Question: Using page 3 of a general journal

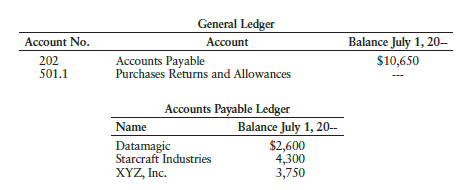

Using page 3 of a general journal and the following general ledger and accounts payable ledger accounts, journalize and post the following transactions:

July 7 Returned merchandise to Starcraft Industries, $700.

15 Returned merchandise to XYZ, Inc., $450.

27 Returned merchandise to Datamagic, $900.

Transcribed Image Text:

General Ledger Account No. Account Balance July 1, 20- $10,650 202 501.1 Accounts Payable Purchases Returns and Allowances Accounts Payable Ledger Balance July 1, 20-- $2,600 4,300 3,750 Name Datamagic Starcraft Industries XYZ, Inc.

> Paulson’s Pet Store completed the work sheet on page 602 for the year ended December 31, 20--. Owner’s equity as of January 1, 20--, was $21,900. The current portion of Mortgage Payable is $500. REQUIRED 1. Prepare a multiple-step income statement. 2. P

> Prepare entries for (a), (b), and (c) listed below using two methods. First, prepare the entries without making a reversing entry. Second, prepare the entries with the use of a reversing entry. Use T-accounts to assist your analysis. (a) Wages paid durin

> From the work sheet used in Exercise 15-5A, Exercise 15-5A: From the work sheet on page 600, prepare the following: 1. Closing entries for Gimbel’s Gifts and Gadgets in a general journal. 2. A post-closing trial balance. Identify the adjusting entry (

> From the work sheet on page 600, prepare the following: 1. Closing entries for Gimbel’s Gifts and Gadgets in a general journal. 2. A post-closing trial balance.

> Name and describe four areas of specialization for a public accountant.

> Based on the financial statements for Jackson Enterprises (income statement, statement of owner’s equity, and balance sheet) shown on pages 598–599, prepare the following financial ratios. All sales are credit sales. T

> Use the following information to prepare a multiple-step income statement, including the revenue section and the cost of goods sold section, for Sauter Office Supplies for the year ended December 31, 20--. Sales ……………………………………………………………. $156,300 Sales Re

> Based on the information that follows, prepare the cost of goods sold section of a multiple-step income statement. Merchandise Inventory, January 1, 20-- ……………………………………………. $ 37,000 Purchases ……………………………………………………………………………………….. 106,000 Purchases Returns

> The partial work sheet shown below is taken from the books of Stark Street Computers, a business owned by Logan Cowart, for the year ended December 31, 20--. REQUIRED 1. Determine the adjusting entries by analyzing the difference between the adjusted t

> Vicki’s Fabric Store shows the trial balance on page 603 as of December 31, 20-1. At the end of the year, the following adjustments need to be made: (a and b) Merchandise inventory as of December 31, $31,600. (c) Unused supplies on hand

> Based on the information that follows, prepare the revenue section of a multiple-step income statement. Sales ……………………………………………………………………… $150,000 Sales Returns and Allowances ………………………………………. 6,000 Sales Discounts …………………………………………………………… 3,400

> The trial balance for the Venice Beach Kite Shop, a business owned by Molly Young is shown on page 550. Year-end adjustment information is as follows: (a and b) Merchandise inventory costing $35,000 is on hand as of December 31, 20--. (The periodic inven

> On December 31, Anup Enterprises completed a physical count of its inventory. Although the merchandise inventory account shows a balance of $350,000, the physical count comes to $325,000. Prepare the appropriate adjusting entry under the perpetual invent

> Bhushan Building Supplies entered into the following transactions. Prepare journal entries under the perpetual inventory system. June 1 purchased merchandise on account from Brij Builder’s Materials, $500,000. 3 Purchased merchandise for cash, $400,000.

> The following partial work sheet is taken from the books of Kelly’s Kittens, a local pet kennel, for the year ended December 31, 20--. Journalize the adjustments in a general journal. Kelly's Kittens Work Sheet (Partial) For Year En

> Explain when expenses are recorded under the cash basis, modified cash basis, and accrual basis of accounting.

> From the following partial work sheet, indicate the dollar amount of beginning and ending merchandise inventory: ADIUSTMENES ADSED RALSLANE KOMESTATMINT MTOUNT E DET DEST DEST DET 1 Merchandise Inventory (b) 60 0 0 0 00 (a) 55 0 0 0 00| 60 0 0 0 60 0

> The following partial work sheet is taken from Kevin’s Gift Shop for the year ended December 31, 20--. The ending merchandise inventory is $50,000. 1. Complete the Adjustments columns for the merchandise inventory. 2. Extend the merchan

> Set up T accounts for Cash, Unearned Ticket Revenue, and Ticket Revenue. Post the following two transactions to the appropriate accounts, indicating each transaction by letter: (a) Sold 1,200 season tickets at $400 each, receiving cash of $480,000. (b) A

> Prepare the cost of goods sold section for Adams Gift Shop. The following amounts are known: Beginning merchandise inventory ………………………………………... $27,000 Ending merchandise inventory ………………………………….…………... 22,000 Purchases …………………………………………………………………………… 78,

> The trial balance for Cascade Bicycle Shop, a business owned by David Lamond, is shown below. Year-end adjustment information is as follows: (a and b) Merchandise inventory costing $22,000 is on hand as of December 31, 20--. (The periodic inventory syste

> Matt Henry owns a business called Henry’s Sporting Goods. His beginning inventory as of January 1, 20--, was $45,000, and his ending inventory as of December 31, 20--, was $57,000. Set up T accounts for Merchandise Inventory and Income Summary and perfor

> The following information is provided by Raynette’s Pharmacy for the last quarter of its fiscal year ending on March 31, 20--: REQUIRED 1. Estimate the ending inventory as of March 31 using the retail inventory method. 2. Estimate the

> A fire completely destroyed all the inventory of Glisan Lumber Yard on August 5, 20--. Fortunately, the accounting records were not destroyed in the fire. The following information is provided by Glisan Lumber Yard for the time period January 1 through A

> Douglas Company’s beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows: REQUIRED 1. Calculate the total amount to be assigned to the ending inventory and cost of goods sold on December 31 un

> Swing Company’s beginning inventory and purchases during the fiscal year ended September 30, 20-2, were as follows: REQUIRED Calculate the total amount to be assigned to cost of goods sold for the fiscal year ended September 30, 20-2,

> Explain when revenues are recorded under the cash basis, modified cash basis, and accrual basis of accounting.

> Stalberg Company’s beginning inventory and pur chases during the fiscal year ended December 31, 20--, were as follows: There are 10 units of inventory on hand on December 31. 1. Calculate the total amount to be assigned to the ending

> Sandy Chen owns a small specialty store, named Chen’s Chattel, whose year-end is June 30. Determine the total amount that should be included in Chen’s Chattel’s year-end inventory. A physical inventory taken on June 30 reveals the following: Cost of merc

> Joan Ziemba owns a small variety store. The following transactions took place during March of the current year. Journalize the transactions in a general journal using the perpetual inventory method. Mar. 3 Purchased merchandise on account from City Galle

> Paul Nasipak owns a business called Diamond Distributors. The following transactions took place during January of the current year. Journalize the transactions in a general journal using the periodic inventory method. Jan. 5 Purchased merchandise on acco

> Flint owns a small retail business called Flint’s Fantasy. The cash account has a balance of $20,000 on July 1. The following transactions occurred during July: July 1 Issued Check No. 414 in payment of July rent, $1,500. 1 Purchased merchandise on accou

> Sam Santiago operates a retail variety store. The books include a cash payments journal and an accounts payable ledger. All cash payments (except petty cash) are entered in the cash payments journal. Selected account balances on May 1 are as follows: T

> The purchases journal of Kevin’s Kettle, a small retail business, is as follows: REQUIRED 1. Post the total of the purchases journal to the appropriate general ledger accounts. Use account numbers as shown in the chapter. 2. Post the

> Assume that in year 1, the ending merchandise inventory is overstated by $50,000. If this is the only error in years 1 and 2, indicate which items will be understated, overstated, or correctly stated for years 1 and 2. Year 1 Year 2 Ending merchandis

> J. B. Speck, owner of Speck’s Galleria, made the following purchases of merchandise on account during the month of September: Sept. 3 Purchase Invoice No. 415, $2,650, from Smith Distributors. 8 Purchase Invoice No. 132, $3,830, from Michaels Wholesaler.

> Owens Distributors is a retail business. The following sales, returns, and cash receipts occurred during March 20--. There is an 8% sales tax. Beginning general ledger account balances were Cash, $9,741; and Accounts Receivable, $1,058.25. Beginning cust

> Describe underapplied and overapplied overhead. What is commonly done with the underapplied or overapplied balance in the factory overhead account?

> Zebra Imaginarium, a retail business, had the following cash receipts during December 20--. The sales tax is 6%. Dec. 1 Received payment on account from Michael Anderson, $1,360. 2 Received payment on account from Ansel Manufacturing, $382. 7 Made cash s

> Futi Ishanyan owns a retail business and made the following sales during the month of August 20--. There is a 6% sales tax on all sales. Aug. 1 Sale No. 213 to Jeter Manufacturing Co., $1,300, plus sales tax. 3 Sale No. 214 to Hassan Co., $2,600, plus sa

> Lakeview Industries uses a cash payments journal. Prepare a cash payments journal using the same format and account titles as illustrated in the chapter. Record the following payments for merchandise purchased: Sept. 5 Issued Check No. 318 to Clausen Cor

> Enter the following transactions in a purchases journal like the one below. May 3 Purchased merchandise from Climen, $7,200. Invoice No. 321, dated May 1, terms n/30. 9 Purchased merchandise from Misho, $3,100. Invoice No. 614, dated May 8, terms 2/10, n

> Enter the following transactions in a cash receipts journal: July 6 Daren Chesbrough made payment on account, $527. 10 Made cash sales for the week, $2,470. 14 Adam Casady made payment on account, $394. 15 Yue Zou made payment on account, $203. 17 Made c

> Enter the following transactions in a sales journal. Use a 6% sales tax rate. May 1 Sold merchandise on account to J. Adams, $2,000, plus sales tax. Sale No 488. 4 Sold merchandise on account to B. Clark, $1,800, plus sales tax. Sale No. 489. 8 Sold merc

> Identify the journal (sales, cash receipts, purchases, cash payments, or general) in which each of the following transactions should be recorded: (a) Sold merchandise on account. (b) Purchased delivery truck on account for use in the business. (c) Receiv

> J. B. Speck, owner of Speck’s Galleria, made the following purchases of merchandise on account during the month of September: Sept. 3 Purchase Invoice No. 415, $2,650, from Smith Distributors. 8 Purchase Invoice No. 132, $3,830, from Michaels Wholesaler.

> Ryan’s Express, a retail business, had the following beginning balances and purchases and payments activity in its accounts payable ledger during October. Prepare a schedule of accounts payable for Ryan’s Express as of

> Enter the following cash payments transactions in a general journal: Sept. 5 Issued Check No. 318 to Whittle Corp. for merchandise purchased August 28, $5,000, terms 2/10, n/30. Payment is made within the discount period. 12 Issued Check No. 319 to Marti

> What steps are followed in posting from the cash payments journal to the accounts payable ledger?

> Journalize the following transactions in a general journal: May 3 Purchased merchandise from Reed, $6,100. Invoice No. 321, dated May 1, terms n/30. 9 Purchased merchandise from Omana, $2,500. Invoice No. 614, dated May 8, terms 2/10, n/30. 18 Purchased

> The following data were taken from the accounts of Fluter Hardware, a small retail business. Determine the gross profit. Sales $120,000 Sales returns and allowances 900 Sales discounts 650 Merchandise inventory, January 1 Purchases during the period

> Using T accounts for Cash, Accounts Payable, Purchases, Purchases Returns and Allowances, Purchases Discounts, and Freight-In, enter the following purchase transactions. Identify each transaction with ts corresponding letter. Use a new set of T accounts

> Merchandise was purchased on account from Jacob’s Distributors on May 17. The purchase price was $2,000, less a 10% trade discount and credit terms of 2/10, n/30. 1. Calculate the net amount to record the invoice, less the 10% trade discount. 2. Calculat

> Based on the information provided in Problem 11-11A, Problem 11-11A: Emily Frank owns a small retail business called Frank’s Fantasy. The cash account has a balance of $21,000 on July 1. The following transactions occurred during July: July 1 Issued C

> Emily Frank owns a small retail business called Frank’s Fantasy. The cash account has a balance of $21,000 on July 1. The following transactions occurred during July: July 1 Issued Check No. 414 in payment of July rent, $2,500. 1 Purchased merchandise on

> Sam Santiago operates a retail variety store. The books include a general journal and an accounts payable ledger. Selected account balances on May 1 are as follows: The following are the transactions related to cash payments for the month of May: May 1

> A partially completed flowchart showing some of the major documents commonly used in the purchasing function of a merchandise business is presented below. Identify documents 1, 3, and 4. 2 Purchase Order

> J. K. Bijan owns a retail business and made the following sales on account during the month of August 20--. There is a 6% sales tax on all sales. Aug. 1 Sale No. 213 to Jung Manufacturing Co., $1,200 plus sales tax. 3 Sale No. 214 to Hassad Co., $3,600

> What steps are followed in posting from the cash payments journal to the general ledger?

> From the accounts receivable ledger shown, prepare a schedule of accounts receivable for Pheng Co. as of August 31, 20--. ACCOUNTS RECEIVABLE LEDGER NAME B&G Distributors ADORESS 2628 Burfington Avenue, Chicago, IL 60604-1329 OST. DATE IEM CREDIT BAL

> Enter the following transactions in a general journal: July 6 James Adler made payment on account, $643. 10 Cash sales for the week were $2,320. 14 Betty Havel made payment on account, $430. 15 J. L. Borg made payment on account, $117. 17 Cash sales for

> Enter the following transactions starting on page 60 of a general journal and post them to the appropriate general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter. Beginning balance in Accounts Receivable is $4

> Enter the following transactions in a general journal. Use a 6% sales tax rate. May 1 Sold merchandise on account to J. Adams, $2,000 plus sales tax. Sale No. 488. 4 Sold merchandise on account to B. Clark, $1,800 plus sales tax. Sale No. 489. 8 Sold mer

> Prepare journal entries for the following transactions. Aug. 4 sold merchandise on account to S. Miller for $320 plus sales tax of 4%, with 2/10, n/30 cash discount terms. 6 Sold merchandise on account to K. Krtek for $210 plus sales tax of 4%. 10 S. Mi

> Based on the following information, compute net sales. Gross sales $3,860 Sales returns and allowances 410 Sales discounts 80

> Using T accounts for Cash, Accounts Receivable, Sales Tax Payable, Sales, Sales Returns and Allowances, and Sales Discounts, enter the following sales transactions. Use a new set of accounts for each part, 1–5. 1. No sales tax. (a) Merchandise is sold fo

> Name the types of cash flows associated with operating activities.

> Financial statement analysis generally focuses on five main aspects of the business’s financial health. What are they?

> List the six steps to be followed when preparing a statement of cash flows. Be sure to include all aspects of the statement’s preparation.

> Describe the indirect method of reporting cash flows from operating activities.

> Identify four disadvantages of a partnership form of business organization.

> Describe leveraging and give an example of how a corporation can gain leverage by issuing bonds.

> Briefly describe five advantages of the corporate form of business organization. Describe two disadvantages.

> If a corporation issues only one class of stock, what four rights does each stockholder have?

> What are the three dates involved in the declaration and payment of dividends? What is the meaning of each date?

> How do the procedures for closing Income Summary of a corporation differ from those of a sole proprietorship or partnership?

> Describe four tips for finding errors on the work sheet.

> What five types of transactions involving notes payable do businesses generally encounter?

> What information usually is included in the charter?

> What seven types of transactions involving notes receivable do businesses generally encounter?

> What are three disadvantages of using the direct write-off method?

> What accounts and related adjustments are new in the work sheet of ToyJoy Manufacturing Co.?

> Rogen Corporation manufactures a single product. The standard cost per unit of product is shown below. Direct materials—1 pound plastic at $7.00 per pound ………………………… $ 7.00 Direct labor—1.6 hours at $12.00 per hour …………………………………………. 19.20 Variable manuf

> Condensed financial data of Cheng Inc. follow. Additional information: 1. New equipment costing $85,000 was purchased for cash during the year. 2. Old equipment having an original cost of $57,500 was sold for $1,500 cash. 3. Bonds matured and were pai

> Data for Nosker Company are presented in P17.7A. Further analysis reveals the following. 1. Accounts payable pertain to merchandise suppliers. 2. All operating expenses except for depreciation were paid in cash. Instructions a. Prepare a statement of ca

> Sentinel Industries has manufactured prefabricated houses for over 20 years. The houses are constructed in sections to be assembled on customers’ lots. Sentinel expanded into the precut housing market when it acquired Jensen Company, on

> Durham Company uses a responsibility reporting system. It has divisions in Denver, Seattle, and San Diego. Each division has three production departments: Cutting, Shaping, and Finishing. The responsibility for each department rests with a manager who re

> Optimus Company manufactures a variety of tools and industrial equipment. The company operates through three divisions. Each division is an investment center. Operating data for the Home Division for the year ended December 31, 2020, and relevant budget

> Clarke Inc. operates the Patio Furniture Division as a profit center. Operating data for this division for the year ended December 31, 2020, are as shown below. In addition, Clarke incurs $180,000 of indirect fi xed costs that were budgeted at $175,000

> Ratchet Company uses budgets in controlling costs. The August 2020 budget report for the company’s Assembling Department is as follows. The monthly budget amounts in the report were based on an expected production of 60,000 units per

> Zelmer Company manufactures tablecloths. Sales have grown rapidly over the past 2 years. As a result, the president has installed a budgetary control system for 2020. The following data were used in developing the master manufacturing overhead budget for

> Data for Cheng Inc. are presented in P17.9A. Further analysis reveals that accounts payable pertain to merchandise creditors. Instructions Prepare a statement of cash flows for Cheng Inc. using the direct method. Data from P17.9A: Condensed financial d

> Brooks Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expendi

> Bumblebee Company estimates that 300,000 direct labor hours will be worked during the coming year, 2020, in the Packaging Department. On this basis, the following budgeted manufacturing overhead cost data are computed for the year. It is estimated that d

> Owen Company manufactures bicycles and tricycles. For both products, materials are added at the beginning of the production process, and conversion costs are incurred uniformly. Owen Company uses the FIFO method to compute equivalent units. Production an

> Krause Industries’ balance sheet at December 31, 2019, is presented below. Budgeted data for the year 2020 include the following. To meet sales requirements and to have 2,500 units of finished goods on hand at December 31, 2020, the

> The budget committee of Suppar Company collects the following data for its San Miguel Store in preparing budgeted income statements for May and June 2020. 1. Sales for May are expected to be $800,000. Sales in June and July are expected to be 5% higher t

> Colter Company prepares monthly cash budgets. Relevant data from operating budgets for 2020 are as follows. All sales are on account. Collections are expected to be 50% in the month of sale, 30% in the first month following the sale, and 20% in the sec

> Hill Industries had sales in 2019 of $6,800,000 and gross profit of $1,100,000. Management is considering two alternative budget plans to increase its gross profit in 2020. Plan A would increase the selling price per unit from $8.00 to $8.40. Sales volum

> Deleon Inc. is preparing its annual budgets for the year ending December 31, 2020. Accounting assistants furnish the data shown below. / / An accounting assistant has prepared the detailed manufacturing overhead budget and the selling and administrativ