Definition of Internal Rate Of Return

The internal rate of return (IRR) is the financial analysis to calculate the projected profit made on potential investments or projects started by the company. The term Internal states the fact that the calculations of NPV exclude external factors like risk-free rate, financial risk, the cost of capital, or inflation. In simple words, it is the rate of return which a company is looking forward to being earned on the projects or investments done by the company.

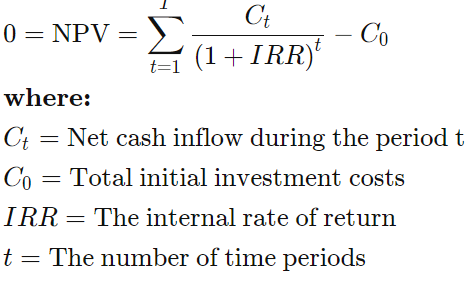

Formula of Internal Rate of Return (IRR):

View More Cost Accounting Definitions

Related Questions of Internal Rate Of Return

You are an audit supervisor assigned to a new client, Go

You recently went to work for Allied Components Company, a supplier

Wendell’s Donut Shoppe is investigating the purchase of a new $18

Casey Nelson is a divisional manager for Pigeon Company. His annual

Henrie’s Drapery Service is investigating the purchase of a new machine for

What are the advantages and disadvantages of the internal rate of return

The Elberta Fruit Farm of Ontario always has hired transient workers to

Write down the equation defining a project’s internal rate of return (

Explain how the cost of capital serves as a screening tool when

It is sometimes stated that “the internal rate of return approach

Show All