Question: A. Cherry owned a farmhouse and land,

A. Cherry owned a farmhouse and land, the latter being used by him and his sons, Tom and Leo, in carrying on a fruit and poultry business in partnership. The partnership agreement stipulated that the father should take one-sixth of the profits, such to be not less than £1,200 per annum, the sons sharing the remainder equallya.

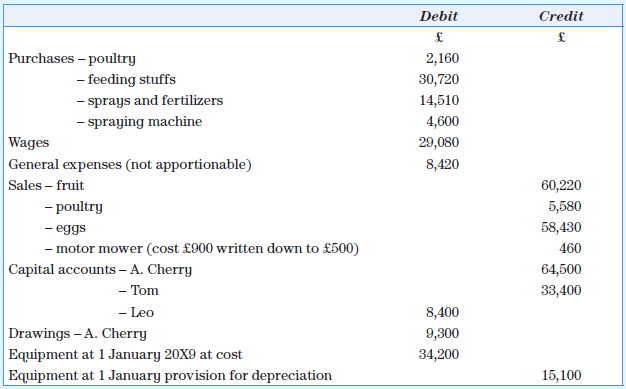

The following are extracts from the trial balance of the business as on 31 December 20X9:

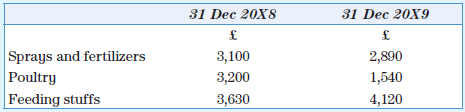

Inventories on hand were as follows:

Additional information

1. Drawings by Tom and Leo have been £150 and £140 per week, respectively. The amounts have been included in the wages account. Of the wages, one-quarter is to be charged to the fruit department and three-quarters to the poultry department.

2. The father and son Tom live in the farmhouse and are to be charged jointly per annum £300 for fruit, and £680 for eggs and poultry, such charges being shared equally. Leo is to be charged £380 for fruit and £620 for eggs and poultry.

3. Independent of the partnership, Leo kept some pigs on the farm and in respect of this private venture he is to be charged £1,400 for feeding stuffs and £400 for wages.

4. A. Cherry is to be credited with £3,600 for rent of the land (to be charged as two-thirds to the fruit and one-third to the poultry departments), and Tom is to be credited with £840 by way of salary for packing eggs and dressing poultry.

5. Eggs sold in December 20X9 and paid for in January 20Y0 amounted to £2,430 and this sum was not included in the trial balance.

6. An account to 31 December 20X9 for £240 was received from a veterinary surgeon after the trial balance had been prepared. This account included a sum of £140 in respect of professional work as regards Leo’s pigs, which he himself paid.

7. Annual provision was to be made for depreciation on equipment at 10 per cent on cost at the end of the year.

Required

a. A trading account (showing separately the trading profit on the fruit and poultry departments) and appropriation accounts for the year ended 31 December 20X9.

b. The partners’ capital accounts in columnar form showing the balances as on 31 December 20X9.

> The directors of Atono plc were informed at a golf outing by fellow directors that it is more valuable to have debt in a company’s capital structure than equity, as debt is cheaper than equity. Atono plc currently has no debt in its cap

> Aragon (a bank) has recently received a request for a term loan from one of its customers, Valencia plc, a company listed on the Alternative Investment Market of the London Stock Exchange. Valencia plc’s directors have requested a furth

> Toome Ltd is a manufacturer of mechanical toys for boys. You have been provided with a schedule of key performance ratios for the company for the period 20X5 to 20X9 as follows: Required Using the historical data above, write a report to the directors

> You are given below, in draft form, the financial statements of Algernon Ltd for 20X8 and 20X9. They are not in publishable format. Required a. Calculate for Algernon Ltd, for 20X8 and 20X9, the following ratios: i. return on capital employed; ii. retu

> The outline statements of financial position of the Nantred Trading Co. Ltd were as shown below: Additional information The only other information available is that the revenue for the years ended 30 September 20X0 and 20X1 was £202,900 an

> Two companies show the following financial statements for the year to 30 November 20X9. Additional information 1. A. Ltd paid a dividend of £150,000 during the year. 2. B. Ltd paid a dividend of £200,000 during the year. Requ

> One of your clients is a beef farmer. She informs you that the price of beef has fallen dramatically over the past few months and that she expects it to fall even further over the next three months. She therefore argues that the prudence principle should

> The following are the summarized financial statements of Alpha and Omega, two companies that operate in the same industry: Required a. Using ratio analysis, comment on the profitability, efficiency, liquidity and gearing of both companies. b. List thre

> J. White, a sole trader, has produced the following statements of financial position for the years ended 31 March 20X8 and 31 March 20X9. J. White is unable to understand why, after he has made a profit for the year ended 31 March 20X9 of £

> The summarized statements of financial position as at 31 March 20X1 and 31 March 20X0 of Higher Ltd are as follows: Additional information 1. Non-current assets Non-current assets disposed of during the year were sold for £22,000. 2. Cur

> The following are the statements of financial positions of Waterloo plc for the last two financial years ended on 30 September. Explanatory notes to the statement of financial positions are as follows: 1. The movement during the year to 30 September 20

> The statement of financial position of Euston Ltd as at 31 December 20X9, with corresponding amounts, showed the following: Notes relevant to 20X9 1. Property, plant and equipment includes the following: 2. An item of plant costing £100,

> The statement of financial position of C.F. Ltd for the year ended 31 December 20X9, together with comparative figures for the previous year, is shown below. Additional information 1. There were no sales of non-current assets during 20X9. 2. The compan

> The following are the financial statements for S. Low for the years ended 30 April 20X0 and 30 April 20X1: Required Prepare a statement of cash flows in accordance with IAS 7 for S. Low for the year ended 30 April 20X1.

> The following are the financial statements for A. Tack for the years ended 30 June 20X1 and 20X0: Required Prepare a statement of cash flows in accordance with IAS 7 for A. Tack for the year ended 30 June 20X1.

> A. Net is a sole trader and reports the following for the year ended 31 December 20X9: Note: The car that was disposed of during the year was sold for £400, which was lodged in A. Net’s bank account. Required Prepare the

> T. Bone is a sole trader and reports the following for the year ended 30 June 20X1: Notes 1. The 20X0 allowance for irrecoverable receivables was £600. 2. The 20X1 allowance for irrecoverable receivables is £840. 3. The motor v

> Classify each of the following as a measurement basis, an accounting policy or an estimation technique, and explain your reasons: a. Advertising expenditure that has been treated as a non-current asset rather than an expense. b. The use of the straight-l

> Prepare a statement of cash flows in accordance with IAS 7 using the information in Question 28.9. There was no investment income or interest paid during the year ended 31 March 20X9.

> Marmite Ltd obtains a £750,000 loan which is repayable over the next five years. The bank has agreed to accept the following repayments. The repayments are varied to match to periods when Marmite Ltd expects to have surplus future cash flows

> Topaz Ltd makes up its financial statements regularly to 31 December each year. The company has operated for some years with four divisions; A, B, C and D, but on 30 June 20X9 Division B was sold for £8m, realizing a profit of £

> The following balances existed in the accounting records of Koppa Ltd at 31 December 20X9: In preparing the company’s statement of comprehensive income and statement of financial position at 31 December 20X9 the following further info

> The trial balance of Harmonica Ltd at 31 December 20X9 is given below. Additional information 1. Closing inventory amounted to £5m. 2. A review of the trade receivables total of £6.9m showed that it was necessary to write off

> The Cirrus Co. Plc has the following balances on its books at 31 December 20X9. The following information is also given: 1. The inventory at 31 December 20X9 has been valued at £32,000. Further investigation reveals that this includes some

> The trial balance of Norr Ltd at 31 December 20X9 is as follows: Additional information 1. During the year a motor vehicle purchased on 31 March 20X6 for £8,000 was sold for £3,000. The sale proceeds were debited to the bank a

> Your managing director is having a polite disagreement with the auditors on the subject of accounting for contingencies. Since the finance director is absent on sick leave, he has come to you for advice. It appears that your firm is involved in four unre

> IAS 10 – Events after the Reporting Period defines the treatment to be given to events arising after the statement of financial position date but before the financial statements are approved by the Board of Directors. Required a. Define the terms ‘adjus

> Cold Heart plc, which has a turnover of £100 million and pre-tax profit of £10 million, has its financial statements drawn up on 30 June each year and at 30 June 20X9 the company’s accountant is considering the items specified below. 1. The directors hav

> State whether the following expenditures for a local school are revenue or capital in nature. In addition, state the name of the classification (current asset, non-current asset, etc.) and the generic account name that the item would appear in within the

> The following information is available for Aston Products Plc as at 30 April 20X8. There were no other reserves in the statement of financial position at 30 April 20X8. You are given the following additional information relating to the year ended 30 Ap

> a. The following items usually appear in the final financial statements of a limited company: i. interim dividend; ii. general reserve; iii. share premium account. Required An explanation of the meaning of each of the above terms. b. The following infor

> Describe the main kinds of debenture loan stock.

> What is the difference between a fixed charge and a floating charge?

> Rank the following stakeholders in terms of who would have priority when a company is settling claims of the stakeholders against it. Note, a rank of 1 means this stakeholder should be paid first. • Debenture holders; • Loan stock holders; • Preference s

> Use the amended information from Exercise 25.6 as a starting point. Dissolution information 1. On 1 January 20X9 the partners decide to form a company and issue £140,000 worth of shares in the company to the partners. They raise an additional loan (£60,0

> Maraid, Wendy and Diane have been in partnership for a number of years sharing profits respectively. They decide to form a limited company on 1 January 20X9, called McKee Ltd, to carry on the business. The statement of financial position of the partners

> Peter, Paul and Mary have been in partnership for several years sharing profits and losses in the ratio 1 : 2 : 3. Their last statement of financial position is as follows: The partnership had become very dependent on one customer, Jefferson, and in or

> Alpha, Beta and Gamma were in partnership for many years sharing profits and losses in the ratio 5 : 3 : 2 and making up their financial statements to 31 December each year. Alpha died on 31 December 20X9, and the partnership was dissolved as from that d

> Gupta, Richards and Jones are in partnership sharing profits and losses in the ratio 5 : 4 : 3. On 1 January 20X9 Richards retired from the partnership and it was agreed that Singh should join the partnership, paying a sum of £30,000. From t

> On 20 December 20X0 your client paid £10,000 for an advertising campaign. The advertisements will be heard on local radio stations between 1 January and 31 January 20X1. Your client believes that as a result sales will increase by 60 per cent in 20X1 (ov

> Al and Bert are in partnership sharing profits equally. At 30 June they have balances on their capital accounts of £12,000 (Al) and £15,000 (Bert). On that day they agree to bring in their friend Hall as a third partner. All three partners are to share p

> X, Y and Z are in partnership sharing profits and losses in the ratio 4 : 2 : 2. Z died on 30 June 20X9. The partnership statement of financial position as at that date was: Additional information It was agreed between X, Y and Z’s re

> A, B and C are in partnership sharing profits and losses in the ratio of 50 : 25 : 25 per cent. Each partner receives a salary of £40,000 and interest on opening capital balance of 15 per cent per year. The draft statement of financial posit

> Hawthorn and Privet have carried on business in partnership for a number of years, sharing profits in the ratio of 4 : 3 after charging interest on capital at 4 per cent per annum. Holly was admitted into the partnership on 1 October 20X8, and the terms

> Matthew, Mark and Luke were in partnership sharing profits and losses in the ratio 5 : 3 : 2, financial statements being made up annually to 30 June. Fixed capital accounts were to bear interest at the rate of 5 per cent per annum, but no inter

> Street, Rhode and Close carried on business in partnership sharing profits and losses, in the ratio 5: 4: 3. Their draft statement of financial position as on 31 March 20X9 was as follows: Street retired from the partnership on 31 March 20X9 and Rhode

> Anna and Thomas are in partnership sharing profits and losses equally. The partnership agreement provides for an annual salary to Anna of £57,000. It also provides for interest on capital of 10 per cent per annum and interest on drawings of

> Mary and Seamus are in partnership sharing profits and losses equally. The partnership agreement provides for annual salaries of £34,000 for Mary and £22,000 for Seamus. It also provides for interest on capital of 8 per cent per

> Field, Green and Lane are in partnership making up financial statements annually to 31 March. Owing to staff difficulties proper records were not maintained for the year ended 31 March 20X9, and the partners request your assistance

> An acquaintance of yours, H. Gee, has recently set up in business for the first time as a general dealer. The majority of his sales will be on credit to trade buyers but he will sell some goods to the public for cash. He is not sure at which point of the

> Brick, Stone and Breeze carry on a manufacturing business in partnership, sharing profits and losses: Brick one-half, Stone one-third and Breeze one-sixth. It is agreed that the minimum annual share of profit to be credited to Breeze is to be Â&pou

> a. When accounting for the relationship of partners inter se, the partnership agreement provides the rules which, in the first instance, are to be applied. What information would you expect to find in a partnership agreement to provide such rules, and wh

> A, B, C and D were partners in a garage business comprising (1) Petrol sales, (2) Repairs and servicing and (3) Second-hand car dealing. A was responsible for petrol sales, B for repairs and servicing and C for second-hand car deals, while D acted pu

> Peter and Paul, whose year-end is 30 June, are in business as food wholesalers. Their partnership deed states that: a. profits and losses are to be shared equally; b. salaries are: Peter £20,000 per annum; Paul £18,000 per annum

> The partnership of Anna, Mary and Seamus has just completed its first year in business. In their partnership agreement each partner is entitled to interest on capital of 12% each year and Anna is to get a salary of £30,

> Light and Dark are in partnership sharing profits and losses in the ratio 7 : 3, respectively. The following information has been taken from the partnership records for the financial year ended 31 May 20X9: Partners’ capital accounts, b

> Miss Fitt owns a retail shop. The statement of profit or loss and statement of financial position are prepared annually by you from records consisting of a bank statement and a file of unpaid suppliers and outstanding trade receivables. The following is

> Jock is a clothing retailer. At 31 December 20X9 he asks you to prepare his final financial statements from very incomplete records. You were able to extract the following information from the limited records that were available. Accruals and prepaymen

> Jane Grimes, retail fruit and vegetable merchant, does not keep a full set of accounting records. However, the following information has been produced from the business’s records: 1. Summary of the bank account for the year ended 31 Aug

> Happy did not keep proper books of account. At 31 August 20X8 his balances were: Details of transactions in year to 31 August 20X9: At 31 August 20X9 the assets and liabilities were: Depreciation on tools £600, lorry now valued at &Acir

> Prepare the statement of financial position for C. Koat at 31 December 20X9: Assets: Office building £25,000, Factory £60,000, Inventory £8,000, Cash £500, Monies owed from a customer £3,500. Liabilities: Bank overdraft £5,000, Monies owed to R. Lodge £

> Capital at the end of 20X8 is £2,000. Capital at the end of 20X9 is £3,000. Drawings were £700. Required Calculate the profit for the year ended 20X9 from the above information.

> Capital at the end of 20X8 is £2,000. Capital at the end of 20X9 is £3,000. There were no drawings; and no capital had been introduced. Required Calculate the profit for the year ended 20X9 from the above information.

> T. Murray has prepared the following bank ledger account for the year ended 31 March 20X9: T. Murray has also supplied you with the following information. a. Commissions received included £85, which had been in arrears at 31 March 20X8, an

> Bugs Bunny, a wholesale dealer in ready-made menswear, achieves a gross profit ratio of 50 per cent. The statement of financial position of the business as at 30 June 20X8 was as follows: Since this date the accounting function has been neglected. Howe

> David Denton set up in business as a plumber a year ago, and he has asked you to act as his accountant. His instructions to you are in the form of the following letter. Dear Henry I was pleased when you agreed to act as my accountant and look forward to

> A year ago, you prepared financial statements for A. Wilson, a retailer. His closing position was then: Mr Wilson does not keep full records (despite your advice) and once again you have to use what information is available to prepare his financial sta

> The draft trial balance of Regent Ltd as at 31 May 20X9 agreed. The business proceeded with the preparation of the draft final financial statements and these showed a profit of £305,660. However, a subsequent audit revealed the following errors: 1. Bank

> Chocolate is a confectionery shop owned by Thomas McKee. Thomas operates a manual bookkeeping system and employs a cashier and a bookkeeper. When writing up the books of account for the year ended 31 December 20X9, the following errors were discovered: 1

> Arthur started a new business on 1 January 20X9. You are supplied with the following nominal ledger accounts, which have been closed off and a trial balance extracted. These are Arthur’s only transactions in this period. Trial balan

> Write journals to correct the following errors (suspense account errors): 1. The debit side of the cash book is undercast by £3,000. 2. A payment of £475 for an electricity bill is correctly entered in the cash book but debited to the telephone account a

> A colleague from the sales department has approached you with an idea for an expansion plan for the car dealership where you both work. Second-hand cars have higher margins. Therefore, he suggests that we change the current system which would mean that w

> Write journals to correct the following errors. These errors are not suspense account errors. 1. A payment of £4,000 for rent was incorrectly posted to the insurance account. 2. The cost of purchasing a delivery van, £12,400, is incorrectly debited to th

> Write journals to correct the following errors. These errors are not suspense account errors. 1. £150 sales invoice posted to the credit customer, D. Brown’s account – should have been posted to the credit customer, D. Black’s account. 2. £50 stationery

> Jacobs Ltd has recently completed its draft financial statements for the year ended 30 December 20X9, which showed a draft profit for the year of £300,000. During the audit a number of mistakes and omissions were uncovered. These are listed

> The draft final financial statements of RST Ltd for the year ended 30 April 20X9 showed a net profit for the year of £78,263. During the subsequent audit, the following errors and omissions were discovered. At the draft stage a suspense account had been

> Chi Knitwear Ltd is an old-fashioned firm with a handwritten set of books. A trial balance is extracted at the end of each month, and a statement of profit or loss and statement of financial position are computed. This month, however, the trial balance d

> At the end of January 20X9 a trial balance extracted from the ledger of Gerald Ltd did not balance and a suspense account was opened for the amount of the difference. Subsequently, the following matters came to light: 1. £234 had been receiv

> The following particulars relating to the year ended 31 March 20X9 have been extracted from the books of a trader: Prepare the sales ledger control account for the year ended 31 March 20X9, using relevant figures selected from the data shown above.

> Formica purchases inventory on credit from a large number of suppliers. The company maintains a purchases ledger control account as an integral part of its double-entry system and in addition maintains supplier accounts on a memorandum basis in a purchas

> A list of balances on the individual customer accounts in the sales ledger did not agree with the balance on the sales ledger control account. You are told that: 1. A sales invoice of £12,900 included in the sales day book had not been pos

> The books of original entry for James Plc showed the following for the month ended 31 March 20X9: Previous trade receivable/trade payable balances were £53,450/£42,150. Required Prepare the sales ledger and the purchases ledg

> Using the information from question 7.8, re-prepare J. Magee’s statement of financial position, using the horizontal format, as at 31 December 20X9.

> Complete the following table showing which ledger account is to be debited and which is to be credited:

> You are a consultant to a large manufacturing corporation that is considering a project with the following net after-tax cash flows (in millions of dollars): Years from Now After-Tax Cash Flow 0 ………………………………………..−40 1–10 ………………………………………15 The

> Characterize each company in the previous problem as underpriced, overpriced, or properly priced.

> Are the following true or false? Explain. a. Stocks with a beta of zero offer an expected rate of return of zero. b. The CAPM implies that investors require a higher return to hold highly volatile securities. c. You can construct a portfolio with beta of

> Outline how you would incorporate the following into the CCAPM: a. Liquidity. b. Nontraded assets. (Do you have to worry about labor income?)

> a. A mutual fund with beta of .8 has an expected rate of return of 14%. If rf = 5%, and you expect the rate of return on the market portfolio to be 15%, should you invest in this fund? What is the fund’s alpha? b. What passive portfolio comprised of a ma

> Suppose the rate of return on short-term government securities (perceived to be risk-free) is about 5%. Suppose also that the expected rate of return required by the market for a portfolio with a beta of 1 is 12%. According to the capital asset pricing m

> Two investment advisers are comparing performance. One averaged a 19% rate of return and the other a 16% rate of return. However, the beta of the first investor was 1.5, whereas that of the second investor was 1. a. Can you tell which investor was a bett

> The market price of a security is $50. Its expected rate of return is 14%. The risk-free rate is 6%, and the market risk premium is 8.5%. What will be the market price of the security if its correlation coefficient with the market portfolio doubles (and

> Assume that the risk-free rate of interest is 6% and the expected rate of return on the market is 16%. I am buying a firm with an expected perpetual cash flow of $1,000 but am unsure of its risk. If I think the beta of the firm is .5, when in fact the be

> If the simple CAPM is valid, which of the following situations are possible? Explain. Consider each situation independently.

> Wilson is now evaluating the expected performance of two common stocks, Furhman Labs Inc. and Garten Testing Inc. He has gathered the following information: The risk-free rate is 5%. The expected return on the market portfolio is 11.5%. The beta of Furhm

> If the simple CAPM is valid, which of the following situations are possible? Explain. Consider each situation independently.

> If the simple CAPM is valid, which of the following situations are possible? Explain. Consider each situation independently.

> Consider the two (excess return) index model regression results for A and B: RA = 1% + 1.2RM R-square = .576 Residual standard deviation = 10.3% RB = −2% + .8RM R-square = .436 Residual standard deviation = 9.1% a. Which stock has more firm-specific risk

> Consider the following two regression lines for stocks A and B in the following figure. a. Which stock has higher firm-specific risk? b. Which stock has greater systematic (market) risk? c. Which stock has higher R2? d. Which stock has higher alpha? e. W

> The following are estimates for two stocks. The market index has a standard deviation of 22% and the risk-free rate is 8%. a. What are the standard deviations of stocks A and B? b. Suppose that we were to construct a portfolio with proportions: Stock A:&