Question: Vatican Co. is considering the following

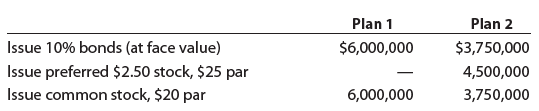

Vatican Co. is considering the following alternative financing plans:

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock, assuming that income before bond interest and income tax is $3,000,000.

> The comparative accounts payable and long-term debt balances for a company follow: Based on this information, what is the amount and percentage of increase or decrease that would be shown on a balance sheet with horizontal analysis?

> A company reports the following: Net income ……………………………………… $ 750,000 Preferred dividends …………………………….. 150,000 Average stockholders’ equity …………….. 5,000,000 Average common stockholders’ equity … 3,750,000 Determine (a) the return on stockholders’ equit

> Journalize the following transactions, using the direct write-off method of accounting for uncollectible receivables: Oct. 2. Received $1,140 from Elita Ramirez and wrote off the remainder owed of $2,570 as uncollectible. Dec. 20. Reinstated the account

> A company reports the following income statement and balance sheet information for the current year: Net income …………………. $ 502,100 Interest expense …………….. 113,500 Average total assets ……. 3,800,000 Determine the return on total assets. Round percentage

> A company reports the following income statement and balance sheet information for the current year: Net income …………………….. $ 110,000 Interest expense …………………. 77,000 Average total assets …………. 1,700,000 Determine the return on total assets. Round percent

> A company reports the following: Sales ………………………….. $5,580,000 Average total assets ……….. 3,100,000 Determine the asset turnover ratio. Round to one decimal place.

> A company reports the following: Sales ……………………….. $6,480,000 Average total assets ……… 2,400,000 Determine the asset turnover ratio. Round to one decimal place.

> A company reports the following: Income before income tax expense ………… $4,300,000 Interest expense ……………………………………….. 600,000 Determine the times interest earned ratio. Round to one decimal place.

> A company reports the following: Income before income tax expense ………. $6,000,000 Interest expense ……………………………………… 300,000 Determine the times interest earned ratio. Round to one decimal place.

> The following information was taken from Jacobus Company’s balance sheet: Fixed assets (net) ……………………… $630,000 Long-term liabilities …………………… 140,000 Total liabilities …………………………… 957,000 Total stockholders’ equity …………… 290,000 Determine the company’s

> The following information was taken from Tyson Company’s balance sheet: Fixed assets (net) ………………….. $ 774,000 Long-term liabilities ……………….. 430,000 Total liabilities ……………………… 1,218,000 Total stockholders’ equity ……….. 580,000 Determine the company’s (

> A company reports the following: Cost of merchandise sold ………………… $680,400 Average merchandise inventory ……………. 94,500 Determine (a) the inventory turnover and (b) the number of days’ sales in inventory. Round to one decimal place.

> The comparative temporary investments and inventory balances of a company follow: Based on this information, what is the amount and percentage of increase or decrease that would be shown on a balance sheet with horizontal analysis?

> Journalize the following transactions, using the direct write-off method of accounting for uncollectible receivables: Apr. 15. Received $1,800 from Joe Brown and wrote off the remainder owed of $2,700 as uncollectible. Aug. 7. Reinstated the account of J

> Lagman Corporation purchased land for $310,000. Later in the year, the company sold a different piece of land with a book value of $114,000 for $81,000. How are the effects of these transactions reported on the statement of cash flows?

> Yeoman Inc. reported the following data: Net income ……………………………………. $170,000 Depreciation expense ………………………… 29,000 Loss on disposal of equipment ……………. 11,850 Increase in accounts receivable ………….. 10,490 Increase in accounts payable ……………….. 5,430 Prep

> Featherstone Inc. reported the following data: Net income ……………………….……… $296,000 Depreciation expense …………………… 113,100 Gain on disposal of equipment …….… 58,200 Decrease in accounts receivable …….. 71,300 Decrease in accounts payable ………… 27,100 Prepare

> Paneous Corporation’s comparative balance sheet for current assets and liabilities was as follows: Adjust net income of $351,000 for changes in operating assets and liabilities to arrive at net cash flows from operating activities.

> Jasneet Corporation’s comparative balance sheet for current assets and liabilities was as follows: Adjust net income of $185,000 for changes in operating assets and liabilities to arrive at net cash flows from operating activities.

> Eastlund Corporation’s accumulated depreciation—equipment account increased by $6,320, while $2,450 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. I

> Nadal Corporation’s accumulated depreciation—furniture account increased by $17,720, while $3,800 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In

> Identify whether each of the following would be reported as an operating, investing, or financing activity on the statement of cash flows: a. Payment of dividends to common stockholders b. Purchase of equipment c. Payment for selling expenses d. Collecti

> Garfunkel Inc. reported the following on the company’s statement of cash flows in Year 2 and Year 1: Eighty percent of the net cash flows used for investing activities was used to replace existing capacity. a. Determine Garfunkelâ

> Burkhalter Inc. reported the following on the company’s statement of cash flows in Year 2 and Year 1: Seventy percent of the net cash flows used for investing activities was used to replace existing capacity. a. Determine Burkhalter&ac

> In teams, select a public company that interests you. Obtain the company’s most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commission (SEC). It includes the company’s financia

> Cosmat Inc. reported net income of $128,000 for 20Y9. The liability and equity accounts from the company’s comparative balance sheet are as follows: During the year, the company retired bonds payable at their face amount, declared divi

> Takaki Inc. reported net income of $53,000 for 20Y7. The liability and equity accounts from the company’s comparative balance sheet are as follows: During the year, the company declared dividends of $4,000 and issued 1,000 shares of co

> PQR Corporation purchased land for $295,000. Later in the year, the company sold a different piece of land with a book value of $148,000 for $177,000. How are the effects of these transactions reported on the statement of cash flows?

> On January 1, 20Y5, Valuation Allowance for Available-for-Sale Investments had a zero balance. On December 31, 20Y5, the cost of the available-for-sale securities was $43,290, and the fair value was $39,120. Journalize the adjusting entry to record the u

> On January 1, 20Y9, Valuation Allowance for Trading Investments had a zero balance. On December 31, 20Y9, the cost of the trading securities portfolio was $72,600, and the fair value was $79,100. Journalize the December 31, 20Y9, adjusting entry to recor

> On January 1, 20Y3, Valuation Allowance for Trading Investments had a zero balance. On December 31, 20Y3, the cost of the trading securities portfolio was $346,000, and the fair value was $309,000. Journalize the December 31, 20Y3, adjusting entry to rec

> Journalize the entries to record the following selected bond investment transactions for Marr Products: a. Purchased for cash $180,000 of Hotline Inc. 5% bonds at 100 plus accrued interest of $1,500. b. Received first semiannual interest payment. c. Sold

> Journalize the entries to record the following selected bond investment transactions for Beacon Trust: a. Purchased for cash $420,000 of Vasquez City 6% bonds at 100 plus accrued interest of $6,300. b. Received first semiannual interest payment. c. Sold

> On January 2, 20Y4, Whitworth Company acquired 40% of the outstanding stock of Aloof Company for $340,000. For the year ended December 31, 20Y4, Aloof Company earned income of $180,000 and paid dividends of $10,000. On January 31 20Y5, Whitworth Company

> On January 2, 20Y7, Mikedes Company acquired 30% of the outstanding stock of Violet Company for $720,000. For the year ended December 31, 20Y7, Violet Company earned income of $190,000 and paid dividends of $40,000. On January 31, 20Y8, Mikedes Company s

> In teams, select a public company that interests you. Obtain the company’s most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commission (SEC). It includes the company’s financia

> On September 12, 3,000 shares of Denver Company’s common stock are acquired at a price of $40 per share plus a $300 brokerage commission. On October 15, an $0.80-pershare dividend was received on the Denver Company stock. On November 10, 1,600 shares of

> On October 23, Brynner Company had a market price of $60 per share of common stock. For the previous year, Brynner paid an annual dividend of $0.90 per share. Compute the dividend yield for Brynner Company.

> On June 30, Rae Corporation had a market price of $100 per share of common stock. For the previous year, Rae paid an annual dividend of $8.00 per share. Compute the dividend yield for Rae Corporation.

> On January 1, 20Y7, Valuation Allowance for Available-for-Sale Investments had a zero balance. On December 31, 20Y7, the cost of the available-for-sale securities was $19,040, and the fair value was $22,870. Journalize the adjusting entry to record the u

> On January 23, 15,000 shares of Aurora Company’s common stock are acquired at a price of $25 per share plus a $150 brokerage commission. On April 12, a $0.50-per-share dividend was received on the Aurora Company stock. On June 10, 6,000 shares of the Aur

> On the first day of the fiscal year, a company issues an $8,600,000, 11%, five-year bond that pays semiannual interest of $473,000 ($8,600,000 × 11% × ½), receiving cash of $8,932,035. Journalize the bond issuance.

> Using the bond from Practice Exercise 14-3B, journalize the first interest payment and the amortization of the related bond discount. Round to the nearest dollar. Data from Exercise 14-3B: On the first day of the fiscal year, a company issues a $4,200,0

> Using the bond from Practice Exercise 14-3A, journalize the first interest payment and the amortization of the related bond discount. Round to the nearest dollar. Data from Practice Exercise 14-3A: On the first day of the fiscal year, a company issues a

> On the first day of the fiscal year, a company issues a $4,200,000, 10%, five-year bond that pays semiannual interest of $210,000 ($4,200,000 x 10% x ½), receiving cash of $4,041,710. Journalize the entry to record the issuance of the bonds.

> On the first day of the fiscal year, a company issues a $1,800,000, 6%, five-year bond that pays semiannual interest of $54,000 ($1,800,000 x 6% x ½), receiving cash of $1,725,151. Journalize the entry to record the issuance of the bonds.

> Marriott International, Inc., and Hyatt Hotels Corporation are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in millions

> The first day of the fiscal year, a company issues a $700,000, 6%, 10-year bond that pays semiannual interest of $21,000 ($700,000 x 6% x ½ year), receiving cash of $700,000. Journalize the entries to record (a) The issuance of the bonds, (b) The first i

> The first day of the fiscal year, a company issues a $3,500,000, 5%, 10-year bond that pays semiannual interest of $87,500 ($3,500,000 x 5% x ½ year), receiving cash of $3,500,000. Journalize the entries to record (a) The issuance of the bonds, (b) The f

> Mahmood Products Inc. reported the following on the company’s income statement in two recent years: a. Determine the times interest earned ratio for the current year and the prior year. Round to one decimal place. b. Is the times inter

> Sprout Company reported the following on the company’s income statement in two recent years: a. Determine the times interest earned ratio for the current year and the prior year. Round to one decimal place. b. Is the times interest ear

> On the first day of the fiscal year, a company issues $35,000, 5%, eight-year installment notes that have annual payments of $5,415. The first note payment consists of $1,750 of interest and $3,665 of principal repayment. a. Journalize the entry to recor

> On the first day of the fiscal year, a company issues $89,000, 6%, five-year installment notes that have annual payments of $21,128. The first note payment consists of $5,340 of interest and $15,788 of principal repayment. a. Journalize the entry to reco

> A $1,900,000 bond issue on which there is an unamortized premium of $101,264 is redeemed for $1,979,000. Journalize the redemption of the bonds.

> A $2,300,000 bond issue on which there is an unamortized discount of $107,500 is redeemed for $2,231,000. Journalize the redemption of the bonds.

> Using the bond from Practice Exercise 14-5B, journalize the first interest payment and the amortization of the related bond premium. Round to the nearest dollar. Data from Practice Exercise 14-5B: On the first day of the fiscal year, a company issues a

> The condensed income statements through income from operations for Amazon.com, Inc., Best Buy, Inc., and Walmart Inc., for a recent fiscal year follow (in millions): 1. Prepare comparative common-sized income statements for each company. Round percentag

> In teams, select a public company that interests you. Obtain the company’s most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commission (SEC). It includes the company’s financia

> Desert Trading Company has issued $100 million worth of long-term bonds at a fixed rate of 7%. The firm then enters into an interest rate swap where it pays LIBOR and receives a fixed 6% on notional principal of $100 million. What is the firm’s effective

> A manager is holding a $1 million bond portfolio with a modified duration of 8 years. She would like to hedge the risk of the portfolio by short-selling Treasury bonds. The modified duration of T-bonds is 10 years. How many dollars’ worth of T-bonds shou

> Farmer Brown grows Number 1 red corn and would like to hedge the value of the coming harvest. However, the futures contract is traded on the Number 2 yellow grade of corn. Suppose that yellow corn typically sells for 90% of the price of red corn. If he g

> a. The spot price of the British pound is currently $1.50. If the risk-free interest rate on 1-year government bonds is 1% in the United States and 2% in the United Kingdom, what must be the forward price of the pound for delivery one year from now? b. H

> Suppose that the spot price of the euro is currently $1.10. The 1-year futures price is $1.15. Is the interest rate higher in the United States or the euro zone?

> a. A single-stock futures contract on a non-dividend-paying stock with current price $150 has a maturity of 1 year. If the T-bill rate is 3%, what should the futures price be? b. What should the futures price be if the maturity of the contract is 3 years

> What is the difference in cash flow between short-selling an asset and entering a short futures position?

> Why might individuals purchase futures contracts rather than the underlying asset?

> Consider this arbitrage strategy to derive the parity relationship for spreads: (1) enter a long futures position with maturity date T1 and futures price F(T1); (2) enter a short position with maturity T2 and futures price F(T2); (3) at T1, when the firs

> The Excel Application box in the chapter (available in Connect; link to Chapter 22 material) shows how to use the spot-futures parity relationship to find a “term structure of futures prices,” that is, futures prices for various maturity dates. a. Suppos

> Noah Kramer, a fixed-income portfolio manager based in the country of Sevista, is considering the purchase of a Sevista government bond. Kramer decides to evaluate two strategies for implementing his investment in Sevista bonds. Table 16A gives the detai

> The S&P portfolio pays a dividend yield of 1% annually. Its current value is 2,000. The T-bill rate is 4%. Suppose the S&P futures price for delivery in 1 year is 2,050. Construct an arbitrage strategy to exploit the mispricing and show that your profits

> OneChicago has just introduced a single-stock futures contract on Brandex stock, a company that currently pays no dividends. Each contract calls for delivery of 1,000 shares of stock in 1 year. The T-bill rate is 6% per year. a. If Brandex stock now sell

> Consider a stock that pays no dividends on which a futures contract, a call option, and a put option trade. The maturity date for all three contracts is T, the exercise price of both the put and the call is X, and the futures price is F. Show that if X =

> Why is there no futures market in cement?

> Show that Black-Scholes call option hedge ratios increase as the stock price increases. Consider a 1-year option with exercise price $50, on a stock with annual standard deviation 20%. The T bill rate is 3% per year. Find N(d1) for stock prices (a) $45,

> Reconsider the determination of the hedge ratio in the two-state model (see Section 21.2), where we showed that one-third share of stock would hedge one option. What would be the hedge ratio for the following exercise prices: (a) 120, (b) 110, (c) 100, (

> Use the put-call parity relationship to demonstrate that an at-the-money European call option on a non-dividend-paying stock must cost more than an at-the-money put option. Show that the prices of the put and call will be equal if X = S0(1 + r)T.

> You build a binomial model with one period and assert that over the course of a year, the stock price will either rise by a factor of 1.5 or fall by a factor of 2/3. What is your implicit assumption about the volatility of the stock’s rate of return over

> All else equal, will a call option with a high exercise price have a higher or lower hedge ratio than one with a low exercise price?

> Suppose you are attempting to value a 1-year expiration option on a stock with volatility (i.e., annualized standard deviation) of σ = .40. What would be the appropriate values for u and d if your binomial model is set up using: a. 1 period of 1 year. b.

> A company’s current ratio is 2.0. Suppose the company uses cash to retire notes payable due within one year. What would be the effect on the current ratio and asset turnover ratio?

> What will happen to the delta of a convertible bond as the stock price becomes very large?

> All else equal, is a call option on a stock with a lot of firm-specific risk worth more than one on a stock with little firm-specific risk? The betas of the two stocks are equal.

> Let p(S, T, X) denote the value of a European put on a stock selling at S dollars, with time to maturity T, and with exercise price X, and let P(S, T, X) be the value of an American put. a. Evaluate p(0, T, X). b. Evaluate P(0, T, X). c. Evaluate p(S, T,

> These three put options are all written on the same stock. One has a delta of −.9, one a delta of −.5, and one a delta of −.1. Assign deltas to the three puts by filling in this table.

> Is a put option on a high-beta stock worth more than one on a low-beta stock? The stocks have identical firm-specific risk.

> The hedge ratio of an at-the-money call option on IBM is .4. The hedge ratio of an at-the-money put option is −.6. What is the hedge ratio of an at-the-money straddle position on IBM?

> According to the Black-Scholes formula, what will be the hedge ratio (delta) of a put option for a very small exercise price?

> According to the Black-Scholes formula, what will be the hedge ratio (delta) of a call option as the stock price becomes infinitely large? Explain briefly.

> If the time to expiration falls and the put price rises, then what has happened to the put option’s implied volatility?

> If the stock price falls and the call price rises, then what has happened to the call option’s implied volatility?

> A firm has net sales of $3,000, cash expenses (including taxes) of $1,400, and depreciation of $500. If accounts receivable increase over the period by $400, what would be cash flow from operations?

> Mark Washington, CFA, is an analyst with BIC. One year ago, BIC analysts predicted that the U.S. equity market would experience a slight downturn and suggested delta-hedging the BIC portfolio. U.S. equity markets did indeed fall, but BIC’s portfolio perf

> Mark Washington, CFA, is an analyst with BIC. One year ago, BIC analysts predicted that the U.S. equity market would experience a slight downturn and suggested delta-hedging the BIC portfolio. U.S. equity markets did indeed fall, but BIC’s portfolio perf

> Mark Washington, CFA, is an analyst with BIC. One year ago, BIC analysts predicted that the U.S. equity market would experience a slight downturn and suggested delta-hedging the BIC portfolio. U.S. equity markets did indeed fall, but BIC’s portfolio perf

> Mark Washington, CFA, is an analyst with BIC. One year ago, BIC analysts predicted that the U.S. equity market would experience a slight downturn and suggested delta-hedging the BIC portfolio. U.S. equity markets did indeed fall, but BIC’s portfolio perf

> Mark Washington, CFA, is an analyst with BIC. One year ago, BIC analysts predicted that the U.S. equity market would experience a slight downturn and suggested delta-hedging the BIC portfolio. U.S. equity markets did indeed fall, but BIC’s portfolio perf

> A call option with X = $50 on a stock priced at S = $55 sells for $10. Using a volatility estimate of σ = .30, you find that N(d1) = .6 and N(d2) = .5. The risk-free interest rate is zero. Is the implied volatility based on the option price more or less

> Recalculate the value of the call option in Problem 11, successively substituting one of the changes below while keeping the other parameters as in Problem 11: a. Time to expiration = 3 months. b. Standard deviation = 25% per year. c. Exercise price = $5

> Find the Black-Scholes value of a put option on the stock in Problem 11 with the same exercise price and expiration as the call option. Data from problem 11: Time to expiration……………………………………6 months Standard deviation……………………………..50% per year Exercise p

> Use the Black-Scholes formula to find the value of a call option on the following stock: Time to expiration……………………………6 months Standard deviation………………………50% per year Exercise price………………………………………….$50 Stock price……………………………………………...$50 Annual interest r