Question: Washer Company has a reporting unit resulting

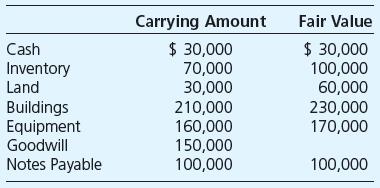

Washer Company has a reporting unit resulting from an earlier business combination. The reporting unit’s current assets and liabilities are

Required

Determine the amount of goodwill to be reported and the amount of goodwill impairment, if any, if the fair value of the reporting unit is determined to be

a. $580,000.

b. $540,000.

c. $500,000.

d. $460,000.

Transcribed Image Text:

Carrying Amount Fair Value $ 30,000 70,000 30,000 210,000 160,000 150,000 100,000 $ 30,000 100,000 60,000 230,000 170,000 Cash Inventory Land Buildings Equipment Goodwill Notes Payable 100,000

> Peanut Company acquired 100 percent of Snoopy Company’s outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000. Problem 2-27 summarizes the first year

> Peanut Company acquired 100 percent of Snoopy Company’s outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000. Peanut uses the cost method to account

> Paper Company acquired 100 percent of Scissor Company’s outstanding common stock for $370,000 on January 1, 20X8, when the book value of Scissor’s net assets was equal to $370,000. Problem 2-25 summarizes the first yea

> Paper Company acquired 100 percent of Scissor Company’s outstanding common stock for $370,000 on January 1, 20X8, when the book value of Scissor’s net assets was equal to $370,000. Paper uses the equity method to accou

> Peanut Company acquired 100 percent of Snoopy Company’s outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000. Problem 2-23 summarizes the first year

> Peanut Company acquired 100 percent of Snoopy Company’s outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000. Peanut uses the equity method to accou

> Wealthy Manufacturing Company purchased 40 percent of the voting shares of Diversified Products Corporation on March 23, 20X4. On December 31, 20X8, Wealthy Manufacturing’s controller attempted to prepare income statements and retained

> Select the correct answer for each of the following questions. 1. Growth in the complexity of the U.S. business environment a. Has led to increased use of partnerships to avoid legal liability. b. Has led to increasingly complex organizational structures

> Dewey Corporation owns 30 percent of the common stock of Jimm Company, which it purchased at underlying book value on January 1, 20X5. Dewey reported a balance of $245,000 for its investment in Jimm Company on January 1, 20X5, and $276,800 at December 31

> Marlow Company acquired 40 percent of the voting shares of Brown Company on January 1, 20X8, for $85,000. The following results are reported for Brown Company: Required Give all journal entries recorded by Marlow for 20X8 and 20X9 assuming that it use

> Gant Company purchased 20 percent of the outstanding shares of Temp Company for $70,000 on January 1, 20X6. The following results are reported for Temp Company: Required Determine the amounts reported by Gant as income from its investment in Temp for

> Idle Corporation has been acquiring shares of Fast Track Enterprises at book value for the last several years. Fast Track provided data including the following: Fast Track declares and pays its annual dividend on November 15 each year. Its net book val

> Lang Company reports net assets with a book value and fair value of $200,000. Pace Corporation acquires 75 percent ownership for $150,000. Pace reports net assets with a book value of $520,000 and a fair value of $640,000 at that time, excluding its inve

> On December 31, 20X8, Banner Corporation acquired 80 percent of Dwyer Company’s common stock for $136,000. At the acquisition date, the book values and fair values of all of Dwyer’s assets and liabilities were equal. B

> Tall Corporation acquired 75 percent of Light Corporation’s voting common stock on January 1, 20X2, at underlying book value. At the acquisition date, the book values and fair values of Light’s assets and liabilities were equal, and the fair value of the

> Ambrose Corporation owns 75 percent of Kroop Company’s common stock, acquired at underlying book value on January 1, 20X4. At the acquisition date, the book values and fair values of Kroop’s assets and liabilities were

> Sanderson Corporation acquired 70 percent of Kline Corporation’s common stock on January 1, 20X7, for $294,000 in cash. At the acquisition date, the book values and fair values of Kline’s assets and liabilities were eq

> Belchfire Motors’ accountant was called away after completing only half of the consolidated statements at the end of 20X4. The data left behind included the following: Required a. Belchfire Motors acquired shares of Premium Body Shop

> When a company assigns goodwill to a reporting unit acquired in a business combination, it must record an impairment loss if’ a. The fair value of the net identifiable assets held by a reporting unit decreases. b. The fair value of the reporting unit dec

> One company may acquire another for a number of different reasons. The acquisition often has a significant impact on the financial statements. In 2005, 3M Corporation acquired CUNO Incorporated. Obtain a copy of the 3M 10-K filing for 2005. The 10-K repo

> Frazer Corporation owns 70 percent of Messer Company’s stock. In the 20X9 consolidated income statement, the noncontrolling interest was assigned $18,000 of income. There was no differential in the acquisition. Required What amount of net income did Me

> Teal Corporation is the primary beneficiary of a variable interest entity with total assets of $500,000, liabilities of $470,000, and owners’ equity of $30,000. Because Teal owns 25 percent of the VIE’s voting stock, it reported a $7,500 investment in th

> Gamble Company convinced Conservative Corporation that the two companies should establish Simpletown Corporation to build a new gambling casino in Simpletown Corner. Although chances for the casino’s success were relatively low, a local bank loaned $140,

> Byte Computer Corporation acquired 90 percent of Nofail Software Company’s common stock on January 2, 20X3, by issuing preferred stock with a par value of $6 per share and a market value of $8.10 per share. A total of 10,000 shares of p

> Byte Computer Corporation acquired 75 percent of Nofail Software Company’s stock on January 2, 20X3, by issuing bonds with a par value of $50,000 and a fair value of $67,500 in exchange for the shares. Summarized balance sheet data pres

> Fineline Pencil Company acquired 80 percent of Smudge Eraser Corporation’s stock on January 2, 20X3, for $72,000 cash. Summarized balance sheet data for the companies on December 31, 20X2, are as follows: Required Prepare a consolida

> Potter Company acquired 90 percent of the voting common shares of Stately Corporation by issuing bonds with a par value and fair value of $121,500 to Stately’s existing shareholders. Immediately prior to the acquisition, Potter reported total assets of $

> On January 1, 20X3, Guild Corporation reported total assets of $470,000, liabilities of $270,000, and stockholders’ equity of $200,000. At that date, Bristol Corporation reported total assets of $190,000, liabilities of $135,000, and stockholders’ equity

> Amber Corporation reported the following summarized balance sheet data on December 31, 20X6: On January 1, 20X7, Purple Company acquired 100 percent of Amber’s stock for $500,000. At the acquisition date, the book values and fair valu

> Trim Corporation acquired 100 percent of Round Corporation’s voting common stock on January 1, 20X2, for $400,000. At that date, the book values and fair values of Round’s assets and liabilities were equal. Round repor

> When an existing company creates a new subsidiary and transfers a portion of its assets and liabilities to the new entity a. The new entity records both the assets and liabilities it received at fair values. b. The new entity records both the assets and

> Blank Corporation acquired 100 percent of Faith Corporation’s common stock on December 31, 20X2, for $150,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: At the date

> On December 31, 20X3, Broadway Corporation reported common stock outstanding of $200,000, additional paid-in capital of $300,000, and retained earnings of $100,000. On January 1, 20X4, Johe Company acquired control of Broadway in a business combination.

> Baldwin Corporation purchased 25 percent of Gwin Company’s common stock on January 1, 20X8, at underlying book value. In 20X8, Gwin reported a net loss of $20,000 and paid dividends of $10,000, and in 20X9, The company reported net income of $68,000 and

> Callas Corporation paid $380,000 to acquire 40 percent ownership of Thinbill Company on January 1, 20X9. The amount paid was equal to Thinbill’s underlying book value. During 20X9, Thinbill reported operating income of $45,000 and an increase of $20,000

> Reden Corporation purchased 45 percent of Montgomery Company’s common stock on January 1, 20X9, at underlying book value of $288,000. Montgomery’s balance sheet contained the following stockholders’ equity balances: Preferred Stock ($5 par value, 50,000

> Kent Company purchased 35 percent ownership of Lomm Company on January 1, 20X8, for $140,000. Lomm reported 20X8 net income of $80,000 and paid dividends of $20,000. At December 31, 20X8, Kent determined the fair value of its investment in Lomm to be $17

> Small Company reported 20X7 net income of $40,000 and paid dividends of $15,000 during the year. Mock Corporation acquired 20 percent of Small’s shares on January 1, 20X7, for $105,000. At December 31, 20X7, Mock determined the fair value of the shares o

> Grandview Company purchased 40 percent of the stock of Spinet Corporation on January 1, 20X8, at underlying book value. Spinet recorded the following income for 20X9: Income before Extraordinary Gain………………………………$60,000 Extraordinary Gain…………………………………………

> Port Company purchased 30,000 of the 100,000 outstanding shares of Sund Company common stock on January 1, 20X2, for $180,000. The purchase price was equal to the book value of the shares purchased. Sund reported the following: Required Compute the am

> Ravine Corporation purchased 30 percent ownership of Valley Industries for $90,000 on January 1, 20X6, when Valley had capital stock of $240,000 and retained earnings of $60,000. The following data were reported by the companies for the years 20X6 throug

> Lead Corporation established a new subsidiary and transferred to it assets with a cost of $90,000 and a book value of $75,000. The assets had a fair value of $100,000 at the time of transfer. The transfer will result in a. A reduction of net assets repo

> Phillips Company bought 40 percent ownership in Jones Bag Company on January 1, 20X1, at underlying book value. In 20X1, 20X2, and 20X3, Jones Bag reported the following: The balance in Phillips Company’s investment account on Decembe

> Winston Corporation purchased 40 percent of the stock of Fullbright Company on January 1, 20X2, at underlying book value. The companies reported the following operating results and dividend payments during the first three years of intercorporate ownershi

> On July 1, 20X2, Alan Enterprises merged with Cherry Corporation through an exchange of stock and the subsequent liquidation of Cherry. Alan issued 200,000 shares of its stock to effect the combination. The book values of Cherry’s asset

> The following financial statement information was prepared for Blue Corporation and Sparse Company at December 31, 20X2: Blue and Sparse agreed to combine as of January 1, 20X3. To effect the merger, Blue paid finder’s fees of $30,000

> The following balance sheets were prepared for Adam Corporation and Best Company on January 1, 20X2, just before they entered into a business combination: Adam acquired all of Best Company’s assets and liabilities on January 1, 20X2,

> Dunyain Company acquired Allsap Corporation on January 1, 20X1, through an exchange of common shares. All of Allsap’s assets and liabilities were immediately transferred to Dunyain, which reported total par value of shares outstanding of $218,400 and $32

> Grant Company acquired all of Bedford Corporation’s assets and liabilities on January 1, 20X2, in a business combination. At that date, Bedford reported assets with a book value of $624,000 and liabilities of $356,000. Grant noted that Bedford had $40,00

> Groft Company purchased Strobe Company’s net assets and assigned them to four separate reporting units. Total goodwill of $186,000 is assigned to the reporting units as indicated: Required Determine the amount of goodwill that Groft

> Double Corporation acquired all of the common stock of Simple Company for $450,000 on January 1, 20X4. On that date, Simple’s identifiable net assets had a fair value of $390,000. The assets acquired in the purchase of Simple are considered to be a separ

> Topper Company established a subsidiary and transferred equipment with a fair value of $72,000 to the subsidiary. Topper had purchased the equipment with ten-year expected life of four years earlier for $100,000 and has used straight-line depreciation wi

> Mesa Corporation purchased Kwick Company’s net assets and assigned goodwill of $80,000 to Reporting Division K. The following assets and liabilities are assigned to Reporting Division K: Required Determine the amount of goodwill to b

> Using the data presented in E1-13, determine the amount Fortune Corporation would record as a gain on bargain purchase and prepare the journal entry Fortune would record at the time of the exchange if Fortune issued bonds with a par value of $580,000 and

> Fortune Corporation used debentures with a par value of $625,000 to acquire 100 percent of Sorden Company’s net assets on January 1, 20X2. On that date, the fair value of the bonds issued by Fortune was $608,000. The following balance s

> Spur Corporation reported the following balance sheet amounts on December 31, 20X1: Required Blanket acquired Spur Corporation’s assets and liabilities for $670,000 cash on December 31, 20X1. Give the entry that Blanket made to recor

> Elm Corporation and Maple Company have announced terms of an exchange agreement under which Elm will issue 8,000 shares of its $10 par value common stock to acquire all of Maple Company’s assets. Elm shares currently are trading at $50,

> McDermott Corporation has been in the midst of a major expansion program. Much of its growth had been internal, but in 20X1 McDermott decided to continue its expansion through the acquisition of other companies. The first company acquired was Tippy Inc.,

> Samper Company reported the book value of its net assets at $160,000 when Public Corporation acquired 100 percent of its voting stock for cash. The fair value of Samper’s net assets was determined to be $190,000 on that date. Required Determine the amo

> Sun Corporation concluded the fair value of Tender Company was $60,000 and paid that amount to acquire its net assets. Tender reported assets with a book value of $55,000 and fair value of $71,000 and liabilities with a book value and fair value of $20,0

> Foster Corporation established Kline Company as a wholly owned subsidiary. Foster reported the following balance sheet amounts immediately before and after it transferred assets and accounts payable to Kline Company in exchange for 4,000 shares of $12 pa

> Foster Corporation established Kline Company as a wholly owned subsidiary. Foster reported the following balance sheet amounts immediately before and after it transferred assets and accounts payable to Kline Company in exchange for 4,000 shares of $12 pa

> Twill Company has a reporting unit with the fair value of its net identifiable assets of $500,000. The carrying value of the reporting unit’s net assets on Twill’s books is $575,000, which includes $90,000 of goodwill. The fair value of the reporting uni

> Lester Company transferred the following assets to a newly created subsidiary, Mumby Corporation, in exchange for 40,000 shares of its $3 par value stock: Required a. Give the journal entry in which Lester recorded the transfer of assets to Mumby Corp

> Lester Company transferred the following assets to a newly created subsidiary, Mumby Corporation, in exchange for 40,000 shares of its $3 par value stock: Required a. Give the journal entry in which Lester recorded the transfer of assets to Mumby Corp

> Pale Company was established on January 1, 20X1. Along with other assets, it immediately purchased land for $80,000, a building for $240,000, and equipment for $90,000. On January 1, 20X5, Pale transferred these assets, cash of $21,000, and inventory cos

> Pale Company was established on January 1, 20X1. Along with other assets, it immediately purchased land for $80,000, a building for $240,000, and equipment for $90,000. On January 1, 20X5, Pale transferred these assets, cash of $21,000, and inventory cos

> What is the basic idea underlying the preparation of consolidated financial statements?

> What is the noncontrolling interest in a subsidiary?

> Why are subsidiary shares not reported as stock outstanding in the consolidated balance sheet?

> What is meant by indirect control? Give an illustration.

> What characteristics are normally examined in determining whether a company is a primary beneficiary of a variable interest entity?

> How has reliance on legal control as a consolidation criterion led to off-balance sheet financing?

> Grout Company reports assets with a carrying value of $420,000 (including goodwill with a carrying value of $35,000) assigned to an identifiable reporting unit purchased at the end of the prior year. The fair value of the net assets held by the reporting

> When is consolidation considered inappropriate even though the parent holds a majority of the voting common shares of another company?

> What major criteria must be met before a company is consolidated?

> Why is ownership of a majority of the common stock of another company considered important in consolidation?

> Are consolidated financial statements likely to be more useful to the creditors of the parent company or the creditors of the subsidiaries? Why?

> What is meant by parent company? When is a company considered to be a parent?

> Are consolidated financial statements likely to be more useful to the owners of the parent company or to the noncontrolling owners of the subsidiaries? Why?

> How might consolidated statements help an investor assess the desirability of purchasing shares of the parent company?

> What is the difference between consolidated and combined financial statements?

> What must be done if the fiscal periods of the parent and its subsidiary are not the same?

> What means other than majority ownership might be used to gain control over a company? Can consolidation occur if control is gained by other means?

> Tear Company, a newly established subsidiary of Stern Corporation, received assets with an original cost of $260,000, a fair value of $200,000, and a book value of $140,000 from the parent in exchange for 7,000 shares of Tear’s $8 par value common stock.

> How does a variable interest entity typically differ from a traditional corporate business entity?

> What types of entities are referred to as special-purpose entities, and how have they generally been used?

> Exacto Company reported the following net income and dividends for the years indicated: True Corporation acquired 75 percent of Exacto’s common stock on January 1, 20X5. On that date, the fair value of Exacto’s net a

> Quoton Corporation acquired 80 percent of Tempro Company’s common stock on December 31, 20X5, at underlying book value. The book values and fair values of Tempro’s assets and liabilities were equal, and the fair value

> Purified Oil Company and Midwest Pipeline Corporation established Venture Company to conduct oil exploration activities in North America to reduce their dependence on imported crude oil. Midwest Pipeline purchased all 20,000 shares of the newly created c

> On December 28, 20X3, Stern Corporation and Ram Company established S&R Partnership, with cash contributions of $10,000 and $40,000, respectively. The partnership’s purpose is to purchase from Stern accounts receivable that have an

> Tally Corporation and its subsidiary reported consolidated net income of $164,300 for 20X2. Tally owns 60 percent of the common shares of its subsidiary, acquired at book value. Noncontrolling interest was assigned income of $15,200 in the consolidated i

> Select the correct answer for each of the following questions. 1. What is the theoretically preferred method of presenting a noncontrolling interest in a consolidated balance sheet? a. As a separate item within the liability section. b. As a deduction fr

> Paper Company acquired 80 percent of Scissor Company’s outstanding common stock for $296,000 on January 1, 20X8, when the book value of Scissor’s net assets was equal to $370,000. Problem 3-30 summarizes the first year

> Paper Company acquired 80 percent of Scissor Company’s outstanding common stock for $296,000 on January 1, 20X8, when the book value of Scissor’s net assets was equal to $370,000. Paper uses the equity method to accoun

> In a business combination, costs of registering equity securities to be issued by the acquiring company are a(n) a. Expense of the combined company for the period in which the costs were incurred. b. Direct addition to stockholders’ equity of the combine

> Paper Company acquired 80 percent of Scissor Company’s outstanding common stock for $296,000 on January 1, 20X8, when the book value of Scissor’s net assets was equal to $370,000. Paper uses the equity method to accoun

> Peanut Company acquired 90 percent of Snoopy Company’s outstanding common stock for $270,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000. Problem 3-34 summarizes the first year

> Peanut Company acquired 90 percent of Snoopy Company’s outstanding common stock for $270,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000. Peanut uses the equity method to accoun

> Peanut Company acquired 90 percent of Snoopy Company’s outstanding common stock for $270,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000. Peanut uses the equity method to accoun