Question: You recently went to work for Allied

You recently went to work for Allied Components Company, a supplier of auto repair parts used in the after-market with products from Daimler, Chrysler, Ford, and other automakers. Your boss, the chief financial officer (CFO), has just handed you the estimated cash flows for two proposed projects. Project L involves adding a new item to the firm’s ignition system line; it would take some time to build up the market for this product, so the cash inflows would increase over time. Project S involves an add-on to an existing line, and its cash flows would decrease over time. Both projects have 3-year lives because Allied is planning to introduce entirely new models after 3 years.

Here are the projects’ net cash flows (in thousands of dollars):

Depreciation, salvage values, net working capital requirements, and tax effects are all included in these cash flows.

The CFO also made subjective risk assessments of each project, and he concluded that both projects have risk characteristics that are similar to the firm’s average project. Allied’s WACC is 10%. You must determine whether one or both of the projects should be accepted.

a. What is capital budgeting? Are there any similarities between a firm’s capital budgeting decisions and an individual’s investment decisions?

b. What is the difference between independent and mutually exclusive projects? Between projects with normal and non-normal cash flows?

c. (1) Define the term net present value (NPV). What is each project’s NPV?

(2) What is the rationale behind the NPV method? According to NPV, which project(s) should be accepted if they are independent? mutually exclusive?

(3) Would the NPVs change if the WACC changed? Explain.

d. (1) Define the term internal rate of return (IRR). What is each project’s IRR?

(2) How is the IRR on a project related to the YTM on a bond?

(3) What is the logic behind the IRR method? According to IRR, which project(s) should be accepted if they are independent? mutually exclusive?

(4) Would the projects’ IRRs change if the WACC changed?

e. (1) Draw NPV profiles for Projects L and S. At what discount rate do the profiles cross?

(2) Look at your NPV profile graph without referring to the actual NPVs and IRRs. Which project(s) should be accepted if they are independent? mutually exclusive? Explain. Are your answers correct at any WACC less than 23.6%?

f. (1) What is the underlying cause of ranking conflicts between NPV and IRR?

(2) What is the reinvestment rate assumption, and how does it affect the NPV versus IRR conflict?

(3) Which method is best? Why?

g. (1) Define the term modified IRR (MIRR). Find the MIRRs for Projects L and S.

(2) What are the MIRR’s advantages and disadvantages vis-à -vis the NPV?

h. (1) What is the payback period? Find the paybacks for Projects L and S.

(2) What is the rationale for the payback method? According to the payback criterion, which project(s) should be accepted if the firm’s maximum acceptable payback is 2 years, if Projects L and S are independent, if Projects L and S are mutually exclusive?

(3) What is the difference between the regular and discounted payback methods?

(4) What are the two main disadvantages of discounted payback? Is the payback method of any real usefulness in capital budgeting decisions? Explain.

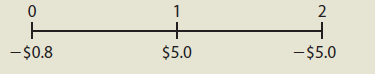

i. As a separate project (Project P), the firm is considering sponsoring a pavilion at the upcoming World’s Fair. The pavilion would cost $800,000, and it is expected to result in $5 million of incremental cash inflows during its 1 year of operation. However, it would then take another year, and $5 million of costs, to demolish the site and return it to its original condition. Thus, Project P’s expected net cash flows look like this (in millions of dollars):

The project is estimated to be of average risk, so its WACC is 10%.

(1) What is Project P’s NPV? What is its IRR? its MIRR?

(2) Draw Project P’s NPV profile. Does Project P have normal or non normal cash flows? Should this project be accepted? Explain.

Transcribed Image Text:

2 + $60 $50 3 -$100 -$100 $10 $70 $80 Project L Project S $20 2 -$0.8 $5.0 -$5.0

> In late 1980, the U.S. Commerce Department released new data showing inflation was 15%. At the time, the prime rate of interest was 21%, a record high. However, many investors expected the new Reagan administration to be more effective in controlling inf

> You must evaluate a proposal to buy a new milling machine. The base price is $108,000, and shipping and installation costs would add another $12,500. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $65,000. The appli

> You must evaluate a proposed spectrometer for the R&D Department. The base price is $140,000, and it would cost another $30,000 to modify the equipment for special use by the firm. The equipment falls into the MACRS 3-year class and would be sold after 3

> Kristin is evaluating a capital budgeting project that should last 4 years. The project requires $800,000 of equipment. She is unsure what depreciation method to use in her analysis, straight-line or the 3-year MACRS accelerated method. Under straight-li

> Corcoran Consulting is deciding which of two computer systems to purchase. It can purchase state-of-the-art equipment (System A) for $20,000, which will generate cash flows of $6,000 at the end of each of the next 6 years. Alternatively, the company can

> The Chang Company is considering the purchase of a new machine to replace an obsolete one. The machine being used for the operation has a book value and a market value of zero. However, the machine is in good working order and will last at least another

> Eisenhower Communications is trying to estimate the first-year net cash flow (at Year 1) for a proposed project. The financial staff has collected the following information on the project: The company has a 40% tax rate, and its WACC is 10%. a. What is

> Truman Industries is considering an expansion. The necessary equipment would be purchased for $9 million, and the expansion would require an additional $3 million investment in working capital. The tax rate is 40%. a. What is the initial investment outla

> The Bigbee Bottling Company is contemplating the replacement of one of its bottling machines with a newer and more efficient one. The old machine has a book value of $600,000 and a remaining useful life of 5 years. The firm does not expect to realize any

> The Erley Equipment Company purchased a machine 5 years ago at a cost of $90,000. The machine had an expected life of 10 years at the time of purchase, and it is being depreciated by the straight-line method by $9,000 per year. If the machine is not repl

> Holmes Manufacturing is considering a new machine that costs $250,000 and would reduce pretax manufacturing costs by $90,000 annually. Holmes would use the 3-year MACRS method to depreciate the machine, and management thinks the machine would have a valu

> Suppose the inflation rate is expected to be 7% next year, 5% the following year, and 3% thereafter. Assume that the real risk-free rate, r*, will remain at 2% and that maturity risk premiums on Treasury securities rise from zero on very short-term bonds

> Your firm, Agrico Products, is considering a tractor that would have a net cost of $36,000, would increase pretax operating cash flows before taking account of depreciation by $12,000 per year, and would be depreciated on a straight-line basis to zero ov

> A firm has two mutually exclusive investment projects to evaluate; both can be repeated indefinitely. The projects have the following cash flows: Projects X and Y are equally risky and may be repeated indefinitely. If the firm’s WACC i

> The Fernandez Company has an opportunity to invest in one of two mutually exclusive machines that will produce a product the company will need for the next 8 years. Machine A costs $10 million but will provide after-tax inflows of $4 million per year for

> Zappe Airlines is considering two alternative planes. Plane A has an expected life of 5 years, will cost $100 million, and will produce after-tax cash flows of $30 million per year. Plane B has a life of 10 years, will cost $132 million, and will produce

> Cotner Clothes Inc. is considering the replacement of its old, fully depreciated knitting machine. Two new models are available: (a) Machine 190-3, which has a cost of $190,000, a 3-year expected life, and after-tax cash flows (labor savings and depreci

> Haley’s Graphic Designs Inc. is considering two mutually exclusive projects. Both projects require an initial investment of $10,000 and are typical average-risk projects for the firm. Project A has an expected life of 2 years with after-tax cash inflows

> Allied Food Products is considering expanding into the fruit juice business with a new fresh lemon juice product. Assume that you were recently hired as assistant to the director of capital budgeting and you must evaluate the new project. The lemon juic

> You must analyze a potential new product—a caulking compound that Cory Materials’ R&D people developed for use in the residential construction industry. Cory’s marketing manager thinks the company can sell 115,000 tubes per year for 3 years at a price of

> What is a mutually exclusive project? How should managers rank mutually exclusive projects?

> What are three potential flaws with the regular payback method? Does the discounted payback method correct all three flaws? Explain.

> A 5-year Treasury bond has a 5.2% yield. A 10-year Treasury bond yields 6.4%, and a 10-year corporate bond yields 8.4%. The market expects that inflation will average 2.5% over the next 10 years (IP10 ¼ 2.5%). Assume that there is no maturity risk premiu

> How are project classifications used in the capital budgeting process?

> A firm has a $100 million capital budget. It is considering two projects, each costing $100 million. Project A has an IRR of 20%; has an NPV of $9 million; and will be terminated after 1 year at a profit of $20 million, resulting in an immediate increase

> What reinvestment rate assumptions are built into the NPV, IRR, and MIRR methods? Give an explanation (other than “because the text says so”) for your answer.

> Project X is very risky and has an NPV of $3 million. Project Y is very safe and has an NPV of $2.5 million. They are mutually exclusive, and project risk has been properly considered in the NPV analyses. Which project should be chosen? Explain.

> Why might it be rational for a small firm that does not have access to the capital markets to use the payback method rather than the NPV method?

> Discuss the following statement: If a firm has only independent projects, a constant WACC, and projects with normal cash flows, the NPV and IRR methods will always lead to identical capital budgeting decisions. What does this imply about the choice betwe

> If two mutually exclusive projects were being compared, would a high cost of capital favor the longer-term or the shorter-term project? Why? If the cost of capital declined, would that lead firms to invest more in longer-term projects or shorter-term pro

> An electric utility is considering a new power plant in northern Arizona. Power from the plant would be sold in the Phoenix area, where it is badly needed. Because the firm has received a permit, the plant would be legal; but it would cause some air poll

> A mining company is considering a new project. Because the mine has received a permit, the project would be legal; but it would cause significant harm to a nearby river. The firm could spend an additional $10 million at Year 0 to mitigate the environment

> A firm with a 14% WACC is evaluating two projects for this year’s capital budget. After-tax cash flows, including depreciation, are as follows: a. Calculate NPV, IRR, MIRR, payback, and discounted payback for each project. b. Assuming

> Which fluctuate more—long-term or short-term interest rates? Why?

> Your division is considering two projects with the following net cash flows (in millions): a. What are the projects’ NPVs assuming the WACC is 5%? 10%? 15%? b. What are the projects’ IRRs at each of these WACCs? c. If

> Refer to Problem 11-1. What is the project’s discounted payback? Problem 11-1 Project K costs $52,125, its expected net cash inflows are $12,000 per year for 8 years, and its WACC is 12%.

> MIRR Refer to Problem 11-1. What is the project’s MIRR? Problem 11-1 Project K costs $52,125, its expected net cash inflows are $12,000 per year for 8 years, and its WACC is 12%.

> A project has the following cash flows: This project requires two outflows at Years 0 and 2, but the remaining cash flows are positive. Its WACC is 10%, and its MIRR is 14.14%. What is the Year 2 cash outflow? 1 2 4 + $196 + -$500 $202 -$X $350 $451

> Project X costs $1,000, and its cash flows are the same in Years 1 through 10. Its IRR is 12%, and its WACC is 10%. What is the project’s MIRR?

> A project has annual cash flows of $7,500 for the next 10 years and then $10,000 each year for the following 10 years. The IRR of this 20-year project is 10.98%. If the firm’s WACC is 9%, what is the project’s NPV?

> A mining company is deciding whether to open a strip mine, which costs $2 million. Net cash inflows of $13 million would occur at the end of Year 1. The land must be returned to its natural state at a cost of $12 million, payable at the end of Year 2. a.

> A store has 5 years remaining on its lease in a mall. Rent is $2,000 per month, 60 payments remain, and the next payment is due in 1 month. The mall’s owner plans to sell the property in a year and wants rent at that time to be high so that the property

> A company has a 12% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following net cash flows: a. What is each project’s NPV? b. What is each project’s IRR? c. What is each

> A company is considering two mutually exclusive expansion plans. Plan A requires a $40 million expenditure on a large-scale integrated plant that would provide expected cash flows of $6.4 million per year for 20 years. Plan B requires a $12 million expen

> Assume that the real risk-free rate is 2% and that the maturity risk premium is zero. If the 1-year bond yield is 5% and a 2-year bond (of similar risk) yields 7%, what is the 1-year interest rate that is expected for Year 2? What inflation rate is expec

> An oil drilling company must choose between two mutually exclusive extraction projects, and each costs $12 million. Under Plan A, all the oil would be extracted in 1 year, producing a cash flow at t = 1 of $14.4 million. Under Plan B, cash flows would be

> K. Kim Inc. must install a new air conditioning unit in its main plant. Kim must install one or the other of the units; otherwise, the highly profitable plant would have to shut down. Two units are available, HCC and LCC (for high and low capital costs,

> A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: The company’s WACC is 10%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.)

> Project S costs $15,000, and its expected cash flows would be $4,500 per year for 5 years. Mutually exclusive Project L costs $37,500, and its expected cash flows would be $11,100 per year for 5 years. If both projects have a WACC of 14%, which project w

> Your division is considering two projects. Its WACC is 10%, and the projects’ after-tax cash flows (in millions of dollars) would be as follows: a. Calculate the projects’ NPVs, IRRs, MIRRs, regular paybacks, and disc

> The WACC is a weighted average of the costs of debt, preferred stock, and common equity. Would the WACC be different if the equity for the coming year came solely in the form of retained earnings versus some equity from the sale of new common stock? Wou

> Suppose a firm estimates its WACC to be 10%. Should the WACC be used to evaluate all of its potential projects, even if they vary in risk? If not, what might be “reasonable” costs of capital for average-, high-, and low-risk projects?

> How should the capital structure weights used to calculate the WACC be determined?

> Suppose 2-year Treasury bonds yield 4.5%, while 1-year bonds yield 3%. r* is 1%, and the maturity risk premium is zero. a. Using the expectations theory, what is the yield on a 1-year bond 1 year from now? b. What is the expected inflation rate in Year 1

> Suppose a new and more liberal Congress and administration are elected. Their first order of business is to take away the independence of the Federal Reserve System and to force the Fed to greatly expand the money supply. What effect will this have: a. O

> Donna Jamison, a 2003 graduate of the University of Florida with 4 years of banking experience, was recently brought in as assistant to the chairperson of the board of D’Leon Inc., a small food producer that operates in north Florida an

> An investment will pay $100 at the end of each of the next 3 years, $200 at the end of Year 4, $300 at the end of Year 5, and $500 at the end of Year 6. If other investments of equal risk earn 8% annually, what is its present value? Its future value?

> What’s the future value of a 7%, 5-year ordinary annuity that pays $300 each year? If this was an annuity due, what would its future value be?

> Should stockholder wealth maximization be thought of as a long-term or a short-term goal? For example, if one action increases a firm’s stock price from a current level of $20 to $25 in 6 months and then to $30 in 5 years but another action keeps the sto

> You have $42,180.53 in a brokerage account, and you plan to deposit an additional $5,000 at the end of every future year until your account totals $250,000. You expect to earn 12% annually on the account. How many years will it take to reach your goal?

> If you deposit $10,000 in a bank account that pays 10% interest annually, how much will be in your account after 5 years?

> A father is now planning a savings program to put his daughter through college. She is 13, she plans to enroll at the university in 5 years, and she should graduate in 4 years. Currently, the annual cost (for everything—food, clothing, tuition, books, tr

> Your father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants a fixed retirement income that has the same purchasing power at the time he retires as $40,000 has today. (The real value

> It is now December 31, 2008 (t = 0), and a jury just found in favor of a woman who sued the city for injuries sustained in a January 2007 accident. She requested recovery of lost wages plus $100,000 for pain and suffering plus $20,000 for legal expenses.

> Simon recently received a credit card with an 18% nominal interest rate. With the card, he purchased a new stereo for $350. The minimum payment on the card is only $10 per month. a. If Simon makes the minimum monthly payment and makes no other charges, h

> a. You plan to make five deposits of $1,000 each, one every 6 months, with the first payment being made in 6 months. You will then make no more deposits. If the bank pays 4% nominal interest, compounded semiannually, how much will be in your account afte

> Laiho Industries’ 2007 and 2008 balance sheets (in thousands of dollars) are shown. a. Sales for 2008 were $455,150,000, and EBITDA was 15% of sales. Furthermore, depreciation and amortization were 11% of net fixed assets, interest was

> What is a loan amortization schedule, and what are some ways these schedules are used?

> You want to buy a house that costs $100,000. You have $10,000 for a down payment, but your credit is such that mortgage companies will not lend you the required $90,000. However, the realtor persuades the seller to take a $90,000 mortgage (called a selle

> a. Set up an amortization schedule for a $25,000 loan to be repaid in equal installments at the end of each of the next 3 years. The interest rate is 10% compounded annually. b. What percentage of the payment represents interest and what percentage repre

> You want to buy a house within 3 years, and you are currently saving for the down payment. You plan to save $5,000 at the end of the first year, and you anticipate that your annual savings will increase by 10% annually thereafter. Your expected annual re

> What are the four forms of business organization? What are the advantages and disadvantages of each?

> Six years from today you need $10,000. You plan to deposit $1,500 annually, with the first payment to be made a year from today, in an account that pays an 8% effective annual rate. Your last deposit, which will occur at the end of Year 6, will be for le

> Starting next year, you will need $10,000 annually for 4 years to complete your education. (One year from today you will withdraw the first $10,000.) Your uncle deposits an amount today in a bank paying 5% annual interest, which will provide the needed $

> Erika and Kitty, who are twins, just received $30,000 each for their 25th birthday. They both have aspirations to become millionaires. Each plans to make a $5,000 annual contribution to her “early retirement fund” on her birthday, beginning a year from t

> Your firm sells for cash only; but it is thinking of offering credit, allowing customers 90 days to pay. Customers understand the time value of money, so they would all wait and pay on the 90th day. To carry these receivables, you would have to borrow fu

> As a jewelry store manager, you want to offer credit, with interest on outstanding balances paid monthly. To carry receivables, you must borrow funds from your bank at a nominal 6%, monthly compounding. To offset your overhead, you want to charge your cu

> Indicate whether the following instruments are examples of money market or capital market securities. a. U.S. Treasury bills b. Long-term corporate bonds c. Common stocks d. Preferred stocks e. Dealer commercial paper

> Bank A pays 4% interest compounded annually on deposits, while Bank B pays 3.5% compounded daily. a. Based on the EAR (or EFF%), which bank should you use? b. Could your choice of banks be influenced by the fact that you might want to with draw your fund

> Banks and other lenders are required to disclose a rate called the APR. What is this rate? Why did Congress require that it be disclosed? Is it the same as the effective annual rate? If you were comparing the costs of loans from different lenders, could

> You have saved $4,000 for a down payment on a new car. The largest monthly payment you can afford is $350. The loan will have a 12% APR based on end-of-month payments. What is the most expensive car you can afford if you finance it for 48 months? for 60

> Find the future values of the following ordinary annuities: a. FV of $400 paid each 6 months for 5 years at a nominal rate of 12% compounded semiannually b. FV of $200 paid each 3 months for 5 years at a nominal rate of 12%compounded quarterly c. These a

> Find the present value of $500 due in the future under each of these conditions: a. 12% nominal rate, semiannual compounding, discounted back 5 years b. 12% nominal rate, quarterly compounding, discounted back 5 years c. 12% nominal rate, monthly compoun

> Find the amount to which $500 will grow under each of these conditions: a. 12% compounded annually for 5 years b. 12% compounded semiannually for 5 years c. 12% compounded quarterly for 5 years d. 12% compounded monthly for 5 years e. 12% compounded dail

> If a company’s board of directors wants management to maximize shareholder wealth, should the CEO’s compensation be set as a fixed dollar amount, or should the compensation depend on how well the firm performs? If it is to be based on performance, how sh

> Jan sold her house on December 31 and took a $10,000 mortgage as part of the payment. The 10-year mortgage has a 10% nominal interest rate, but it calls for semiannual payments beginning next June 30. Next year Jan must report on Schedule B of her IRS Fo

> You have applied for a job with a local bank. As part of its evaluation process, you must take an examination on time value of money analysis covering the following questions: a. Draw time lines for (1) A $100 lump sum cash flow at the end of Year 2; (

> Answer the following questions: a. Assuming a rate of 10% annually, find the FV of $1,000 after 5 years. b. What is the investment’s FV at rates of 0%, 5%, and 20% after 0, 1, 2, 3, 4, and 5 years? c. Find the PV of $1,000 due in 5 year

> Describe the different ways in which capital can be transferred from suppliers of capital to those who are demanding capital.

> Over the past year, M. D. Ryngaert & Co. had an increase in its current ratio and a decline in its total assets turnover ratio. However, the company’s sales, cash and equivalents, DSO, and fixed assets turnover ratio remained constant. What balance sheet

> Why would the inventory turnover ratio be more important for someone analyzing a grocery store chain than an insurance company?

> If a firm’s earnings per share grew from $1 to $2 over a 10-year period, the total growth would be 100%, but the annual growth rate would be less than 10%. True or false? Explain.

> Financial ratio analysis is conducted by three main groups of analysts: credit analysts, stock analysts, and managers. What is the primary emphasis of each group, and how would that emphasis affect the ratios they focus on?

> Indicate the effects of the transactions listed in the following table on total current assets, current ratio, and net income. Use (+) to indicate an increase, (−) to indicate a decrease, and (0) to indicate either no effect or an indet

> Suppose you were comparing a discount merchandiser with a high-end merchandiser. Suppose further that both companies had identical ROEs. If you applied the DuPont equation to both firms, would you expect the three components to be the same for each compa

> Why is it sometimes misleading to compare a company’s financial ratios with those of other firms that operate in the same industry?

> Give some examples that illustrate how (a) Seasonal factors and (b) Different growth rates might distort a comparative ratio analysis. How might these problems be alleviated?

> Is it better for a firm’s actual stock price in the market to be under, over, or equal to its intrinsic value? Would your answer be the same from the standpoints of stockholders in general and a CEO who is about to exercise a million dollars in options a

> If a firm’s ROE is low and management wants to improve it, explain how using more debt might help.

> How does a cost-efficient capital market help reduce the prices of goods and services?