Question: Using the following data for Jackson Products

Using the following data for Jackson Products Company, answer Parts a through g:

Income Statement for the Year Ended December 31, 2016

Net sales (all on credit) ……………………………………………………………….……………. $3,000,000

Cost of sales………………………………………………………………………………………………. 1,800,000

Gross profit………………………………………………………………………………….…….……. $1,200,000

Selling, general, and administrative expenses………………………………….….…………...860,000

Earnings before interest and taxes Interest: ……………………………………...….…...……$340,000

Notes…………………………………………………………………………………………….……..….……$37,800

Long-term debt…………………………………………………………………………….…………………80,000

Total interest charges…………………………………………………………………….…………………117,800

Earnings before taxes……………………………………………………………………………………$ 222,200

Federal income tax…………………………………………………………………………………. (40%) 88,880

Earnings after taxes………………………………………………………………………………………$ 133,320

Industry Averages

Current ratio………………………………………...…...…………...………………2.5:1

Quick ratio………………...………………………………...…...….……….…………1.1:1

Average collection period (365-day year)………...………….……….35 days

Inventory turnover ratio………………….….…….….………...………...2.4 times

Total asset turnover ratio………………………….……..……………….1.4 times

Times interest earned ratio……………………….…….…………………3.5 times

Net profit margin ratio……………………………………...……………………4.0%

Return on investment ratio……………………………………..………………5.6%

Total assets/stockholders’ equity (equity multiplier)……ratio 3.0 times

Return on stockholders’ equity ratio……………………………………….16.8%

P/E ratio…………………………………………………………………………9.0 times

a. Evaluate the liquidity position of Jackson relative to that of the average firm in the industry. Consider the current ratio, the quick ratio, and the net working capital (current assets minus current liabilities) for Jackson. What problems, if any, are suggested by this analysis?

b. Evaluate Jackson’s performance by looking at key asset management ratios. Are any problems apparent from this analysis?

c. Evaluate the financial risk of Jackson by examining its times interest earned ratio and its equity multiplier ratio relative to the same industry average ratios.

d. Evaluate the profitability of Jackson relative to that of the average firm in its industry.

e. Give an overall evaluation of the performance of Jackson relative to other firms in its industry.

f. Perform a DuPont analysis for Jackson. What areas appear to have the greatest need for improvement?

g. Jackson’s current P/E ratio is seven times. What factor(s) are most likely to account for this ratio relative to the higher industry average ratio?

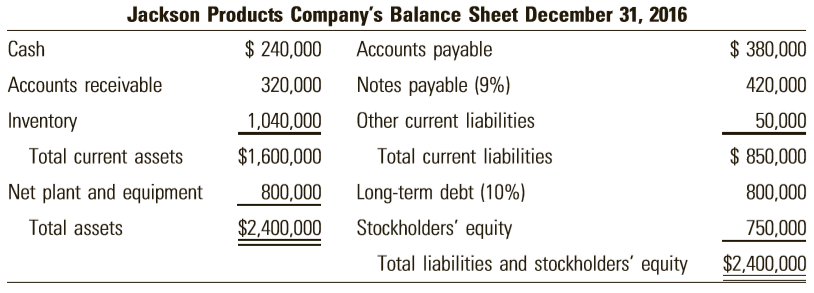

Transcribed Image Text:

Jackson Products Company's Balance Sheet December 31, 2016 Cash $ 240,000 Accounts payable $ 380,000 Accounts receivable 320,000 Notes payable (9%) 420,000 Inventory 1,040,000 Other current liabilities 50,000 Total current assets $1,600,000 Total current liabilities $ 850,000 Net plant and equipment 800,000 Long-term debt (10%) 800,000 Total assets $2,400,000 Stockholders' equity 750,000 Total liabilities and stockholders' equity $2,400,000

> Explain what is meant by agency relationships and agency costs.

> Explain why management may tend to pursue goals other than shareholder wealth maximization.

> It has been argued that shareholder wealth maximization is not a realistic normative goal for the firm, given the social responsibility activities that the firm is “expected” to engage in (such as contributing to the arts, education, etc.). Explain why t

> Is the shareholder wealth maximization goal a short- or long-term goal? Explain your answer.

> Which type of corporation is more likely to be a shareholder wealth maximizer— one with wide ownership and no owners directly involved in the firm’s management, or one that is closely held?

> What are the differences between shareholder wealth maximization and profit maximization? If a firm chooses to pursue the objective of shareholder wealth maximization, does this preclude the use of profit maximization decision-making rules? Explain.

> Why would you anticipate a lower P/E ratio for a typical natural gas utility than for a computer technology firm, such as Apple?

> Define shareholder wealth. Explain how it is measured.

> Japanese Motors exports cars and trucks to the U.S. market. On February 25, 2013, its most popular model was selling (wholesale) to U.S. dealers for $20,000. What price must Japanese Motors charge for the same model on November 18, 2015, to realize the s

> Which would you prefer to invest in: a savings account paying 6 percent compounded annually, or a savings account paying 6 percent compounded daily? Why?

> The stock of Tips, Inc., a new firm operating a chain of sports betting parlors, has just been sold in an initial public offering at a price of $25 per share. One week after this offering, the stock has risen in value to $35. You believe the stock will r

> Six months ago, you purchased a tract of land in an area where a new industrial park was rumored to be planned. This land cost you $110,000, and the seller offered you an interest-free loan for 70 percent of the land cost. Today, the industrial park proj

> One year ago, you purchased a rare Indian-head penny for $14,000. Because of the recession and the need to generate current income, you plan to sell the coin and invest in Treasury bills. The Treasury bill yield now stands at 8 percent, although it was 7

> a. National Telephone and Telegraph (NTT) Company common stock currently sells for $60 per share. NTT is expected to pay a $4 dividend during the coming year, and the price of the stock is expected to increase to $65 a year from now. Determine the expect

> Suppose a Midwest Telephone and Telegraph (MTT) Company bond, maturing in one year, can be purchased today for $975. Assuming that the bond is held until maturity, the investor will receive $1,000 (principal) plus 6 percent interest (that is, 0.06 × $100

> Suppose a U.S. Treasury bill, maturing in 30 days, can be purchased today for $99,500. Assuming that the security is held until maturity, the investor will receive $100,000 (face amount). Determine the percentage holding period return on this investment

> An investor bought 10 Ellis Industries, Inc. long-term bonds one year ago, when they were first issued by the company. In addition, he bought 200 shares of the company’s common stock at the same time for $30 per share. He paid $1,000 each for the bonds,

> Discuss the general factors that influence the quality of a company’s reported earnings and its balance sheet.

> An investor bought 100 shares of Venus Corporation common stock one year ago for $40 per share. She just sold the shares for $44 each, and during the year, she received four quarterly dividend checks for $40 each. She expects the price of the Venus share

> Using the data contained in Figure 2.3, what 52-week rate of return, excluding dividend yields, would an investor have received by purchasing the following portfolios of stocks? • a. The stocks in the Dow Jones Industrial Average b. T

> Over the past 10 years, your $15,000 in gold coins has increased in value by 200 percent. You plan to sell these coins today. You have paid annual storage and insurance costs of $500 per year. Assay expenses at the time of sale are expected to total $400

> What happens to the present value of an annuity as the interest rate increases? What happens to the future value of an annuity as the interest rate increases? Table III: Continue to next pages……

> Determine the percentage change in the value of the following currencies relative to the U.S. dollar between February 25, 2013 and November 18, 2015. (Refer to Table 2.1.) • a. Rupee b. Pound c. Yen d. Euro e. Canadian dollar Tabl

> Valley Stores, a U.S. department store chain, annually negotiates a contract with Alpine Watch Company, located in Switzerland, to purchase a large shipment of watches. On February 25, 2013, Valley purchased 10,000 watches for a total of 1.26 million Swi

> Define the following terms: a. Multinational corporation b. Spot exchange rate c. Forward exchange rate d. Direct quote versus indirect quote e. Option f. LIBOR g. Euro

> If a capital market is not efficient, what is the impact on a firm seeking to raise capital in that market? Why?

> Describe the concept of market efficiency. In what sense is this concept an important part of the shareholder wealth maximization objective?

> What is the primary distinction between the trading process on the New York Stock Exchange and the OTC markets?

> What is the relationship between a firm’s P/E multiple and that firm’s risk and growth potential?

> How do primary and secondary financial markets differ?

> What factors need to be considered when determining the optimal form of organization for a business enterprise?

> Describe the various types of financial intermediaries, including the sources of their funds and the types of investments they make.

> How do money and capital markets differ?

> Which is greater: the future value interest factor (FVIF) for 10 percent and two years, or the present value interest factor (PVIF) for 10 percent and two years?

> What roles do financial middlemen and financial intermediaries play in the operation of the U.S. financial system? How do the two differ?

> Describe and discuss the saving-investment cycle.

> Armbrust Corporation is the maker of fine fitness equipment. Armbrust’s bank has been pressuring the firm to improve its liquidity. Which of the following actions proposed by the CFO do you believe will actually achieve this objective? Why or why not? a

> The Southwick Company has the following balance sheet ($000): Financial Ratios Current ratio…………………â€

> Fill in the balance sheet for the Jamestown Company based on the following data (assume a 365-day year): Sales = $3,650,000 Total asset turnover = 4× Current ratio = 3:1 Quick ratio = 2:1 Current liabilities to net worth = 30% Average c

> How can inflation affect the comparability of financial ratios between firms?

> The balance sheet and income statement of Eastland Products, Inc., are as follows: Income Statement for Year Ended December 31, 2016 (in Millions of Dollars) Sales…………&acir

> Sun Minerals, Inc., is considering issuing additional long-term debt to finance an expansion. Currently, the company has $50 million in 10 percent debt outstanding. Its after-tax net income is $12 million, and the company is in the 40 percent tax bracket

> Hoffman Paper Company, a profitable distributor of stationery and office supplies, has an agreement with its banks that allows Hoffman to borrow money on a short-term basis to finance its inventories and accounts receivable. The agreement states that Hof

> The stock of Jenkins Corporation, a major steel producer, is currently selling for $50 per share. The book value per share is $125. In contrast, the price per share of Dataquest’s stock is $40, compared to a book value per share of $10. Dataquest, a lead

> Palmer Chocolates, a maker of chocolates that specializes in Easter candy, had the following inventories over the past year: Month……………………………………………Inventory Amount January……………….………...………………………$25,000,000 February………………..……….………………………60,000,000 March………

> Which would you rather receive: the proceeds from a 2-year investment paying 5 percent simple interest per year, or from one paying 5 percent compound interest? Why?

> Keystone Resources has a net profit margin of 8 percent and earnings after taxes of $2 million. Its current balance sheet is as follows: a. Calculate Keystone’s return on stockholders’ equity. b. Industry average ra

> If a company sells additional common stock and uses the proceeds to increase its inventory level and to increase its cash balances, what is the near-term (immediate) impact (increase, decrease, no change) of this transaction on the following ratios? a.

> Given the following data for Profiteers, Inc., and the corresponding industry averages, perform a trend analysis of the return on investment and the return on stockholders’ equity. Plot the data and discuss any trends that are apparent.

> Describe the basic features of each of the following types of bonds: a. Floating rate bonds b. Original issue deep discount bonds c. Zero coupon bonds d. Extendable notes (put bonds)

> What specific effects can the use of alternative accounting procedures have on the validity of comparative financial analyses?

> What are the three most important determinants of a firm’s return on stockholders’ equity?

> What factors limit the use of the fixed-asset turnover ratio in comparative analyses?

> What problems may be indicated by an inventory turnover ratio that is substantially above or below the industry average?

> What problems may be indicated by an average collection period that is substantially above or below the industry average?

> What is the major limitation of the current ratio as a measure of a firm’s liquidity? How may this limitation be overcome?

> Gulf Controls, Inc., has a net profit margin of 10 percent and earnings after taxes of $600,000. Its current balance sheet follows: a. Calculate Gulf’s return on stockholders’ equity. b. The industry average ratios

> What are the primary limitations of ratio analysis as a technique of financial statement analysis?

> Appalachian Registers, Inc. (ARI) has current sales of $50 million. Sales are expected to grow to $75 million next year. ARI currently has accounts receivable of $10 million, inventories of $15 million, and net fixed assets of $20 million. These assets a

> Berea Resources is planning a $75 million capital expenditure program for the coming year. Next year, Berea expects to report to the IRS earnings of $40 million after interest and taxes. The company presently has 20 million shares of common stock issued

> In the Industrial Supply Company example (Table 4.4), it was assumed that the company’s fixed assets were being used at nearly full capacity and that net fixed assets would have to increase proportionately as sales increased. Alternativ

> Explain how a bond can be classified as a fixed-income security when the yield to-maturity can fluctuate significantly over time, depending on the market price of the bond.

> Baldwin Products Company anticipates reaching a sales level of $6 million in one year. The company expects earnings after taxes during the next year to equal $400,000. During the past several years, the company has been paying $50,000 in dividends to its

> The Podrasky Corporation is considering a $200 million expansion (capital expenditure) program next year. The company wants to know approximately how much additional financing (if any) will be required if it decides to go through with the expansion progr

> Prepare a cash budget for Elmwood Manufacturing Company for the first three months of 2017 based on the following information: The company has found that approximately 40 percent of sales are collected during the month the sale is made and the remainin

> Prepare a cash budget for Atlas Products, Inc., for the first quarter of 2017, based on the following information: The budgeting section of the corporate finance department of Atlas Products has received the following sales estimates from the marketing d

> Consider the Industrial Supply Company example (Table 4.4) again. Assume that the company plans to maintain its dividend payments at the same level in 2017 as in 2016. Also assume that all of the additional financing needed is in the form of short-term n

> The Jamesway Printing Corporation has current assets of $3.0 million. Of this total, $1.0 million is inventory, $0.5 million is cash, $1.0 million is accounts receivable, and the balance is marketable securities. Jamesway has $1.5 million in current liab

> Prepare a statement of cash flows (using the indirect method) for the Midland Manufacturing Corporation for the year ending December 2016, based on the following comparative balance sheets. Midland Manufacturing Corporation Comparative Balance Sheet

> Last year, Blue Lake Mines, Inc., had earnings after tax of $650,000. Included in its expenses were depreciation of $400,000 and deferred taxes of $100,000. The company also purchased new capital equipment for $300,000 last year. Calculate Blue Lake’s af

> Explain the difference between deterministic and probabilistic financial planning models.

> Illustrate how the statement of cash flows can be used as a financial planning technique.

> What is a cash budget? What are the usual steps involved in preparing a cash budget?

> Explain what is meant by interest rate risk.

> What is the percentage of sales forecasting method? What are some of the limitations financial analysts should be aware of in applying this method?

> What are pro forma financial statements?

> What are deferred taxes, and how do they come into being?

> Determine the monthly rate of interest that will yield an effective annual rate of interest of 12 percent.

> The Sooner Equipment Company has total assets of $100 million. Of this total, $40 million was financed with common equity and $60 million with debt (both long term and short term). Its average accounts receivable balance is $20 million, and this represen

> You have decided to start planning for your retirement by analyzing different retirement plans. The plan offered by IRA Managers requires you to deposit $5,000 at the beginning of each of the next 30 years. The retirement plan guarantees a 10 percent ann

> Bobbi Proctor does not want to “gamble” on Social Security taking care of her in retirement. Hence she wants to begin to plan now for retirement. She has enlisted the services of Hackney Financial Planning to assist her in meeting her goals. Proctor has

> Garrett Erdle has just turned 26 years of age. Although Garrett currently has a negative net worth, he expects to pay off all of his financial obligations within four years and then to embark on an aggressive plan to save for retirement. He wishes to be

> Crab State Bank has offered you a $1,000,000 five-year loan at an interest rate of 11.25 percent, requiring equal annual end-of-year payments that include both principal and interest on the unpaid balance. Develop an amortization schedule for this loan.

> Torbet Fish Packing Company wants to accumulate enough money over the next 10 years to pay for the expected replacement of its digitalized, automated scaling machine. The new machine is expected to cost $200,000 in 10 years. Torbet currently has $10,000

> Ted Gardiner has just turned 30 years old. He has currently accumulated $35,000 toward his planned retirement at age 60. He wants to accumulate enough money over the next 30 years to provide for a 20-year retirement annuity of $100,000 at the beginning o

> Explain why bondholders often prefer a sinking fund provision in a bond issue.

> Frank Chang is planning for the day when his child, Laura, will go to college. Laura has just turned eight and plans to enter college on her 18th birthday. She will need $25,000 at the beginning of each year in school. Frank plans to give Laura a Mercede

> Your son, Charlie, has just turned 15. Charlie plans to go to college to study electronics on his 18th birthday. College is expected to cost Charlie $15,000, $16,000, $17,000, and $18,000 for each of his four years in school. You want these funds to be a

> Suppose today is July 1, 2014, and you deposit $2,000 into an account today. Then you deposit $1,000 into the same account on each July 1, beginning in 2015 and continuing until the last $1,000 deposit is made on July 1, 2020. Also, assume that you withd

> Tarheel Furniture Company is planning to establish a wholly owned subsidiary to manufacture upholstery fabrics. Tarheel expects to earn $1 million after taxes on the venture during the first year. The president of Tarheel wants to know what the subsidiar

> Steven White is considering taking early retirement, having saved $400,000. White desires to determine how many years the savings will last if $40,000 per year is withdrawn at the end of each year. White feels the savings can earn 10 percent per year. Ho

> You are currently 30 years of age. You intend to retire at age 60 and you want to be able to receive a 20-year, $100,000 beginning-of-year annuity with the first payment to be received on your 60th birthday. You would like to save enough money over the n

> You have just had your 30th birthday. You have two children. One will go to college 10 years from now and require four beginning-of-year payments for college expenses of $10,000, $11,000, $12,000, and $13,000. The second child will go to college 15 years

> IRA Investments develops retirement programs for individuals. You are 30 years old and plan to retire on your 60th birthday. You want to establish a plan with IRA that will require a series of equal, annual, end-of-year deposits into the retirement accou

> How much must you deposit at the end of each quarter in an account that pays a nominal interest rate of 20 percent, compounded quarterly, if at the end of five years you want $10,000 in the account? (Hint: In working with the compound interest tables whe

> James Street’s son, Harold, is 10 years old today. Harold, a studious young fellow, is already making plans to go to college on his 18th birthday, and his father wants to start putting money away now for that purpose. Street estimates that Harold will ne

> An investment offers the following year-end cash flows: End of Year…………………….Cash Flow 1………………………………………$20,000 2……………………………………...$30,000 3……………………………………….$15,000 Using a 15 percent interest rate, convert this series of irregular cash flows to an equi

> In what ways is preferred stock similar to long-term debt? In what ways is it similar to common stock?

> An investment of $100,000 is expected to generate cash inflows of $60,000 in one year and $79,350 in two years. Calculate the expected rate of return on this investment to the nearest whole percent

> An investment requires an outlay of $100,000 today. Cash inflows from the investment are expected to be $40,000 per year at the end of years 4, 5, 6, 7, and 8. If you require a 20 percent rate of return on this type of investment, should the investment b