Question: The Booth Company’s sales are forecasted

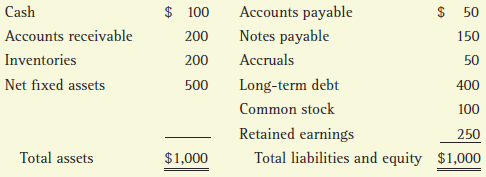

The Booth Company’s sales are forecasted to double from $1,000 in 2015 to $2,000 in 2016.Here is the December 31, 2015, balance sheet:

Booth’s fixed assets were used to only 50% of capacity during 2015, but its current assets were at their proper levels in relation to sales. All assets except fixed assets must increase at the same rate as sales, and fixed assets would also have to increase at the same rate if the current excess capacity did not exist. Booth’s after-tax profit margin is forecasted to be 5% and its payout ratio to be 60%. What is Booth’s additional funds needed (AFN) for the coming year?

Transcribed Image Text:

Cash $ 100 Accounts payable $ 50 Accounts receivable 200 Notes payable 150 Inventories 200 Accruals 50 Net fixed assets 500 Long-term debt 400 Common stock 100 Retained earnings Total liabilities and equity $1,000 250 Total assets $1,000

> The following table contains the ACT scores and the GPA (grade point average) for eight college students. Grade point average is based on a four-point scale and has been rounded to one digit after the decimal. a. Estimate the relationship between GPA an

> In the simple linear regression model y = (0 + (1x + u, suppose that E(u) =! 0. Letting (0 = E(u), show that the model can always be rewritten with the same slope, but a new intercept and error, where the new error has a zero expected value.

> Let kids denote the number of children ever born to a woman, and let educ denote years of education for the woman. A simple model relating fertility to years of education is kids = 0+ 1 educ + , where is the unobserved error. a. What kinds of fact

> The data set in CATHOLIC includes test score information on over 7,000 students in the United States who were in eighth grade in 1988. The variables math12 and read12 are scores on twelfth grade standardized math and reading tests, respectively. a. How m

> Use the data in COUNTYMURDERS to answer this questions. Use only the data for 1996. a. How many counties had zero murders in 1996? How many counties had at least one execution? What is the largest number of executions? b. Estimate the equation murders =

> To complete this exercise, you need a software package that allows you to generate data from the uniform and normal distributions. a. Start by generating 500 observations on xi—the explanatory variable—from the unifor

> Use the data in CHARITY [obtained from Franses and Paap (2001)] to answer the following questions: a. What is the average gift in the sample of 4,268 people (in Dutch guilders)? What percentage of people gave no gift? b. What is the average mailings per

> We used the data in MEAP93 for Example 2.12. Now we want to explore the relationship between the math pass rate (math10) and spending per student (expend). a. Do you think each additional dollar spent has the same effect on the pass rate, or does a dimi

> For the population of firms in the chemical industry, let rd denote annual expenditures on research and development, and let sales denote annual sales (both are in millions of dollars). a. Write down a model (not an estimated equation) that implies a con

> Use the data in WAGE2 to estimate a simple regression explaining monthly salary (wage) in terms of IQ score (IQ). a. Find the average salary and average IQ in the sample. What is the sample standard deviation of IQ? (IQ scores are standardized so that t

> Use the data in SLEEP75 from Biddle and Hamermesh (1990) to study whether there is a tradeoff between the time spent sleeping per week and the time spent in paid work. We could use either variable as the dependent variable. For concreteness, estimate the

> The data set in CEOSAL2 contains information on chief executive officers for U.S. corporations. The variable salary is annual compensation, in thousands of dollars, and ceoten is prior number of years as company CEO. a. Find the average salary and the a

> The data in 401K are a subset of data analyzed by Papke (1995) to study the relationship between participation in a 401(k) pension plan and the generosity of the plan. The variable prate is the percentage of eligible workers with an active account; this

> Consider the estimated equation from Example 4.3, which can be used to study the effects of skipping class on college GPA: colGPA = 1.39 + .412 hsGPA + .015 ACT - .083 skipped (.33) (.094) (.011) (.026) n = 1

> The following histogram was created using the variable score in the data file ECONMATH. Thirty bins were used to create the histogram, and the height of each cell is the proportion of observations falling within the corresponding interval. The best-fitti

> In the simple regression model (5.16), under the first four Gauss-Markov assumptions, we showed that estimators of the form (5.17) are consistent for the slope, B1. Given such an estimator, define an estimator of

> The data set SMOKE contains information on smoking behavior and other variables for a random sample of single adults from the United States. The variable cigs is the (average) number of cigarettes smoked per day. Do you think cigs has a normal distributi

> Suppose that the model pctstck = B0+ B1funds + B2risktol + u satisfies the first four Gauss-Markov assumptions, where pctstck is the percentage of a worker’s pension invested in the stock market, funds is the number of mutual funds that the worker c

> In the simple regression model under MLR.1 through MLR.4, we argued that the slope estimator,

> Use the data in ECONMATH to answer this question. Logically, what are the smallest and largest values that can be taken on by the variable score? What are the smallest and largest values in the sample? Consider the linear model score = B0 + B1colgp

> educ is the dependent variable in a regression. (a) How many different values are taken on by educ in the sample? Does educ have a continuous distribution? (b) Plot a histogram of educ with a normal distribution overlay. Does the distribution of educ a

> Several statistics are commonly used to detect nonnormality in underlying population distributions. Here we will study one that measures the amount of skewness in a distribution. Recall that any normally distributed random variable is symmetric about

> In given equation, using the data set BWGHT, compute the LM statistic for testing whether motheduc and fatheduc are jointly significant. In obtaining the residuals for the restricted model, be sure that the restricted model is estimated using only those

> Use the data in GPA2 for this exercise. (1) Using all 4,137 observations, estimate the equation colgpa = B0 + B1hsperc + B2sat + u and report the results in standard form. (2) Reestimate the equation in part (1), using the first 2,070 observations.

> Use the data in WAGE1 for this exercise. (i) Estimate the equation wage = B0 + B1educ + B2exper + B3tenure + u. Save the residuals and plot a histogram. (ii) Repeat part (i), but with log(wage) as the dependent variable. (iii) Would you say that Assumpt

> The data in MEAPSINGLE were used to estimate the following equations relating school-level performance on a fourth-grade math test to socioeconomic characteristics of students attending school. The variable free, measured at the school level, is the perc

> The following analysis was obtained using data in MEAP93, which contains school-level pass rates (as a percent) on a tenth-grade math test. (i) The variable expend is expenditures per student, in dollars, and math10 is the pass rate on the exam. The foll

> The variable mktval is market value of the firm, profmarg is profit as a percentage of sales, ceoten is years as CEO with the current company, and comten is total years with the company. (i) Comment on the effect of profmarg on CEO salary. (ii) Does mark

> Use the data in WAGE1 for this exercise. a. Find the average education level in the sample. What are the lowest and highest years of education? b. Find the average hourly wage in the sample. Does it seem high or low? c. The wage data are reported in

> The Pinkerton Publishing Company is considering two mutually exclusive expansion plans. Plan A calls for the expenditure of $50 million on a largescale, integrated plant that will provide an expected cash flow stream of $8 million per year for 20 years.

> Your company is considering two mutually exclusive projects, X and Y, whose costs and cash flows are shown below: The projects are equally risky, and their cost of capital is 12%. You must make a recommendation, and you must base it on the modified IRR (

> Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects’ NPVs, IRRs, MIRRs,

> The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500, and it is expected to generate net after-tax operating cash flows, including depreciation, of $6,250 per year. The truck has a 5-year expected life. The ex

> Your division is considering two investment projects, each of which requires an up-front expenditure of $25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dol

> The Aubey Coffee Company is evaluating the within-plant distribution system for its new roasting, grinding, and packing plant. The two alternatives are: (1) a conveyor system with a high initial cost but low annual operating costs, and (2) several fork

> The Ulmer Uranium Company is deciding whether or not to open a strip mine whose net cost is $4.4 million. Net cash inflows are expected to be $27.7 million, all coming at the end of Year 1. The land must be returned to its natural state at a cost of $25

> Filkins Fabric Company is considering the replacement of its old, fully depreciated knitting machine. Two new models are available: Machine 190-3, which has a cost of $190,000, a 3-year expected life, and after-tax cash flows (labor savings and depreciat

> The table below gives the balance sheet for Travelers’ Inn Inc. (TII), a company that was formed by merging a number of regional motel chains. The following facts also apply to TII. (1) Short-term debt consists of bank loans that curre

> Suppose the Schoof Company has this book value balance sheet: The notes payable are to banks, and the interest rate on this debt is 10%, the same as the rate on new bank loans. These bank loans are not used for seasonal financing but instead are part of

> Distinguish between beta (i.e., market) risk, within-firm (i.e., corporate) risk, and stand-alone risk for a potential project. Of the three measures, which is theoretically the most relevant, and why?

> On January 1, the total market value of the Tysseland Company was $60 million. During the year, the company plans to raise and invest $30 million in new projects. The firm’s present market value capital structure, shown below, is consid

> The Ewert Exploration Company is considering two mutually exclusive plans for extracting oil on property for which it has mineral rights. Both plans call for the expenditure of $10 million to drill development wells. Under Plan A, all the oil will be ext

> Cummings Products is considering two mutually exclusive investments whose expected net cash flows are as follows: a. Construct NPV profiles for Projects A and B. b. What is each project’s IRR? c. If each project’s cost

> Spencer Supplies’ stock is currently selling for $60 a share. The firm is expected to earn $5.40 per share this year and to pay a year-end dividend of $3.60. a. If investors require a 9% return, what rate of growth must be expected for Spencer? b. If S

> Radon Homes’ current EPS is $6.50. It was $4.42 5 years ago. The company pays out 40% of its earnings as dividends, and the stock sells for $36. a. Calculate the historical growth rate in earnings. (Hint: This is a 5-year growth period.) b. Calculate t

> The earnings, dividends, and stock price of Shelby Inc. are expected to grow at 7% per year in the future. Shelby’s common stock sells for $23 per share, its last dividend was $2.00, and the company will pay a dividend of $2.14 at the end of the current

> Garlington Technologies Inc.’s 2015 financial statements are shown below: Suppose that in 2016 sales increase by 10% over 2015 sales and that 2016 dividends will increase to $112,000. Forecast the financial statements using the forecast

> Stevens Textiles’ 2015 financial statements are shown below: Balance Sheet as of December 31, 2015 (Thousands of Dollars) Income Statement for December 31, 2015 (Thousands of Dollars) a. Suppose 2016 sales are projected to increase by

> Upton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers. Upton’s bal

> How would each of the factors in the following table affect a firm’s cost of debt, rd(1 2 T); its cost of equity, rs; and its weighted average cost of capital, WACC? Indicate by a plus (1), a minus (2), or a zero (0) if the factor would

> At year-end 2015, Wallace Landscaping’s total assets were $2.17 million and its accounts payable were $560,000. Sales, which in 2015 were $3.5 million, are expected to increase by 35% in 2016. Total assets and accounts payable are proportional to sales,

> Maggie’s Muffins Inc. generated $5,000,000 in sales during 2015, and its year-end total assets were $2,500,000. Also, at year-end 2015, current liabilities were $1,000,000, consisting of $300,000 of notes payable, $500,000 of accounts payable, and $200,0

> Refer to Problem 12-1. What is the project’s MIRR? Problem 12-1: A project has an initial cost of $40,000, expected net cash inflows of $9,000 per year for 7 years, and a cost of capital of 11%.

> The financial staff of Cairn Communications has identified the following information for the first year of the roll-out of its new proposed service: The Company faces a 40% tax rate. What is the project’s operating cash flow for the fir

> Broussard Skateboard’s sales are expected to increase by 15% from $8 million in 2015 to $9.2 million in 2016. Its assets totaled $5 million at the end of 2015. Broussard is already at full capacity, so its assets must grow at the same rate as projected s

> Pettit Printing Company has a total market value of $100 million, consisting of 1 million shares selling for $50 per share and $50 million of 10% perpetual bonds now selling at par. The company’s EBIT is $13.24 million, and its tax rate is 15%. Pettit ca

> The Rivoli Company has no debt outstanding, and its financial position is given by the following data: The firm is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 30% debt based on mark

> Schweser Satellites Inc. produces satellite earth stations that sell for $100,000 each. The firm’s fixed costs, F, are $2 million, 50 earth stations are produced and sold each year, profits total $500,000, and the firm’s assets (all equity financed) are

> Dye Trucking raised $150 million in new debt and used this to buy back stock. After the recap, Dye’s stock price is $7.50. If Dye had 60 million shares of stock before the recap, how many shares does it have after the recap?

> Lee Manufacturing’s value of operations is equal to $900 million after a recapitalization. (The firm had no debt before the recap.) Lee raised $300 million in new debt and used this to buy back stock. Lee had no short-term investments before or after the

> Define each of the following terms: a. Weighted average cost of capital, WACC; after-tax cost of debt, rd(1 - T); after-tax cost of short-term debt, rstd(1 - T) b. Cost of preferred stock, rps; cost of common equity (or cost of common stock), rs c. Ta

> Nichols Corporation’s value of operations is equal to $500 million after a recapitalization (the firm had no debt before the recap). It raised $200 million in new debt and used this to buy back stock. Nichols had no short-term investments before or after

> Ethier Enterprise has an unlevered beta of 1.0. Ethier is financed with 50% debt and has a levered beta of 1.6. If the risk-free rate is 5.5% and the market risk premium is 6%, how much is the additional premium that Ethier’s shareholders require to be c

> Unlevered Beta Counts Accounting has a beta of 1.15. The tax rate is 40%, and Counts is financed with 20% debt. What is Counts’ unlevered beta?

> Start with the partial model in the file Ch16 P12 Build a Model.xls on the textbook’s Web site. Reacher Technology has consulted with investment bankers and determined the interest rate it would pay for different capital structures, as

> F. Pierce Products Inc. is considering changing its capital structure. F. Pierce currently has no debt and no preferred stock, but it would like to add some debt to take advantage of low interest rates and the tax shield. Its investment banker has indica

> Beckman Engineering and Associates (BEA) is considering a change in its capital structure. BEA currently has $20 million in debt carrying a rate of 8%, and its stock price is $40 per share with 2 million shares outstanding. BEA is a zero-growth firm and

> Shapland Inc. has fixed operating costs of $500,000 and variable costs of $50 per unit. If it sells the product for $75 per unit, what is the break-even quantity?

> Harris Company must set its investment and dividend policies for the coming year. It has three independent projects from which to choose, each of which requires a $3 million investment. These projects have different levels of risk, and therefore differen

> Bayani Bakery’s most recent FCF was $48 million; the FCF is expected to grow at a constant rate of 6%. The firm’s WACC is 12%, and it has 15 million shares of common stock outstanding. The firm has $30 million in short-term investments, which it plans to

> Kendra Brown is analyzing the capital requirements for Reynolds Corporation for next year. Kendra forecasts that Reynolds will need $15 million to fund all of its positive-NPV projects and her job is to determine how to raise the money. Reynolds’s net in

> What are some possible agency conflicts between borrowers and lenders?

> Boehm Corporation has had stable earnings growth of 8% a year for the past 10 years and in 2015 Boehm paid dividends of $2.6 million on net income of $9.8 million. However, in 2016 earnings are expected to jump to $12.6 million, and Boehm plans to invest

> Puckett Products is planning for $5 million in capital expenditures next year. Puckett’s target capital structure consists of 60% debt and 40% equity. If net income next year is $3 million and Puckett follows a residual distribution policy with all distr

> Rework Problem 14-5 using the Black-Scholes model to estimate the value of the option. Assume that the variance of the project’s rate of return is 20.25% and that the risk-free rate is 6%. Data from Problem 14-5: Fethe’s Funny Hats is considering sellin

> Rework Problem 14-2 using the Black-Scholes model to estimate the value of the option. Assume that the variance of the project’s rate of return is 1.11% and that the risk-free rate is 6%. Problem 14-2: The Karns Oil Company is deciding whether to drill

> Rework Problem 14-1 using the Black-Scholes model to estimate the value of the option. Assume that the variance of the project’s rate of return is 6.87% and that the risk-free rate is 8%. Problem 14-1:

> Fethe’s Funny Hats is considering selling trademarked, orange-haired curly wigs for University of Tennessee football games. The purchase cost for a 2-year franchise to sell the wigs is $20,000. If demand is good (40% probability), then the net cash flows

> Utah Enterprises is considering buying a vacant lot that sells for $1.2 million. If the property is purchased, the company’s plan is to spend another $5 million today (t = 0) to build a hotel on the property. The after-tax cash flows from the hotel will

> Hart Lumber is considering the purchase of a paper company, which would require an initial investment of $300 million. Hart estimates that the paper company would provide net cash flows of $40 million at the end of each of the next 20 years. The cost of

> The Karns Oil Company is deciding whether to drill for oil on a tract of land the company owns. The company estimates the project would cost $8 million today. Karns estimates that, once drilled, the oil will generate positive net cash flows of $4 million

> Investment Timing Option: Decision-Tree Analysis Kim Hotels is interested in developing a new hotel in Seoul. The company estimates that the hotel would require an initial investment of $20 million. Kim expects the hotel will produce positive cash flows

> What is meant by the term “self-supporting growth rate”? How is this rate related to the AFN equation, and how can that equation be used to calculate the self-supporting growth rate?

> The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape guitar sides. The steamer has 6 years of remaining life. If kept, the steamer will have depreciation expenses of $650 for 5 years and $325 for the six

> The Rodriguez Company is considering an average-risk investment in a mineral water spring project that has a cost of $150,000. The project will produce 1,000 cases of mineral water per year indefinitely. The current sales price is $138 per case, and the

> The president of the company you work for has asked you to evaluate the proposed acquisition of a new chromatograph for the firm’s R&D department. The equipment’s basic price is $70,000, and it would cost another $15,000 to modify it for special use by y

> The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer’s base price is $1,080,000, and it would cost another $22,500 to install it. The machine falls into the MACRS 3-year class, and it would be sold after

> Wendy’s boss wants to use straight-line depreciation for the new expansion project because he said it will give higher net income in earlier years and give him a larger bonus. The project will last 4 years and requires $1,700,000 of equipment. The compan

> Although the Chen Company’s milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling

> Allen Air Lines must liquidate some equipment that is being replaced. The equipment originally cost $12 million, of which 75% has been depreciated. The used equipment can be sold today for $4 million, and its tax rate is 40%. What is the equipment’s afte

> Assume you have just been hired as a business manager of Pizza Palace, a regional pizza restaurant chain. The company’s EBIT was $50 million last year and is not expected to grow. The firm is currently financed with all equity, and it h

> Assume you have just been hired as a financial analyst by Tropical Sweets Inc., a mid-sized California company that specializes in creating exotic candies from tropical fruits such as mangoes, papayas, and dates. The firm’s CEO, George Yamaguchi, recentl

> Define each of the following terms: a. Agent; principal; agency relationship b. Agency cost c. Basic types of agency conflicts d. Managerial entrenchment; nonpecuniary benefits e. Greenmail; poison pills; restricted voting rights f. Stock option; ESOP

> Shrieves Casting Company is considering adding a new line to its product mix, and the capital budgeting analysis is being conducted by Sidney Johnson, a recently graduated MBA. The production line would be set up in unused space in Shrieves’ main plant.

> You have just graduated from the MBA program of a large university, and one of your favorite courses was “Today’s Entrepreneurs.” In fact, you enjoyed it so much you have decided you want to â&#

> During the last few years, Harry Davis Industries has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansi

> Suppose you decide (as did Steve Jobs and Mark Zuckerberg) to start a company. Your product is a software platform that integrates a wide range of media devices, including laptop computers, desktop computers, digital video recorders, and cell phones. You

> Hatfield Medical Supplies’ stock price had been lagging its industry averages, so its board of directors brought in a new CEO, Jaiden Lee. Lee had brought in Ashley Novak, a finance MBA who had been working for a consulting company, to

> If a firm went from zero debt to successively higher levels of debt, why would you expect its stock price to first rise, then hit a peak, and then begin to decline?

> Why is EBIT generally considered to be independent of financial leverage? Why might EBIT be influenced by financial leverage at high debt levels?