Question: Waylander Coatings Company purchased waterproofing

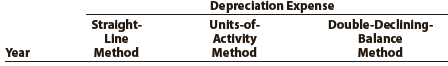

Waylander Coatings Company purchased waterproofing equipment on January 6 for $320,000. The equipment was expected to have a useful life of four years, or 20,000 operating hours, and a residual value of $35,000. The equipment was used for 7,200 hours during Year 1, 6,400 hours in Year 2, 4,400 hours in Year 3, and 2,000 hours in Year 4.

Instructions

1. Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by

(a) The straight-line method,

(b) The units-of-activity method, and

(c) The double-declining-balance method. Also determine the total depreciation expense for the four years by each method. The following columnar headings are suggested for recording the depreciation expense amounts:

2. What method yields the highest depreciation expense for Year 1?

3. What method yields the most depreciation over the four-year life of the equipment?

Transcribed Image Text:

Depreciation Expense Stralght- Line Units-of- Activity Method Double-Declining- Balance Method Year Method

> Using the bond from Practice Exercise 14-3B, journalize the first interest payment and the amortization of the related bond discount. Round to the nearest dollar. In Practice Exercise 14-3B On the first day of the fiscal year, a company issues a $3,000,

> Holly Renfro contributed a patent, accounts receivable, and $20,000 cash to a partnership. The patent had a book value of $8,000. However, the technology covered by the patent appeared to have significant market potential. Thus, the patent was appraised

> Antique Buggy Corporation has 820,000 shares of $35 par common stock outstanding. On June 8, Antique Buggy Corporation declared a 5% stock dividend to be issued August 12 to stockholders of record on July 13. The market price of the stock was $63 per sha

> Hiro has a capital balance of $75,000 after adjusting assets to fair market value. Marone contributes $20,000 to receive a 40% interest in a new partnership with Hiro. Determine the amount and recipient of the partner bonus.

> The payroll register of Ruggerio Co. indicates $10,500 of social security withheld and $2,625 of Medicare tax withheld on total salaries of $175,000 for the period. Federal withholding for the period totaled $34,650. Provide the journal entry for the per

> A company reports the following: Sales ……………………………………………………… $1,500,000 Average accounts receivable (net) ………………… 100,000 Determine (a) The accounts receivable turnover and (b) The number of days’ sales in receivables. Round to one decimal place.

> Demers Inc. reported the following data: Net income ……………………………………………….. $490,000 Depreciation expense …………………………………….. 52,000 Gain on disposal of equipment ……………………….. 26,500 Decrease in accounts receivable ……………………… 32,400 Decrease in accounts payable

> On January 1, Valuation Allowance for Trading Investments had a zero balance. On December 31, the cost of the trading securities portfolio was $260,000, and the fair value was $214,000. Prepare the December 31 adjusting journal entry to record the unreal

> Using the bond from Practice Exercise 14-3A, journalize the first interest payment and the amortization of the related bond discount. Round to the nearest dollar. In Practice Exercise 14-3A On the first day of the fiscal year, a company issues a $3,000,

> Pro-Builders Corporation has 1,500,000 shares of $5 par common stock outstanding. On September 2, Pro-Builders Corporation declared a 3% stock dividend to be issued November 30 to stockholders of record on October 3. The market price of the stock was $36

> Berry Company reported the following on the company’s income statement in two recent years: a. Determine the times interest earned ratio for the current year and the prior year. Round to one decimal place. b. Is the number of times in

> Gomez has a capital balance of $240,000 after adjusting assets to fair market value. Banks contributes $380,000 to receive a 60% interest in a new partnership with Gomez. Determine the amount and recipient of the partner bonus.

> The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $82.60 on December 31, 20Y2. Instructions Determine the following measures for 20Y2, rounding to one decimal place, including percentage

> Journalize the entries to record the following selected bond investment transactions for Hall Trust: a. Purchased for cash $240,000 of Medina City 6% bonds at 100 plus accrued interest of $3,600. b. Received first semiannual interest payment. c. Sold $12

> Marsha Mellow’s weekly gross earnings for the week ended May 23 were $1,250, and her federal income tax withholding was $201.65. Assuming that the social security rate is 6% and Medicare is 1.5% of all earnings, what is Mellow’s net pay?

> The following items are reported on a company’s balance sheet: Cash ……………………………………….. $210,000 Marketable securities ………………… 120,000 Accounts receivable (net) …………… 110,000 Inventory …………………………………. 160,000 Accounts payable ……………………… 200,000 Determine (a

> Huluduey Corporation’s comparative balance sheet for current assets and liabilities was as follows: Adjust net income of $160,000 for changes in operating assets and liabilities to arrive at net cash flow from operating activities.

> On January 2, Yorkshire Company acquired 40% of the outstanding stock of Fain Company for $600,000. For the year ended December 31, Fain Company earned income of $140,000 and paid dividends of $50,000. Prepare the entries for Yorkshire Company for the pu

> On the first day of the fiscal year, a company issues a $3,000,000, 11%, five-year bond that pays semiannual interest of $165,000 ($3,000,000 × 11% × ½), receiving cash of $2,889,599. Journalize the bond issuance.

> The declaration, record, and payment dates in connection with a cash dividend of $480,000 on a corporation’s common stock are February 1, March 18, and May 1. Journalize the entries required on each date.

> Demarco Lee invested $60,000 in the Camden and Sayler partnership for ownership equity of $60,000. Prior to the investment, equipment was revalued to a market value of $39,000 from a book value of $30,000. Kevin Camden and Chloe Sayler share net income i

> An employee earns $25 per hour and 2 times that rate for all hours in excess of 40 hours per week. Assume that the employee worked 48 hours during the week. Assume further that the social security tax rate was 6.0%, the Medicare tax rate was 1.5%, and fe

> Tam Worldly’s weekly gross earnings for the week ended April 22 were $2,000, and her federal income tax withholding was $372.02. Assuming that the social security rate is 6% and Medicare is 1.5% of all earnings, what is Worldly’s net pay?

> The following items are reported on a company’s balance sheet: Cash ………………………………………….. $100,000 Marketable securities ……………………… 50,000 Accounts receivable (net) ……………….. 60,000 Inventory ………………………………………. 70,000 Accounts payable …………………………. 140,000 Deter

> Zwilling Corporation’s comparative balance sheet for current assets and liabilities was as follows: Adjust net income of $320,000 for changes in operating assets and liabilities to arrive at net cash flow from operating activities.

> Frey Co. is considering the following alternative financing plans: Income tax is estimated at 40% of income. Determine the earnings per share of common stock, assuming that income before bond interest and income tax is $800,000. Plan 1 Plan 2 Issue

> On January 2, Cohan Company acquired 40% of the outstanding stock of Sanger Company for $500,000. For the year ended December 31, Sanger Company earned income of $80,000 and paid dividends of $30,000. Prepare the entries for Cohan Company for the purchas

> On the first day of the fiscal year, a company issues a $2,500,000, 4%, five-year bond that pays semiannual interest of $50,000 ($2,500,000 × 4% × ½), receiving cash of $2,390,599. Journalize the bond issuance.

> The declaration, record, and payment dates in connection with a cash dividend of $350,000 on a corporation’s common stock are February 28, April 1, and May 15. Journalize the entries required on each date.

> Craig Roberts purchased one-half of Ennis Leighton’s interest in the Vale and Leighton partnership for $34,000. Prior to the investment, land was revalued to a market value of $130,000 from a book value of $80,000. Tony Vale and Ennis Leighton share net

> Data pertaining to the current position of Forte Company follow: Cash ……………………â€&br

> Marsha Mellow’s weekly gross earnings for the present week were $1,250. Mellow has one exemption. Using the wage bracket withholding table in Exhibit 2 with a $75 standard withholding allowance for each exemption, what is Mellow’s federal income tax with

> Adieu Company reported the following current assets and liabilities for December 31 for two recent years: a. Compute the quick ratio on December 31 of both years. b. Interpret the company’s quick ratio. Is the quick ratio improving or

> Income statement information for Einsworth Corporation follows: Sales …………………………………….. $1,200,000 Cost of goods sold ……………………… 780,000 Gross profit ……………………………….. 420,000 Prepare a vertical analysis of the income statement for Einsworth Corporation.

> Ya Wen Corporation’s accumulated depreciation—equipment account increased by $8,750, while $3,250 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In

> On September 12, 2,000 shares of Aspen Company are acquired at a price of $50 per share plus a $200 brokerage commission. On October 15, a $0.50-per-share dividend was received on the Aspen Company stock. On November 10, 1,200 shares of the Aspen Company

> On January 1, the first day of the fiscal year, a company issues an $800,000, 4%, 10-year bond that pays semiannual interest of $16,000 ($800,000 × 4% × ½ year), receiving cash of $800,000. Journalize the entries to record (a) The issuance of the bonds,

> Reinhardt Furniture Company has 40,000 shares of cumulative preferred 2% stock, $150 par, and 100,000 shares of $5 par common stock. The following amounts were distributed as dividends: Year 1 ……………………… $ 70,000 Year 2 ……………………… 200,000 Year 3 ………………………

> On January 22, Zentric Corporation issued for cash 180,000 shares of no-par common stock at $4. On February 14, Zentric Corporation issued at par value 44,000 shares of preferred 2% stock, $55 par for cash. On August 30, Zentric Corporation issued for ca

> John Prado and Ayana Nicks formed a partnership, dividing income as follows: 1. Annual salary allowance to Prado, $10,000 and Nicks, $28,000. 2. Interest of 5% on each partner’s capital balance on January 1. 3. Any remaining net income divided equally. P

> Tam Worldly’s weekly gross earnings for the present week were $2,000. Worldly has two exemptions. Using the wage bracket withholding table in Exhibit 2 with a $75 standard withholding allowance for each exemption, what is Worldly’s federal income tax wit

> Income statement information for Omega Corporation follows: Sales …………………………………………… $500,000 Cost of goods sold ………………………….. 300,000 Gross profit ……………………………………. 200,000 Prepare a vertical analysis of the income statement for Omega Corporation.

> Dillin Inc. reported the following on the company’s statement of cash flows in Year 2 and Year 1: Eighty percent of the net cash flow used for investing activities was used to replace existing capacity. a. Determine Dillinâ€

> On the first day of the fiscal year, a company issues $45,000, 8%, six-year installment notes that have annual payments of $9,734. The first note payment consists of $3,600 of interest and $6,134 of principal repayment. a. Journalize the entry to record

> Financial statement data for the years ended December 31 for Black Bull Inc. follow: a. Determine the earnings per share for 20Y6 and 20Y5. b. Does the change in the earnings per share from 20Y5 to 20Y6 indicate a favorable or unfavorable trend? 20

> Ripley Corporation’s accumulated depreciation—furniture account increased by $11,575, while $2,500 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In

> For 20Y2, Tri-Comic Company initiated a sales promotion campaign that included the expenditure of an additional $50,000 for advertising. At the end of the year, Lumi Neer, the president, is presented with the following condensed comparative income statem

> For 20Y2, McDade Company reported a decline in net income. At the end of the year, T. Burrows, the president, is presented with the following condensed comparative income statement: Instructions 1. Prepare a comparative income statement with horizontal

> Layton Company purchased tool sharpening equipment on October 1 for $108,000. The equipment was expected to have a useful life of three years, or 12,000 operating hours, and a residual value of $7,200. The equipment was used for 1,350 hours during Year 1

> Perdue Company purchased equipment on April 1 for $270,000. The equipment was expected to have a useful life of three years, or 18,000 operating hours, and a residual value of $9,000. The equipment was used for 7,500 hours during Year 1, 5,500 hours in Y

> Dexter Industries purchased packaging equipment on January 8 for $72,000. The equipment was expected to have a useful life of three years, or 18,000 operating hours, and a residual value of $4,500. The equipment was used for 7,600 hours during Year 1, 6,

> The following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale ceramic business. The receipts are identified by an asterisk. a. Fee paid to attorney for title search . . . . . . . . . . . . . . .

> Data related to the acquisition of timber rights and intangible assets during the current year ended December 31 are as follows: a. Timber rights on a tract of land were purchased for $1,600,000 on February 22. The stand of timber is estimated at 5,000,0

> Equipment acquired at a cost of $105,000 has an estimated residual value of $12,000 and an estimated useful life of 10 years. It was placed into service on May 1 of the current fiscal year, which ends on December 31. Determine the depreciation for the cu

> A Kubota tractor acquired on January 8 at a cost of $85,000 has an estimated useful life of 10 years. Assuming that it will have no residual value, determine the depreciation for each of the first two years (a) By the straight-line method and (b) By the

> The following transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-declining-balance method of depreciation is used. Year 1 Jan. 4. Purchased a

> Prior to adjustment at the end of the year, the balance in Trucks is $296,900 and the balance in Accumulated Depreciation—Trucks is $99,740. Details of the subsidiary ledger are as follows: a. Determine for each truck the depreciation

> Convert each of the following estimates of useful life to a straight-line depreciation rate, stated as a percentage: (a) 10 years, (b) 8 years, (c) 25 years, (d) 40 years, (e) 5 years, (f) 4 years, (g) 20 years.

> Tri-City Ironworks Co. reported $44,500,000 for equipment and $29,800,000 for accumulated depreciation—equipment on its balance sheet. Does this mean (a) That the replacement cost of the equipment is $44,500,000 and (b) That $29,800,000 is set aside in a

> On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $90,000 and giving a short-term note for $50,000. Legal fees paid were $1,750, delinquent taxes assumed were $25,000, and fees paid to remove an old building from the

> On October 1, Bentley Delivery Services acquired a new truck with a list price (fair market value) of $75,000. Bentley Delivery received a trade-in allowance (fair market value) of $24,000 on an old truck of similar type and paid cash of $51,000. The fol

> On July 1, Twin Pines Co., a water distiller, acquired new bottling equipment with a list price (fair market value) of $220,000. Twin Pines received a trade-in allowance (fair market value) of $45,000 on the old equipment of a similar type and paid cash

> Assume the same facts as in Exercise 9-27, except that the book value of the press traded in is $108,500. (a) What is the amount of cash given? (b) What is the gain or loss on the exchange? In Exercise 9-27 A printing press priced at a fair market value

> A printing press priced at a fair market value of $275,000 is acquired in a transaction that has commercial substance by trading in a similar press and paying cash for the difference between the trade-in allowance and the price of the new press. a. Assum

> The following table shows the sales and average book value of fixed assets for three different companies from three different industries for a recent year: a. For each company, determine the fixed asset turnover ratio. Round to one decimal place. b. Ex

> New lithographic equipment, acquired at a cost of $800,000 on March 1 of Year 1 (beginning of the fiscal year), has an estimated useful life of five years and an estimated residual value of $90,000. The manager requested information regarding the effect

> Dave Elliott, CPA, is an assistant to the controller of Lyric Consulting Co. In his spare time, Dave also prepares tax returns and performs general accounting services for clients. Frequently, Dave performs these services after his normal working hours,

> Hard Bodies Co. is a fitness chain that has just completed its second year of operations. At the beginning of its first fiscal year, the company purchased fitness equipment at a cost of $600,000 and estimated that the equipment would have a useful life of fiv

> The following is an excerpt from a conversation between two employees of WXT Technologies, Nolan Sears and Stacy Mays. Nolan is the accounts payable clerk, and Stacy is the cashier. Nolan: Stacy, could I get your opinion on something? Stacy: Sure, Nolan.

> Godwin Co. owns three delivery trucks. Details for each truck at the end of the most recent year follow: • At the beginning of the year, a hydraulic lift is added to Truck 1 at a cost of $4,500. The addition of the hydraulic lift will

> Go to the Internet and review the procedures for applying for a patent, a copyright, and a trademark. You may find information available on Wikipedia (Wikipedia.org) useful for this purpose. Prepare a brief written summary of these procedures.

> In teams, select a public company that interests you. Obtain the company’s most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commission (SEC). It includes the company’s financia

> The following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale apparel business. The receipts are identified by an asterisk. a. Fee paid to attorney for title search . . . . . . . . . . . . . . .

> Data related to the acquisition of timber rights and intangible assets during the current year ended December 31 are as follows: a. On December 31, the company determined that $3,400,000 of goodwill was impaired. b. Governmental and legal costs of $4,800

> The following transactions and adjusting entries were completed by Robinson Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-declining-balance method of depreciation is used. Year 1 Jan. 8. Purchased

> New tire retreading equipment, acquired at a cost of $110,000 on September 1 of Year 1 (beginning of the fiscal year), has an estimated useful life of four years and an estimated residual value of $7,500. The manager requested information regarding the e

> A building with a cost of $1,200,000 has an estimated residual value of $250,000, has an estimated useful life of 40 years, and is depreciated by the straight-line method. (a) What is the amount of the annual depreciation? (b) What is the book value at t

> a. Under what conditions is the use of the straight-line depreciation method most appropriate? b. Under what conditions is the use of the units-of-activity depreciation method most appropriate? c. Under what conditions is the use of the double-declining-

> Apple Inc. designs, manufactures, and markets personal computers and related software. Apple also manufactures and distributes music players (iPod) and mobile phones (iPhone) along with related accessories and services, including online distribution of t

> For some of the fixed assets of a business, the balance in Accumulated Depreciation is equal to the cost of the asset. (a) Is it permissible to record additional depreciation on the assets if they are still useful to the business? Explain. (b) When shoul

> Distinguish between the accounting for capital expenditures and revenue expenditures.

> In teams, select a public company that interests you and is a business that has accounts receivable. Obtain the company’s most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commi

> Bev Wynn, vice president of operations for Dillon County Bank, has instructed the bank’s computer programmer to use a 365-day year to compute interest on depository accounts (liabilities). Bev also instructed the programmer to use a 360-day year to compu

> Bud Lighting Co. is a retailer of commercial and residential lighting products. Gowen Geter, the company’s chief accountant, is in the process of making year-end adjusting entries for uncollectible accounts receivable. In recent years, the company has ex

> The accounts receivable turnover ratio will vary across companies, depending on the nature of the company’s operations. For example, an accounts receivable turnover of 6 for a retailer is unacceptable but might be excellent for a manufacturer of specialt

> Costco Wholesale Corporation operates membership warehouses that sell a variety of branded and private label products. Headquartered in Issaquah, Washington, it also sells merchandise online in the United States (Costco.com) and in Canada (Costco.ca). Fo

> Apple Inc. designs, manufactures, and markets personal computers and related personal computing and communicating solutions for sale primarily to education, creative, consumer, and business customers. Substantially all of the company’s

> Best Buy is a specialty retailer of consumer electronics, including personal computers, entertainment software, and appliances. Best Buy operates retail stores in addition to the Best Buy, Media Play, On Cue, and Magnolia Hi-Fi websites. For two recent y

> For several years, Xtreme Co.’s sales have been on a “cash only” basis. On January 1, 20Y4, however, Xtreme Co. began offering credit on terms of n/30. The amount of the adjusting entry to record the

> Kleen Company acquired patent rights on January 10 of Year 1 for $2,800,000. The patent has a useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $38,000. a. Determi

> On January 1, Xtreme Co. began offering credit with terms of n/30. Uncollectible accounts are estimated to be 1% of credit sales, which is the average for the industry. The CEO, Todd Hurley, has no background in accounting and is struggling to understand

> Digital Depot Company, which operates a chain of 40 electronics supply stores, has just completed its fourth year of operations. The direct write-off method of recording bad debt expense has been used during the entire period. Because of substantial incr

> Wig Creations Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The accounts receivable clerk for Wig Creations prepared the following partially completed aging of receivables schedule as of the end of busi

> The following transactions were completed by The Wild Trout Gallery during the current fiscal year ended December 31: Jan. 19. Reinstated the account of Arlene Gurley, which had been written off in the preceding year as uncollectible. Journalized the rec

> The following were selected from among the transactions completed during the current year by Danix Co., an appliance wholesale company: Jan. 21. Sold merchandise on account to Black Tie Co., $28,000. The cost of merchandise sold was $16,800. Mar. 18. Acc

> The following data relate to notes receivable and interest for Owens Co., a financial services company. (All notes are dated as of the day they are received.) Mar. 8. Received a $33,000, 5%, 60-day note on account. 31. Received an $80,000, 7%, 90-day not

> Gen-X Ads Co. produces advertising videos. During the current fiscal year, Gen-X Ads Co. received the following notes: Instructions 1. Determine for each note (a) The due date and (b) The amount of interest due at maturity, identifying each note by num

> Trophy Fish Company supplies flies and fishing gear to sporting goods stores and outfitters throughout the western United States. The accounts receivable clerk for Trophy Fish prepared the following partially completed aging of receivables schedule as of

> The following transactions were completed by Daws Company during the current fiscal year ended December 31: Jan. 29. Received 35% of the $9,000 balance owed by Kovar Co., a bankrupt business, and wrote off the remainder as uncollectible. Apr. 18. Reinsta

> The following were selected from among the transactions completed by Caldemeyer Co. during the current year. Caldemeyer Co. sells and installs home and business security systems. Jan. 3. Loaned $18,000 cash to Trina Gelhaus, receiving a 90-day, 8% note.