Question: Using the information in E25.3, assume

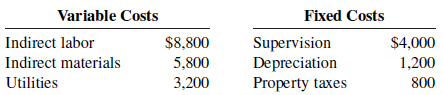

Using the information in E25.3, assume that in July 2020, Myers Company incurs the following manufacturing overhead costs.

Instructions

a. Prepare a flexible budget performance report, assuming that the company worked 9,000 direct labor hours during the month.

b. Prepare a flexible budget performance report, assuming that the company worked 8,500 direct labor hours during the month.

c. Comment on your findings.

Transcribed Image Text:

Variable Costs Fixed Costs Indirect labor $8,800 $4,000 Supervision Depreciation Property taxes Indirect materials 5,800 1,200 Utilities 3,200 800

> Macgregor Company completed its fi rst year of operations on December 31, 2020. Its initial income statement showed that Macgregor had revenues of $192,000 and operating expenses of $78,000. Accounts receivable and accounts payable at year-end were $60,0

> Rodriquez Corporation’s comparative balance sheets are presented below. Additional information: 1. Net income was $18,300. Dividends declared and paid were $16,400. 2. Equipment which cost $10,000 and had accumulated depreciation of $

> Tabares Corporation had these transactions during 2020. a. Issued $50,000 par value common stock for cash. b. Purchased a machine for $30,000, giving a long-term note in exchange. c. Issued $200,000 par value common stock upon conversion of bonds having

> Writing Agee Company purchased 70% of the outstanding common stock of Himes Corporation. Instructions a. Explain the relationship between Agee Company and Himes Corporation. b. How should Agee account for its investment in Himes? c. Why is the accountin

> The following are two independent situations. 1. Gambino Cosmetics acquired 10% of the 200,000 shares of common stock of Nevins Fashion at a total cost of $13 per share on March 18, 2020. On June 30, Nevins declared and paid a $60,000 dividend. On Decemb

> The following section is taken from Mareska’s balance sheet at December 31, 2020. Interest is payable annually on January 1. The bonds are callable on any annual interest date. Instructions a. Journalize the payment of the bond inter

> On January 1, Zabel Corporation purchased a 25% equity in Helbert Corporation for $180,000. At December 31, Helbert declared and paid a $60,000 cash dividend and reported net income of $200,000. Instructions a. Journalize the transactions. b. Determine

> On February 1, Rinehart Company purchased 500 shares (2% ownership) of Givens Company common stock for $32 per share. On March 20, Rinehart Company sold 100 shares of Givens stock for $2,900. Rinehart received a dividend of $1.00 per share on April 25. O

> Nosker Inc. had the following transactions pertaining to investments in common stock. Jan. 1 Purchased 2,500 shares of Escalante Corporation common stock (5%) for $152,000 cash. July 1 Received a cash dividend of $3 per share. Dec. 1 Sold 500 shares of E

> Financial Statement Hulse Company had the following transactions pertaining to stock investments. Feb. 1 Purchased 600 shares of Wade common stock (2%) for $7,200 cash. July 1 Received cash dividends of $1 per share on Wade common stock. Sept. 1 Sold 300

> Flynn Company purchased 70 Rinehart Company 6%, 10-year, $1,000 bonds on January 1, 2020, for $70,000. The bonds pay interest annually on January 1. On January 1, 2021, after receipt of interest, Flynn Company sold 40 of the bonds for $38,500. Instructi

> Jenek Corporation had the following transactions pertaining to debt investments. 1. Purchased 40 Leeds Co. 9% bonds (each with a face value of $1,000) for $40,000 cash. Interest is payable annually on January 1, 2020. 2. Accrued interest on Leeds Co. bon

> Adcock Company issued $600,000, 9%, 20-year bonds on January 1, 2020, at 103. Interest is payable annually on January 1. Adcock uses straight-line amortization for bond premium or discount. Instructions Prepare the journal entries to record the followin

> On January 1, 2020, Throm Inc. entered into an agreement to lease 20 computers from Drummond Electronics. The terms of the lease agreement require three annual rental payments of $20,000 (including 10% interest) beginning December 31, 2020. The present v

> Hatfield Corporation reports the following amounts in its 2020 financial statements: Instructions a. Compute the December 31, 2020, balance in stockholders’ equity. b. Compute the debt to assets ratio at December 31, 2020. c. Compute

> Uttinger Company has the following data at December 31, 2020. The available-for-sale securities are held as a long-term investment. Instructions a. Prepare the adjusting entries to report each class of securities at fair value. b. Indicate the stateme

> Kershaw Electric sold $6,000,000, 10%, 10-year bonds on January 1, 2020. The bonds were dated January 1, 2020, and paid interest on January 1. The bonds were sold at 98. Instructions a. Prepare the journal entry to record the issuance of the bonds on Ja

> Data for debt investments classified as trading securities are presented in E16.10. Assume instead that the investments are classified as available for- sale debt securities. They have the same cost and fair value as indicated in E16.10. The securities a

> Financial Statement At December 31, 2020, the trading debt securities for Storrer, Inc. are as follows. Instructions a. Prepare the adjusting entry at December 31, 2020, to report the securities at fair value. b. Show the balance sheet and income state

> Mr. Taliaferro is studying for an accounting test and has developed the following questions about investments. 1. What are three reasons why companies purchase investments in debt or stock securities? 2. Why would a corporation have excess cash that it d

> Jernigan Co. receives $300,000 when it issues a $300,000, 10%, mortgage note payable to finance the construction of a building at December 31, 2020. The terms provide for annual installment payments of $50,000 on December 31. Instructions Prepare the jo

> The following are two independent situations. 1. Longbine Corporation redeemed $130,000 face value, 12% bonds on June 30, 2020, at 102. The carrying value of the bonds at the redemption date was $117,500. The bonds pay annual interest, and the interest p

> The following section is taken from Ohlman Corp.’s balance sheet at December 31, 2019. Bond interest is payable annually on January 1. The bonds are callable on any interest date. Instructions a. Journalize the payment of the bond in

> Whitmore Company issued $500,000 of 5-year, 8% bonds at 97 on January 1, 2020. The bonds pay interest annually. Instructions a. 1. Prepare the journal entry to record the issuance of the bonds. 2. Compute the total cost of borrowing for these bonds. b.

> Swisher Company issued $2,000,000 of bonds on January 1, 2020. Instructions a. Prepare the journal entry to record the issuance of the bonds if they are issued at (1) 100, (2) 98, and (3) 103. b. Prepare the journal entry to record the redemption of

> Laudie Company issued $400,000 of 9%, 10-year bonds on January 1, 2020, at face value. Interest is payable annually on January 1, 2021. Instructions Prepare the journal entries to record the following events. a. The issuance of the bonds. b. The accrual

> On January 1, 2020, Forrester Company issued $400,000, 8%, 5-year bonds at face value. Interest is payable annually on January 1. Instructions Prepare journal entries to record the following. a. The issuance of the bonds. b. The accrual of interest on D

> On May 1, 2020, Herron Corp. issued $600,000, 9%, 5-year bonds at face value. The bonds were dated May 1, 2020, and pay interest annually on May 1. Financial statements are prepared annually on December 31. Instructions a. Prepare the journal entry to r

> On January 1, 2020, Klosterman Company issued $500,000, 10%, 10-year bonds at face value. Interest is payable annually on January 1. Instructions Prepare journal entries to record the following. a. The issuance of the bonds. b. The accrual of interest o

> Gilliland Airlines is considering two alternatives for the financing of a purchase of a fleet of airplanes. These two alternatives are: 1. Issue 90,000 shares of common stock at $30 per share. (Cash dividends have not been paid nor is the payment of any

> Lopez Company uses a standard cost accounting system. Some of the ledger accounts have been destroyed in a fi re. The controller asks your help in reconstructing some missing entries and balances. Instructions Answer the following questions. a. Material

> In May 2020, the budget committee of Grand Stores assembles the following data in preparation of budgeted merchandise purchases for the month of June. 1. Expected sales: June $500,000, July $600,000. 2. Cost of goods sold is expected to be 75% of sales.

> The Ferrell Transportation Company uses a responsibility reporting system to measure the performance of its three investment centers: Planes, Taxis, and Limos. Segment performance is measured using a system of responsibility reports and return on investm

> Indicate which of the four perspectives in the balanced scorecard is most likely associated with the objectives that follow. 1. Percentage of repeat customers. 2. Number of suggestions for improvement from employees. 3. Contribution margin. 4. Brand reco

> The South Division of Wiig Company reported the following data for the current year. Sales ………………………………….. $3,000,000 Variable costs …………………….…. 1,950,000 Controllable fixed costs ………….… 600,000 Average operating assets ………. 5,000,000 Top management is

> Fisk Company uses a standard cost accounting system. During January, the company reported the following manufacturing variances. In addition, 8,000 units of product were sold at $8 per unit. Each unit sold had a standard cost of $5. Selling and adminis

> Urban Corporation prepared the following variance report. Instructions Fill in the appropriate amounts or letters for the question marks in the report. Urban Corporation Variance Report–Purchasing Department For the Week Ended January 9, 2020 Туре

> The Mixing Department manager of Malone Company is able to control all overhead costs except rent, property taxes, and salaries. Budgeted monthly overhead costs for the Mixing Department, in alphabetical order, are: Actual costs incurred for January 20

> Vilander Carecenters Inc. provides financing and capital to the healthcare industry, with a particular focus on nursing homes for the elderly. The following selected transactions relate to bonds acquired as an investment by Vilander, whose fiscal year en

> The Current Designs staff has prepared the annual manufacturing budget for the rotomolded line based on an estimated annual production of 4,000 kayaks during 2020. Each kayak will require 54 pounds of polyethylene powder and a finishing kit (rope, seat,

> Ceelo Company purchased (at a cost of $10,200) and used 2,400 pounds of materials during May. Ceelo’s standard cost of materials per unit produced is based on 2 pounds per unit at a cost $5 per pound. Production in May was 1,050 units. Instructions a. C

> Kirkland Company combines its operating expenses for budget purposes in a selling and administrative expense budget. For the first 6 months of 2020, the following data are available. 1. Sales: 20,000 units quarter 1; 22,000 units quarter 2. 2. Variable c

> Drake Corporation is reviewing an investment proposal. The initial cost is $105,000. Estimates of the book value of the investment at the end of each year, the net cash flows for each year, and the net income for each year are presented in the schedule b

> During March 2020, Toby Tool & Die Company worked on four jobs. A review of direct labor costs reveals the following summary data. Analysis reveals that Job A257 was a repeat job. Job A258 was a rush order that required overtime work at premium rat

> Legend Service Center just purchased an automobile hoist for $32,400. The hoist has an 8-year life and an estimated salvage value of $3,000. Installation costs and freight charges were $3,300 and $700, respectively. Legend uses straight-line depreciation

> Fuqua Company’s sales budget projects unit sales of part 198Z of 10,000 units in January, 12,000 units in February, and 13,000 units in March. Each unit of part 198Z requires 4 pounds of materials, which cost $2 per pound. Fuqua Company desires its endin

> Iggy Company is considering three capital expenditure projects. Relevant data for the projects are as follows. Annual income is constant over the life of the project. Each project is expected to have zero salvage value at the end of the project. Iggy C

> The actual selling expenses incurred in March 2020 by Fallon Company are as follows. Instructions a. Prepare a flexible budget performance report for March using the budget data in E25.5, assuming that March sales were $170,000. b. Prepare a flexible b

> Bruno Corporation is involved in the business of injection molding of plastics. It is considering the purchase of a new computer-aided design and manufacturing machine for $430,000. The company believes that with this new machine it will improve producti

> Saberhagen Company sold $3,500,000, 8%, 10-year bonds on January 1, 2020. The bonds were dated January 1, 2020 and pay interest annually on January 1. Saberhagen Company uses the straight-line method to amortize bond premium or discount. Instructions a.

> Hillsong Inc. manufactures snowsuits. Hillsong is considering purchasing a new sewing machine at a cost of $2.45 million. Its existing machine was purchased five years ago at a price of $1.8 million; six months ago, Hillsong spent $55,000 to keep it oper

> Crede Company budgeted selling expenses of $30,000 in January, $35,000 in February, and $40,000 in March. Actual selling expenses were $31,200 in January, $34,525 in February, and $46,000 in March. The company considers any difference that is less than 5

> Linkin Corporation is considering purchasing a new delivery truck. The truck has many advantages over the company’s current truck (not the least of which is that it runs). The new truck would cost $56,000. Because of the increased capacity, reduced maint

> Kelli Deane is discussing the advantages of the effective-interest method of bond amortization with her accounting staff . What do you think Kelli is saying?

> Jill Ernst is the controller of J-Products, Inc. At December 31, the end of its first year of operations, the company’s investments in trading debt securities cost $74,000 and have a fair value of $72,000. Indicate how Jill would report these data in the

> a. What is a statement of cash flows? b. Mark Paxson maintains that the statement of cash flows is an optional financial statement. Do you agree? Explain.

> Ling Corporation uses the equity method to account for its ownership of 35% of the common stock of Gorman Packing. During 2020, Gorman reported a net income of $80,000 and declares and pays cash dividends of $10,000. What recognition should Ling Corporat

> What is the cost of an investment in stock?

> a. What are the major sources (inflows) of cash in a statement of cash flows? b. What are the major uses (outfows) of cash?

> Molino Inc. reported sales revenue of $2 million for 2020. Accounts receivable decreased $200,000 and accounts payable increased $300,000. Compute cash receipts from customers, assuming that the receivable and payable transactions related to operations.

> Paris Electric sold $3,000,000, 10%, 10-year bonds on January 1, 2020. The bonds were dated January 1 and pay interest annually on January 1. Paris Electric uses the straight-line method to amortize bond premium or discount. The bonds were sold at 104.

> a. What is the cost of an investment in bonds? b. When is interest on bonds recorded?

> The president of Merando Company is puzzled. During the last year, the company experienced a net loss of $800,000, yet its cash increased $300,000 during the same period of time. Explain to the president how this could occur.

> Why is it necessary to convert accrual-basis net income to cash-basis income when preparing a statement of cash flows?

> What constitutes “significant influence” when an investor’s financial interest is below the 50% level?

> To acquire Peoples Corporation stock, J. Rich pays $62,000 in cash. What entry should be made for this investment?

> Seibel Company sells Mayo’s bonds costing $40,000 for $45,000, including $500 of accrued interest. Seibel records a $5,000 gain on this sale. Is this correct? Explain.

> Alex Ramirez is confused about losses and gains on the sale of debt investments. Explain to Alex (a) how the gain or loss is computed, and (b) the statement presentation of the gains and losses.

> In general, what are the requirements for the financial statement presentation of long-term liabilities?

> (a) What are long-term liabilities? Give three examples. (b) What is a bond?

> Bargain Wholesale Supply owns stock in Cyrus Corporation, which it intends to hold indefinitely because of some negative tax consequences if sold. Should the investment in Cyrus be classified as a short-term investment? Why?

> Talkington Electronics issues a $400,000, 8%, 15-year mortgage note on December 31, 2019. The proceeds from the note are to be used in financing a new research laboratory. The terms of the note provide for annual installment payments, exclusive of real e

> Where is Accumulated Other Comprehensive Loss reported on the balance sheet?

> What are the valuation guidelines for trading and available for- sale debt investments at a balance sheet date?

> What are consolidated financial statements?

> What are the reasons that corporations invest in securities?

> Rattigan Corporation is considering issuing a convertible bond. What is a convertible bond? Discuss the advantages of a convertible bond from the standpoint of (a) the bondholders and (b) the issuing corporation.

> If the Bonds Payable account has a balance of $900,000 and the Discount on Bonds Payable account has a balance of $120,000, what is the carrying value of the bonds?

> If a 7%, 10-year, $800,000 bond is issued at face value and interest is paid annually, what is the amount of the interest payment at the end of the first year period?

> Assume that Remington Inc. sold bonds with a face value of $100,000 for $104,000. Was the market interest rate equal to, less than, or greater than the bonds’ contractual interest rate? Explain.

> The following terms are important in issuing bonds: (a) face value, (b) contractual interest rate, (c) bond indenture, and (d) bond certificate. Explain each of these terms.

> Contrast the following types of bonds: (a) secured and unsecured, and (b) convertible and callable.

> Condensed financial data of Oakley Company appear below. Additional information: 1. Equipment costing $97,000 was purchased for cash during the year. 2. Investments were sold at cost. 3. Equipment costing $47,000 was sold for $15,550, resulting in gai

> DeWeese Corporation issues $400,000 of 8%, 5-year bonds on January 1, 2020, at 105. Assuming that the straight-line method is used to amortize the premium, what is the total amount of interest expense for 2020?

> Did Apple redeem any of its debt during the fiscal year ended September 26, 2015?

> Benedict Company entered into an agreement to lease 12 computers from Haley Electronics, Inc. The present value of the lease payments is $186,300. Assuming that this is a finance lease, what entry would Benedict Company make on the date of the lease agre

> (a) What is a lease agreement? (b) What are the two common types of leases?

> (a) As a source of long-term financing, what are the major advantages of bonds over common stock? (b) What are the major disadvantages in using bonds for long-term financing?

> Why is it advantageous to use a worksheet when preparing a statement of cash flows? Is a worksheet required to prepare a statement of cash flows?

> Rob Grier, a friend of yours, has recently purchased a home for $125,000, paying $25,000 down and the remainder financed by a 10.5%, 20-year mortgage, payable at $998.38 per month. At the end of the first month, Rob receives a statement from the bank ind

> What are some of the limitations of regression analysis?

> Mary Webster owns and manages a company that provides trenching services. Her clients are companies that need to lay power lines, gas lines, and fiber optic cable. Because trenching machines require considerable maintenance due to the demanding nature of

> James Brooks estimated the variable and fixed components of his company’s utility costs using the high-low method. He is concerned that the cost equation that resulted from the high-low method might not provide an accurate representation of his company’s

> The comparative balance sheets for Rothlisberger Company as of December 31 are presented below. Additional information: 1. Operating expenses include depreciation expense of $42,000 and charges from prepaid expenses of $5,720. 2. Land was sold for cash

> In its 2015 statement of cash flows, what amount did Apple report for net cash (a) provided by operating activities, (b) used for investing activities, and (c) used for financing activities?

> During 2020, Doubleday Company converted $1,700,000 of its total $2,000,000 of bonds payable into common stock. Indicate how the transaction would be reported on a statement of cash flows, if at all.

> Boise Company’s investments in equity securities at December 31 show total cost of $200,000 and total fair value of $210,000. Boise has less than a 20% ownership interest in the equity securities. Prepare the adjusting entry.

> Using the data in Question 13, how would Jill report the data if the investments were long-term and the debt securities were classified as available-for-sale?

> Total fixed costs are $26,000 for Daz Inc. It has a unit contribution margin of $15, and a contribution margin ratio of 25%. Compute the break-even sales in dollars.

> Alou Company has 20,000 beginning finished goods units. Budgeted sales units are 160,000. If management desires 15,000 ending finished goods units, what are the required units of production?