Question: Whaley Distributors is a wholesale distributor of

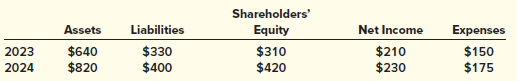

Whaley Distributors is a wholesale distributor of electronic components. Financial statements for the year ended December 31, 2024, reported the following amounts and subtotals ($ in millions):

In 2025, the following situations occurred or came to light:

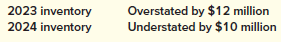

a. Internal auditors discovered that ending inventories reported in the financial statements the two previous years were misstated due to faulty internal controls. The errors were in the following amounts:

b. A patent costing $18 million at the beginning of 2023, expected to benefit operations for a total of six years, has not been amortized since acquired.

c. Whaley’s conveyer equipment has been depreciated by the sum-of-the-years’-digits (SYD) method since constructed at the beginning of 2023 at a cost of $30 million. It has an expected useful life of five years and no expected residual value. At the beginning of 2025, Whaley decided to switch to straight-line depreciation.

Required:

For each situation:

1. Prepare any journal entry necessary as a direct result of the change or error correction as well as any adjusting entry for 2025 related to the situation described. (Ignore tax effects.)

2. Determine the amounts to be reported for each of the items shown above from the 2023 and 2024 financial statements when those amounts are reported again in the 2025, 2024, and 2023 comparative financial statements.

> Rice Corporation is negotiating a loan for expansion purposes and the bank requires financial statements. Before closing the accounting records for the year ended December 31, 2024, Rice’s controller prepared the following financial sta

> In 2024, Waterway International, Inc.’s controller discovered that ending inventories for 2022 and 2023 were overstated by $200,000 and $500,000, respectively. Determine the effect of the errors on retained earnings at January 1, 2024. (Ignore income tax

> Companies often voluntarily provide non-GAAP earnings when they announce annual or quarterly earnings. These numbers are controversial as they represent management’s view of permanent earnings. The Sarbanes Oxley Act (SOX), issued in 20

> Norse Manufacturing Inc. prepares an annual single, continuous statement of income and comprehensive income. The following situations occurred during the company’s 2024 fiscal year: 1. Restructuring costs were incurred due to the closing of a factory. 2

> The following events occurred during 2024 for various audit clients of your firm. Consider each event to be independent and the effect of each event to be material. 1. A manufacturing company recognized a loss on the sale of investments. 2. An automobile

> Each of the following situations occurred during 2024 for one of your audit clients: 1. An inventory write-down due to obsolescence. 2. Discovery that depreciation expenses were omitted by accident from 2023’s income statement. 3. The u

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org) and select Basic View for free access. Determine each of the following: 1. The topic number (Topic XXX) that addresses exit or disposal cost obligations. 2. The specific

> Performance and profitability of a company often are evaluated using the financial information provided by a firm’s annual report in comparison with other firms in the same industry. Ratios are useful in this assessment. Required: Obtain annual reports

> Refer to the income statement of The Home Depot, Inc., in Illustration 4–2 of this chapter. Required: 1. Is this income statement presented in the single-step or multiple-step format? 2. What is the company’s approximate income tax rate? 3. What is the

> Vodafone Group, Plc. a U.K. company, is the largest mobile telecommunications network company in the world. The company prepares its financial statements in accordance with International Financial Reporting Standards. Below are partial company balance sh

> The usefulness of the balance sheet is enhanced when assets and liabilities are grouped according to common characteristics. The broad distinction made in the balance sheet is the current versus long-term classification of both assets and liabilities. R

> Insight concerning the performance and financial condition of a company often comes from evaluating its financial data in comparison with other firms in the same industry. Required: Obtain annual reports from three corporations in the same primary indus

> In 2024, Clear Window and Glass changed its inventory method from FIFO to LIFO. Inventory at the end of 2023 is $150,000. Describe the steps Clear Window and Glass should take to report this change.

> Air France–KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2019, are available in Connect. This m

> Examine the segment disclosures of Abbott Laboratories reported in Appendix 3 and answer the following questions. 1. Does Abbott Laboratories define its operating segments by business or geography? 2. Determine which business segment has the greatest amo

> Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended February 1, 2020, are available in the Connect library. This material also is available under the Investor

> A common problem facing any business entity is the debt versus equity decision. When funds are required to obtain assets, should debt or equity financing be used? This decision also is faced when a company is initially formed. What will be the mix of de

> Obtain the quarterly financial report (10-Q) of Delta Airlines for the period ended June 30, 2020. You can access this report through the SEC’s EDGAR, the Electronic Data Gathering, Analysis, and Retrieval system. You can also access this report at the c

> The fiscal year-end for the Northwest Distribution Corporation is December 31. The company’s 2024 financial statements were issued on March 15, 2025. The following events occurred between December 31, 2024, and March 15, 2025. 1. On January 22, 2025, the

> The balance sheet and disclosure of significant accounting policies taken from the January 31, 2020, annual report of Walmart Inc. appear below. Use this information to answer the following questions: 1. Does Walmart separately report current assets vers

> You recently joined the auditing staff of Best, Best, and Krug, CPAs. You have been assigned to the audit of Clear view, Inc., and have been asked by the audit senior to examine the balance sheet prepared by Clear view’s accountant. Re

> You have recently been hired by Davis & Company, a small public accounting firm. One of the firm’s partners, Alice Davis has asked you to deal with a disgruntled client, Mr. Sean Pitt, owner of the city’s largest hardware store. Mr. Pitt is applying to a

> A company has always kept its records on a cash basis. You are provided with the following transaction information for the fiscal year ending December 31, 2024: 1. A new comprehensive insurance policy requires an annual payment of $12,000 for the upcomin

> Air France-KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2019, are provided in Connect. This ma

> In 2024, Hopyard Lumber changed its inventory method from LIFO to FIFO. Inventory at the end of 2023 of $127,000 would have been $145,000 if FIFO had been used. Inventory at the end of 2024 is $162,000 using the new FIFO method but would have been $151,0

> Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended February 1, 2020, are available in Connect. This material also is available under the Investor Relations li

> The following is an excerpt from ABC News: Required: 1. Why must Microsoft report this charge of over $1 billion entirely in one quarter, the last quarter of the company’s fiscal year? 2. When the announcement was made, analyst Richard

> As a second-year financial analyst for A.J. Straub Investments, you are performing an initial analysis on Reliant Pharmaceuticals. A difficulty you’ve encountered in making comparisons with its chief rival is that Reliant uses U.S. GAAP, and the competin

> IGF Foods Company is a large, primarily domestic, consumer Foods Company involved in the manufacture, distribution, and sale of a variety of food products. Industry averages are derived from Troy’s The Almanac of Business and Industrial

> A fellow accountant has solicited your opinion regarding the classification of short-term obligations repaid prior to being replaced by a long-term security. Cheshire Foods, Inc., issued $5,000,000 of short-term commercial paper during 2023 to finance co

> The following True blood case is recommended for use with this chapter. The case provides an excellent opportunity for class discussion, group projects, and writing assignments. The case, along with Professor’s Discussion Material, can be obtained from t

> Obtain the 2019 annual report of FCA Group (archived at www.stellantis.com), which manufactures Fiat-brand automobiles as well as other products. Required: Find FCA’s discussion of “Basis of Consolidation” in the “Significant Accounting Policies” note th

> The following are excerpts from the 2019 financial statements of Renault, a large French automobile manufacturer. / In view of this situation, Renault is considered to exercise significant influence over Nissan, and therefore uses the equity method to in

> General Motors invests in securities of other companies. Access GM’s 2019 10-K (which includes financial statements) using EDGAR at www.sec.gov. Required: 1. What is the amount and classification of any AFS investment securities reported in the balance s

> Microsoft’s 2020 10-K includes the following information relevant to its available-for-sale investments in Note 17—Accumulated Other Comprehensive Income (Loss): Required: 1. Prepare a journal entry to record unrealize

> A1 Electronics has one product in its ending inventory. Per unit data consist of the following: cost, $20; replacement cost, $18; selling price, $30; selling costs, $4. The normal profit is 30% of selling price. What unit value should A1 use when applyin

> The following disclosure note appeared in the July 27, 2019, annual report of Cisco Systems, Inc. Note 9: Available-for-Sale Debt Investments and Equity Investments (in part) Available-for-sale investments as of July 27, 2019, and July 28, 2018, were as

> Imani West, CEO of West Industries, stopped by the company’s finance department with a question. “I am considering having West Industries purchase bonds of Triton Corporation as an investment. Our auditor told me that ordinary changes in the market value

> Redline Publishers, Inc. produces various manuals ranging from computer software instructional booklets to manuals explaining the installation and use of large pieces of industrial equipment. At the end of 2024, the company’s balance sheet reported total

> EDGAR, the Electronic Data Gathering, Analysis, and Retrieval system, performs automated collection, validation, indexing, and forwarding of submissions by companies and others who are required by law to file forms with the U.S. Securities and Exchange C

> Amgen, Inc. is an American multinational biopharmaceutical company headquartered in Thousand Oaks, California. Located in the Conejo Valley, Amgen is the world’s largest independent biotechnology firm. Amgen reported the following in a

> The Cummings Company charged various expenditures made during 2024 to an account called repairs and maintenance expense. You have been asked by your supervisor in the company’s internal audit department to review the expenditures to determine if they wer

> Companies often are under pressure to meet or beat Wall Street earnings projections in order to increase stock prices and also to increase the value of stock options. Some resort to earnings management practices to artificially create desired results. Re

> At the beginning of 2022, the Healthy Life Food Company purchased equipment for $42 million to be used in the manufacture of a new line of gourmet frozen foods. The equipment was estimated to have a 10-year service life and no residual value. The straigh

> The company controller, Barry Melrose, has asked for your help in interpreting the authoritative accounting literature that addresses the recognition and measurement of impairment losses for property, plant, and equipment and intangible assets. “We have

> There are various types of accounting changes, each of which is required to be reported differently. Required: 1. What type of accounting change is a change from the double-declining-balance method of depreciation to the straight-line method for previous

> Refer to the situation described in BE 8–6. Record (1) the purchase of inventory on account and (2) freight charges, assuming the company uses a periodic inventory system.

> At a recent luncheon, you were seated next to Mr. Hopkins, the president of a local company that manufactures bicycle parts. He heard that you were a CPA and made the following comments to you: Why is it that I am forced to recognize depreciation expense

> The terms depreciation, depletion, and amortization all refer to the process of allocating the cost of an asset to the periods the asset is used. Required: Discuss the differences between depreciation, depletion, and amortization as the terms are used in

> After graduating near the top of his class, Ben Angele was hired by the local office of a Big 4 CPA firm in his hometown. Two years later, impressed with his technical skills and experience, Park Electronics, a large regional consumer electronics chain,

> British Telecommunications Plc. (BT), a U.K. company, is the world’s oldest communications company. The company prepares its financial statements in accordance with International Financial Reporting Standards. Locate BT’s statement of cash flows from its

> I’m so confused,” your study partner snarls, throwing up his hands in exasperation. “As part of our team’s group project, I need to find out how much cash Microsoft spent on leases l

> I doubt my eating these Cheerios will boost their ability to pay me dividends,” you quip, referring to General Mills, the maker of the best-selling breakfast cereal. It’s General Mills’ dividend-paying ability, in fact, that you plan to investigate right

> Be careful with that coffee!” Your roommate is staring in disbelief at the papers in front of her. “This was my contribution to our team project,” she moaned. “When you spilled your

> Locate the financial statements and related disclosure notes of FedEx Corporation for the fiscal year ended May 31, 2020. You can locate the report online at www.fedex.com. Use the information provided in the statement of cash flows to respond to the que

> You are a loan officer for First Benevolent Bank. You have an uneasy feeling as you examine a loan application from Daring Corporation. The application included the following financial statements. It is not Daring’s profitability that w

> A company purchased inventory on account for $100,000. Freight charges to have the inventory shipped to the company’s location were $5,000 (paid in cash). Record (1) the purchase of inventory on account and (2) freight charges, assuming the company uses

> Why can’t we pay our shareholders a dividend?” shouted your new boss. “This income statement you prepared for me says we earned $5 million in our first half-year!” You were hired las

> Danville Bottlers is a wholesale beverage company. Danville uses the FIFO inventory method to determine the cost of its ending inventory. Ending inventory quantities are determined by a physical count. For the fiscal yearend June 30, 2024, ending invento

> Late in 2024, you and two other officers of Carob Fabrications Corporation just returned from a meeting with officials of the City of Jackson. The meeting was unexpectedly favorable even though it culminated in a settlement with city authorities that you

> Ray Solutions decided to make the following changes in its accounting policies on January 1, 2024: a. Changed from the cash to the accrual basis of accounting for recognizing revenue on its service contracts. b. Adopted straight-line depreciation for all

> Some inventory errors are said to be “self-correcting” in that the error has the opposite financial statement effect in the period following the error, thereby “correcting,” the original account balance errors. Despite this self-correcting feature, these

> Sometimes a business entity will change its method of accounting for certain items. The change may be classified as a change in accounting principle, a change in accounting estimate, or a change in reporting entity. Listed below are three independent, un

> DRS Corporation changed the way it depreciates its computers from the sum-of-the-year’s-digits method to the straight-line method beginning January 1, 2024. DRS also changed its estimated residual value used in computing depreciation for its office build

> Early one Wednesday afternoon, Ken and Larry studied in the dormitory room they shared at Fogelman College. Ken, an accounting major, was advising Larry, a management major, regarding a project for Larry’s Business Policy class. One asp

> Mayfair Department Stores operates over 30 retail stores in the Pacific Northwest. Prior to 2024, the company used the FIFO method to value its inventory. In 2024, Mayfair decided to switch to the dollar-value LIFO retail inventory method. One of your re

> Webster Products, Inc., adopted the dollar-value LIFO method of determining inventory costs for financial and income tax reporting on January 1, 2024. Webster continues to use the FIFO method for internal decision making purposes. Websterâ€

> Dinoland Manufacturing shipped consignment inventory of $200,000 to Storing Company on December 1, 2024. Storing agrees to sell the inventory for a 10% sales commission, while Dinoland maintains title and control over pricing. By the end of the year, $60

> You are assistant controller of Stamps & Company, a medium-sized manufacturer of machine parts. On October 22, 2023, the board of directors approved a stock option plan for key executives. On January 1, 2024, a specific number of stock options were grant

> While eating his Kellogg’s Frosted Flakes one February morning, Tony noticed the following notification on his iPhone: A quick click revealed reported earnings per share of $0.59 and $3.63 for the quarter and year ended January 2, 2021

> IGF Foods Company is a large, primarily domestic, consumer Foods Company involved in the manufacture, distribution, and sale of a variety of food products. Industry averages are derived from Troy’s The Almanac of Business and Industrial

> Del Conte Construction Company has experienced generally steady growth since its inception in 1976. Management is proud of its record of having maintained or increased its earnings per share in each year of its existence. The economic downturn has led to

> “I guess I’ll win that bet!” you announced to no one in particular. “What bet?” Renee asked. Renee Patsy was close enough to overhear you. “When I

> The shareholders’ equity of Proactive Solutions, Inc., included the following at December 31, 2024: Additional Information: • Proactive had 7 million shares of preferred stock authorized, of which 2 million were outst

> The 2021 annual report of Best Buy Co., Inc. reported profitable operations. However, the company has not always been profitable. The company suffered a net loss for the 12 months ended March 3, 2012: Note: The calculation of diluted (loss) per share for

> Microsoft provides compensation to executives in the form of a variety of incentive compensation plans, including restricted stock award grants. The following is an excerpt from a disclosure note from Microsoft’s 2020 annual report: Re

> You are in your third year as internal auditor with VXI International, manufacturer of parts and supplies for jet aircraft. VXI began a defined contribution pension plan three years ago. The plan is a so-called 401(k) plan (named after the Tax Code secti

> Stacy Per off is the newly hired assistant controller of Kemp Industries, a regional supplier of hardwood derivative products. The company sponsors a defined benefit pension plan that covers its 420 employees. On reviewing last year’s f

> Kryoton Corporation shipped goods to a customer f.o.b. destination on December 29, 2024. The goods arrived at the customer’s location in January. In addition, one of Kryoton’s major suppliers shipped goods to Kryoton f.o.b. shipping point on December 30.

> LGD Consulting is a medium-sized provider of environmental engineering services. The corporation sponsors a noncontributory, defined benefit pension plan. Alan Barlow, a new employee and participant in the pension plan, obtained a copy of the 2024 financ

> Refer to the financial statements of Macy’s, Inc. for the year ended February 1, 2020, and related disclosure notes of the company. The financial statements can be found at the company’s website (www.macys.com). Required: 1. From the information provide

> While doing some online research concerning a possible investment you come across an article that mentions in passing that a representative of Morgan Stanley had indicated that a company’s pension plan had benefited its reported earnings. Curiosity pique

> Charles Rubin is a 30-year employee of Amalgamated Motors. Charles was pleased with recent negotiations between his employer and the United Auto Workers. Among other favorable provisions of the new agreement, the pact also includes a 14% increase in pens

> Refer to the 2020 financial statements and related disclosure notes of FedEx Corporation. The financial statements can be found at the company’s website (www.fedex.com). Required: 1. Does FedEx sponsor defined benefit pension plans for its employees? De

> Refer to the 2020 financial statements and related disclosure notes of Microsoft Corporation (www.microsoft.com). Required: 1. What type of pension plan does Microsoft sponsor for its employees? 2. Who bears the “risk” of factors that might reduce retir

> I only get one shot at this?” you wonder aloud. Martina, human resources manager at Covington State University, has just explained that newly hired assistant professors must choose between two retirement plan options. “

> The following is a portion of the balance sheets of Macy’s, Inc., for the years ended February 1, 2020, and February 2, 2019: Required: 1. What is Macy’s debt to equity ratio for the year ended February 1, 2020? 2. Wh

> The Internal Revenue Service (IRS) maintains an information site on the Internet that provides tax information and services. Among those services is a server for publications and forms which allows a visitor to download a variety of IRS forms and publica

> Williams-Santana Inc. is a manufacturer of high-tech industrial parts that was started in 2010 by two talented engineers with little business training. In 2024, the company was acquired by one of its major customers. As part of an internal audit, the fol

> Refer to the situation described in BE 8–2. Prepare the journal entries to record these transactions using a periodic inventory system.

> CVS Health Corporation showed 2019 net income from continuing operations of $6,631 million. The following is an excerpt from a disclosure note to CVS Health’s 2019 financial statements: Required: 1. Did CVS’s valuatio

> Access the 2019 financial statements and related disclosure notes of Ford Motor Company from its website at corporate.ford.com. Required: 1. In Note 7, find Ford’s net deferred tax asset or liability. What is that number? 2. Does Ford show a valuation a

> Kroger Co. is one of the largest retail food companies in the United States as measured by total annual sales. The Kroger Co. operates supermarkets, convenience stores, and manufactures and processes food that its supermarkets sell. Using EDGAR (sec.gov)

> The income tax disclosure note accompanying the January 31, 2020, financial statements of Walmart is reproduced below: // Required: 1. Focusing on only the first part of Note 9, relating current, deferred, and total provision for income taxes, prepare a

> Francesca’s Holdings Corporation is a specialty retailer that operates boutiques throughout the United States under Francesca’s trademark. Access the financial statements and related disclosure notes of Francesca for the fiscal year ended February 1, 202

> The date is January 10, 2023, and Mary ton Hotels’ CFO George Smith is looking with dismay at his company’s financial performance during 2022. Already facing stiff competition from other hotel chains as well as Earbob, Mary ton had run an operating loss

> The date is November 15, 2020. You are the new controller for Engineered Solutions. The company treasurer, Randy Pate, believes that as a result of pending legislation, the currently enacted 40% income tax rate may be decreased for 2021 to 25% and is unc

> The following True blood case is recommended for use with this chapter. The case provides an excellent opportunity for class discussion, group projects, and writing assignments. The case, along with Professor’s Discussion Material, can be obtained from t

> The following True blood case is recommended for use with this chapter. The case provides an excellent opportunity for class discussion, group projects, and writing assignments. The case, along with Professor’s Discussion material, can be obtained from t

> An August 11, 2020 article from World Oil Magazine had the following headline: “Marathon Sets Up for $1.1 Billion Tax Refund via Coronavirus Aid Law.” * The article goes on to indicate, “That measure included a tax provision that allows companies to imme