Definition of Weighted Average Cost Of Capital

The weighted average cost of capital or WACC is the average total cost of raising funds for a particular project with weights allocated based on the sum of market values of all the funds. Normally the funds are raised from two primary sources; debt and equity. A third source can also be used for raising funds that are preferred stock.

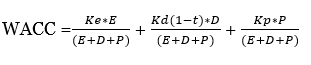

The formula of WACC is as follows:

Ke = Cost of Equity = Dividend / Market value of share

Kd (1-t) = After tax interest cost on debt

Kp = Preferred dividend percentage

E = Market value of Equity

D = Market value of Debt

P = Market value of Preferred stock

(E+D+P) = Sum of market values of all the funds

View More Corporate Finance Definitions

Related Questions of Weighted Average Cost Of Capital

Roybus, Inc., a manufacturer of flash memory, just reported

Nina Corp. uses no debt. The weighted average cost of

Sora Industries has 60 million outstanding shares, $120 million in

Heavy Metal Corporation is expected to generate the following free cash flows

Williamson, Inc., has a debt–equity ratio of 2

The Alpha One Software Corporation was organized to develop software products that

Bolero, Inc., has compiled the following information on its financing

Fama’s Llamas has a weighted average cost of capital of 9.

Hatfield Medical Supplies’ stock price had been lagging its industry averages,

Swishing Shoe Company of Durham, North Carolina, has received an

Show All