Question: Wolfgang Kitchens has always used the FIFO

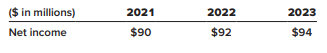

Wolfgang Kitchens has always used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2024, Wolfgang decided to change to the LIFO method. Net income in 2024 was correctly stated as $90 million. If the company had used LIFO in 2023, its cost of goods sold would have been higher by $7 million that year. Company accountants are able to determine that the cumulative net income for all years prior to 2023 would have been lower by $23 million if LIFO had been used all along, but have insufficient information to determine specific effects of using LIFO in 2022. Last year, Wolfgang reported the following net income amounts in its comparative income statements:

Required:

1. Prepare the journal entry at the beginning of 2024 to record the change in accounting principle. (Ignore income taxes.)

2. Wolfgang should revise reported account balances retrospectively as of the beginning of what year?

3. What amounts will Wolfgang report for net income in its 2022–2024 comparative income statements?

> Refer to the situation described in E 11–27. Required: How might your solution differ if Chadwick Enterprises, Inc., prepares its financial statements according to International Financial Reporting Standards? Assume that the fair value amount given in th

> On January 1, 2024, Farmer Fabrication issued stock options for 100,000 shares to a division manager. The options have an estimated fair value of $6 each. To provide additional incentive for managerial achievement, the options are not exercisable unless

> Chadwick Enterprises, Inc., operates several restaurants throughout the Midwest. Three of its restaurants located in the center of a large urban area have experienced declining profits due to declining population. The company’s manageme

> In 2024, internal auditors discovered that PKE Displays, Inc., had debited an expense account for the $350,000 cost of equipment purchased on January 1, 2021. The equipment’s life was expected to be five years with no residual value. Straight-line deprec

> For financial reporting, Clinton Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired at the beginning of 2021 for $2,560,000. Its useful life was estimated to be six years, with a $160,000 residual value. A

> Alteran Corporation purchased office equipment for $1.5 million at the beginning of 2022. The equipment is being depreciated over a 10-year life using the double-declining-balance method. The residual value is expected to be $300,000. At the beginning of

> Wardell Company purchased a minicomputer on January 1, 2022, at a cost of $40,000. The computer was depreciated using the straight-line method over an estimated five-year life with an estimated residual value of $4,000. On January 1, 2024, the estimate o

> Saint John Corporation prepares its financial statements according to IFRS. On June 30, 2024, the company purchased a franchise for $1,200,000. The franchise is expected to have a 10-year useful life with no residual value. Saint John uses the straight-l

> Van Frank Telecommunications has a patent on a cellular transmission process. The company has amortized the patent on a straight-line basis since 2020, when it was acquired at a cost of $9 million at the beginning of that year. Due to rapid technological

> On January 2, 2024, David Corporation purchased a patent for $500,000. The remaining legal life is 12 years, but the company estimated that the patent will be useful only for eight years. In January 2026, the company incurred legal fees of $45,000 in suc

> On January 1, 2024, the Allegheny Corporation purchased equipment for $115,000. The estimated service life of the equipment is 10 years and the estimated residual value is $5,000. The equipment is expected to produce 220,000 units during its life. Requi

> Janes Company provided the following information on intangible assets: a. A patent was purchased from the Lou Company for $700,000 on January 1, 2022. Janes estimated the remaining useful life of the patent to be 10 years. The patent was carried on Lou&

> At the end of the first year of operations, Gaur Manufacturing had gross accounts receivable of $300,000. Gaur’s management estimates that 6% of the accounts will prove uncollectible. What journal entry should Gaur record to establish an allowance for un

> Jackpot Mining Company operates a copper mine in central Montana. The company paid $1,000,000 in 2024 for the mining site and spent an additional $600,000 to prepare the mine for extraction of the copper. After the copper is extracted in approximately fo

> At the beginning of 2024, Terra Lumber Company purchased a timber tract from Boise Cantor for $3,200,000. After the timber is cleared, the land will have a residual value of $600,000. Roads to enable logging operations were constructed and completed on M

> On April 17, 2024, the Loadstone Mining Company purchased the rights to a copper mine. The purchase price plus additional costs necessary to prepare the mine for extraction of the copper totaled $4,500,000. The company expects to extract 900,000 tons of

> On January 2, 2024, the Jackson Company purchased equipment to be used in its manufacturing process. The equipment has an estimated life of eight years and an estimated residual value of $30,625. The expenditures made to acquire the asset were as follows

> Highsmith Rental Company purchased an apartment building early in 2024. There are 20 apartments in the building and each is furnished with major kitchen appliances. The company has decided to use the group depreciation method for the appliances. The foll

> On March 31, 2024, management of Quality Appliances committed to a plan to sell equipment. The equipment was available for immediate sale, and an active plan to locate a buyer was initiated. The equipment had been purchased on January 1, 2022, for $260,0

> Howarth Manufacturing Company purchased equipment on June 30, 2020, at a cost of $800,000. The residual value of the equipment was estimated to be $50,000 at the end of a five-year life. The equipment was sold on March 31, 2024, for $170,000. Howarth use

> On July 1, 2019, Farm Fresh Industries purchased a specialized delivery truck for $126,000. At the time, Farm Fresh estimated the truck to have a useful life of eight years and a residual value of $30,000. On March 1, 2024, the truck was sold for $58,000

> Mercury Inc. purchased equipment in 2022 at a cost of $400,000. The equipment was expected to produce 700,000 units over the next five years and have a residual value of $50,000. The equipment was sold for $210,000 part way through 2024. Actual productio

> On January 1, 2024, the Excel Delivery Company purchased a delivery van for $33,000. At the end of its five-year service life, it is estimated that the van will be worth $3,000. During the five-year period, the company expects to drive the van 100,000 mi

> Refer to the situation described in BE 7–6. Prepare the year-end adjusting journal entries to account for anticipated sales returns, assuming that all sales are made on credit and all accounts receivable are outstanding.

> The income statement and the cash flows from operating activities section of the statement of cash flows are provided below for Synergic Company. The merchandise inventory account balance neither increased nor decreased during the reporting period. Syner

> The statement of retained earnings of Gary Larson Publishers is presented below. Required: For the transactions that affected Larson’s retained earnings, reconstruct the journal entries that can be used to determine cash flows to be re

> On January 1, 2024, Corporal Enterprises bought 20% of the outstanding common stock of Chen Construction Company for $600 million cash. Chen’s net income for the year ended December 31, 2024, was $300 million. During 2024, Chen declared

> Nery Foods Corporation leased a commercial food processor on September 30, 2024. The five-year finance lease agreement calls for Nery to make quarterly lease payments of $195,774, payable each September 30, December 31, March 31, June 30, with the first

> In preparation for developing its statement of cash flows for the year ended December 31, 2024, D-Krug Solutions, Inc. collected the following information: Required: 1. In D-Krug’s statement of cash flows, what were net cash inflows (o

> In preparation for developing its statement of cash flows for the year ended December 31, 2024, Rapid Pac, Inc., collected the following information: Required: 1. In Rapid Pac’s statement of cash flows, what were net cash inflows (or o

> National Food Services, Inc., borrowed $4 million from its local bank on January 1, 2024, and issued a four-year installment note to be paid in four equal payments at the end of each year. The payments include interest at the rate of 10%. Installment pay

> Refer to the data provided in E 21–27 for Red, Inc. Required: Prepare the statement of cash flows (direct method) for Red, Inc. Use the T-account method to assist in your analysis.

> Refer to the data provided in E 21–27 for Red, Inc. Required: Prepare the statement of cash flows for Red, Inc., using the indirect method to report operating activities.

> Most Solutions, Inc., issued 10% bonds, dated January 1, with a face amount of $640 million on January 1, 2024. The bonds mature in 2034 (10 years). For bonds of similar risk and maturity the market yield is 12%. Interest expense is recorded at the effec

> During 2024, its first year of operations, Hollis Industries recorded sales of $10,600,000 and experienced returns of $720,000. Cost of goods sold totaled $6,360,000 (60% of sales). The company estimates that 8% of all sales will be returned. Prepare the

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org) and select Basic View for free access. Determine the specific eight-digit Codification citation (XXX-XX-XX-X) for accounting for each of the following items: 1. Disclosu

> The statement of cash flows (as well as the balance sheet) includes within cash the notion of cash equivalents. The FASB Accounting Standards Codification represents the single source of authoritative U.S. generally accepted accounting principles. Requi

> Hutchison-Sun Corporation has a defined benefit pension plan. Hutchison-Sun’s policy is to fund the plan annually, cash payments being made at the end of each year. Data relating to the pension plan for 2024 are as follows: Required: R

> Comparative balance sheets for 2024 and 2023, a statement of income for 2024, and additional information from the accounting records of Red, Inc., are provided below. Additional information from the accounting records: a. During 2024, $230 million of equ

> Refer to the data provided in E 21–25 for Clear Transmissions Company. Required: Prepare the cash flows from operating activities section of the statement of cash flows for Clear Transmissions Company using the indirect method.

> Portions of the financial statements for Clear Transmissions Company are provided on the next page. Required: Prepare the cash flows from operating activities section of the statement of cash flows for Clear Transmissions Company using the direct method

> Refer to the data provided in E 21–23 for Myriad Products Company. Required: Prepare the cash flows from the operating activities section of the statement of cash flows for Myriad Products Company using the indirect method.

> Portions of the financial statements for Myriad Products are provided below. Required: Prepare the cash flows from operating activities section of the statement of cash flows for Myriad Products Company using the direct method.

> The accounting records of Bad dour Company provided the data below. Prepare a reconciliation of net income to net cash flows from operating activities.

> The income statement and a schedule reconciling cash flows from operating activities to net income are provided below ($ in thousands) for Peach Computers. Required: 1. Calculate each of the following amounts for Peach Computers: a. Cash received from c

> Refer to the situation described in BE 7–4. Answer the questions assuming that Tri star uses the net method to account for sales discounts.

> Air France–KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2019, are available in Connect. This m

> Determine the amount of cash received from customers for each of the three independent situations below. All dollars are in millions.

> For financial reporting, Kumis Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired at the beginning of 2021 for $2,560,000. Its useful life was estimated to be six years with a $160,000 residual value. At t

> Flay Foods has always used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2024, Flay decided to change to the LIFO method. As a result of the change, net income in 2024 was $80 million. If the company

> Millington Materials is a leading supplier of building equipment, building products, materials, and timber for sale, with over 200 branches across the Mid-South. On January 1, 2024, management decided to change from the average inventory costing method t

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org and select Basic View for free access). Determine the specific eight-digit Codification citation (XXX-XX-XX-X) for accounting for each of the following items: 1. Reportin

> The Hoyle Companies, Inc. has ownership interests in several public companies. At the beginning of 2024, the company’s ownership interest in the common stock of Paik Properties increased to the point that it became appropriate to begin using the equity m

> In keeping with a modernization of corporate statutes in its home state, UMC Corporation decided in 2024 to discontinue accounting for reacquired shares as treasury stock. Instead, shares repurchased will be viewed as having been retired, reassuming the

> Aquatic Equipment Corporation decided to switch from the LIFO method of costing inventories to the FIFO method at the beginning of 2024. The inventory as reported at the end of 2023 using LIFO would have been $60,000 higher using FIFO. Retained earnings

> For each of the following inventory errors occurring in 2024, determine the effect of the error on 2024’s cost of goods sold, net income, and retained earnings. Assume that the error is not discovered until 2025 and that a periodic inve

> On December 28, 2024, Tristar Communications sold 10 units of its new satellite uplink system to various customers for $25,000 each. The terms of each sale were 1/10, n/30. Tristar uses the gross method to account for sales discounts. In what year will i

> Below are three independent and unrelated errors. a. On December 31, 2023, Wolfe-Bache Corporation failed to accrue salaries expense of $1,800. In January 2024, when it paid employees for the December 27–January 2 workweek, Wolfe-Bache

> At the end of 2023, Martinez Furniture Company failed to accrue $61,000 of interest expense that accrued during the last five months of 2023 on bonds payable. The bonds mature in 2035. The discount on the bonds is amortized by the straight-line method. T

> Wilkins Food Products Inc. acquired a packaging machine from Lawrence Specialists Corporation. Lawrence completed construction of the machine on January 1, 2022. In payment for the machine Wilkins issued a three year installment note to be paid in three

> On December 12, 2024, an investment in equity securities costing $80,000 was sold for $100,000. The total of the sale proceeds was credited to the investment in equity securities account. Required: 1. Prepare the journal entry to correct the error, assu

> During 2024, Lope and Lope Corporation discovered that its ending inventories reported on its financial statements were misstated by the following amounts: Lope and Lope uses the periodic inventory system and the FIFO cost method. Required: 1. Determine

> The Commonwealth of Virginia filed suit in October 2022 against Northern Timber Corporation, seeking civil penalties and injunctive relief for violations of environmental laws regulating forest conservation. When the financial statements were issued in 2

> S. J. Byland Engineering Group receives royalties on a technical manual written by two of its engineers and sold to William B. Irving Publishing, Inc. Royalties are 10% of net sales, receivable on October 1 for sales in January through June and on April

> The Canlas Milling Company purchased machinery on January 2, 2022, for $800,000. A five-year life was estimated and no residual value was anticipated. Canlas decided to use the straight-line depreciation method and recorded $160,000 in depreciation in 20

> During 2022 (its first year of operations) and 2023, Fiery Foods used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2024, Fiery decided to change to the average method for both financial reporting an

> SSG Cycles manufactures and distributes motorcycle parts and supplies. Employees are offered a variety of share based compensation plans. Under its nonqualified stock option plan, SSG granted options to key officers on January 1, 2024. The options permit

> What is the main difference between a perpetual inventory system and a periodic inventory system? Which system is used more often by major companies?

> Martinez Audio Visual Inc. offers an incentive stock option plan to its regional managers. On January 1, 2024, options were granted for 40 million $1 par common shares. The exercise price is the market price on the grant date—$8 per share. Options cannot

> On January 1, 2024, Adams-Men eke Corporation granted 25 million incentive stock options to division managers, each permitting holders to purchase one share of the company’s $1 par common shares within the next six years, but not before December 31, 2026

> Heidi Software Corporation provides a variety of share-based compensation plans to its employees. Under its executive stock option plan, the company granted options on January 1, 2024, that permit executives to acquire 4 million of the company’s $1 par c

> On January 1, 2024, Vijay Communications granted restricted stock units (RSUs) representing 30 million of its $1 par common shares to executives, subject to forfeiture if employment is terminated within three years. After the recipients of the RSUs satis

> Magnetic-Optical Corporation offers a variety of share-based compensation plans to employees. Under its restricted stock unit plan, the company on January 1, 2024, granted restricted stock units (RSUs) representing 4 million of its $1 par common shares t

> FedEx Corporation included the following disclosure note in an annual report: Required: 1. Assuming a four-year vesting period, how much compensation expense did FedEx report in the year ended May 31, 2021, for the restricted stock granted during the y

> As part of its stock-based compensation package, on January 1, 2024, International Electronics granted restricted stock units (RSUs) representing 50 million $1 par common shares. At exercise, holders of the RSUs are entitled to receive cash or stock equa

> As part of its stock-based compensation package, International Electronics granted 24 million stock appreciation rights (SARs) to top officers on January 1, 2024. At exercise, holders of the SARs are entitled to receive cash or stock equal in value to th

> As part of its stock-based compensation package, International Electronics (IE) granted 24 million stock appreciation rights (SARs) to top officers on January 1, 2024. At exercise, holders of the SARs are entitled to receive stock equal in value to the e

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org) and select Basic View for free access. Determine the specific seven-, eight-, or nine-digit Codification citation (XXX-XX-XX-X) for accounting for each of the following

> At the beginning of 2024, a company adopts the dollar-value LIFO inventory method for its one inventory pool. The pool’s value on that date was $1,400,000. The 2024 ending inventory valued at year-end costs was $1,664,000 and the year-end cost index was

> During 2024, its first year of operations, Kevin Berry Industries entered into the following transactions relating to shareholders’ equity. The corporation was authorized to issue 100 million common shares, $1 par per share. Net income

> Justin Short Foods granted 18 million of its no-par common shares to executives, subject to forfeiture if employment is terminated within three years. The common shares have a market price of $5 per share on January 1, 2023, the grant date. Required: 1.

> As part of its executive compensation plan, Vertovec Inc. granted 54,000 of its no-par common shares to executives, subject to forfeiture if employment is terminated within three years. Vertovec’s common shares have a market price of $5 per share on Janu

> Information from the financial statements of Ames Fabricators, Inc., included the following: Ames’s net income for the year ended December 31, 2024, is $500,000. The income tax rate is 25%. Ames paid dividends of $5 per share on its pre

> Stanley Department Stores reported net income of $720,000 for the year ended December 31, 2024.Additional Information: Required: Compute Stanley’s basic and diluted earnings per share for the year ended December 31, 2024.

> On January 1, 2024, True Fashions Corporation awarded restricted stock units (RSUs) representing 12 million of its $1 par common shares to key personnel, subject to forfeiture if employment is terminated within three years. After the recipients of the RS

> On December 31, 2023, Barclay Inc. had 200 million shares of common stock and 3 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. On March 1, 2024, Barclay purchased 24 million shares of its common stock as treasury

> On December 31, 2023, Barclay Inc. had 200 million shares of common stock and 3 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. On March 1, 2024, Barclay purchased 24 million shares of its common stock as treasury

> On December 31, 2023, Barclay Inc. had 200 million shares of common stock and 3 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. On March 1, 2024, Barclay purchased 24 million shares of its common stock as treasury

> On December 31, 2023, Barclay Inc. had 200 million shares of common stock and 3 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. On March 1, 2024, Barclay purchased 24 million shares of its common stock as treasury

> Selected financial statement data for Schmitzer Inc. is shown below: Calculate the gross profit ratio and inventory turnover ratio in 2024.

> At December 31, 2023, Albrecht Corporation had outstanding 373,000 shares of common stock and 8,000 shares of 9.5%, $100 par value cumulative, nonconvertible preferred stock. On May 31, 2024, Albrecht sold for cash 12,000 shares of its common stock. No c

> Hardaway Fixtures’ balance sheet at December 31, 2023, included the following: On July 21, 2024, Hardaway issued a 25% stock dividend on its common stock. On December 12, it paid $50,000 cash dividends on the preferred stock. Net income

> The Li Group had 202,000 shares of common stock outstanding at January 1, 2024. The following activities affected common shares during the year. There are no potential common shares outstanding. Required: 1. Determine the 2024 EPS. 2. Determine the 2025

> For the year ended December 31, 2024, Nor star Industries reported net income of $655,000. At January 1, 2024, the company had 900,000 common shares outstanding. The following changes in the number of shares occurred during 2024: Required: Compute nor st

> Microsoft Corporation’s disclosure notes for the year ending June 30, 2020, included the following regarding its $0.00000625 par common stock: Required: Prepare the journal entry that summarizes Microsoft’s employee s

> In order to encourage employee ownership of the company’s $1 par common shares, Washington Distribution permits any of its employees to buy shares directly from the company through payroll deduction. There are no brokerage fees and shares can be purchase

> Allied Paper Products, Inc., offers a restricted stock award plan to its vice presidents. On January 1, 2024, the company granted 16 million of its $1 par common shares, subject to forfeiture if employment is terminated within two years. The common share

> A partially completed pension spreadsheet showing the relationships among the elements that comprise the defined benefit pension plan of Universal Products is given below. The actuary’s discount rate is 5%. At the end of 2022, the pensi

> Luciana Fashions calculated pension expense for its underfunded pension plan as follows: Required: Which elements of Luciana’s balance sheet are affected by the components of pension expense? What are the specific changes in these acco

> Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2024, are shown below: Required: 1. For each independent case, calculate any amortization of the net loss or gain that should