Question: Whitman Company began operations on January 1,

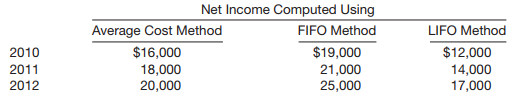

Whitman Company began operations on January 1, 2010, and uses the average cost method of pricing inventory. Management is contemplating a change in inventory methods for 2013. The following information is available for the years 2010–2012.

Instructions

(Ignore all tax effects.)

(a) Prepare the journal entry necessary to record a change from the average cost method to the FIFO method in 2013.

(b) Determine net income to be reported for 2010, 2011, and 2012, after giving effect to the change in accounting principle.

(c) Assume Whitman Company used the LIFO method instead of the average cost method during the years 2010–2012. In 2013, Whitman changed to the FIFO method. Prepare the journal entry necessary to record the change in principle.

Transcribed Image Text:

Net Income Computed Using Average Cost Method FIFO Method LIFO Method $19,000 $16,000 18,000 20,000 $12,000 14,000 17,000 2010 2011 21,000 25,000 2012

> Jones Company had 100 units in beginning inventory at a total cost of $10,000. The company purchased 200 units at a total cost of $26,000. At the end of the year, Jones had 80 units in ending inventory. Instructions (a) Compute the cost of the ending in

> Alou Appliance Center accumulates the following cost and market data at December 31. Compute the lower-of-cost-or-market valuation for the company’s total inventory. Inventory Categories Cost Market Data Data $12,000 9,500 14,000 $1

> In its first month of operation, Gulletson Company purchased 100 units of inventory for $6, then 200 units for $7, and finally 150 units for $8.At the end of the month, 180 units remained. Compute the amount of phantom profit that would result if the com

> Yount Company reports the following for the month of June. Instructions (a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO and (2) LIFO. (b) Which costing method gives the higher ending inventory? Why? (c) Which metho

> An analysis of transactions for S. Moses & Co. was presented in E1–8. Instructions Prepare an income statement and an owner’s equity statement for August and a balance sheet at August 31, 2010. Accounts Office

> (a) How does the time period assumption affect an accountant’s analysis of business transactions? (b) Explain the terms fiscal year, calendar year, and interim periods.

> Rick Kleckner Corporation recorded a capital lease at $300,000 on January 1, 2012. The interest rate is 12%. Kleckner Corporation made the first lease payment of $53,920 on January 1, 2012. The lease requires eight annual payments. The equipment has a us

> Novak Corporation is preparing its 2012 statement of cash flows, using the indirect method. Presented below is a list of items that may affect the statement. Using the code below, indicate how each item will affect Novak’s 2012 statement of cash flows.

> Shannon, Inc., changed from the LIFO cost flow assumption to the FIFO cost flow assumption in 2012. The increase in the prior year’s income before taxes is $1,200,000. The tax rate is 40%. Prepare Shannon’s 2012 journal entry to record the change in acco

> For Warren Corporation, year-end plan assets were $2,000,000. At the beginning of the year, plan assets were $1,780,000. During the year, contributions to the pension fund were $120,000, and benefits paid were $200,000. Compute Warren’s actual return on

> Veldre Company provides the following information about its defined benefit pension plan for the year 2012. Service cost ……………………………………………………………………………….. $ 90,000 Contribution to the plan ………………………………………………….…………… 105,000 Prior service cost amortization

> Stansfield Corporation had the following activities in 2012. 1. Payment of accounts payable $770,000 2. Issuance of common stock $250,000 3. Payment of dividends $350,000 4. Collection of note receivable $100,000 5. Issuance of bonds payable $510,000

> Garner Inc. provides the following information related to its postretirement benefits for the year 2012. Accumulated postretirement benefit obligation at January 1, 2012 …………………. $710,000 Actual and expected return on plan assets ………………………………………………………. 3

> For 2012, Sampsell Inc. computed its annual postretirement expense as $240,900. Sampsell’s contribution to the plan during 2012 was $180,000. Prepare Sampsell’s 2012 entry to record postretirement expense.

> In 2012, Leppard Inc. issued 1,000 shares of $10 par value common stock for land worth $40,000. (a) Prepare Leppard’s journal entry to record the transaction. (b) Indicate the effect the transaction has on cash. (c) Indicate how the transaction is report

> Manno Corporation has the following information available concerning its postretirement benefit plan for 2012. Service cost ………………………………………………………………………. $40,000 Interest cost ………………………………………………………………………… 47,400 Actual and expected return on plan assets …

> In 2012, Wild Corporation reported a net loss of $70,000. Wild’s only net income adjustments were depreciation expense $81,000, and increase in accounts receivable $8,100. Compute Wild’s net cash provided (used) by operating activities.

> Geiberger Corporation manufactures replicators. On January 1, 2012, it leased to Althaus Company a replicator that had cost $110,000 to manufacture. The lease agreement covers the 5-year useful life of the replicator and requires 5 equal annual rentals o

> Refer to the accounting change by Wertz Construction Company in BE22-1. Wertz has a profit sharing plan, which pays all employees a bonus at year-end based on 1% of pretax income. Compute the indirect effect of Wertz’s change in accounting principle that

> Lahey Corp. has three defined benefit pension plans as follows. How will Lahey report these multiple plans in its financial statements? Projected Benefit Obligation Pension Assets (at Fair Value) Plan X Plan Y $600,000 $500,000 900,000 720,000 Plan

> Hendrickson Corporation reported net income of $50,000 in 2012. Depreciation expense was$17,000. The following working capital accounts changed. Accounts receivable………….……………………….. $11,000 increase Available-for-sale securities…………………………. 16,000 increase

> Use the information for Indiana Jones Corporation from BE21-9. Assume that for Lost Ark Company, the lessor, collectibility is reasonably predictable, there are no important uncertainties concerning costs, and the carrying amount of the equipment is $202

> Indiana Jones Corporation enters into a 6-year lease of equipment on January 1, 2012, which requires 6 annual payments of $40,000 each, beginning January 1, 2012. In addition, Indiana Jones guarantees the lessor a residual value of $20,000 at lease-end.

> Hawkins Corporation has the following balances at December 31, 2012. Projected benefi t obligation …………………………. $2,600,000 Plan assets at fair value ………………………………….. 2,000,000 Accumulated OCI (PSC) …………………………….…… 1,100,000 How should these balances be rep

> In 2012, Elbert Corporation had net cash provided by operating activities of $531,000; net cash used by investing activities of $963,000; and net cash provided by financing activities of $585,000. At January 1, 2012, the cash balance was $333,000. Comput

> Jennifer Brent Corporation owns equipment that cost $80,000 and has a useful life of 8 years with no salvage value. On January 1, 2012, Jennifer Brent leases the equipment to Donna Havaci Inc. for one year with one rental payment of $15,000 on January 1.

> Shin Corporation had a projected benefit obligation of $3,100,000 and plan assets of $3,300,000 at January 1, 2012. Shin also had a net actuarial loss of $465,000 in accumulated OCI at January 1, 2012. The average remaining service period of Shin’s emplo

> Moxley Corporation had January 1 and December 31 balances as follows. For 2012, cost of goods sold was $500,000. Compute Moxley’s 2012 cash payments to suppliers. 1/1/12 12/31/12 Inventory Accounts payable $95,000 61,000 $113,000

> Use the information for IBM from BE21-6. Assume the direct-financing lease was recorded at a present value of $150,000. Prepare IBM’s December 31, 2012, entry to record interest. In BE21-6 Assume that IBM leased equipment that was carried at a cost of $

> AMR Corporation (parent company of American Airlines) reported the following for 2009 (in millions). Service cost ………………………………………………….. $333 Interest on P.B.O. …………………………………………… 712 Return on plan assets …………………………………….. 566 Amortization of prior service

> At December 31, 2012, Besler Corporation had a projected benefit obligation of $560,000, plan assets of $322,000, and prior service cost of $127,000 in accumulated other comprehensive income. Determine the pension asset/liability at December 31, 2012.

> At January 1, 2012, Eikenberry Inc. had accounts receivable of $72,000. At December 31, 2012, accounts receivable is $54,000. Sales for 2012 total $420,000. Compute Eikenberry’s 2012 cash receipts from customers.

> In 2012, Bailey Corporation discovered that equipment purchased on January 1, 2010, for $50,000 was expensed at that time. The equipment should have been depreciated over 5 years, with no salvage value. The effective tax rate is 30%. Prepare Bailey’s 201

> Assume that IBM leased equipment that was carried at a cost of $150,000 to Sharon Swander Company. The term of the lease is 6 years beginning January 1, 2012, with equal rental payments of $30,044 at the beginning of each year. All executory costs are pa

> Mancuso Corporation amended its pension plan on January 1, 2012, and granted $160,000 of prior service costs to its employees. The employees are expected to provide 2,000 service years in the future, with 350 service years in 2012. Compute prior service

> Use the information from BE23-4 for Bloom Corporation. Prepare the cash flows from operating activities section of Bloom’s 2012 statement of cash flows using the indirect method. In BE23-4 Bloom Corporation had the following 2012 income statement. Sales

> Jana Kingston Corporation enters into a lease on January 1, 2012, that does not transfer ownership or contain a bargain-purchase option. It covers 3 years of the equipment’s 8-year useful life, and the present value of the minimum lease payments is less

> For 2010, Campbell Soup Company had pension expense of $68 million and contributed $284 million to the pension fund. Prepare Campbell Soup Company’s journal entry to record pension expense and funding.

> Bloom Corporation had the following 2012 income statement. Sales …………………………………………………………….…………. $200,000 Cost of goods sold ……………………………………………………….. 120,000 Gross profit …………………………………………………………….……… 80,000 Operating expenses (includes depreciation of $21,00

> Use the information for Rick Kleckner Corporation from BE21-3. Assume that at December 31, 2012, Kleckner made an adjusting entry to accrue interest expense of $29,530 on the lease. Prepare Kleckner’s January 1, 2013, journal entry to record the second l

> Wainwright Corporation had the following activities in 2012. 1. Sale of land $180,000 2. Purchase of inventory $845,000 3. Purchase of treasury stock $72,000 4. Purchase of equipment $415,000 5. Issuance of common stock $320,000 6. Purchase of availab

> Dexter Company appropriately uses the asset liability method to record deferred income taxes. Dexter reports depreciation expense for certain machinery purchased this year using the modified accelerated cost recovery system (MACRS) for income tax purpose

> Shanahan Construction Company has entered into a contract beginning January 1, 2012, to build a parking complex. It has been estimated that the complex will cost $600,000 and will take 3 years to construct. The complex will be billed to the purchasing co

> Jackson Company adopts acceptable accounting for its defined benefit pension plan on January 1, 2011, with the following beginning balances: plan assets $200,000; projected benefit obligation $250,000. Other data relating to 3 years’ op

> The comparative balance sheets for Hinckley Corporation show the following information. Additional data related to 2012 are as follows. 1. Equipment that had cost $11,000 and was 40% depreciated at time of disposal was sold for $2,500. 2. $10,000 of th

> Botticelli Inc. was organized in late 2010 to manufacture and sell hosiery. At the end of its fourth year of operation, the company has been fairly successful, as indicated by the following reported net incomes. The company has decided to expand operat

> Cleveland Inc. leased a new crane to Abriendo Construction under a 5-year noncancelable contract starting January 1, 2012. Terms of the lease require payments of $33,000 each January 1, starting January 1, 2012. Cleveland will pay insurance, taxes, and m

> The pretax financial income of Truttman Company differs from its taxable income throughout each of 4 years as follows. Pretax financial income for each year includes a nondeductible expense of $30,000 (never deductible for tax purposes). The remainder

> The following information is available for McKee Corporation for 2012. 1. Excess of tax depreciation over book depreciation, $40,000. This $40,000 difference will reverse equally over the years 2013–2016. 2. Deferral, for book purposes, of $25,000 of ren

> Brecker Company leases an automobile with a fair value of $10,906 from Emporia Motors, Inc., on the following terms. 1. Noncancelable term of 50 months. 2. Rental of $250 per month (at end of each month). (The present value at 1% per month is $9,800.) 3.

> An annual report of Crestwood Industries states, “The company and its subsidiaries have long term leases expiring on various dates after December 31, 2012. Amounts payable under such commitments, without reduction for related rental income, are expected

> Each of the following items must be considered in preparing a statement of cash flows (indirect method) for Granderson Inc. for the year ended December 31, 2012. (a) Plant assets that had cost $25,000 6 years before and were being depreciated on a straig

> Adani Inc. sells goods to Geo Company for $11,000 on January 2, 2012, with payment due in 12 months. The fair value of the goods at the date of sale is $10,000. Prepare the journal entry to record this transaction on January 2, 2012. How much total reven

> An annual report of Ford Motor Corporation states, “Net income a share is computed based upon the average number of shares of capital stock of all classes outstanding. Additional shares of common stock may be issued or delivered in the future on conversi

> Oxford Corporation began operations in 2012 and reported pretax financial income of $225,000 for the year. Oxford’s tax depreciation exceeded its book depreciation by $40,000. Oxford’s tax rate for 2012 and years thereafter is 30%. In its December 31, 20

> What is viewed as a major criticism of GAAP as regards revenue recognition?

> What are the two objectives of accounting for income taxes?

> Bradley Co. is expanding its operations and is in the process of selecting the method of financing this program. After some investigation, the company determines that it may (1) Issue bonds and with the proceeds purchase the needed assets or (2) Lease th

> What are some examples of related parties?

> Name five cash inflows that would qualify as a “financing activity.”

> When a company has to restate its financial statements to correct an error, what information must the company disclose?

> In 2012, Amirante Corporation had pretax financial income of $168,000 and taxable income of $120,000. The difference is due to the use of different depreciation methods for tax and accounting purposes. The effective tax rate is 40%. Compute the amount to

> In general, how can an employer choose an appropriate discount rate for its pension plan? What information could an employer use in choosing a discount rate?

> What are the two basic requirements applied to the measurement of current and deferred income taxes at the date of the financial statements?

> Access the glossary (“Master Glossary”) to answer the following. (a) What is the cost-recovery method? (b) What is the percentage-of-completion method? (c) What is the deposit method? (d) What is the installment method?

> Where can authoritative IFRS related to the statement of cash flows be found?

> What is a major difference between IFRS and GAAP as regards revenue recognition practices?

> Where can authoritative IFRS related to the accounting for leases be found?

> Where can authoritative IFRS related to the accounting for taxes be found?

> In this simulation, you are asked to address questions related to the accounting for leases. Prepare responses to all parts. KWW_Professional_Simulation Accounting for Leases Time Remaining 2 hours 00 minutes Ursplit Split Horiz Spik Vertical | Spre

> In this simulation, you are asked to address questions related to the accounting for taxes. Prepare responses to all parts. KWW_Professional_Simulation Accounting for Taxes Time Remaining 2 hours 40 minutes Unsplit Spit Horiz Spit Vertical Spreadshe

> Explain the difference between pretax financial income and taxable income.

> In this simulation, you are asked to address questions related to revenue recognition issues. Prepare responses to all parts. KwW_Professional_Simulation Revenue Time Remaining Recognition 3 hours 00 minutes Unspit Split Horiz Split Vertical Spreads

> The professional simulation for this chapter asks you to address questions related to the accounting for the statement of cash flows. KWW_Professional_Simulation Statement of Cash Flows Time Remaining 1 hour 00 minutes Unaplit Spit Horiz Spik Vertic

> In this simulation, you are asked to address questions regarding accounting for pensions. Prepare responses to all parts. KWW_Professional_Simulation Accounting for Pensions Time Remaining 2 hours 20 minutes Unsplit Spit Horiz Spit Vertical Spreadsh

> Where can authoritative IFRS related to accounting changes be found?

> Kleckner Company started operations in 2009, and although it has grown steadily, the company reported accumulated operating losses of $450,000 in its first four years in business. In the most recent year (2013), Kleckner appears to have turned the corner

> In this simulation, you are asked questions about changes in accounting principle. Prepare responses to all parts. KWW_Professional_Simulation Changes in Accounting Principle Time Remaining 1 hour 20 minutes Unspit Spit Horiz Split Verical Spreadshe

> As part of the year-end accounting process for your company, you are preparing the statement of cash flows according to GAAP. One of your team, a finance major, believes the statement should be prepared to report the change in working capital, because an

> Daniel Hardware Co. is considering alternative financing arrangements for equipment used in its warehouses. Besides purchasing the equipment outright, Daniel is also considering a lease. Accounting for the outright purchase is fairly straightforward, but

> Monat Company has grown rapidly since its founding in 2002. To instill loyalty in its employees, Monat is contemplating establishment of a defined benefit plan. Monat knows that lenders and potential investors will pay close attention to the impact of th

> Access the glossary (“Master Glossary”) to answer the following. (a) What is the definition of “ordinary income” (loss)? (b) What is an error in previously issued financial statements? (c) What is the definition of “earnings per share”? (d) What is a pub

> Employees at your company disagree about the accounting for sales returns. The sales manager believes that granting more generous return provisions can give the company a competitive edge and increase sales revenue. The controller cautions that, dependin

> As part of the year-end audit, you are discussing the disclosure checklist with your client. The checklist identifies the items that must be disclosed in a set of GAAP financial statements. The client is surprised by the disclosure item related to accoun

> As part of the year-end accounting process and review of operating policies, Cullen Co. is considering a change in the accounting for its equipment from the straight-line method to an accelerated method. Your supervisor wonders how the company will repor

> Salaur Company is evaluating a lease arrangement being offered by TSP Company for use of a computer system. The lease is noncancelable, and in no case does Salaur receive title to the computers during or at the end of the lease term. The lease starts on

> PENCOMP’s balance sheet at December 31, 2012, is as follows. Additional information concerning PENCOMP’s defined benefit pension plan is as follows. Projected benefit obligation at 12/31/12 …&acir

> Allman Company, which began operations at the beginning of 2010, produces various products on a contract basis. Each contract generates a gross profit of $80,000. Some of Allman’s contracts provide for the customer to pay on an installment basis. Under t

> Diversified Products, Inc. operates in several lines of business, including the construction and real estate industries. While the majority of its revenues are recognized at point of sale, Diversified appropriately recognizes revenue on long-term constru

> Savannah, Inc. is a company that manufactures and sells a single product. Unit sales for each of the four quarters of 2012 are projected as follows. Quarter________________Units First …………………………………………. 80,000 Second ……………………………………… 150,000 Third ……………………

> The income statement for the year ended December 31, 2012, for Laskowski Manufacturing Company contains the following condensed information. Included in operating expenses is a $24,000 loss resulting from the sale of machinery for $270,000 cash. The co

> A Wall Street Journal article discussed a $1.8 billion charge to income made by General Electric for postretirement benefit costs. It was attributed to previously unrecognized healthcare and life insurance cost. As financial vice president and controller

> Access the glossary (“Master Glossary”) to answer the following. (a) What are cash equivalents? (b) What are financing activities? (c) What are investing activities? (d) What are operating activities?

> Homestake Mining Company is a 120-year-old international gold mining company with substantial gold mining operations and exploration in the United States, Canada, and Australia. At year-end, Homestake reported the following items related to income taxes

> The following note appears in the “Summary of Significant Accounting Policies” section of the Annual Report of Westinghouse Electric Corporation. Note 1 (in part): Revenue Recognition. Sales are primarily recorded as products are shipped and services are

> RNA Inc. manufactures a variety of consumer products. The company’s founders have run the company for 30 years and are now interested in retiring. Consequently, they are seeking a purchaser who will continue its operations, and a group

> Founded in the early 1980s, the Vermont Teddy Bear Co. designs and manufactures American-made teddy bears and markets them primarily as gifts called Bear-Grams or Teddy Bear-Grams. Bear-Grams are personalized teddy bears delivered directly to the recipie

> Presented in Illustration 21-31 are the financial statement disclosures from the 2009 annual report of Tasty Baking Company. Instructions Answer the following questions related to these disclosures. (a) What is the total obligation under capital leases

> Why in franchise arrangements may it not be proper to recognize the entire franchise fee as revenue at the date of sale?

> When is revenue recognized under the deposit method? How does the deposit method differ from the installment sales and cost-recovery methods?