills are currently paying 4.7 percent and the inflation rate is 2.2 percent, what is the approximate real rate of interest? The exact real rate?

> We are examining a new project. We expect to sell 7,100 units per year at $56 net cash flow apiece for the next 10 years. In other words, the annual cash flow is projected to be $56 × 7,100 = $397,600. The relevant discount rate is 14 percent, and the in

> Your company is deciding whether to invest in a new machine. The new machine will increase cash flow by $275,000 per year. You believe the technology used in the machine has a 10-year life; in other words, no matter when you purchase the machine, it will

> A bond with 20 detachable warrants has just been offered for sale at $1,000. The bond matures in 20 years and has an annual coupon of $24. Each warrant gives the owner the right to purchase two shares of stock in the company at $45 per share. Ordinary bo

> Suppose you are going to receive $13,500 per year for five years. The appropriate interest rate is 6.8 percent. a. What is the present value of the payments if they are in the form of an ordinary annuity? What is the present value if the payments are an

> You have been hired to value a new 30-year callable, convertible bond. The bond has a coupon rate of 2.7 percent, payable semiannually, and its face value is $1,000. The conversion price is $54, and the stock currently sells for $38.a. What is the minimu

> The following facts apply to a convertible bond making semiannual payments:Conversion price …………………………………………………………………… $37/shareCoupon rate …………………………………………………………………………………. 2.6%Par value …………………………………………………………………………………… $1,000Yield on nonconvertible debe

> T-bills currently yield 3.4 percent. Stock in Deadwood Manufacturing is currently selling for $58 per share. There is no possibility that the stock will be worth less than $50 per share in one year.a. What is the value of a call option with a $45 exercis

> Suppose your company imports computer motherboards from Singapore. The exchange rate is given in Figure 21.1. You have just placed an order for 30,000 motherboards at a cost to you of 218.50 Singapore dollars each. You will pay for the shipment when it a

> Suppose the current exchange rate for the Polish zloty is Z 4.04. The expected exchange rate in three years is Z 4.13. What is the difference in the annual inflation rates for the United States and Poland over this period? Assume that the anticipated rat

> Refer to Table 23.1 in the text to answer this question. Suppose today is February 10, 2017, and your firm produces breakfast cereal and needs 145,000 bushels of corn in May 2017 for an upcoming promotion. You would like to lock in your costs today becau

> Union Local School District has a bond outstanding with a coupon rate of 2.8 percent paid semiannually and 16 years to maturity. The yield to maturity on this bond is 3.4 percent, and the bond has a par value of $5,000. What is the price of the bond?

> Suppose your company has a building worth $165 million. Because it is located in a high-risk area for natural disasters, the probability of a total loss in any particular year is 1.15 percent. What is your company’s expected loss per year on this buildin

> Refer to Table 23.2 in the text to answer this question. Suppose you purchase the May 2017 put option on corn futures with a strike price of $3.80. Assume your purchase was at the last price. What is the total cost? Suppose the price of corn futures is $

> Suppose a financial manager buys call options on 50,000 barrels of oil with an exercise price of $57 per barrel. She simultaneously sells a put option on 50,000 barrels of oil with the same exercise price of $57 per barrel. Consider her gains and losses

> Refer to Table 23.2 in the text to answer this question. Suppose you purchase the May 2017 call option on corn futures with a strike price of $3.85. Assume you purchased the option at the last price. How much does your option cost per bushel of corn? Wha

> A five-year annuity of 10 $5,900 semiannual payments will begin 9 years from now, with the first payment coming 9.5 years from now. If the discount rate is 8 percent compounded monthly, what is the value of this annuity five years from now? What is the v

> In Problem 21, assume that the probability of default is 15 percent. Should the orders be filled now? Assume the number of repeat customers is affected by the defaults. In other words, 30 percent of the customers who do not default are expected to be rep

> Solar Engines manufactures solar engines for tractor-trailers. Given the fuel savings available, new orders for 125 units have been made by customers requesting credit. The variable cost is $6,900 per unit, and the credit price is $7,600 each. Credit is

> Assuming a world of corporate taxes only, show that the cost of equity, RE, is as given in the chapter by M&M Proposition II with corporate taxes

> Refer to Table 23.1 in the text to answer this question. Suppose you sell five March 2017 silver futures contracts this day at the last price of the day. What will your profit or loss be if silver prices turn out to be $17.81 per ounce at expiration? Wha

> In Problem 15, what is the break-even price per unit under the new credit policy? Assume all other values remain the same.Problem 15:Veni, Inc., currently has an all-cash credit policy. It is considering making a change in the credit policy by going to t

> Yan Yan Corp. has a $2,000 par value bond outstanding with a coupon rate of 4.4 percent paid semiannually and 13 years to maturity. The yield to maturity of the bond is 4.8 percent. What is the price of the bond?

> In Problem 14, what is the break-even price per unit that should be charged under the new credit policy? Assume that the sales figure under the new policy is 3,310 units and all other values remain the same.Problem 14:The Snedecker Corporation is conside

> In Problem 16, assume the equity increases by 1,250 solaris due to retained earnings. If the exchange rate at the end of the year is 1.54 solaris per dollar, what does the balance sheet look like?Problem 16:Atreides International has operations in Arraki

> Atreides International has operations in Arrakis. The balance sheet for this division in Arrakeen solaris shows assets of 38,000 solaris, debt in the amount of 12,000 solaris, and equity of 26,000 solaris. a. If the current exchange ratio is 1.50 solaris

> You are evaluating a proposed expansion of an existing subsidiary located in Switzerland. The cost of the expansion would be SF 13.8 million. The cash flows from the project would be SF 3.9 million per year for the next five years. The dollar required re

> Lakonishok Equipment has an investment opportunity in Europe. The project costs €10.5 million and is expected to produce cash flows of €1.7 million in Year 1, €2.4 million in Year 2, and €3.3 million in Year 3. The current spot exchange rate is €.94/$ a

> A local finance company quotes an interest rate of 17.1 percent on one-year loans. So, if you borrow $20,000, the interest for the year will be $3,420. Because you must repay a total of $23,420 in one year, the finance company requires you to pay $23,420

> Suppose the spot exchange rate for the Hungarian forint is HUF 289.97. The inflation rate in the United States will be 2.9 percent per year. It will be 4.5 percent in Hungary. What do you predict the exchange rate will be in one year? In two years? In fi

> Suppose the spot and three-month forward rates for the yen are ¥113.65 and ¥113.18, respectively. a. Is the yen expected to get stronger or weaker?b. What would you estimate is the difference between the annual inflation rates of the United States and Ja

> You observe that the inflation rate in the United States is 3.5 percent per year and that T-bills currently yield 4.1 percent annually. Using the approximate international Fisher effect, what do you estimate the inflation rate to be in:a. Australia, if s

> In calculating insurance premiums, the actuarially fair insurance premium is the premium that results in a zero NPV for both the insured and the insurer. As such, the present value of the expected loss is the actuarially fair insurance premium. Suppose y

> McCann Co. has identified an investment project with the following cash flows. If the discount rate is 10 percent, what is the present value of these cash flows? What is the present value at 18 percent? At 24 percent?Year ………………………………………………………………………… Cas

> A stock is currently priced at $47. A call option with an expiration of one year has an exercise price of $50. The risk-free rate is 12 percent per year, compounded continuously, and the standard deviation of the stock’s return is infinitely large. What

> Refer to Table 23.1 in the text to answer this question. Suppose you purchase a March 2017 cocoa futures contract this day at the last price of the day. What will your profit or loss be if cocoa prices turn out to be $1,965 per metric ton at expiration?T

> The treasurer of a major U.S. firm has $30 million to invest for three months. The interest rate in the United States is .28 percent per month. The interest rate in Great Britain is .31 percent per month. The spot exchange rate is £.791, and the three-mo

> Use Figure 21.1 to answer the following questions: Suppose interest rate parity holds, and the current six-month risk-free rate in the United States is 1.3 percent. What must the six-month risk free rate be in Great Britain? In Japan? In Switzerland?Figu