Question: Your firm has been engaged to examine

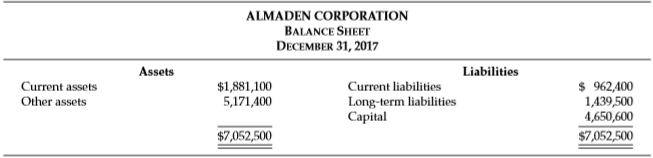

Your firm has been engaged to examine the financial statements of Almaden Corporation for the year 2017. The bookkeeper who maintains the financial records has prepared all the unaudited financial statements for the corporation since its organization on January 2, 2012. The client provides you with the following information.

An analysis of current assets discloses the following.

Cash (restricted in the amount of $300,000 for plant expansion)…….$ 571,000

Investments in land…………………………………………………………………………..185,000

Accounts receivable less allowance of $30,000…………………………………..480,000

Inventories (LIFO flow assumption)……………………………………………………645,100

$1,881,100

Other assets include:

Prepaid expenses…………………………………………………………………………….$ 62,400

Plant and equipment less accumulated depreciation of $1,430,000…….4,130,000

Cash surrender value of life insurance policy…………………………………………..84,000

Unamortized bond discount……………………………………………………………………34,500

Notes receivable (short-term)……………………………………………………………….162,300

Goodwill……………………………………………………………………………………………252,000

Land………………………………………………………………………………………………..446,200

$5,171,400

Current liabilities include:

Accounts payable……………………………..$ 510,000

Notes payable (due 2020)……………………..157,400

Estimated income taxes payable…………..145,000

Premium on common stock…………………150,000

$ 962,400

Long-term liabilities include:

Unearned revenue…………………………..$ 489,500

Dividends payable (cash)……………………..200,000

8% bonds payable (due May 1, 2022)…….750,000

$1,439,500

Capital includes:

Retained earnings……………………………………………..$2,810,600

Common stock, par value $10; authorized 200,000 shares,

184,000 shares issued………………………………………….1,840,000

$4,650,600

The supplementary information below is also provided.

1. On May 1, 2017, the corporation issued at 95.4, $750,000 of bonds to finance plant expansion. The long-term bond agreement provided for the annual payment of interest every May 1. The existing plant was pledged as security for the loan. Use the straight-line method for discount amortization.

2. The bookkeeper made the following mistakes.

a. I n 2015, the ending inventory was overstated by $183,000. The ending inventories for 2016 and 2017 were correctly computed.

b. I n 2017, accrued wages in the amount of $225,000 were omitted from the balance sheet, and these expenses were not charged on the income statement.

c. In 2017, a gain of $175,000 (net of tax) on the sale of certain plant assets was credited directly to retained earnings.

3. A major competitor has introduced a line of products that will compete directly with Almaden’s primary line, now being produced in a specially designed new plant. Because of manufacturing innovations, the competitor’s line will be of comparable quality but priced 50% below Almaden’s line. The competitor announced its new line on January 14, 2018. Almaden indicates that the company will meet the lower prices that are high enough to cover variable manufacturing and selling expenses, but permit recovery of only a portion of fixed costs.

4. You learned on January 28, 2018, prior to completion of the audit, of heavy damage because of a recent fire to one of Almaden’s two plants; the loss will not be reimbursed by insurance. The newspapers described the event in detail.

Instructions

Analyze the above information to prepare a corrected balance sheet for Almaden in accordance with proper accounting and reporting principles. Prepare a description of any notes that might need to be prepared. The books are closed and adjustments to income are to be made through retained earnings.

Transcribed Image Text:

ALMADEN CORPORATION BALANCE SHEET DECEMBER 31, 2017 Assets Liabilities Current assets Other assets $1,881,100 5,171,400 Current liabilities Long-term liabilities Сapital $ 962,400 1,439,500 4,650,600 $7,052,500 $7,052,500

> In 2017, Elbert Corporation had net cash provided by operating activities of $531,000, net cash used by investing activities of $963,000, and net cash provided by financing activities of $585,000. At January 1, 2017, the cash balance was $333,000. Comput

> Moxley Corporation had January 1 and December 31 balances as follows. For 2017, cost of goods sold was $500,000. Compute Moxley’s 2017 cash payments to suppliers. 1/1/17 12/31/17 $95,000 Inventory Accounts payable $113,000 69,000

> At January 1, 2017, Eikenberry Inc. had accounts receivable of $72,000. At December 31, 2017, accounts receivable is $54,000. Sales revenue for 2017 total $420,000. Compute Eikenberry’s 2017 cash receipts from customers.

> Use the information from BE23-4 for Bloom Corporation. Prepare the cash flows from operating activities section of Bloom’s 2017 statement of cash flows using the indirect method. From BE23-4: Bloom Corporation had the following 2017 income statement. S

> Bloom Corporation had the following 2017 income statement. Sales revenue………………….…………$200,000 Cost of goods sold………………………...120,000 Gross profit……………………………………80,000 Operating expenses (includes depreciation of $21,000)…………………………………..50,000 Net income…………

> Stansfield Corporation had the following activities in 2017. 1. Payment of accounts payable $770,000. 2. Issuance of common stock $250,000. 3. Payment of dividends $350,000. 4. Collection of note receivable $100,000. 5. Issuance of bonds payable $51

> Wainwright Corporation had the following activities in 2017. 1. Sale of land $180,000. 2. Purchase of inventory $845,000. 3. Purchase of treasury stock $72,000. 4. Purchase of equipment $415,000. 5. Issuance of common stock $320,000. 6. Purchase of

> On January 3, 2016, Martin Company purchased for $500,000 cash a 10% interest in Renner Corp. On that date, the net assets of Renner had a book value of $3,700,000. The excess of cost over the underlying equity in net assets is attributable to undervalue

> In 2017, Leppard Inc. issued 1,000 shares of $10 par value common stock for land worth $40,000. a. Prepare Leppard’s journal entry to record the transaction. b. Indicate the effect the transaction has on cash. c. Indicate how the transaction is report

> In 2017, Wild Corporation reported a net loss of $70,000. Wild’s only net income adjustments were depreciation expense $81,000, and increase in accounts receivable $8,100. Compute Wild’s net cash provided (used) by operating activities.

> In June 2017, the board of directors for McElroy Enterprises Inc. authorized the sale of $10,000,000 of corporate bonds. Jennifer Grayson, treasurer for McElroy Enterprises Inc., is concerned about the date when the bonds are issued. The company really n

> Hendrickson Corporation reported net income of $50,000 in 2017. Depreciation expense was $17,000. The following working capital accounts changed. Accounts receivable…………………………….$11,000 increase Available-for-sale debt securities………….16,000 increase Inve

> Novak Corporation is preparing its 2017 statement of cash flows, using the indirect method. Presented below is a list of items that may affect the statement. Using the code below, indicate how each item will affect Novak’s 2017 statement of cash flows.

> Indicate the effect—Understate, Overstate, No Effect—that each of the following errors has on 2017 net income and 2018 net income. 2017 2018 (a) Equipment (with a useful life of 5 years) wa purchased and expensed

> In 2017, Bailey Corporation discovered that equipment purchased on January 1, 2015, for $50,000 was expensed at that time. The equipment should have been depreciated over 5 years, with no salvage value. The effective tax rate is 30%. Prepare Bailey’s 201

> Sesame Company purchased a computer system for $74,000 on January 1, 2016. It was depreciated based on a 7-year life and an $18,000 salvage value. On January 1, 2018, Sesame revised these estimates to a total useful life of 4 years and a salvage value of

> Shannon, Inc., changed from the LIFO cost flow assumption to the FIFO cost flow assumption in 2017. The increase in the prior year’s income before taxes is $1,200,000. The tax rate is 40%. Prepare Shannon’s 2017 journal entry to record the change in acco

> Simmons Corporation owns stock of Armstrong, Inc. Prior to 2017, the investment was accounted for using the equity method. In early 2017, Simmons sold part of its investment in Armstrong, and began using the fair value method. In 2017, Armstrong earned n

> The management of Utrillo Instrument Company had concluded, with the concurrence of its independent auditors, that results of operations would be more fairly presented if Utrillo changed its method of pricing inventory from last-in, first-out (LIFO) to a

> Oliver Corporation has owned stock of Conrad Corporation since 2014. At December 31, 2017, its balances related to this investment were: Equity Investments……………………………………………….$185,000 Fair Value Adjustment (AFS)……………………………….34,000 Dr. Accumulated Unrealiz

> Geiberger Corporation manufactures replicators. On January 1, 2017, it leased to Althaus Company a replicator that had cost $110,000 to manufacture. The lease agreement covers the 5-year useful life of the replicator and requires 5 equal annual rentals o

> Use the information for Indiana Jones Corporation from BE21-9. Assume that for Lost Ark Company, the lessor, collectibility is reasonably predictable, there are no important uncertainties concerning costs, and the carrying amount of the equipment is $202

> Nancy Tercek, the financial vice president, and Margaret Lilly, the controller, of Romine Manufacturing Company are reviewing the financial ratios of the company for the years 2017 and 2018. The financial vice president notes that the profit margin on sa

> Refer to the accounting change by Wertz Construction Company in BE22-1. Wertz has a profit-sharing plan, which pays all employees a bonus at year-end based on 1% of pretax income. Compute the indirect effect of Wertz’s change in accounting principle that

> Jennifer Brent Corporation owns equipment that cost $80,000 and has a useful life of 8 years with no salvage value. On January 1, 2017, Jennifer Brent leases the equipment to Donna Havaci Inc. for 1 year with one rental payment of $15,000 on January 1. P

> Use the information for IBM from BE21-6. Assume the direct-financing lease was recorded at a present value of $150,000. Prepare IBM’s December 31, 2017, entry to record interest. From BE21-6: Assume that IBM leased equipment that was carried at a cost o

> Assume that IBM leased equipment that was carried at a cost of $150,000 to Sharon Swander Company. The term of the lease is 6 years beginning January 1, 2017, with equal rental payments of $30,044 at the beginning of each year. All executory costs are pa

> Jana Kingston Corporation enters into a lease on January 1, 2017, that does not transfer ownership or contain a bargain-purchase option. It covers 3 years of the equipment’s 8-year useful life, and the present value of the minimum lease payments is less

> Use the information for Rick Kleckner Corporation from BE21-3. Assume that at December 31, 2017, Kleckner made an adjusting entry to accrue interest expense of $29,530 on the lease. Prepare Kleckner’s January 1, 2018, journal entry to record the second l

> On January 1, 2017, Millay Inc. paid $700,000 for 10,000 shares of Genso Company’s voting common stock, which was a 10% interest in Genso. At that date, the net assets of Genso totaled $6,000,000. The fair values of all of Genso’s identifiable assets and

> Rick Kleckner Corporation recorded a capital lease at $300,000 on January 1, 2017. The interest rate is 12%. Kleckner Corporation made the first lease payment of $53,920 on January 1, 2017. The lease requires eight annual payments. The equipment has a us

> Waterworld Company leased equipment from Costner Company. The lease term is 4 years and requires equal rental payments of $43,019 at the beginning of each year. The equipment has a fair value at the inception of the lease of $150,000, an estimated useful

> At the beginning of 2017, Wertz Construction Company changed from the completed-contract method to recognizing revenue over time (percentage-of-completion) for financial reporting purposes. The company will continue to use the completed-contract method f

> Whittier Construction Co. had followed the practice of expensing all materials assigned to a construction job without recognizing any salvage inventory. On December 31, 2017, it was determined that salvage inventory should be valued at $52,000. Of this a

> Koch Corporation is in the process of preparing its annual financial statements for the fiscal year ended April 30, 2018. Because all of Koch’s shares are traded intrastate, the company does not have to file any reports with the Securities and Exchange C

> What are the major sources of cash (inflows) in a statement of cash flows? What are the major uses (outflows) of cash?

> Explain the meaning of the following terms: a. commonsize analysis, b. vertical analysis, c. horizontal analysis, and d. percentage analysis.

> On January 2, 2017, $100,000 of 11%, 10-year bonds were issued for $97,000. The $3,000 discount was charged to Interest Expense. The bookkeeper, Mark Landis, records interest only on the interest payment dates of January 1 and July 1. What is the effect

> In January 2017, installation costs of $6,000 on new machinery were charged to Maintenance and Repairs Expense. Other costs of this machinery of $30,000 were correctly recorded and have been depreciated using the straight-line method with an estimated li

> Each of the following items must be considered in preparing a statement of cash flows for Blackwell Inc. for the year ended December 31, 2017. State where each item is to be shown in the statement, if at all. a. Plant assets that had cost $18,000 6½ yea

> Colbert Corporation had the following 2017 income statement. Revenues………$100,000 Expenses…………..60,000 $ 40,000

> Prior to 2017, Heberling Inc. excluded manufacturing overhead costs from work in process and finished goods inventory. These costs have been expensed as incurred. In 2017, the company decided to change its accounting methods for manufacturing inventories

> Broussard Company reported net income of $3.5 million in 2017. Depreciation for the year was $520,000, accounts receivable increased $500,000, and accounts payable increased $300,000. Compute net cash flow from operating activities using the indirect met

> Winston Industries and Ewing Inc. enter into an agreement that requires Ewing Inc. to build three diesel-electric engines to Winston’s specifications. Upon completion of the engines, Winston has agreed to lease them for a period of 10 years and to assume

> Cleveland Inc. leased a new crane to Abriendo Construction under a 5-year noncancelable contract starting January 1, 2017. Terms of the lease require payments of $33,000 each January 1, starting January 1, 2017. Cleveland will pay insurance, taxes, and m

> Glaus Leasing Company agrees to lease machinery to Jensen Corporation on January 1, 2017. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic l

> On January 1, 2017, Irwin Animation sold a truck to Peete Finance for $33,000 and immediately leased it back. The truck was carried on Irwin’s books at $28,000. The term of the lease is 5 years, and title transfers to Irwin at lease-end. The lease requir

> Matheny Inc. went public 3 years ago. The board of directors will be meeting shortly after the end of the year to decide on a dividend policy. In the past, growth has been financed primarily through the retention of earnings. A stock or a cash dividend h

> Cineplex Corporation is a diversified company that operates in five different industries: A, B, C, D, and E. The following information relating to each segment is available for 2018. Sales of segments B and C included intersegment sales of $20,000 and

> Dingel Corporation has contracted with you to prepare a statement of cash flows. The controller has provided the following information. Additional data related to 2017 are as follows. 1. Equipment that had cost $11,000 and was 30% depreciated at time

> An annual report of Crestwood Industries states, “The company and its subsidiaries have long-term leases expiring on various dates after December 31, 2017. Amounts payable under such commitments, without reduction for related rental income, are expected

> Comparative balance sheet accounts of Sharpe Company are presented below. Additional data: 1. Equipment that cost $10,000 and was 60% depreciated was sold in 2017. 2. Cash dividends were declared and paid during the year. 3. Common stock was issued

> You have been asked by a client to review the records of Roberts Company, a small manufacturer of precision tools and machines. Your client is interested in buying the business, and arrangements have been made for you to review the accounting records. Yo

> Shapiro Inc. was incorporated in 2016 to operate as a computer software service firm with an accounting fiscal year ending August 31. Shapiro’s primary product is a sophisticated online inventory-control system; its customers pay a fixed fee plus a usage

> On January 1, 2017, Cage Company contracts to lease equipment for 5 years, agreeing to make a payment of $137,899 (including the executory costs of $6,000) at the beginning of each year, starting January 1, 2017. The taxes, the insurance, and the mainten

> Chapman Company, a major retailer of bicycles and accessories, operates several stores and is a publicly traded company. The comparative balance sheet and income statement for Chapman as of May 31, 2017, are as follows. The company is preparing its state

> Ludwick Steel Company as lessee signed a lease agreement for equipment for 5 years, beginning December 31, 2017. Annual rental payments of $40,000 are to be made at the beginning of each lease year (December 31). The taxes, insurance, and the maintenance

> The following facts pertain to a noncancelable lease agreement between Faldo Leasing Company and Vance Company, a lessee. Inception date………………………………………January 1, 2017 Annual lease payment due at the beginning of each year, beginning with January 1, 201

> Aston Corporation performs year-end planning in November of each year before its calendar year ends in December. The preliminary estimated net income is $3 million. The CFO, Rita Warren, meets with the company president, J. B. Aston, to review the projec

> Penn Company is in the process of adjusting and correcting its books at the end of 2017. In reviewing its records, the following information is compiled. 1. Penn has failed to accrue sales commissions payable at the end of each of the last 2 years, as f

> Morlan Corporation is preparing its December 31, 2017, financial statements. Two events that occurred between December 31, 2017, and March 10, 2018, when the statements were authorized for issue, are described below. 1. A liability, estimated at $160,00

> Snider Corporation, a publicly traded company, is preparing the interim financial data which it will issue to its shareholders at the end of the first quarter of the 2017–2018 fiscal year. Snider’s financial accounting department has compiled the followi

> The financial statements of M&S are presented in Appendix E. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to M&S’s financial statements and the accompanying notes to answ

> Indiana Jones Corporation enters into a 6-year lease of equipment on January 1, 2017, which requires 6 annual payments of $40,000 each, beginning January 1, 2017. In addition, Indiana Jones guarantees the lessor a residual value of $20,000 at lease-end.

> As part of the year-end audit, you are discussing the disclosure checklist with your client. The checklist identifies the items that must be disclosed in a set of IFRS financial statements. The client is surprised by the disclosure item related to accoun

> Dingel Corporation has contracted with you to prepare a statement of cash flows. The controller has provided the following information. Additional data related to 2017 are as follows. 1. Equipment that had cost $11,000 and was 40% depreciated at time

> Comparative balance sheet accounts of Marcus Inc. are presented below. Additional data (ignoring taxes): 1. Net income for the year was $42,500. 2. Cash dividends declared and paid during the year were $21,125. 3. A 20% stock dividend was declared d

> Following are selected statement of financial position accounts of Sander Bros. Corp. at December 31, 2017 and 2016, and the increases or decreases in each account from 2016 to 2017. Also presented is selected income statement information for the year en

> The financial statements of M&S are presented in Appendix E. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to M&S’s financial statements and the accompanying notes to answ

> Daniel Hardware Co. is considering alternative financing arrangements for equipment used in its warehouses. Besides purchasing the equipment outright, Daniel is also considering a lease. Accounting for the outright purchase is fairly straightforward, but

> A lease agreement between Lennox Leasing Company and Gill Company is described in IFRS21-10. Refer to the data in IFRS21-10 and do the following for the lessor. Instructions (Round all numbers to the nearest cent.) a. Compute the amount of the lease

> The following facts pertain to a non-cancelable lease agreement between Lennox Leasing Company and Gill Company, a lessee. Inception date: May 1, 2017 Annual lease payment due at the beginning of each year, beginning with May 1, 2017: $18,829.49 Bargain-

> The financial statements of M&S are presented in Appendix E. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to M&S’s financial statements and the accompanying notes to ans

> The financial statements of M&S are presented in Appendix E. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to M&S’s financial statements and the accompanying notes to ans

> As part of the year-end accounting process and review of operating policies, Cullen Co. is considering a change in the accounting for its equipment from the straight-line method to an accelerated method. Your supervisor wonders how the company will repor

> As a certified public accountant, you have been contacted by Joe Davison, CEO of Sports-Pro Athletics, Inc., a manufacturer of a variety of athletic equipment. He has asked you how to account for the following changes. 1. Sports-Pro appropriately changed

> Joblonsky Inc. has recently hired a new independent auditor, Karen Ogleby, who says she wants “to get everything straightened out.” Consequently, she has proposed the following accounting changes in connection with Joblonsky Inc.’s 2017 financial stateme

> You have completed the field work in connection with your audit of Alexander Corporation for the year ended December 31, 2017. The balance sheet accounts at the beginning and end of the year are shown below. Your working papers from the audit contain

> Keystone Corporation’s financial statements for the year ended December 31, 2017, were authorized for issue on March 10, 2018. The following events took place early in 2018. a. On January 10, 10,000 ordinary shares of $5 par value were issued at $66 per

> Taveras Co. decides at the beginning of 2017 to adopt the FIFO method of inventory valuation. Taveras had used the LIFO method for financial reporting since its inception on January 1, 2015, and had maintained records adequate to apply the FIFO method re

> Pam Erickson Construction Company changed from the completed-contract to the percentage-of-completion method of accounting for long-term construction contracts during 2018. For tax purposes, the company employs the completed-contract method and will cont

> On January 1, 2017, Burke Corporation signed a 5-year noncancelable lease for a machine. The terms of the lease called for Burke to make annual payments of $8,668 at the beginning of each year, starting January 1, 2017. The machine has an estimated usefu

> Following are selected balance sheet accounts of Allman Bros. Corp. at December 31, 2017 and 2016, and the increases or decreases in each account from 2016 to 2017. Also presented is selected income statement information for the year ended December 31, 2

> Presented below are the comparative income and retained earnings statements for Denise Habbe Inc. for the years 2017 and 2018. The following additional information is provided: 1. In 2018, Denise Habbe Inc. decided to switch its depreciation method fr

> Kathleen Cole Inc. acquired the following assets in January of 2015. Equipment, estimated service life, 5 years; salvage value, $15,000………$525,000 Building, estimated service life, 30 years; no salvage value…………………$693,000 The equipment has been depreci

> Below is the net income of Anita Ferreri Instrument Co., a private corporation, computed under the three inventory methods using a periodic system. Instructions (Ignore tax considerations.) a. Assume that in 2018 Ferreri decided to change from the FI

> Gordon Company started operations on January 1, 2012, and has used the FIFO method of inventory valuation since its inception. In 2018, it decides to switch to the average-cost method. You are provided with the following information. Instructions a. W

> At January 1, 2017, Beidler Company reported retained earnings of $2,000,000. In 2017, Beidler discovered that 2016 depreciation expense was understated by $400,000. In 2017, net income was $900,000 and dividends declared were $250,000. The tax rate is 4

> Michaels Company had available at the end of 2017 the following information. Instructions Prepare a statement of cash flows for Michaels Company using the direct method accompanied by a reconciliation schedule. Assume the short-term investments are de

> The first audit of the books of Bruce Gingrich Company was made for the year ended December 31, 2018. In examining the books, the auditor found that certain items had been overlooked or incorrectly handled in the last 3 years. These items are: 1. At the

> Dan Aykroyd Corp. was a 30% owner of Steve Martin Company, holding 210,000 shares of Martin’s common stock on December 31, 2016. The investment account had the following entries. On January 2, 2017, Aykroyd sold 126,000 shares of Mart

> On January 1, 2017, Beyonce Co. purchased 25,000 shares (a 10% interest) in Elton John Corp. for $1,400,000. At the time, the book value and the fair value of John’s net assets were $13,000,000. On July 1, 2018, Beyonce paid $3,040,000

> Gerald Englehart Industries changed from the double-declining-balance to the straight-line method in 2018 on all its equipment. There was no change in the assets’ salvage values or useful lives. Plant assets, acquired on January 2, 2015, had an original

> The before-tax income for Lonnie Holdiman Co. for 2017 was $101,000 and $77,400 for 2018. However, the accountant noted that the following errors had been made: 1. Sales for 2017 included amounts of $38,200 which had been received in cash during 2017, b

> A partial trial balance of Julie Hartsack Corporation is as follows on December 31, 2018. Additional adjusting data: 1. A physical count of supplies on hand on December 31, 2018, totaled $1,100. 2. Through oversight, the Salaries and Wages Payable ac

> Peter Henning Tool Company’s December 31 year-end financial statements contained the following errors. An insurance premium of $66,000 was prepaid in 2017 covering the years 2017, 2018, and 2019. The entire amount was charged to expen

> The reported net incomes for the first 2 years of Sandra Gustafson Products, Inc., were as follows: 2017, $147,000; 2018, $185,000. Early in 2019, the following errors were discovered. 1. Depreciation of equipment for 2017 was overstated $17,000. 2. De

> The following are four independent situations. a. On December 31, 2017, Zarle Inc. sold computer equipment to Daniell Co. and immediately leased it back for 10 years. The sales price of the equipment was $520,000, its carrying amount is $400,000, and it

> Assume that on January 1, 2017, Elmer’s Restaurants sells a computer system to Liquidity Finance Co. for $680,000 and immediately leases the computer system back. The relevant information is as follows. 1. The computer was carried on Elmer’s books at a

> The following are Sullivan Corp.’s comparative balance sheet accounts at December 31, 2017 and 2016, with a column showing the increase (decrease) from 2016 to 2017. Additional information: 1. On December 31, 2016, Sullivan acquire