Question: Why did New York Governor Cuomo cut

Why did New York Governor Cuomo cut state spending in 2011–2012? How did that affect AD?

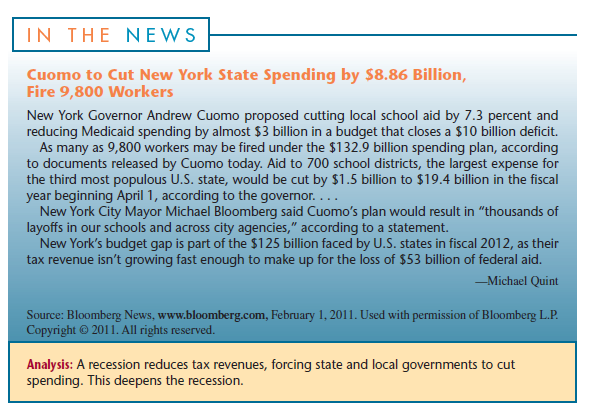

(See News, p. 192.)

> If equilibrium is compatible with both buyers’ and sellers’ intentions, how can it be undesirable?

> In 2010, how many of the 800,000 black teenagers who participated in the labor market (a) Were unemployed? (b) Were employed? (c) Would have been employed if they had the same unemployment rate as white teenagers? 40 36 32 Teenagers 43.0 28 24 20 Ad

> Why might more reliance on markets rather than government be desirable? When and how might it be undesirable?

> The World View on page 63 explains why gasoline prices rose in 2011. What will bring prices down?

> The goal of the price cut described in the News on page 51 was to (select one– enter letter) (A) Increase supply. (B) Increase quantity supplied. (C) Increase demand. (D) Increase quantity demanded. |N THE NEWS AT&T Cuts Price on IP

> On the accompanying graph, illustrate (A) nominal per capita GDP and (B) real per capita GDP for each year. (The necessary data appear on the endpapers of this book.) (a) By what percentage did nominal per capita GDP increase in the 1990s? (b) By what pe

> What is the connection between North Korea’s missile program and its hunger problem?

> How many resources should we allocate to space exploration? How will we make this decision?

> What events might prompt consumers to demand fewer goods at current prices?

> Use the GDP deflator data on the inside cover of this book to compute real GDP in 2000 at 2010 prices.

> Should the government try to equalize incomes more by raising taxes on the rich and giving more money to the poor? How might such redistribution affect total output and growth?

> Why do people around the world have so much faith in free markets?

> Illustrate what’s happening to oil prices in the World View on page 63. (a) Which direction did the demand curve shift (left or right)? (b) Which direction did the supply curve shift (left or right)? (c) Did price (A) increase or (B) decrease?

> Who would go to college in a completely private (market) college system? How does government intervention change this FOR WHOM outcome?

> How does the slope of the AS curve affect the size of the AD shortfall? If the AS curve were horizontal, how large would the AD shortfall be in Figure 11.3?

> (a) If Haiti’s per capita GDP of roughly $1,150 were to DOUBLE every decade (an annual growth rate of 7.2 percent), what would Haiti’s per capita GDP be in 50 years? (b) What is U.S. per capita GDP in 2010 (World View

> What are the opportunity costs of developing wind farms to generate “clean” electricity? Should we make the investment?

> If the labor force of 150 million people is growing by 1.5 percent per year, how many new jobs have to be created each month to keep unemployment from increasing? Web query: By how much did U.S. employment actually increase last month ( www.bls.gov )?

> In the previous problem’s market equilibrium, what is (a) The market value of the good? (b) The social value of the good?

> What was the “soaring” inflation rate in the United Kingdom in early 2011 (World View, p. 148)? Why was it such a concern? WORLD VIE W U.K. Inflation Soars U.K. consumer price inflation accelerated sharply in Decem

> How might a nation’s production possibilities be affected by the following? a. A decrease in income taxes. b. An increase in immigration. c. An increase in military spending. d. An increase in college tuition.

> What would have happened to shrimp prices and consumption if the government had prohibited price increases after the BP oil spill (see News, p. 58)?

> Between 2000 and 2010, by how much did (a) The labor force increase? (b) Total employment increase? (c) Total unemployment increase? (d) Total output (real GDP) increase?

> What was real per capita GDP in 1933 measured in 2008 prices? (Use the data in Table 5.4 to compute your answer.)

> Should the firefighters have saved the house in the News on page 73? What was the justification for their belated intervention? I N T H E N E W S Firefighters Watch as Home Burns to the Ground OBION COUNTY, Tenn.—Imagine your home catches fire but th

> What’s the real cost of the food in the “free lunch” cartoon on page 6?

> According to the World View on page 32, what percentage of America’s GDP per capita is available to the average citizen of (a) Mexico? (b) China? (c) Haiti? 47,020 GDP per Capita (2010) 37,380 34,790 34,440 29,010 24,020 19,190 15

> Use Figure 4.3 (p. 75) to illustrate on the accompanying production possibilities curve the optimal mix of output (X). M CIGARETTES (packs per year) CTHER GOO DS (units per year) FIGURE 4.3 Externalities Market supply The market responds to consumer

> How much time could you spend on homework in a day? How much do you spend? How do you decide?

> What opportunity costs did you incur in reading this chapter? If you read another chapter today, would your opportunity costs (per chapter) increase? Explain.

> Could demand-pull inflation occur before an economy was producing at capacity? How?

> Why is the failure of a major bank so frightening?

> By how much did defense spending increase in 1940 to 1944? (See the front endpapers of this book.) What was crowded out?

> Can you forecast next year’s deficit without knowing how fast GDP will grow?

> When are larger deficits desirable?

> According to the World View on page 235, what prompted China’s fiscal stimulus in 2008? Had the government not intervened, what might have happened?

> Why are the AD shortfall and AD excess larger than their respective GDP gaps? Are they ever the same size as the GDP gap?

> Why did increasing inflation cause the British to rein in their policy?

> Will the price level always rise when AD increases? Why or why not?

> What is the “ripple effect” in the News on page 216?

> How might construction industry job losses affect incomes in the clothing and travel industries?

> Identify two groups that benefit from deflation and two that lose.

> (a) Between 2000 and 2010, by what percentage did federal spending increase in (i) in nominal terms? (ii) in real (inflation-adjusted terms)? Use the following values: 2000 - $698.1 billion; 2010 - $1,075.9 billion. (b) What percentage of nominal total

> Why wouldn’t investment and saving flows at full employment always be equal?

> What causes consumer confidence to change (Figure 10.10)? 118 114 110 Changes in confidence shift AD. 106 102 98 94 90 86 82 78 74 66 62 58 54 50 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 ΥΕΑΠ INDEX OF CONSUMER CONFIDENCE

> How might declining prices affect a firm’s decision to borrow and invest?

> If an inflationary gap exists, what will happen to business inventories? How will producers respond?

> Why wouldn’t market participants always want to buy all the output produced?

> Why are faster supplier deliveries considered a negative leading indicator? (See News, p. 198.) IN THE NE WS U.S. Leading Indicators Index Increases More Than Forecast The index of U.S. leading economic indicators increased in December more than fore

> According to the World View on page 191, why did Panasonic cut investment spending in 2009? What this a rational response? WORLD VIEW Panasonic Slashes Spending Hurt by sliding consumer spending around the world, electronics giant Panasonic Corp. sai

> Why would an employed consumer cut spending when other workers were being laid off (see News, p. 187)? IN THE NE WS Consumer Confidence Index at All-Time Low NEW YORK (CNNMoney.com)-A key measure of consumer confidence fell to an all-time low in Dece

> Why do rich people have a higher marginal propensity to save than poor people?

> Are people worse off when the price level rises as fast as their income? Why do people often feel worse off in such circumstances?

> Why might rising prices stimulate short-run production but have no effect on long-run production?

> What’s wrong with the classical theory of self-adjustment? Why didn’t sales and employment increase in 1929–1933 in response to declining prices and wages (see Figure 8.1)? 26 24 22 20 18 Unempl

> How did the decline in U.S. home prices in 2006–2008 affect aggregate demand?

> If business cycles were really inevitable, what purpose would macro policy serve?

> Who gains and who loses from rising house prices?

> How might rapid inflation affect college enrollments?

> How do higher gasoline prices contribute to inflation?

> Why would farmers rather store their output than sell it during periods of hyperinflation? How does this behavior affect prices?

> Identify (a) two jobs at your school that could be outsourced and (b) two jobs that would be hard to outsource.

> Why might job market (re)entrants have a harder time finding a job than job losers?

> Would it be advantageous to borrow money if you expected prices to rise? Would you want a fixed-rate loan or one with an adjustable interest rate?

> How can the outsourcing of U.S. computer jobs generate new U.S. jobs in construction or retail trade?( See News, page 127) IN THE NEWWS Outsourcing May Create U.S. Jobs Higher Productivity Allows for Investment in Staffing, Expanslon, a Study Finds W

> Over 4 million websites sell a combined $100 billion of pornography a year. Should these sales be included in (a) GDP and (b) an index of social welfare?

> The value of total expenditure must equal the value of total income. Why?

> Are you better off today than a year ago? How do you measure the change?

> Should the government be downsized? Which functions should be cut back? Which ones should be expanded?

> How might free markets help reduce global poverty? How might they impede that goal?

> How does XM Satellite deter nonsubscribers from listening to its transmissions? Does this make radio programming a private good or a public good?

> What jobs are likely part of the underground economy?

> Clear-cutting a forest adds to GDP the value of the timber, but it also destroys the forest. How should we value that loss?

> In Figure 3.8, why is the organ demand curve downward-sloping rather than vertical? Figure 3.8: Market demand Market supply -Equilibrium - Market shortage at p = 0 > 9a QUANTITY (organs per year) PRICE (per organ)

> If all prices increased at the same rate (i.e., no relative price changes), would inflation have any redistributive effects?

> If more teenagers stay in school longer, what happens to (a) production possibilities? (b) unemployment rates?

> Which determinants of pizza demand change when the White House is in crisis?

> If gross investment is not large enough to replace the capital that depreciates in a particular year, is net investment greater or less than zero? What happens to our production possibilities?

> GDP in 1981 was $2.96 trillion. It grew to $3.07 trillion in 1982, yet the quantity of output actually decreased. How is this possible?

> Is it possible for unemployment rates to increase at the same time that the number of employed persons is increasing? How?

> Could a nation reorder Rostow’s five stages of development and still grow? Explain.

> How do nations expect nationalization of basic industries to foster economic growth?

> Why do economists put so much emphasis on entrepreneurship? How can poor nations encourage it?

> Would you invest in Cambodia or Kenya on the basis of the information in Figure 21.5?

> Is a stronger dollar good or bad for the United States? Explain.

> Whose real wealth (see Table 7.3) declined in the 1990s? Who else might have lost real income or wealth? Who gained as a result of inflation? Table 7.3: Asset Change In Value (%), 1991–2001 Stocks +250% +71 Diamonds Oil +66 Housing U.S. farmland

> How does international trade restrain the price behavior of domestic firms?

> Should military spending be subject to macroeconomic constraints? What programs should be expanded or contracted to bring about needed changes in the budget? Is this feasible?

> Why did Fed Chairman Bernanke expect there would be no recession in 2008? Why was he wrong?

> Why were banks reluctant to use their lending capacity in 2008? (See News, p. 322.) What did they do with their increased reserves?

> Why might China’s monetary restraint (World View, p. 321) not have worked?

> Why might the Fed want to decrease the money supply?

> Why did China raise reserve requirements in 2011? How did they expect consumers and businesses to respond?

> What are the current price and yield of 10-year U.S. Treasury bonds? Of General Motors bonds? (Check the financial section of your daily newspaper.) What accounts for the difference?

> What are the economic risks of aggressive Fed open market purchases?

> If all banks heeded Shakespeare's admonition "Neither a borrower nor a lender be,” what would happen to the circular flow?

> Who gained and who lost from the price changes in Table 7.2? Table 7.2: Prices That Rose (%) Prices That Fell (%) Gasoline +18.4% Bananas - 5.7% Used cars Cigarettes Air fares +12.7 -7.2 Computers Televisions -24.7 +10.5 +7.8 Textbooks +5.4 +5.2 Av

> Why do banks pay higher interest rates for longer-term certificates of deposit?

> In what respects are modern forms of money superior to the colonial use of wampum as money?

> If inflation raises U.S. prices by 3 percent and the U.S. dollar appreciates by 5 percent, by how much does the foreign price of U.S. exports change?