Question: You have two clients that are considering

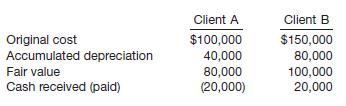

You have two clients that are considering trading machinery with each other. Although the machines are different from each other, you believe that an assessment of expected cash flows on the exchanged assets will indicate the exchange lacks commercial substance. Your clients would prefer that the exchange be deemed to have commercial substance, to allow them to record gains. Here are the facts:

Instructions

(a) Record the trade-in on Client A’s books assuming the exchange has commercial substance.

(b) Record the trade-in on Client A’s books assuming the exchange lacks commercial substance.

(c) Write a memo to the controller of Company A indicating and explaining the dollar impact on current and future statements of treating the exchange as having, versus lacking, commercial substance.

(d) Record the entry on Client B’s books assuming the exchange has commercial substance.

(e) Record the entry on Client B’s books assuming the exchange lacks commercial substance.

(f) Write a memo to the controller of Company B indicating and explaining the dollar impact on current and future statements of treating the exchange as having, versus lacking, commercial substance.

> On January 1, 2013, Locke Company, a small machine-tool manufacturer, acquired for $1,260,000 a piece of new industrial equipment. The new equipment had a useful life of 5 years, and the salvage value was estimated to be $60,000. Locke estimates that the

> On January 1, 2012, a machine was purchased for $90,000. The machine has an estimated salvage value of $6,000 and an estimated useful life of 5 years. The machine can operate for 100,000 hours before it needs to be replaced. The company closed its books

> Kohlbeck Corporation, a manufacturer of steel products, began operations on October 1, 2013. The accounting department of Kohlbeck has started the fixed-asset and depreciation schedule presented on page 632. You have been asked to assist in completing th

> Roland Company uses special strapping equipment in its packaging business. The equipment was purchased in January 2013 for $10,000,000 and had an estimated useful life of 8 years with no salvage value. At December 31, 2014, new technology was introduced

> Darby Sporting Goods Inc. has been experiencing growth in the demand for its products over the last several years. The last two Olympic Games greatly increased the popularity of basketball around the world. As a result, a European sports retailing consor

> Bronson Paper Products purchased 10,000 acres of forested timberland in March 2014. The company paid $1,700 per acre for this land, which was above the $800 per acre most farmers were paying for cleared land. During April, May, June, and July 2014, Brons

> Conan O’Brien Logging and Lumber Company owns 3,000 acres of timberland on the north side of Mount Leno, which was purchased in 2002 at a cost of $550 per acre. In 2014, O’Brien began selectively logging this timber tract. In May 2014, Mount

> Khamsah Mining Company has purchased a tract of mineral land for $900,000. It is estimated that this tract will yield 120,000 tons of ore with sufficient mineral content to make mining and processing profitable. It is further estimated that 6,000 tons of

> A depreciation schedule for semi-trucks of Ichiro Manufacturing Company was requested by your auditor soon after December 31, 2015, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period

> Explain how estimation of service lives can result in unrealistically high carrying values for fixed assets.

> The following data relate to the Machinery account of Eshkol, Inc. at December 31, 2014. The following transactions occurred during 2015.(a) On May 5, Machine A was sold for $13,000 cash. The company’s bookkeeper recorded this retirement in the

> The cost of equipment purchased by Charleston, Inc., on June 1, 2014, is $89,000. It is estimated that the machine will have a $5,000 salvage value at the end of its service life. Its service life is estimated at 7 years, its total working hours are esti

> Alladin Company purchased Machine #201 on May 1, 2014. The following information relating to Machine #201 was gathered at the end of May. It is expected that the machine could be used for 10 years, after which the salvage value would be zero. Alladin

> Francis Corporation purchased an asset at a cost of $50,000 on March 1, 2014. The asset has a useful life of 8 years and a salvage value of $4,000. For tax purposes, the MACRS class life is 5 years. Compute tax depreciation for each year 2014–2019.

> In its 2011 annual report, Campbell Soup Company reports beginning-of-the-year total assets of $6,276 million, end-of-the-year total assets of $6,862 million, total sales of $7,719 million, and net income of $805 million. (a) Compute Campbell’s ass

> Everly Corporation acquires a coal mine at a cost of $400,000. Intangible development costs total $100,000. After extraction has occurred, Everly must restore the property (estimated fair value of the obligation is $80,000), after which it can be sold fo

> Jurassic Company owns equipment that cost $900,000 and has accumulated depreciation of $380,000. The expected future net cash flows from the use of the asset are expected to be $500,000. The fair value of the equipment is $400,000. Prepare the journal en

> Holt Company purchased a computer for $8,000 on January 1, 2013. Straight-line depreciation is used, based on a 5-year life and a $1,000 salvage value. In 2015, the estimates are revised. Holt now feels the computer will be used until December 31, 2016,

> Dickinson Inc. owns the following assets. Compute the composite depreciation rate and the composite life of Dickinson’s assets.

> Cominsky Company purchased a machine on July 1, 2015, for $28,000. Cominsky paid $200 in title fees and county property tax of $125 on the machine. In addition, Cominsky paid $500 shipping charges for delivery, and $475 was paid to a local contractor to

> Some believe that accounting depreciation measures the decline in the value of fixed assets. Do you agree? Explain.

> Use the information for Lockard Company given in BE11-2. In BE11-2 Lockard Company purchased machinery on January 1, 2014, for $80,000. The machinery is estimated to have a salvage value of $8,000 after a useful life of 8 years (a) Compute 2014 depreciat

> Use the information for Lockard Company given in BE11-2. In BE11-2 Lockard Company purchased machinery on January 1, 2014, for $80,000. The machinery is estimated to have a salvage value of $8,000 after a useful life of 8 years (a) Compute 2014 depreciat

> Lockard Company purchased machinery on January 1, 2014, for $80,000. The machinery is estimated to have a salvage value of $8,000 after a useful life of 8 years. (a) Compute 2014 depreciation expense using the straight-line method. (b) Compute 2014 depre

> Fernandez Corporation purchased a truck at the beginning of 2014 for $50,000. The truck is estimated to have a salvage value of $2,000 and a useful life of 160,000 miles. It was driven 23,000 miles in 2014and 31,000 miles in 2015. Compute depreciation ex

> What is a modified accelerated cost recovery system (MACRS)? Speculate as to why this system is now required for tax purposes.

> Target in 2012 reported net income of $2.9 billion, net sales of $69.8 billion, and average total assets of $45.2 billion. What is Target’s asset turnover? What is Target’s return on assets?

> Shumway Oil uses successful-efforts accounting and also provides full-cost results as well. Under full-cost, Shumway Oil would have reported retained earnings of $42 million and net income of $4 million. Under successfulefforts, retained earnings were $2

> The following statement appeared in a financial magazine: “RRA—or Rah-Rah, as it’s sometimes dubbed—has kicked up quite a storm. Oil companies, for example, are convinced that the approach is misleading. Major accounting firms

> Describe cost depletion and percentage depletion. Why is the percentage depletion method permitted?

> List (a) the similarities and (b) the differences in the accounting treatments of depreciation and cost depletion.

> Identify the factors that are relevant in determining the annual depreciation charge, and explain whether these factors are determined objectively or whether they are based on judgment.

> Neither depreciation on replacement cost nor depreciation adjusted for changes in the purchasing power of the dollar has been recognized as generally accepted accounting principles for inclusion in the primary financial statements. Briefly present the ac

> It has been suggested that plant and equipment could be replaced more quickly if depreciation rates for income tax and accounting purposes were substantially increased. As a result, business operations would receive the benefit of more modern and more ef

> Explain how gains or losses on impaired assets should be reported in income.

> Toro Co. has equipment with a carrying amount of $700,000. The expected future net cash flows from the equipment are $705,000, and its fair value is $590,000. The equipment is expected to be used in operations in the future. What amount (if any) should T

> Walkin Inc. is considering the write-down of its long-term plant because of a lack of profitability. Explain to the management of Walkin how to determine whether a write-down is permitted.

> Andrea Torbert purchased a computer for $8,000 on July 1, 2014. She intends to depreciate it over 4 years using the double-declining-balance method. Salvage value is $1,000. Compute depreciation for 2015.

> Charlie Parker, president of Spinners Company, has recently noted that depreciation increases cash provided by operations and therefore depreciation is a good source of funds. Do you agree? Discuss.

> A building that was purchased on December 31, 2000, for $2,500,000 was originally estimated to have a life of 50 years with no salvage value at the end of that time. Depreciation has been recorded through 2014. During 2015, an examination of the building

> If Remmers, Inc. uses the composite method and its composite rate is 7.5% per year, what entry should it make when plant assets that originally cost $50,000 and have been used for 10 years are sold for $14,000?

> Under what conditions is it appropriate for a business to use the composite method of depreciation for its plant assets? What are the advantages and disadvantages of this method?

> Distinguish among depreciation, depletion, and amortization.

> Briefly describe how the purchases and sales of inventory with the same counterparty are similar to the accounting for other nonmonetary exchanges.

> Herb Scholl, the owner of Scholl’s Company, wonders whether interest costs associated with developing land can ever be capitalized. What does the Codification say on this matter?

> Access the glossary (“Master Glossary”) to answer the following. (a) What does it mean to “capitalize” an item? (b) What is the definition of a nonmonetary asset? (c) What is a nonreciprocal transfer? (d) What is the d

> New machinery, which replaced a number of employees, was installed and put in operation in the last month of the fiscal year. The employees had been dismissed after payment of an extra month’s wages, and this amount was added to the cost of the mac

> Tones Company purchased a warehouse in a downtown district where land values are rapidly increasing. Gerald Carter, controller, and Wilma Ankara, financial vice president, are trying to allocate the cost of the purchase between the land and the building.

> The invoice price of a machine is $50,000. Various other costs relating to the acquisition and installation of the machine including transportation, electrical wiring, special base, and so on amount to $7,500. The machine has an estimated life of 10 year

> What interest rates should be used in determining the amount of interest to be capitalized? How should the amount of interest to be capitalized be determined?

> Vania Magazine Company started construction of a warehouse building for its own use at an estimated cost of $5,000,000 on January 1, 2013, and completed the building on December 31, 2013. During the construction period, Vania has the following debt oblig

> Troopers Medical Labs, Inc., began operations 5 years ago producing stetrics, a new type of instrument it hoped to sell to doctors, dentists, and hospitals. The demand for stetrics far exceeded initial expectations, and the company was unable to produce

> Tonkawa Company purchased land for use as its corporate headquarters. A small factory that was on the land when it was purchased was torn down before construction of the office building began. Furthermore, a substantial amount of rock blasting and remova

> On August 1, Hyde, Inc. exchanged productive assets with Wiggins, Inc. Hyde’s asset is referred to below as “Asset A,” and Wiggins’ is referred to as “Asset B.” The following facts pertain to these assets. Instructi

> Holyfield Corporation wishes to exchange a machine used in its operations. Holyfield has received the following offers from other companies in the industry.1. Dorsett Company offered to exchange a similar machine plus $23,000. (The exchange has commercia

> Laserwords Inc. is a book distributor that had been operating in its original facility since 1987. The increase in certification programs and continuing education requirements in several professions has contributed to an annual growth rate of 15% for Las

> What accounting treatment is normally given to the following items in accounting for plant assets? (a) Additions. (b) Major repairs. (c) Improvements and replacements.

> Grieg Landscaping began construction of a new plant on December 1, 2014. On this date, the company purchased a parcel of land for $139,000 in cash. In addition, it paid $2,000 in surveying costs and $4,000 for a title insurance policy. An old dwelling on

> On January 1, 2014, Blair Corporation purchased for $500,000 a tract of land (site number 101) with a building. Blair paid a real estate broker’s commission of $36,000, legal fees of $6,000, and title guarantee insurance of $18,000. The closing sta

> Presented below is a schedule of property dispositions for Hollerith Co. The following additional information is available.Land: On February 15, a condemnation award was received as consideration for unimproved land held primarily as an investment, an

> Spitfire Company was incorporated on January 2, 2015, but was unable to begin manufacturing activities until July 1, 2015, because new factory facilities were not completed until that date. The Land and Buildings account reported the following items duri

> Provide examples of assets that do not qualify for interest capitalization.

> Selected accounts included in the property, plant, and equipment section of Lobo Corporation’s balance sheet at December 31, 2013, had the following balances. During 2014, the following transactions occurred.1. A tract of land was acquired for $

> At December 31, 2013, certain accounts included in the property, plant, and equipment section of Reagan Company’s balance sheet had the following balances. During 2014, the following transactions occurred.1. Land site number 621 was acquired for

> On April 1, 2014, Gloria Estefan Company received a condemnation award of $430,000 cash as compensation for the forced sale of the company’s land and building, which stood in the path of a new state highway. The land and building cost $60,000 and $

> On December 31, 2014, Travis Tritt Inc. has a machine with a book value of $940,000. The original cost and related accumulated depreciation at this date are as follows. Depreciation is computed at $60,000 per year on a straight-line basis.Instructions

> Plant assets often require expenditures subsequent to acquisition. It is important that they be accounted for properly. Any errors will affect both the balance sheets and income statements for a number of years. Instructions For each of the follow

> Once equipment has been installed and placed in operation, subsequent expenditures relating to this equipment are frequently thought of as repairs or general maintenance and, hence, chargeable to operations in the period in which the expenditure is made.

> The following transactions occurred during 2014. Assume that depreciation of 10% per year is charged on all machinery and 5% per year on buildings, on a straight-line basis, with no estimated salvage value. Depreciation is charged for a full year on all

> King Donovan Resources Group has been in its plant facility for 15 years. Although the plant is quite functional, numerous repair costs are incurred to maintain it in sound working order. The company’s plant asset book value is currently $800,000,

> Dana Ashbrook Inc. has negotiated the purchase of a new piece of automatic equipment at a price of $8,000 plus trade-in, f.o.b. factory. Dana Ashbrook Inc. paid $8,000 cash and traded in used equipment. The used equipment had originally cost $62,000; it

> Carlos Arruza Company exchanged equipment used in its manufacturing operations plus $3,000 in cash for similar equipment used in the operations of Tony LoBianco Company. The following information pertains to the exchange. Instructions (a) Prepare the

> Cannondale Company purchased an electric wax melter on April 30, 2014, by trading in its old gas model and paying the balance in cash. The following data relate to the purchase. Instructions Prepare the journal entry(ies) necessary to record this exch

> The Buildings account of Postera Inc. includes the following items that were used in determining the basis for depreciating the cost of a building. (a) Organization and promotion expenses. (b) Architect’s fees. (c) Interest and taxes durin

> Busytown Corporation, which manufactures shoes, hired a recent college graduate to work in its accounting department. On the first day of work, the accountant was assigned to total a batch of invoices with the use of an adding machine. Before long, the a

> Hayes Industries purchased the following assets and constructed a building as well. All this was done during the current year. Assets 1 and 2: These assets were purchased as a lump sum for $100,000 cash. The following information was gathered. Asset 3

> Cardinals Corporation purchased a computer on December 31, 2013, for $105,000, paying $30,000 down and agreeing to pay the balance in five equal installments of $15,000 payable each December 31 beginning in 2014. An assumed interest rate of 10% is implic

> Chippewas Inc. has decided to purchase equipment from Central Michigan Industries on January 2, 2014, to expand its production capacity to meet customers’ demand for its product. Chippewas issues an $800,000, 5-year, zero-interest-bearing note to C

> Crowe Company purchased a heavy-duty truck on July 1, 2011, for $30,000. It was estimated that it would have a useful life of 10 years and then would have a trade-in value of $6,000. The company uses the straight-line method. It was traded on August 1, 2

> Presented below is information related to Zonker Company. 1. On July 6, Zonker Company acquired the plant assets of Doonesbury Company, which had discontinued operations. The appraised value of the property is: Zonker Company gave 12,500 shares of its

> Below are transactions related to Duffner Company;(a) The City of Pebble Beach gives the company 5 acres of land as a plant site. The fair value of this landis determined to be $81,000.(b) 13,000 shares of common stock with a par value of $50 per share a

> Jane Geddes Engineering Corporation purchased conveyor equipment with a list price of $10,000. Presented below are three independent cases related to the equipment. (a) Geddes paid cash for the equipment 8 days after the purchase. The vendor’s c

> The following three situations involve the capitalization of interest.Situation I: On January 1, 2014, Oksana Baiul, Inc. signed a fixed-price contract to have Builder Associates construct a major plant facility at a cost of $4,000,000. It was estimated

> On July 31, 2014, Amsterdam Company engaged Minsk Tooling Company to construct a special-purpose piece of factory machinery. Construction was begun immediately and was completed on November 1, 2014. To help finance construction, on July 31 Amsterdam issu

> On December 31, 2013, Main Inc. borrowed $3,000,000 at 12% payable annually to finance the construction of a new building. In 2014, the company made the following expenditures related to this building: March 1, $360,000; June 1, $600,000; July 1, $1,500,

> Two positions have normally been taken with respect to the recording of fixed manufacturing overhead as an element of the cost of plant assets constructed by a company for its own use: (a) It should be excluded completely. (b) It should be included

> Harrisburg Furniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of $5,000,000 on January 1, 2014. Harrisburg expected to complete the building by December 31, 2014. Harrisburg has the

> Plant acquisitions for selected companies are as follows.1. Belanna Industries Inc. acquired land, buildings, and equipment from a bankrupt company, Torres Co., for a lump-sum price of $700,000. At the time of purchase, Torres’s assets had the foll

> Worf Co. both purchases and constructs various equipment it uses in its operations. The following items for two different types of equipment were recorded in random order during the calendar year 2014. Purchase Cash paid for equipment, including sales

> Stan Ott is evaluating two recent transactions involving exchanges of equipment. In one case, the exchange has commercial substance. In the second situation, the exchange lacks commercial substance. Explain to Stan the differences in accounting for these

> Kelly Clarkson Corporation operates a retail computer store. To improve delivery services to customers, the company purchases four new trucks on April 1, 2014. The terms of acquisition for each truck are described below. 1. Truck #1 has a list price o

> Martin Buber Co. purchased land as a factory site for $400,000. The process of tearing down two old buildings on the site and constructing the factory required 6 months. The company paid $42,000 to raze the old buildings and sold salvaged lumber and bric

> The following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses.(a) Money borrowed to pay building contractor (signed a note) $(275,000)(b)

> Use the information presented for Ottawa Corporation in BE10-14, but assume the machinery is sold for $5,200 instead of $10,500. In BE10-14 Ottawa Corporation owns machinery that cost $20,000 when purchased on July 1, 2011. Depreciation has been recorded

> Ottawa Corporation owns machinery that cost $20,000 when purchased on July 1, 2011. Depreciation has been recorded at a rate of $2,400 per year, resulting in a balance in accumulated depreciation of $8,400 at December 31, 2014. The machinery is sold on S

> Slaton Corporation traded a used truck for a new truck. The used truck cost $20,000 and has accumulated depreciation of $17,000. The new truck is worth $35,000. Slaton also made a cash payment of $33,000. Prepare Slaton’s entry to record the exchan

> Cheng Company traded a used truck for a new truck. The used truck cost $30,000 and has accumulated depreciation of $27,000. The new truck is worth $37,000. Cheng also made a cash payment of $36,000. Prepare Cheng’s entry to record the exchange. (Th

> Indicate where the following items would be shown on a balance sheet. (a) A lien that was attached to the land when purchased. (b) Landscaping costs. (c) Attorney’s fees and recording fees related to purchasing land. (d) Variable overhe

> Mehta Company traded a used welding machine (cost $9,000, accumulated depreciation $3,000) for office equipment with an estimated fair value of $5,000. Mehta also paid $3,000 cash in the transaction. Prepare the journal entry to record the exchange. (The

> Use the information for Navajo Corporation from BE10-8. In BE10-8 Navajo Corporation traded a used truck (cost $20,000, accumulated depreciation $18,000) for a small computer worth $3,300. Navajo also paid $500 in the transaction. Prepare the journal ent