Question: Hatfield Medical Supplies’ stock price had been

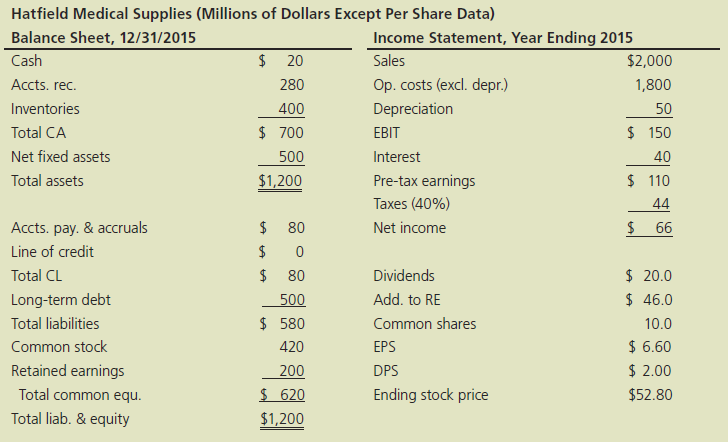

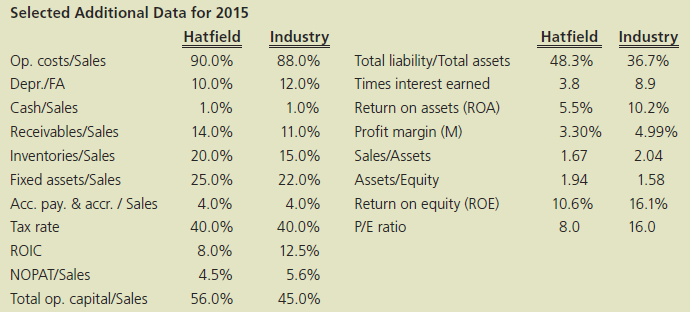

Hatfield Medical Supplies’ stock price had been lagging its industry averages, so its board of directors brought in a new CEO, Jaiden Lee. Lee had brought in Ashley Novak, a finance MBA who had been working for a consulting company, to replace the old CFO, and Lee asked Ashley to develop the financial planning section of the strategic plan. In her previous job, Novak’s primary task had been to help clients develop financial forecasts, and that was one reason Lee hired her.

Novak began by comparing Hatfield’s financial ratios to the industry averages. If any ratio was substandard, she discussed it with the responsible manager to see what could be done to improve the situation. The following data show Hatfield’s latest financial statements plus some ratios and other data that Novak plans to use in her analysis.

a. Using Hatfield’s data and its industry averages, how well run would you say Hatfield appears to be compared to other firms in its industry? What are its primary strengths and weaknesses? Be specific in your answer, and point to various ratios that support your position. Also, use the DuPont equation (see Chapter 7) as one part of your analysis.

b. Use the AFN equation to estimate Hatfield’s required new external capital for 2016 if the sales growth rate is 10%. Assume that the firm’s 2015 ratios will remain the same in 2016. (Hint: Hatfield was operating at full capacity in 2015.)

c. Define the term capital intensity. Explain how a decline in capital intensity would affect the AFN, other things held constant. Would economies of scale combined with rapid growth affect capital intensity, other things held constant? Also, explain how changes in each of the following would affect AFN, holding other things constant: the growth rate, the amount of accounts payable, the profit margin, and the payout ratio.

d. Define the term self-supporting growth rate. What is Hatfield’s self-supporting growth rate? Would the self-supporting growth rate be affected by a change in the capital intensity ratio or the other factors mentioned in the previous question? Other things held constant, would the calculated capital intensity ratio change over time if the company were growing and were also subject to economies of scale and/or lumpy assets?

e. Use the following assumptions to answer the questions below :(1) Operating ratios remain unchanged. (2) Sales will grow by 10%, 8%, 5%, and 5% for the next 4 years. (3) The target weighted average cost of capital (WACC) is 9%. This is the No Change scenario because operations remain unchanged.

(1) For each of the next 4 years, forecast the following items: sales, cash, accounts receivable, inventories, net fixed assets, accounts payable & accruals, operating costs (excluding depreciation), depreciation, and earnings before interest and taxes (EBIT).

(2) Using the previously forecasted items, calculate for each of the next 4 years the net operating profit after taxes (NOPAT), net operating working capital, total operating capital, free cash flow, (FCF), annual growth rate in FCF, and return on invested capital. What does the forecasted free cash flow in the first year imply about the need for external financing? Compare the forecasted ROIC with the WACC. What does this imply about how well the company is performing?

(3) Assume that FCF will continue to grow at the growth rate for the last year in the forecast horizon (Hint: gL = 5%). What is the horizon value at 2019? What is the present value of the horizon value? What is the present value of the forecasted FCF? (Hint: Use the free cash flows for 2016 through 2019.) What is the current value of operations? Using information from the 2015 financial statements, what is the current estimated intrinsic stock price?

f. Continue with the same assumptions for the No Change scenario from the previous question, but now forecast the balance sheet and income statements for 2016 (but not for the following 3 years) using the following preliminary financial policy. (1) Regular dividends will grow by 10%. (2) No additional long-term debt or common stock will be issued. (3) The interest rate on all debt is 8%. (4) Interest expense for long-term debt is based on the average balance during the year. (5) If the operating results and the preliminary financing plan cause a financing deficit, eliminate the deficit by drawing on a line of credit. The line of credit would be tapped on the last day of the year, so it would create no additional interest expenses for that year. (6) If there is a financing surplus, eliminate it by paying a special dividend. After forecasting the 2016 financial statements, answer the following questions.

(1) How much will Hatfield need to draw on the line of credit?

(2) What are some alternative ways than those in the preliminary financial policy that Hatfield might choose to eliminate the financing deficit?

g. Repeat the analysis performed the previous question, but now assume that Hatfield is able to improve the following inputs: (1) reduce operating costs (excluding depreciation)/sales to 89.5% at a cost of $40 million; and (2) reduce inventories/ sales to 16% at a cost of $10 million. This is the Improve scenario.

(1) Should Hatfield implement the plans? How much value would they add to the company?

(2) How much can Hatfield pay as a special dividend in the Improve scenario? What else might Hatfield do with the financing surplus?

Transcribed Image Text:

Hatfield Medical Supplies (Millions of Dollars Except Per Share Data) Balance Sheet, 12/31/2015 Income Statement, Year Ending 2015 Cash $ 20 Sales $2,000 Accts. rec. 280 Op. costs (excl. depr.) 1,800 Inventories 400 Depreciation 50 Total CA $ 700 ЕBIT $ 150 Net fixed assets 500 Interest 40 Total assets $1,200 Pre-tax earnings $ 110 Taxes (40%) 44 Accts. pay. & accruals $ 80 Net income 66 Line of credit 2$ $ 20.0 $ 46.0 Total CL 2$ 80 Dividends Long-term debt 500 Add. to RE Total liabilities $ 580 Common shares 10.0 Common stock 420 ЕPS $ 6.60 Retained earnings 200 DPS $ 2.00 Total common equ. $ 620 Ending stock price $52.80 Total liab. & equity $1,200 Selected Additional Data for 2015 Hatfield Industry Hatfield Industry Op. costs/Sales 90.0% 88.0% Total liability/Total assets 48.3% 36.7% Depr./FA 10.0% 12.0% Times interest earned 3.8 8.9 Cash/Sales 1.0% 1.0% Return on assets (ROA) 5.5% 10.2% Receivables/Sales 14.0% 11.0% Profit margin (M) 3.30% 4.99% Inventories/Sales 20.0% 15.0% Sales/Assets 1.67 2.04 Fixed assets/Sales 25.0% 22.0% Assets/equity 1.94 1.58 Acc. pay. & accr. / Sales 4.0% 4.0% Return on equity (ROE) 10.6% 16.1% Tax rate 40.0% 40.0% P/E ratio 8.0 16.0 ROIC 8.0% 12.5% NOPAT/Sales 4.5% 5.6% Total op. capital/Sales 56.0% 45.0%

> The Booth Company’s sales are forecasted to double from $1,000 in 2015 to $2,000 in 2016.Here is the December 31, 2015, balance sheet: Booth’s fixed assets were used to only 50% of capacity during 2015, but its current

> How would each of the factors in the following table affect a firm’s cost of debt, rd(1 2 T); its cost of equity, rs; and its weighted average cost of capital, WACC? Indicate by a plus (1), a minus (2), or a zero (0) if the factor would

> At year-end 2015, Wallace Landscaping’s total assets were $2.17 million and its accounts payable were $560,000. Sales, which in 2015 were $3.5 million, are expected to increase by 35% in 2016. Total assets and accounts payable are proportional to sales,

> Maggie’s Muffins Inc. generated $5,000,000 in sales during 2015, and its year-end total assets were $2,500,000. Also, at year-end 2015, current liabilities were $1,000,000, consisting of $300,000 of notes payable, $500,000 of accounts payable, and $200,0

> Refer to Problem 12-1. What is the project’s MIRR? Problem 12-1: A project has an initial cost of $40,000, expected net cash inflows of $9,000 per year for 7 years, and a cost of capital of 11%.

> The financial staff of Cairn Communications has identified the following information for the first year of the roll-out of its new proposed service: The Company faces a 40% tax rate. What is the project’s operating cash flow for the fir

> Broussard Skateboard’s sales are expected to increase by 15% from $8 million in 2015 to $9.2 million in 2016. Its assets totaled $5 million at the end of 2015. Broussard is already at full capacity, so its assets must grow at the same rate as projected s

> Pettit Printing Company has a total market value of $100 million, consisting of 1 million shares selling for $50 per share and $50 million of 10% perpetual bonds now selling at par. The company’s EBIT is $13.24 million, and its tax rate is 15%. Pettit ca

> The Rivoli Company has no debt outstanding, and its financial position is given by the following data: The firm is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 30% debt based on mark

> Schweser Satellites Inc. produces satellite earth stations that sell for $100,000 each. The firm’s fixed costs, F, are $2 million, 50 earth stations are produced and sold each year, profits total $500,000, and the firm’s assets (all equity financed) are

> Dye Trucking raised $150 million in new debt and used this to buy back stock. After the recap, Dye’s stock price is $7.50. If Dye had 60 million shares of stock before the recap, how many shares does it have after the recap?

> Lee Manufacturing’s value of operations is equal to $900 million after a recapitalization. (The firm had no debt before the recap.) Lee raised $300 million in new debt and used this to buy back stock. Lee had no short-term investments before or after the

> Define each of the following terms: a. Weighted average cost of capital, WACC; after-tax cost of debt, rd(1 - T); after-tax cost of short-term debt, rstd(1 - T) b. Cost of preferred stock, rps; cost of common equity (or cost of common stock), rs c. Ta

> Nichols Corporation’s value of operations is equal to $500 million after a recapitalization (the firm had no debt before the recap). It raised $200 million in new debt and used this to buy back stock. Nichols had no short-term investments before or after

> Ethier Enterprise has an unlevered beta of 1.0. Ethier is financed with 50% debt and has a levered beta of 1.6. If the risk-free rate is 5.5% and the market risk premium is 6%, how much is the additional premium that Ethier’s shareholders require to be c

> Unlevered Beta Counts Accounting has a beta of 1.15. The tax rate is 40%, and Counts is financed with 20% debt. What is Counts’ unlevered beta?

> Start with the partial model in the file Ch16 P12 Build a Model.xls on the textbook’s Web site. Reacher Technology has consulted with investment bankers and determined the interest rate it would pay for different capital structures, as

> F. Pierce Products Inc. is considering changing its capital structure. F. Pierce currently has no debt and no preferred stock, but it would like to add some debt to take advantage of low interest rates and the tax shield. Its investment banker has indica

> Beckman Engineering and Associates (BEA) is considering a change in its capital structure. BEA currently has $20 million in debt carrying a rate of 8%, and its stock price is $40 per share with 2 million shares outstanding. BEA is a zero-growth firm and

> Shapland Inc. has fixed operating costs of $500,000 and variable costs of $50 per unit. If it sells the product for $75 per unit, what is the break-even quantity?

> Harris Company must set its investment and dividend policies for the coming year. It has three independent projects from which to choose, each of which requires a $3 million investment. These projects have different levels of risk, and therefore differen

> Bayani Bakery’s most recent FCF was $48 million; the FCF is expected to grow at a constant rate of 6%. The firm’s WACC is 12%, and it has 15 million shares of common stock outstanding. The firm has $30 million in short-term investments, which it plans to

> Kendra Brown is analyzing the capital requirements for Reynolds Corporation for next year. Kendra forecasts that Reynolds will need $15 million to fund all of its positive-NPV projects and her job is to determine how to raise the money. Reynolds’s net in

> What are some possible agency conflicts between borrowers and lenders?

> Boehm Corporation has had stable earnings growth of 8% a year for the past 10 years and in 2015 Boehm paid dividends of $2.6 million on net income of $9.8 million. However, in 2016 earnings are expected to jump to $12.6 million, and Boehm plans to invest

> Puckett Products is planning for $5 million in capital expenditures next year. Puckett’s target capital structure consists of 60% debt and 40% equity. If net income next year is $3 million and Puckett follows a residual distribution policy with all distr

> Rework Problem 14-5 using the Black-Scholes model to estimate the value of the option. Assume that the variance of the project’s rate of return is 20.25% and that the risk-free rate is 6%. Data from Problem 14-5: Fethe’s Funny Hats is considering sellin

> Rework Problem 14-2 using the Black-Scholes model to estimate the value of the option. Assume that the variance of the project’s rate of return is 1.11% and that the risk-free rate is 6%. Problem 14-2: The Karns Oil Company is deciding whether to drill

> Rework Problem 14-1 using the Black-Scholes model to estimate the value of the option. Assume that the variance of the project’s rate of return is 6.87% and that the risk-free rate is 8%. Problem 14-1:

> Fethe’s Funny Hats is considering selling trademarked, orange-haired curly wigs for University of Tennessee football games. The purchase cost for a 2-year franchise to sell the wigs is $20,000. If demand is good (40% probability), then the net cash flows

> Utah Enterprises is considering buying a vacant lot that sells for $1.2 million. If the property is purchased, the company’s plan is to spend another $5 million today (t = 0) to build a hotel on the property. The after-tax cash flows from the hotel will

> Hart Lumber is considering the purchase of a paper company, which would require an initial investment of $300 million. Hart estimates that the paper company would provide net cash flows of $40 million at the end of each of the next 20 years. The cost of

> The Karns Oil Company is deciding whether to drill for oil on a tract of land the company owns. The company estimates the project would cost $8 million today. Karns estimates that, once drilled, the oil will generate positive net cash flows of $4 million

> Investment Timing Option: Decision-Tree Analysis Kim Hotels is interested in developing a new hotel in Seoul. The company estimates that the hotel would require an initial investment of $20 million. Kim expects the hotel will produce positive cash flows

> What is meant by the term “self-supporting growth rate”? How is this rate related to the AFN equation, and how can that equation be used to calculate the self-supporting growth rate?

> The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape guitar sides. The steamer has 6 years of remaining life. If kept, the steamer will have depreciation expenses of $650 for 5 years and $325 for the six

> The Rodriguez Company is considering an average-risk investment in a mineral water spring project that has a cost of $150,000. The project will produce 1,000 cases of mineral water per year indefinitely. The current sales price is $138 per case, and the

> The president of the company you work for has asked you to evaluate the proposed acquisition of a new chromatograph for the firm’s R&D department. The equipment’s basic price is $70,000, and it would cost another $15,000 to modify it for special use by y

> The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer’s base price is $1,080,000, and it would cost another $22,500 to install it. The machine falls into the MACRS 3-year class, and it would be sold after

> Wendy’s boss wants to use straight-line depreciation for the new expansion project because he said it will give higher net income in earlier years and give him a larger bonus. The project will last 4 years and requires $1,700,000 of equipment. The compan

> Although the Chen Company’s milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling

> Allen Air Lines must liquidate some equipment that is being replaced. The equipment originally cost $12 million, of which 75% has been depreciated. The used equipment can be sold today for $4 million, and its tax rate is 40%. What is the equipment’s afte

> Assume you have just been hired as a business manager of Pizza Palace, a regional pizza restaurant chain. The company’s EBIT was $50 million last year and is not expected to grow. The firm is currently financed with all equity, and it h

> Assume you have just been hired as a financial analyst by Tropical Sweets Inc., a mid-sized California company that specializes in creating exotic candies from tropical fruits such as mangoes, papayas, and dates. The firm’s CEO, George Yamaguchi, recentl

> Define each of the following terms: a. Agent; principal; agency relationship b. Agency cost c. Basic types of agency conflicts d. Managerial entrenchment; nonpecuniary benefits e. Greenmail; poison pills; restricted voting rights f. Stock option; ESOP

> Shrieves Casting Company is considering adding a new line to its product mix, and the capital budgeting analysis is being conducted by Sidney Johnson, a recently graduated MBA. The production line would be set up in unused space in Shrieves’ main plant.

> You have just graduated from the MBA program of a large university, and one of your favorite courses was “Today’s Entrepreneurs.” In fact, you enjoyed it so much you have decided you want to â&#

> During the last few years, Harry Davis Industries has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansi

> Suppose you decide (as did Steve Jobs and Mark Zuckerberg) to start a company. Your product is a software platform that integrates a wide range of media devices, including laptop computers, desktop computers, digital video recorders, and cell phones. You

> If a firm went from zero debt to successively higher levels of debt, why would you expect its stock price to first rise, then hit a peak, and then begin to decline?

> Why is EBIT generally considered to be independent of financial leverage? Why might EBIT be influenced by financial leverage at high debt levels?

> Why do public utility companies usually have capital structures that are different from those of retail firms?

> Why is the following statement true? “Other things being the same, firms with relatively stable sales are able to carry relatively high debt ratios.”

> “One type of leverage affects both EBIT and EPS. The other type affects only EPS.” Explain this statement.

> The following equation is sometimes used to forecast financial requirements: AFN = (A0*/S0)(∆S) ( (L0*/S0)(∆S) (MS1(1 - POR) What key assumption do we make when using this equation? Under what conditions might this assumption not hold true?

> Firms with relatively high nonfinancial fixed costs are said to have a high degree of what?

> What term refers to the uncertainty inherent in projections of future ROIC?

> Define each of the following terms: a. Capital structure; business risk; financial risk b. Operating leverage; financial leverage; break-even point c. Reserve borrowing capacity

> Indicate whether the following statements are true or false. If the statement is false, explain why. a. If a firm repurchases its stock in the open market, the shareholders who tender the stock are subject to capital gains taxes. b. If you own 100 share

> One position expressed in the financial literature is that firms set their dividends as a residual after using income to support new investments. Explain what a residual policy implies (assuming that all distributions are in the form of dividends), illus

> What is the difference between a stock dividend and a stock split? As a stockholder, would you prefer to see your company declare a 100% stock dividend or a 2-for-1 split? Assume that either action is feasible.

> How would each of the following changes tend to affect aggregate payout ratios (that is, the average for all corporations), other things held constant? Explain your answers. a. An increase in the personal income tax rate b. A liberalization of depreciati

> Define each of the following terms: a. Optimal distribution policy b. Dividend irrelevance theory; bird-in-the-hand theory; tax effect theory c. Information content, or signaling, hypothesis; clientele effect d. Residual distribution model; extra divide

> Define each of the following terms: a. Real option; managerial option; strategic option; embedded option b. Investment timing option; growth option; abandonment option; flexibility option c. Decision tree

> For most firms, there is some sales growth rate at which they could grow without needing any external financing, that is, where AFN = $0. How could you determine that growth rate? What variables under management’s control would affect this sustainable gr

> All forecasts are subject to error. Do you think top managers would be concerned about the effects on the firm if sales revenues or unit costs, for example, turned out to be different from the forecasted level? How could you provide information on the ef

> How are the component costs combined to form a weighted average cost of capital (WACC), and why is it necessary to use the WACC in capital budgeting?

> A company’s 6% coupon rate, semiannual payment, $1,000 par value bond that matures in 30 years sells at a price of $515.16. The company’s federal plus- state tax rate is 40%. What is the firm’s after-tax component cost of debt for purposes of calculating

> David Ortiz Motors has a target capital structure of 40% debt and 60% equity. The yield to maturity on the company’s outstanding bonds is 9%, and the company’s tax rate is 40%. Ortiz’s CFO has calculated the company’s WACC as 9.96%. What is the company’s

> Shi Importers’ balance sheet shows $300 million in debt, $50 million in preferred stock, and $250 million in total common equity. Shi’s tax rate is 40%, rd = 6%, rps = 5.8%, and r = 12%. If Shi has a target capital structure of 30% debt, 5% preferred sto

> Booher Book Stores has a beta of 0.8. The yield on a 3-month T-bill is 4%, and the yield on a 10-year T-bond is 6%. The market risk premium is 5.5%, and the return on an average stock in the market last year was 15%. What is the estimated cost of common

> Summerdahl Resort’s common stock is currently trading at $36 a share. The stock is expected to pay a dividend of $3.00 a share at the end of the year (D1 = $3.00), and the dividend is expected to grow at a constant rate of 5% a year. What is its cost of

> What are some differences in the analysis for a replacement project versus that for a new expansion project?

> What is the possible agency conflict between inside owner/managers and outside shareholders?

> Burnwood Tech plans to issue some $60 par preferred stock with a 6% dividend. A similar stock is selling on the market for $70. Burnwood must pay flotation costs of 5% of the issue price. What is the cost of the preferred stock?

> Refer to Problem 9-1. Return to the assumption that the company had $5 million in assets at the end of 2015, but now assume that the company pays no dividends. Under these assumptions, what would be the additional funds needed for the coming year? Why is

> Refer to Problem 9-1. What would be the additional funds needed if the company’s year-end 2015 assets had been $7 million? Assume that all other numbers, including sales, are the same as in Problem 9-1 and that the company is operating at full capacity.

> Refer to Problem 12-1. What is the project’s IRR? Data from Problem 12-1: A project has an initial cost of $40,000, expected net cash inflows of $9,000 per year for 7 years, and a cost of capital of 11%.

> A project has an initial cost of $40,000, expected net cash inflows of $9,000 per year for 7 years, and a cost of capital of 11%. What is the project’s NPV? (Hint: Begin by constructing a time line.)

> Suppose a company will issue new 20-year debt with a par value of $1,000 and a coupon rate of 9%, paid annually. The tax rate is 40%. If the flotation cost is 2% of the issue proceeds, then what is the after-tax cost of debt? Disregard the tax shield fro

> Messman Manufacturing will issue common stock to the public for $30. The expected dividend and the growth in dividends are $3.00 per share and 5%, respectively. If the flotation cost is 10% of the issue’s gross proceeds, what is the cost of external equi

> After discovering a new gold vein in the Colorado mountains, CTC Mining Corporation must decide whether to go ahead and develop the deposit. The most cost-effective method of mining gold is sulfuric acid extraction, a process that could result in environ

> Duggins Veterinary Supplies can issue perpetual preferred stock at a price of $50 a share with an annual dividend of $4.50 a share. Ignoring flotation costs, what is the company’s cost of preferred stock, rps?

> LL Incorporated’s currently outstanding 11% coupon bonds have a yield to maturity of 8%. LL believes it could issue new bonds at par that would provide a similar yield to maturity. If its marginal tax rate is 35%, what is LL’s after-tax cost of debt?

> Most firms generate cash inflows every day, not just once at the end of the year. In capital budgeting, should we recognize this fact by estimating daily project cash flows and then using them in the analysis? If we do not, will this bias our results? If

> Fauver Enterprises declared a 3-for-1 stock split last year, and this year its dividend is $1.50 per share. This total dividend payout represents a 6% increase over last year’s pre-split total dividend payout. What was last year’s dividend per share?

> Suppose you own 2,000 common shares of Laurence Incorporated. The EPS is $10.00, the DPS is $3.00, and the stock sells for $80 per share. Laurence announces a 2-for-1 split. Immediately after the split, how many shares will you have, what will the adjust

> Gardial GreenLights, a manufacturer of energy-efficient lighting solutions, has had such success with its new products that it is planning to substantially expand its manufacturing capacity with a $15 million investment in new machinery. Gardial plans to

> JPix management is considering a stock split. JPix currently sells for $120 per share and a 3-for-2 stock split is contemplated. What will be the company’s stock price following the stock split, assuming that the split has no effect on the total market v

> A firm has 10 million shares outstanding with a market price of $20 per share. The firm has $25 million in extra cash (short-term investments) that it plans to use in a stock repurchase; the firm has no other financial investments or any debt. What is th

> The Wei Corporation expects next year’s net income to be $15 million. The firm’s debt ratio is currently 40%. Wei has $12 million of profitable investment opportunities, and it wishes to maintain its existing debt ratio. According to the residual distrib

> sPetersen Company has a capital budget of $1.2 million. The company wants to maintain a target capital structure which is 60% debt and 40% equity. The company forecasts that its net income this year will be $600,000. If the company follows a residual dis

> If a company has an option to abandon a project, would this tend to make the company more or less likely to accept the project today?

> In general, do timing options make it more or less likely that a project will be accepted today?

> What factors should a company consider when it decides whether to invest in a project today or to wait until more information becomes available?

> How do simulation analysis and scenario analysis differ in the way they treat very bad and very good outcomes? What does this imply about using each technique to evaluate project riskiness?

> Why are interest charges not deducted when a project’s cash flows are calculated for use in a capital budgeting analysis?

> Why is it true, in general, that a failure to adjust expected cash flows for expected inflation biases the calculated NPV downward?

> Suppose a firm is considering two mutually exclusive projects. One has a life of 6 years and the other a life of 10 years. Would the failure to employ some type of replacement chain analysis bias an NPV analysis against one of the projects? Explain.

> When two mutually exclusive projects are being compared, explain why the short-term project might be ranked higher under the NPV criterion if the cost of capital is high, whereas the long-term project might be deemed better if the cost of capital is low.