Question: You are the general manager of a

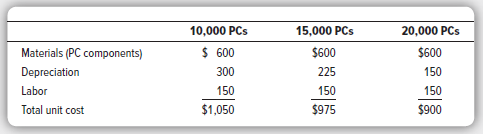

You are the general manager of a firm that manufactures personal computers. Due to a soft economy, demand for PCs has dropped 50 percent from the previous year. The sales manager of your company has identified only one potential client, who has received several quotes for 10,000 new PCs. According to the sales manager, the client is willing to pay $800 each for 10,000 new PCs. Your production line is currently idle, so you can easily produce the 10,000 units. The accounting department has provided you with the following information about the unit (or average) cost of producing three potential quantities of PCs:

Based on this information, should you accept the offer to produce 10,000 PCs at $800 each? Explain.

> While there is a degree of differentiation between major grocery chains like Albertsons and Kroger, the regular offering of sale prices by both firms for many of their products provides evidence that these firms engage in price competition. For markets w

> Using the same payoff matrix as in question 9, suppose this game is infinitely repeated and that the interest rate is sufficiently “low.” Identify trigger strategies that permit players 1 and 2 to earn equilibrium payoffs of 140 and 180, respectively, in

> Use the following payoff matrix to answer the following questions. Suppose this is a one-shot game: a. Determine the dominant strategy for each player. If such strategies do not exist, explain why not. b. Determine the secure strategy for each player. If

> Use the following payoff matrix for a one-shot game to answer the accompanying questions. a. Determine the Nash equilibrium outcomes that arise if the players make decisions independently, simultaneously, and without any communication. Which of these out

> Use the following extensive-form game to answer the following questions. a. List the feasible strategies for player 1 and player 2. b. Identify the Nash equilibria to this game. c. Find the subgame perfect equilibrium.

> Consider a two-player, sequential-move game where each player can choose to play right or left. Player 1 moves first. Player 2 observes player 1’s actual move and then decides to move right or left. If player 1 moves right, player 1 receives $0 and playe

> Provide a real-world example of a market that approximates each oligopoly setting, and explain your reasoning. a. Cournot oligopoly. b. Stackelberg oligopoly. c. Bertrand oligopoly.

> An industry consists of three firms with sales of $225,000, $45,000, and $315,000. a. Calculate the Herfindahl-Hirschman index (HHI). b. Calculate the four-firm concentration ratio (C4). c. Based on the FTC and DOJ Horizontal Merger Guidelines described

> Consider a Bertrand oligopoly consisting of four firms that produce an identical product at a marginal cost of $140. Analysts estimate that the inverse market demand for this product is P = 400 − 5Q. (LO2) a. Determine the equilibrium level of output in

> The inverse demand for a homogeneous-product Stackelberg duopoly is P = 16,000 − 4Q. The cost structures for the leader and the follower, respectively, are CL(QL) = 4,000QL and CF(QF) = 6,000QF. (LO2, LO3) a. What is the follower’s reaction function? b.

> The following diagram illustrates the reaction functions and isoprofit curves for a homogeneous- product duopoly in which each firm produces at constant marginal cost. a. If your rival produces 50 units of output, what is your optimal level of output? b.

> Analysts have estimated inverse market demand in a homogeneous-product Cournot duopoly to be P = 200 − 3(Q1 + Q2). They estimate costs to be C1(Q1) = 26Q1 and C2(Q2) = 32Q2. a. Determine the reaction function for each firm. b. Calculate each firm’s equil

> The graph that accompanies this question illustrates two demand curves for a firm operating in a differentiated-product oligopoly. Initially, the firm charges a price of $60 and produces 10 units of output. One of the demand curves is relevant when rival

> Your firm competes in a local duopoly. You’ve hired consultants to examine how your rival responds to changes in your prices. To do this, over a period of time, your consultants helped your firm to experiment with different price points and observe your

> You are a new entrant in a market with just one incumbent, who sells a roughly equivalent product. You initially take on the follower role when it comes to choosing the amount of your product to manufacture. In researching your market, youâ€&#

> In the late 1990s, Vanguard Airlines operated as a low-cost carrier, offering low prices and limited services, out of Kansas City, Missouri. Not long after its inception, Vanguard began offering a significant number of flights based out of Midway Interna

> In an attempt to increase tax revenues, legislators in several states have introduced legislation that would increase state excise taxes. Examine the impact of such an increase on the equilibrium prices paid and quantities consumed by consumers in market

> Jones is the manager of an upscale clothing store in a shopping mall that contains only two such stores. While these two competitors do not carry the same brands of clothes, they serve a similar clientele. Jones was recently notified that the mall is goi

> Ten firms compete in a market to sell product X. The total sales of all firms selling the product are $3 million. Ranking the firms’ sales from highest to lowest, we find the top four firms’ sales to be $425,000, $385,000, $320,000, and $290,000, respect

> PC Connection and CDW are two online retailers that compete in an Internet market for digital cameras. While the products they sell are similar, the firms attempt to differentiate themselves through their service policies. Over the last couple of months,

> During the 1980s, most of the world’s supply of lysine was produced by a Japanese company named Ajinomoto. Lysine is an essential amino acid that is an important livestock feed component. At this time, the United States imported most of the world’s suppl

> You are the manager of Taurus Technologies, and your sole competitor is Spyder Technologies. The two firms’ products are viewed as identical by most consumers. The relevant cost functions are C (Qi) = 4Qi, and the inverse market demand curve for this uni

> The market for a standard-sized cardboard container consists of two firms: Composite Box and Fiberboard. As the manager of Composite Box, you enjoy a patented technology that permits your company to produce boxes faster and at a lower cost than Fiberboar

> You are the manager of a firm that competes against four other firms by bidding for government contracts. While you believe your product is better than the competition’s, the government purchasing agent views the products as identical and purchases from

> Semi-Salt Industries began its operation in 1975 and remains the only firm in the world that produces and sells commercial-grade polyglutamate. While virtually anyone with a degree in college chemistry could replicate the firm’s formula, due to the relat

> The opening statement on the website of the Organization of Petroleum Exporting Countries (OPEC) says its members seek “. . . to secure an efficient, economic and regular supply of petroleum to consumers, a steady income to producers and a fair return on

> You are the manager of the only firm worldwide that specializes in exporting fish products to Japan. Your firm competes against a handful of Japanese firms that enjoy a significant first-mover advantage. Recently, one of your Japanese customers has calle

> The Hull Petroleum Company and Inverted V are retail gasoline franchises that compete in a local market to sell gasoline to consumers. Hull and Inverted V are located across the street from each other and can observe the prices posted on each other’s mar

> You are the manager of BlackSpot Computers, which competes directly with Condensed Computers to sell high-powered computers to businesses. From the two businesses’ perspectives, the two products are indistinguishable. The large investment required to bui

> Suppose that the U.S. Congress passes legislation that imposes a one-time lump-sum tariff on the product that a foreign firm exports to the United States. a. What happens to the foreign firm’s marginal cost curve as a result of the lump-sum tariff? b. Wi

> Ford executives announced that the company would extend its most dramatic consumer incentive program in the company’s long history—the Ford Drive America Program. The program provides consumers with either cash back or zero percent financing for new Ford

> Suppose a single firm produces all of the output in a contestable market. Analysts determine that the market inverse demand function is P = 150 − 2Q, and the firm’s cost function is C (Q) = 4Q. Determine the firm’s equilibrium price and corresponding pro

> Determine whether each of the following scenarios best reflects features of Sweezy, Cournot, Stackelberg, or Bertrand duopoly: a. Neither manager expects her own output decision to impact the other manager’s output decision. b. Each manager charges a pri

> Consider a homogeneous-product duopoly where each firm initially produces at a constant marginal cost of $200 and there are no fixed costs. Determine what would happen to each firm’s equilibrium output and profits if firm 2’s marginal cost increased to $

> Two firms compete in a market to sell a homogeneous product with inverse demand function P = 600 − 3Q. Each firm produces at a constant marginal cost of $300 and has no fixed costs. Use this information to compare the output levels and profits in setting

> You are the manager of a monopolistically competitive firm, and your demand and cost functions are estimated as Q = 36 − 4P and C(Q) = 4 + 4Q + Q2. (LO1, LO3, LO5) a. Find the inverse demand function for your firm’s product. b. Determine the profit-maxim

> The accompanying diagram shows the demand, marginal revenue, and marginal cost of a monopolist. a. Determine the profit-maximizing output and price. b. What price and output would prevail if this firm’s product were sold by price-taking

> You are the manager of a firm that produces a product according to the cost function C(qi) = 160 + 58qi − 6qi 2 + qi 3. Determine the short-run supply function if: a. You operate a perfectly competitive business. b. You operate a monopoly. c. You operate

> You are the manager of a monopoly, and your analysts have estimated your demand and costs functions as P = 300 − 3Q and C(Q) = 1,500 + 2Q2, respectively. a. What price–quantity combination maximizes your firm’s profits? b. Calculate the maximum profits.

> The following graph summarizes the demand and costs for a firm that operates in a monopolistically competitive market. a. What is the firm’s optimal output? b. What is the firm’s optimal price? c. What are the firm&aci

> Consider a competitive market served by many domestic and foreign firms. The domestic demand for these firms’ product is Qd = 600 − 2P. The supply function of the domestic firms is QSD = 200 + P, while that of the foreign firms is QSF = 250. a. Determine

> A firm sells its product in a perfectly competitive market where other firms charge a price of $110 per unit. The firm estimates its total costs as C(Q) = 70 + 14Q + 2Q2. (LO3) a. How much output should the firm produce in the short run? b. What price sh

> The following graph summarizes the demand and costs for a firm that operates in a perfectly competitive market. a. What level of output should this firm produce in the short run? b. What price should this firm charge in the short run? c. What is the firm

> Last month you assumed the position of manager for a large car dealership. The distinguishing feature of this dealership is its “no hassle” pricing strategy; prices (usually well below the sticker price) are posted on the windows, and your sales staff ha

> The owner of an Italian restaurant has just been notified by her landlord that the monthly lease on the building in which the restaurant operates will increase by 20 percent at the beginning of the year. Her current prices are competitive with nearby res

> The French government announced plans to convert state-owned power firms EDF and GDF into separate limited companies that operate in geographically distinct markets. BBC News reported that France’s CFT union responded by organizing a mass strike, which t

> Recently, the spot market price of U.S. hot rolled steel plummeted to $400 per ton. Just one year ago, this same ton of steel cost $700. According to Metals Monitor, the drop in price was due to falling oil prices, along with a rise in cheap imports and

> In a statement to P&G shareholders, the CEO of Gillette (which is owned by P&G) indicated, “Despite several new product launches, Gillette’s advertising-to-sales declined dramatically . . . to 7.5 percent last year. Gillette’s advertising spending, in fa

> You are a manager at Spacely Sprockets—a small firm that manufactures Type A and Type B bolts. The accounting and marketing departments have provided you with the following information about the per-unit costs and demand for Type A bolt

> You are the manager of College Computers, a manufacturer of customized computers that meet the specifications required by the local university. More than 90 percent of your clientele consists of college students. College Computers is not the only firm th

> Evaluate this statement: “If the United States imposed a uniform excise tariff on all foreign imports, all U.S. businesses and workers would benefit. Consequently, if a bill to impose a uniform excise tariff were introduced in the U.S. Congress, it would

> The second-largest public utility in the nation is the sole provider of electricity in 32 counties of southern Florida. To meet the monthly demand for electricity in these counties, which is represented by the estimated inverse demand function P = 1,200

> You are the manager of a small pharmaceutical company that received a patent on a new drug three years ago. Despite strong sales ($150 million last year) and a low marginal cost of producing the product ($0.50 per pill), your company has yet to show a pr

> When the first Pizza Hut opened its doors back in 1958, it offered consumers one style of pizza: its Original Thin Crust Pizza. Since its modest beginnings, Pizza Hut has established itself as the leader of the $25 billion pizza industry. Today, Pizza Hu

> You are the manager of a small U.S. firm that sells nails in a competitive U.S. market (the nails you sell are a standardized commodity; stores view your nails as identical to those available from hundreds of other firms). You are concerned about two eve

> The CEO of a major automaker overheard one of its division managers make the following statement regarding the firm’s production plans: “In order to maximize profits, it is essential that we operate at the minimum point of our average total cost curve.”

> There are two workers. Each worker’s demand for a public good is P = 20 − Q. The marginal cost of providing the public good is $24. The accompanying graph summarizes the relevant information. a. What is the socially ef

> You are an industry analyst who specializes in an industry where the market inverse demand is P = 200 − 4Q. The external marginal cost of producing the product is MC External = 6Q, and the internal cost is MC Internal = 12Q. (LO1) a. What is the socially

> Suppose that, prior to the passage of the Truth in Lending Simplification Act and Regulation Z, the demand for consumer loans was given by Q pre-TILSA d = 12 − 100P (in billions of dollars) and the supply of consumer loans by credit unions and other lend

> Enrodes is a monopoly provider of residential electricity in a region of northern Michigan. Total demand by its 3 million households is Qd = 1,500 − 2P, and Enrodes can produce electricity at a constant marginal cost of $4 per megawatt-hour. Consumers in

> The manager of a local monopoly estimates that the elasticity of demand for its product is constant and equal to –4. The firm’s marginal cost is constant at $25 per unit. a. Express the firm’s marginal revenue as a function of its price. b. Determine the

> Section 16(a) of the Securities and Exchange Act of 1934, as amended in 1990, requires that the officers, directors, and principal shareholders of companies disclose the extent of their ownership of equity securities of the company and any changes in the

> You are the manager of a paper mill and have been subpoenaed to appear before a joint session of the Senate Consumer Affairs and the Senate Environmental subcommittees. The Consumer Affairs Subcommittee is interested in your testimony about the pricing p

> A well-known conglomerate that manufactures a multitude of noncompeting consumer products instituted a corporate wide initiative to encourage the managers of its many divisions to share consumer demographic information. However, since the initiative was

> Is “fairness” the economic basis for government laws and regulations designed to remedy market failures? If so, why; if not, what is the economic basis?

> Explain, using precise economic terminology, the economic rationale for laws against insider trading.

> The accompanying diagram depicts a monopolist whose price is regulated at $10 per unit. Use this figure to answer the questions that follow. a. What price will an unregulated monopoly charge? b. What quantity will an unregulated monopoly produce? c. How

> As the manager of a monopoly, you face potential government regulation. Your inverse demand is P = 40 − 2Q, and your costs are C (Q) = 8Q. a. Determine the monopoly price and output. b. Determine the socially efficient price and output. c. What is the ma

> Use the accompanying graph to answer the questions that follow. a. Suppose this monopolist is unregulated. (1) What price will the firm charge to maximize its profits? (2) What is the level of consumer surplus at this price? b. Suppose the firmâ

> You are the manager in a market composed of eight firms, each of which has a 12.5 percent market share. In addition, each firm has a strong financial position and is located within a 100-mile radius of its competitors. a. Calculate the premerger Herfinda

> The Federal Trade Commission (FTC) issued a complaint against Nestlé and Ralston Purina alleging that a proposed merger between the two companies would violate, among other things, section 7 of the Clayton Act. While these two companies sell many product

> A monopolist’s inverse demand function is estimated as P = 150 − 3Q. The company produces output at two facilities; the marginal cost of producing at facility 1 is MC1(Q1) = 6Q1, and the marginal cost of producing at facility 2 is MC2(Q2) = 2Q2. a. Provi

> Moses Inc. is a small electric company that provides power to customers in a small rural area in the Southwest. The company is currently maximizing its profits by selling electricity to consumers at a price of $0.15 per kilowatt-hour. Its marginal cost i

> Social Dynamo Corporation earned profits last year of $49 million on sales of $500 million. During the same period, its major competitor—EIO Corp.—enjoyed sales of $490 million and earned profits of $52 million. Currently, Social Dynamo is negotiating a

> Between 1972 and 1981, Texaco sold gasoline to independent Texaco retailers at “retail tank wagon prices” but granted substantial discounts to distributors Gull and Dompier. Gull resold the gas under its own name. Dompier resold the gas under the Texaco

> The fighters of the Ultimate Fighting Championship (UFC) filed suit against the UFC, alleging that the UFC unlawfully monopolized the output and input markets in mixed martial arts. In particular, the fighters claimed that UFC used long-term exclusive co

> On November 18, 2012, Nintendo released its eighth-generation video game console, the Wii U. In November 2013, Microsoft and Sony followed suit by releasing the Xbox One and PlayStation 4, respectively. Although these three video game consoles have domin

> A firm is considering building a two-way network that links 12 users. The cost of building the network is $10,000. a. How many potential connection services does this network provide? b. If each user is willing to pay $150 to connect to the network, will

> Bank 1 and Bank 2 are considering entering a compatibility agreement that would permit the users of each bank’s automated teller machines (ATMs) access to the other bank’s ATMs. Bank 1 has a network of branches and ATMs extending from Connecticut to Flor

> During the dot-com era, mergers among some brokerage houses resulted in the acquiring firm paying a premium on the order of $100 for each of the acquired firm’s customers. Is there a business rationale for such a strategy? Do you think these circumstance

> During the early days of the Internet, most dot-coms were driven by revenues rather than profits. A large number were even driven by “hits” to their site rather than revenues. This all changed in early 2000, however, when the prices of unprofitable dot-c

> Consider the following simultaneous move game: 1In working this problem, note that the positive integers consist of the numbers {1, 2, 3, 4, . . .}, and “infinity” is not an integer. a. What is the maximum amount playe

> The elasticity of demand for a firm’s product is –4 and its advertising elasticity of demand is 0.32. a. Determine the firm’s optimal advertising-to-sales ratio. b. If the firm’s revenues are $30,000, what is its profit-maximizing level of advertising?

> Tom Jackson has been running a successful steakhouse that specializes in serving upscale steak dinners. His current marketing campaign targets residential households. Recently, it was announced that a new conference hotel was to open near his steakhouse,

> You are the manager of 3D Designs—a large imaging company that does graphics and web design work for companies. You and your only competitor are contemplating the purchase of a new 3-D imaging device. If only one of you acquires the device, that firm wil

> In the following game, determine the maximum amount you would be willing to pay for the privilege of moving (a) first, (b) second, or (c) third: There are three players, you and two rivals. The player announcing the largest integer gets a payoff of $10,

> The market for taxi services in a Midwestern town is monopolized by firm 1. Currently, any taxi services firm must purchase a $40,000 “medallion” from the city in order to offer its services. A potential entrant (firm

> Two firms compete in a Cournot fashion. Firm 1 successfully engages in an activity that raises its rival’s marginal cost of production. a. Provide two examples of activities that might raise rivals’ marginal costs. b. In order for such strategies to be b

> Discuss how price discrimination can enhance the effectiveness of predatory pricing and strategies that raise rivals’ costs.

> Evaluate the following: “Since a rival’s profit-maximizing price and output depend on its marginal cost and not its fixed costs, a firm cannot profitably lessen competition by implementing a strategy that raises its rival’s fixed costs.”

> The CEO of a regional airline recently learned that its only competitor is suffering from a significant cash-flow constraint. The CEO realizes that its competitor’s days are numbered but has asked whether you would recommend the carrier significantly low

> In 2015 Qualcomm Inc., an American multinational semiconductor company, came under scrutiny for its business practices by the United States and the European Union. It was argued that Qualcomm was paying a major customer to exclusively use its chips. In a

> Argyle is a large, vertically integrated firm that manufactures sweaters from a rare type of wool produced on its sheep farms. Argyle has adopted a strategy of selling wool to companies that compete against it in the market for sweaters. Explain why this

> As a newly hired manager at your firm, you decide to start your tenure by assessing the sensibility of your current advertising expenditure. To do this, you ask your analytics team to collect useful data on the quantity of your product sold, the price, a

> A number of professional associations, such as the American Medical Association and the American Bar Association, support regulations that make it more costly for their members (e.g., doctors and lawyers) to practice their services. While some of these r

> Between 1995 and 1997, American Airlines competed in the Dallas/Ft. Worth Airport against several other low-cost carriers. In response to these low-cost carriers, American Airlines reduced its price and increased service on selected routes. As a result,

> You are the manager of an international firm headquartered in Antarctica. You are contemplating a business tactic that will permit your firm to raise prices and increase profits in the long run by eliminating one of your competitors. Do you think it woul

> Two firms compete in a homogeneous product market where the inverse demand function is P = 20 − 5Q (quantity is measured in millions). Firm 1 has been in business for one year, while firm 2 just recently entered the market. Each firm has a legal obligati

> Suppose that, prior to other firms entering the market, the maker of a new smart phone (Way Cool Inc.) earns $80 million per year. By reducing its price by 60 percent, Way Cool could discourage entry into “its” market, but doing so would cause its profit

> A monopolist earns $30 million annually and will maintain that level of profit indefinitely, provided that no other firm enters the market. However, if another firm enters the market, the monopolist will earn $30 million in the current period and $15 mil