Question: Jacobs Ltd has recently completed its draft

Jacobs Ltd has recently completed its draft financial statements for the year ended 30 December 20X9, which showed a draft profit for the year of £300,000. During the audit a number of mistakes and omissions were uncovered. These are listed below.

1. A payment from a credit customer amounting to £7,100 had been received on 27 December 20X9 but had not been banked or included in the financial statements.

2. Depreciation on a non-current asset had been incorrectly calculated. The asset’s cost was

£125,000, it was being depreciated on a straight-line basis over four years. £16,250 was charged in the financial statements.

3. Although included in inventory an invoice for goods sold by Jacobs amounting to £17,500, dated 26 December 20X9, had not been included in the financial statements.

4. Two items of inventory, currently valued at a total cost of £35,000, are now considered obsolete. The director estimates that they will only realize about £10,000 between them.

5. The company accountant forgot to include a charge for interest on the 10 per cent long-term loan of £240,000 for the final six months of the year.

6. Rates of £1,500 for the year to 1 April 20X9 were paid for in April 20X8. No entries have been made in the financial statements in relation to this item other than correctly recording the original payment.

7. An item of capital worth £3,000 had been incorrectly entered into the prepayments account instead of non-current assets. The asset has a useful life of three years and a residual value of £600. The accounting policy states that the reducing balance method is most appropriate for this type of asset.

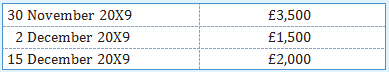

8. One of the credit customers contacted Jacobs Ltd to inform them that the cashier had not given him the correct agreed trade discount of 20 per cent. The invoices affected were noted by the accountant as follows:

Required

a. For each of the items (1) to (8) above, state and describe the effect on the profit for the year and calculate the total effect on Jacobs’ draft profit figure.

b. For each of the items (1) to (8) above, describe the changes, if any, which will have to be made on the statement of financial position of Jacobs Ltd.

> IAS 10 – Events after the Reporting Period defines the treatment to be given to events arising after the statement of financial position date but before the financial statements are approved by the Board of Directors. Required a. Define the terms ‘adjus

> Cold Heart plc, which has a turnover of £100 million and pre-tax profit of £10 million, has its financial statements drawn up on 30 June each year and at 30 June 20X9 the company’s accountant is considering the items specified below. 1. The directors hav

> State whether the following expenditures for a local school are revenue or capital in nature. In addition, state the name of the classification (current asset, non-current asset, etc.) and the generic account name that the item would appear in within the

> The following information is available for Aston Products Plc as at 30 April 20X8. There were no other reserves in the statement of financial position at 30 April 20X8. You are given the following additional information relating to the year ended 30 Ap

> a. The following items usually appear in the final financial statements of a limited company: i. interim dividend; ii. general reserve; iii. share premium account. Required An explanation of the meaning of each of the above terms. b. The following infor

> Describe the main kinds of debenture loan stock.

> What is the difference between a fixed charge and a floating charge?

> Rank the following stakeholders in terms of who would have priority when a company is settling claims of the stakeholders against it. Note, a rank of 1 means this stakeholder should be paid first. • Debenture holders; • Loan stock holders; • Preference s

> Use the amended information from Exercise 25.6 as a starting point. Dissolution information 1. On 1 January 20X9 the partners decide to form a company and issue £140,000 worth of shares in the company to the partners. They raise an additional loan (£60,0

> Maraid, Wendy and Diane have been in partnership for a number of years sharing profits respectively. They decide to form a limited company on 1 January 20X9, called McKee Ltd, to carry on the business. The statement of financial position of the partners

> Peter, Paul and Mary have been in partnership for several years sharing profits and losses in the ratio 1 : 2 : 3. Their last statement of financial position is as follows: The partnership had become very dependent on one customer, Jefferson, and in or

> Alpha, Beta and Gamma were in partnership for many years sharing profits and losses in the ratio 5 : 3 : 2 and making up their financial statements to 31 December each year. Alpha died on 31 December 20X9, and the partnership was dissolved as from that d

> Gupta, Richards and Jones are in partnership sharing profits and losses in the ratio 5 : 4 : 3. On 1 January 20X9 Richards retired from the partnership and it was agreed that Singh should join the partnership, paying a sum of £30,000. From t

> On 20 December 20X0 your client paid £10,000 for an advertising campaign. The advertisements will be heard on local radio stations between 1 January and 31 January 20X1. Your client believes that as a result sales will increase by 60 per cent in 20X1 (ov

> Al and Bert are in partnership sharing profits equally. At 30 June they have balances on their capital accounts of £12,000 (Al) and £15,000 (Bert). On that day they agree to bring in their friend Hall as a third partner. All three partners are to share p

> X, Y and Z are in partnership sharing profits and losses in the ratio 4 : 2 : 2. Z died on 30 June 20X9. The partnership statement of financial position as at that date was: Additional information It was agreed between X, Y and Z’s re

> A, B and C are in partnership sharing profits and losses in the ratio of 50 : 25 : 25 per cent. Each partner receives a salary of £40,000 and interest on opening capital balance of 15 per cent per year. The draft statement of financial posit

> Hawthorn and Privet have carried on business in partnership for a number of years, sharing profits in the ratio of 4 : 3 after charging interest on capital at 4 per cent per annum. Holly was admitted into the partnership on 1 October 20X8, and the terms

> Matthew, Mark and Luke were in partnership sharing profits and losses in the ratio 5 : 3 : 2, financial statements being made up annually to 30 June. Fixed capital accounts were to bear interest at the rate of 5 per cent per annum, but no inter

> Street, Rhode and Close carried on business in partnership sharing profits and losses, in the ratio 5: 4: 3. Their draft statement of financial position as on 31 March 20X9 was as follows: Street retired from the partnership on 31 March 20X9 and Rhode

> Anna and Thomas are in partnership sharing profits and losses equally. The partnership agreement provides for an annual salary to Anna of £57,000. It also provides for interest on capital of 10 per cent per annum and interest on drawings of

> Mary and Seamus are in partnership sharing profits and losses equally. The partnership agreement provides for annual salaries of £34,000 for Mary and £22,000 for Seamus. It also provides for interest on capital of 8 per cent per

> Field, Green and Lane are in partnership making up financial statements annually to 31 March. Owing to staff difficulties proper records were not maintained for the year ended 31 March 20X9, and the partners request your assistance

> A. Cherry owned a farmhouse and land, the latter being used by him and his sons, Tom and Leo, in carrying on a fruit and poultry business in partnership. The partnership agreement stipulated that the father should take one-sixth of the

> An acquaintance of yours, H. Gee, has recently set up in business for the first time as a general dealer. The majority of his sales will be on credit to trade buyers but he will sell some goods to the public for cash. He is not sure at which point of the

> Brick, Stone and Breeze carry on a manufacturing business in partnership, sharing profits and losses: Brick one-half, Stone one-third and Breeze one-sixth. It is agreed that the minimum annual share of profit to be credited to Breeze is to be Â&pou

> a. When accounting for the relationship of partners inter se, the partnership agreement provides the rules which, in the first instance, are to be applied. What information would you expect to find in a partnership agreement to provide such rules, and wh

> A, B, C and D were partners in a garage business comprising (1) Petrol sales, (2) Repairs and servicing and (3) Second-hand car dealing. A was responsible for petrol sales, B for repairs and servicing and C for second-hand car deals, while D acted pu

> Peter and Paul, whose year-end is 30 June, are in business as food wholesalers. Their partnership deed states that: a. profits and losses are to be shared equally; b. salaries are: Peter £20,000 per annum; Paul £18,000 per annum

> The partnership of Anna, Mary and Seamus has just completed its first year in business. In their partnership agreement each partner is entitled to interest on capital of 12% each year and Anna is to get a salary of £30,

> Light and Dark are in partnership sharing profits and losses in the ratio 7 : 3, respectively. The following information has been taken from the partnership records for the financial year ended 31 May 20X9: Partners’ capital accounts, b

> Miss Fitt owns a retail shop. The statement of profit or loss and statement of financial position are prepared annually by you from records consisting of a bank statement and a file of unpaid suppliers and outstanding trade receivables. The following is

> Jock is a clothing retailer. At 31 December 20X9 he asks you to prepare his final financial statements from very incomplete records. You were able to extract the following information from the limited records that were available. Accruals and prepaymen

> Jane Grimes, retail fruit and vegetable merchant, does not keep a full set of accounting records. However, the following information has been produced from the business’s records: 1. Summary of the bank account for the year ended 31 Aug

> Happy did not keep proper books of account. At 31 August 20X8 his balances were: Details of transactions in year to 31 August 20X9: At 31 August 20X9 the assets and liabilities were: Depreciation on tools £600, lorry now valued at &Acir

> Prepare the statement of financial position for C. Koat at 31 December 20X9: Assets: Office building £25,000, Factory £60,000, Inventory £8,000, Cash £500, Monies owed from a customer £3,500. Liabilities: Bank overdraft £5,000, Monies owed to R. Lodge £

> Capital at the end of 20X8 is £2,000. Capital at the end of 20X9 is £3,000. Drawings were £700. Required Calculate the profit for the year ended 20X9 from the above information.

> Capital at the end of 20X8 is £2,000. Capital at the end of 20X9 is £3,000. There were no drawings; and no capital had been introduced. Required Calculate the profit for the year ended 20X9 from the above information.

> T. Murray has prepared the following bank ledger account for the year ended 31 March 20X9: T. Murray has also supplied you with the following information. a. Commissions received included £85, which had been in arrears at 31 March 20X8, an

> Bugs Bunny, a wholesale dealer in ready-made menswear, achieves a gross profit ratio of 50 per cent. The statement of financial position of the business as at 30 June 20X8 was as follows: Since this date the accounting function has been neglected. Howe

> David Denton set up in business as a plumber a year ago, and he has asked you to act as his accountant. His instructions to you are in the form of the following letter. Dear Henry I was pleased when you agreed to act as my accountant and look forward to

> A year ago, you prepared financial statements for A. Wilson, a retailer. His closing position was then: Mr Wilson does not keep full records (despite your advice) and once again you have to use what information is available to prepare his financial sta

> The draft trial balance of Regent Ltd as at 31 May 20X9 agreed. The business proceeded with the preparation of the draft final financial statements and these showed a profit of £305,660. However, a subsequent audit revealed the following errors: 1. Bank

> Chocolate is a confectionery shop owned by Thomas McKee. Thomas operates a manual bookkeeping system and employs a cashier and a bookkeeper. When writing up the books of account for the year ended 31 December 20X9, the following errors were discovered: 1

> Arthur started a new business on 1 January 20X9. You are supplied with the following nominal ledger accounts, which have been closed off and a trial balance extracted. These are Arthur’s only transactions in this period. Trial balan

> Write journals to correct the following errors (suspense account errors): 1. The debit side of the cash book is undercast by £3,000. 2. A payment of £475 for an electricity bill is correctly entered in the cash book but debited to the telephone account a

> A colleague from the sales department has approached you with an idea for an expansion plan for the car dealership where you both work. Second-hand cars have higher margins. Therefore, he suggests that we change the current system which would mean that w

> Write journals to correct the following errors. These errors are not suspense account errors. 1. A payment of £4,000 for rent was incorrectly posted to the insurance account. 2. The cost of purchasing a delivery van, £12,400, is incorrectly debited to th

> Write journals to correct the following errors. These errors are not suspense account errors. 1. £150 sales invoice posted to the credit customer, D. Brown’s account – should have been posted to the credit customer, D. Black’s account. 2. £50 stationery

> The draft final financial statements of RST Ltd for the year ended 30 April 20X9 showed a net profit for the year of £78,263. During the subsequent audit, the following errors and omissions were discovered. At the draft stage a suspense account had been

> Chi Knitwear Ltd is an old-fashioned firm with a handwritten set of books. A trial balance is extracted at the end of each month, and a statement of profit or loss and statement of financial position are computed. This month, however, the trial balance d

> At the end of January 20X9 a trial balance extracted from the ledger of Gerald Ltd did not balance and a suspense account was opened for the amount of the difference. Subsequently, the following matters came to light: 1. £234 had been receiv

> The following particulars relating to the year ended 31 March 20X9 have been extracted from the books of a trader: Prepare the sales ledger control account for the year ended 31 March 20X9, using relevant figures selected from the data shown above.

> Formica purchases inventory on credit from a large number of suppliers. The company maintains a purchases ledger control account as an integral part of its double-entry system and in addition maintains supplier accounts on a memorandum basis in a purchas

> A list of balances on the individual customer accounts in the sales ledger did not agree with the balance on the sales ledger control account. You are told that: 1. A sales invoice of £12,900 included in the sales day book had not been pos

> The books of original entry for James Plc showed the following for the month ended 31 March 20X9: Previous trade receivable/trade payable balances were £53,450/£42,150. Required Prepare the sales ledger and the purchases ledg

> Using the information from question 7.8, re-prepare J. Magee’s statement of financial position, using the horizontal format, as at 31 December 20X9.

> Complete the following table showing which ledger account is to be debited and which is to be credited:

> You are a consultant to a large manufacturing corporation that is considering a project with the following net after-tax cash flows (in millions of dollars): Years from Now After-Tax Cash Flow 0 ………………………………………..−40 1–10 ………………………………………15 The

> Characterize each company in the previous problem as underpriced, overpriced, or properly priced.

> Are the following true or false? Explain. a. Stocks with a beta of zero offer an expected rate of return of zero. b. The CAPM implies that investors require a higher return to hold highly volatile securities. c. You can construct a portfolio with beta of

> Outline how you would incorporate the following into the CCAPM: a. Liquidity. b. Nontraded assets. (Do you have to worry about labor income?)

> a. A mutual fund with beta of .8 has an expected rate of return of 14%. If rf = 5%, and you expect the rate of return on the market portfolio to be 15%, should you invest in this fund? What is the fund’s alpha? b. What passive portfolio comprised of a ma

> Suppose the rate of return on short-term government securities (perceived to be risk-free) is about 5%. Suppose also that the expected rate of return required by the market for a portfolio with a beta of 1 is 12%. According to the capital asset pricing m

> Two investment advisers are comparing performance. One averaged a 19% rate of return and the other a 16% rate of return. However, the beta of the first investor was 1.5, whereas that of the second investor was 1. a. Can you tell which investor was a bett

> The market price of a security is $50. Its expected rate of return is 14%. The risk-free rate is 6%, and the market risk premium is 8.5%. What will be the market price of the security if its correlation coefficient with the market portfolio doubles (and

> Assume that the risk-free rate of interest is 6% and the expected rate of return on the market is 16%. I am buying a firm with an expected perpetual cash flow of $1,000 but am unsure of its risk. If I think the beta of the firm is .5, when in fact the be

> If the simple CAPM is valid, which of the following situations are possible? Explain. Consider each situation independently.

> Wilson is now evaluating the expected performance of two common stocks, Furhman Labs Inc. and Garten Testing Inc. He has gathered the following information: The risk-free rate is 5%. The expected return on the market portfolio is 11.5%. The beta of Furhm

> If the simple CAPM is valid, which of the following situations are possible? Explain. Consider each situation independently.

> If the simple CAPM is valid, which of the following situations are possible? Explain. Consider each situation independently.

> Consider the two (excess return) index model regression results for A and B: RA = 1% + 1.2RM R-square = .576 Residual standard deviation = 10.3% RB = −2% + .8RM R-square = .436 Residual standard deviation = 9.1% a. Which stock has more firm-specific risk

> Consider the following two regression lines for stocks A and B in the following figure. a. Which stock has higher firm-specific risk? b. Which stock has greater systematic (market) risk? c. Which stock has higher R2? d. Which stock has higher alpha? e. W

> The following are estimates for two stocks. The market index has a standard deviation of 22% and the risk-free rate is 8%. a. What are the standard deviations of stocks A and B? b. Suppose that we were to construct a portfolio with proportions: Stock A:&

> A portfolio management organization analyzes 60 stocks and constructs a mean-variance efficient portfolio using only these 60 securities. a. How many estimates of expected returns, variances, and covariances are needed to optimize this portfolio? b. If o

> Why do we call alpha a “nonmarket” return premium? Why are high-alpha stocks desirable investments for active portfolio managers? With all other parameters held fixed, what would happen to a portfolio’s Sharpe ratio as the alpha of its component securiti

> How does the magnitude of firm-specific risk affect the extent to which an active investor will be willing to depart from an indexed portfolio?

> Suppose that the alpha forecasts in row 39 of Spreadsheet 8.1 are doubled. All the other data remain the same. a. Use the Summary of Optimization Procedure to estimate back-of-the-envelope calculations of the information ratio and Sharpe ratio of the new

> Suppose that on the basis of the analyst’s past record, you estimate that the relationship between forecast and actual alpha is: Actual abnormal return = .3 × Analyst’s forecast of alpha a. Redo Problem 17 using appropriately adjusted forecasts of alpha.

> You manage an equity fund with an expected risk premium of 10% and an expected standard deviation of 14%. The rate on Treasury bills is 6%. Your client chooses to invest $60,000 of her portfolio in your equity fund and $40,000 in a T-bill money market fu

> Recalculate Problem 17 for a portfolio manager who is not allowed to short sell securities. a. What is the cost of the restriction in terms of Sharpe’s measure? b. What is the utility loss to the investor (A = 2.8) given his new complet

> A portfolio manager summarizes the input from the macro and micro forecasters in the following table: a. Calculate expected excess returns, alpha values, and residual variances for these stocks. b. Construct the optimal risky portfolio. c. What is the S

> A stock recently has been estimated to have a beta of 1.24: a. What will a beta book compute as the “adjusted beta” of this stock? b. Suppose that you estimate the following regression describing the evolution of beta over time: βt = .3 + .7βt−1 What wou

> Suppose that the index model for stocks A and B is estimated from excess returns with the following results: For portfolio P with investment proportions of .60 in A and .40 in B, rework Problems 9, 10, and 12.

> What are the advantages of the index model compared to the Markowitz procedure for obtaining an efficiently diversified portfolio? What are its disadvantages?

> A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows: The c

> A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows: / T

> A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows: The

> Convert the asset returns by decade presented in the table into real rates. Repeat Problem 20 for the real rates of return.

> Input the data from the table into a spreadsheet. Compute the serial correlation in decade returns for each asset class and for inflation. Also find the correlation between the returns of various asset classes. What do the data indicate?

> a. John Wilson is a portfolio manager at Austin & Associates. For all of his clients, Wilson manages portfolios that lie on the Markowitz efficient frontier. Wilson asks Mary Regan, CFA, a managing director at Austin, to review the portfolios of two of h

> When adding real estate to an asset allocation program that currently includes only stocks, bonds, and cash, which of the properties of real estate returns most affects portfolio risk? Explain. a. Standard deviation. b. Expected return. c. Covariance wit

> The correlation coefficients between several pairs of stocks are as follows: Corr(A, B) = .85; Corr(A, C) = .60; Corr(A, D) = .45. Each stock has an expected return of 8% and a standard deviation of 20%. If your entire portfolio is now composed of stock

> True or false: The standard deviation of the portfolio is always equal to the weighted average of the standard deviations of the assets in the portfolio.

> Suppose that there are many stocks in the security market and that the characteristics of stocks A and B are given as follows: / Suppose that it is possible to borrow at the risk-free rate, rf . What must be the value of the riskfree rate? (Hint: Think

> Stocks offer an expected rate of return of 18% with a standard deviation of 22%. Gold offers an expected return of 10% with a standard deviation of 30%. a. In light of the apparent inferiority of gold with respect to both mean return and volatility, woul

> A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows: The c

> Now draw the indifference curve corresponding to a utility level of .05 for an investor with risk aversion coefficient A = 4. Comparing your answer to Problem 6, what do you conclude?

> Draw the indifference curve in the expected return–standard deviation plane corresponding to a utility level of .05 for an investor with a risk aversion coefficient of 3. (Hint: Choose several possible standard deviations, ranging from 0 to .25, and find

> Consider a portfolio that offers an expected rate of return of 12% and a standard deviation of 18%. T-bills offer a risk-free 7% rate of return. What is the maximum level of risk aversion for which the risky portfolio is still preferred to T-bills?